Beruflich Dokumente

Kultur Dokumente

ISHUP Guidelines

Hochgeladen von

kayalonthewebOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ISHUP Guidelines

Hochgeladen von

kayalonthewebCopyright:

Verfügbare Formate

Andhra Bank, Priority Sector Department (DGSS),HO, Hyderabad

INTEREST SUBSIDY FOR HOUSING URBAN POOR

Ministry of Housing and Urban Poverty Alleviation (MHUPA), Govt. of India have approved the

‘Interest Subsidy Scheme for Housing the Urban Poor’(ISHUP) for implementation by public

sector banks and other finance institutions.

The scheme aims at enabling the EWS and LIG segments in the urban areas to construct or

purchase houses by providing an interest subsidy of 5% on loan amount of Rs.1.00 lakh. The

National Housing Bank (NHB) and HUDCO have been designated as the Nodal Agencies (NAs)

for administration of and release the subsidy under the scheme to the lending institutions.

Background:

”Affordable Housing for All” is an important policy agenda of Govt. of India which is

to create a supportive environment for expanding credit flow to the housing sector

and increasing home ownership in the country.

As per the Technical Group set up by the Ministry of Housing and Urban Poverty

Alleviation (MHUPA),Govt. of India, the estimated urban housing shortage was 24.7

million units in the year 2007 and 99% of it related to EWS & LIG segments.

The Ministry of Housing and Urban Poverty Alleviation (MH&UPA), Govt. of India has

designed an Interest Subsidy Scheme as an additional instrument for addressing the

housing needs of the EWS /LIG segments in urban areas to enable them to buy or

construct houses.

Salient features of ‘Interest Subsidy Scheme for Housing the Urban Poor(ISHUP)’:

Purpose: The scheme will provide home loan with Central Govt. subsidy to EWS /LIG

persons for acquisition of house as also for construction of house to such beneficiary,

who does not own a house in his / her name or in the name of his / her spouse or any

dependent child. Such beneficiaries who own land in any urban area but do not have

any pucca house in their name or in the name of their spouse or any dependent child

will also be covered under the scheme.

Eligibility: The economic parameter of EWS is defined as households having an

average monthly income upto Rs.5,000 and the economic parameter of LIG is defined

as households having an average monthly income between Rs.5,001 upto Rs10,000.

This will be subject to revision by the steering Committee of the Scheme from time

to time.

Loan amount admissible: The scheme will provide a subsidized loan for 15-20 years

for a maximum amount of Rs.1,00,000 for an EWS individual for a house at least of 25

sq. mts. & Rs.1,60,000 for a LIG individual for a house at least 40 sq.mts. will be

admissible. However, subsidy will be given for loan amount upto Rs.1 lakh only.

Additional loans, if needed would be at unsubsidized rates.

Terms for Loan and Subsidy Reimbursement: The subsidy will be 5% p.a. on interest

charged on the admissible loan amount for EWS and LIG, over full period of the loan

for construction or acquisition of a new house.

Andhra Bank, State Level Convenor Bank, A.P Page 1

Andhra Bank, Priority Sector Department (DGSS),HO, Hyderabad

The system for passing on subsidy will be as follows:

1) The Net present value (NPV) of this subsidy will be arrived at on the basis of

notional discount rate of 9% p.a.(equivalent to Govt. security rate) for the period

of loan and on the interest chargeable at the time the loan is contracted.

2) Loan repayment periods will be permissible generally ranging from 15-20 years.

3) The Nodal agencies for the scheme i.e., NHB & HUDCO will not lend directly to

the borrower but through banks or Housing Finance Companies (HFCs), who agree

to be part of the Scheme as the lenders. The NPV subsidy will be released by the

Government to the nodal agencies on upfront &quarterly basis in advance based

on the number of housing loans sanctioned by their lenders, who join the scheme.

It will be passed on by the lender to the borrower by deducting the subsidy

amount from the principal loan amount of the borrower and charging interest on

the net amount of loan at the agreed rate of interest, which will be fixed as per

RBI guidelines for loans upto Rs.2.00 lakhs & the rates would be monitored by the

Steering Committee of the scheme.

4) The nodal agencies will publish the list of the lenders under the scheme, which

will be approved by the Steering Committee for the scheme set up by the

Ministry.

5) Borrowers may choose fixed or floating rates (the consequences clearly explained

to the borrowers by PLIs). An additional 1% p.a. maximum will be permitted to be

charged by the banks /HFCs, if fixed rate loans are extended which will be

subject to reset after a minimum period of 5 years.

6) Mortgage of the dwelling unit may be accepted as primary security. However,

there would be no collateral security / third party guarantee for loans upto and

inclusive of Rs.1.00 lakh. No levy of prepayment charges would be permitted.

7) The scheme will close in 2012, the last year of the 11th Five Year Plan Period

(2007-12). However, the loans extended in the last year will also have repayment

period upto 20 years.

Selection of Beneficiaries: The borrowers under the scheme must belong to the EWS

or LIG, and must have a plot of land for the construction or have identified a

purchasable house. Borrowers would be free to approach for loan under the scheme

directly with the lender. The borrowers & lenders would require the intercession of

State Govt. / Urban Local bodies (ULBs) to identify borrowers with land, help them

with preparation of papers and liaise for them with the lenders. The preference

under the scheme (subject to beneficiaries being from EWS/LIG segments) should be

given to the following in accordance with their population in the total population of

the area as per 2001 census.

i. Scheduled Caste;

ii. Scheduled Tribe;

iii. Minorities;

iv. Persons with disabilities; and

v. Women beneficiaries

Both individuals as well as Group Housing like Cooperative group housing

societies

Andhra Bank, State Level Convenor Bank, A.P Page 2

Andhra Bank, Priority Sector Department (DGSS),HO, Hyderabad

or Employees Welfare Housing / Labour Housing organizations are equally eligible

under

the scheme. The borrowers selected by State/ULBs /banks should be as far as possible

in

the ratio of 70:30 respectively for EWS and LIG categories.

The loan application can be made directly or through the ULB or the local agency

identified by the State for the purpose, who will ensure that it is complete with

necessary certification.

The documentation will be as per the procedural requirement of the lender and the

lender will sanction the loan as per their own risk assessment & procedural

requirements and release the loan as per the progress of construction.

Role of Steering Committee:

The Steering Committee under the Chairmanship of Secretary, MH& UPA and

members drawn from selected State Govt.s, senior executives from Ministry of

Finance, Reserve Bank of India, NHB, HUDCO, eminent bankers & social researchers /

workers in the field of urban housing, finance and allied areas will be set up by the

MH & UPA and will be responsible for suggesting operational instructions and also for

monitoring the implementation of the Scheme.

The disbursal of subsidy will be made by NHB / HUDCO as decided by the Steering

Committee.

The Steering Committee will formulate separate guidelines for association of NGOs,

community Based Organizations (CBOs), Micro Finance Institutions (MFIs), Self-Help

Groups (SHGs) with the scheme.

Role of Central Govt.:

The Ministry of Housing and Urban Poverty Alleviation (MH & UPA) will

review and monitor the implementation of the scheme and release the subsidy to

Nodal agencies on a quarterly basis on receiving a request. Second and

subsequent installments will be released on a revolving basis on the basis of 70%

utilization.

Role of State Govt.s / Urban Local Bodies (ULBs):

They will identify a local level nodal agency duly informing MH & UPA for

identification of beneficiaries under the scheme and forward the applications to

the financing institutions.

They will ensure availability of basic infrastructure services to the home sites

assisted, so that new slums do not get created.

They will undertake publicity campaigns about the scheme.

Role of Central Nodal agencies:

The NHB and HUDCO will be the Central Nodal agencies for disbursement of the NPV

based subsidy to the banks /HFIs on a quarterly basis based on Utilisation /End use

Certificate and will provide final utilization certificate to MH & UPA in the prescribed

Andhra Bank, State Level Convenor Bank, A.P Page 3

Andhra Bank, Priority Sector Department (DGSS),HO, Hyderabad

format. They will be responsible for monitoring and data collection of the NPV

Based amount of subsidy for the entire duration of the scheme.

NHB & HUDCO will devolve the subsidy in the following manner:

1) On receipt of information regarding the total loan disbursed by a primary lending

institution to EWS and LIG beneficiaries during a 3 month period, the NHB or HUDCO

will release the subsidy amount to them directly at the end of each quarter.

2) The subsidy will be 5% p.a. for EWS and LIG, admissible for a maximum loan amount

of Rs.1.00 lakh over the full period of he loan for construction or acquisition. The Net

Present Value (NPV) subsidy will be given to the lenders on upfront and quarterly

basis. The NPV subsidy given to the lender will be deducted from the principal loan

amount of the borrower, who will then have to pay interest to the Banks / Housing

finance Institution (HFI) at an agreed document rate for the whole duration of the

loan.

3) The NHB & HUDCO will monitor the construction of the housing units for their

respective jurisdictions in terms of the aforesaid subsidy by conducting periodical

inspection of the units by their officers.

4) These institutions will also ensure that the Primary Lending Institutions (PLIs) provide

them 'Utilization certificates' in relation to completion of housing units within one

year period from the start of construction. In case certain housing units are not

completed within one year period, the lending institutions should ask for specific

extension while giving reasons for delay in construction.

Role of Banks / Housing Finance Institutions:

Banks/ Housing Finance Institutions (HFIs) i.e., HFCs, MFIs etc. will have the option to

avail the resources of either of the Nodal Agencies or both for the period of the

scheme.

Banks / HFIs will have to provide Utilisation / end use Certificate to NHB / HUDCO on

a half-yearly basis.

Banks / HFIs will provide each loanee a statement which will make him / her

understand the amount given as subsidy, how the subsidy has been adjusted and the

impact of the subsidy on his / her EMI.

Banks / HFIs will clearly explain to the borrowers the consequences of availing loan

on fixed / floating rates of interest.

Evaluation and Mid course Adjustments:

A detailed review of provision of subsidy by PLIs to EWS & LIG beneficiaries will be

undertaken by the Ministry through an external institution of repute after every 2

years. Such reviews are intended with a view to making mid-course adjustments and

improvements in the implementation of the 'Interest Subsidy scheme'.

Andhra Bank, State Level Convenor Bank, A.P Page 4

Das könnte Ihnen auch gefallen

- Promoting Social Bonds for Impact Investments in AsiaVon EverandPromoting Social Bonds for Impact Investments in AsiaNoch keine Bewertungen

- Affordable Housing in PartnershipDokument18 SeitenAffordable Housing in PartnershipRahil AlamNoch keine Bewertungen

- PMDG 737NGX Tutorial 2 PDFDokument148 SeitenPMDG 737NGX Tutorial 2 PDFMatt HenryNoch keine Bewertungen

- 1001 Questions For Last Moment Banking PreparationsDokument35 Seiten1001 Questions For Last Moment Banking PreparationsAparajito SethNoch keine Bewertungen

- National Policies of HousingDokument15 SeitenNational Policies of HousingVernika Agrawal100% (1)

- Final Report On Reverse Mortgage in IndiaDokument59 SeitenFinal Report On Reverse Mortgage in Indiashivab445100% (1)

- NCP - DMDokument4 SeitenNCP - DMMonica Garcia88% (8)

- Guidelines For Interest Subsidy Scheme For Housing The Urban Poor (Ishup)Dokument10 SeitenGuidelines For Interest Subsidy Scheme For Housing The Urban Poor (Ishup)kayalonthewebNoch keine Bewertungen

- Rajiv Rinn Yojana (RRY) : October 2013Dokument9 SeitenRajiv Rinn Yojana (RRY) : October 2013Sudheer MacNoch keine Bewertungen

- Pradhan Mantri Awas Yojna FAQ PDFDokument2 SeitenPradhan Mantri Awas Yojna FAQ PDFPratul ShindeNoch keine Bewertungen

- GHJHJKDokument16 SeitenGHJHJKCheGanJiNoch keine Bewertungen

- Pradhan Mantri Awas Yojna 2019 (PMAY) प्रधानमंत्री आवास योजना - 2019 स्कीम की पूरी जानकारीDokument20 SeitenPradhan Mantri Awas Yojna 2019 (PMAY) प्रधानमंत्री आवास योजना - 2019 स्कीम की पूरी जानकारीAbinash MandilwarNoch keine Bewertungen

- RRY Operational Guidelines - FinalDokument23 SeitenRRY Operational Guidelines - FinalsahajanandaNoch keine Bewertungen

- Rajiv Rinnyojana (Rry) : Operational GuidelinesDokument23 SeitenRajiv Rinnyojana (Rry) : Operational Guidelinespavan6595Noch keine Bewertungen

- Self-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeDokument7 SeitenSelf-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeVirender KulhariaNoch keine Bewertungen

- Credit Risk Guarantee Fund Scheme For Low Income HousingDokument20 SeitenCredit Risk Guarantee Fund Scheme For Low Income HousingRaja SundaramNoch keine Bewertungen

- DAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Dokument9 SeitenDAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Abinash MandilwarNoch keine Bewertungen

- Swarnjayanti Gram Swarozgar Yojana ZaidDokument10 SeitenSwarnjayanti Gram Swarozgar Yojana ZaidIqra ShaikhNoch keine Bewertungen

- Finance For Housing SchemesDokument21 SeitenFinance For Housing SchemesPravin JadhavNoch keine Bewertungen

- CLSS EWS Single Leaf LeafletDokument2 SeitenCLSS EWS Single Leaf LeafletSrijan SinghNoch keine Bewertungen

- Guideline For Weavers Mudra SchemeDokument5 SeitenGuideline For Weavers Mudra SchemearavindambatiNoch keine Bewertungen

- Day NulmDokument9 SeitenDay NulmganpatigajanandganeshNoch keine Bewertungen

- Housing Finance: Presented by Sulekha Beri I.D.NO .43847Dokument46 SeitenHousing Finance: Presented by Sulekha Beri I.D.NO .43847mehakdadwalNoch keine Bewertungen

- Housing Finance: Roll #2812 & 2811Dokument18 SeitenHousing Finance: Roll #2812 & 2811shalinganatraNoch keine Bewertungen

- National Law University, Jodhpur School of Insurance StudiesDokument52 SeitenNational Law University, Jodhpur School of Insurance StudiesKhushboo BalaniNoch keine Bewertungen

- RMS PDFDokument26 SeitenRMS PDFKhushboo BalaniNoch keine Bewertungen

- Innovative Practices Followed by The Institution To Enhance Financial Inclusion Canara BankDokument4 SeitenInnovative Practices Followed by The Institution To Enhance Financial Inclusion Canara BankShanu RajpalNoch keine Bewertungen

- Pmay UDokument37 SeitenPmay UNikita AntonyNoch keine Bewertungen

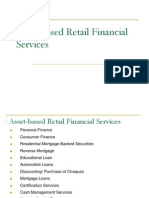

- Asset Based Retail Financial ServicesDokument37 SeitenAsset Based Retail Financial Servicesjimi02100% (1)

- Sarothi 1 0Dokument11 SeitenSarothi 1 0ikonmobileshopNoch keine Bewertungen

- Poverty SchemesDokument3 SeitenPoverty Schemesharsha143saiNoch keine Bewertungen

- Direct Housing FinanceDokument3 SeitenDirect Housing Financesagar1089Noch keine Bewertungen

- Reverse Mortgage in IDBI BANKDokument66 SeitenReverse Mortgage in IDBI BANKMohmmad SameemNoch keine Bewertungen

- E-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Dokument7 SeitenE-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Ramya MaddulaNoch keine Bewertungen

- Housing FinanceDokument22 SeitenHousing FinanceMitesh DhoriyaNoch keine Bewertungen

- I) Ii) Iii) : Housing FinanceDokument5 SeitenI) Ii) Iii) : Housing FinanceAnkit SinghNoch keine Bewertungen

- Ministry of Housing and Urban AffairsDokument24 SeitenMinistry of Housing and Urban AffairsNeha RathoreNoch keine Bewertungen

- Memorandum of Understanding (Mou)Dokument4 SeitenMemorandum of Understanding (Mou)zil_bestNoch keine Bewertungen

- SWAYAM SchemeDokument8 SeitenSWAYAM Schemekashif raja khanNoch keine Bewertungen

- Gramin Bhandaran Yojana/Rural Godown SchemeDokument22 SeitenGramin Bhandaran Yojana/Rural Godown SchememadhusudhansNoch keine Bewertungen

- Housing Finance 1Dokument9 SeitenHousing Finance 1HimanshiNoch keine Bewertungen

- Housing Finance and NHBDokument19 SeitenHousing Finance and NHBiqbal_puneetNoch keine Bewertungen

- Banks RM ProductsDokument20 SeitenBanks RM ProductsShruti AshokNoch keine Bewertungen

- Housing Finance IndustryDokument18 SeitenHousing Finance IndustrySiva annaNoch keine Bewertungen

- Financing of Joint Liability Groups (JLGS) of Micro Entrepreneurs /artisans in Non Farm SectorDokument6 SeitenFinancing of Joint Liability Groups (JLGS) of Micro Entrepreneurs /artisans in Non Farm SectorRakesh RanjanNoch keine Bewertungen

- A Comparative Study of Home Loan Finance Facilities in ShegaonDokument74 SeitenA Comparative Study of Home Loan Finance Facilities in ShegaonMpsc Banking ExamNoch keine Bewertungen

- HFA Guidelines March2016-English PDFDokument62 SeitenHFA Guidelines March2016-English PDFSourav HaitNoch keine Bewertungen

- Rajiv Awas YojanaDokument23 SeitenRajiv Awas YojanaRitika KherotiaNoch keine Bewertungen

- 3.4.5. Agricultural Debt Waiver and Debt Relief Scheme, 2008Dokument18 Seiten3.4.5. Agricultural Debt Waiver and Debt Relief Scheme, 2008RAJESHSAHU112Noch keine Bewertungen

- RBI Direction 25 July 2022Dokument13 SeitenRBI Direction 25 July 2022Tender infoNoch keine Bewertungen

- HousingDokument2 SeitenHousingANNENoch keine Bewertungen

- Housing LoansDokument37 SeitenHousing LoansHemant bhanawatNoch keine Bewertungen

- Objectives of NABARDDokument5 SeitenObjectives of NABARDAbhinav Ashok ChandelNoch keine Bewertungen

- NBCFDC-VISVAS FAQ BookletDokument12 SeitenNBCFDC-VISVAS FAQ Bookletnimish coolNoch keine Bewertungen

- AIFDokument2 SeitenAIFomkar maharanaNoch keine Bewertungen

- 1.1 Introduction To Reverse MortgageDokument20 Seiten1.1 Introduction To Reverse MortgageSandeep SandhuNoch keine Bewertungen

- NHB Guidelines On RMLDokument8 SeitenNHB Guidelines On RMLsreejit.mohanty4016Noch keine Bewertungen

- Pradhan Mantri Awas YojanaDokument4 SeitenPradhan Mantri Awas YojanaShah SwaraNoch keine Bewertungen

- Mo Ghara GuidelinesDokument28 SeitenMo Ghara GuidelinesRajnikant BilungNoch keine Bewertungen

- Is Government Sponsored Economic Assistance Aimed Towards Alleviating Housing Costs and Expenses For Impoverished People With Low To Moderate IncomesDokument12 SeitenIs Government Sponsored Economic Assistance Aimed Towards Alleviating Housing Costs and Expenses For Impoverished People With Low To Moderate Incomescass0608Noch keine Bewertungen

- Wok Bung Wantaim: Using Subnational Government Partnerships to Improve Infrastructure Implementation in Papua New GuineaVon EverandWok Bung Wantaim: Using Subnational Government Partnerships to Improve Infrastructure Implementation in Papua New GuineaNoch keine Bewertungen

- Banking India: Accepting Deposits for the Purpose of LendingVon EverandBanking India: Accepting Deposits for the Purpose of LendingNoch keine Bewertungen

- China 1 PDFDokument21 SeitenChina 1 PDFkayalonthewebNoch keine Bewertungen

- Appeal No.100 of 2015 (SZ) - National Green Tribunal - JudgmentDokument34 SeitenAppeal No.100 of 2015 (SZ) - National Green Tribunal - Judgmentkayalontheweb100% (1)

- Kayalpattinam Municipality - July 2015 - Draft Agenda - Version 1Dokument24 SeitenKayalpattinam Municipality - July 2015 - Draft Agenda - Version 1kayalonthewebNoch keine Bewertungen

- Brochure of UEF Trade Summit - 2015Dokument26 SeitenBrochure of UEF Trade Summit - 2015kayalonthewebNoch keine Bewertungen

- Appeal No.37 of 2014 (SZ) - National Green Tribunal - JudgmentDokument84 SeitenAppeal No.37 of 2014 (SZ) - National Green Tribunal - JudgmentkayalonthewebNoch keine Bewertungen

- Kayalpatnam Tombstones S RamachandranDokument3 SeitenKayalpatnam Tombstones S RamachandrankayalonthewebNoch keine Bewertungen

- Kayalpattinam Municipality - July 2015 - Draft Agenda - Version 1Dokument24 SeitenKayalpattinam Municipality - July 2015 - Draft Agenda - Version 1kayalonthewebNoch keine Bewertungen

- Form 4 LPG Linking Form - PAHAL / DBTLDokument1 SeiteForm 4 LPG Linking Form - PAHAL / DBTLkayalonthewebNoch keine Bewertungen

- Form2 LPG Linking FormDokument1 SeiteForm2 LPG Linking FormSayantan172Noch keine Bewertungen

- DCW LTD - Quarterly Results - Ending December 31, 2014Dokument4 SeitenDCW LTD - Quarterly Results - Ending December 31, 2014kayalonthewebNoch keine Bewertungen

- Form 3 LPG Linking Form - PAHAL / DBTLDokument1 SeiteForm 3 LPG Linking Form - PAHAL / DBTLkayalontheweb100% (2)

- Unified Form DBTLDokument1 SeiteUnified Form DBTLkayalonthewebNoch keine Bewertungen

- Grievance Redressal Form - Form 6Dokument2 SeitenGrievance Redressal Form - Form 6kayalonthewebNoch keine Bewertungen

- Local Body Election - Tamil Nadu - Candidate Affidavit (English)Dokument10 SeitenLocal Body Election - Tamil Nadu - Candidate Affidavit (English)kayalonthewebNoch keine Bewertungen

- Form-1 Bank Linking FormDokument1 SeiteForm-1 Bank Linking FormSayantan172Noch keine Bewertungen

- DCW Quareterly ResultsDokument4 SeitenDCW Quareterly ResultskayalonthewebNoch keine Bewertungen

- Septic Tank - New Regulations - Tamil NaduDokument24 SeitenSeptic Tank - New Regulations - Tamil NadukayalonthewebNoch keine Bewertungen

- EMPLOYEES' PROVIDENT FUND ORGANISATION - DCW LTD - August 2014Dokument28 SeitenEMPLOYEES' PROVIDENT FUND ORGANISATION - DCW LTD - August 2014kayalonthewebNoch keine Bewertungen

- DBTL Optout FormDokument1 SeiteDBTL Optout Formkayalontheweb100% (1)

- Wavoo Wajeeha Women's College - Annual Report - 2013-14Dokument29 SeitenWavoo Wajeeha Women's College - Annual Report - 2013-14kayalonthewebNoch keine Bewertungen

- Form 3 - Local Body Election - Tamil NaduDokument2 SeitenForm 3 - Local Body Election - Tamil Nadukayalontheweb0% (2)

- Local Body Election - Tamil Nadu - Candidate Affidavit (Tamil)Dokument17 SeitenLocal Body Election - Tamil Nadu - Candidate Affidavit (Tamil)kayalonthewebNoch keine Bewertungen

- DCW (Sahupuram, Kayalpattinam) Employees Satisfaction SurveyDokument68 SeitenDCW (Sahupuram, Kayalpattinam) Employees Satisfaction SurveykayalonthewebNoch keine Bewertungen

- KCGC Bullettin - Volume 1, Issue 2Dokument12 SeitenKCGC Bullettin - Volume 1, Issue 2kayalonthewebNoch keine Bewertungen

- Guide To Haj 1435 (Tamil)Dokument100 SeitenGuide To Haj 1435 (Tamil)kayalonthewebNoch keine Bewertungen

- DCW LTD Quarterly Result Ending June 30 2014Dokument3 SeitenDCW LTD Quarterly Result Ending June 30 2014kayalonthewebNoch keine Bewertungen

- LIST OF PTOs ALLOTTED QUOTA FOR HAJ 2014Dokument28 SeitenLIST OF PTOs ALLOTTED QUOTA FOR HAJ 2014kayalonthewebNoch keine Bewertungen

- Tamil Nadu Government - Notaries - 2014Dokument119 SeitenTamil Nadu Government - Notaries - 2014kayalonthewebNoch keine Bewertungen

- DCW Fourth Quarters and Annual Statement 2013-2014Dokument2 SeitenDCW Fourth Quarters and Annual Statement 2013-2014kayalonthewebNoch keine Bewertungen

- Understanding Culture Society, and PoliticsDokument3 SeitenUnderstanding Culture Society, and PoliticsVanito SwabeNoch keine Bewertungen

- Reflective Memo 1-PracticumDokument5 SeitenReflective Memo 1-Practicumapi-400515862Noch keine Bewertungen

- Alufix Slab Formwork Tim PDFDokument18 SeitenAlufix Slab Formwork Tim PDFMae FalcunitinNoch keine Bewertungen

- Historical Perspective of OBDokument67 SeitenHistorical Perspective of OBabdiweli mohamedNoch keine Bewertungen

- MBA-7002-20169108-68 MarksDokument17 SeitenMBA-7002-20169108-68 MarksN GNoch keine Bewertungen

- Edtpa Lesson 3Dokument3 SeitenEdtpa Lesson 3api-299319227Noch keine Bewertungen

- ACTIX Basic (Sample CDMA)Dokument73 SeitenACTIX Basic (Sample CDMA)radhiwibowoNoch keine Bewertungen

- Characteristics of Trochoids and Their Application To Determining Gear Teeth Fillet ShapesDokument14 SeitenCharacteristics of Trochoids and Their Application To Determining Gear Teeth Fillet ShapesJohn FelemegkasNoch keine Bewertungen

- Under Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisDokument13 SeitenUnder Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisMahmud RahmanNoch keine Bewertungen

- Sidomuncul20190313064235169 1 PDFDokument298 SeitenSidomuncul20190313064235169 1 PDFDian AnnisaNoch keine Bewertungen

- Sheet (8) Synchronous Machine Problem (1) :: SolutionDokument5 SeitenSheet (8) Synchronous Machine Problem (1) :: Solutionمكاريوس عيادNoch keine Bewertungen

- 04 Membrane Structure NotesDokument22 Seiten04 Membrane Structure NotesWesley ChinNoch keine Bewertungen

- Operator'S Manual PM20X-X-X-BXX: 2" Diaphragm PumpDokument12 SeitenOperator'S Manual PM20X-X-X-BXX: 2" Diaphragm PumpOmar TadeoNoch keine Bewertungen

- ARTS10 Q2 ModuleDokument12 SeitenARTS10 Q2 ModuleDen Mark GacumaNoch keine Bewertungen

- Lecture 1 Electrolyte ImbalanceDokument15 SeitenLecture 1 Electrolyte ImbalanceSajib Chandra RoyNoch keine Bewertungen

- Marine-Derived Biomaterials For Tissue Engineering ApplicationsDokument553 SeitenMarine-Derived Biomaterials For Tissue Engineering ApplicationsDobby ElfoNoch keine Bewertungen

- The Chassis OC 500 LE: Technical InformationDokument12 SeitenThe Chassis OC 500 LE: Technical InformationAbdelhak Ezzahrioui100% (1)

- Influence of Freezing and Pasteurization of The Physical Condition of The Plastik (PE, PP and HDPE) As Selar Fish Packaging (Selaroides Leptolepis) in Sendang Biru, Malang, East Java. IndonesiaDokument7 SeitenInfluence of Freezing and Pasteurization of The Physical Condition of The Plastik (PE, PP and HDPE) As Selar Fish Packaging (Selaroides Leptolepis) in Sendang Biru, Malang, East Java. IndonesiaInternational Network For Natural SciencesNoch keine Bewertungen

- OM Part B - Rev1Dokument45 SeitenOM Part B - Rev1Redouane BelaassiriNoch keine Bewertungen

- Subject: PSCP (15-10-19) : Syllabus ContentDokument4 SeitenSubject: PSCP (15-10-19) : Syllabus ContentNikunjBhattNoch keine Bewertungen

- CIGRE Operational Evaluation of RTV Coating Performance Over 17 Years On The Coastal Area at Jubail-SADokument9 SeitenCIGRE Operational Evaluation of RTV Coating Performance Over 17 Years On The Coastal Area at Jubail-SAMalik Shoaib khalidNoch keine Bewertungen

- Sinamics g120p Cabinet Catalog d35 en 2018Dokument246 SeitenSinamics g120p Cabinet Catalog d35 en 2018Edgar Lecona MNoch keine Bewertungen

- Small Business and Entrepreneurship ProjectDokument38 SeitenSmall Business and Entrepreneurship ProjectMădălina Elena FotacheNoch keine Bewertungen

- OracleCarrierManifestingPartnerIntegration PDFDokument40 SeitenOracleCarrierManifestingPartnerIntegration PDFvishal_vishnu11Noch keine Bewertungen

- Newsela Teacher Review - Common Sense EducationDokument1 SeiteNewsela Teacher Review - Common Sense EducationJessicaNoch keine Bewertungen

- Previous Papers GPSC Veterinary Officer AHI Advt. No. 33 2016 17 Date of Preliminary Test 08 01 2017 Subject Concerned Subject Que 101 To 300 Provisional Key PDFDokument18 SeitenPrevious Papers GPSC Veterinary Officer AHI Advt. No. 33 2016 17 Date of Preliminary Test 08 01 2017 Subject Concerned Subject Que 101 To 300 Provisional Key PDFDrRameem Bloch100% (1)

- DILG Opinion-Sanggunian Employees Disbursements, Sign Checks & Travel OrderDokument2 SeitenDILG Opinion-Sanggunian Employees Disbursements, Sign Checks & Travel OrderCrizalde de DiosNoch keine Bewertungen

- Chapter 08 MGT 202 Good GovernanceDokument22 SeitenChapter 08 MGT 202 Good GovernanceTHRISHIA ANN SOLIVANoch keine Bewertungen