Beruflich Dokumente

Kultur Dokumente

Rtgs Neft Request Form

Hochgeladen von

Feeroz Khan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

182 Ansichten2 SeitenRTGS / NEFT Transaction Request Form Please write in block letters We hereby request you to kindly make the transfer as per the details given below: Amount to be remitted (Rs. In figures): Amount (in words): Beneficiary Details: Beneficiary Name: Beneficiary Credit Account Number: Beneficiary Bank IFS Code (Mandatory 11 character field): is the destination account an NRE Account? customer shall ensure that the NRE Accounts of beneficiaries, if any, will be

Originalbeschreibung:

Originaltitel

rtgs_neft_request_form

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRTGS / NEFT Transaction Request Form Please write in block letters We hereby request you to kindly make the transfer as per the details given below: Amount to be remitted (Rs. In figures): Amount (in words): Beneficiary Details: Beneficiary Name: Beneficiary Credit Account Number: Beneficiary Bank IFS Code (Mandatory 11 character field): is the destination account an NRE Account? customer shall ensure that the NRE Accounts of beneficiaries, if any, will be

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

182 Ansichten2 SeitenRtgs Neft Request Form

Hochgeladen von

Feeroz KhanRTGS / NEFT Transaction Request Form Please write in block letters We hereby request you to kindly make the transfer as per the details given below: Amount to be remitted (Rs. In figures): Amount (in words): Beneficiary Details: Beneficiary Name: Beneficiary Credit Account Number: Beneficiary Bank IFS Code (Mandatory 11 character field): is the destination account an NRE Account? customer shall ensure that the NRE Accounts of beneficiaries, if any, will be

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

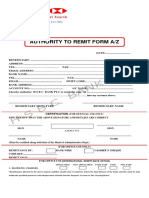

To: The Manager

Hongkong & Shanghai Banking Corporation

* Date: D1 D

3 M

1M2 Y2 0

Y Y1 Y

0

RTGS / NEFT Transaction Request Form

Please select ( ) one option (MANDATORY):

RTGS NEFT

* Please write in block letters

We hereby request you to kindly make the transfer as per the details given below:

* Amount to be remitted (Rs. In figures):

* Amount to be remitted (Rs. In words):

Beneficiary Details:

* Beneficiary Name:

* Beneficiary Credit Account Number:

* Beneficiary Bank IFS Code (Mandatory 11 character field):

Search for Beneficiary Bank and Branch IFSC Code

* Beneficiary Bank Name:

* Branch Name:

* Is the destination account an NRE Account? YES NO

Applicant (Remitter) Details:

* Account Title / Name:

* Debit Account Number:

* Details / Purpose of Payments (maximum 140 characters):

Please tick ( )(MANDATORY):

* I am/We are aware of the RTGS / NEFT system launched by the Reserve Bank of India

* I/We have read and understood the conditions printed overleaf and agree to be bound by the same

Stamp and Signature(s) of Authorized Signatory

For Bank Use Only

Signatures Verified

Fax Indemnity received

Agreement exists

CBID code

Terms & Conditions in respect of RTGS / NEFT Transactions

Rights and obligations of customer negligence or misconduct.

• The Customer shall be entitled , subject to other terms and • Customer shall ensure that the NRE Accounts of beneficiaries,

conditions in this Agreement, to issue an REFT request for if any, will be included in the REFT request after ensuring

execution by the Bank. compliance with the rules/regulations issued by Reserve Bank

of India (Foreign Exchange Department) from time to time

• The REFT request shall be issued by the Customer with

complete particulars provided and within the timelines • The Customer will ensure the security procedure established by

specified by the Bank from time to time. The Customer shall be the Bank for the purpose of verifying that the payment order or

responsible for the accuracy of the particulars given in the REFT communication is that of the customer or for detecting error in

request and shall be liable to compensate the Bank for any loss the transmission for the content of the funds transfer request or

arising on account of any error in the REFT request. communication. A security procedure may require the use of

• The Customer shall be bound by the REFT request executed by algorithms or other codes identifying words or numbers,

encryption mode, callback procedures or similar security

the Bank if the Bank had executed the REFT in good faith

and in compliance with the security procedure. devices . A security procedure once established shall remain

valid until amended by the Bank

• The Customer shall ensure availability of funds or available

limits in Customer’s account properly applicable to the REFT Rights and Obligation of the Bank

request before submitting the request to the Bank. However, if • The Bank shall execute the REFT request issued by the

the Bank executes the REFT without properly applicable funds

being a vailable in the Customer's account the Customer shall Customer duly authenticated by the Cust omer as verified by

the security procedure, unless:

be bound to pay to the Bank, the amount debited to Customer’s

account for which the REFT was executed by the Bank o The funds available in the account of the Customer are not

pursuant to Customer’s REFT request together with the

adequate or properly applicable to comply with the REFT

charges including interest payable to the Bank.

request and the Customer has not made any other arrange

• The Customer hereby authorizes the Bank to debit Customer’s ment to meet the payment obligation,

account for any liability incurred by the Bank for and due to the o The REFT request is incomplete or it is not issued in the

Execution of any REFT request issued by Customer agreed form,

to the Bank.

o The REFT request is attached with notice of any special

• In case the Customer requests the Bank to cancel or modify any conditions,

REFT request for whatever reason after submission of the REFT

request to the Bank , the Bank will make all reasonable efforts to o The Bank has reason to believe that the REFT request is

comply with the Customer’s request on a best efforts basis. issued to carry out an unlawful transaction,

However, the Bank is not liable for any failure to cancel or

modify the REFT request, if such request is received at a time or o The REFT request cannot be executed under the RBI’s RTGS,

under circumstances that renders the Bank unable to comply and/or NEFT system,.

with the Customer’s request. The Customer agrees that the • No REFT request issued by the Customer shall be binding on

REFT request shall become irrevocable when it is executed by

the Bank until the Bank has accepted it. . The bank will make all

The Bank.

reasonable efforts to comply with cust omer request, however,

• Customer agrees that the Bank is not bound by any notice of we are not liable for any failure to execute the REFT request , if,

such request is received at a time or under circumstances that

revocation unless it is in compliance with the security render us unable to comply with your request

procedure.

• The Bank shall, upon execution of every REFT request executed

• Customer agrees that Customer shall not be entitled to make

by it, be entitled to debit the designated account of the Cust

any claim against any party in the RBI RTGS or NEFT system

except the Bank omer, the amount of the funds transferred together with char

ges payable thereon, whether or not the account has

• Customer agrees that in the event of any loss suffered by the sufficient balance.

Customer on account of:

Force Majeure

o delay on the Bank’s part in the execution of the REFT • Neither party (i.e . Bank or Cust omer) will be liable for any delay

pursuant to a REFT request submitted as per the security

procedure, where such delay has arisen due to negligence or in performing or failure to perform any obligations hereunder

fraud on the part of any employee of the Bank, the Bank's due to any cause beyond its reasonable control, provided that

liability shall be limited to the extent of payment of interest where performance by one party is dependent upon perfor-

at the Bank Rate for any period of delay. mance by the other party and such performance is

delayed or fails in such circumstances , the other party shall not

o error in the execution of the REFT , pursuant to a REFT be obliged to perform (or shall be given such extended time to

requestsubmitted as per the security procedure, where such perform as is necessary in the circumstances) such obligations

error has occurred due to negligence or fraud on the part of

any employee of the Bank, the Bank’s liability shall be limited Governing Law

to the extent of refund of the principal amount together with

interest at the Bank Rate upto the date of refund.

• These terms and conditions shall be governed by the laws of

India

• Under no circumstances , Customer shall be entitled to claim

any compensation in excess of that which is provided in Definitions

clause (i) for any breach of contract or otherwise

For the purposes of these terms and conditions:

• Customer agrees that no special conditions shall be attached

• Bank shall mean The Hongkong and Shanghai Banking

to any REFT request under this agreement.

Corpor ation Limited

• The Customer agrees to indemnify the Bank and shall keep the • “REFT” means the RTGS / NEFT Funds Transfer

Bank indemnified from time to time and at all times hereafter

from any loss , claim, damage, cost, char ge and expenses

• "R TGS" means the Real Time Gross Settlement of Reserve

howsoever caused or arising out of or in connection with the Bank of India (RBI)

services offered by the Bank in terms of this Agreement, save • “NEFT” Facility means the electronic funds transfer facility

and except that caused through the Bank’s own error, gross

through the RBI NEFT system. Print Form

Das könnte Ihnen auch gefallen

- Audio Title: Beneficiary: Jack Smith Audio Download For February 23, 2009Dokument54 SeitenAudio Title: Beneficiary: Jack Smith Audio Download For February 23, 2009marisolchavez88% (32)

- International Wire Transfer Form PDFDokument1 SeiteInternational Wire Transfer Form PDFSumitNoch keine Bewertungen

- US Internal Revenue Service: f8879c - 2003Dokument2 SeitenUS Internal Revenue Service: f8879c - 2003IRSNoch keine Bewertungen

- Credit ReportDokument19 SeitenCredit ReportJaimee Tepper100% (3)

- Ag Gold Loan FormatDokument22 SeitenAg Gold Loan Formatmevrick_guy100% (1)

- (Please Specify) : Fedwire CH Chips BIC Bank Identifier CodeDokument1 Seite(Please Specify) : Fedwire CH Chips BIC Bank Identifier CodeThirdxkie Solosa RamosNoch keine Bewertungen

- Money Transfer Form - NewDokument2 SeitenMoney Transfer Form - Newbitane_meNoch keine Bewertungen

- Wire Transfer Receipt 3Dokument1 SeiteWire Transfer Receipt 3namdrikaleleNoch keine Bewertungen

- Payment ApprovalDokument1 SeitePayment ApprovalkanthigaduNoch keine Bewertungen

- PEMI - Investment Application Form (IAF)Dokument1 SeitePEMI - Investment Application Form (IAF)junmiguelNoch keine Bewertungen

- Mt103 Swift CodesDokument3 SeitenMt103 Swift CodesCh Waqas NawazNoch keine Bewertungen

- Gold Bullion & AgreementDokument61 SeitenGold Bullion & AgreementMahmoud AlkartaNoch keine Bewertungen

- Sending A Payment To Europe Gibraltar Nwi68546Dokument3 SeitenSending A Payment To Europe Gibraltar Nwi68546jamalazoz05Noch keine Bewertungen

- BrokerDokument286 SeitenBrokerPrakhar JainNoch keine Bewertungen

- Notes On Sales LawDokument61 SeitenNotes On Sales LawAj ManuelNoch keine Bewertungen

- Partnership Agreement On InvestmentDokument13 SeitenPartnership Agreement On InvestmentAnne Marie-NicholsonNoch keine Bewertungen

- Outstanding Processing FeeDokument2 SeitenOutstanding Processing Feeapi-3708362100% (1)

- HSBC Fund Transfer FORMDokument1 SeiteHSBC Fund Transfer FORMPinzariuSimona100% (1)

- B2B Bitcoin DT421-BTC 90K-1Dokument22 SeitenB2B Bitcoin DT421-BTC 90K-1ionel claudiu RatNoch keine Bewertungen

- Bank HSBC LTD Atm Card Payment NoticeDokument3 SeitenBank HSBC LTD Atm Card Payment NoticeGiriDharan100% (1)

- RR 2-98Dokument85 SeitenRR 2-98restless11Noch keine Bewertungen

- Remitly Matteo MazzaDokument4 SeitenRemitly Matteo MazzahkbiguivgNoch keine Bewertungen

- UTI - New Editable Transaction Application Form For Purchase Redemption and SwitchDokument2 SeitenUTI - New Editable Transaction Application Form For Purchase Redemption and SwitchAnilmohan Sreedharan0% (1)

- Application Form - Funds Transfer (SWIFT) / Demand Draft: Indian Overseas Bank, BangkokDokument2 SeitenApplication Form - Funds Transfer (SWIFT) / Demand Draft: Indian Overseas Bank, Bangkokdhanaraj4uNoch keine Bewertungen

- Tax ClearanceDokument1 SeiteTax ClearanceAmbrose Ikwueme100% (1)

- Internal Procedure Wire Fund Transfers: Financial Services DepartmentDokument4 SeitenInternal Procedure Wire Fund Transfers: Financial Services DepartmentPaul Julius de PioNoch keine Bewertungen

- Sending and Receiving Wire Transfers - CIBCDokument3 SeitenSending and Receiving Wire Transfers - CIBCGopi NathNoch keine Bewertungen

- Bank Loan Approval LetterDokument1 SeiteBank Loan Approval LetterHelge Sandoy100% (1)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintVon EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintBewertung: 4 von 5 Sternen4/5 (1)

- Outward Payment Form PDFDokument3 SeitenOutward Payment Form PDFGrehim IT consulting and Training LtdNoch keine Bewertungen

- Sap-Fico Course Content: Erp Concepts General Ledger Accounting (GL)Dokument2 SeitenSap-Fico Course Content: Erp Concepts General Ledger Accounting (GL)kumar_3233Noch keine Bewertungen

- HSBC Rtgs Form - 241109Dokument2 SeitenHSBC Rtgs Form - 241109Kevin HillNoch keine Bewertungen

- ContractsDokument15 SeitenContractsNnNoch keine Bewertungen

- PDFDokument2 SeitenPDFParesh GawandNoch keine Bewertungen

- Government Accounting Test BankDokument23 SeitenGovernment Accounting Test BankMyles Ninon LazoNoch keine Bewertungen

- Bank Loan Approval LetterDokument1 SeiteBank Loan Approval LetterHelge SandoyNoch keine Bewertungen

- 1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA December 6 2018Dokument14 Seiten1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA December 6 2018Jose Lahoz100% (1)

- Financial Scam - Prime Bank Investment SchemeDokument11 SeitenFinancial Scam - Prime Bank Investment SchemefarhanaNoch keine Bewertungen

- Temenos T24 Teller: User GuideDokument67 SeitenTemenos T24 Teller: User GuideYousra Hafid100% (2)

- NatWest Current Account Application Form Non UK EU ResDokument17 SeitenNatWest Current Account Application Form Non UK EU ResL mNoch keine Bewertungen

- Bank Guarantee (FormatDokument2 SeitenBank Guarantee (Formatmsadhanani3922Noch keine Bewertungen

- 1.permanent Account Number (Pan)Dokument13 Seiten1.permanent Account Number (Pan)Ali Shaikh AbdulNoch keine Bewertungen

- Payment PDFDokument1 SeitePayment PDFAnonymous Hdt55GxYNoch keine Bewertungen

- Cyrel Endaya: Your Changes Were Successfully SavedDokument1 SeiteCyrel Endaya: Your Changes Were Successfully SavedSally VibalNoch keine Bewertungen

- Uco Bank: Zonal Office: Hyderabad Revised Format Weekly Key Parameter Statement Branch: DateDokument3 SeitenUco Bank: Zonal Office: Hyderabad Revised Format Weekly Key Parameter Statement Branch: Datesuresh2323Noch keine Bewertungen

- SGS Analytical GuideDokument46 SeitenSGS Analytical GuideCésar VargasNoch keine Bewertungen

- Online Funds TransferDokument2 SeitenOnline Funds TransferKarthi kk mobileNoch keine Bewertungen

- CANCEL Bank Guarantee ApplicationDokument8 SeitenCANCEL Bank Guarantee ApplicationNhi NguyễnNoch keine Bewertungen

- Confirmation of Bank Details With Signature Attestation Form Annexure I PDFDokument1 SeiteConfirmation of Bank Details With Signature Attestation Form Annexure I PDFRaj PatelNoch keine Bewertungen

- Final Example-Long MessageDokument2 SeitenFinal Example-Long MessageJanette LabbaoNoch keine Bewertungen

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDokument1 SeiteThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoNoch keine Bewertungen

- Ejecting A Problem TenantDokument9 SeitenEjecting A Problem TenantYouthly ScribeNoch keine Bewertungen

- Transaction Receipt 2Dokument1 SeiteTransaction Receipt 2Mohammed RaffiNoch keine Bewertungen

- Seller'S F2F Closing ProcedureDokument2 SeitenSeller'S F2F Closing ProcedureTanayaa NandvidkarNoch keine Bewertungen

- How To Wire Money ToDokument13 SeitenHow To Wire Money ToscrewyouregNoch keine Bewertungen

- Bank Account Transfer LetterDokument1 SeiteBank Account Transfer LetterChanduChandran100% (1)

- Bank Vouchers BiDokument1 SeiteBank Vouchers BiJitu YadavNoch keine Bewertungen

- VIBHS - Funds Withdrawal RequestDokument3 SeitenVIBHS - Funds Withdrawal RequestAkhil HussainNoch keine Bewertungen

- Sila Masukkan Semua Maklumat Yang Berkenaan Dengan BetulDokument8 SeitenSila Masukkan Semua Maklumat Yang Berkenaan Dengan Betulmadir7712Noch keine Bewertungen

- KYC Test CasesDokument18 SeitenKYC Test CasesrekhaNoch keine Bewertungen

- Independent Contractor AgreementDokument5 SeitenIndependent Contractor AgreementWang JinNoch keine Bewertungen

- Council Special Agenda 6.28.22. 1Dokument19 SeitenCouncil Special Agenda 6.28.22. 1Live 5 NewsNoch keine Bewertungen

- Bank Islam IBDokument1 SeiteBank Islam IBMuhammad Khairul HafiziNoch keine Bewertungen

- HDFC Neft Rtgs FormDokument1 SeiteHDFC Neft Rtgs FormSameer Ganekar100% (4)

- Swift Car SampleDokument3 SeitenSwift Car SampleAjish KumarNoch keine Bewertungen

- DCB RTGSDokument2 SeitenDCB RTGSBharat VardhanNoch keine Bewertungen

- Rtgs Neft RulesDokument11 SeitenRtgs Neft RuleschennaimechNoch keine Bewertungen

- Terms and Conditions With Respect To RTGS/NEFT Transactions: DefinitionsDokument2 SeitenTerms and Conditions With Respect To RTGS/NEFT Transactions: DefinitionsSumeet Kumar TripathyNoch keine Bewertungen

- CF BILPL ClickWrapTermsAndConditionDokument13 SeitenCF BILPL ClickWrapTermsAndConditionNiaz RNoch keine Bewertungen

- Chapter 6 Solutions AllDokument41 SeitenChapter 6 Solutions AllDennis JeonNoch keine Bewertungen

- Feb2024-1Dokument8 SeitenFeb2024-1godkiller992018Noch keine Bewertungen

- Rib A Uk Chartered FormDokument8 SeitenRib A Uk Chartered FormralucaelenapricopNoch keine Bewertungen

- SWIFT Enabling The Future: A Payments Industry VisionDokument14 SeitenSWIFT Enabling The Future: A Payments Industry VisionforcetenNoch keine Bewertungen

- Bill of Supply For The Month of Sep 2021: Maharashtra State Electricity Distribution Co. LTDDokument3 SeitenBill of Supply For The Month of Sep 2021: Maharashtra State Electricity Distribution Co. LTDAshwin GoleNoch keine Bewertungen

- Merchandise Order Form NewDokument2 SeitenMerchandise Order Form NewTauqeer Salim100% (1)

- Audit Check ListDokument8 SeitenAudit Check ListpriyeshNoch keine Bewertungen

- JASTHAN RAJYA VIDYUT Construction Manual For Lines11A 2de236 - 8934 - RoDokument120 SeitenJASTHAN RAJYA VIDYUT Construction Manual For Lines11A 2de236 - 8934 - RoasirprakashNoch keine Bewertungen

- An Autonomous Organization Under The Department of Higher Education, Ministry of Education, Government of IndiaDokument19 SeitenAn Autonomous Organization Under The Department of Higher Education, Ministry of Education, Government of IndiaRicha PandeyNoch keine Bewertungen

- Answers 142-162Dokument19 SeitenAnswers 142-162AKHLAK UR RASHID CHOWDHURYNoch keine Bewertungen

- Rer Form Sample For Communication ExpenseDokument10 SeitenRer Form Sample For Communication ExpenseLorna RodriguezNoch keine Bewertungen

- ERP Document For Trading CompanyDokument37 SeitenERP Document For Trading Companyprashant badoniNoch keine Bewertungen

- Ab Document PDFDokument24 SeitenAb Document PDFSrikanth GabbetaNoch keine Bewertungen

- Final RFP UpssclDokument58 SeitenFinal RFP Upssclbikashsingh01Noch keine Bewertungen

- Pre-Employment Orientation Seminar CertificateDokument1 SeitePre-Employment Orientation Seminar CertificateLeniel Mae JovenNoch keine Bewertungen

- Issue 50Dokument24 SeitenIssue 50The Indian NewsNoch keine Bewertungen

- Social Gaming Merchant AccountDokument2 SeitenSocial Gaming Merchant AccountstarprocessingusNoch keine Bewertungen

- A Study On Consumer Satisfaction Towards E - Banking" With Special Reference To Syndicate Bank, Vidya Nagara, ShivamoggaDokument55 SeitenA Study On Consumer Satisfaction Towards E - Banking" With Special Reference To Syndicate Bank, Vidya Nagara, ShivamoggaShiva KumarNoch keine Bewertungen

- YDO - Citizen Charter - 2019Dokument5 SeitenYDO - Citizen Charter - 2019Kat MendozaNoch keine Bewertungen

- Mcchord Afb Joint Base Lewis-Mcchord, Wa, UsaDokument1 SeiteMcchord Afb Joint Base Lewis-Mcchord, Wa, Usajessemoore234 INoch keine Bewertungen

- THESIS FINAL GROUP 3 EditedDokument44 SeitenTHESIS FINAL GROUP 3 EditedKathleen RamiloNoch keine Bewertungen