Beruflich Dokumente

Kultur Dokumente

Greening The MFIs Concept Paper

Hochgeladen von

Abong'o ChachaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Greening The MFIs Concept Paper

Hochgeladen von

Abong'o ChachaCopyright:

Verfügbare Formate

GREENING THE MICRO

FINANCE SECTOR

Strategy to Improve Ecological Soundness of Micro Finance

Institutions

INTRODUCTION

Micro finance businesses – which no less than the United Nations hailed as today’s

instruments of the poor and powerless in combating poverty – are no different from

typical businesses: they also pose environmental threats, although not as severe as

that of commercial giants.

But the good news is that there are many ways to check, report and mitigate the

negative impacts of micro finance businesses on the environment without sacrificing

their economic benefits to communities.

In recent years, environmental soundness has become synonymous to good

business. Businesses which have adopted tools such as environmental management

system (EMS), environmental management accounting (EMA), Cleaner Production

and waste minimization programs have somehow created a market niche as socially

responsible and fair companies.

MFIs and the Philippine Environment

In the Philippines, financial sector organizations are not required to integrate

environmental management and protection in their operations. Lack of legislation

indicates that most sectoral players, including micro-finance institutions (MFIs),

regard environmental management as an unlikely approach to enhance business

performance.

EMS also remains remote among MFIs because of lack of knowledge on links

between the environment and entrepreneurial efficiency.

Bulk of clients in micro finance operations are in micro and small enterprises (MSE),

which many experts say may not be totally innocent of harming the environment.

The website www.greenmicrofinance.org listed the following MSEs that pose

environmental hazards:

• Agriculture - crop, and cattle grazing

• Aquaculture

• Metal work and electroplating

• Forest product collecting, including fuel wood and non-timber forest products

• Pesticide and chemical manufacturing

• Tanneries

• Small-scale mining

• Textiles and dyeing operations

• Automobile and motor repair

• Wood processing (carpentry and construction)

• Transportation (rickshaws, taxis, and small buses)

These businesses, the website says, poorly dispose of their own hazardous wastes

because of lack of awareness, competence and commitment in waste management.

Weak enforcement of environmental laws and poor waste disposal infrastructure

further increase the threats from these businesses. More so, an individual MSE may

not pose a major threat but the problem looms when looking at the collective impact

of MSEs.

The Foundation for Sustainable Society, Inc, with its goal to lead in establishing eco-

enterprise standards, considers these developments as lush grounds in enabling

partner MFIs to pursue environment-friendly enterprises.

MFIs play roles in advancing the environment component of the triple bottom line

(3BL) framework of FSSI. They should all the more become active partners since

most of their clients fall under the abovementioned industries.

It is in this context that FSSI comes up with the strategy “Greening of the Micro

Finance Sector.” This paper is FSSI’s attempt to offer a matter-of-fact guide for MFIs

in using environmental management tools that would also suit their clients’ needs.

THE FRAMEWORK

MFI partners are engaged to use EMS and other environmental management and

productivity tools to improve environmental and financial performance.

The framework below involves interventions which are grounded on the

environmental policy of both FSSI and its MFI partners.

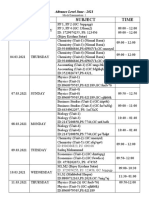

GREENING THE MICRO FINANCE SECTOR

PROJE

Inclusion of

Environmental Policy and environmental criteria

in investment and

Program financial appraisal

Business

Clients/Partner

• Support on EMS Promotion of s

Installation environmental

• Training Provision on Management &

FSSI various

MFI Productivity Tools

environmental Partners (EMA, Cleaner

management and Production, Good

productivity tools Housekeeping, Waste

• Incentive Provision Minimization

Improved Environmental and Financial Performance

INTEGRATING EMS IN MF SECTOR: SOME TOOLS AND

APPROACHES

(1) Awareness-raising programs and management trainings

MFIs are encouraged to use different techniques on raising environmental

awareness. These include dissemination of readily available information, education

and communication (IEC) materials such as flyers, video showing, and songs among

others; discussion sessions; individual orientation; and discussions during project

visits.

MFIs are also encouraged to maximize their built-in training program such as pre-

loan training to impart knowledge on environmental protection and management.

In the long term, FSSI would develop a social marketing plan to help promote the

greening strategy.

(2) Environmental assessment

MFIs are encouraged to use the environmental impact assessment (EIA) to influence

environmental management of client businesses.

EIA is an established tool in natural resource management that estimates the

environmental impact of a particular project, identifies measures to lessen impact,

and maps necessary alternatives.

(3) Loan application analysis

Loan applications are effective means to ask potential MFI clients on their activities.

Along the way, these could even complement EIA among their clients.

For instance, the material and energy flow accounting (MEFA), an established tool

on environmental management accounting, is used to determine environmental

impact of an enterprise based on input and output analysis in its production

processes.

MFIs could also simply discuss with clients on the potential environmental effects of

their operations, focusing on source of inputs, outputs and waste management

techniques.

(4) Sector and sub-sector based assessment and intervention delivery

MFI enterprise-borrowers are clustered into sectors or sub-sectors to facilitate

systematic EIA and effective implementation of environmental management

programs and projects.

This assessment tool is already embedded among enterprise development

organizations to enable entrepreneurs to identify production lapses, usually the

sources of environmental degradation.

(5) Incentives

MFIs provide their enterprise clients with incentives to encourage them to

incorporate environmental management in the production systems. Incentives may

include low interest rates, longer repayment schedules, and prospective loans or

investments. Another form of incentive is rewarding enterprises with the least

negative impact on the environment.

Net effect of these incentives is good banking reputation to the enterprises. This will

give them a cutting edge in selling their products and services in the market.

(6) Networks and partnerships

MFIs build networks in the public and private sector to improve knowledge and

skills on environmental management.

At some point, partner organizations assist in the implementation of environmental

management systems through training and technology development. They could

also obtain environmental certification at the MFI and their enterprise client level,

which could be an added value to certain products. MFIs work with organizations

that promote environment-friendly products, which actually provide credit or

business training needs of small producers.

Networking with government agencies and environmental groups also aim to

support entrepreneurs involved in recycling and waste management and small-scale

transportation. Government now require small transportation operators to improve

their efficiency or to switch to cleaner alternatives.

CONCLUSION

With their diversity and reach, micro finance institutions play significant roles to

achieve environmentally sustainable development. Their contributions are even

magnified because they are set in societies where the environment continues to face

strains from rapid population, industrialization and weak environmental awareness.

Tools and methods to mitigate environmental impact of small enterprises are

already in place. The larger task now is to institutionalize these systems in the target

enterprises and to ensure that they are efficiently implemented.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Service Manual 900 OG Factory 16V M85-M93Dokument572 SeitenService Manual 900 OG Factory 16V M85-M93Sting Eyes100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- FSR & FST First Stage Regulator: Maintenance Manual FOR Authorised TechniciansDokument23 SeitenFSR & FST First Stage Regulator: Maintenance Manual FOR Authorised TechniciansпавелNoch keine Bewertungen

- Large Generator Protection enDokument14 SeitenLarge Generator Protection enNguyen Xuan TungNoch keine Bewertungen

- Borrero Nuevo Delaunay Mendez - 2019 - Ethnographical and Historical Accounts For Understanding The Exploration of New Lands The Case PDFDokument16 SeitenBorrero Nuevo Delaunay Mendez - 2019 - Ethnographical and Historical Accounts For Understanding The Exploration of New Lands The Case PDFBárbara Olguín MuñozNoch keine Bewertungen

- Fop 2.1Dokument11 SeitenFop 2.1Paramita HalderNoch keine Bewertungen

- Installation Procedure for Castwel Supercast-II CastableDokument3 SeitenInstallation Procedure for Castwel Supercast-II CastableRAJKUMARNoch keine Bewertungen

- Bio-Climatic Tower/Eco-Tower: Bachelor of ArchitectureDokument12 SeitenBio-Climatic Tower/Eco-Tower: Bachelor of ArchitectureZorawar Singh Basur67% (3)

- Research 3Dokument30 SeitenResearch 3Lorenzo Maxwell GarciaNoch keine Bewertungen

- Appendix 1c Bridge Profiles Allan TrussesDokument43 SeitenAppendix 1c Bridge Profiles Allan TrussesJosue LewandowskiNoch keine Bewertungen

- Spatial data analysis with GIS (DEMDokument11 SeitenSpatial data analysis with GIS (DEMAleem MuhammadNoch keine Bewertungen

- Chapter 2 - Cross-Cultural Management SkillsDokument26 SeitenChapter 2 - Cross-Cultural Management Skillsfatematuj johoraNoch keine Bewertungen

- Pengaruh Komunikasi DGN KinerjaDokument15 SeitenPengaruh Komunikasi DGN KinerjaTitHa AwallunnisaNoch keine Bewertungen

- Factors Affecting Drying Rates and MechanismsDokument4 SeitenFactors Affecting Drying Rates and MechanismsMahesh VoraNoch keine Bewertungen

- Tos Template Arpan 1Dokument25 SeitenTos Template Arpan 1florence s. fernandezNoch keine Bewertungen

- Mock Examination Routine A 2021 NewDokument2 SeitenMock Examination Routine A 2021 Newmufrad muhtasibNoch keine Bewertungen

- Vehicle and Driver Vibration - PPTDokument16 SeitenVehicle and Driver Vibration - PPTAnirban MitraNoch keine Bewertungen

- JBF Winter2010-CPFR IssueDokument52 SeitenJBF Winter2010-CPFR IssueakashkrsnaNoch keine Bewertungen

- E-Governance in KeralaDokument10 SeitenE-Governance in KeralaRahmath SafeenaNoch keine Bewertungen

- BrainSpace - January 2024 CADokument46 SeitenBrainSpace - January 2024 CARafal ZawadkaNoch keine Bewertungen

- Electonics Final HandoutsDokument84 SeitenElectonics Final HandoutsDiane BasilioNoch keine Bewertungen

- Win Top Prizes in Investizo's SuperTrader ContestDokument3 SeitenWin Top Prizes in Investizo's SuperTrader ContestJafrid NassifNoch keine Bewertungen

- Reflection 4Dokument7 SeitenReflection 4danilo miguelNoch keine Bewertungen

- BS EN 50131-1998 Alarm Systems Intrusion Systems Part 6Dokument30 SeitenBS EN 50131-1998 Alarm Systems Intrusion Systems Part 6Michael Camit EsoNoch keine Bewertungen

- ZF 4hp14 - 2Dokument9 SeitenZF 4hp14 - 2Miguel BentoNoch keine Bewertungen

- Stress Amongst Healthcare Professionals and Migrant Workers During Covid-19 PandemicDokument6 SeitenStress Amongst Healthcare Professionals and Migrant Workers During Covid-19 PandemicIJAR JOURNALNoch keine Bewertungen

- Jigsaw IIDokument1 SeiteJigsaw IIapi-239373469Noch keine Bewertungen

- A.3s Scheme Used in Managing Epp ClassDokument35 SeitenA.3s Scheme Used in Managing Epp Classpixie02100% (2)

- Qc-Sop-0 - Drilling of PoleDokument7 SeitenQc-Sop-0 - Drilling of PoleAmeerHamzaWarraichNoch keine Bewertungen

- The Housekeeping Department: Learning Activity #1Dokument4 SeitenThe Housekeeping Department: Learning Activity #1Limar Geoff G. RosalesNoch keine Bewertungen

- Learn About Steganography TechniquesDokument11 SeitenLearn About Steganography TechniquesashaNoch keine Bewertungen