Beruflich Dokumente

Kultur Dokumente

Chapter 4 Test Bank Consolidation Techniques and Procedures: Investment Account?

Hochgeladen von

AldwinOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 4 Test Bank Consolidation Techniques and Procedures: Investment Account?

Hochgeladen von

AldwinCopyright:

Verfügbare Formate

Chapter 4 Test Bank

CONSOLIDATION TECHNIQUES AND PROCEDURES

Multiple Choice Questions

LO1

1. Which of the following will be debited to the Investment

account when the equity method is used?

a. Investee net losses.

b. Investee net profits.

c. Investee declaration of dividends.

d. Depreciation of excess purchase cost attributable to

investee equipment.

LO1

2. A parent company uses the equity method to account for its

wholly-owned subsidiary. The company correctly uses this method

and has fully reflected all items of subsidiary gain, loss,

income, deductions, and dividends. If the parent company is

preparing the consolidation working papers, which of the

following will be a correct working paper procedure for the

Investment account?

a. A debit for a subsidiary loss and a credit for dividends

received.

b. A credit for subsidiary income and a debit for dividends

received.

c. A debit for subsidiary dividends received and a credit for

a subsidiary loss.

d. A credit for a subsidiary loss and a credit for dividends

received.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-1

LO1

3. A parent corporation owns 55% of the outstanding voting common

stock of one domestic subsidiary, but does not control the

subsidiary because it is in bankruptcy. Which of the following

statements is correct?

a. The parent corporation must still prepare consolidated

financial statements for the economic entity.

b. The parent corporation must stop using the equity method of

accounting for the subsidiary and start using the cost

method.

c. The parent company may continue to use the equity method

but the subsidiary cannot be consolidated.

d. The parent company would suspend the operation of the

Investment account until notified by the bankruptcy court

that the subsidiary has emerged from bankruptcy.

LO1

Use the following information to answer questions 4 through 9.

On January 1, 2005, Finch Corporation purchased 75% of the common stock

of Grass Co. Separate balance sheet data for the companies at the

combination date are given below:

Finch Grass

Cash $ 24,000 $ 206,000

Accounts Receivable 144,000 26,000

Inventory 132,000 38,000

Land 68,000 32,000

Plant assets 700,000 300,000

Accum. Depreciation ( 240,000 ) ( 60,000 )

Investment in Lapp 392,000

Total assets $ 1,230,000 $ 542,000

Accounts payable $ 206,000 $ 142,000

Capital stock 800,000 300,000

Retained earnings 224,000 100,000

Total liabilities & equities $ 1,230,000 $ 542,000

At the date of combination, the book values of Grass’s net assets were

equal to the fair value except for Grass’s inventory, which had a fair

value of $60,000.

Determine below what the consolidated balance would be for each of the

requested accounts.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-2

4. What amount of Inventory will be reported?

a. $170,000.

b. $169,000.

c. $186,500.

d. $192,000.

5. What amount of Goodwill will be reported?

a. $10,500.

b. $20,000.

c. $42,000.

d. $75,500.

6. What amount of total liabilities will be reported?

a. $206,000.

b. $261,000.

c. $302,500.

d. $348,000.

7. What is the reported amount for the minority interest?

a. $ 69,333.

b. $100,000.

c. $130,666.

d. $150,000.

8. What is the amount of consolidated Retained Earnings?

a. $224,000.

b. $299,000.

c. $324,000.

d. $346,666.

9. What is the amount of total assets?

a. $1,244,500.

b. $1,380,000.

c. $1,472,000.

d. $1,762,000.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-3

LO2

10. Bird Corporation has several subsidiaries that are included in

its consolidated financial statements and several other

investments in corporations that are not consolidated. In its

year-end trial balance, the following intercompany balances

appear. Ostrich Corporation is the unconsolidated company; the

rest are consolidated.

Due from Pheasant Corporation $ 25,000

Due from Turkey Corporation 5,000

Cash advance to Skylark Company 8,000

Cash advance to Starling 15,000

Current receivable from Ostrich 10,000

What amount should Bird report as intercompany receivables on

its consolidated balance sheet?

a. $0.

b. $10,000.

c. $30,000.

d. $63,000.

LO3

11. The majority of errors in consolidated statements

a. result because the Investment in Subsidiary account on the

parent’s books and the subsidiary equity accounts on the

subsidiary’s books are reciprocal.

b. have conceptual problems from the minority interest

representation of the equity investment in consolidated net

assets by stockholders outside the affiliation structure.

c. involve the amortization of book/market differences.

d. appear when the consolidated balance sheet does not

balance.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-4

LO3

12. At the beginning of 2005, Starling Inc. acquired an 80%

interest in Orchard Corporation when the book values of

identifiable net assets equaled their fair values. On December

26, 2005, Orchard declared dividends of $50,000, and the

dividends were unpaid at year-end. Starling had not recorded

the dividend receivable at December 31. A consolidated working

paper entry is necessary to

a. enter $50,000 dividends receivable in the consolidated

balance sheet.

b. enter $40,000 dividends receivable in the consolidated

balance sheet.

c. reduce the dividends payable account by $40,000 in the

consolidated balance sheet.

d. eliminate the dividend payable account from the

consolidated balance sheet.

LO3

13. A parent company uses the equity method to account for its

wholly-owned subsidiary, but has applied it incorrectly. In

each of the past four full years, the company adjusted the

Investment account when it received dividends from the

subsidiary but did not adjust the account for any of the

subsidiary’s profits. The subsidiary had four years of profits

and paid yearly dividends in amounts that were less than

reported net incomes. Which one of the following statements is

correct if the parent company discovered its mistake at the end

of the fourth year, and is now preparing consolidation working

papers?

a. The parent company's Retained Earnings will be increased by

the cumulative total of four years of subsidiary profits.

b. The parent company's Retained Earnings will be increased by

the cumulative total of the first three years of subsidiary

profit, and the Subsidiary Income account will be increased

by the profit for the current year.

c. The parent company's Subsidiary Income account will be

increased by the cumulative total of four years of

subsidiary profits.

d. A prior period adjustment must be recorded for the

cumulative effect of four years of accounting errors.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-5

LO4

14. Pigeon Corporation acquired a 60% interest in Home Company on

January 1, 2005, for $70,000 cash when Home had Capital Stock

of $60,000 and Retained Earnings of $40,000. All excess

purchase cost was attributable to equipment with a 10-year

(straight-line) life. Home suffered a $10,000 net loss in 2005

and paid no dividends. At year-end 2005, Home owed Pigeon

$12,000 on account. Pigeon’s separate income for 2005 was

$150,000. Consolidated net income for 2005 was

a. $135,800.

b. $136,800.

c. $143,000.

d. $144,000.

LO4

15. On consolidated working papers, a subsidiary’s income has

a. to be reduced from beginning retained earnings.

b. to be completely eliminated.

c. to have an allocation between the noncontrolling interest

share and the parent’s share (which is eliminated).

d. only an entry in the parent company's general ledger.

LO4

16. Which one of the following will increase consolidated retained

earnings?

a. An increase in the value of goodwill subsequent to the

parent's date of acquisition.

b. The amortization of a $10,000 excess in the fair value of a

note payable over its recorded book value.

c. The depreciation of a $10,000 excess in the fair value of

equipment over its recorded book value.

d. The sale of inventory by a subsidiary that had a $10,000

excess in fair value over recorded book value on the

parent's date of acquisition.

LO5

17. In contrast with single entity organizations, consolidated

financial statements include which of the following in the

calculation of cash flows from operating activities under the

direct method?

a. The change in the balance sheet of the investee account.

b. Noncontrolling interest dividends.

c. Noncontrolling interest income expense.

d. Cash dividends from equity investees.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-6

LO5

18. In contrast with single entity organizations, consolidated

financial statements include which of the following in the

calculation of cash flows from operating activities under the

indirect method?

a. The change in the balance sheet of the investee account.

b. Noncontrolling interest dividends.

c. Noncontrolling interest income expense.

d. Cash dividends from equity investees.

LO5

19. In contrast with single entity organizations, in preparing

consolidated financial statements which of the following is a

subtraction in the calculation of cash flows from operating

activities under the indirect method?

a. The change in the balance sheet of the investee account.

b. Noncontrolling interest dividends.

c. Noncontrolling interest income expense.

d. Undistributed income of equity investees.

LO6

20. Which of the following would be used if the trial balance

new approach is followed?

a. Post-closing trial balances.

b. Adjusted trial balances.

c. Unadjusted trial balances.

d. All of the above are used equally.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-7

LO1

Exercise 1

Parrot Corporation acquired 80% of Hollow Co. on January 1, 2005 for

$24,000 cash when Hollow’s stockholders’ equity consisted of $10,000

of Common Stock and $3,000 of Retained Earnings. The difference

between the price paid by Parrot and the underlying equity acquired

in Hollow was allocated solely to a patent amortized over 10 years.

The separate company statements for Parrot and Hollow appear in the

first two columns of the partially completed consolidation working

papers.

Required:

Complete the consolidation working papers for Parrot and Hollow for

the year 2005.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-8

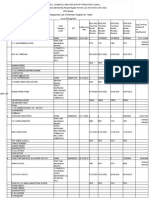

Parrot Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Non- Consol-

Parrot Hollow Debit Credit Cntl. idated

INCOME STATEMENT

Sales $ 20,000 $15,000

Income of Hollow 3,680

Cost of Sales ( 9,200) ( 4,700)

Other Expenses ( 2,300) ( 4,000)

Net income 12,180 6,300

Retained

Earnings 1/1 11,000 3,000

Add:

Net income 12,180 6,300

Less:

Dividends ( 3,000) ( 2,000)

Retained

Earnings 12/31 $ 20,180 $ 7,300

BALANCE SHEET

Cash 2,000 1,900

Accounts

Receivable-net 12,000 5,500

Inventories 14,000 8,000

Patent

Land 27,000 42,000

Equipment and

Buildings-net 60,000 43,000

Investment in

Hollow Co. 26,080

TOTAL ASSETS $ 141,080 $100,400

LIAB. & EQUITY

Accounts payable 90,900 83,100

Capital

Stock 30,000 10,000

Retained

Earnings 20,180 7,300

1/1 Noncontrol.

Interest

12/31 Noncontrol.

Interest

Earnings

TOTAL LIAB. & $

EQUITY 141,080 $100,400

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-9

LO2

Exercise 2

Cuckoo Company acquired all the voting stock of Perch Corporation on

January 1, 2004 for $70,000 when Perch had Capital Stock of $50,000

and Retained Earnings of $8,000. The excess of cost over book value

was allocated $3,000 to inventories that were sold in 2004, $4,000 to

equipment with a 4-year remaining useful life under the straight-line

method, and the remainder to goodwill.

Financial statements for Cuckoo and Perch at the end of the fiscal

year ended December 31, 2005 (two years after acquisition), appear in

the first two columns of the partially completed consolidation

working papers. Cuckoo has accounted for its investment in Slim using

an incomplete equity method of accounting.

Required:

Complete the consolidation working papers for Cuckoo Company and

Subsidiary.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-10

Cuckoo Company and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Non- Consol-

Cuckoo Perch Debit Credit Cntl idated

INCOME STATEMENT

Sales $ 206,000 $ 60,000

Income from

Perch 12,000

Cost of Sales (150,000) ( 30,000)

Other expenses ( 38,000) ( 18,000)

Net income 30,000 12,000

Cuckoo Retained

Earnings 1/1 24,000

Perch Retained

Earnings 10,000

Add:

Net income $ 30,000 $ 12,000

Less:

Dividends ( 20,000) ( 4,000)

Retained

Earnings 12/31 $ 34,000 $ 18,000

BALANCE SHEET

Other current

assets 14,000 7,000

Inventories 21,000 15,000

Land 11,000 6,000

Equipment and

Buildings-net 64,000 55,000

Investment in

Perch Corp. 80,000

TOTAL ASSETS $ 190,000 $ 83,000

LIAB. & EQUITY

Liabilities 56,000 15,000

Capital Stock 100,000 50,000

Retained

Earnings 34,000 18,000

TOTAL LIAB. &

EQUITY 190,000 83,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-11

LO2

Exercise 3

Owl Corporation acquired 90% of the voting stock of Hunt Corporation

on January 1, 2004 for $7,000 when Hunt had Capital Stock of $5,000

and Retained Earnings of $1,500. The excess of cost over book value

was allocated $150 to inventories that were sold in 2004, $200 to

undervalued land, $400 to undervalued equipment with a remaining

useful life of 5 years under the straight-line method, and the

remainder to goodwill.

Financial statements for Owl and Hunt Corporations at the end of the

fiscal year ended December 31, 2005 appear in the first two columns

of the partially completed consolidation working papers. Owl has

accounted for its investment in Hunt using the equity method of

accounting. Owl Corporation owed Hunt Corporation $100 on open

account at the end of the year. Dividends receivable in the amount

of $450 payable from Hunt to Owl is included in Owl’s net

receivables.

Required:

Complete the consolidation working papers for Owl Corporation and

Subsidiary.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-12

Owl Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Non- Consol-

Owl Hunt Debit Credit Cntl idated

INCOME STATEMENT

Sales $ 10,000 $ 6,500

Income from Hunt 1,270

Cost of Sales ( 4,000) ( 3,300)

Depreciation

expense ( 1,000) ( 1,000)

Other expenses ( 1,800) ( 700)

Net income 4,470 1,500

Retained

Earnings 1/1 2,510 2,000

Add:

Net income 4,470 1,500

Less:

Dividends ( 2,000) ( 1,000)

Retained

Earnings 12/31 $ 4,980 $ 2,500

BALANCE SHEET

Cash 1,440 1,900

Receivables-net 1,550 600

Inventories 1,500 1,200

Land 1,000 600

Equipment and

Buildings-net 7,500 5,700

Investment in

Hunt Corporation 7,590

TOTAL ASSETS $ 20,580 $10,000

LIAB. & EQUITY

Accounts payable 3,000 2,000

Dividends

payable 1,000 500

Capital Stock 11,600 5,000

Retained

Earnings 4,980 2,500

LIAB. & EQUITY $ 20,580 $10,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-13

LO3

Exercise 4

Koel Corporation acquired all the voting stock of Rain Company for

$500,000 on January 1, 2005 when Rain had Capital Stock of $300,000

and Retained Earnings of $150,000. Rain’s assets and liabilities were

fairly valued except for the plant assets. The entire cost-book

differential is allocated to plant assets and is fully depreciated on

a straight-line basis over a 10-year period.

During 2005, Koel borrowed $25,000 on a short-term non-interest-

bearing note from Rain, and on December 31, 2005, Koel mailed a check

to Rain to settle the note. Rain deposited the check on January 5,

2006, but receipt of payment of the note was not reflected in Rain’s

December 31, 2005 balance sheet.

Required:

Complete the consolidation working papers.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-14

Koel Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Non- Balance

Koel Rain Debit Credit Cntl Sheet

INCOME STATEMENT

Sales $ 500,000 $400,000

Income from

Rain 135,000

Cost of Sales (350,000) (200,000)

Other expenses (100,000) (60,000)

Net income 185,000 140,000

Koel Retained

Earnings 1/1 300,000

Rain Retained

Earnings 150,000

Add:

Net income $ 185,000 $140,000

Less:

Dividends (70,000)

Retained

Earnings 12/31 $ 485,000 $220,000

BALANCE SHEET

Note Receivable

from Koel 25,000

Other current

assets 210,000 300,000

Plant assets-

net 200,000 425,000

Investment in

Rain Company 565,000

TOTAL ASSETS $ 975,000 $750,000

EQUITIES

Liabilities 290,000 230,000

Capital Stock 200,000 300,000

Retained

Earnings 485,000 220,000

TOTAL EQUITIES $ 975,000 $750,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-15

LO4

Exercise 5

Owl Corporation acquired 90% of Barn Corporation on January 1, 2005

for $72,000 cash when Barn’s stockholders’ equity consisted of

$30,000 of Common Stock and $30,000 of Retained Earnings. The

difference between the price paid by Owl and the underlying equity

acquired in Barn was allocated to a plant asset with a remaining 10-

year straight-line life that was overvalued by $5,000. The remainder

was attributable to goodwill. The separate company statements for

Owl and Barn appear in the first two columns of the partially

completed consolidation working papers.

Required:

Complete the consolidation working papers for Owl and Barn for the

year 2005.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-16

Owl Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Min Consol-

Owl Barn Debit Credit Int idated

INCOME STATEMENT

Sales $ 60,000 $22,000

Income of Barn 3,510

Cost of Sales ( 13,000) ( 9,500)

Depreciation

Expense ( 2,000) ( 3,000)

Other

Expenses ( 23,000) ( 6,100)

Net income 25,510 3,400

Retained

Earnings 1/1 25,000 30,000

Add:

Net income 25,510 3,400

Less:

Dividends ( 15,000) ( 3,000)

Retained

Earnings 12/31 $ 35,510 $30,400

BALANCE SHEET

Cash 26,520 7,000

Accounts

Receivable-net 22,000 10,000

Inventories 20,000 14,000

Land 27,000 42,000

Equipment and

Buildings-net 70,000 38,000

Investment in

Barn Corporation 72,810

TOTAL ASSETS $ 238,330 $111,000

LIAB. & EQUITY

Accounts payable 32,820 50,600

Capital

Stock 170,000 30,000

Retained

Earnings 35,510 30,400

Noncontrolling

Interest

TOTAL LIAB. & $

EQUITY 238,330 $111,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-17

LO4

Exercise 6

Lorikeet Company has the following information collected in order to

do make a cash flow statement and uses the direct format for Cash

Flow from Operations. The annual report year end is December 31,

2005.

Noncontrolling Interest Dividends $20,000

Dividends Received from Equity Investees 17,000

Cash Paid to Employees 37,000

Cash Paid for Other Operating Activities 34,000

Cash Paid for Interest Expense 22,300

Cash Proceeds from the Sale of Equipment 70,000

Cash Paid to Suppliers 192,700

Cash Received from Customers 412,600

Required:

1. Prepare the Cash Flow for Operations part of the cash flow

statement for Lorikeet.

LO4

Exercise 7

Bronzewing Company has the following information collected in order

to do make a cash flow statement and uses the indirect format for

Cash Flow from Operations. The annual report year end is December

31, 2005.

Noncontrolling Interest Dividends $17,000

Undistributed Income of Equity Investees 7,500

Depreciation Expense 65,000

Consolidated Net Income 175,000

Increase in Accounts Payable 15,000

Amortization of Patent 13,000

Decrease in Accounts Receivable 48,000

Increase in Inventories 27,500

Gain on sale of equipment 45,000

Noncontrolling Interest Expense 17,000

Required:

1. Prepare the Cash Flow for Operations part of the cash flow

statement for Bronzewing.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-18

LO6

Exercise 8

Swift Corporation paid $88,500 for a 70% interest in Cave Corporation

on January 1, 2005, when Cave’s Capital Stock was $70,000 and its

Retained Earnings $30,000. The fair values of Cave's identifiable

assets and liabilities were the same as the recorded book values on

the acquisition date. Trial balances at the end of the year on

December 31, 2005 are given below:

Swift Cave

Inc. Inc.

Cash $ 4,500 $ 20,000

Accounts Receivable 25,000 30,000

Inventory 100,000 80,000

Investment in Cave 88,500

Cost of Goods Sold 60,000 40,000

Operating Expenses 22,000 37,000

Dividends 15,000 10,000

$ 315,000 $ 217,000

Liabilities $ 47,000 $ 27,000

Capital stock, $10 par value 100,000 70,000

Additional Paid-in Capital 10,000

Retained Earnings 31,000 30,000

Sales Revenue 120,000 90,000

Dividend Income 7,000

$ 315,000 $ 217,000

During 2005, Swift made only two journal entries with respect to its

investment in Cave. On January 1, 2005, it debited the Investment in

Cave account for $88,500 and on November 1, 2005, it credited

Dividend Income for $7,000.

Required:

1. Prepare a consolidated income statement and a statement of

retained earnings for Swift and Subsidiary for the year ended

December 31, 2005.

2. Prepare a consolidated balance sheet for Swift and Subsidiary as

of December 31, 2005.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-19

LO6

Exercise 9

Emu Corporation paid $77,000 for a 60% interest in Chick Inc. on

January 1, 2005, when Chick’s Capital Stock was $80,000 and its

Retained Earnings $20,000. The fair values of Chick's identifiable

assets and liabilities were the same as the recorded book values on

the acquisition date. Trial balances at the end of the year on

December 31, 2005 are given below:

Emu Chick

Inc. Inc.

Cash $ 4,500 $ 20,000

Accounts Receivable 25,000 30,000

Inventory 100,000 70,000

Investment in Cave 77,000

Cost of Goods Sold 71,500 50,000

Operating Expenses 22,000 37,000

Dividends 15,000 10,000

$ 315,000 $ 217,000

Liabilities $ 47,000 $ 27,000

Capital stock, $10 par value 100,000 80,000

Additional Paid-in Capital 11,000

Retained Earnings 31,000 20,000

Sales Revenue 120,000 90,000

Dividend Income 6,000

$ 315,000 $ 217,000

During 2005, Emu made only two journal entries with respect to its

investment in Chick. On January 1, 2005, it debited the Investment in

Chick account for $77,000 and on November 1, 2005, it credited

Dividend Income for $6,000.

Required:

1. Prepare a consolidated income statement and a statement of

retained earnings for Emu and Subsidiary for the year ended

December 31, 2005.

2. Prepare a consolidated balance sheet for Emu and Subsidiary as

of December 31, 2005.

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-20

SOLUTIONS

Multiple Choice Questions

1 b

2 d

3 c

4 c Parent’s inventory of $132,000 plus subsidiary’s

book value of inventory of $38,000 plus 75% of

the excess of the fair value over the book value

= $132,000+$38,000+(75%)x($22,000) = $186,500

5 d Purchase price minus 75% of Grass’s underlying

book value - $16,500 of excess cost over book

value allocated to inventory (see 9) =

$392,000 – (75%)x(400,000) - $16,500 = $75,500

6 d Just add the liability amounts together

7 b (25%)x($400,000) = $100,000

8 a The parent’s Retained Earnings is the amount of

consolidated Retained Earnings

9 c Cash $230,000

Accounts Receivable 170,000

Inventory $132,000+$38,000+ 186,500

$16,500=

Land 100,000

Plant assets-net 700,000

Goodwill 75,500

Total assets $1,472,000

10 b Intercompany receivables and

payables from unconsolidated

subsidiaries would not be

eliminated.

11 d

12 c

13 b

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-21

14 c Pigeon’s separate income $ 150,000

Less: 60% of Home’s $10,000 loss

= ( 6,000 )

Less: Equipment depreciation

$10,000/ 10 years = ( 1,000 )

Consolidated net income $ 143,000

15 c

16 b

17 d

18 c

19 d

20 b

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-22

Exercise 1

Parrot Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Non- Consoli-

Parrot Hollow Debit Credit Cntl. dated

INCOME STATEMENT

Sales $ 20,000 $ 15,000 $ 35,000

Income of Hollow 3,680 a $ 3,680

Cost of Sales ( 9,200) ( 4,700) ( 13,900)

Other

Expenses ( 2,300) ( 4,000) c 1,360 ( 7,660)

Minority Income $1,260 ( 1,260)

Net income 12,180 6,300 $ 12,180

Retained

Earnings 1/1 11,000 3,000 b 3,000 11,000

Add:

Net income 12,180 6,300 12,180

Less:

Dividends ( 3,000) ( 2,000) a $ 1,600 ( 400) 3,000

Retained

Earnings 12/31 $ 20,180 $ 7,300 $ 20,180

BALANCE SHEET

Cash 2,000 1,900 $ 3,900

Accounts

Receivable-net 12,000 5,500 17,500

Inventories 14,000 8,000 22,000

Patent b 13,600 c 1,360 12,240

Land 27,000 42,000 69,000

Equipment and

Buildings-net 60,000 43,000 103,000

Investment in a 2,080

Hollow Co. 26,080 b 24,000

TOTAL ASSETS $ 141,080 $100,400 $227,640

LIB. & EQUITY

Accounts payable 90,900 83,100 $174,000

Capital

Stock 30,000 10,000 b 10,000 30,000

Retained

Earnings 20,180 7,300 20,180

1/1 Noncontrol.

Interest b 2,600 2,600

12/31 Noncontrol.

Interest 3,460 3,460

TOTAL LIAB. &

EQUITY $ 141,080 $100,400 $227,640

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-23

Exercise 2

Cuckoo Company and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations

Balance

Sheet

Cuckoo Perch Debit Credit

INCOME STATEMENT

Sales $ 206,000 $60,000 $266,000

Income from a $ 1,000

Perch 12,000 b 11,000

Cost of Sales (150,000) ( 30,000) ( 180,000)

d 1,000

Other expenses ( 38,000) ( 18,000) ( 57,000)

Net income 30,000 12,000 29,000

Cuckoo Retained

Earnings 1/1 24,000 a 4,000 20,000

Perch Retained

Earnings 10,000 c 10,000

Add:

Net income $ 30,000 $12,000 29,000

Less:

Dividends ( 20,000) ( 4,000) b $( 4,000) ( 20,000)

Retained

Earnings 12/31 $ 34,000 $18,000 $ 29,000

BALANCE SHEET

Cash 14,000 7,000 21,000

Inventories 21,000 15,000 36,000

Land 11,000 6,000 17,000

Equipment and

Buildings-net 64,000 55,000 c 3,000 d 1,000 121,000

Investment in a 5,000

Perch Corporation 80,000 b 7,000

c 68,000

Goodwill c 5,000 5,000

TOTAL ASSETS $ 190,000 $83,000 $200,000

LIAB. & EQUITY

Liabilities 56,000 15,000 71,000

Capital Stock 100,000 50,000 c 50,000 100,000

Retained

Earnings 34,000 18,000 29,000

TOTAL LIAB. &

EQUITY $ 190,000 $83,000 $200,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-24

Exercise 3

Owl Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Balance

Owl Hunt Debit Credit Sheet

INCOME STATEMENT

Sales $ 10,000 $6,500 $16,500

Income from Hunt 1,270 a $1,270

Cost of Sales ( 4,000) ( 3,300) ( 7,300)

Depreciation

expense ( 1,000) ( 1,000) c 80 ( 2,080)

Other expenses ( 1,800) ( 700) ( 2,500)

Minority income $(150) ( 150)

Net income 4,470 1,500 4,470

Retained Earnings 2,510 2,000 b 2,000 2,510

Add:

Net income 4,470 2,500 4,470

Less:

Dividends ( 2,000) ( 1,000) a $ 900 (100) ( 2,000)

Retained

Earnings 12/31 $ 4,980 $ 2,500 $4,980

BALANCE SHEET

Cash 1,440 1,900 $3,340

d 100

Receivables-net 1,550 600 e 450 1,600

Inventories 1,500 1,200 2,700

Goodwill b 400 400

Land 1,000 600 b 200 1,800

Equipment and

Buildings-net 7,500 5,700 b 320 c 80 13,440

Investment in a 1,270

Hunt Corporation 8,490 b 7,220

TOTAL ASSETS $ 21,480 $10,000 $ 23,280

LIAB. & EQUITY

Accounts payable 3,000 2,000 d 100 $ 4,900

Dividends payable 1,000 500 e 450 1,050

Capital Stock 11,600 5,000 b 5,000 11,600

Retained earnings 5,880 3,500 4,980

Noncntl. interest

1/1 b 700 700

Noncntl. interest

12/31 850 750

LIAB. & EQUITY $ 21,480 $10,000 $ 23,280

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-25

Exercise 4

Koel Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2005

Eliminations Balance

Koel Rain Debit Credit Sheet

INCOME STATEMENT

Sales $ 500,000 $400,000 $900,000

Income from

Rain 135,000 b $135,000

Cost of Sales (350,000) (200,000) (550,000)

Other expenses (100,000) ( 60,000) d 5,000 (165,000)

Net income 185,000 140,000 185,000

Koel Retained

Earnings 1/1 300,000 300,000

Rain Retained

Earnings 150,000 c 150,000

Add:

Net income $ 185,000 $140,000 185,000

Less:

Dividends ( 70,000) b $70,000

Retained

Earnings 12/31 $ 485,000 $220,000 $485,000

BALANCE SHEET

Note Receivable

from Koel 25,000 a 25,000

Other current

assets 210,000 300,000 a 25,000 $535,000

Plant assets- c 50,000 d 5,000

net 200,000 425,000 670,000

Investment in b 65,000

Rain Company 565,000 c 500,000

TOTAL ASSETS $ 975,000 $750,000 $1,205,000

LIAB & EQUITY

Liabilities 290,000 230,000 520,000

Capital Stock 200,000 300,000 c 300,000 200,000

Retained

Earnings 485,000 220,000 485,000

TOTAL LIAB & EQUITY $ 975,000 $750,000 $1,205,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-26

Exercise 5

Owl Corporation and Subsidiary

Consolidated Balance Sheet Working Papers at December 31, 2005

Eliminations Min Consoli-

Owl Barn Debit Credit Int dated

INCOME STATEMENT

Sales $ 60,000 $ 22,000 $ 82,000

Income from Barn 3,510 a $ 3,510

Cost of Sales ( 13,000) ( 9,500) ( 22,500)

Depreciation

Expense ( 2,000) ( 3,000) d $ 450 ( 4,550)

Other

Expenses ( 23,000) ( 6,100) ( 29,100)

Minority Income $ 340 ( 340)

Net income 25,510 3,400 25,510

Retained

Earnings 1/1 25,000 30,000 b 30,000 25,000

Add:

Net income 25,510 3,400 25,510

Less:

Dividends ( 15,000) ( 3,000) a 2,700 $( 300) ( 15,000)

Retained

Earnings 12/31 $ 35,510 $30,400 $ 35,510

BALANCE SHEET

Cash 26,520 7,000 33,520

Accounts

Receivable-net 22,000 10,000 32,000

Inventories 20,000 14,000 34,000

Goodwill b 22,500 22,500

Land 27,000 42,000 69,000

Equipment and

Buildings-net 70,000 38,000 c 450 b 4,500 103,950

Investment in b 72,000

Barn Corporation 72,810

a 810

TOTAL ASSETS $ 238,330 $111,000 294,970

EQUITIES

Accounts payable 32,820 50,600 83,420

Capital

Stock 170,000 30,000 170,000

Retained

Earnings 35,510 30,400 35,510

1/1 Minority

Interest b 6,000 6,000

12/31 Minority

Interest 6,040 6,040

Earnings

TOTAL EQUITIES $ 238,330 $111,000 $294,970

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-27

Preliminary computations

Investment cost on January 1, 19X4 $ 72,000

Less: Book value acquired = (90%)x($60,000) = 54,000

Excess cost over book value acquired = $ 18,000

Excess allocated to:

Overvalued equipment ($5,000) x (90%)= $( 4,500)

Remainder to goodwill 22,500

Excess cost over book value $ 18,000

Income from Barn Corporation:

Equity in Barn’s net income (90%)x(3,400)= $ 3,060

Depreciation “savings” on equipment $4,500/10 yrs = 450

Income from Barn $ 1,260

Investment in Barn account:

Initial investment cost $ 72,000

Plus: Income from Barn 3,510

Less: Dividends (3,000)x(90%)= ( 2,700)

Investment in Barn at December 31 $ 72,810

Exercise 6

Lorikeet Company and Subsidiary Consolidated Statement of

Cash Flows for the Year Ended December 31,2005

Cash Flows from Operating Activities

Cash Received from Customers $412,600

Dividends Received from Equity Investees 17,000

Less

Cash Paid to Suppliers $192,700

Cash Paid to Employees 37,000

Cash Paid for Other Operating Activities 34,000

Cash Paid for Interest Expense 22,300 (286,000)

Net cash flows from operating activities $143,600

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-28

Exercise 7

Bronzewing Company and Subsidiary Consolidated Statement of

Cash Flows for the Year Ended December 31,2005

Cash Flows from Operating Activities

Consolidated Net Income $175,000

Adjustments to reconcile net income to cash

Noncontrolling Interest Expense $17,000

Undistributed Income of Equity Investees ( 7,500 )

Depreciation Expense 65,000

Increase in Accounts Payable 15,000

Amortization of Patent 13,000

Decrease in Accounts Receivable 48,000

Increase in Inventories ( 27,500 )

Gain on sale of equipment ( 45,000 ) 78,000

Net cash flows from operating activities 253,000

Exercise 8

Requirement 1

Swift and Subsidiary Corporation

Consolidated Income Statement

for the year ended December 31, 2005

Sales Revenue $ 210,000

Cost of Goods Sold 100,000

Gross Profit 110,000

Operating Expenses $ 59,000

Minority Interest Income 3,900

Total Expenses and Minority Income 62,900

Consolidated Net Income 47,100

Retained Earnings, January 1, 2005 31,000

Dividends ( 15,000)

Retained Earnings, December 31, 2005 $ 63,100

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-29

Requirement 2

Swift and Subsidiary Corporation

Consolidated Balance Sheet

December 31, 2005

Assets

Cash $ 24,500

Accounts Receivable 55,000

Inventory 180,000

Goodwill 18,500

Total Assets $ 278,000

Equities

Liabilities $ 74,000

Capital Stock 100,000

Additional Paid-in Capital 10,000

Retained Earnings 63,100

Minority Interest 30,900

Total Liabilities and Equities $ 278,000

Minority Interest Calculation:

$30,000 Beginning equity + $3,900 Net income - $3,000 Dividends = $30,900

Exercise 9

Requirement 1

Emu and Subsidiary Corporation

Consolidated Income Statement

for the year ended December 31, 2005

Sales Revenue $ 210,000

Cost of Goods Sold 121,500

Gross Profit 88,500

Operating Expenses $ 59,000

Minority Interest Income 1,200

Total Expenses and Minority Income 60,200

Consolidated Net Income 28,300

Retained Earnings, January 1, 2005 31,000

Dividends ( 15,000)

Retained Earnings, December 31, 2005 $ 44,300

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-30

Requirement 2

Emu and Subsidiary Corporation

Consolidated Balance Sheet

December 31, 2005

Assets

Cash $ 24,500

Accounts Receivable 55,000

Inventory 170,000

Goodwill 17,000

Total Assets $ 266,500

Equities

Liabilities $ 74,000

Capital Stock 100,000

Additional Paid-in Capital 11,000

Retained Earnings 44,300

Minority Interest 37,200

Total Liabilities and Equities $ 266,500

Minority Interest Calculation:

$40,000 Beginning equity + $1,200 Net income - $4,000 Dividends = $37,200

©2009 Pearson Education, Inc. publishing as Prentice Hall

4-31

Das könnte Ihnen auch gefallen

- An Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankDokument32 SeitenAn Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankKaren MagsayoNoch keine Bewertungen

- Chapter 10 Subsidiary Preferred StockDokument15 SeitenChapter 10 Subsidiary Preferred StockNicolas ErnestoNoch keine Bewertungen

- Test Bank CH 3Dokument32 SeitenTest Bank CH 3Sharmaine Rivera MiguelNoch keine Bewertungen

- Chapter 10 Subsidiary Preferred StockDokument28 SeitenChapter 10 Subsidiary Preferred StockNicolas ErnestoNoch keine Bewertungen

- ADV ACC TBch05Dokument21 SeitenADV ACC TBch05hassan nassereddineNoch keine Bewertungen

- Acc401advancedaccountingweek11quizfinalexam 170306122641Dokument103 SeitenAcc401advancedaccountingweek11quizfinalexam 170306122641Izzy BNoch keine Bewertungen

- ch11 Beams10e TBDokument28 Seitench11 Beams10e TBK. CustodioNoch keine Bewertungen

- Mid Advanced Acc. First09-10Dokument4 SeitenMid Advanced Acc. First09-10Carl Adrian ValdezNoch keine Bewertungen

- InvesmentDokument5 SeitenInvesmentMaricar San AntonioNoch keine Bewertungen

- Solution Final Advanced Acc. First09 10Dokument6 SeitenSolution Final Advanced Acc. First09 10RodNoch keine Bewertungen

- ch02 Beams10e TBDokument22 Seitench02 Beams10e TBbabycatine100% (3)

- AFAR SimulationDokument111 SeitenAFAR SimulationLloyd Sonica100% (1)

- Advanced Financial Accounting Work SheetDokument7 SeitenAdvanced Financial Accounting Work SheetAshenafi ZelekeNoch keine Bewertungen

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDokument27 SeitenChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationAlfi Wahyu TifaniNoch keine Bewertungen

- Adv Acct CH 6 HoyleDokument76 SeitenAdv Acct CH 6 Hoylewaverider750% (2)

- Adv Acct CH 6 HoyleDokument76 SeitenAdv Acct CH 6 HoyleFatima AL-SayedNoch keine Bewertungen

- Acc 4100 Chapter 2 QuestionsDokument13 SeitenAcc 4100 Chapter 2 Questionssam luiNoch keine Bewertungen

- Bac 412 - Advacc2-Reviewer For Final Departmental ExamDokument11 SeitenBac 412 - Advacc2-Reviewer For Final Departmental ExamAudreyMaeNoch keine Bewertungen

- Quiz 2 SolutionsDokument5 SeitenQuiz 2 Solutions820090150% (2)

- Chapter 10 Subsidiary Preferred StockDokument14 SeitenChapter 10 Subsidiary Preferred StockNicolas ErnestoNoch keine Bewertungen

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDF DownloadDokument8 SeitenModern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDF DownloadSpencerMoorenbds100% (24)

- CH 3Dokument6 SeitenCH 3usiddiquiNoch keine Bewertungen

- AFAR - BC OneDokument2 SeitenAFAR - BC OneJoanna Rose DeciarNoch keine Bewertungen

- Advacc Midterm ExamDokument13 SeitenAdvacc Midterm ExamJosh TanNoch keine Bewertungen

- Test Bank Advanced Accounting 3e by Jeter 05 ChapterDokument22 SeitenTest Bank Advanced Accounting 3e by Jeter 05 Chapterkevin galandeNoch keine Bewertungen

- Consolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsDokument290 SeitenConsolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsKim FloresNoch keine Bewertungen

- ADV ACC TBch04Dokument21 SeitenADV ACC TBch04hassan nassereddine100% (2)

- Far Pet Class - Mock Quiz CorporationDokument11 SeitenFar Pet Class - Mock Quiz CorporationNia BranzuelaNoch keine Bewertungen

- Chapter 03Dokument37 SeitenChapter 03Bilal SarwarNoch keine Bewertungen

- Afar 2019Dokument9 SeitenAfar 2019TakuriNoch keine Bewertungen

- AE 191 M-TEST 2 With AnswersDokument7 SeitenAE 191 M-TEST 2 With AnswersVenus PalmencoNoch keine Bewertungen

- Question - FS and FADokument4 SeitenQuestion - FS and FAPhương NhungNoch keine Bewertungen

- Ch15 Beams10e TBDokument22 SeitenCh15 Beams10e TBJenn sayongNoch keine Bewertungen

- BAC 522 Mid Term ExamDokument9 SeitenBAC 522 Mid Term ExamJohn Carlo Cruz0% (1)

- ACC 410 Critical AssignmentDokument34 SeitenACC 410 Critical AssignmentMichael LeibaNoch keine Bewertungen

- AccountingDokument9 SeitenAccountingTakuriNoch keine Bewertungen

- Partnerships - Formation, Operations, and Changes in Ownership InterestsDokument12 SeitenPartnerships - Formation, Operations, and Changes in Ownership InterestsJEFFERSON CUTENoch keine Bewertungen

- مانيول شابتر 3Dokument38 Seitenمانيول شابتر 3Abood AlissaNoch keine Bewertungen

- Chapter 09 Indirect and Mutual HoldingsDokument12 SeitenChapter 09 Indirect and Mutual HoldingsNicolas ErnestoNoch keine Bewertungen

- ADV ACC TBch03Dokument18 SeitenADV ACC TBch03hassan nassereddineNoch keine Bewertungen

- Ilide - Info Bac 412 Advacc2 Reviewer For Final Departmental Exam PRDokument11 SeitenIlide - Info Bac 412 Advacc2 Reviewer For Final Departmental Exam PRJoyce Anne GarduqueNoch keine Bewertungen

- Fundamentals of Advanced Accounting 5Th Edition Hoyle Test Bank Full Chapter PDFDokument52 SeitenFundamentals of Advanced Accounting 5Th Edition Hoyle Test Bank Full Chapter PDFDaisyHillyowek100% (12)

- Auditing Theory Solution Manual by SalosagcolDokument21 SeitenAuditing Theory Solution Manual by SalosagcolMiakaNoch keine Bewertungen

- Chapter 2 Financial Statement, Taxes - Cash Flow - Student VersionDokument4 SeitenChapter 2 Financial Statement, Taxes - Cash Flow - Student VersionNga PhamNoch keine Bewertungen

- Mixed Accounting QuestionsDokument10 SeitenMixed Accounting QuestionsSVTKhsiaNoch keine Bewertungen

- Chap 003Dokument37 SeitenChap 003ChuyuZhang100% (2)

- FM Testbank Ch03Dokument18 SeitenFM Testbank Ch03David LarryNoch keine Bewertungen

- Partial Text 2Dokument7 SeitenPartial Text 2Spring000Noch keine Bewertungen

- Chapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsDokument22 SeitenChapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsOBC LingayenNoch keine Bewertungen

- Consolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsDokument221 SeitenConsolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsAurcus JumskieNoch keine Bewertungen

- Financial Reporting: Specimen Exam Applicable From September 2016Dokument25 SeitenFinancial Reporting: Specimen Exam Applicable From September 2016Jodlike bolteNoch keine Bewertungen

- Financial Reporting: Specimen Exam Applicable From September 2016Dokument25 SeitenFinancial Reporting: Specimen Exam Applicable From September 2016Hari RamNoch keine Bewertungen

- PARCOR DiscussionDokument6 SeitenPARCOR DiscussionSittiNoch keine Bewertungen

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsVon EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNoch keine Bewertungen

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownVon EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNoch keine Bewertungen

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Von EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Noch keine Bewertungen

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachVon EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNoch keine Bewertungen

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Von EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Midterm - Special ExamDokument2 SeitenMidterm - Special ExamDhanica C. MabignayNoch keine Bewertungen

- Prelude To Industrial RevolutionDokument14 SeitenPrelude To Industrial RevolutionEslam FekryNoch keine Bewertungen

- Reading 2 The Time Value of Money in Finance - AnswersDokument20 SeitenReading 2 The Time Value of Money in Finance - Answersmenexe9137Noch keine Bewertungen

- Pros and ConsDokument4 SeitenPros and ConsShivani KarkeraNoch keine Bewertungen

- 1) - How Do Consumers Process and Evaluate Prices?Dokument4 Seiten1) - How Do Consumers Process and Evaluate Prices?Nasir HussainNoch keine Bewertungen

- Report On Quantitative Reporting Templates - PDF - ENDokument89 SeitenReport On Quantitative Reporting Templates - PDF - ENrox_dumitruNoch keine Bewertungen

- Reply To Notice 138Dokument4 SeitenReply To Notice 138LEED SP100% (1)

- A Statement of Account Is IssuedDokument13 SeitenA Statement of Account Is IssuedEliza Marie LisbeNoch keine Bewertungen

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDokument6 SeitenReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleSamyuktha RaoNoch keine Bewertungen

- SCS PDFDokument1 SeiteSCS PDFscs groupNoch keine Bewertungen

- Guidance For Outward International Swift Payment Off201117nwiDokument4 SeitenGuidance For Outward International Swift Payment Off201117nwijamalazoz05Noch keine Bewertungen

- Sr. No. Category Fixed Charges Energy Charges Domestic: AnnexureDokument5 SeitenSr. No. Category Fixed Charges Energy Charges Domestic: AnnexureAam aadmiNoch keine Bewertungen

- Excersie ETDokument2 SeitenExcersie ETdaoviethung29Noch keine Bewertungen

- Gpva PDF FreeDokument3 SeitenGpva PDF FreeMariah LuisaNoch keine Bewertungen

- PartnershipDokument49 SeitenPartnership20230773Noch keine Bewertungen

- Final CBR 21Dokument142 SeitenFinal CBR 21Prashant TiwariNoch keine Bewertungen

- Bank - Reconciliatio Statement PowerpointDokument61 SeitenBank - Reconciliatio Statement PowerpointLoida Yare LauritoNoch keine Bewertungen

- Arkansas Business Rankings: Wealthiest Arkansas Families.Dokument64 SeitenArkansas Business Rankings: Wealthiest Arkansas Families.gamypoet3380Noch keine Bewertungen

- Saving FunctionDokument3 SeitenSaving FunctionAsterisk SoulsNoch keine Bewertungen

- IM Gudang Sementara BPDokument1 SeiteIM Gudang Sementara BPFajar Abubakar RahanyamtelNoch keine Bewertungen

- Income Tax AssignmentDokument5 SeitenIncome Tax AssignmentsasmallulusitakantNoch keine Bewertungen

- CorporationDokument64 SeitenCorporationJanaisa BugayongNoch keine Bewertungen

- We Discussed How Hard It Is To Keep Ad StableDokument2 SeitenWe Discussed How Hard It Is To Keep Ad Stabletrilocksp SinghNoch keine Bewertungen

- Solar Power World 01 2021Dokument100 SeitenSolar Power World 01 2021Sorin PiciuNoch keine Bewertungen

- Practice Exercise 11-28-22Dokument82 SeitenPractice Exercise 11-28-22崔梦炎Noch keine Bewertungen

- Floor Ready Merchandise CommitteeDokument17 SeitenFloor Ready Merchandise Committeesahu_dishaNoch keine Bewertungen

- 09b - Micro - Demand and Supply - Changes in Market Price - Concept Consolidation Worksheet - Q&ADokument10 Seiten09b - Micro - Demand and Supply - Changes in Market Price - Concept Consolidation Worksheet - Q&Arrrrr88888Noch keine Bewertungen

- BHMH2002 - QP - V1 - B (Formatted) (Signed)Dokument9 SeitenBHMH2002 - QP - V1 - B (Formatted) (Signed)andy wongNoch keine Bewertungen

- Lesson 4 Sources of IncomeDokument9 SeitenLesson 4 Sources of IncomeErick MeguisoNoch keine Bewertungen

- All Panels - (All Categories) List of Member Eligible For VotesDokument385 SeitenAll Panels - (All Categories) List of Member Eligible For Votesshawon azamNoch keine Bewertungen