Beruflich Dokumente

Kultur Dokumente

Tax On Corporation

Hochgeladen von

MervidelleOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax On Corporation

Hochgeladen von

MervidelleCopyright:

Verfügbare Formate

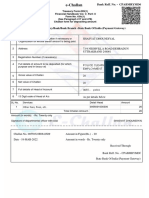

NAME: ____Mervidelle F.

Castro_______________________________________ DATE/SCORE: OCTOBER 17, 2020/ _____/90 QUIZ – TAX

ON CORPORATION

Direction: Read and solve the following problems below. Write your answers on the space provided after each letter. Provide your

solutions. 1. Dynasty Corporation just completed its third year of operations. It has the following financial information for the taxable year

2018, its third year:

Philippines China

Gross income P1,250,000 P800,000

Deductions 945,000 540,000

a. Assuming that the taxpayer is a domestic corporation, what is the taxable income? _565,000____.

b. What is the tax due? ___169,500_______.

c. Assuming that the taxpayer is a resident foreign corporation, what is the taxable income? __305,000_______.

d. What is the tax due? __91,500_______________.

e. Assume that the taxpayer is a non-resident foreign corporation, what is the taxable income? __1,250,000_____.

f. What is the tax due? ___375,000_______.

2. The following were computed income taxes (MCIT for minimum corporate income tax and NIT for normal income tax) of a domestic

corporation:

MCIT NIT

Seventh year P70,000 P20,000

Eight year 10,000 30,000

Ninth year 40,000 15,000

Tenth year 2,000 5,000

Eleventh year 45,000 80,000

(Disregard considerations of quarterly income tax payments). Compute the income tax for:

a. Seventh year? ____70,000____________________

b. Eight year? ______30,000______________

c. Ninth year? ______40,000______________

d. Tenth year? ______5,000______________

e. Eleventh year? ___80,000_______________

3. A domestic corporation, in its fourth year of operations, had the following data on transactions in each of the four quarters of a taxable

year:

First Second Third Fourth

Gross profit from sales P500,000 P350,000 P800,000 P900,000 Dividend income from a domestic corporation

20,000 20,000

Interest on bank deposit 4,000 8,000 12,000 Operating expenses 450,000 340,000 810,000 450,000

Income tax due (refundable or creditable) at the end of:

a. First quarter? _____15,000_____________

b. Second quarter? ___3,000______________

c. Third quarter? ______(3,000)_____________

d. Year? ___________129,000____________

4. A foreign corporation, authorized to do business in the Philippines by Philippine regulatory agencies, had the following data from

operations in 2018:

Gross income, Philippines P30,000,000

Gross income, Foreign 90,000,000

Business expenses, Philippines 10,000,000

Business expenses, Foreign 40,000,000

Out of the Philippine income, there was an actual remittance abroad of P8,500,000.

Philippine income tax on income from operations? ____6,000,000_____________.

Profit remittance tax paid? ____1,275,000__________________________________________.

5. The following nonresident foreign corporations operate in the Philippines with their respective income and expenses:

A. Butterfly Film, cinematographic film distributor:

Within Without

Gross receipts P10,000,000 P200,000,000

Cost of film distributed 6,000,000 120,000,000

Operating expenses 3,000,000 50,000,000

B. China Aircraft, a lessor of airplanes to Philippine Airlines:

Within Without

Gross receipts P20,000,000 P100,000,000

Operating expenses 15,000,000 80,000,000

What is the amount of Philippine income taxes to be paid by?

a. Butterfly Film _250,000________

b. China Aircraft __375,000_________________

“Education is the passport to the future, for tomorrow belongs to those who prepare for it today.” - Malcolm X

Das könnte Ihnen auch gefallen

- Materials - Controlling, Costing and PlanningDokument10 SeitenMaterials - Controlling, Costing and PlanningShane SabioNoch keine Bewertungen

- MGT 1 Cost Volume Profit RelationshipsDokument3 SeitenMGT 1 Cost Volume Profit RelationshipsExequiel AdradaNoch keine Bewertungen

- Strategic Cost Management Exercises 12369Dokument2 SeitenStrategic Cost Management Exercises 12369Arlene Diane OrozcoNoch keine Bewertungen

- Name: - Section: - Schedule: - Class Number: - DateDokument13 SeitenName: - Section: - Schedule: - Class Number: - Datechristine_pineda_2Noch keine Bewertungen

- QUIZ OPT Part IIDokument2 SeitenQUIZ OPT Part IIJenny Gomez Ibasco0% (2)

- Cost Acctg. - HO#9Dokument5 SeitenCost Acctg. - HO#9JOSE COTONER0% (1)

- Public Accountancy PracticeDokument69 SeitenPublic Accountancy Practicelov3m3100% (2)

- COST ACCTNG - Chapters 5-6 ActivitiesDokument30 SeitenCOST ACCTNG - Chapters 5-6 ActivitiesAnjelika ViescaNoch keine Bewertungen

- Partnership and CorporationDokument41 SeitenPartnership and CorporationJoana TatacNoch keine Bewertungen

- Job Order Costing Difficult RoundDokument8 SeitenJob Order Costing Difficult RoundsarahbeeNoch keine Bewertungen

- BLT Quizzer Unknown Donors TaxDokument6 SeitenBLT Quizzer Unknown Donors TaxtrishaNoch keine Bewertungen

- Property, Plant and EquipmentDokument40 SeitenProperty, Plant and EquipmentNatalie SerranoNoch keine Bewertungen

- Accounting For Factory OverheadDokument27 SeitenAccounting For Factory Overheadspectrum_480% (1)

- Chapter9-Accounting For LaborDokument46 SeitenChapter9-Accounting For LaborNashaNoch keine Bewertungen

- Process CostingDokument6 SeitenProcess Costingbae joohyun0% (2)

- Cost - Concepts and ClassificationsDokument23 SeitenCost - Concepts and ClassificationsYehetNoch keine Bewertungen

- CH 27 FinmanDokument3 SeitenCH 27 FinmanKismith Aile MacedaNoch keine Bewertungen

- AFAR.020 JIT and Backflush CostingquestDokument3 SeitenAFAR.020 JIT and Backflush CostingquestZao MeshikovNoch keine Bewertungen

- Eoq PDFDokument23 SeitenEoq PDFMica Ella Gutierrez0% (1)

- Solman Cost Accounting 1 Guerrero 2015 Chapters 1-16 PDFDokument46 SeitenSolman Cost Accounting 1 Guerrero 2015 Chapters 1-16 PDFMarylorieanne CorpuzNoch keine Bewertungen

- Both Statements Are FalseDokument26 SeitenBoth Statements Are FalseBanana QNoch keine Bewertungen

- Ia FifoDokument5 SeitenIa FifoNadine SofiaNoch keine Bewertungen

- Accounting 7 07 Cost Acctg Cost ManagementDokument7 SeitenAccounting 7 07 Cost Acctg Cost ManagementAvegail MagtuboNoch keine Bewertungen

- Economics PrelimsDokument2 SeitenEconomics PrelimsYannie Costibolo IsananNoch keine Bewertungen

- Chapter 1 Introduction To Cost AccountingDokument9 SeitenChapter 1 Introduction To Cost AccountingSteffany RoqueNoch keine Bewertungen

- CosthuliDokument7 SeitenCosthulikmarisseeNoch keine Bewertungen

- Fifo Costing Problems - Even and UnevenDokument3 SeitenFifo Costing Problems - Even and UnevenDarra MatienzoNoch keine Bewertungen

- Cost Accounting RefresherDokument16 SeitenCost Accounting RefresherDemi PardilloNoch keine Bewertungen

- TAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsDokument1 SeiteTAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsGie MaeNoch keine Bewertungen

- Accounting For Factory OverheadDokument12 SeitenAccounting For Factory OverheadStephNoch keine Bewertungen

- Assignment-VAT On Sale of Goods or PropertiesDokument2 SeitenAssignment-VAT On Sale of Goods or PropertiesBenzon Agojo OndovillaNoch keine Bewertungen

- CA - 06 Job Order CostingDokument6 SeitenCA - 06 Job Order CostingRonalyn ManuelNoch keine Bewertungen

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Dokument1 Seite(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoNoch keine Bewertungen

- Explaining Effects of Cost Misclassification and Its Impact On Decision MakingDokument1 SeiteExplaining Effects of Cost Misclassification and Its Impact On Decision MakingRikki Mae TeofistoNoch keine Bewertungen

- Activity 1 Cost Concepts and Cost BehaviorDokument2 SeitenActivity 1 Cost Concepts and Cost BehaviorLacie Hohenheim (Doraemon)Noch keine Bewertungen

- 7166materials Problems-Standard CostingDokument14 Seiten7166materials Problems-Standard CostingLumina JulieNoch keine Bewertungen

- Multiple Choice-ProbDokument5 SeitenMultiple Choice-ProbAngela RuedasNoch keine Bewertungen

- JocDokument7 SeitenJocYours Always 12:30100% (1)

- BUSE 3 - Practice ProblemDokument8 SeitenBUSE 3 - Practice ProblemPang SiulienNoch keine Bewertungen

- Variable Costing: A Decision-Making Perspective: True-False StatementsDokument8 SeitenVariable Costing: A Decision-Making Perspective: True-False StatementsJanina Marie GarciaNoch keine Bewertungen

- 2nd Week - The Master Budget ExercisesDokument5 Seiten2nd Week - The Master Budget ExercisesLuigi Enderez BalucanNoch keine Bewertungen

- Bus Com 12Dokument3 SeitenBus Com 12Chabelita MijaresNoch keine Bewertungen

- CVP Analysis in One ProductDokument6 SeitenCVP Analysis in One ProductShaira GampongNoch keine Bewertungen

- Acctg201 Assignment 1Dokument7 SeitenAcctg201 Assignment 1sarahbeeNoch keine Bewertungen

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDokument5 SeitenPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNoch keine Bewertungen

- Module 1.a The Accountancy ProfessionDokument6 SeitenModule 1.a The Accountancy ProfessionJonathanTipay0% (1)

- Sample ProblemDokument4 SeitenSample ProblemLealyn CuestaNoch keine Bewertungen

- Semi Final Exam AE23Dokument6 SeitenSemi Final Exam AE23HotcheeseramyeonNoch keine Bewertungen

- Ronquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodDokument9 SeitenRonquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodRamainne RonquilloNoch keine Bewertungen

- Chapter 4 Job Order CostingDokument9 SeitenChapter 4 Job Order CostingSteffany RoqueNoch keine Bewertungen

- Seatwork # 1Dokument2 SeitenSeatwork # 1Joyce Anne GarduqueNoch keine Bewertungen

- Far Ii Finals ProblemDokument17 SeitenFar Ii Finals ProblemSaeym SegoviaNoch keine Bewertungen

- Intermediate Accounting - Investment PropertyDokument22 SeitenIntermediate Accounting - Investment PropertyNickNoch keine Bewertungen

- Cost Acc G4 2Dokument6 SeitenCost Acc G4 2Asdfghjkl LkjhgfdsaNoch keine Bewertungen

- Cost Accounting ProblemsDokument3 SeitenCost Accounting ProblemsRowena TamboongNoch keine Bewertungen

- Income Tax QuizDokument1 SeiteIncome Tax QuizMervidelleNoch keine Bewertungen

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Dokument3 SeitenName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- Intax-Activity 1Dokument1 SeiteIntax-Activity 1Venus PalmencoNoch keine Bewertungen

- Of Shares Of: ST ND RDDokument6 SeitenOf Shares Of: ST ND RDKingChryshAnneNoch keine Bewertungen

- Taxation SituationalDokument113 SeitenTaxation SituationalDaryl Mae Mansay100% (1)

- Linux ComputerDokument15 SeitenLinux ComputerMervidelleNoch keine Bewertungen

- Grita Case Study 7Dokument2 SeitenGrita Case Study 7Mervidelle100% (1)

- Lobrigo Strat Pulp MagazineDokument1 SeiteLobrigo Strat Pulp MagazineMervidelle100% (1)

- Quiz 2Dokument2 SeitenQuiz 2MervidelleNoch keine Bewertungen

- Mervidelle Castro - Aud in CIS PrelimDokument3 SeitenMervidelle Castro - Aud in CIS PrelimMervidelleNoch keine Bewertungen

- Amla PDFDokument5 SeitenAmla PDFMervidelleNoch keine Bewertungen

- Anti Money Laundering Act PDFDokument8 SeitenAnti Money Laundering Act PDFMervidelleNoch keine Bewertungen

- Income Tax QuizDokument1 SeiteIncome Tax QuizMervidelleNoch keine Bewertungen

- Tax On Corporation - NotesDokument9 SeitenTax On Corporation - NotesMervidelleNoch keine Bewertungen

- Mervidelle Castro - GradesDokument5 SeitenMervidelle Castro - GradesMervidelleNoch keine Bewertungen

- SYNTDokument4 SeitenSYNTMervidelleNoch keine Bewertungen

- SM Ch5Dokument21 SeitenSM Ch5MervidelleNoch keine Bewertungen

- Jim Roppel Market Action 3Dokument1 SeiteJim Roppel Market Action 3LNoch keine Bewertungen

- Asian RegionalismDokument26 SeitenAsian RegionalismChesca Marie Arenal PeñarandaNoch keine Bewertungen

- RBI - Grade BDokument4 SeitenRBI - Grade Bamank114Noch keine Bewertungen

- Conceptions and Dimensions of DevelopmentDokument19 SeitenConceptions and Dimensions of DevelopmentGrace Talamera-Sandico100% (1)

- Relationship Between The Financial System and The Economic GrowthDokument2 SeitenRelationship Between The Financial System and The Economic GrowthMarcus AureliusNoch keine Bewertungen

- Economic integr-WPS OfficeDokument3 SeitenEconomic integr-WPS OfficeJohnNoch keine Bewertungen

- Dependency Theory PDFDokument12 SeitenDependency Theory PDFVartikaNoch keine Bewertungen

- Address - 1KFHE7w8BhaENAswwryaoccDb6qcT6DbYY - Mempool - Bitcoin ExplorerDokument9 SeitenAddress - 1KFHE7w8BhaENAswwryaoccDb6qcT6DbYY - Mempool - Bitcoin Explorermike100% (2)

- NR #2421B, 05.31.2011, Cooperatives Banking ActDokument1 SeiteNR #2421B, 05.31.2011, Cooperatives Banking Actpribhor2Noch keine Bewertungen

- Pax Britannica (1815-1914)Dokument4 SeitenPax Britannica (1815-1914)IzzahIkramIllahiNoch keine Bewertungen

- Michigan Unemployment Insurance AgencyDokument2 SeitenMichigan Unemployment Insurance AgencyCourtney BennettNoch keine Bewertungen

- Important Dates IEDDokument3 SeitenImportant Dates IEDMihika Guntur100% (1)

- Solved MR Alm Earned A 61 850 Salary and Recognized A 5 600Dokument1 SeiteSolved MR Alm Earned A 61 850 Salary and Recognized A 5 600Anbu jaromiaNoch keine Bewertungen

- Midterm Practice With AnswersDokument5 SeitenMidterm Practice With AnswersherrajohnNoch keine Bewertungen

- Tax InvoiceDokument1 SeiteTax InvoiceSunny SinghNoch keine Bewertungen

- SOADokument6 SeitenSOAHil HariNoch keine Bewertungen

- Currency Carry TradeDokument12 SeitenCurrency Carry TradeBhaskaryya BaruahNoch keine Bewertungen

- FKCHR21000013552626077712117306005Dokument2 SeitenFKCHR21000013552626077712117306005Dr. Bhoopendra FoujdarNoch keine Bewertungen

- Chapter-III Production and Employment: Fill in The BlanksDokument3 SeitenChapter-III Production and Employment: Fill in The Blanksrai venugopalNoch keine Bewertungen

- CFADokument2 SeitenCFAedupristine6Noch keine Bewertungen

- Credit Crisis of 1772Dokument1 SeiteCredit Crisis of 1772Aflia SabrinaNoch keine Bewertungen

- Name of The Treasury/Sub-Treasury/Bank/Bank Branch - State Bank of India (Payment Gateway)Dokument1 SeiteName of The Treasury/Sub-Treasury/Bank/Bank Branch - State Bank of India (Payment Gateway)Shasvat DhoundiyalNoch keine Bewertungen

- Statement of Account: Date IDR USD RemarkDokument8 SeitenStatement of Account: Date IDR USD RemarkRickyFernandoNoch keine Bewertungen

- Meaning and Scope of Foreign TradeDokument2 SeitenMeaning and Scope of Foreign Tradekrisszen67% (3)

- IMF & Developing Countries - An Argumentative EssayDokument19 SeitenIMF & Developing Countries - An Argumentative EssayMaas Riyaz Malik100% (7)

- PEST Analysis of The RMG Industries in BDokument2 SeitenPEST Analysis of The RMG Industries in BMd. Shazzadi Alam ParvezNoch keine Bewertungen

- The Abraaj Group Divests Its Stake in Careem To Kingdom Holding CompanyDokument3 SeitenThe Abraaj Group Divests Its Stake in Careem To Kingdom Holding CompanyMohNoch keine Bewertungen

- Macroeconomics Theory Final Q2Dokument6 SeitenMacroeconomics Theory Final Q2Michelle EsperalNoch keine Bewertungen

- Pestel Analysis of Banking Industry: BY: Nancy TatwaniDokument2 SeitenPestel Analysis of Banking Industry: BY: Nancy TatwaninancyNoch keine Bewertungen

- PAN of All Banks in IndiaDokument21 SeitenPAN of All Banks in Indiakumar45caNoch keine Bewertungen