Beruflich Dokumente

Kultur Dokumente

Bir Form No. 0622

Hochgeladen von

Joel SyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bir Form No. 0622

Hochgeladen von

Joel SyCopyright:

Verfügbare Formate

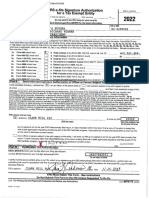

Annex B

(To be filled up tne BIR;

Republic of the Philippines Voluntary Assessment BIR Form No.

Department of Financei

Bureau of lnternal Revenue

and Payment Program (VAPP)

Payment Form

0622August 2020

Fill in all appllcable spaces. Mark all appropriate boxes with an "X" I

Voluntary Assessment

ffiffiilfiffi ffifr

ine ValidationiRevenue Official Receipt Details (lf not filed with the bank) Stamp of Receiving Office/AAB and Date of Receipt

(RO's Signature/Bank Teller's lnitial)

Taxpayer Classifi cation :

BIR Form 0622 - PAGE:

BIR Form No. 0622 - Voluntary Assessment and Payment program (VApp)

Payment Form

Guidelines and Instructions

Who Shall Use This Form

Any person. natural orjuridical, including estates and husts, liable to pay any intemal revenue taxes covering the

taxable year ending December 31,2018, and fiscal year ending on last day ofthe months ofJuly 2018 to June 2019

who due to inadveftence or otherwise erroneously paid his/its intemal revenue tax liabilities or failed to file tax

retums/pay to(es, may avail of the VAPP pursuant to RR No.

Where to Pay

This payment fbrm shall be accomplished in three (3) copies [original for Large Taxpayers (LT) Office/Revenue

District Office (RDO), duplicate for the taxpayer and triplicate for the collecting agentl. The amount payable shall be

paid with the Authorized Agent Bank (AAB) under the LT OfficeiRDO having jurisdiction over the ta:ipayer. In

places where there are no AABs, this form shall be filed and the tax shall be paid to the Revenue Collection Officer

(RCO) under the LT Office/RDO having iurisdiction over the taxpayer. The RCO shall issue an Electronic Revenue

Official Receipt (eROR) or manually issued ROR therefor.

Where the form is filed with an AAB, the taxpayer must accomplish and submit BlR-prescribed deposit slip,

which the bank teller machine-validate as evidence that payment was received by the AAB. The AAB receiving the

form sh.all stamp mark with the word "Received'' on the form and also machine validate the form as proof of filing and

VAPP payment of the taxpayer. The machine validation shall reflect the date of payment, amount paid and

transactions code, the name of the bank, branch code, teller's code and teller's initial. Bank debit memo number and

date should be indicated in the form for taxpayers paying under the bank debit system.

For one time transactions (ONETT) involving sale of real property, this form shall be filed and tax shall be paid

vvith the AAB/RCO under the RDo having jurisdiction over the location of the property.

Attachment

For additional payment arising from BIR Notice. copy of the said notice to this payment form.

Note:

l. This form shall cover t&x liabilities for one (l) taxable yearlperiod and/or taxable ONETTfor dparticular period

in 2018.

2. Payment should be in cash as a condition to avail of the privilege under RR No.

_ . Hence, non-cash modes of

payment such as Tax Debit Memo and the like. will not qualif as a valid payment.

3. For additional payment per BIRNotice, copy of the proof of payment shall be submitted to the concerned LT

OfficeiRDO prior to issuance of the Certificate of the Availment.

TE

r,Nl

sEP 1 u 2tjZfi

Das könnte Ihnen auch gefallen

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDokument144 SeitenLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- Registration, Taxation & Accounting Compliance of Construction IndustryDokument52 SeitenRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNoch keine Bewertungen

- 7 ElevenDokument17 Seiten7 ElevenCir Arnold Santos IIINoch keine Bewertungen

- Chapter 2 (Basic Financial Statements)Dokument25 SeitenChapter 2 (Basic Financial Statements)Brylle Leynes100% (1)

- RTMF 990Dokument49 SeitenRTMF 990Craig MaugerNoch keine Bewertungen

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNoch keine Bewertungen

- Transmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueDokument2 SeitenTransmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueLayne Kendee100% (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- Taxation Laws - Ms. de CastroDokument54 SeitenTaxation Laws - Ms. de CastroCC100% (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- The California Fire Chronicles First EditionDokument109 SeitenThe California Fire Chronicles First EditioneskawitzNoch keine Bewertungen

- Delisted Top Withholding Agents - Non-IndividualDokument20 SeitenDelisted Top Withholding Agents - Non-IndividualJoel SyNoch keine Bewertungen

- Green Bonds Getting The Harmony RightDokument82 SeitenGreen Bonds Getting The Harmony RightLía Lizzette Ferreira MárquezNoch keine Bewertungen

- Bir Form 0605Dokument2 SeitenBir Form 0605alona_245883% (6)

- For Amo WebinarsDokument79 SeitenFor Amo WebinarsLiezl Tizon ColumnasNoch keine Bewertungen

- 21St Century Computer Solutions: A Manual Accounting SimulationVon Everand21St Century Computer Solutions: A Manual Accounting SimulationNoch keine Bewertungen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Bir 0605Dokument11 SeitenBir 0605Sheelah Sawi0% (1)

- The Quarters Theory Chapter 1 BasicsDokument11 SeitenThe Quarters Theory Chapter 1 BasicsKevin MwauraNoch keine Bewertungen

- International Taxation In Nepal Tips To Foreign InvestorsVon EverandInternational Taxation In Nepal Tips To Foreign InvestorsNoch keine Bewertungen

- Bir Form Percentage TaxDokument3 SeitenBir Form Percentage TaxEc MendozaNoch keine Bewertungen

- 6939 - Cash and Accruals BasisDokument5 Seiten6939 - Cash and Accruals BasisAljur SalamedaNoch keine Bewertungen

- Sample Complaint For EjectmentDokument3 SeitenSample Complaint For EjectmentPatrick LubatonNoch keine Bewertungen

- FICO Configuration Transaction CodesDokument3 SeitenFICO Configuration Transaction CodesSoumitra MondalNoch keine Bewertungen

- Additional Withholding Agents - Non-IndividualsDokument14 SeitenAdditional Withholding Agents - Non-IndividualsJoel SyNoch keine Bewertungen

- Corporate Liquidation CaseDokument1 SeiteCorporate Liquidation CaseASGarcia24Noch keine Bewertungen

- Form 1600Dokument4 SeitenForm 1600KialicBetito50% (2)

- Treehouse Toy Library Business PlanDokument16 SeitenTreehouse Toy Library Business PlanElizabeth BartleyNoch keine Bewertungen

- Payment Form: Voluntary Assessment and Payment Program (VAPP)Dokument2 SeitenPayment Form: Voluntary Assessment and Payment Program (VAPP)Joel SyNoch keine Bewertungen

- RMC No. 108-2020 Annex BDokument2 SeitenRMC No. 108-2020 Annex BJoel SyNoch keine Bewertungen

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDokument2 SeitenReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNoch keine Bewertungen

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDokument3 SeitenRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNoch keine Bewertungen

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDokument4 SeitenMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNoch keine Bewertungen

- Tax Updates BGC Jekell Dec13, 2019Dokument115 SeitenTax Updates BGC Jekell Dec13, 2019Darlene GanubNoch keine Bewertungen

- Return of Percentage TaxDokument2 SeitenReturn of Percentage TaxfatmaaleahNoch keine Bewertungen

- 2551 MDokument2 Seiten2551 MAdrian AyrosoNoch keine Bewertungen

- 0605Dokument6 Seiten0605Ivy TampusNoch keine Bewertungen

- Payment Form: Kawanihan NG Rentas InternasDokument2 SeitenPayment Form: Kawanihan NG Rentas InternasJanice BautistaNoch keine Bewertungen

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDokument1 SeiteAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNoch keine Bewertungen

- RMC No. 76-2020Dokument11 SeitenRMC No. 76-2020Bobby LockNoch keine Bewertungen

- BIR Form No. 0622 - Rev - Guidelines2correctedDokument2 SeitenBIR Form No. 0622 - Rev - Guidelines2correctedjomarNoch keine Bewertungen

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDokument5 SeitenRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNoch keine Bewertungen

- Payment FormDokument2 SeitenPayment FormDaryl Jay YubalNoch keine Bewertungen

- BIR Payment Form for No Audit ProgramDokument1 SeiteBIR Payment Form for No Audit ProgramTzuyu TchaikovskyNoch keine Bewertungen

- POGO licensees BIR clearance requirementsDokument2 SeitenPOGO licensees BIR clearance requirementsAceGun'nerNoch keine Bewertungen

- RMC No. 73-2018Dokument3 SeitenRMC No. 73-2018Madi KomoaNoch keine Bewertungen

- Bir46 PDFDokument2 SeitenBir46 PDFJulia SmithNoch keine Bewertungen

- BIR Form 0605 - Annual Registration FeeDokument2 SeitenBIR Form 0605 - Annual Registration FeeRonn Robby Rosales100% (3)

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Dokument9 SeitenGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNoch keine Bewertungen

- CRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Dokument2 SeitenCRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Salman ArshadNoch keine Bewertungen

- DHBVN Tax Statement DeadlineDokument13 SeitenDHBVN Tax Statement DeadlineResearch AccountNoch keine Bewertungen

- BIR Form 0605Dokument3 SeitenBIR Form 0605rafael soriao0% (1)

- 2551QDokument3 Seiten2551QJerry Bantilan JrNoch keine Bewertungen

- Guidelines 1702-EX June 2013Dokument4 SeitenGuidelines 1702-EX June 2013Julio Gabriel AseronNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDokument2 SeitenGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNoch keine Bewertungen

- 1601e Form PDFDokument3 Seiten1601e Form PDFLee GhaiaNoch keine Bewertungen

- 1601e PDFDokument2 Seiten1601e PDFJanKhyrelFloresNoch keine Bewertungen

- Babu SinghDokument1 SeiteBabu SinghRohitNoch keine Bewertungen

- 0605 (July 1999)Dokument1 Seite0605 (July 1999)Yulo Vincent Bucayu PanuncioNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesVon EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNoch keine Bewertungen

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionVon EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNoch keine Bewertungen

- CPA Financial Accounting and Reporting: Second EditionVon EverandCPA Financial Accounting and Reporting: Second EditionNoch keine Bewertungen

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryVon EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- RMC No. 46-2021Dokument1 SeiteRMC No. 46-2021Joel SyNoch keine Bewertungen

- Revenue Memorandum Circular No.Dokument5 SeitenRevenue Memorandum Circular No.Joel SyNoch keine Bewertungen

- BB No. 2020-14Dokument1 SeiteBB No. 2020-14Joel SyNoch keine Bewertungen

- RMC No. 16-2022Dokument2 SeitenRMC No. 16-2022Joel SyNoch keine Bewertungen

- VAPP Clarifications on Tax Payment Program RulesDokument7 SeitenVAPP Clarifications on Tax Payment Program RulesKram Ynothna BulahanNoch keine Bewertungen

- Annex C - Vapp Bir NoticeDokument2 SeitenAnnex C - Vapp Bir NoticeJoel SyNoch keine Bewertungen

- RMC No. 108-2020Dokument1 SeiteRMC No. 108-2020Joel SyNoch keine Bewertungen

- RMO No. 39-2020 DigestDokument2 SeitenRMO No. 39-2020 DigestJoel SyNoch keine Bewertungen

- RMC No. 111-2020 (Digest)Dokument4 SeitenRMC No. 111-2020 (Digest)Joel SyNoch keine Bewertungen

- RMC No. 108-2020 (Digest)Dokument1 SeiteRMC No. 108-2020 (Digest)Joel SyNoch keine Bewertungen

- RMC No. 108-2020 Annex ADokument3 SeitenRMC No. 108-2020 Annex AJoel SyNoch keine Bewertungen

- RMO No. 34-2020 - DigestDokument1 SeiteRMO No. 34-2020 - DigestJoel SyNoch keine Bewertungen

- Annex A - Certificate of AvailmentDokument1 SeiteAnnex A - Certificate of AvailmentJoel SyNoch keine Bewertungen

- Annex C - Vapp Bir NoticeDokument2 SeitenAnnex C - Vapp Bir NoticeJoel SyNoch keine Bewertungen

- Annex F - Cancelled LAs-TVNsDokument2 SeitenAnnex F - Cancelled LAs-TVNsJoel SyNoch keine Bewertungen

- BIR Updates Issue No. 15Dokument1 SeiteBIR Updates Issue No. 15Joel SyNoch keine Bewertungen

- RMO No. 34-2020Dokument1 SeiteRMO No. 34-2020Joel SyNoch keine Bewertungen

- Annex CDokument1 SeiteAnnex CJoel SyNoch keine Bewertungen

- RMO No. 39-2020Dokument6 SeitenRMO No. 39-2020Joel SyNoch keine Bewertungen

- Annex E - Availments of VAPP FiledDokument1 SeiteAnnex E - Availments of VAPP FiledJoel SyNoch keine Bewertungen

- RR No. 21-2020Dokument10 SeitenRR No. 21-2020Joel SyNoch keine Bewertungen

- Annex D - Availments of VAPP FiledDokument1 SeiteAnnex D - Availments of VAPP FiledJoel SyNoch keine Bewertungen

- RR 21-2020 (Digest)Dokument4 SeitenRR 21-2020 (Digest)Joel SyNoch keine Bewertungen

- Annex A - Application Form BIR Form 2119Dokument2 SeitenAnnex A - Application Form BIR Form 2119Antonio Reyes IVNoch keine Bewertungen

- Included Individual TAMP Dec 16 2019Dokument6 SeitenIncluded Individual TAMP Dec 16 2019CROCS Acctg & Audit Dep'tNoch keine Bewertungen

- Marketing Strategy of Master CardDokument36 SeitenMarketing Strategy of Master CardParas GalaNoch keine Bewertungen

- Portfolio Management (Assignment)Dokument4 SeitenPortfolio Management (Assignment)Isha AggarwalNoch keine Bewertungen

- Study On Methanol Project in Puerto Libertad, The United Mexican StatesDokument91 SeitenStudy On Methanol Project in Puerto Libertad, The United Mexican StatesLamSalamNoch keine Bewertungen

- 21 Asian Terminals vs. First LepantoDokument9 Seiten21 Asian Terminals vs. First LepantoMichelle Montenegro - AraujoNoch keine Bewertungen

- Gift Case InvestigationsDokument17 SeitenGift Case InvestigationsFaheemAhmadNoch keine Bewertungen

- Transfer Register All: Bangladesh Krishi BankDokument13 SeitenTransfer Register All: Bangladesh Krishi Bankabdul kuddusNoch keine Bewertungen

- Analysis of Surety ReservesDokument14 SeitenAnalysis of Surety ReservesPaola Fuentes OgarrioNoch keine Bewertungen

- A Closed-Form GARCH Option Pricing ModelDokument34 SeitenA Closed-Form GARCH Option Pricing ModelBhuwanNoch keine Bewertungen

- Nigerian Stock Exchange Performance On Economic GrowthDokument18 SeitenNigerian Stock Exchange Performance On Economic GrowthsonyNoch keine Bewertungen

- FINC2011 Corporate Finance I: Semester 2, 2019Dokument1 SeiteFINC2011 Corporate Finance I: Semester 2, 2019Jackson ChenNoch keine Bewertungen

- Is Banking Becoming More CompetitiveDokument42 SeitenIs Banking Becoming More CompetitiveSwarnima SinghNoch keine Bewertungen

- Assignment 1 - Lecture 4 Protective Call & Covered Call Probelm Hatem Hassan ZakariaDokument8 SeitenAssignment 1 - Lecture 4 Protective Call & Covered Call Probelm Hatem Hassan ZakariaHatem HassanNoch keine Bewertungen

- Quoteplus I3 CMR LRB 26148085Dokument3 SeitenQuoteplus I3 CMR LRB 26148085janmejoydasNoch keine Bewertungen

- Business Math - Discounts Rate Interest (Version 1)Dokument56 SeitenBusiness Math - Discounts Rate Interest (Version 1)grace paragasNoch keine Bewertungen

- 190 Financial Math and Analysis Concepts-Open R 2014Dokument10 Seiten190 Financial Math and Analysis Concepts-Open R 2014api-250674550Noch keine Bewertungen

- Capital BudgetingDokument21 SeitenCapital BudgetingGabriella RaphaelNoch keine Bewertungen

- Pledge From Atty BontosDokument7 SeitenPledge From Atty BontosarielramadaNoch keine Bewertungen

- Rosillo:61-64: 61) Pratts v. CADokument2 SeitenRosillo:61-64: 61) Pratts v. CADiosa Mae SarillosaNoch keine Bewertungen

- Exam TimetableDokument17 SeitenExam Timetableninja980117Noch keine Bewertungen

- EC3114 Autumn 2022 CourseworkDokument2 SeitenEC3114 Autumn 2022 Courseworkjanani8Noch keine Bewertungen

- Critique of PDP 2017-2022 on Monetary and Fiscal PoliciesDokument19 SeitenCritique of PDP 2017-2022 on Monetary and Fiscal PoliciesKarlRecioBaroroNoch keine Bewertungen