Beruflich Dokumente

Kultur Dokumente

Exam 9 September 2020, Questions and Answers Exam 9 September 2020, Questions and Answers

Hochgeladen von

ben yi0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten2 SeitenThe document contains exam questions and answers about accounting.

The primary reasons for segmenting organizations are to promote specialization and cost efficiencies, and to help managers focus on narrow areas of responsibility. Accounting must be organizationally separate to maintain integrity and prevent financial bias between departments. Separating accounting restricts intrusion and ensures accounting reports measure income and are shared only with concerned parties.

Originalbeschreibung:

Originaltitel

exam-9-september-2020-questions-and-answers

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document contains exam questions and answers about accounting.

The primary reasons for segmenting organizations are to promote specialization and cost efficiencies, and to help managers focus on narrow areas of responsibility. Accounting must be organizationally separate to maintain integrity and prevent financial bias between departments. Separating accounting restricts intrusion and ensures accounting reports measure income and are shared only with concerned parties.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten2 SeitenExam 9 September 2020, Questions and Answers Exam 9 September 2020, Questions and Answers

Hochgeladen von

ben yiThe document contains exam questions and answers about accounting.

The primary reasons for segmenting organizations are to promote specialization and cost efficiencies, and to help managers focus on narrow areas of responsibility. Accounting must be organizationally separate to maintain integrity and prevent financial bias between departments. Separating accounting restricts intrusion and ensures accounting reports measure income and are shared only with concerned parties.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

lOMoARcPSD|6242499

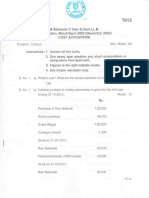

Exam 9 September 2020, questions and answers

Accountancy (First Asia Institute of Technology and Humanities )

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Mikay Lising (mikaylising28@gmail.com)

lOMoARcPSD|6242499

1.What are the primary reasons for segmenting organizations?

The primary reasons for segmenting organizations are to promote internal

efficiencies through specialization of labor and effective cost allocation of resources and

to help the managers focus their attention on narrow areas of responsibilities to attain

higher levels of operating efficiency. For example, there are organizations who are

conducting operations in different countries, they do this in order to gain access to

resources of distribution. Accordingly, each management of the firm are then organized

around each geographical segment as a quasi-autonomous entity. In a more enclosed

function like in business, functional segmentation dissects the organization into certain

areas of responsibilities based on tasks given such as finance, accounting, marketing

and production. Thus, these functional areas are determined in relation to the flow of the

primary resources through the entity.

2. Why is it important to organizationally separate the accounting function from other

functions of the organization?

It is important that the accounting function is separate from other functions of the

organization so that the integrity of the accounting function will be maintained. Having it

completely separated from the rest will prevent any financial bias toward a department

to another. For instance, the purpose of accounting is to ensure such profit and loss

over the entity’s property and to provide all the records for all the operations of the entity

which affects the financial position of the business. Since only accounting personnel are

normally working on it and it restricts any intrusion from purchasing or marketing

departments, the accounting reports and records are maintained to measure the income

of the entity and are communicated only to managers and interested parties alike.

Therefore, it should not be shared to all the employees of the entity. Thus, accounting

records should be shared only to those employees concerned with such matters.

Downloaded by Mikay Lising (mikaylising28@gmail.com)

Das könnte Ihnen auch gefallen

- Introduction To Research and Research MethodsDokument46 SeitenIntroduction To Research and Research MethodsStacie Simmons100% (4)

- Water Refilling Station Business ProposalDokument4 SeitenWater Refilling Station Business ProposalCarren BorasNoch keine Bewertungen

- WBCSD TIP Sustainability Driven SDG Tire Sector RoadmapDokument49 SeitenWBCSD TIP Sustainability Driven SDG Tire Sector RoadmapComunicarSe-ArchivoNoch keine Bewertungen

- Module Study Pack (Stretigic Management Accounting)Dokument328 SeitenModule Study Pack (Stretigic Management Accounting)Rimon BD100% (3)

- Four Green Houses... One Red HotelDokument325 SeitenFour Green Houses... One Red HotelDhruv Thakkar100% (1)

- SegmentationDokument5 SeitenSegmentationChahatBhattiAli75% (4)

- IFID BrochureDokument6 SeitenIFID BrochurePrabhakar SharmaNoch keine Bewertungen

- AccountsDokument9 SeitenAccountsReya TaujaleNoch keine Bewertungen

- RMK 9 - Groups 3 - Divisional Financial Performance MeasuresDokument9 SeitenRMK 9 - Groups 3 - Divisional Financial Performance MeasuresdinaNoch keine Bewertungen

- RMK 3 Divisional Financial Performance MeasuresDokument7 SeitenRMK 3 Divisional Financial Performance MeasuresdinaNoch keine Bewertungen

- CHAPTER 5 Management StudyDokument62 SeitenCHAPTER 5 Management StudyKrystel Ann Demaosa CarballoNoch keine Bewertungen

- P5 Apc NOTEDokument248 SeitenP5 Apc NOTEprerana pawarNoch keine Bewertungen

- Final Project On Cash Flow StatementDokument55 SeitenFinal Project On Cash Flow Statementkkishorekumar2601Noch keine Bewertungen

- Shivi Management AccountantDokument7 SeitenShivi Management AccountantShivin OvNoch keine Bewertungen

- MS - 43 Solved AssignmentDokument13 SeitenMS - 43 Solved AssignmentIGNOU ASSIGNMENTNoch keine Bewertungen

- FINANCE FOR MANAGER TERM PAPERxxxDokument12 SeitenFINANCE FOR MANAGER TERM PAPERxxxFrank100% (1)

- Strategic Management AccountingDokument4 SeitenStrategic Management AccountingAishah SamanNoch keine Bewertungen

- Mainfreight DraftDokument5 SeitenMainfreight Draft秦雪岭Noch keine Bewertungen

- Management Control SystemDokument7 SeitenManagement Control SystemAnjana PNoch keine Bewertungen

- Balanced Scorecard: Frequently Asked Questions (Faqs)Dokument3 SeitenBalanced Scorecard: Frequently Asked Questions (Faqs)ananndNoch keine Bewertungen

- F2 Notes LatestDokument267 SeitenF2 Notes LatestWaseem Ahmad100% (1)

- Accountd TRIM III ProjectDokument11 SeitenAccountd TRIM III ProjectcooL_ISHHHHHNoch keine Bewertungen

- Assigment - MifcoDokument13 SeitenAssigment - Mifcojitha nipunikaNoch keine Bewertungen

- ASSIGNMENT Principle ManagementDokument17 SeitenASSIGNMENT Principle ManagementSlim ShaddysNoch keine Bewertungen

- Mba 301Dokument26 SeitenMba 301Akash skillsNoch keine Bewertungen

- Contoh Assignment PDFDokument18 SeitenContoh Assignment PDFSiti Fatimah A Salam67% (3)

- MA515 Managerial Accounting Individual AssignmentDokument8 SeitenMA515 Managerial Accounting Individual AssignmentnepalsgreatNoch keine Bewertungen

- MA AssignmentDokument11 SeitenMA AssignmentGurung AnshuNoch keine Bewertungen

- Assignment Mfa 01Dokument5 SeitenAssignment Mfa 01Supriya SubashNoch keine Bewertungen

- Management 111204015409 Phpapp01Dokument12 SeitenManagement 111204015409 Phpapp01syidaluvanimeNoch keine Bewertungen

- Chapter - 3 MNC'S and International BusinessDokument27 SeitenChapter - 3 MNC'S and International BusinessRiks jainNoch keine Bewertungen

- Chapter I: Management and The Nature of Management AccountingDokument11 SeitenChapter I: Management and The Nature of Management AccountingMark ManuntagNoch keine Bewertungen

- Gateway Managerial Accounting Master (Dragged) 3Dokument1 SeiteGateway Managerial Accounting Master (Dragged) 3algokar999Noch keine Bewertungen

- Business ResearchDokument9 SeitenBusiness ResearchSahriar EmonNoch keine Bewertungen

- Sahriar EmonDokument9 SeitenSahriar EmonSahriar EmonNoch keine Bewertungen

- Chapter 7 - Strategy Implementation - NarrativeDokument14 SeitenChapter 7 - Strategy Implementation - NarrativeShelly Mae SiguaNoch keine Bewertungen

- Accounting ComparisonsDokument5 SeitenAccounting ComparisonsNeo MothaoNoch keine Bewertungen

- FEEDBACK On RestructureDokument4 SeitenFEEDBACK On Restructuresazia afrinNoch keine Bewertungen

- Mba 507: Management Accounting: Revised Edition 2013 Published by Kenya Methodist University P.O. BOX 267 - 60200, MERUDokument73 SeitenMba 507: Management Accounting: Revised Edition 2013 Published by Kenya Methodist University P.O. BOX 267 - 60200, MERUMarkmarie GaileNoch keine Bewertungen

- Responsibility AccountingDokument16 SeitenResponsibility AccountingSruti Pujari100% (3)

- SagarKaramchand Sanjay Shahid AmeetDokument23 SeitenSagarKaramchand Sanjay Shahid AmeetJaved DawoodaniNoch keine Bewertungen

- Buy-Side Business Attribution - TABB VersionDokument11 SeitenBuy-Side Business Attribution - TABB VersiontabbforumNoch keine Bewertungen

- Project Synopsis FinanceDokument8 SeitenProject Synopsis FinanceMuhammed SanadNoch keine Bewertungen

- Unit II - IBMDokument18 SeitenUnit II - IBMPal ShristiNoch keine Bewertungen

- Assignment On: "Impact of Cost Accounting On Business Decision Making in Manufacturing Industries of Bangladesh''Dokument9 SeitenAssignment On: "Impact of Cost Accounting On Business Decision Making in Manufacturing Industries of Bangladesh''Enaiya IslamNoch keine Bewertungen

- Dissertation On Strategic Management AccountingDokument6 SeitenDissertation On Strategic Management AccountingWhereToBuyWritingPaperCanada100% (1)

- Management Accounting CourseworkDokument5 SeitenManagement Accounting Courseworkydzkmgajd100% (2)

- What Is Strategic Business Unit (SBU) - Definition, Characteristics and Structure - Business JargonsDokument8 SeitenWhat Is Strategic Business Unit (SBU) - Definition, Characteristics and Structure - Business JargonsPRIYA GARGNoch keine Bewertungen

- FM Report Group8Dokument4 SeitenFM Report Group8MEGHA DAGARNoch keine Bewertungen

- Financial Management 1Dokument8 SeitenFinancial Management 1Nuraini JafarNoch keine Bewertungen

- Assignment ON: Course # Act201 Section: 1 Semester: Summer 2010Dokument11 SeitenAssignment ON: Course # Act201 Section: 1 Semester: Summer 2010Md MohimanNoch keine Bewertungen

- Rinjani Ummu Syina - 008201400093 Auditing I / Accounting I 2014Dokument4 SeitenRinjani Ummu Syina - 008201400093 Auditing I / Accounting I 2014Rinjani Ummu SyinaNoch keine Bewertungen

- (Name of Student) (Course ID) (Date)Dokument37 Seiten(Name of Student) (Course ID) (Date)zakiatalhaNoch keine Bewertungen

- Business Intelligence and Performance Management in Academic DisciplineDokument15 SeitenBusiness Intelligence and Performance Management in Academic DisciplineRajan ChristianNoch keine Bewertungen

- Use of The Balanced Scorecard For ICT Performance ManagementDokument14 SeitenUse of The Balanced Scorecard For ICT Performance ManagementHenry HoveNoch keine Bewertungen

- Q4. What Is Strategic Business Unit? What Are Conditions Required For Creating An Sbu? How Is Performance of Sbu Measured? What Are The Advantages and Disadvantages of Creating Sbus?Dokument4 SeitenQ4. What Is Strategic Business Unit? What Are Conditions Required For Creating An Sbu? How Is Performance of Sbu Measured? What Are The Advantages and Disadvantages of Creating Sbus?Jitendra AshaniNoch keine Bewertungen

- GVJ SIP ReportDokument26 SeitenGVJ SIP ReportRohit JainNoch keine Bewertungen

- To Enhance Learner's Understanding of The Disclosure Requirements of Published Financial StatementsDokument10 SeitenTo Enhance Learner's Understanding of The Disclosure Requirements of Published Financial StatementsKetz NKNoch keine Bewertungen

- Bbac 142 - Managerial Accounting 2022Dokument8 SeitenBbac 142 - Managerial Accounting 2022sipanjegivenNoch keine Bewertungen

- Management Accounting Course WorkDokument4 SeitenManagement Accounting Course Worknazziwa.sarahNoch keine Bewertungen

- Student Name: Nishat Shabbir Management Accounting AssignmentDokument13 SeitenStudent Name: Nishat Shabbir Management Accounting AssignmentaliNoch keine Bewertungen

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldVon EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNoch keine Bewertungen

- Performance Management - An Essential Discipline of SuccessVon EverandPerformance Management - An Essential Discipline of SuccessNoch keine Bewertungen

- Management Accounting for New ManagersVon EverandManagement Accounting for New ManagersBewertung: 1 von 5 Sternen1/5 (1)

- 2019 Icreate FSDokument4 Seiten2019 Icreate FSben yiNoch keine Bewertungen

- Module 3 Feedback and Control SystemDokument2 SeitenModule 3 Feedback and Control Systemben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 1 (Audit Objectives and Management Assertions)Dokument31 SeitenAuditing Concepts and Applications - Reviewer 1 (Audit Objectives and Management Assertions)ben yiNoch keine Bewertungen

- At-5909 Risk AssessmentDokument7 SeitenAt-5909 Risk Assessmentshambiruar100% (2)

- Auditing Concepts and Applications - Reviewer 3 (Audit Planning)Dokument29 SeitenAuditing Concepts and Applications - Reviewer 3 (Audit Planning)ben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 5 (Internal Control)Dokument28 SeitenAuditing Concepts and Applications - Reviewer 5 (Internal Control)ben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 6 (Risk of Fraud)Dokument21 SeitenAuditing Concepts and Applications - Reviewer 6 (Risk of Fraud)ben yiNoch keine Bewertungen

- Installment Sales Basic ProblemDokument1 SeiteInstallment Sales Basic Problemben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 1 (Audit Objectives and Management Assertions)Dokument31 SeitenAuditing Concepts and Applications - Reviewer 1 (Audit Objectives and Management Assertions)ben yiNoch keine Bewertungen

- 2019 Icreate Notes To FsDokument13 Seiten2019 Icreate Notes To FsJoanna GarciaNoch keine Bewertungen

- At Quizzer (CPAR) - Audit PlanningDokument9 SeitenAt Quizzer (CPAR) - Audit Planningparakaybee100% (3)

- Report of Independent AuditorDokument3 SeitenReport of Independent Auditorben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 4 (Materiality and Audit Risk)Dokument32 SeitenAuditing Concepts and Applications - Reviewer 4 (Materiality and Audit Risk)ben yiNoch keine Bewertungen

- Research Methods Handbook PDFDokument37 SeitenResearch Methods Handbook PDFWilliam Guillermo Galanto CustodioNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 3 (Audit Planning)Dokument29 SeitenAuditing Concepts and Applications - Reviewer 3 (Audit Planning)ben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 2 (Nature and Type of Audit Evidence)Dokument30 SeitenAuditing Concepts and Applications - Reviewer 2 (Nature and Type of Audit Evidence)ben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 4 (Materiality and Audit Risk)Dokument32 SeitenAuditing Concepts and Applications - Reviewer 4 (Materiality and Audit Risk)ben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 3 (Audit Planning)Dokument29 SeitenAuditing Concepts and Applications - Reviewer 3 (Audit Planning)ben yiNoch keine Bewertungen

- QUIZ1-Financial Markets QUIZ1 - Financial MarketsDokument6 SeitenQUIZ1-Financial Markets QUIZ1 - Financial Marketsben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 6 (Risk of Fraud)Dokument21 SeitenAuditing Concepts and Applications - Reviewer 6 (Risk of Fraud)ben yiNoch keine Bewertungen

- Auditing Concepts and Applications - Reviewer 5 (Internal Control)Dokument28 SeitenAuditing Concepts and Applications - Reviewer 5 (Internal Control)ben yiNoch keine Bewertungen

- Exam 3 February 2015, Questions and Answers Exam 3 February 2015, Questions and AnswersDokument15 SeitenExam 3 February 2015, Questions and Answers Exam 3 February 2015, Questions and Answersben yiNoch keine Bewertungen

- ACTIVITY # 2 - Number Systems and Codes Directions: Answer The Following Questions. Show The SolutionsDokument1 SeiteACTIVITY # 2 - Number Systems and Codes Directions: Answer The Following Questions. Show The Solutionsben yiNoch keine Bewertungen

- Chapter 17 Test BankDokument29 SeitenChapter 17 Test BankIvhy Cruz Estrella100% (1)

- Sample/practice Exam 10 May 2019, Questions and Answers Sample/practice Exam 10 May 2019, Questions and AnswersDokument2 SeitenSample/practice Exam 10 May 2019, Questions and Answers Sample/practice Exam 10 May 2019, Questions and Answersben yiNoch keine Bewertungen

- Income Taxation Solution Manual: 2019 TRAIN EditionDokument39 SeitenIncome Taxation Solution Manual: 2019 TRAIN EditionPoison Ivy100% (1)

- TRAIN Update PDFDokument73 SeitenTRAIN Update PDFaaronNoch keine Bewertungen

- Key Answer in Qualifying Exam Reviewer: TAX RFBT MASDokument1 SeiteKey Answer in Qualifying Exam Reviewer: TAX RFBT MASben yiNoch keine Bewertungen

- "The New Science of Salesforce Productivity": Reading SummaryDokument2 Seiten"The New Science of Salesforce Productivity": Reading SummarypratyakshmalviNoch keine Bewertungen

- BBA-2017 Punjab University Past PapersDokument97 SeitenBBA-2017 Punjab University Past PapersRana Amjad0% (1)

- Partnership Memory Aid AteneoDokument13 SeitenPartnership Memory Aid AteneojdispositivumNoch keine Bewertungen

- Corbridge The Impossibility of Development StudiesDokument34 SeitenCorbridge The Impossibility of Development StudiesJessy BalanagNoch keine Bewertungen

- Literature Review - Fashion and The Environment 1Dokument5 SeitenLiterature Review - Fashion and The Environment 1api-508580203Noch keine Bewertungen

- Luca Nogler, Udo Reifner Life Time ContractsDokument871 SeitenLuca Nogler, Udo Reifner Life Time ContractsMohamad mahdiNoch keine Bewertungen

- Monthly Digest Dec 2013Dokument134 SeitenMonthly Digest Dec 2013innvolNoch keine Bewertungen

- 3rd Sem Cost Accounting Apr 2023Dokument8 Seiten3rd Sem Cost Accounting Apr 2023Chandan GNoch keine Bewertungen

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDokument29 SeitenSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100Noch keine Bewertungen

- Analisis Konsumsi Rumah Tangga Petani Padi Dan Palawija Di Kabupaten DemakDokument11 SeitenAnalisis Konsumsi Rumah Tangga Petani Padi Dan Palawija Di Kabupaten DemakDinar SmurfNoch keine Bewertungen

- Writing Covered Calls: The Ultimate Guide ToDokument36 SeitenWriting Covered Calls: The Ultimate Guide ToRamus PerssonNoch keine Bewertungen

- Accounting Textbook Solutions - 37Dokument19 SeitenAccounting Textbook Solutions - 37acc-expertNoch keine Bewertungen

- Dissertation TopicsDokument5 SeitenDissertation TopicsAnuska MohantyNoch keine Bewertungen

- PDF DocumentDokument2 SeitenPDF DocumentNavya RaiNoch keine Bewertungen

- End of Life Management ICT PDFDokument68 SeitenEnd of Life Management ICT PDFFarah DivantiNoch keine Bewertungen

- T-IEET001 - Business-Model-Canvas - Ta-Ay, Jay L. - MEE31Dokument1 SeiteT-IEET001 - Business-Model-Canvas - Ta-Ay, Jay L. - MEE31JayNoch keine Bewertungen

- HR - Manpower PlanningDokument128 SeitenHR - Manpower PlanningPrashant Chaubey100% (1)

- 2023 HSC Business StudiesDokument22 Seiten2023 HSC Business StudiesSreemoye ChakrabortyNoch keine Bewertungen

- TUTORIAL 3 (Questions) Q1: UKAT3033/UBAT3033 Taxation IIDokument2 SeitenTUTORIAL 3 (Questions) Q1: UKAT3033/UBAT3033 Taxation IIIzaac PovanesNoch keine Bewertungen

- Pableo - Case Analysis Paper - Case Study 1.2Dokument2 SeitenPableo - Case Analysis Paper - Case Study 1.2Gerline PableoNoch keine Bewertungen

- 1Dokument51 Seiten1dakine.kdkNoch keine Bewertungen

- 6 Operations ImprovementDokument30 Seiten6 Operations ImprovementAnushaBalasubramanya100% (1)

- A Study On Customer Preference Towards Brand FactoryDokument21 SeitenA Study On Customer Preference Towards Brand FactoryH.Arokiaraj100% (2)

- Muhammad Irfan Arshad S/O Muhammad Arshad Tahir: Urriculum ItaeDokument3 SeitenMuhammad Irfan Arshad S/O Muhammad Arshad Tahir: Urriculum ItaeIrfan Arshad100% (2)

- Wcms 629759Dokument60 SeitenWcms 629759Avril FerreiraNoch keine Bewertungen