Beruflich Dokumente

Kultur Dokumente

Detecting Financial Statement Fraud and Profiling Fraudsters

Hochgeladen von

Aureen TabamoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Detecting Financial Statement Fraud and Profiling Fraudsters

Hochgeladen von

Aureen TabamoCopyright:

Verfügbare Formate

Error, Fraud, and Non

compliance LAR In an audit of

financial

Misstatements in FS can arise in fraud or error. Noncompliance with LAR cannot

cause a misstatement in FS because it is a legal duty.

RELATED STANDARDS

PSA 240 Redrafted) Auditor's responsibilities relating to fraud n an audit of

financial statements

in conjunction with the following:

PSA 315

PSA 330

PSQc 1

Code of Ethics

BASIC PREMISE

PSA 240.5 " AN auditor conducting an audit in accordance with PSAs is

responsible for obtaining reasonable assurance that the financial statements

taken as a whole are free from material missttatement, whether caused by fraud

or error"

Auditor is only concerned with the fraud and errors that can affect the financial

statements.

The responsibility of the auditor in fraud or error is stated in the standard. Kung

ano yung responsibility ni auditor sa fraud, ganoon din sa error.

Error, Fraud, and Non compliance LAR In an audit of financial 1

ERROR vs. FRAUD

FRAUD INTENTIONAL

nagcocorrect ng fraud is management.

cannot be easily corrected.

ERROR UNINTENTIONAL

ERROR

→ Refers to an involuntary or unintentional misstatement occurred in financial

statements, including the omission of an amount or disclosure

Incorrect accounting estimate due to overlooking or misinterpretation of

facts

Error in applying accounting policies related to recognition, classification,

valuation and disclosure

Inherent limitations of the preparer of financial statements. (judgments,

fatigue, mathematical error)

FRAUD

→ refers to an intentional act by one or more individuals among the management,

charged with governance of a collusion with the management, third parties and

other persons outside the entity.

The auditor is concerned with fraud that causes a material misstatement in the

financial statement

🗯 The risk of not detecting a material misstatement resulting from a fraud

is HIGHER THAN the risk of not detecting one resulting from error.

Collusion may cause the auditor to believe that audit evidence is persuasive when

it is, in fact, false. The auditor's ability to detect a fraud depends on factors such

Error, Fraud, and Non compliance LAR In an audit of financial 2

as:

skillfulness of the perpetrator

frequency and extent of manipulation

the degree of collusion involved

the relative size of individual amounts manipulated

the seniority of those individuals involved.

Responsibilities to fraud

To identify and assess the risks of material misstatement of the financial

statements due to fraud

To obtain sufficient appropriate audit evidence about the assessed RMM (risk

of material misstatement) due to fraud, through designing and implementing

responses.

The higher the risk, the more procedures you need to perform.

To respond appropriately to identified or suspected fraud

🗯 PSA 240 provides also that the primary responsibility for the prevention

and detection of fraud RESTS WITH BOTH THOSE CHARGED WITH

GOVERNANCE OF THE COMPANY AND THE MANAGEMENT.

WHAT SHOUD THE MANAGEMENT DO?

emphasis on FRAUD PREVENTION

→ reduces opportunities for fraud

emphasis on FRAUD DETERRENCE

→ persuade individuals not to commit fraud

Error, Fraud, and Non compliance LAR In an audit of financial 3

🗯 It is the management's responsibility, the auditor can only give

suggestion.

Decoding Fraud and Profiling the Fraudster

Fraud exists when all of the ff elements exist:

There must be a perpetrator that makes an untrue representation about

an important fact or event

victim who believed in the untrue representation

materialize the

PROFILING FRAUD

Employee fraud

How?

→ the transaction is immaterial

→ misappropriation of assets

Mas madaling idetect and ma- avoid

Management Fraud

How?

→ fraudulent reporting of FS

→ Amount involved is large and concealed in an intelligent manner

Mas mahirap madetect.

HOW?

stealing something of value (an asset)

Error, Fraud, and Non compliance LAR In an audit of financial 4

converting the asset to usable form (cash)

concealing the crime to avoid detection

Management fraud

perpetrated at levels of management above the one to which internal control

structures generally relate.

Fraud Schemes types according to IIA

Fraudulent financial reporting → PSA 240

Asset misappropriation

Corruption

→ rampant that's why it is included

Fraudulent Financial Reporting

Usually in the form of Window Dressing it is made to appear the financial

statements to make the copy appear better than it is. It often involves

management override of controls that otherwise may appear to be operating

effectively.

Includes the following activities:

record fictitious journal entries

omitting

Usually occurs as Management Fraud. It may be tied to focus on short-term

financial measures for success.

Asset Misappropriation

Error, Fraud, and Non compliance LAR In an audit of financial 5

Relates to those committed by the low-level employees or the rank and file

employees who have the easy access to the resources of the company. It is the

most common fraud scheme in which assets are directly or indirectly diverted to

perpetrators benefit.

Examples:

Cash fraud; Embezzling receipts

Skimming → cash fraud wherein the perpetrator steal cash before it is

recorded in the books.

Cash Larceny → it involves stealing of cash from the org's book and record;

stole cash after recording

Lapping → usually happens in the area responsible for the incoming payments

or receiving cash; pinagpapatong patong ng individul yung collection for a

certain person by another person.

October 2, 2020

Continuation

Institute of Internal Auditors:

Financial fraudulent report

Asset Misappropriation

Corruption

Corruption

Involves those at the top level as they have control and authority. It s defined as

the misuse of entrusted power for private/personal gain.

Bribery → giving, offering or receiving things of value to influence an official

to his duties or responsibilities. It is committed before the fraud.

Illegal gratuity - also involves giving, offering or receiving things of value

after the fraudulent act has been committed.

Error, Fraud, and Non compliance LAR In an audit of financial 6

Conflicts of interest - occurs when an employee acts in behalf of a third party

during his performance of duties or responsibilities or he has his own

business and he markets his business to be favored by the other employees.

Economic Extortion - threat or use of force to favor you or your business.

These activities technically involves 3rd persons or 3rd persons take part in

performing these activity.

Profiling the fraudster

In terms of value, it is the male who commits fraud. It usually involves large

amounts of money but low in frequency.

🗯 Males are usually fraudster.

In terms of frequency/volume, it is the female who commits fraud. Amount

involved is immaterial but it is frequently committed.

Fraudster Characteristics

Intelligent → always challenged by established systems, challenged by

"secure" systems, bored with the job routine. Always aggressive as the higher

the risk, the higher the return.

Egotistical → scornful of "obvious" control flaws

Inquisitive → tempted by the discovery of a computer vulnerability

A risk taker → willing to bend the rules, take chances, challenges/ tests the

control owners/ process owners

A rule breaker → takes shortcuts, self- justifies infractions of law, rules, etc.

hard worker → first arrives in the morning and last to leave at night, takes a

few vacations

Reasons why they commit fraud

Error, Fraud, and Non compliance LAR In an audit of financial 7

Under stress → suffering from a personal crisis, such as financial problem,

bad marriage

Greedy or has genuine financial need → illness, drugs, gambling

Disgruntled at work or a complainer → may try to get even or take what he/

she really deserves

A big spender → expensive hobbies, living beyond means.

Fraud Risk Factors

The Fraud Diamond ( the first three factors considered in PSA 240 are the same

with IIA

Opportunity → has something to do with the environment where the fraud

can be committed. The environment is very relaxed or there is a management

collusion.

Motivation → can be associated with pressure/incentive

Rationalization → ethical behavior of the fraudster. It is the justification of the

fraudster upon the fraudulent action committed.

Capability → these are personal traits and abilities. Part and parcel of the

opportunity. Even though there is an opportunity, motivation, or

rationalization, but you don't have the capability, you won't be able to

perform fraud.

The fraud triangle

Error, Fraud, and Non compliance LAR In an audit of financial 8

if malaki ang ethics, mababa ang pressure at opportunity na magcommit ng

fraud.

if maliit ang ethics, there is a bigger chance to commit fraud as the opportunity

and pressure is bigger

More on Fraud Risk Factors

Error, Fraud, and Non compliance LAR In an audit of financial 9

It is on ethical behavior of those inside the organization or outside the

organization in connection with the organization that are deterrent.

The risks of fraud involving accounts in the income statement might be higher

than the balance sheet.

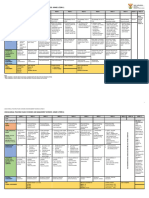

Risk Assessment Procedures and Related Activities

Steps the Auditor could do

Inquiries of Management

Should be done by the auditor

Management is responsible for the entity's internal control and for the

preparation of the financial statements. The management knows the functions

of the organization. Management is responsible for internal control.

The auditor's job is to inquire if the management experienced fraud or knows

of suspicious activities.

Inquiries of Management and Others within the entity

Error, Fraud, and Non compliance LAR In an audit of financial 10

inquire with the rank-and-file employees as they may provide information to

the auditor that may not otherwise be communicated.

If you're already asking for "how much?" you are already performing

substantive testing.

Error, Fraud, and Non compliance LAR In an audit of financial 11

Error, Fraud, and Non compliance LAR In an audit of financial 12

Das könnte Ihnen auch gefallen

- 01 Forensic Accounting, Fraud, Fraudster ProfileDokument27 Seiten01 Forensic Accounting, Fraud, Fraudster ProfileArif Ahmed100% (1)

- Audit PlanningDokument6 SeitenAudit PlanningFrancis Martin90% (10)

- Nonprofit Accounting Policies ManualDokument20 SeitenNonprofit Accounting Policies ManualLaurice Melepyano100% (1)

- CFOs Guide To Measuring The Finance FunctionDokument1 SeiteCFOs Guide To Measuring The Finance FunctionHitesh UppalNoch keine Bewertungen

- Module 9 FraudDokument4 SeitenModule 9 FraudYnah ForwardNoch keine Bewertungen

- Case Study On Forensic Audit: Presented by Sandeep Das Date: March 25,2016Dokument21 SeitenCase Study On Forensic Audit: Presented by Sandeep Das Date: March 25,2016Swastika SharmaNoch keine Bewertungen

- CA Final Audit Important Questions Compiler PDFDokument309 SeitenCA Final Audit Important Questions Compiler PDFNick VincikNoch keine Bewertungen

- AC316 Chapter 6 & 7 Test BankDokument30 SeitenAC316 Chapter 6 & 7 Test BankNanon Wiwatwongthorn100% (1)

- Accounting Information SystemDokument39 SeitenAccounting Information SystemTAETAENoch keine Bewertungen

- Error and Fraud NoresDokument17 SeitenError and Fraud NoresTehreem MujiebNoch keine Bewertungen

- Fraud - Internal Auditing PDFDokument4 SeitenFraud - Internal Auditing PDFJaJ08Noch keine Bewertungen

- The Effectiveness of Auditing Standards to Detect Fraudulent Financial Reporting: The Case of Ethio TelecomDokument90 SeitenThe Effectiveness of Auditing Standards to Detect Fraudulent Financial Reporting: The Case of Ethio TelecomJuh MenNoch keine Bewertungen

- Detect fraud red flags auditorsDokument5 SeitenDetect fraud red flags auditorsIrsani KurniatiNoch keine Bewertungen

- Frauds in Banks- An OverviewDokument7 SeitenFrauds in Banks- An OverviewtareqNoch keine Bewertungen

- AT - Fraud, Error, NoncomplianceDokument9 SeitenAT - Fraud, Error, NoncomplianceRey Joyce Abuel100% (1)

- Group 4 - Fraud, Computer Fraud, and Abuse TechniquesDokument13 SeitenGroup 4 - Fraud, Computer Fraud, and Abuse Techniquesamelya puspitaNoch keine Bewertungen

- Assurance Services: Definition, Types and LimitationsDokument146 SeitenAssurance Services: Definition, Types and LimitationsMudassar Iqbal0% (1)

- PCAB License Renewal DocumentsDokument23 SeitenPCAB License Renewal DocumentsRo Land100% (6)

- Fundamentals of ABM 1 ModulesDokument165 SeitenFundamentals of ABM 1 ModulesAdrian DonayreNoch keine Bewertungen

- Management FraudsDokument21 SeitenManagement Fraudsksmann88100% (7)

- Audit Lanjutan Fraud and Forensic InvestigationDokument37 SeitenAudit Lanjutan Fraud and Forensic InvestigationYouJianNoch keine Bewertungen

- Structural Analysis RamamruthamDokument3 SeitenStructural Analysis RamamruthamManjari Arasada50% (6)

- Preventing Fraud PDFDokument56 SeitenPreventing Fraud PDFNdubisi EfuribeNoch keine Bewertungen

- E AuditDokument21 SeitenE AuditNahian HasanNoch keine Bewertungen

- Study of Frauds and Assets MisappropriationsDokument9 SeitenStudy of Frauds and Assets Misappropriationsharshita patniNoch keine Bewertungen

- Isa 240Dokument67 SeitenIsa 240Darren LowNoch keine Bewertungen

- Error Fraud and Non Compliance LAR in An Audit of Financial PDFDokument12 SeitenError Fraud and Non Compliance LAR in An Audit of Financial PDFAureen TabamoNoch keine Bewertungen

- FRAUDDokument3 SeitenFRAUDprincess manlangitNoch keine Bewertungen

- Distinguishing Errors and Fraud in Financial ReportingDokument5 SeitenDistinguishing Errors and Fraud in Financial ReportingKurt Del RosarioNoch keine Bewertungen

- Rodriguez Zyra-Denelle 09 JournalDokument9 SeitenRodriguez Zyra-Denelle 09 JournalDaena NicodemusNoch keine Bewertungen

- CHP 5 SummaryDokument25 SeitenCHP 5 Summaryfarah zulkefliNoch keine Bewertungen

- ERRORS AND FRAU-WPS OfficeDokument2 SeitenERRORS AND FRAU-WPS Officemujuni brianmjuNoch keine Bewertungen

- Real - Fraud and ErrorDokument5 SeitenReal - Fraud and ErrorRhea May BaluteNoch keine Bewertungen

- Chapter 14Dokument4 SeitenChapter 14Jomer FernandezNoch keine Bewertungen

- Chapter 2 Note Audit From The Book. Learning Object 1 Define The Various Types of Fraud That Affect OrganizationDokument12 SeitenChapter 2 Note Audit From The Book. Learning Object 1 Define The Various Types of Fraud That Affect OrganizationkimkimNoch keine Bewertungen

- Chapter 14 17Dokument13 SeitenChapter 14 17John Lloyd De JesusNoch keine Bewertungen

- F1AB-Session17 d08Dokument14 SeitenF1AB-Session17 d08Zohair HumayunNoch keine Bewertungen

- Chapter 3 - Auditors' ResponsibilityDokument51 SeitenChapter 3 - Auditors' ResponsibilityddddddaaaaeeeeNoch keine Bewertungen

- Manatad - Corporate Governance - Fraud and ErrorDokument3 SeitenManatad - Corporate Governance - Fraud and ErrorPring PringNoch keine Bewertungen

- Chapter 5 (AUDIT)Dokument33 SeitenChapter 5 (AUDIT)iuNoch keine Bewertungen

- 01 Forensic Accounting PPTsDokument30 Seiten01 Forensic Accounting PPTsISHAAN VARSHNEYNoch keine Bewertungen

- Ais CH5Dokument5 SeitenAis CH5Divine Grace BravoNoch keine Bewertungen

- Financial Statement Fraud in an OrganizationDokument14 SeitenFinancial Statement Fraud in an OrganizationRebecca Fady El-hajjNoch keine Bewertungen

- Govbusman Module 9.1 (11) - Chapter 14Dokument7 SeitenGovbusman Module 9.1 (11) - Chapter 14Rohanne Garcia AbrigoNoch keine Bewertungen

- Chapter 4 NotesDokument2 SeitenChapter 4 NotesmatthewNoch keine Bewertungen

- Chap 14 Corp Gov Biasura Jhazreel 2 BDokument6 SeitenChap 14 Corp Gov Biasura Jhazreel 2 BJhazreel BiasuraNoch keine Bewertungen

- Module 13Dokument3 SeitenModule 13AstxilNoch keine Bewertungen

- Fraud Risk Assessment: An Empirical AnalysisDokument11 SeitenFraud Risk Assessment: An Empirical AnalysisGDPNoch keine Bewertungen

- Auditors ResponisbilityDokument5 SeitenAuditors ResponisbilityGigi LuceroNoch keine Bewertungen

- Dafd Unit-1Dokument33 SeitenDafd Unit-1NIKHIL kUMARNoch keine Bewertungen

- Definition of Fraud 1-3Dokument3 SeitenDefinition of Fraud 1-3Nada An-NaurahNoch keine Bewertungen

- Auditing fraud and errorsDokument6 SeitenAuditing fraud and errorskris salacNoch keine Bewertungen

- Fraud and Responsibilities of AuditorDokument35 SeitenFraud and Responsibilities of AuditorSamratNoch keine Bewertungen

- Lesson 15 Considering Fraud, Error and Non-Compliance With Laws and RegulationsDokument8 SeitenLesson 15 Considering Fraud, Error and Non-Compliance With Laws and RegulationsMark TaysonNoch keine Bewertungen

- AFAA Handbook on Fraud and Waste IndicatorsDokument75 SeitenAFAA Handbook on Fraud and Waste IndicatorsAmira HerreraNoch keine Bewertungen

- Fraud Error Non-Compliance and Legal Liability Final1 PDFDokument7 SeitenFraud Error Non-Compliance and Legal Liability Final1 PDFJa NilNoch keine Bewertungen

- Audit Theory Chapter 3 and 4Dokument9 SeitenAudit Theory Chapter 3 and 4Ruiz, CherryjaneNoch keine Bewertungen

- Module 4 - Auditor's ResponsibilityDokument28 SeitenModule 4 - Auditor's ResponsibilityMAG MAG100% (1)

- Jimmy de Vera Roldan, MsitDokument43 SeitenJimmy de Vera Roldan, MsitCindy BartolayNoch keine Bewertungen

- Chap. 14 15Dokument37 SeitenChap. 14 15Dan MichaelNoch keine Bewertungen

- ACCT1111 Topic 5 v2Dokument7 SeitenACCT1111 Topic 5 v2Mariann Jane GanNoch keine Bewertungen

- CHAPTER 8 Investigation of FraudDokument45 SeitenCHAPTER 8 Investigation of FraudHanis ZahiraNoch keine Bewertungen

- ACCT1111 Topic 3 v2Dokument7 SeitenACCT1111 Topic 3 v2Mariann Jane GanNoch keine Bewertungen

- Acc114a Fraud and ErrorDokument8 SeitenAcc114a Fraud and Errorsophia lorreine chattoNoch keine Bewertungen

- FRAUD - 3rd GroupDokument18 SeitenFRAUD - 3rd GroupDwi NovianaNoch keine Bewertungen

- Ethics, Fraud, and Internal Controls GuideDokument7 SeitenEthics, Fraud, and Internal Controls Guidejudel ArielNoch keine Bewertungen

- Assessing and Responding To Fraud RisksDokument7 SeitenAssessing and Responding To Fraud RisksRisal EfendiNoch keine Bewertungen

- Chapter 3 - Fraud, Ethics and Internal ControlsDokument6 SeitenChapter 3 - Fraud, Ethics and Internal ControlsMichael AnibanNoch keine Bewertungen

- Manatad - Corporate Governance - Analyzing Business IssuesDokument4 SeitenManatad - Corporate Governance - Analyzing Business IssuesPring PringNoch keine Bewertungen

- Auditing Theory Chapter 3 and 4Dokument60 SeitenAuditing Theory Chapter 3 and 4Cherryjane RuizNoch keine Bewertungen

- Accounting Information System 1Dokument5 SeitenAccounting Information System 1Aureen TabamoNoch keine Bewertungen

- EthicsDokument9 SeitenEthicsAureen TabamoNoch keine Bewertungen

- Accounting for Derivatives and Hedging TransactionsDokument2 SeitenAccounting for Derivatives and Hedging TransactionsAureen TabamoNoch keine Bewertungen

- 10 General Accepted Auditing StandardsDokument7 Seiten10 General Accepted Auditing StandardsAureen TabamoNoch keine Bewertungen

- Management Advisory ServicesDokument10 SeitenManagement Advisory ServicesAureen TabamoNoch keine Bewertungen

- 5 6316821492734624084 PDFDokument5 Seiten5 6316821492734624084 PDFAureen TabamoNoch keine Bewertungen

- Management Advisory ServicesDokument10 SeitenManagement Advisory ServicesAureen TabamoNoch keine Bewertungen

- 5 6316821492734624084 PDFDokument5 Seiten5 6316821492734624084 PDFAureen TabamoNoch keine Bewertungen

- Sectors of Accounting ProfessionDokument18 SeitenSectors of Accounting ProfessionAureen TabamoNoch keine Bewertungen

- Auditor RespDokument1 SeiteAuditor RespAureen TabamoNoch keine Bewertungen

- EthicsDokument9 SeitenEthicsAureen TabamoNoch keine Bewertungen

- Management Advisory ServicesDokument10 SeitenManagement Advisory ServicesAureen TabamoNoch keine Bewertungen

- 5 6316821492734624084 PDFDokument5 Seiten5 6316821492734624084 PDFAureen TabamoNoch keine Bewertungen

- Normal Course of Trade or Business Are Subject To Vat "Unless Exempt 'Dokument14 SeitenNormal Course of Trade or Business Are Subject To Vat "Unless Exempt 'Aureen TabamoNoch keine Bewertungen

- Oblicon NotesDokument17 SeitenOblicon NotesAureen TabamoNoch keine Bewertungen

- MCR 2012 WebDokument228 SeitenMCR 2012 WebIulia PotorNoch keine Bewertungen

- 1 Accounting Theory and PracticeDokument16 Seiten1 Accounting Theory and PracticeFirman PrasetyaNoch keine Bewertungen

- Baf4101 Financial Statement and AnalysisDokument98 SeitenBaf4101 Financial Statement and AnalysisBrian GitauNoch keine Bewertungen

- 1.620 ATP 2023-24 GR 8 EMS FinalDokument4 Seiten1.620 ATP 2023-24 GR 8 EMS Finalbritneykoen02Noch keine Bewertungen

- Chapter 1 SummaryDokument11 SeitenChapter 1 SummaryMiaNoch keine Bewertungen

- Advanced Auditing Chapter FourDokument52 SeitenAdvanced Auditing Chapter FourmirogNoch keine Bewertungen

- CAS 720 Auditor's ResponsibilitiesDokument6 SeitenCAS 720 Auditor's ResponsibilitieszelcomeiaukNoch keine Bewertungen

- Accounting For Management: Project On Financial Statement Analysis of H U L (HUL)Dokument34 SeitenAccounting For Management: Project On Financial Statement Analysis of H U L (HUL)Aditya ChughNoch keine Bewertungen

- Corporate Governance: Q.1) What Are The Factors Affecting Corporate Governance? (400 Words, 10 Marks)Dokument12 SeitenCorporate Governance: Q.1) What Are The Factors Affecting Corporate Governance? (400 Words, 10 Marks)Tanay Kumar DasNoch keine Bewertungen

- Nedbank Group Financial StatementsDokument132 SeitenNedbank Group Financial StatementsNeo NakediNoch keine Bewertungen

- Annual Report 2014-15Dokument128 SeitenAnnual Report 2014-15bharath289Noch keine Bewertungen

- Corporate M&A - Indonesia 2022Dokument13 SeitenCorporate M&A - Indonesia 2022Andhika Hananta RNoch keine Bewertungen

- Suggested Quey4uujjrstions For Advance Assignment To StudentsDokument3 SeitenSuggested Quey4uujjrstions For Advance Assignment To StudentsDendy FebrianNoch keine Bewertungen

- Assl Auditor General Annual Report 2011Dokument290 SeitenAssl Auditor General Annual Report 2011Ngevao Morie NgevaoNoch keine Bewertungen

- Financial StatementsDokument10 SeitenFinancial StatementsSergei DragunovNoch keine Bewertungen

- Business Transaction Questions and AnswersDokument3 SeitenBusiness Transaction Questions and AnswersAbdul GaffarNoch keine Bewertungen

- CM Week 1 and 2Dokument20 SeitenCM Week 1 and 2Nikki CastilloNoch keine Bewertungen

- B100 TMA03 Preparation - How To Succeed in B100 TMA03Dokument19 SeitenB100 TMA03 Preparation - How To Succeed in B100 TMA03Ines RomanskaNoch keine Bewertungen

- Activity Design Local TreasurerDokument2 SeitenActivity Design Local TreasurerVernon BacangNoch keine Bewertungen