Beruflich Dokumente

Kultur Dokumente

Explaining a Lower Retirement Projection

Hochgeladen von

anon_103901460Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Explaining a Lower Retirement Projection

Hochgeladen von

anon_103901460Copyright:

Verfügbare Formate

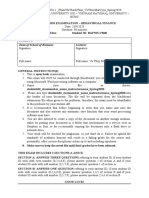

INSTITUTE AND FACULTY OF ACTUARIES

EXAMINATION

November 2015

Subject CA3 – Communications

Paper 1

Time allowed: 1 hour 30 minutes + 15 minutes reading time

INSTRUCTIONS TO THE CANDIDATE

1. You have 15 minutes before the start of the examination in which to read the question.

You are strongly encouraged to use this time for reading only, but notes may be made.

You then have 1 hour 30 minutes to complete the paper.

2. The work you submit MUST be saved in Microsoft Word 2007 format, e.g. using the docx

file extension. You may only upload one document and you must not embed files in the

document.

3. Copies of the Formulae and Tables, Core Reading for subjects CT1–CT8 inclusive and

CA1 will be available electronically during the exam. These documents are for use

during the exam period only and not for general use. No other material can be referred

to.

4. In addition to this paper you should have available your own electronic calculator from

the approved list, http://www.actuaries.org.uk/research-and-resources/documents/exam-

policies

5. You are not permitted to use the internet to help you during the exam.

6. You are required to work through the exam assignment without assistance from another

person. You are reminded that by undertaking this exam you are bound by the Institute

and Faculty of Actuaries’ Examinations Rules and Regulations. By submitting your files

you are confirming that all the material is entirely your own work and you wish this to

be taken into account for this assessment. Only the first submissions will be accepted.

7. Save your work regularly. Saving your work is your responsibility so failure to do so

will not be a significant mitigating circumstance. Do NOT log off the application until

you receive confirmation of receipt from the Online Education Team.

8. At the end of the examination, save your completed assignment and follow the upload

instructions that have been provided. Once the exam is over all related material and

notes made during the examination must be destroyed.

9. If you encounter any difficulties please email online-exams@actuaries.org.uk or

telephone the Online Education Team on +44 (0)1865 268255.

10. Professional behaviour is mandatory and no material relating to the exam may be

disclosed or discussed with others, nor used in a further attempt at the exam. Failure to

comply with this will be deemed to be a breach of the examination regulations and may

result in disciplinary action.

PLEASE NOTE THAT THE CONTENT OF THIS PAPER IS CONFIDENTIAL AND

STUDENTS ARE NOT TO DISCUSS OR REVEAL THE CONTENTS UNDER ANY

CIRCUMSTANCES.

CA3 Paper 1, November 2015 Institute and Faculty of Actuaries

You work as an actuarial student in a life insurance company. A policyholder has written the

following letter to the customer services department of your company, ABC Limited:

“Dear Sir 10 April 2015

Policy number 21252133 – ABC saver plus product

I reach age 65 in around 5 years’ time and in February 2015 I wrote to ask for an updated

projection of what I am likely to get from the saver policy I have with you.

I must say I was horrified at what you sent me. The updated illustration you sent me is

ridiculous as it shows vastly lower numbers to what you originally led me to believe 20 years

ago. The stock market has nearly doubled since the 2008 crash so I don’t think there is any

way the numbers can be so low: something must be wrong and a mistake has been made. It

seems as if £127,000 has been wiped off my fund. Where has this money gone?

Your letter also mentioned the projection had been referred to and agreed with your actuarial

department. I knew an actuarial student many years ago and know that actuaries are highly

paid and have to pass lots of complicated exams and are supposed to be experts in this sort of

thing, but if they come up with answers like this then clearly they can’t really know much

about the future.

Such a low figure will create severe financial hardship and will mean I have to delay my

retirement plans by several years. I would appreciate it if you give this your urgent attention

and send me a new and more realistic projection as soon as possible.

Yours faithfully

Steven Donohoe”

The customer services team has passed a copy of the letter to your manager.

Your manager has asked you to draft a letter in around 550 words that can be sent by the

customer services team to Mr Donohoe, explaining why there is such a difference between

the projection he received when he took out the policy in 1995, and the recent projection sent

in 2015.

Your response letter should cover:

1. the difference in actual versus expected fund performance and comment on market

returns since 2008.

2. the difference in the basis for future fund projection.

3. the use of current money terms in the February 2015 projection.

Your manager has indicated you should include figures to explain the impact of each of the

three parts above.

CA3 Paper 1, November 2015–2

A student in your team has prepared the following information:

Original quotation dated February 1995

ABC Limited

Saver Plus – policy number 21252133

Policy details

Mr S Donohoe

Date of birth: 1 February 1955

Policy maturity date: 1 February 2020

Date of initial investment: 1 February 1995

Initial lump sum invested: £25,000

Projected fund amount at age 65: £215,577

Assumptions

Future investment returns: 9% p.a.

Inflation: 3% p.a.

Note: Your funds will be invested by ABC Limited in our Diversified Mixed Managed Fund. This fund

has a long term investment objective of investing in an asset mix of: 50% shares (UK and overseas),

15% property, and 35% bonds and cash (please see our Saver Plus explanatory leaflet for more

information). Please note that neither the future investment performance nor projected fund amounts

are guaranteed: what you will actually receive will be dependent on the actual investment returns

achieved.

Date: 12 February 1995

Latest quotation dated February 2015ABC Limited

ABC Limited

Saver Plus – policy number 21252133

Policy details

Mr S Donohoe

Date of birth: 1 February 1955

Policy maturity date: 1 February 2020

Date of initial investment: 1 February 1995

Initial lump sum invested: £25,000

Fund amount at 1 February 2015: £80,178.39

Projected fund amount at age 65: £88,270.93

Assumptions

Future investment returns: 5% p.a.

Inflation: 3% p.a.

Notes:

1. Future funds are projected at 5% p.a. in line with the requirements of the Financial Oversight

Authority in response to Statutory Instrument SI2014/8888: “Basis of projection of fund

illustrations for insurance company policyholders”.

2. Projected fund values are expressed in current money terms, as is required under the above

legislation.

3. Your fund continues to be invested by ABC Limited in our Diversified Mixed Managed Fund.

This fund continues to be split 50% shares (UK and overseas), 15% property, and 35% bonds and

cash. Neither the future investment performance nor projected fund amounts are guaranteed:

what you will actually receive will be dependent on the actual investment returns achieved.

Date: 25 February 2015

CA3 Paper 1, November 2015–3

Further notes from the student:

The investment mix of the Diversified Mixed Managed Fund has remained constant over the

period, and is anticipated to remain so over the next 5 years.

The “Projected fund amount” using the recent statutory requirements is calculated as follows:

Fund Amount = F

Future investment return = r% p.a.

Inflation = i% p.a.

Term to maturity = n (years and days as a fraction of a year)

Projected Fund Amount (PFA) = F [ (1 + r) / (1 + i) ]n

Mr Donohoe mentions a loss of £127,000. If we perform an analysis of surplus this can be

broken down into three components:

Source of surplus Contribution to surplus Notes

Past investment returns - £60,000 6% v 9%

Change in basis for future - £53,000 5% v 9%

fund projection

Conversion to current - £14,000 Impact of fund @ 65 / 1.035

money terms

Total - £127,000

You should:

1. assume all figures are correct.

2. ignore tax and expenses.

3. ignore any other regulatory or legislative requirements.

END OF PAPER

CA3 Paper 1, November 2015–4

Das könnte Ihnen auch gefallen

- NYU Final2Dokument12 SeitenNYU Final2HE HUNoch keine Bewertungen

- Ecg Marrow (Notespaedia) Only@neetpgdiscussion PDFDokument99 SeitenEcg Marrow (Notespaedia) Only@neetpgdiscussion PDFanon_1039014600% (1)

- BSBFIM501A Assessment 21042015 1Dokument10 SeitenBSBFIM501A Assessment 21042015 1Anonymous YGpyYSH0% (2)

- FINANCIAL ACCOUNTING AND REPORTING QUIZBOWLDokument67 SeitenFINANCIAL ACCOUNTING AND REPORTING QUIZBOWLKae Abegail Garcia0% (1)

- ACC701 Mid Exam - Question PaperDokument5 SeitenACC701 Mid Exam - Question PaperSALESHNI LALNoch keine Bewertungen

- AC3093 Summer 2020 Online Assessment Guidance AC3093 Auditing and AssuranceDokument19 SeitenAC3093 Summer 2020 Online Assessment Guidance AC3093 Auditing and AssuranceDương DươngNoch keine Bewertungen

- Afw 1000 Final Q s1 2014Dokument17 SeitenAfw 1000 Final Q s1 2014Mohammad RashmanNoch keine Bewertungen

- Advanced AccountingDokument14 SeitenAdvanced AccountingBehbehlynn67% (3)

- Financial AccountingDokument17 SeitenFinancial Accountingashibhallau100% (1)

- IGI Insurance CompanyDokument26 SeitenIGI Insurance Companymach!50% (2)

- Accounting Feb 2021Dokument11 SeitenAccounting Feb 2021TAQQI JAFFARINoch keine Bewertungen

- MOJAKOE AK1 UTS 2010 GasalDokument10 SeitenMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudNoch keine Bewertungen

- ABC's Accounting IssuesDokument12 SeitenABC's Accounting Issuesnandhu prasadNoch keine Bewertungen

- The Imperial College of Australia: SIT60316 BSBFIM601 Advanced Diploma of Hospitality Management Manage FinancesDokument7 SeitenThe Imperial College of Australia: SIT60316 BSBFIM601 Advanced Diploma of Hospitality Management Manage Financesosama najmiNoch keine Bewertungen

- Financial ReportsDokument59 SeitenFinancial Reportsnursingdoc50% (4)

- Iandfca2-Paper2201505exampaper 0Dokument12 SeitenIandfca2-Paper2201505exampaper 0Bare GroupNoch keine Bewertungen

- Ac3093 2020Dokument7 SeitenAc3093 2020Freya SunNoch keine Bewertungen

- Icaew Audit Assurance Questions PDF FreeDokument39 SeitenIcaew Audit Assurance Questions PDF FreeAbdul ToheedNoch keine Bewertungen

- ACCT8144 - Accounting For ManagersDokument4 SeitenACCT8144 - Accounting For ManagersManoesia DjakartaNoch keine Bewertungen

- DsdsDokument10 SeitenDsdsAnonymous zXwP003Noch keine Bewertungen

- ProblemC ch05Dokument5 SeitenProblemC ch05Adan FakihNoch keine Bewertungen

- BSB 5005 – Introduction to Accounting Group Case AssessmentDokument8 SeitenBSB 5005 – Introduction to Accounting Group Case AssessmentDalyaNoch keine Bewertungen

- Moneysprite Investment ViewpointDokument4 SeitenMoneysprite Investment ViewpointJody SturmanNoch keine Bewertungen

- HMW 3Dokument2 SeitenHMW 3brahim.safa2018Noch keine Bewertungen

- t10 2010 Jun QDokument10 Seitent10 2010 Jun QAjay TakiarNoch keine Bewertungen

- CR Questions July 2015Dokument16 SeitenCR Questions July 2015JianHao SooNoch keine Bewertungen

- Final Paper 1Dokument12 SeitenFinal Paper 1ishujain007Noch keine Bewertungen

- Institute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalDokument15 SeitenInstitute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalAlexander FriendNoch keine Bewertungen

- SITXFIN009 Student Assessment TasksDokument28 SeitenSITXFIN009 Student Assessment Tasksaishariaz342Noch keine Bewertungen

- Discussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSDokument7 SeitenDiscussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSmimi96Noch keine Bewertungen

- General Marking Criteria Short Answer QuestionsDokument12 SeitenGeneral Marking Criteria Short Answer QuestionsMuhammad Ramiz AminNoch keine Bewertungen

- ACCT 1026 Lesson 4 Posting and SummarizingDokument7 SeitenACCT 1026 Lesson 4 Posting and SummarizingRoshane Deil PascualNoch keine Bewertungen

- MHDDokument6 SeitenMHDSakariyeFarooleNoch keine Bewertungen

- Assessment of The 'Accounting Cycle': Test Tools For The Accounting ProfessorDokument45 SeitenAssessment of The 'Accounting Cycle': Test Tools For The Accounting ProfessorKasthuri MohanNoch keine Bewertungen

- Kureemun - Fundamentals Finance - 15 OctDokument6 SeitenKureemun - Fundamentals Finance - 15 OctBhavna AkhjahNoch keine Bewertungen

- 2011 Paper F3 QandA Sample Download v1Dokument25 Seiten2011 Paper F3 QandA Sample Download v1hoozhoon hoodhoodNoch keine Bewertungen

- Examination: Subject SA6 Investment Specialist ApplicationsDokument148 SeitenExamination: Subject SA6 Investment Specialist Applicationschan chadoNoch keine Bewertungen

- Soal Uas MK Gasal 2021-2022 KkiDokument6 SeitenSoal Uas MK Gasal 2021-2022 KkiRifqi RinaldiNoch keine Bewertungen

- DONE2_BSBFIN601___Assessment_Task_2.docxDokument25 SeitenDONE2_BSBFIN601___Assessment_Task_2.docxKitpipoj PornnongsaenNoch keine Bewertungen

- July 2015 Case Study EPDokument19 SeitenJuly 2015 Case Study EPmagnetbox8Noch keine Bewertungen

- BSBFIN601 - Assessment Task 2Dokument25 SeitenBSBFIN601 - Assessment Task 2Kitpipoj PornnongsaenNoch keine Bewertungen

- BSBFIN601_Task_2_Woobin_JUN.docxDokument27 SeitenBSBFIN601_Task_2_Woobin_JUN.docxKitpipoj PornnongsaenNoch keine Bewertungen

- Brennan, Niamh and Clarke, Peter (1985) Objective Tests in Financial Accounting, ETA Publications, DublinDokument90 SeitenBrennan, Niamh and Clarke, Peter (1985) Objective Tests in Financial Accounting, ETA Publications, DublinProf Niamh M. BrennanNoch keine Bewertungen

- Dean of School of Business LecturerDokument7 SeitenDean of School of Business LecturerThạchThảooNoch keine Bewertungen

- DD The Superior College Lahore: InstructionsDokument3 SeitenDD The Superior College Lahore: Instructionsmehzil haseebNoch keine Bewertungen

- Semester 1 - PAPER IDokument7 SeitenSemester 1 - PAPER IShilongo OliviaNoch keine Bewertungen

- Assignment 01 Audit of LiabilitiesDokument4 SeitenAssignment 01 Audit of LiabilitiesDan Andrei BongoNoch keine Bewertungen

- Imt 07Dokument4 SeitenImt 07Prasanta Kumar NandaNoch keine Bewertungen

- 10 March AssignmnetDokument4 Seiten10 March Assignmnetkevin kipkemoiNoch keine Bewertungen

- Iandfct2exam201504 0Dokument8 SeitenIandfct2exam201504 0Patrick MugoNoch keine Bewertungen

- Humber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsDokument5 SeitenHumber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsAnisaNoch keine Bewertungen

- 2023 Summer Capital AssignmentDokument2 Seiten2023 Summer Capital AssignmentPoetic YatchyNoch keine Bewertungen

- 2014 Web AccountingDokument67 Seiten2014 Web AccountingpankajauwaNoch keine Bewertungen

- Advanced Audit and Assurance: Acca P P7 ACCA Paper P7Dokument10 SeitenAdvanced Audit and Assurance: Acca P P7 ACCA Paper P7Dustu CheleNoch keine Bewertungen

- PL AA J15 Exam PaperDokument8 SeitenPL AA J15 Exam PaperIssa BoyNoch keine Bewertungen

- Assignment Front Sheet: BusinessDokument13 SeitenAssignment Front Sheet: BusinessHassan AsgharNoch keine Bewertungen

- Project Valuation Review: Beyond The BasicsDokument14 SeitenProject Valuation Review: Beyond The BasicsBabar AdeebNoch keine Bewertungen

- Vcta 2015 Exam Unit 3 4Dokument34 SeitenVcta 2015 Exam Unit 3 4api-320309588Noch keine Bewertungen

- Acct1511 2013s2c2 Handout 2 PDFDokument19 SeitenAcct1511 2013s2c2 Handout 2 PDFcelopurpleNoch keine Bewertungen

- ACCT1501 IntroductionDokument15 SeitenACCT1501 IntroductionPrashanth RatnabalaNoch keine Bewertungen

- ACCT1501 TUTORIAL WEEK 3 SOLUTIONSDokument3 SeitenACCT1501 TUTORIAL WEEK 3 SOLUTIONSseling97Noch keine Bewertungen

- International Financial Statement AnalysisVon EverandInternational Financial Statement AnalysisBewertung: 1 von 5 Sternen1/5 (1)

- Institute and Faculty of Actuaries: Instructions To The CandidateDokument5 SeitenInstitute and Faculty of Actuaries: Instructions To The Candidateanon_103901460Noch keine Bewertungen

- Institute and Faculty of Actuaries: Instructions To The CandidateDokument5 SeitenInstitute and Faculty of Actuaries: Instructions To The Candidateanon_103901460Noch keine Bewertungen

- Institute and Faculty of Actuaries Examination: Subject CA3 - Communications Paper 2Dokument6 SeitenInstitute and Faculty of Actuaries Examination: Subject CA3 - Communications Paper 2anon_103901460Noch keine Bewertungen

- IandF CA3 201511 Paper2 ExaminersReportDokument9 SeitenIandF CA3 201511 Paper2 ExaminersReportanon_103901460Noch keine Bewertungen

- Institute and Faculty of Actuaries: Instructions To The CandidateDokument6 SeitenInstitute and Faculty of Actuaries: Instructions To The Candidateanon_103901460Noch keine Bewertungen

- IandF CA3 2015 MortgageTraining ExamDokument5 SeitenIandF CA3 2015 MortgageTraining ExamXavier SnowyNoch keine Bewertungen

- Evaluate WB's coffee machine marketing proposalsDokument4 SeitenEvaluate WB's coffee machine marketing proposalsanon_103901460Noch keine Bewertungen

- Institute and Faculty of Actuaries: Instructions To The CandidateDokument6 SeitenInstitute and Faculty of Actuaries: Instructions To The Candidateanon_103901460Noch keine Bewertungen

- Institute and Faculty of Actuaries Examination: Subject CA3 - Communications Paper 2Dokument6 SeitenInstitute and Faculty of Actuaries Examination: Subject CA3 - Communications Paper 2anon_103901460Noch keine Bewertungen

- Evaluate WB's coffee machine marketing proposalsDokument4 SeitenEvaluate WB's coffee machine marketing proposalsanon_103901460Noch keine Bewertungen

- IandF CA3 201608 Paper2 ExaminersReportDokument9 SeitenIandF CA3 201608 Paper2 ExaminersReportanon_103901460Noch keine Bewertungen

- Institute and Faculty of Actuaries Examination: Subject CA3 - Communications Paper 2Dokument6 SeitenInstitute and Faculty of Actuaries Examination: Subject CA3 - Communications Paper 2anon_103901460Noch keine Bewertungen

- IandF CA3 2015 IllHealthQuotation ExamDokument5 SeitenIandF CA3 2015 IllHealthQuotation ExamXavier SnowyNoch keine Bewertungen

- Institute and Faculty of Actuaries: Subject CA3 - Communications (Written Paper)Dokument4 SeitenInstitute and Faculty of Actuaries: Subject CA3 - Communications (Written Paper)anon_103901460Noch keine Bewertungen

- S36C 107102308220Dokument1 SeiteS36C 107102308220anon_103901460Noch keine Bewertungen

- Intellectual Property Rights in India With Special Reference To Trademarks: An Analytical StudyDokument1 SeiteIntellectual Property Rights in India With Special Reference To Trademarks: An Analytical Studyanon_103901460Noch keine Bewertungen

- 1Dokument9 Seiten1anon_103901460Noch keine Bewertungen

- Customer Satisfaction Study of Citifinancial Personal LoansDokument93 SeitenCustomer Satisfaction Study of Citifinancial Personal Loansanon_103901460Noch keine Bewertungen

- ICICI Lombard Health Care Claim Form - Outpatient DepartmentDokument2 SeitenICICI Lombard Health Care Claim Form - Outpatient Departmentanon_103901460Noch keine Bewertungen

- DAV School Fee Receipt for Class 6 StudentDokument1 SeiteDAV School Fee Receipt for Class 6 Studentanon_103901460Noch keine Bewertungen

- D.A.V. SENIOR SECONDARY PUBLIC SCHOOL, Ashok Vihar, Delhi-110052, India. Phone: 01145552751Dokument1 SeiteD.A.V. SENIOR SECONDARY PUBLIC SCHOOL, Ashok Vihar, Delhi-110052, India. Phone: 01145552751anon_103901460Noch keine Bewertungen

- ICICI Lombard Health Care Claim Form - Outpatient DepartmentDokument2 SeitenICICI Lombard Health Care Claim Form - Outpatient Departmentanon_103901460Noch keine Bewertungen

- 20150219fee Receipt PDFDokument1 Seite20150219fee Receipt PDFanon_103901460Noch keine Bewertungen

- 20150218fee ReceiptDokument1 Seite20150218fee Receiptanon_103901460Noch keine Bewertungen

- D.A.V. SENIOR SECONDARY PUBLIC SCHOOL, Ashok Vihar, Delhi-110052, India. Phone: 01145552751Dokument1 SeiteD.A.V. SENIOR SECONDARY PUBLIC SCHOOL, Ashok Vihar, Delhi-110052, India. Phone: 01145552751anon_103901460Noch keine Bewertungen

- 20150218fee ReceiptDokument1 Seite20150218fee Receiptanon_103901460Noch keine Bewertungen

- Motor Insurance - Two Wheeler Multiyear Liability Only: Certificate of Insurance Cum Policy ScheduleDokument3 SeitenMotor Insurance - Two Wheeler Multiyear Liability Only: Certificate of Insurance Cum Policy Scheduleanon_103901460Noch keine Bewertungen

- Thank You For Being A #Green Customer: Transaction DetailsDokument2 SeitenThank You For Being A #Green Customer: Transaction Detailsanon_103901460Noch keine Bewertungen

- Eo 398-2005 PDFDokument2 SeitenEo 398-2005 PDFDalton ChiongNoch keine Bewertungen

- The Contemporary World Activity (Essay)Dokument2 SeitenThe Contemporary World Activity (Essay)rose revillaNoch keine Bewertungen

- CP Redeemed As On 24-01-2023Dokument136 SeitenCP Redeemed As On 24-01-2023Prem JeswaniNoch keine Bewertungen

- Definition of Money and its EvolutionDokument3 SeitenDefinition of Money and its EvolutionMJ PHOTOGRAPHYNoch keine Bewertungen

- Banking License ApplicationDokument22 SeitenBanking License ApplicationFrancNoch keine Bewertungen

- Customer Journey MappingDokument10 SeitenCustomer Journey MappingpradieptaNoch keine Bewertungen

- Inedic Manual en - Innovation and Ecodesign in The Ceramic IndustryDokument163 SeitenInedic Manual en - Innovation and Ecodesign in The Ceramic Industryfrancisco33Noch keine Bewertungen

- Montenegro Taxation Chapter 16 PresentationDokument16 SeitenMontenegro Taxation Chapter 16 PresentationAngus DoijNoch keine Bewertungen

- 2020 Specimen Paper 1Dokument10 Seiten2020 Specimen Paper 1mohdportmanNoch keine Bewertungen

- Report On Non Performing Assets of BankDokument53 SeitenReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- Costing By-Product and Joint ProductsDokument36 SeitenCosting By-Product and Joint ProductseltantiNoch keine Bewertungen

- Digital - Marketing Notes On Bosch and Grainger Strategy Plan Final Problem Statement - CourseraDokument1 SeiteDigital - Marketing Notes On Bosch and Grainger Strategy Plan Final Problem Statement - CourseraSserunkuma MosesNoch keine Bewertungen

- Account Statement 12-10-2023T22 26 37Dokument1 SeiteAccount Statement 12-10-2023T22 26 37muawiyakhanaNoch keine Bewertungen

- SELLING SKILLS: CUSTOMER-CENTRIC STRATEGIESDokument19 SeitenSELLING SKILLS: CUSTOMER-CENTRIC STRATEGIESNatsu DeAcnologiaNoch keine Bewertungen

- Case Study On Citizens' Band RadioDokument7 SeitenCase Study On Citizens' Band RadioরাসেলআহমেদNoch keine Bewertungen

- PPCFDokument4 SeitenPPCFAbdulkerim kedirNoch keine Bewertungen

- 1 CombinedDokument405 Seiten1 CombinedMansi aggarwal 171050Noch keine Bewertungen

- Presentation 6Dokument14 SeitenPresentation 6Akshay MathurNoch keine Bewertungen

- Impact of Microfinance Services On Rural Women Empowerment: An Empirical StudyDokument8 SeitenImpact of Microfinance Services On Rural Women Empowerment: An Empirical Studymohan ksNoch keine Bewertungen

- MCQ Corporate FinanceDokument13 SeitenMCQ Corporate FinancesubyraoNoch keine Bewertungen

- Tesalt India Private LimitedDokument16 SeitenTesalt India Private LimitedSaiganesh JayakaranNoch keine Bewertungen

- PM RN A4.Throughput CostingDokument5 SeitenPM RN A4.Throughput Costinghow cleverNoch keine Bewertungen

- VAT ReportDokument32 SeitenVAT ReportNoel Christopher G. BellezaNoch keine Bewertungen

- Labour Law Notes GeneralDokument55 SeitenLabour Law Notes GeneralPrince MwendwaNoch keine Bewertungen

- The Optimal Choice of Index-Linked Gics: Some Canadian EvidenceDokument14 SeitenThe Optimal Choice of Index-Linked Gics: Some Canadian EvidenceKevin DiebaNoch keine Bewertungen

- Role-Play EditedDokument3 SeitenRole-Play EditedNingning RomarateNoch keine Bewertungen

- White Paper Auriga Smart AtmsDokument2 SeitenWhite Paper Auriga Smart AtmsirwinohNoch keine Bewertungen

- The Case For New Leadership: Prepared by Icahn Capital LPDokument24 SeitenThe Case For New Leadership: Prepared by Icahn Capital LPMiguel RamosNoch keine Bewertungen