Beruflich Dokumente

Kultur Dokumente

List of Registrable Instruments

Hochgeladen von

adv_vinayakOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

List of Registrable Instruments

Hochgeladen von

adv_vinayakCopyright:

Verfügbare Formate

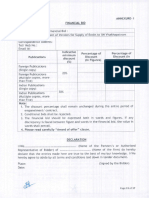

List of Registrable & Non-Registrable

Instruments

Sr. No. Description of Instrument Proper Stamp Duty

Rs.2/- upto Rs.5000/-

1. Acknowledgement

Exceeding 5000/- Rs.2/- for every 1000/- or part there of.

2. Administration Bond The same duty as Bond No.12 upto Rs.1000/- and in any other case Rs.100/-.

3. Adoption Deed Rs.500/-

4. Affidavit Rs.20/-

i) Same duty as conveyance on the market value of the property when the possession of the property is delivered or

Agreement relating to Sale of

5. agreed to be delivered.

Immoveable property.

ii) Rs.10/- to Rs.200/- depending upon the value of the property where the possession of the property is not delivered.

6. Agreement relating to DTD 0.5% on the loan amount

Appointment in execution of

7. Rs.1000/-

power

8. Appraisement or Valuation The same duty as Bond No.12 upto Rs.1000/- and in any other case Rs.100/-.

9. Apprenticeship Rs.50/-

10. Article of Association Rs.500/- for every Rs.10 lakhs or part there of.

11. Award Same duty as bond on the MV of the property which is the subject matter of Award.

Rs.5/- for every Rs. One Hundred upto Rs.1000/-.

12. Bond

Rs.25/- for every Rs .Five Hundred or part there of in excess of Rs.1000/-

13. Bottomry Bond Same duty as Bond No.12.

14. Cancellation of Instruments The same duty as on the original instruments.

Rs.1/- for Rs.10/- Purchase Money.

15. Certificate of sale

Rs.1.50/- for the Purchase Money exceeding Rs.10/- but below Rs.25/-.

Duty on conveyance in any other case.

Certificate or other Rs.1/- for every Rs.1000/- or part there of the value of the share script or stock.

documents, evidencing the

right or title of the holder there

of, or any other person, either

to any share, script or stock in

16. or of any incorporated

company or other body

corporate or to become

proprietor of share, script or

stock in of any such company

or body.

17. Certificate of Enrolment Rs.500/-

18. Charter Party Rs.50/-

18(A) Clearance List The sum of duties chargeable under Article 5(b),(e),(c) and Article 37(e), (b) or (c) as the case may be.

19. Composition Deed Rs.100/-

20. Conveyance 7.5% of the Market value

21. Copy of a extract Rs.5/- to Rs.10/-

22. Counter part or Duplicate Rs.4.50 paisa to Rs.50/-

23. Customs Bond Same duty as bond upto Rs.1000/- in any other case Rs.100/-.

Delivery order in respect of Rs.1/- where the value of Goods does not exceed Rs.1000/-

24.

Goods Rs.5/- for every Rs.1000/- where the value of the Goods exceeds Rs.1000/-.

25. Divorce Rs.100/-

Same duty as conveyance No.20 for market value equal to the market value of the property of greatest value which is

26. Exchange of Property

subject matter of exchange.

27. Further Charge Same duty as conveyance No.20 for market value equal to the amount of the further charge secure for such instruments

Gift Same duty as conveyance No.20 for market value equal to the market value of the property which is the subject matter

of gift.

28.

Rs.1000/- Where the donee is a member of the family of the donor.

29. Indemnity Bond Same duty as a Security Bond No.47.

The duty chargeable varies depending upon the amount of rent, lease period and lease granted for amount advanced

30. Lease of Immovable Property

etc. Kindly go through the Article for details.

31. Letter of Allotment Rs.1/-

32. Letter of License Rs.100/-

License of Immovable and The duty chargeable varies depending upon the amount of rent, lease, license period and license granted for the

32 (A)

Movable Property lumpsum amount advanced etc. Kindly go through the Article for details.

Memorandum of Association Rs.1000/- if accompanied by the Articles of Associations u/s 26 of companies Act 1956.

33.

of a company The same duty as under Article No.10, according to the share capital of the company if not accompanied as above.

Same duty as conveyance No.20. when possession is given.

34. Mortgage Deed

Rs.50 paisa for every Rs.100/- or part there of when possession is not given.

The duty chargeable varies depending upon the amount secured and the period of re-payment etc. Kindly go through the

35. Mortgage of a Crop

Article for details.

36. Notarial Act Rs.10/-

37. Note or Memorandum Rs.1/- for every Rs.10,000/-

Note of Protest by the Master

38. Rs.2/-

of a ship

39. Partition Rs.250/- to Rs.500/- depending upon the nature of the property.

Rs.100/- where capital does not exceed Rs.5000/-

40(A) Partnership :

Rs.1000/- in any other case.

Same duty as conveyance No.20 on the MV of the property of the Immovable property remaining with the firm.

40(B) Reconstitution

Rs.500/- in any other case.

40 (C) Dissolution a) The same duty as conveyance for a market value equal to the market value of the property distributed or allotted or

given to partner or partners under the instrument of dissolution, in addition to the duty which would have been

chargeable on such dissolution if such property has not been distributed or allotted or given.

b) In any other case Rs.500/-

41. Power of Attorney When given to a promoter or developer by a whatever name called for construction, development on, or sale or transfer

of any immoveable property situated in Karnataka. Rs.10,000/- to Rs.1.50 lakhs based on the market value of the

property.

When given to a person other than Father, Mother, Wife or Husband, Sons, Daughters, Brothers, Sisters in relation to

the executants authorizing such person to sell immoveable property situated in Karnataka. 7.5% on the market value of

the property.

In any other case Rs.100/-

42. Protest of Bill Rs.10/-

Protest by the Master of a

43. Rs.5/-

Ship

44. Re-conveyance of Mortgage Same duty as conveyance No.20 on the MV equal to the amount of such consideration not exceeding Rs.1000/-.

Rs.100/- in any other case.

45. Release Release is not between the family members, where the release is not for consideration 2.5% on the MV of the subject

matter of release.

Release is not between the family members, where the release is for consideration 50% of the rate applicable to

conveyance on the MV of the property which is the subject matter of release.

Where the release is between the family members Rs.1000/-.

Release of mortgage rights Rs.100/-

46. Respodentia Bond The same duty as Bond No.12, for the amount of the loan secured.

Security Bond or Mortgage a) Same duty as Bond No.12 for the amount secured does not exceed Rs.1000/-

47.

Duty b) Rs.100/- in any other case.

I. Same duty as conveyance for market value equal to the market value of the property which is the subject matter of the

settlement where disposition is not for the purpose of the distributing the property of the settlor among is family.

48. Settlement

II. Rs.1000/- where disposition is for the purpose of the distributing the property of the settlor among the members of his

family.

One half times the duty payable on a conveyance for MV equal to the nominal amount of the shares specified in the

49. Share Warrants

warrants.

50. Shipping Rs.2/-

1. The duty with which such lease is chargeable where the duty chargeable does not exceed Rs.22.50 paisa.

51. Surrender of Lease

2. Rs.100/- in any other case.

52. Transfer Please see the Article.

a) Same duty as conveyance for a market value equal to the amount of consideration if the remaining period of lease

does not exceed 30 years.

53. Transfer of Lease

b) The same duty as conveyance on the market value of the property which is the subject matter of transfer, where lease

period exceeds 30 yrs.

53(A). Transfer of License Same duty as conveyance No.20

54. Trust : A) Declaration Rs.500/-

i) Concerning any money of

amount conveyed by the

author to the trust as corpus.

Rs.500/-

ii) Concerning any immovable

property owned by the author

and conveyed to the trust of

which, the author is the sole

trusties.

Same duty as conveyance for MV of the property conveyed.

iii) Concerning any immovable

property owned by the author

and conveyed to the trust of

which, the author is not a

trusties or one of the trusties.

B) Revocation of concerning

any property when made by The Same duty as Bond No.12 for a sum equal to the amount or value of the property concerned as set forth in the

any instruments other than a instruments but not exceeding Rs.200/-

will.

55. Warrant of Goods Rs.10/-

Das könnte Ihnen auch gefallen

- Haryana Stamp ActDokument4 SeitenHaryana Stamp ActRupali SamuelNoch keine Bewertungen

- Chandigarh - Stamp DutyDokument5 SeitenChandigarh - Stamp DutyVirajNoch keine Bewertungen

- GO ChangeInStampDutyDokument9 SeitenGO ChangeInStampDutySANTHOSH SANTHOSHNoch keine Bewertungen

- Duty & Fees - Stamp Duty and Registration FeeDokument5 SeitenDuty & Fees - Stamp Duty and Registration FeeBoopathy RangasamyNoch keine Bewertungen

- Stamp Duty and Registration FeeDokument3 SeitenStamp Duty and Registration FeeJerard francis victorNoch keine Bewertungen

- Bombay Stamp Act SCHDokument39 SeitenBombay Stamp Act SCHManoj Kumar SinsinwarNoch keine Bewertungen

- Bare Acts & Rules: Hello Good People !Dokument25 SeitenBare Acts & Rules: Hello Good People !Fathima FarhathNoch keine Bewertungen

- INDIAN STAMP ACT, 1899 Schedule I-A - SCHEDULE I-ADokument28 SeitenINDIAN STAMP ACT, 1899 Schedule I-A - SCHEDULE I-AyashNoch keine Bewertungen

- Farm Machinery LoansDokument2 SeitenFarm Machinery Loansagrarian farmer producerNoch keine Bewertungen

- Schedule 1-A of Indian Stamp Act 1899Dokument10 SeitenSchedule 1-A of Indian Stamp Act 1899Prem MahalaNoch keine Bewertungen

- SCHEDULE 1 -A” DOCUMENTDokument52 SeitenSCHEDULE 1 -A” DOCUMENTmayankNoch keine Bewertungen

- Procedures Prescribed Under The Stamp Act To Check Undervaluation From Evasion of Stamp DutyDokument49 SeitenProcedures Prescribed Under The Stamp Act To Check Undervaluation From Evasion of Stamp DutymohantamilNoch keine Bewertungen

- Topic 5Dokument49 SeitenTopic 5SanyamNoch keine Bewertungen

- West BengalDokument41 SeitenWest BengalpriyalNoch keine Bewertungen

- Huda Agreement To Sell FormatDokument3 SeitenHuda Agreement To Sell FormatLive lifeNoch keine Bewertungen

- Maharashtra Stamp Act 1958Dokument7 SeitenMaharashtra Stamp Act 1958Kunal GangulyNoch keine Bewertungen

- UBI Valuation FeesDokument1 SeiteUBI Valuation FeesMONEY WEALTH HUBNoch keine Bewertungen

- Schedule I-B Stamp Duty RatesDokument20 SeitenSchedule I-B Stamp Duty Ratesblogs414Noch keine Bewertungen

- Karnataka Stamp Act 1957 Schedule PDFDokument53 SeitenKarnataka Stamp Act 1957 Schedule PDFRAJESH KUMARNoch keine Bewertungen

- Brief Note On Stamp Duty On POADokument4 SeitenBrief Note On Stamp Duty On POAharshalaNoch keine Bewertungen

- Contract for Iron Ore SaleDokument5 SeitenContract for Iron Ore Salesv net100% (1)

- Registration of Document, HaryanaDokument5 SeitenRegistration of Document, HaryanaSunil PrasadNoch keine Bewertungen

- User Charges S.No. Ltem On Which User Charges To Be Levied Rate of LevyDokument1 SeiteUser Charges S.No. Ltem On Which User Charges To Be Levied Rate of LevyseshuNoch keine Bewertungen

- Analysis Criteria 2Dokument4 SeitenAnalysis Criteria 2torchbarsNoch keine Bewertungen

- 2020-03-26 Stamp Duty and Registration Fee T NaduDokument5 Seiten2020-03-26 Stamp Duty and Registration Fee T Naduvganapathy1000Noch keine Bewertungen

- Stamp Duty and Registration Fee Chart: OptionalDokument14 SeitenStamp Duty and Registration Fee Chart: OptionalYatish RanjanNoch keine Bewertungen

- Analyzing Court Fee ActDokument15 SeitenAnalyzing Court Fee Actzenab tayyab 86Noch keine Bewertungen

- Andhra Pradesh and Telangana Stamp ActDokument53 SeitenAndhra Pradesh and Telangana Stamp ActASHUTOSH MISHRANoch keine Bewertungen

- Kerala registration rates and fees guideDokument12 SeitenKerala registration rates and fees guideranjithxavierNoch keine Bewertungen

- Haryana Stamp Duty RatesDokument16 SeitenHaryana Stamp Duty RatesPankaj Vivek88% (17)

- Chit Fund FeesDokument5 SeitenChit Fund Feesvinod kumarNoch keine Bewertungen

- Stamp Duty and Registration Fee Chart: OptionalDokument14 SeitenStamp Duty and Registration Fee Chart: Optionalkalluri raviNoch keine Bewertungen

- Bombay Stamp Act, 1958 Schedule I PDFDokument23 SeitenBombay Stamp Act, 1958 Schedule I PDFtejasj171484Noch keine Bewertungen

- Class ExamDokument17 SeitenClass ExamScribdTranslationsNoch keine Bewertungen

- Maharashtra and Goa Stamp DutyDokument2 SeitenMaharashtra and Goa Stamp DutyPratyash KhannaNoch keine Bewertungen

- SCHEDULE 1 STAMP DUTY HIGHLIGHTSDokument16 SeitenSCHEDULE 1 STAMP DUTY HIGHLIGHTSMavra GhaznaviNoch keine Bewertungen

- Stamp Duty and Registration Fee Detail PDFDokument7 SeitenStamp Duty and Registration Fee Detail PDFyashpalahujaNoch keine Bewertungen

- Jlo NotesDokument13 SeitenJlo Notessaket agarwalNoch keine Bewertungen

- Section 2 - Amendment of Schedule-1 of Act No. 2 of 1899Dokument34 SeitenSection 2 - Amendment of Schedule-1 of Act No. 2 of 1899ASHUTOSH MISHRANoch keine Bewertungen

- Stamp Act duties and rulesDokument16 SeitenStamp Act duties and rulesMuhammad Ehsan QadirNoch keine Bewertungen

- Sale Deed For Half of The Property or Floor of A House in NCT of DelhiDokument4 SeitenSale Deed For Half of The Property or Floor of A House in NCT of DelhiSudeep SharmaNoch keine Bewertungen

- Court Fee TableDokument4 SeitenCourt Fee TablepadampaulNoch keine Bewertungen

- Release of Legacy Charge for Marriage ExpensesDokument1 SeiteRelease of Legacy Charge for Marriage ExpensesSudeep SharmaNoch keine Bewertungen

- General Financial and Accounts Rules: Government of RajasthanDokument64 SeitenGeneral Financial and Accounts Rules: Government of RajasthanDrManoj Kumar SharmaNoch keine Bewertungen

- Karnataka Stamp Duty Rates Updated Upto 31-07-2010Dokument28 SeitenKarnataka Stamp Duty Rates Updated Upto 31-07-2010Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್50% (2)

- Annex UreDokument8 SeitenAnnex UreSiva PrasadNoch keine Bewertungen

- Development Agreement by The LandlordsDokument14 SeitenDevelopment Agreement by The LandlordsnamanNoch keine Bewertungen

- Sale Deed For Floor of A House To Woman in Delhi: Form No. 14Dokument4 SeitenSale Deed For Floor of A House To Woman in Delhi: Form No. 14Sudeep SharmaNoch keine Bewertungen

- Karnataka Stamp ActDokument53 SeitenKarnataka Stamp ActAkshay BhatiaNoch keine Bewertungen

- Investments in Property, Plant, and Equipment and in Intangible AssetsDokument53 SeitenInvestments in Property, Plant, and Equipment and in Intangible AssetsGaluh Boga KuswaraNoch keine Bewertungen

- Stamp Duty in RajasthanDokument22 SeitenStamp Duty in RajasthanPooja MisraNoch keine Bewertungen

- Sarawak Government Gazette: Vol. Lxxiii 16th April, 2018 No. 27Dokument22 SeitenSarawak Government Gazette: Vol. Lxxiii 16th April, 2018 No. 27Azam TrudinNoch keine Bewertungen

- Karnataka Stamp Act, 1957 ScheduleDokument83 SeitenKarnataka Stamp Act, 1957 SchedulePratim MajumderNoch keine Bewertungen

- Taxation RegulationsDokument31 SeitenTaxation RegulationsIsaacNoch keine Bewertungen

- Business Law Questions Sem 3Dokument32 SeitenBusiness Law Questions Sem 3Aashna JainNoch keine Bewertungen

- Indian Stamp Duty (Nagaland Amendment) Act, 1989Dokument67 SeitenIndian Stamp Duty (Nagaland Amendment) Act, 1989Latest Laws TeamNoch keine Bewertungen

- Exchange of Immovable PropertyDokument3 SeitenExchange of Immovable PropertyCharran saNoch keine Bewertungen

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsVon EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNoch keine Bewertungen

- An Optimum Base for Pricing Middle Eastern Crude OilVon EverandAn Optimum Base for Pricing Middle Eastern Crude OilNoch keine Bewertungen

- Ub One Level 11-For SaleDokument16 SeitenUb One Level 11-For SaleJason WongNoch keine Bewertungen

- MyLegalWhiz - Deed of Conditional Sale Condominium UnitDokument2 SeitenMyLegalWhiz - Deed of Conditional Sale Condominium UnitConcon FabricanteNoch keine Bewertungen

- Staggers PropertyDokument8 SeitenStaggers PropertyBen KellerNoch keine Bewertungen

- Commercial Lease Agreement SummaryDokument7 SeitenCommercial Lease Agreement SummaryMazana ÁngelNoch keine Bewertungen

- Additional Affidavit in Lieu of Examination in Chief of Pw2Dokument6 SeitenAdditional Affidavit in Lieu of Examination in Chief of Pw2KamshadNoch keine Bewertungen

- Chapter 11 - Letting and Hiring PDFDokument6 SeitenChapter 11 - Letting and Hiring PDFMacdonald PhashaNoch keine Bewertungen

- Deed of Absolute Sale GarciaDokument26 SeitenDeed of Absolute Sale GarciaSampaguita RamosNoch keine Bewertungen

- House Rental Agreement: Tenant Information Landlord InformationDokument4 SeitenHouse Rental Agreement: Tenant Information Landlord Informationas d-fNoch keine Bewertungen

- Art 415-439 ReviewerDokument12 SeitenArt 415-439 ReviewerjunaNoch keine Bewertungen

- Rental LawDokument26 SeitenRental LawAnonymous uYSyru2Noch keine Bewertungen

- Rental Agreement FileDokument3 SeitenRental Agreement Filejaspriya17Noch keine Bewertungen

- Silent Cry of The PoorDokument137 SeitenSilent Cry of The PoorViola DavisNoch keine Bewertungen

- Residences by Armani CasaDokument2 SeitenResidences by Armani CasaHakanNoch keine Bewertungen

- List 07-31-2012 Alpha OrderDokument674 SeitenList 07-31-2012 Alpha OrderMichael LindenbergerNoch keine Bewertungen

- F038-Deed of Sale With Assumption of MortgageDokument2 SeitenF038-Deed of Sale With Assumption of MortgageMark Jhon PasamonNoch keine Bewertungen

- Assignment of Lease Option AgreementDokument3 SeitenAssignment of Lease Option AgreementAlberta Real Estate100% (1)

- Dilapidation Survey Schedule of Dilapidation (Sod) :: CostingDokument7 SeitenDilapidation Survey Schedule of Dilapidation (Sod) :: CostingsyahidatulNoch keine Bewertungen

- Saqs - Chapter 15 - Law of LeaseDokument2 SeitenSaqs - Chapter 15 - Law of LeaseStg the LabelNoch keine Bewertungen

- Indefeasibility of Title Paper PMM PDFDokument22 SeitenIndefeasibility of Title Paper PMM PDFAnonymous LFHNULfsNoch keine Bewertungen

- A Method To Obtain An Allodial Title To Your PropertyDokument2 SeitenA Method To Obtain An Allodial Title To Your Propertykatia100% (1)

- Property Course OutlineDokument40 SeitenProperty Course OutlineKatlyn Cinelli100% (1)

- 2018 Ico 2068Dokument5 Seiten2018 Ico 2068Nidheesh TpNoch keine Bewertungen

- College of Law Publishing Commercial Property 2012-2013 (2013)Dokument481 SeitenCollege of Law Publishing Commercial Property 2012-2013 (2013)Login ScribdNoch keine Bewertungen

- Deed of Quitclaim of Real Property. FormatDokument2 SeitenDeed of Quitclaim of Real Property. Formatanna_no93% (58)

- Fide Claim of Ownership Since June 12, 1945 or EarlierDokument10 SeitenFide Claim of Ownership Since June 12, 1945 or EarlierAreeNoch keine Bewertungen

- Format - Rent AgreementDokument2 SeitenFormat - Rent Agreementdeepak bhardwajNoch keine Bewertungen

- SICAD VS. CA - Donation Mortis Causa vs Inter VivosDokument2 SeitenSICAD VS. CA - Donation Mortis Causa vs Inter VivosLeo TumaganNoch keine Bewertungen

- Application FormDokument1 SeiteApplication FormjvenatorNoch keine Bewertungen

- SouthWood Home Inventory (July)Dokument2 SeitenSouthWood Home Inventory (July)Nathan Cross100% (2)