Beruflich Dokumente

Kultur Dokumente

Maryland Real Estate Market Activity 02-07-2011

Hochgeladen von

Nishika JGCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Maryland Real Estate Market Activity 02-07-2011

Hochgeladen von

Nishika JGCopyright:

Verfügbare Formate

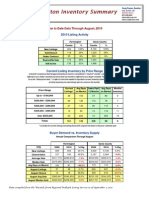

Publish Date: February 7, 2011

Weekly Activity

Housing market activity in our nation's capital will struggle to clear the high New Listings ......... 2

water mark set during the spring 2010 tax credit. This dynamic reared its

head as sellers placed about 1,100 fewer properties on the market than

y did during

they g the same week in 2010. That made for a 29.8 p percent

Pending Sales ......... 3

decrease and this year's trendline has begun to diverge somewhat from

last year's.

Active Listings ......... 4

Pending Sales posted their smallest year-over-year gain in over two

months. Buyer activity increased 2.3 percent over year-ago levels, Most Recent Month

following seven consecutive weeks of double-digit gains. After hovering

somewhat above it, the current Pending Sales trendline has begun to

converge with the previous year's. Days on Market Until Sale ......... 5

Fortunately, the number of Active Listings for sale continued to fall. This

metric dropped 6.2 percent from a year prior to just under 54,000 homes. Percent of Original List Price Received at Sale ......... 6

That's the sixth consecutive week of inventory drops – a factor that will help

maintain price stability even as we're comparing a non-incentive market to

an incentive market. Housing Affordability Index ......... 7

Months Supply of Inventory ......... 8

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 1

New Listings

As of February 7, 2011

Last Three Months Weekly New Listings

4,500

For the week Current One Year One Year

Current Activity

ending: Activity Ago Change

4,000 One Year Ago

11/6/2010 3,180 3,324 - 4.3%

11/13/2010 3,170 3,274 - 3.2%

3,500 11/20/2010 2,882 3,020 - 4.6%

11/27/2010 1,780 1,931 - 7.8%

3,000

12/4/2010 2,897 2,978 - 2.7%

12/11/2010 2,662 2,789 - 4.6%

12/18/2010 2,349 2,209 + 6.3%

2,500

12/25/2010 1,656 1,295 + 27.9%

1/1/2011 1,597 1,875 - 14.8%

2,000 1/8/2011 3,159 3,400 - 7.1%

1/15/2011 3,068 3,644 - 15.8%

1/22/2011 3,066 3,618 - 15.3%

1,500

1/29/2011 2,620 3,730 - 29.8%

3-Month Total: 34,086 37,087 - 8.1%

1,000

11/6/10 11/13/10 11/20/10 11/27/10 12/4/10 12/11/10 12/18/10 12/25/10 1/1/11 1/8/11 1/15/11 1/22/11 1/29/11

Compared to Last Year: Down (-)

Historical New Listings Compared to 2003: Down (-)

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

1/4/03 5/4/03 9/1/03 12/30/03 4/28/04 8/26/04 12/24/04 4/23/05 8/21/05 12/19/05 4/18/06 8/16/06 12/14/06 4/13/07 8/11/07 12/9/07 4/7/08 8/5/08 12/3/08 4/2/09 7/31/09 11/28/09 3/28/10 7/26/10 11/23/10

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 2

Pending Sales

As of February 7, 2011

Last Three Months Weekly Pending Sales

2,400

For the week Current One Year One Year

ending: Activity Ago Change

2,200

11/6/2010 2,008 1,866 + 7.6%

2,000 11/13/2010 1,941 1,798 + 8.0%

11/20/2010 2,066 1,829 + 13.0%

1,800 11/27/2010 1,319 1,290 + 2.2%

12/4/2010 1,772 1,709 + 3.7%

1,600

12/11/2010 1,732 1,558 + 11.2%

12/18/2010 1,755 1,471 + 19.3%

1,400

12/25/2010 1,354 926 + 46.2%

1/1/2011 1,250 1,047 + 19.4%

1/8/2011 1,671 1,449 + 15.3%

1,200

1/15/2011 2,056 1,780 + 15.5%

Current Activity 1/22/2011 2,201 1,984 + 10.9%

1,000

One Year Ago 1/29/2011 2,135 2,087 + 2.3%

3-Month Total: 23,260 20,794 + 11.9%

800

11/6/10 11/13/10 11/20/10 11/27/10 12/4/10 12/11/10 12/18/10 12/25/10 1/1/11 1/8/11 1/15/11 1/22/11 1/29/11

Compared to Last Year: Up (+)

Historical Pending Sales Compared to 2003: Down (-)

5,000

4,000

3,000

2,000

1,000

0

1/4/03 5/4/03 9/1/03 12/30/03 4/28/04 8/26/04 12/24/04 4/23/05 8/21/05 12/19/05 4/18/06 8/16/06 12/14/06 4/13/07 8/11/07 12/9/07 4/7/08 8/5/08 12/3/08 4/2/09 7/31/09 11/28/09 3/28/10 7/26/10 11/23/10

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 3

Active Listings for Sale

As of February 7, 2011

Last Three Months Weekly Inventory for Sale

70,000

Current One Year One Year

Inventory as of:

Current Inventory Inventory Ago Change

67,500

One Year Ago 10/30/2010 67,212 64,633 + 4.0%

11/6/2010 65,616 63,226 + 3.8%

65,000 11/13/2010 65,029 63,138 + 3.0%

11/20/2010 64,335 62,819 + 2.4%

62,500

11/27/2010 63,363 62,402 + 1.5%

12/4/2010 62,614 61,189 + 2.3%

12/11/2010 61,130 60,685 + 0.7%

60,000

12/18/2010 60,287 60,121 + 0.3%

12/25/2010 59,085 59,318 - 0.4%

57,500 1/1/2011 58,473 58,992 - 0.9%

1/8/2011 55,281 56,367 - 1.9%

1/15/2011 55,099 56,834 - 3.1%

55,000

1/22/2011 54,606 57,200 - 4.5%

1/29/2011 53,959 57,505 - 6.2%

52,500

3 Month Avg:

3-Month 59 914

59,914 59 984

59,984 - 0.1%

0 1%

10/30/10 11/6/10 11/13/10 11/20/10 11/27/10 12/4/10 12/11/10 12/18/10 12/25/10 1/1/11 1/8/11 1/15/11 1/22/11 1/29/11

Compared to Last Year: Even

Historical Weekly Inventory for Sale Compared to 2003: Down (-)

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

1/11/03 5/11/03 9/8/03 1/6/04 5/5/04 9/2/04 12/31/04 4/30/05 8/28/05 12/26/05 4/25/06 8/23/06 12/21/06 4/20/07 8/18/07 12/16/07 4/14/08 8/12/08 12/10/08 4/9/09 8/7/09 12/5/09 4/4/10 8/2/10 11/30/10

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 4

Days on Market Until Sale

December 2010 — 90

Current One Year One Year

Month

112 Year Previous Change

1-2010 86 124 - 31.2%

2-2010 86 123 - 30.2%

90

85 3-2010 85 119 - 28.9%

4-2010 78 110 - 29.5%

5-2010 74 108 - 31.4%

6-2010 72 100 - 27.9%

7-2010 71 95 - 24.8%

8-2010 76 92 - 17.4%

9-2010 82 91 - 10.4%

- 23.9% + 5.9% 10-2010 83 90 - 7.5%

11-2010 86 84 + 1.7%

12-2010 90 85 + 5.9%

12-Month Avg: 81 102 - 20.8%

12-2008 12-2009 12-2010

Compared to Last Year: Up (+)

Historical Days on Market Until Sale Compared to 2003: Up (+)

140

120

100

80

60

40

20

1-2003 1-2004 1-2005 1-2006 1-2007 1-2008 1-2009 1-2010

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 5

Percent of Original List Price Received at Sale

December 2010 — 92.0%

Does not account for list prices from any previous

100%

listing contracts or seller concessions. Current One Year One Year

Month

98% Year Previous Change

1-2010 93.6% 90.2% + 3.8%

96%

93.9% 2-2010 93.9% 90.0% + 4.4%

94%

3-2010 94.2% 90.4% + 4.1%

92.0%

4-2010 94.7% 91.3% + 3.7%

92% 90.9%

5-2010 94.9% 92.2% + 2.9%

90%

6-2010 94.7% 92.9% + 2.0%

88% 7-2010 94.3% 93.4% + 0.9%

8-2010 93.6% 93.8% - 0.2%

86%

9-2010 93.0% 94.1% - 1.2%

84% + 3.3% - 2.0% 10-2010 92.8% 94.1% - 1.4%

82% 11-2010 92.5% 94.4% - 2.0%

12-2010 92.0% 93.9% - 2.0%

80%

12-Month Avg: 93.7% 92.6% + 1.2%

12-2008 12-2009 12-2010

C d to Last

Compared L Y

Year: Down (-)

Historical Percent of Original List Price Received at Sale Compared to 2003: Down (-)

102%

100%

98%

96%

94%

92%

90%

88%

1-2003 1-2004 1-2005 1-2006 1-2007 1-2008 1-2009 1-2010

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 6

Housing Affordability Index

December 2010 — 148

146 148 Current One Year One Year

144 Month

Year Previous Change

1-2010 152 152 + 0.2%

2-2010 149 155 - 4.4%

3-2010 149 146 + 2.2%

4-2010 144 146 - 1.6%

5-2010 139 136 + 1.7%

6-2010 132 131 + 1.3%

7-2010 131 131 + 0.4%

8-2010 134 134 + 0.1%

9-2010 142 141 + 0.9%

+ 27.7% + 2.8% 10-2010 144 144 - 0.3%

11-2010 145 147 - 1.2%

12-2010 148 144 + 2.8%

12-2008 12-2009 12-2010 12-Month Avg: 142 142 + 0.1%

The Housing Affordability Index measures housing affordability for the MRIS service

region. The higher the number, the more affordable our housing is. Compared to Last Year: Even

Historical Housing Affordability Index An HAI of 120 would mean that the median household income was 120% of the

Up (+)

necessary income to qualify for the median priced home under prevailing interest rates. Compared to 2003:

160

150

140

130

120

110

100

90

1-2003 1-2004 1-2005 1-2006 1-2007 1-2008 1-2009 1-2010

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 7

Months Supply of Inventory

December 2010 — 6.9 Months

Current One Year One Year

9.1 Month

Year Previous Change

1-2010 6.1 8.3 - 26.6%

2-2010 6.1 8.2 - 24.9%

6.9

6.5 3-2010 6.2 8.2 - 24.1%

4-2010 6.6 8.1 - 19.5%

5-2010 6.7 8.1 - 18.1%

6-2010 7.0 8.0 - 11.7%

7-2010 7.3 7.7 - 6.1%

8-2010 7.5 7.6 - 0.9%

9-2010 7.5 7.4 + 2.3%

- 28.1% + 5.5% 10-2010 7.7 7.2 + 6.3%

11-2010 7.5 6.9 + 8.9%

12-2010 6.9 6.5 + 5.5%

12-Month Avg: 6.9 7.7 - 9.9%

12-2008 12-2009 12-2010

C d to

Compared t Last

L t Year:

Y Up (+)

Historical Months Supply of Inventory Compared to 2003: Up (+)

12

10

1-2004 1-2005 1-2006 1-2007 1-2008 1-2009 1-2010

All data provided by RealEstate Business Intelligence, LLC | An MRIS company

Reports are created and maintained by 10K Research and Marketing. Data current as of 2/7/2011. This report may be reproduced by MRIS members. 8

Das könnte Ihnen auch gefallen

- Real Estate Market Activity 01-24-2011Dokument8 SeitenReal Estate Market Activity 01-24-2011Nishika JGNoch keine Bewertungen

- MRIS MarketActivity 9132010Dokument8 SeitenMRIS MarketActivity 9132010Nishika JGNoch keine Bewertungen

- Maryland Real Estate Market Activity10-11-2010Dokument8 SeitenMaryland Real Estate Market Activity10-11-2010Nishika JGNoch keine Bewertungen

- Market ActivityDokument8 SeitenMarket ActivitytmcintyreNoch keine Bewertungen

- Market ActivityDokument8 SeitenMarket ActivitytmcintyreNoch keine Bewertungen

- Maryland Real Estate Market Activity, March 7, 2011, New Listings, Pending Sales, Days On MarketDokument5 SeitenMaryland Real Estate Market Activity, March 7, 2011, New Listings, Pending Sales, Days On MarkettmcintyreNoch keine Bewertungen

- Maryland Real Estate Market Activity, February 1, 2010, New Listings, Pending Sales, Days On MarketDokument4 SeitenMaryland Real Estate Market Activity, February 1, 2010, New Listings, Pending Sales, Days On MarkettmcintyreNoch keine Bewertungen

- A Publication of RMLS, The Source For Real Estate Statistics in Your CommunityDokument7 SeitenA Publication of RMLS, The Source For Real Estate Statistics in Your CommunitymwarmanenNoch keine Bewertungen

- Austin Local Market Report by Area March 2011Dokument27 SeitenAustin Local Market Report by Area March 2011Bryce CathcartNoch keine Bewertungen

- Baltimore County Real Estate Market Update April 18, 2011Dokument1 SeiteBaltimore County Real Estate Market Update April 18, 2011tmcintyreNoch keine Bewertungen

- Austin Real Estate Market Statistics For March 2009Dokument15 SeitenAustin Real Estate Market Statistics For March 2009Daniel PriceNoch keine Bewertungen

- October 2010 Portland Oregon Real Estate Market Action Report From RMLS Courtesy of Listed SoldDokument7 SeitenOctober 2010 Portland Oregon Real Estate Market Action Report From RMLS Courtesy of Listed SoldAndrewBeachNoch keine Bewertungen

- Residential Review:: A Publication of RMLS, The Source For Real Estate Statistics in Your CommunityDokument20 SeitenResidential Review:: A Publication of RMLS, The Source For Real Estate Statistics in Your Communitywrite4uNoch keine Bewertungen

- January 2011 Portland Oregon Market Statistics Courtesy of Liste2Sold Andrew BeachDokument7 SeitenJanuary 2011 Portland Oregon Market Statistics Courtesy of Liste2Sold Andrew BeachAndrewBeachNoch keine Bewertungen

- BGL Consumer Insider Food Distributors Hungry For AcquisitionsDokument13 SeitenBGL Consumer Insider Food Distributors Hungry For AcquisitionsIleanaNoch keine Bewertungen

- Baltimore County Real Estate Market Update February 21, 2011Dokument1 SeiteBaltimore County Real Estate Market Update February 21, 2011tmcintyreNoch keine Bewertungen

- Retail Constituents: Laura Ellis: Date Last % Change High Low VolDokument4 SeitenRetail Constituents: Laura Ellis: Date Last % Change High Low Vollaura_ellisNoch keine Bewertungen

- Existing HomeDokument1 SeiteExisting HomeJessica Kister-LombardoNoch keine Bewertungen

- Loadfile RMLS Market Stats October '10 Portand MetroDokument7 SeitenLoadfile RMLS Market Stats October '10 Portand Metrosanwest60Noch keine Bewertungen

- Austin Residential Sales Report March 2011Dokument12 SeitenAustin Residential Sales Report March 2011Bryce CathcartNoch keine Bewertungen

- A Publication of RMLS, The Source For Real Estate Statistics in Your CommunityDokument7 SeitenA Publication of RMLS, The Source For Real Estate Statistics in Your CommunityAndrewBeachNoch keine Bewertungen

- Lakeville 3.19 Market ReportDokument1 SeiteLakeville 3.19 Market ReportLeslie DahlenNoch keine Bewertungen

- Housing Supply Overview: January 2011 Quick FactsDokument7 SeitenHousing Supply Overview: January 2011 Quick FactsDaniel PriceNoch keine Bewertungen

- Portland Home Sale Values August 2010 Courtesy Listed SoldDokument7 SeitenPortland Home Sale Values August 2010 Courtesy Listed SoldAndrewBeachNoch keine Bewertungen

- Farmington Update 2010 - 08Dokument1 SeiteFarmington Update 2010 - 08CraigFrazerNoch keine Bewertungen

- Austin Local Market Report by Regions April 2011Dokument27 SeitenAustin Local Market Report by Regions April 2011Bryce CathcartNoch keine Bewertungen

- Market Watch Feb 22 2010Dokument4 SeitenMarket Watch Feb 22 2010annalena_thomas4235Noch keine Bewertungen

- September 2009 Portland Oregon Real Estate Market Report Sponsored by Listed2SoldDokument7 SeitenSeptember 2009 Portland Oregon Real Estate Market Report Sponsored by Listed2SoldAndrewBeachNoch keine Bewertungen

- Johnson, KSDokument1 SeiteJohnson, KSVicki FountainNoch keine Bewertungen

- Invest in Pakistan (2019)Dokument10 SeitenInvest in Pakistan (2019)Cornhill StrategyNoch keine Bewertungen

- Sizing Up The Executive Branch - 1Dokument9 SeitenSizing Up The Executive Branch - 1Edison BreggerNoch keine Bewertungen

- Timber Sector Update: Positive Signs of Recovery-07/09/2010Dokument5 SeitenTimber Sector Update: Positive Signs of Recovery-07/09/2010Rhb InvestNoch keine Bewertungen

- April Experiences Record Number of Buyers and Sellers: InsideDokument1 SeiteApril Experiences Record Number of Buyers and Sellers: Insideapi-27043054Noch keine Bewertungen

- January 2010 RMLS Market Action Statistics For Portland Oregon Real Estate Presented by Listed Sold Team at Prudential NW PropertiesDokument7 SeitenJanuary 2010 RMLS Market Action Statistics For Portland Oregon Real Estate Presented by Listed Sold Team at Prudential NW PropertiesAndrewBeachNoch keine Bewertungen

- Guyana Revenue Authority outlines income tax rates and thresholdsDokument5 SeitenGuyana Revenue Authority outlines income tax rates and thresholdsStephen FrancisNoch keine Bewertungen

- Data Land, Inc.: The Silk Residences Tower 1 Unit 3803Dokument1 SeiteData Land, Inc.: The Silk Residences Tower 1 Unit 3803Prince MagallanesNoch keine Bewertungen

- Inventory Summary FarmingtonDokument1 SeiteInventory Summary FarmingtonCraigFrazerNoch keine Bewertungen

- July2010 Market StatsDokument15 SeitenJuly2010 Market StatsRomeo ManzanillaNoch keine Bewertungen

- Tampa Economic IndicatorsDokument1 SeiteTampa Economic IndicatorsTampaEDCNoch keine Bewertungen

- Austin Residential Sales Report February 2011Dokument12 SeitenAustin Residential Sales Report February 2011Bryce CathcartNoch keine Bewertungen

- FRED Release Highlights Third Quarter 2018Dokument198 SeitenFRED Release Highlights Third Quarter 2018Adm TntNoch keine Bewertungen

- Austin Residential Sales Report April 2011Dokument12 SeitenAustin Residential Sales Report April 2011Bryce CathcartNoch keine Bewertungen

- Employment March 2011Dokument38 SeitenEmployment March 2011Nathan MartinNoch keine Bewertungen

- Maryland Real Estate Market Activity, May 2, 2011, New Listings, Pending Sales, Days On MarketDokument13 SeitenMaryland Real Estate Market Activity, May 2, 2011, New Listings, Pending Sales, Days On MarkettmcintyreNoch keine Bewertungen

- Austin Real Estate Market Statistics For July 2009Dokument15 SeitenAustin Real Estate Market Statistics For July 2009Daniel PriceNoch keine Bewertungen

- Home SalesDokument1 SeiteHome Salesgayle8961Noch keine Bewertungen

- Retail AnalyticsDokument21 SeitenRetail AnalyticsSaumya SinghNoch keine Bewertungen

- Motor - May TIV Rises 15.6% YoY, 4.2% MoM - 23/6/2010Dokument5 SeitenMotor - May TIV Rises 15.6% YoY, 4.2% MoM - 23/6/2010Rhb InvestNoch keine Bewertungen

- Timber: Prospects Are Looking Better-17/03/2010Dokument5 SeitenTimber: Prospects Are Looking Better-17/03/2010Rhb InvestNoch keine Bewertungen

- Semiconductor Sector Update: Jun Chip Sales Growth Narrows Mom - 03/08/2010Dokument4 SeitenSemiconductor Sector Update: Jun Chip Sales Growth Narrows Mom - 03/08/2010Rhb InvestNoch keine Bewertungen

- Short History of MalaysiaDokument1 SeiteShort History of MalaysiaamranNoch keine Bewertungen

- Montgomery Township: 1 Quarter 2011 Budget ReportDokument7 SeitenMontgomery Township: 1 Quarter 2011 Budget ReportAndy StettlerNoch keine Bewertungen

- Paparan Public 08 06 2017 FinalDokument11 SeitenPaparan Public 08 06 2017 FinalAsha anasthasyaNoch keine Bewertungen

- Bwcu Htsqwn00sorvupdk.3Dokument22 SeitenBwcu Htsqwn00sorvupdk.3JoshKernNoch keine Bewertungen

- Austin Real Estate Market Statistics For February 2009Dokument15 SeitenAustin Real Estate Market Statistics For February 2009Daniel PriceNoch keine Bewertungen

- Federal Reserve Releases Q1 2020 Financial Accounts DataDokument198 SeitenFederal Reserve Releases Q1 2020 Financial Accounts DataSam RobnettNoch keine Bewertungen

- J O L T - J 2022: For Release 10:00 A.M. (ET) Wednesday, March 9, 2022Dokument34 SeitenJ O L T - J 2022: For Release 10:00 A.M. (ET) Wednesday, March 9, 2022daviddaka1Noch keine Bewertungen

- Oil and Gas Sector Update - Getting Better? - 19/07/2010Dokument6 SeitenOil and Gas Sector Update - Getting Better? - 19/07/2010Rhb InvestNoch keine Bewertungen

- Mid-Year Economic Update: 2010: The United States and CaliforniaDokument29 SeitenMid-Year Economic Update: 2010: The United States and CaliforniajddishotskyNoch keine Bewertungen

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsVon EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNoch keine Bewertungen

- Broward County Luxury Condos For Sale ComparisonDokument1 SeiteBroward County Luxury Condos For Sale ComparisonNishika JGNoch keine Bewertungen

- Dade County Market TrendsDokument6 SeitenDade County Market TrendsNishika JGNoch keine Bewertungen

- DemographicsDokument4 SeitenDemographicsNishika JGNoch keine Bewertungen

- HUD Asset ManagersDokument2 SeitenHUD Asset ManagersNishika JGNoch keine Bewertungen

- Maryland Mortgage Program - Free KitDokument16 SeitenMaryland Mortgage Program - Free KitNishika JGNoch keine Bewertungen

- Miami-Fort Lauderdale-Pompano Beach MSA Single Family Homes 2015-01 DetailDokument9 SeitenMiami-Fort Lauderdale-Pompano Beach MSA Single Family Homes 2015-01 DetailNishika JGNoch keine Bewertungen

- Cooper City FL Homes For Sale - 9748 Darlington PlaceDokument1 SeiteCooper City FL Homes For Sale - 9748 Darlington PlaceNishika JGNoch keine Bewertungen

- HUD Homes For SaleDokument3 SeitenHUD Homes For SaleNishika JGNoch keine Bewertungen

- Good Neighbor Next Door Program Certification - Teachers and Police OfficersDokument5 SeitenGood Neighbor Next Door Program Certification - Teachers and Police OfficersNishika JGNoch keine Bewertungen

- EPA Pamphlet 27 - Lead-Based PaintDokument17 SeitenEPA Pamphlet 27 - Lead-Based PainthafuchieNoch keine Bewertungen

- Real Estate Market Activity Sept - 2011Dokument9 SeitenReal Estate Market Activity Sept - 2011Nishika JGNoch keine Bewertungen

- Baltimore HUD Homes Inventory $50,000 To $90,000Dokument1 SeiteBaltimore HUD Homes Inventory $50,000 To $90,000Nishika JGNoch keine Bewertungen

- Good Neighbor Next Door Program - Law EnforcementDokument2 SeitenGood Neighbor Next Door Program - Law EnforcementNishika JGNoch keine Bewertungen

- HUD Baltimore Sold Stats Analysis Detail 1-1-2011 To 3 31 2011Dokument1 SeiteHUD Baltimore Sold Stats Analysis Detail 1-1-2011 To 3 31 2011Nishika JGNoch keine Bewertungen

- Maryland Mortgage Program - Recapture TaxDokument12 SeitenMaryland Mortgage Program - Recapture TaxNishika JGNoch keine Bewertungen

- HUD Homes Baltimore - 5507 DECATUR ST, BLADENSBURG MD 20710Dokument30 SeitenHUD Homes Baltimore - 5507 DECATUR ST, BLADENSBURG MD 20710Nishika JGNoch keine Bewertungen

- Congressman Elijah Cummings - Foreclosure Prevention WorkshopDokument1 SeiteCongressman Elijah Cummings - Foreclosure Prevention WorkshopNishika JGNoch keine Bewertungen

- Baltimore HUD Stats Analysis Detail 1-1-2011 To 3 31 2011Dokument3 SeitenBaltimore HUD Stats Analysis Detail 1-1-2011 To 3 31 2011Nishika JGNoch keine Bewertungen

- HUD Homes Baltimore - 3101 CHELSEA TERRACE, BALTIMORE MD 21216Dokument27 SeitenHUD Homes Baltimore - 3101 CHELSEA TERRACE, BALTIMORE MD 21216Nishika JGNoch keine Bewertungen

- HUD Home Owner Occupant Certification FormDokument1 SeiteHUD Home Owner Occupant Certification FormNishika JGNoch keine Bewertungen

- Real Estate Market ActivityDokument8 SeitenReal Estate Market ActivityNishika JGNoch keine Bewertungen

- Baltimore Real Estate Market ActivityDokument8 SeitenBaltimore Real Estate Market ActivityNishika JGNoch keine Bewertungen

- HUD Homes Baltimore - 4308 DANA ST, BALTIMORE, MD 21229 (Baltimore City County)Dokument27 SeitenHUD Homes Baltimore - 4308 DANA ST, BALTIMORE, MD 21229 (Baltimore City County)Nishika JGNoch keine Bewertungen

- HUD Homes Baltimore - 13959 PALMER HOUSE WAY UNIT 27, SILVER SPRING MD 20904Dokument29 SeitenHUD Homes Baltimore - 13959 PALMER HOUSE WAY UNIT 27, SILVER SPRING MD 20904Nishika JGNoch keine Bewertungen

- HUD Homes Baltimore - 20571 SUMMERSONG LANE, GERMANTOWN MD 20874Dokument29 SeitenHUD Homes Baltimore - 20571 SUMMERSONG LANE, GERMANTOWN MD 20874Nishika JGNoch keine Bewertungen

- HUD Homes Baltimore-304 WINTERBERRY DR, EDGEWOOD, MD 21040Dokument31 SeitenHUD Homes Baltimore-304 WINTERBERRY DR, EDGEWOOD, MD 21040Nishika JGNoch keine Bewertungen

- Cost RecoveryDokument3 SeitenCost RecoveryObe AbsinNoch keine Bewertungen

- Presentation - Payment BanksDokument14 SeitenPresentation - Payment BanksAstral HeightsNoch keine Bewertungen

- Ferrari Case - C4Dokument7 SeitenFerrari Case - C4George KangasNoch keine Bewertungen

- Standard Chartered GroupDokument9 SeitenStandard Chartered GroupALINoch keine Bewertungen

- Chapter 8 CFAS Problem 8-1 Page 162Dokument6 SeitenChapter 8 CFAS Problem 8-1 Page 162Rhoda Claire M. GansobinNoch keine Bewertungen

- 110 WarmupDay1Dokument25 Seiten110 WarmupDay1shiieeNoch keine Bewertungen

- Corporate Fraud AnalysisDokument39 SeitenCorporate Fraud AnalysisAnonymous u6yR25kiobNoch keine Bewertungen

- Projected Financials and Valuation of a Pharmaceutical CompanyDokument14 SeitenProjected Financials and Valuation of a Pharmaceutical Companyvardhan100% (1)

- Vital Subject of Business Logistics/Supply ChainDokument27 SeitenVital Subject of Business Logistics/Supply ChainAbu SyeedNoch keine Bewertungen

- SFAC No 5Dokument29 SeitenSFAC No 5FridRachmanNoch keine Bewertungen

- Tri Level 2 Promo 17Dokument5 SeitenTri Level 2 Promo 17asdfafNoch keine Bewertungen

- VI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFDokument10 SeitenVI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFSakshi MehraNoch keine Bewertungen

- Fair Value Measurement and ImpairmentDokument2 SeitenFair Value Measurement and Impairmentyonatan tesemaNoch keine Bewertungen

- Chapter 3 Core Principles in Business OperationsDokument20 SeitenChapter 3 Core Principles in Business OperationsClaire Evann Villena Ebora0% (1)

- Examination About Investment 6Dokument2 SeitenExamination About Investment 6BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- 2017 AEP Risks and Vulnerabilities of Virtual CurrencyDokument40 Seiten2017 AEP Risks and Vulnerabilities of Virtual CurrencyLisaNoch keine Bewertungen

- Bengal & Assam Company LTD - ULJK PDFDokument2 SeitenBengal & Assam Company LTD - ULJK PDFAnonymous OqMWnzGs7zNoch keine Bewertungen

- Future GroupDokument7 SeitenFuture GroupAbhay Pratap SinghNoch keine Bewertungen

- Conspiracy of The Rich PDFDokument290 SeitenConspiracy of The Rich PDFMinhTien Pham100% (9)

- Project Identification TechniquesDokument80 SeitenProject Identification TechniqueshailegebraelNoch keine Bewertungen

- How Age and Income Impact Savings and Investment HabitsDokument22 SeitenHow Age and Income Impact Savings and Investment HabitsManas MhatreNoch keine Bewertungen

- Differentiating The Forms of Business Organization and Giving Examples of Forms of Business OrganizationsDokument24 SeitenDifferentiating The Forms of Business Organization and Giving Examples of Forms of Business OrganizationsJohn Fort Edwin AmoraNoch keine Bewertungen

- Sfac 6Dokument91 SeitenSfac 6Raymond Parmonangan Hutahaean100% (1)

- Mindset Learner Version GR 11 Acc Session 4Dokument5 SeitenMindset Learner Version GR 11 Acc Session 4Iqra MughalNoch keine Bewertungen

- Whats Your OTB Purchase Planning Made Easy.17143105Dokument2 SeitenWhats Your OTB Purchase Planning Made Easy.17143105ramjee prasad jaiswalNoch keine Bewertungen

- 59 Shareholders Agreement TP VerifyDokument3 Seiten59 Shareholders Agreement TP VerifyRicky ChodhaNoch keine Bewertungen

- AREIT to list as Philippines' first REIT, eyes Teleperformance Cebu acquisitionDokument12 SeitenAREIT to list as Philippines' first REIT, eyes Teleperformance Cebu acquisitionJajahinaNoch keine Bewertungen

- Calcutta Stock Exchange Limited: Summer Internship Project ReportDokument4 SeitenCalcutta Stock Exchange Limited: Summer Internship Project ReportNikhil SaurabhNoch keine Bewertungen

- This Study Resource Was: Easy Move On Consulting Company (Emoc)Dokument4 SeitenThis Study Resource Was: Easy Move On Consulting Company (Emoc)v lNoch keine Bewertungen

- INDOBeX RebalancingAnnouncementDokument24 SeitenINDOBeX RebalancingAnnouncementHadyan WidyadhanaNoch keine Bewertungen