Beruflich Dokumente

Kultur Dokumente

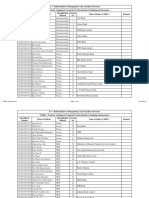

Mutual Fund Types

Hochgeladen von

nilpandeOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mutual Fund Types

Hochgeladen von

nilpandeCopyright:

Verfügbare Formate

It's important to understand that each mutual fund has different risks and rewards.

In general,

the higher the potential return, the higher the risk of loss. Although some funds are less risky

than others, all funds have some level of risk - it's never possible to diversify away all risk. This

is a fact for all investments.

By Investment Objective

Open-ended schemes

These funds do not have a fixed maturity and one can invest in such funds on any working day, during

business hours. Investors can buy or sell units of open-ended schemes directly from the fund house at

NAV related prices.

Examples –

HDFC Cash Management Fund Savings Plan – 7.89% return annually

ICICI Prudential Sweep Plan-Cash Option – 7.91% returns annually

U.S. mutual funds:

• T. Rowe Price

• Fidelity Investments' Magellan

• The Vanguard Group's S&P 500

• PIMCO Total Return

• WorldCommodity Fund

Close-ended schemes

Such funds have a fixed maturity period and are open for subscription only for a specified period. After

the expiry of this period, investors can buy or sell the units on the stock exchanges where such funds

are listed. Some funds also have the option of periodic repurchase, whereby investors can sell back

their units to the fund at NAV related prices.

Examples

ICICI Prudential Fusion Fund – Growth 41.44% returns annually

Birla Long Term Adv Fund Growth 28.24% returns annually

Among the biggest, long-running CEFs are:

• Adams Express Company (NYSE:ADX)

• Foreign & Colonial Investment Trust plc (LSE:FRCL)

• Witan Investment Trust plc (LSE:WTAN)

• Tri-Continental Corporation (NYSE:TY)

• Gabelli Equity Trust (NYSE:GAB)

• General American Investors Company, Inc. (NYSE:GAM)

Interval schemes

Interval schemes are a combination of both open and close-ended schemes. Investors can purchase or

redeem their shares from the fund house at pre-determined intervals at NAV related prices

By Structure

Growth schemes \ Equity Schemes

Such funds are aimed at capital appreciation over the medium to long term. Usually, such funds invest

a major portion of the portfolio in equities.

HDFC Capital Builder Fund Growth – 48.53% returns

Kotak MidCap Fund Growth – 38.89% returns annually

Income schemes \ Debt Oriented Scheme\Bond Scheme Funds

their purpose is to provide current income on a steady basis. When referring to mutual funds, the terms

"fixed-income," "bond," and "income" are synonymous.

These schemes invest primarily in fixed income instruments issued by the government, banks, financial

institutions and private companies. The main objective of income schemes is preservation of capital

and to provide fixed income over the medium to long term.

HDFC Income Fund – 05.14% returns annually

Birla Sunlife Income Funds – 11.94% returns annually

Bond/Income Funds

Income funds are named appropriately: These terms denote funds that invest primarily in government

and corporate debt. While fund holdings may appreciate in value, the primary objective of these funds

is to provide a steady cashflow to investors. As such, the audience for these funds consists of

conservative investors and retirees.

Bond funds are likely to pay higher returns than certificates of deposit and money market investments,

but bond funds aren't without risk. Because there are many different types of bonds, bond funds can

vary dramatically depending on where they invest. For example, a fund specializing in high-yield junk

bonds is much more risky than a fund that invests in government securities. Furthermore, nearly all

bond funds are subject to interest rate risk, which means that if rates go up the value of the fund goes

down.

Other Schemes

Tax saving schemes

Such schemes are aimed at offering tax rebates to investors under specific provisions of the Income

Tax Act, 1961. For instance, investors of Equity Linked Savings Schemes (ELSS) and Pension

Schemes are applicable for deduction u/s 88 of the Income Tax Act, 1961.

• These schemes offer tax rebates to the investors under tax laws as prescribed from time to time. This

is made possible because the Government offers tax incentives for investment in specified avenues.

For example, Equity Linked Savings Schemes (ELSS) and Pension Schemes. Recent amendments to

the Income Tax Act provide further opportunities to investors to save capital gains by investing in

Mutual Funds. The details of such tax savings are provided in the relevant offer documents.

• Investors seeking tax rebates.

HDFC Tax Saver – Growth – 33.81%

Principal Tax Saving Funds – 43.57%

Tata Tax Saving Funds – 35.49%

Balanced schemes

Such funds have a balanced portfolio and invest in equity and preference shares in addition to fixed

income securities. The aim of such funds is to provide both income and capital appreciation over a

long-term.

The objective of these funds is to provide a balanced mixture of safety, income and capital

appreciation. The strategy of balanced funds is to invest in a combination of fixed income and equities.

A typical balanced fund might have a weighting of 60% equity and 40% fixed income. The weighting

might also be restricted to a specified maximum or minimum for each asset class.

Birla Sunlife – 95 – 38.93% returns annually

HDFC Prudence Fund – 31.62% annually

Money market schemes \ Liquid Schemes

Money market schemes invest in short-term debt instruments, which earn interest and have high

liquidity. Though these are considered to be the safest investment option, such funds are subject to

fluctuations in the rates of interest.

The money market consists of short-term debt instruments, mostly Treasury bills. This is a safe place

to park your money. You won't get great returns, but you won't have to worry about losing your

principal. A typical return is twice the amount you would earn in a regular checking/savings account and

a little less than the average certificate of deposit (CD).

HDFC Liquid Fund – Premium Plus – 7.95% returns annually

ICICI prudential Liquid – inst plus – 8.05 % returns annually

Index schemes

Such funds strive to mirror the performance of specific market indices, such as the BSE SENSEX, CNX

Nifty, etc which are called the base index. Investments in such funds are made in the same stocks as

the base index and in similar proportion.

Sensex – 41.4% returns annually

Nifty – 42.6% returns annually

ICICI Pru Index Fund – 44.1% returns annually

Sector-specific schemes

Such funds invest in a specific industry or sector. The investments could be in a particular industry

(Banking, Pharmaceuticals, Infrastructure, etc) or a group of industries, or various segments (like ‘A’

Group shares).

SBI Magnum COMMA Fund – Growth 49.79%

ICICI Prudential Infrastructure Fund – Growth 64.30%

Exchange-traded funds

Such funds are listed and traded on the stock exchange in a similar manner as stocks. Such funds

invest in a basket of stocks and aim at replicating an index (S&P CNX Nifty, BSE Sensex) or a

particular industry (banking, information technology) or commodity (gold, crude oil, petroleum).

Capital protection funds

These funds are designed to safeguard the capital invested therein, by investing in suitable securities.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Business Valuation: Economic ConditionsDokument10 SeitenBusiness Valuation: Economic ConditionscuteheenaNoch keine Bewertungen

- Index For Capital Gains TaxDokument15 SeitenIndex For Capital Gains TaxWilma P.Noch keine Bewertungen

- BIR Ruling No. 317-18 (BVI Law)Dokument3 SeitenBIR Ruling No. 317-18 (BVI Law)Liz100% (1)

- Government of PunjabDokument1 SeiteGovernment of PunjabPunjab Drainage Department0% (1)

- Certificate in Bookkeeping and Accounting Level 2Dokument38 SeitenCertificate in Bookkeeping and Accounting Level 2McKay TheinNoch keine Bewertungen

- The - Faber.report CNBSDokument154 SeitenThe - Faber.report CNBSWilly Pérez-Barreto MaturanaNoch keine Bewertungen

- Computation 2022-23Dokument2 SeitenComputation 2022-23DKINGNoch keine Bewertungen

- Kyc Supplemental Form: Signature Over Printed Name / Date SignedDokument1 SeiteKyc Supplemental Form: Signature Over Printed Name / Date SignedRoan Noreen DazoNoch keine Bewertungen

- US Internal Revenue Service: Irb98-02Dokument44 SeitenUS Internal Revenue Service: Irb98-02IRSNoch keine Bewertungen

- Year Project A Project B: Total PV NPVDokument19 SeitenYear Project A Project B: Total PV NPVChin EENoch keine Bewertungen

- Pulz ElectronicsDokument37 SeitenPulz ElectronicsBandaru NarendrababuNoch keine Bewertungen

- Introduction To AccountingDokument57 SeitenIntroduction To AccountingJustine MaravillaNoch keine Bewertungen

- Dodd Frank CertificationDokument1 SeiteDodd Frank CertificationTara IsmineNoch keine Bewertungen

- Pmec ChallanDokument1 SeitePmec ChallanSubhendu BarisalNoch keine Bewertungen

- Request For Strategic Advice On Business Schools in Scottish UniversitiesDokument22 SeitenRequest For Strategic Advice On Business Schools in Scottish UniversitiesThe Royal Society of EdinburghNoch keine Bewertungen

- ITR 1 - AY 2023-24 - V1.3.xlsmDokument18 SeitenITR 1 - AY 2023-24 - V1.3.xlsmsrinukkNoch keine Bewertungen

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDokument168 SeitenNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikNoch keine Bewertungen

- Case Study On Insider TradingDokument2 SeitenCase Study On Insider TradingAyushi Singh100% (2)

- Business Plan For FloristDokument26 SeitenBusiness Plan For Floristmohammed hajiademNoch keine Bewertungen

- Disclosure No. 132 2016 Top 100 Stockholders As of December 31 2015Dokument6 SeitenDisclosure No. 132 2016 Top 100 Stockholders As of December 31 2015Mark AgustinNoch keine Bewertungen

- Exhaustive List of Analytics Companies in IndiaDokument4 SeitenExhaustive List of Analytics Companies in IndiagoodthoughtsNoch keine Bewertungen

- Course Guide: AGW 610/3 Finance and Accounting For Management Graduate School of Business Universiti Sains MalaysiaDokument7 SeitenCourse Guide: AGW 610/3 Finance and Accounting For Management Graduate School of Business Universiti Sains MalaysiasamhensemNoch keine Bewertungen

- Weighted Average Cost of Capital (WACC) GuideDokument5 SeitenWeighted Average Cost of Capital (WACC) GuideJahangir KhanNoch keine Bewertungen

- BJs AnnouncementDokument2 SeitenBJs AnnouncementiBerkshires.comNoch keine Bewertungen

- Unit 5 Iapm CapmDokument11 SeitenUnit 5 Iapm Capmshubham JaiswalNoch keine Bewertungen

- Country Wide Litigation Database 01072007Dokument15 SeitenCountry Wide Litigation Database 01072007Carrieonic100% (1)

- List of Groups and Topic For Practical Assignment 1Dokument5 SeitenList of Groups and Topic For Practical Assignment 1pareek gopalNoch keine Bewertungen

- Detailed MBA CourseStructureDokument132 SeitenDetailed MBA CourseStructureanchals_20Noch keine Bewertungen

- HSBC iPad-iPod Touch Application FormDokument1 SeiteHSBC iPad-iPod Touch Application FormBc CyNoch keine Bewertungen

- Annexure - 1: S.Vasudevan CPS Index NumberDokument8 SeitenAnnexure - 1: S.Vasudevan CPS Index NumbertnadehkjpdNoch keine Bewertungen