Beruflich Dokumente

Kultur Dokumente

The Next Two Items Are Based On The Following Information:: Activity 3.1.2

Hochgeladen von

Tine Vasiana DuermeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Next Two Items Are Based On The Following Information:: Activity 3.1.2

Hochgeladen von

Tine Vasiana DuermeCopyright:

Verfügbare Formate

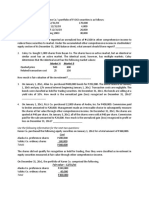

Activity 3.1.

Direction: Provide what is asked. Show your solution.

1. The following items were among those that appeared on Rubi Co.’s books at the end of 20x1:

Merchandise inventory P 600,000

Loans to Employees 20,000

What amount should Rubi classify as monetary assets in preparing constant peso financial statements? _________

2. The following assets were among those that appeared on Baird Co.’s books at the end of the year:

Demand bank deposits P 650,000

Net long-term receivables 400,000

Patents and trademarks 150,000

In preparing constant peso financial statements, how much should Baird classify as monetary assets? ___________

The next two items are based on the following information:

The following schedule lists the general price-level index at the end of each of the five indicated years:

20x5 100

20x6 110

20x7 115

20x8 120

20x9 140

3. In December 20x8, the Meetu Corporation purchased land for P 300,000. The land was held until December 20x9, when it

was sold for P 400,000. The historical cost/constant peso statement of profit or loss for the year ended December 31, 20x9,

should include how much gain or loss on this sale? ________________

4. On January 1, 20x6, the Silver Company purchased equipment for P 300,000. The equipment was being depreciated over an

estimated life of 10 years on the straight-line method, with no estimated residual value. On December 31, 20x9, the equipment

was sold for P 200,000. The historical cost/constant peso statement of profit or loss prepared for the year ended December

31, 20x9, should include how much gain or loss from this sale? _________________

5. The Chalk Company reported sales of P 2,000,000 in 20x6 and P 3,000,000 in 20x7 made evenly throughout each year. The

consumer price index during 20x5 remained constant at 100, and at the end of 20x6 and 20x7 it was 102 and 2014,

respectively. What should Chalk report as sales for 20x7 restated for general price-level changes? _____________

6. Lewis Company was formed on January 1, 20x6. Selected balances from the historical cost balance sheet at December 31,

20x7 were as follows:

Land (purchased in 20x6) P 120,000

Investment in nonconvertible bonds (purchased in 20x6, and expected to be held to maturity) 60,000

Long-term debt 80,000

The average Consumer Price Index was 100 for 20x6, and 110 for 20x7. In a constant peso balance sheet (adjusted for

changing prices) at December 31, 20x7, these selected account balances should be shown at

Land _______________ Investment _____________ Long-term Debt ____________________

7. On January 1, 20x8, Nutley Corporation had monetary assets of P 2,000,000 and monetary liabilities of P 1,000,000. During

20x8, Nutley’s monetary inflows and outflows were relatively constant and equal so that it ended the year with net monetary

assets of P 1,000,000. Assume that the Consumer Price Index was 200 on January 1, 20x8, and 220 on December 31, 20x8.

In end of year constant pesos, what is Nutley’s purchasing power gain or loss on net monetary items for 20x8?

______________

8. At both the beginning and end of the year, Lang Co.’s monetary assets exceeded monetary liabilities by P 3,000,000. On

January 1, the general price level was P 125. On December 31, the general price level was P 150. How much was Lang’s

purchasing power loss on net monetary items during the year? ______________

Das könnte Ihnen auch gefallen

- Answers - Activity 2.4 2.5 and 3.1Dokument38 SeitenAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Yamaha TW 125 Service Manual - 1999Dokument275 SeitenYamaha TW 125 Service Manual - 1999slawkomax100% (11)

- Apr 4/accounting For Business Combinations: General InstructionDokument8 SeitenApr 4/accounting For Business Combinations: General InstructionJoannah maeNoch keine Bewertungen

- Use The Following Information For The Next Three Questions:: Activity 3.2Dokument2 SeitenUse The Following Information For The Next Three Questions:: Activity 3.2Tine Vasiana DuermeNoch keine Bewertungen

- Credit Sales AR and Equity Chapters QuestionsDokument4 SeitenCredit Sales AR and Equity Chapters QuestionsSakhawat HossainNoch keine Bewertungen

- F3 Mock Questions 201603 PDFDokument14 SeitenF3 Mock Questions 201603 PDFMD.Rakibul HasanNoch keine Bewertungen

- Use The Following Information For The Next Three Questions:: Activity 3.2Dokument11 SeitenUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNoch keine Bewertungen

- CH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Dokument71 SeitenCH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Lina SakhiNoch keine Bewertungen

- Use The Following Information For The Next Three Questions:: Activity 3.2Dokument2 SeitenUse The Following Information For The Next Three Questions:: Activity 3.2Tine Vasiana DuermeNoch keine Bewertungen

- Cargill VinodDokument98 SeitenCargill Vinodsaurajindal09Noch keine Bewertungen

- Bank ATM Use CasesDokument12 SeitenBank ATM Use Casessbr11Noch keine Bewertungen

- Business Research Chapter 1Dokument27 SeitenBusiness Research Chapter 1Toto H. Ali100% (2)

- Accounting For Business Combinations Final Term ExaminationDokument3 SeitenAccounting For Business Combinations Final Term ExaminationJasper LuagueNoch keine Bewertungen

- Quiz On InvestmentDokument3 SeitenQuiz On InvestmentDan Andrei BongoNoch keine Bewertungen

- Ia Reviewer QuizzesandexamsDokument22 SeitenIa Reviewer QuizzesandexamsReady PlayerNoch keine Bewertungen

- 04 Additional Exercises On InvestmentsDokument3 Seiten04 Additional Exercises On InvestmentsMaxin TanNoch keine Bewertungen

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Dokument11 SeitenACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNoch keine Bewertungen

- Long Quiz in Intermediate Accounting 1 PART 1aDokument4 SeitenLong Quiz in Intermediate Accounting 1 PART 1aGillian mae Garcia0% (2)

- IF2 - Project 1 PDFDokument6 SeitenIF2 - Project 1 PDFBillNoch keine Bewertungen

- XH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewDokument6 SeitenXH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewHà Mai VõNoch keine Bewertungen

- Chapter 7 To Chapter 9: CorrectDokument10 SeitenChapter 7 To Chapter 9: CorrectChaiz MineNoch keine Bewertungen

- Sample IA QuestionDokument3 SeitenSample IA QuestionElisa Ferrer RamosNoch keine Bewertungen

- Test 3 - Chap 24Dokument7 SeitenTest 3 - Chap 24Bhushan SawantNoch keine Bewertungen

- CH7 - DiscussionDokument8 SeitenCH7 - DiscussionRichell ArtuzNoch keine Bewertungen

- REVIEWer Take Home QuizDokument3 SeitenREVIEWer Take Home QuizNeirish fainsan0% (1)

- Mock Test 2 Review TestDokument8 SeitenMock Test 2 Review TestYing LiuNoch keine Bewertungen

- Quiz Chapter 11 Advance AccountingDokument5 SeitenQuiz Chapter 11 Advance Accounting20174112008 HERI AHMAD FAUZINoch keine Bewertungen

- IF2FInalExamSampleQuestions 1-12Dokument12 SeitenIF2FInalExamSampleQuestions 1-12Percy IFNNoch keine Bewertungen

- Drill Problems-Wps OfficeDokument6 SeitenDrill Problems-Wps OfficeJp Ayalde0% (1)

- Exam 1 8Dokument9 SeitenExam 1 8Kenneth DelacruzNoch keine Bewertungen

- IAS 40 Investment Properties - Out-Of-Class practice-EN NewDokument5 SeitenIAS 40 Investment Properties - Out-Of-Class practice-EN NewDAN NGUYEN THENoch keine Bewertungen

- baitap-sinhvien-IAS 21Dokument12 Seitenbaitap-sinhvien-IAS 21tonight752Noch keine Bewertungen

- Auditing Investments 1Dokument2 SeitenAuditing Investments 1Sabel FordNoch keine Bewertungen

- Current Liabilities: Redemption of Certificates Lapse of CertificatesDokument3 SeitenCurrent Liabilities: Redemption of Certificates Lapse of CertificatesGrezel NiceNoch keine Bewertungen

- Intercompany TransactionsDokument5 SeitenIntercompany Transactionsmisonim.eNoch keine Bewertungen

- PRE BATTERY EXAM 2018 Part 1 FARDokument11 SeitenPRE BATTERY EXAM 2018 Part 1 FARFrl RizalNoch keine Bewertungen

- 16Dokument23 Seiten16Alex liao0% (1)

- Midterm Exam - Ac-2Dokument7 SeitenMidterm Exam - Ac-2Lyca ArcenaNoch keine Bewertungen

- FR ACCA Test FullDokument16 SeitenFR ACCA Test Fullduducchi2308Noch keine Bewertungen

- F3 Final Mock 2Dokument8 SeitenF3 Final Mock 2Nicat IsmayıloffNoch keine Bewertungen

- F7 - QuestionsDokument10 SeitenF7 - QuestionspavishneNoch keine Bewertungen

- Ifrs December 2020 EnglishDokument10 SeitenIfrs December 2020 Englishjad NasserNoch keine Bewertungen

- Use The Following Information For The Next Seven Questions:: Activity 2.4Dokument2 SeitenUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- Cash Flow and InterpretationDokument9 SeitenCash Flow and InterpretationPriya NairNoch keine Bewertungen

- 2014Q6 IntercompanyDokument6 Seiten2014Q6 IntercompanyI'm K8Noch keine Bewertungen

- Ffa Mock3 JS2020Dokument20 SeitenFfa Mock3 JS2020alibanaylaNoch keine Bewertungen

- Investment Test BankDokument9 SeitenInvestment Test BankSherri BonquinNoch keine Bewertungen

- Intermediate Accounting 1 FinalDokument5 SeitenIntermediate Accounting 1 FinalCix SorcheNoch keine Bewertungen

- DP1 Finance HWDokument4 SeitenDP1 Finance HWAmmar AlaaNoch keine Bewertungen

- DL PT1Q F3 201301Dokument14 SeitenDL PT1Q F3 201301MpuTitasNoch keine Bewertungen

- Joint Arrangements AssessmentsDokument9 SeitenJoint Arrangements AssessmentsVon Andrei MedinaNoch keine Bewertungen

- Ae 191 F-Test 1Dokument3 SeitenAe 191 F-Test 1Venus PalmencoNoch keine Bewertungen

- Working 7Dokument5 SeitenWorking 7Hà Lê DuyNoch keine Bewertungen

- Finals-Business CombiDokument5 SeitenFinals-Business Combijhell de la cruzNoch keine Bewertungen

- CXC Principles of Accounts Past Paper Jan 2009Dokument8 SeitenCXC Principles of Accounts Past Paper Jan 2009lordNoch keine Bewertungen

- Financial Assets at Fair Value ProblemsDokument5 SeitenFinancial Assets at Fair Value ProblemsJames R JunioNoch keine Bewertungen

- Foreign Currency - QuestionsDokument4 SeitenForeign Currency - QuestionsMakita BatitaNoch keine Bewertungen

- Workshop F2 May 2011Dokument18 SeitenWorkshop F2 May 2011roukaiya_peerkhanNoch keine Bewertungen

- AFAR - Forex 2019Dokument3 SeitenAFAR - Forex 2019Joanna Rose DeciarNoch keine Bewertungen

- Assignment - Subsequent To AcquisitionDokument1 SeiteAssignment - Subsequent To AcquisitionWilliam LanzuelaNoch keine Bewertungen

- Final Exam - Intermediate Accounting 2Dokument11 SeitenFinal Exam - Intermediate Accounting 2Patricia EsplagoNoch keine Bewertungen

- Remedial Exam On Partnership and Corporation ADokument4 SeitenRemedial Exam On Partnership and Corporation Abinibining piaNoch keine Bewertungen

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Von EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Noch keine Bewertungen

- How Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?Von EverandHow Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?Noch keine Bewertungen

- Learning: Misamis University Wilnirose C. MalinaoDokument3 SeitenLearning: Misamis University Wilnirose C. MalinaoTine Vasiana DuermeNoch keine Bewertungen

- Learning: Misamis University Wilnirose C. MalinaoDokument4 SeitenLearning: Misamis University Wilnirose C. MalinaoTine Vasiana DuermeNoch keine Bewertungen

- Learning: Corporate Portfolio Strategy What Make An Owner The Best?Dokument4 SeitenLearning: Corporate Portfolio Strategy What Make An Owner The Best?Tine Vasiana DuermeNoch keine Bewertungen

- Learning: Misamis University Wilnirose C. MalinaoDokument4 SeitenLearning: Misamis University Wilnirose C. MalinaoTine Vasiana DuermeNoch keine Bewertungen

- Learning: Framework For DCF-Based Valuation Model Measure Discount Factor AssessmentDokument5 SeitenLearning: Framework For DCF-Based Valuation Model Measure Discount Factor AssessmentTine Vasiana DuermeNoch keine Bewertungen

- Use The Following Information For The Next Four QuestionsDokument1 SeiteUse The Following Information For The Next Four QuestionsTine Vasiana DuermeNoch keine Bewertungen

- Isamis Niversity: College of Computer StudiesDokument1 SeiteIsamis Niversity: College of Computer StudiesTine Vasiana DuermeNoch keine Bewertungen

- Nikki Villarta - Rank FunctionDokument3 SeitenNikki Villarta - Rank FunctionTine Vasiana DuermeNoch keine Bewertungen

- Isamis Niversity: College of Computer StudiesDokument4 SeitenIsamis Niversity: College of Computer StudiesTine Vasiana DuermeNoch keine Bewertungen

- Final 10 Google SheetsDokument2 SeitenFinal 10 Google SheetsTine Vasiana DuermeNoch keine Bewertungen

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDokument2 SeitenAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNoch keine Bewertungen

- Use The Following Information For The Next Seven Questions:: Activity 2.4Dokument2 SeitenUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- Isamis Niversity: College of Computer StudiesDokument1 SeiteIsamis Niversity: College of Computer StudiesTine Vasiana DuermeNoch keine Bewertungen

- Materials and MethodsDokument18 SeitenMaterials and MethodsTine Vasiana DuermeNoch keine Bewertungen

- Viruses Corrected FormatDokument25 SeitenViruses Corrected FormatTine Vasiana DuermeNoch keine Bewertungen

- North America Asia South America Europe Africa Oceania: ContinentsDokument4 SeitenNorth America Asia South America Europe Africa Oceania: ContinentsTine Vasiana DuermeNoch keine Bewertungen

- Robert Jansmit O. YapDokument1 SeiteRobert Jansmit O. YapTine Vasiana DuermeNoch keine Bewertungen

- Basic Consolidation ProceduresDokument17 SeitenBasic Consolidation ProceduresTine Vasiana DuermeNoch keine Bewertungen

- Nikki Villarta - Chart On COVID CasesDokument4 SeitenNikki Villarta - Chart On COVID CasesTine Vasiana DuermeNoch keine Bewertungen

- Nikki Villarta - Rank FunctionDokument3 SeitenNikki Villarta - Rank FunctionTine Vasiana DuermeNoch keine Bewertungen

- Picture SourceDokument1 SeitePicture SourceTine Vasiana DuermeNoch keine Bewertungen

- NIKKI DIANNE P. VILLARTA ReflectionDokument1 SeiteNIKKI DIANNE P. VILLARTA ReflectionTine Vasiana DuermeNoch keine Bewertungen

- Vision: DescriptionDokument5 SeitenVision: DescriptionTine Vasiana DuermeNoch keine Bewertungen

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDokument2 SeitenAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNoch keine Bewertungen

- Research Chapter 3Dokument9 SeitenResearch Chapter 3Tine Vasiana DuermeNoch keine Bewertungen

- John Spencer L. Guangco Midterm Activity 2Dokument4 SeitenJohn Spencer L. Guangco Midterm Activity 2Tine Vasiana DuermeNoch keine Bewertungen

- Language Biodata FormDokument1 SeiteLanguage Biodata FormTine Vasiana DuermeNoch keine Bewertungen

- Palladium Skill Book 1a.Dokument10 SeitenPalladium Skill Book 1a.Randy DavisNoch keine Bewertungen

- Robbins FOM10ge C05Dokument35 SeitenRobbins FOM10ge C05Ahmed Mostafa ElmowafyNoch keine Bewertungen

- Dampak HidrokarbonDokument10 SeitenDampak HidrokarbonfikririansyahNoch keine Bewertungen

- SMTP/POP3/IMAP Email Engine Library For C/C++ Programmer's ManualDokument40 SeitenSMTP/POP3/IMAP Email Engine Library For C/C++ Programmer's Manualadem ademNoch keine Bewertungen

- Minneapolis Police Department Lawsuit Settlements, 2009-2013Dokument4 SeitenMinneapolis Police Department Lawsuit Settlements, 2009-2013Minnesota Public Radio100% (1)

- Connecting Microsoft Teams Direct Routing Using AudioCodes Mediant Virtual Edition (VE) and Avaya Aura v8.0Dokument173 SeitenConnecting Microsoft Teams Direct Routing Using AudioCodes Mediant Virtual Edition (VE) and Avaya Aura v8.0erikaNoch keine Bewertungen

- Hybrid and Derivative Securities: Learning GoalsDokument2 SeitenHybrid and Derivative Securities: Learning GoalsKristel SumabatNoch keine Bewertungen

- BcuDokument25 SeitenBcuyadvendra dhakadNoch keine Bewertungen

- Fundamentals of Group DynamicsDokument12 SeitenFundamentals of Group DynamicsLimbasam PapaNoch keine Bewertungen

- Citizen's Army Training (CAT) Is A Compulsory Military Training For High School Students. Fourth-Year High SchoolDokument2 SeitenCitizen's Army Training (CAT) Is A Compulsory Military Training For High School Students. Fourth-Year High SchoolJgary Lagria100% (1)

- Performance Appraisal System-Jelly BellyDokument13 SeitenPerformance Appraisal System-Jelly BellyRaisul Pradhan100% (2)

- Turb Mod NotesDokument32 SeitenTurb Mod NotessamandondonNoch keine Bewertungen

- Hop Movie WorksheetDokument3 SeitenHop Movie WorksheetMARIA RIERA PRATSNoch keine Bewertungen

- Caterpillar Cat 304.5 Mini Hydraulic Excavator (Prefix WAK) Service Repair Manual (WAK00001 and Up)Dokument23 SeitenCaterpillar Cat 304.5 Mini Hydraulic Excavator (Prefix WAK) Service Repair Manual (WAK00001 and Up)kfmuseddk100% (1)

- MELSEC System Q: QJ71MES96 MES Interface ModuleDokument364 SeitenMELSEC System Q: QJ71MES96 MES Interface ModuleFajri AsyukronNoch keine Bewertungen

- 00000000Dokument4 Seiten00000000GagoNoch keine Bewertungen

- Daily Mail 2022-10-25Dokument74 SeitenDaily Mail 2022-10-25mohsen gharbiNoch keine Bewertungen

- Republic of The Philippines Legal Education BoardDokument25 SeitenRepublic of The Philippines Legal Education BoardPam NolascoNoch keine Bewertungen

- Venetian Shipping During The CommercialDokument22 SeitenVenetian Shipping During The Commercialakansrl100% (1)

- The Best John Green QuotesDokument10 SeitenThe Best John Green Quotesapi-586467925Noch keine Bewertungen

- Assignments Is M 1214Dokument39 SeitenAssignments Is M 1214Rohan SharmaNoch keine Bewertungen

- Shaping School Culture Case StudyDokument7 SeitenShaping School Culture Case Studyapi-524477308Noch keine Bewertungen

- The SU Electric Fuel Pump Type Car Reference List AUA 214Dokument4 SeitenThe SU Electric Fuel Pump Type Car Reference List AUA 214Anonymous aOXD9JuqdNoch keine Bewertungen

- Learning Activity 5.2 Concept ReviewDokument4 SeitenLearning Activity 5.2 Concept ReviewJames CantorneNoch keine Bewertungen

- Poetry Analysis The HighwaymanDokument7 SeitenPoetry Analysis The Highwaymanapi-257262131Noch keine Bewertungen

- The Health Anxiety Inventory Development and Validation of Scales For The Measurement of Health Anxiety and HypochondriasisDokument11 SeitenThe Health Anxiety Inventory Development and Validation of Scales For The Measurement of Health Anxiety and HypochondriasisJan LAWNoch keine Bewertungen