Beruflich Dokumente

Kultur Dokumente

Earnings Per Share

Hochgeladen von

hae12340 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

295 Ansichten2 SeitenOriginaltitel

EARNINGS-PER-SHARE

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

295 Ansichten2 SeitenEarnings Per Share

Hochgeladen von

hae1234Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

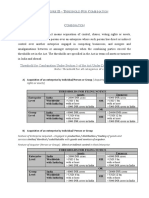

Submitted by: Limense, Princess Kathleen S.

(FARON & COURAGE COMPANY)

1. Faron Company reported the following at year end:

Bonds payable, 10% 1,000,000

Ordinary shares, P100 par,80,000 shares 5,000,000

Net income 1,730,000

The bonds are convertible into ordinary shares in the ratio of 10 ordinary shares for P1,000 each. The

income tax rate is 30%.

REQUIRED:

A. Basic earnings per share

B. Diluted earnings per share

ANSWER:

1. Basic earnings per share (1,730,000/80,000) 21.63

2. Ordinary shares outstanding 80,000

Assumed issued ordinary share through bond conversion (1,000 x 10) 10,000

Total ordinary share 90,000

Net Income 1,730,000

Add: Interest on bonds payable (10% x 1,000,000 x 70%) 70,000

Adjusted income 1,800,000

Diluted EPS (1,800,000 / 60,000) 30

2. Courage Company had the following share capital at the end of reporting period:

Preference share capital* 5,000,000

Ordinary share capital** 10,000,000

*The cumulative preference share capital has P100 par, 50,000 shares outstanding, 10% dividend rate

and each share convertible into 2 ordinary shares.

**The ordinary share capital has P50 par, 500,000 shares authorized, 200,000 shares outstanding.

The entity reported net income of P5,400,000 for the current year. No share capital activity took place

during the year. The income tax rate is 30%. The preference share was issued in the prior year at par

value.

REQUIRED:

A. Basic earnings per share

B. Diluted earnings per share

ANSWER:

1. Net income 5,400,000

Less: Preference dividend (10% x 5,000,000) 500,000

Adjusted income to ordinary share 4,900,000

Basic EPS (4,900,000 / 200,000) 24.50

2. Ordinary share outstanding 200,000

Assumed issue ordinary shares through bond conversion

of preference share (50,000 x 2) 100,000

Total ordinary shares 300,000

Diluted EPS (5,400,000 / 300,000) 18

Das könnte Ihnen auch gefallen

- Phil. Health ContributionsDokument5 SeitenPhil. Health Contributionshae123467% (9)

- Basic Earnings Per ShareDokument20 SeitenBasic Earnings Per ShareDJ Nicart100% (3)

- Star River Assignment-ReportDokument15 SeitenStar River Assignment-ReportBlessing Simons33% (3)

- San Beda College Alabang Homework Exercise-Act851RDokument4 SeitenSan Beda College Alabang Homework Exercise-Act851RJomel BaptistaNoch keine Bewertungen

- ParCor AccountingDokument2 SeitenParCor AccountinggirlieNoch keine Bewertungen

- PPE Government Grant Borrowing Cost Intangible AssetsDokument7 SeitenPPE Government Grant Borrowing Cost Intangible AssetsLian Garl100% (4)

- QuestionsDokument16 SeitenQuestionsRuby JaneNoch keine Bewertungen

- Financial Management (251.301.007) Spring 2014, SNU-CBA UndergraduateDokument5 SeitenFinancial Management (251.301.007) Spring 2014, SNU-CBA UndergraduateTack Wei HoNoch keine Bewertungen

- Chapter 17 Donor's TaxDokument7 SeitenChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- Far Ii Finals ProblemDokument17 SeitenFar Ii Finals ProblemSaeym SegoviaNoch keine Bewertungen

- 3rd ActivityDokument2 Seiten3rd Activitydar •Noch keine Bewertungen

- CVP AnalysisDokument24 SeitenCVP AnalysisKim Cherry BulanNoch keine Bewertungen

- Silver Company Provided The Following Information at Year-EndDokument1 SeiteSilver Company Provided The Following Information at Year-EndKatrina Dela CruzNoch keine Bewertungen

- AssignmentDokument2 SeitenAssignmentLois JoseNoch keine Bewertungen

- Las# 5 - (Iaa) Error CorrectionDokument7 SeitenLas# 5 - (Iaa) Error CorrectionStella MarieNoch keine Bewertungen

- Intacc Employee BenefitDokument8 SeitenIntacc Employee BenefitJoyce ManaloNoch keine Bewertungen

- Quantitative TechiniquesDokument7 SeitenQuantitative TechiniquesJohn Nowell DiestroNoch keine Bewertungen

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDokument4 Seiten06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNoch keine Bewertungen

- Chapter 21 Ia2Dokument15 SeitenChapter 21 Ia2JM Valonda Villena, CPA, MBANoch keine Bewertungen

- Module 1 ExamDokument4 SeitenModule 1 ExamTabatha Cyphers100% (2)

- This Study Resource Was: Assessment Task 3Dokument5 SeitenThis Study Resource Was: Assessment Task 3maria evangelistaNoch keine Bewertungen

- Petite Company Reported The Following Current Assets On December 31Dokument1 SeitePetite Company Reported The Following Current Assets On December 31Katrina Dela CruzNoch keine Bewertungen

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDokument12 SeitenCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNoch keine Bewertungen

- Problem 5-31 (Verna Company)Dokument7 SeitenProblem 5-31 (Verna Company)Jannefah Irish SaglayanNoch keine Bewertungen

- This Study Resource Was: F-ACADL-01Dokument8 SeitenThis Study Resource Was: F-ACADL-01Marjorie PalmaNoch keine Bewertungen

- Chap 17Dokument24 SeitenChap 17alice123h210% (1)

- IA2 Quiz 1 QuestionsDokument6 SeitenIA2 Quiz 1 QuestionsJames Daniel SwintonNoch keine Bewertungen

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableDokument6 SeitenPrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaNoch keine Bewertungen

- Bonds Payable: Intermediate Accounting 2Dokument38 SeitenBonds Payable: Intermediate Accounting 2Rolando Verano TanNoch keine Bewertungen

- Ae 211 Solutions-PrelimDokument10 SeitenAe 211 Solutions-PrelimNhel AlvaroNoch keine Bewertungen

- Easy Problem Chapter 5Dokument5 SeitenEasy Problem Chapter 5Natally LangfeldtNoch keine Bewertungen

- 20-1 To 20-13Dokument16 Seiten20-1 To 20-13Jesica Vargas0% (2)

- Lobrigas Unit3 Topic1 AssessmentDokument9 SeitenLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNoch keine Bewertungen

- Quiz ReorganizationDokument7 SeitenQuiz ReorganizationJam SurdivillaNoch keine Bewertungen

- CH 27 FinmanDokument3 SeitenCH 27 FinmanKismith Aile MacedaNoch keine Bewertungen

- Acc 224L 1st Laboratory ExamDokument13 SeitenAcc 224L 1st Laboratory ExamJuziel Rosel PadilloNoch keine Bewertungen

- Assessment Task 2Dokument4 SeitenAssessment Task 2Christian N MagsinoNoch keine Bewertungen

- Audit of Shareholders' Equity - July 22, 2021Dokument35 SeitenAudit of Shareholders' Equity - July 22, 2021Kathrina RoxasNoch keine Bewertungen

- Mahusay Acc227 Module 4Dokument4 SeitenMahusay Acc227 Module 4Jeth MahusayNoch keine Bewertungen

- Arabian Company Reported The Following at YearDokument1 SeiteArabian Company Reported The Following at YearKatrina Dela CruzNoch keine Bewertungen

- Activity 2Dokument3 SeitenActivity 2LFGS Finals0% (1)

- Define Business Combination, Identify Its ElementsDokument4 SeitenDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNoch keine Bewertungen

- Assets MCDokument19 SeitenAssets MCpahuyobea cutiepatootieNoch keine Bewertungen

- Statement of Comprehensive Income Cost of Goods Sold and Operating Expenses Problem 4-1 (AICPA Adapted)Dokument11 SeitenStatement of Comprehensive Income Cost of Goods Sold and Operating Expenses Problem 4-1 (AICPA Adapted)Clarisse PelayoNoch keine Bewertungen

- Compound Financial Instruments and Note PayableDokument4 SeitenCompound Financial Instruments and Note PayablePaula Rodalyn MateoNoch keine Bewertungen

- ACC 226 Week 4 To 5 SIMDokument33 SeitenACC 226 Week 4 To 5 SIMMireya YueNoch keine Bewertungen

- LeasesDokument5 SeitenLeasesCamille BacaresNoch keine Bewertungen

- IA3 Chapter 22 29Dokument5 SeitenIA3 Chapter 22 29ZicoNoch keine Bewertungen

- Answer Value 800000Dokument1 SeiteAnswer Value 800000Kath LeynesNoch keine Bewertungen

- 1Dokument20 Seiten1Denver AcenasNoch keine Bewertungen

- PAS34 Questio N& Answer!: Welcome To..Dokument18 SeitenPAS34 Questio N& Answer!: Welcome To..Faker MejiaNoch keine Bewertungen

- This Study Resource WasDokument6 SeitenThis Study Resource WasKimberly Claire AtienzaNoch keine Bewertungen

- Examination About Investment 7Dokument3 SeitenExamination About Investment 7BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Pre FinactDokument6 SeitenPre FinactMenardNoch keine Bewertungen

- Chapter 5 - Adv Acc 1Dokument18 SeitenChapter 5 - Adv Acc 1Maurice AgbayaniNoch keine Bewertungen

- Act Day 1-3Dokument45 SeitenAct Day 1-3Joyce Anne GarduqueNoch keine Bewertungen

- Intermediate Accounting Chapters 19 21Dokument61 SeitenIntermediate Accounting Chapters 19 21Jonathan NavalloNoch keine Bewertungen

- Which Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in AssociatesDokument1 SeiteWhich Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in Associatesjahnhannalei marticio0% (1)

- AFAR-07:Home Office and Branch AccountingDokument8 SeitenAFAR-07:Home Office and Branch AccountingJhekka FerrerNoch keine Bewertungen

- Nature and Background of The Specialized IndustryDokument3 SeitenNature and Background of The Specialized IndustryEly RiveraNoch keine Bewertungen

- Reading 36: Cost of CapitalDokument41 SeitenReading 36: Cost of CapitalEmiraslan MhrrovNoch keine Bewertungen

- Single Entry MethodDokument6 SeitenSingle Entry MethodNhel AlvaroNoch keine Bewertungen

- DocxDokument5 SeitenDocxJohn Vincent CruzNoch keine Bewertungen

- Basic Earnings Per ShareDokument20 SeitenBasic Earnings Per Sharemaria evangelistaNoch keine Bewertungen

- Assignment #1 ANSWER: LETTER A. 2,205Dokument5 SeitenAssignment #1 ANSWER: LETTER A. 2,205hae1234100% (1)

- Notes PayableDokument1 SeiteNotes Payablehae1234Noch keine Bewertungen

- Types of BenchmarkingDokument1 SeiteTypes of Benchmarkinghae1234Noch keine Bewertungen

- Marketing Brief Formulatio N SourcingDokument1 SeiteMarketing Brief Formulatio N Sourcinghae1234Noch keine Bewertungen

- Final Activity in Financial Accounting, PT 2 (ACCL04B)Dokument4 SeitenFinal Activity in Financial Accounting, PT 2 (ACCL04B)hae1234Noch keine Bewertungen

- IAS 12 Income TaxesDokument4 SeitenIAS 12 Income Taxeshae1234Noch keine Bewertungen

- Operating LeaseDokument1 SeiteOperating Leasehae1234Noch keine Bewertungen

- Income Tax AccountingDokument3 SeitenIncome Tax Accountinghae1234Noch keine Bewertungen

- IAS 19 Employee BenefitsDokument5 SeitenIAS 19 Employee Benefitshae1234Noch keine Bewertungen

- Answer: 2018 Employee Benefit ExpenseDokument1 SeiteAnswer: 2018 Employee Benefit Expensehae1234100% (1)

- Formation of Partnership 1. 1-JanDokument23 SeitenFormation of Partnership 1. 1-Janhae1234100% (1)

- BLWN06B - Ac302 - Puno, eDokument1 SeiteBLWN06B - Ac302 - Puno, ehae1234Noch keine Bewertungen

- Compound Financial InstrumentDokument2 SeitenCompound Financial Instrumenthae1234Noch keine Bewertungen

- Cash 18,000 Equipment 8,000 Land 20,000 X's Capital 18,000 Y's Capital 28,000Dokument18 SeitenCash 18,000 Equipment 8,000 Land 20,000 X's Capital 18,000 Y's Capital 28,000hae1234Noch keine Bewertungen

- Problem 3 Problem 9Dokument4 SeitenProblem 3 Problem 9hae1234Noch keine Bewertungen

- Finance LeaseDokument1 SeiteFinance Leasehae1234Noch keine Bewertungen

- Assignment#2Dokument10 SeitenAssignment#2hae1234Noch keine Bewertungen

- Reflection On Lpu Mission and Vision Statement and Core ValuesDokument1 SeiteReflection On Lpu Mission and Vision Statement and Core Valueshae1234Noch keine Bewertungen

- BLWN06B - Ac302 - Puno, E.Dokument1 SeiteBLWN06B - Ac302 - Puno, E.hae1234Noch keine Bewertungen

- Elements of Cost - Direct LaborDokument26 SeitenElements of Cost - Direct Laborhae1234Noch keine Bewertungen

- Elements of Cost - Factory OverheadDokument20 SeitenElements of Cost - Factory Overheadhae1234Noch keine Bewertungen

- Cash ManagementDokument3 SeitenCash Managementhae1234Noch keine Bewertungen

- IFRS16Dokument2 SeitenIFRS16hae1234Noch keine Bewertungen

- Departmentalized Factory OverheadDokument10 SeitenDepartmentalized Factory Overheadhae1234Noch keine Bewertungen

- Assignment FINALSDokument1 SeiteAssignment FINALShae1234Noch keine Bewertungen

- Underline The Correct Verb That Will Complete The SentenceDokument2 SeitenUnderline The Correct Verb That Will Complete The Sentencehae1234Noch keine Bewertungen

- Lecture 5 - Notes On LeasingDokument1 SeiteLecture 5 - Notes On LeasingCalvin MaNoch keine Bewertungen

- Understanding Equidam Business Valuation-2Dokument11 SeitenUnderstanding Equidam Business Valuation-2Djamaludin Akmal IqbalNoch keine Bewertungen

- Annexure II - CombinationDokument2 SeitenAnnexure II - CombinationAVNISH PRAKASHNoch keine Bewertungen

- Chapter 1 - The Role of Accounting in BusinessDokument10 SeitenChapter 1 - The Role of Accounting in BusinessHa Phuoc Hau100% (1)

- Accounting Cycle Week 2 ReviewerDokument11 SeitenAccounting Cycle Week 2 ReviewerVinz Danzel BialaNoch keine Bewertungen

- A Short Walk On Wall Street: Does Short Selling Exposure Improve M&A Quality?Dokument75 SeitenA Short Walk On Wall Street: Does Short Selling Exposure Improve M&A Quality?Anonymous TyoVWGtgQNoch keine Bewertungen

- Strategic Financial Management Mergers and Acquisitions Notes FinanceDokument17 SeitenStrategic Financial Management Mergers and Acquisitions Notes FinanceNNoch keine Bewertungen

- Disadvantage and Advantage of PartnershipDokument9 SeitenDisadvantage and Advantage of PartnershipErick MeguisoNoch keine Bewertungen

- Rekening Koran Agustus 2023Dokument2 SeitenRekening Koran Agustus 2023Ade AlfianNoch keine Bewertungen

- Chapter 12-Eneman20Dokument3 SeitenChapter 12-Eneman20Reynald John PastranaNoch keine Bewertungen

- (Company Name) : Profit and Loss StatementDokument8 Seiten(Company Name) : Profit and Loss StatementRonald GarciaNoch keine Bewertungen

- DepreciationnnDokument127 SeitenDepreciationnnHYDER ALINoch keine Bewertungen

- CA 03 - Cost Accounting CycleDokument6 SeitenCA 03 - Cost Accounting CycleJoshua UmaliNoch keine Bewertungen

- Audit December 2017 EngDokument17 SeitenAudit December 2017 EngNthabiseng ButsanaNoch keine Bewertungen

- Tesco 2023 Ar Primary Statements Updated 230623Dokument5 SeitenTesco 2023 Ar Primary Statements Updated 230623Ñízãr ÑzrNoch keine Bewertungen

- Acctg1 PDF Instruction ManualDokument115 SeitenAcctg1 PDF Instruction ManualhannahNoch keine Bewertungen

- 06 Departmental AccountsDokument6 Seiten06 Departmental AccountsUjwal Singh XI - A '51' CSNoch keine Bewertungen

- MA 3103 Market ApproachDokument7 SeitenMA 3103 Market ApproachJacinta Fatima ChingNoch keine Bewertungen

- FA Consolidation Test - Answers S20-A21 PDFDokument14 SeitenFA Consolidation Test - Answers S20-A21 PDFAlpha MpofuNoch keine Bewertungen

- Ind AS: An Overview (Simplified)Dokument28 SeitenInd AS: An Overview (Simplified)Mehran AvNoch keine Bewertungen

- Error CorrectionDokument5 SeitenError CorrectionBea ChristineNoch keine Bewertungen

- Banking and FinanceDokument7 SeitenBanking and Financeomiraskar1212Noch keine Bewertungen

- AFAR8717 Joint Arrangement SolutionsDokument2 SeitenAFAR8717 Joint Arrangement SolutionsGJames ApostolNoch keine Bewertungen

- Makalah Manajemen Dana (BRI)Dokument7 SeitenMakalah Manajemen Dana (BRI)23253018Noch keine Bewertungen

- QUESTION BANK - Corporate Restructuring - VIVADokument15 SeitenQUESTION BANK - Corporate Restructuring - VIVANick ShahuNoch keine Bewertungen

- Tax Havens & How They Work: Group 7Dokument10 SeitenTax Havens & How They Work: Group 7Magical MakeoversNoch keine Bewertungen

- Chapter 3. The Accounting EquationDokument2 SeitenChapter 3. The Accounting EquationKarysse Arielle Noel JalaoNoch keine Bewertungen