Beruflich Dokumente

Kultur Dokumente

Local Media1556764160936285934

Hochgeladen von

Prince PierreOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Local Media1556764160936285934

Hochgeladen von

Prince PierreCopyright:

Verfügbare Formate

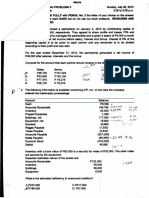

Aimee C.

Delgado Unit 3 Investment Property INTACC2

Exercise 1 – Investment Property Journal Entries

1. Fair Value Model - Building

Journal entries in 2020:

Investment property P9,000,000

Repairs expense P400,000

Cash P9,400,000

To record investment property and repairs

Loss on change in fair value P1,000,000

Investment property P1,000,000

To record fair value change

Building FV at Dec. 31, 2020 P8,000,000

Building cost at Jan. 1, 2020 - P9,000,000

Loss on change in FV 2020 (P1,000,000)

2021:

Loss on change in fair value P500,000

Investment property P500,000

To record fair value change

Building FV at Dec. 31, 2021 P7,500,000

Building FV at Dec. 31, 2020 - P8,000,000

Loss on change in FV 2021 (P500,000)

Fair Value Model – Land

Journal entries in 2020:

Investment property P7,700,000

Repairs expense P20,000

Cash P7,720,000

To record investment property and repairs

Purchase price P7,500,000

Broker’s Fee P200,000

Investment property P7,700,000

Investment property P1,000,000

Gain on change in fair value P1,000,000

To record fair value change

Building FV at Dec. 31, 2020 P8,500,000

Building cost at Jan. 1, 2020 - P7,500,000

Gain on change in FV 2020 P1,000,000

2021:

Investment property P1,000,000

Gain on change in fair value P1,000,000

To record fair value change

Building FV at Dec. 31, 2021 P9,500,000

Building FV at Dec. 31, 2020 - P8,500,000

Gain on change in FV 2021 P1,000,000

2. Cost Model – Building

Journal entries in 2020:

Investment property P9,000,000

Repairs expense P400,000

Cash P9,400,000

To record investment property and repairs

Depreciation expense P900,000

Accumulated depreciation P900,000

To record depreciation

Building cost at Jan. 1, 2020 P9,000,000

Useful life ÷ 10 years

Annual depreciation P900,000

2021:

Depreciation expense P900,000

Accumulated depreciation P900,000

To record depreciation

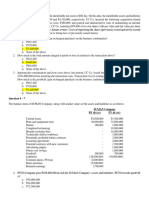

Exercise 2 – Investment property using cost and fair value model

1. Loss on change in fair value P100,000

Investment property P100,000

To record fair value change

Building FV at Dec. 31, 2019 P5,900,000

Building FV at Dec. 31, 2018 - P6,000,000

Loss on change in FV 2019 (P100,000)

2. Depreciation expense P145,000

Accumulated depreciation P145,000

To record depreciation

Building cost at Jan. 1, 2016 P5,800,000

Useful life ÷ 40 years

Annual depreciation P145,000

Exercise 3 – Investment property transfers

1. Fair value of building – Dec. 31, 2019 P35,000,000

Carrying amount – Dec. 31, 2019 (P20,000,000)

Revaluation surplus P15,000,000

2. Fair value of land – Dec. 31, 2019 P15,000,000

Carrying amount – Dec. 31, 2019 (P10,000,000)

Gain on reclassification P5,000,000

3. Journal entries:

Building:

Building P15,000,000

Revaluation surplus P15,000,000

To record revaluation of building

Investment property P35,000,000

Building P35,000,000

To record reclassification of building

Land:

Investment property P15,000,000

Land P10,000,000

Gain on change in fair value P5,000,000

To record inventory reclassification

Exercise 4 – Investment property transfers

1. Cost of Property P10,000,000

Net realizable value (P8,000,000)

Decrease in value P2,000,000

2. Fair value of property 2020 P7,000,000

Net realizable value – Dec. 31, 2019 (P8,000,000)

Loss on change in FV (1,000,000)

Exercise 5 – Investment property transfers

100 M

Annual depreciation = = P4,000,000

25 years

4M x 5 years (2016-2020 depreciation) = P20,000,000

Original cost of the Building P100,000,000

Accumulated depreciation (2016-2020) (P20,000,000)

Carrying amount – Dec. 31, 2020 P80,000,000

Fair value of building – Dec. 31, 2020 P70,000,000

Carrying amount – Dec. 31, 2020 (P80,000,000)

Loss on change in FV (P10,000,000)

Exercise 6 – Investment property disposal

220,000

Annual depreciation = = P5,500

40 years

P5,500 x 3 years (2017-2019 depreciation) = P16,500

Original cost P220,000

Accumulated depreciation (2017-2019) (P16,500)

Carrying amount – Jan. 1, 2020 P203,500

Net Proceeds from sale P290,000

Carrying amount P203,500

Gain on disposal P86,500

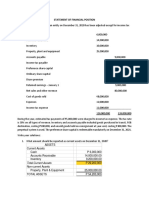

Exercise 7 – Investment property transfers

1. Inventory P35,000,000

Investment property P35,000,000

To record property reclassification

2. Building P35,000,000

Investment property P35,000,000

To record property reclassification

Depreciation expense P1,750,000

Accumulated depreciation P1,750,000

To record depreciation expense

35,000,000

Depreciation expense = = P1,750,000

20 years

Exercise 8 – Investment property transfers

1. Cost model

25,000,000

Annual depreciation = = P1,388,888.89

18 years

P1,388,888.89 x 3 years = P4,166,666.67

Carrying amount = 25,000,000 – 4,166,666.67 = P20,833,333.33

Investment property P20,833,333.33

Building P20,833,333.33

To record reclassification of building

2. Fair value model

Investment property P23,500,000

Building P20,833,333.33

Gain on change in fair value P2,666,666.67

To record reclassification of building

Das könnte Ihnen auch gefallen

- Investment PropertyDokument14 SeitenInvestment PropertyJerome BaluseroNoch keine Bewertungen

- Synthesis - AudProb (Q)Dokument8 SeitenSynthesis - AudProb (Q)Anna Gian SobrevillaNoch keine Bewertungen

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeVon EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNoch keine Bewertungen

- Audit of Financial Statement PresentationDokument7 SeitenAudit of Financial Statement PresentationHasmin Saripada Ampatua100% (1)

- Answers, Solutions and ClarificationsDokument4 SeitenAnswers, Solutions and ClarificationsAnnie Lind100% (1)

- Problem 5 29 38Dokument23 SeitenProblem 5 29 38Renelyn David100% (2)

- Aa050218003019p RC19062018Dokument3 SeitenAa050218003019p RC19062018Kartik Bhatt100% (1)

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDokument7 SeitenUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNoch keine Bewertungen

- Examination About Investment 17Dokument4 SeitenExamination About Investment 17BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Chapter12 - Answer PDFDokument25 SeitenChapter12 - Answer PDFAvon Jade RamosNoch keine Bewertungen

- T24 Islamic Banking - Commodity MurabahaDokument52 SeitenT24 Islamic Banking - Commodity MurabahaSaif RehmanNoch keine Bewertungen

- I. Case BackgroundDokument7 SeitenI. Case BackgroundHiya BhandariBD21070Noch keine Bewertungen

- Report On Environment, Social and Governance ReportingDokument18 SeitenReport On Environment, Social and Governance ReportingCA Manish BasnetNoch keine Bewertungen

- Budgeting and Profit Planning CR PDFDokument24 SeitenBudgeting and Profit Planning CR PDFLindcelle Jane DalopeNoch keine Bewertungen

- TLE W5 JennilynlucasDokument20 SeitenTLE W5 Jennilynlucasrezel joyce catloanNoch keine Bewertungen

- Problem 22-1, Page 610 Classic Company: GivenDokument3 SeitenProblem 22-1, Page 610 Classic Company: GivenDeanne LumakangNoch keine Bewertungen

- Problems Chapter 22 Investment PropertyDokument8 SeitenProblems Chapter 22 Investment PropertyXNoch keine Bewertungen

- Porter's Five Force AnalysisDokument24 SeitenPorter's Five Force AnalysisAman Oza R100% (1)

- Exercise 5 Intacc 2 Azarcon Juneil AndrewDokument12 SeitenExercise 5 Intacc 2 Azarcon Juneil AndrewBARANGAY SIXTYNoch keine Bewertungen

- Investment PropertyDokument5 SeitenInvestment PropertyKristine PerezNoch keine Bewertungen

- Exercise 5: To Record The Investment PropertyDokument6 SeitenExercise 5: To Record The Investment PropertyPearl Isabelle SudarioNoch keine Bewertungen

- Acc113 P1 QuizDokument5 SeitenAcc113 P1 QuizEDELYN PoblacionNoch keine Bewertungen

- Cpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsDokument14 SeitenCpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsKyla MilanNoch keine Bewertungen

- Gonzales, Ian Rogel L. - Assignment #2Dokument4 SeitenGonzales, Ian Rogel L. - Assignment #2GONZALES, IAN ROGEL L.Noch keine Bewertungen

- Gonzales, Ian Rogel L. - Assignment#3Dokument4 SeitenGonzales, Ian Rogel L. - Assignment#3GONZALES, IAN ROGEL L.Noch keine Bewertungen

- Investment Property ProblemsDokument3 SeitenInvestment Property ProblemsAbigail TalusanNoch keine Bewertungen

- Name: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsDokument7 SeitenName: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsEsse ValdezNoch keine Bewertungen

- Accounting For Business Transaction Final ExamDokument7 SeitenAccounting For Business Transaction Final ExamtiffNoch keine Bewertungen

- PpeDokument3 SeitenPpeellie Mateo100% (1)

- Revaluation Model, Impairment Loss, and Cash Generating UnitDokument6 SeitenRevaluation Model, Impairment Loss, and Cash Generating UnitKlariza Paula Ng HuaNoch keine Bewertungen

- AA 4101 Midterm With AnswersDokument9 SeitenAA 4101 Midterm With AnswersAlyssa AnnNoch keine Bewertungen

- Batch 19 2nd Preboard (P1)Dokument10 SeitenBatch 19 2nd Preboard (P1)Jericho PedragosaNoch keine Bewertungen

- Answer 6Dokument5 SeitenAnswer 6Sinclair faith galarioNoch keine Bewertungen

- aNSWER 2Dokument5 SeitenaNSWER 2Sinclair faith galarioNoch keine Bewertungen

- Answer 6Dokument5 SeitenAnswer 6Sinclair faith galarioNoch keine Bewertungen

- aNSWER 2Dokument5 SeitenaNSWER 2Sinclair faith galarioNoch keine Bewertungen

- aNSWER 2Dokument5 SeitenaNSWER 2Sinclair faith galarioNoch keine Bewertungen

- aNSWER 2Dokument5 SeitenaNSWER 2Sinclair faith galarioNoch keine Bewertungen

- Answer 6Dokument5 SeitenAnswer 6Sinclair faith galarioNoch keine Bewertungen

- Answer 6Dokument5 SeitenAnswer 6Sinclair faith galarioNoch keine Bewertungen

- NCPAR - P2 2nd Preboard (2012)Dokument7 SeitenNCPAR - P2 2nd Preboard (2012)Mydel AvelinoNoch keine Bewertungen

- Chapter 39Dokument9 SeitenChapter 39Mike SerafinoNoch keine Bewertungen

- Investment-Property-Non-Current-Asset-Held-For-Sale AnswersDokument6 SeitenInvestment-Property-Non-Current-Asset-Held-For-Sale AnswersEvelina Del RosarioNoch keine Bewertungen

- Accounting For Business CombinationsDokument5 SeitenAccounting For Business CombinationsJohn JackNoch keine Bewertungen

- Module 2 - Topic 3 (Notes Receivable)Dokument7 SeitenModule 2 - Topic 3 (Notes Receivable)GRACE ANN BERGONIONoch keine Bewertungen

- Andiam: January 2, 2019Dokument5 SeitenAndiam: January 2, 2019Avox EverdeenNoch keine Bewertungen

- Assignment Auditing Problemmichelle PagulayanDokument7 SeitenAssignment Auditing Problemmichelle PagulayanEsse ValdezNoch keine Bewertungen

- Chapter12 - Answer PDFDokument25 SeitenChapter12 - Answer PDFJONAS VINCENT SamsonNoch keine Bewertungen

- Chapter12 - Answer PDFDokument25 SeitenChapter12 - Answer PDFAvon Jade RamosNoch keine Bewertungen

- Cpa Review School of The PhilippinesDokument6 SeitenCpa Review School of The PhilippinesMarwin AceNoch keine Bewertungen

- ACCO20093Dokument7 SeitenACCO20093jfcNoch keine Bewertungen

- Solution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination ReviewerDokument11 SeitenSolution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination Reviewerhpp academicmaterialsNoch keine Bewertungen

- Problem 17-1, ContinuedDokument6 SeitenProblem 17-1, ContinuedJohn Carlo D MedallaNoch keine Bewertungen

- 2016 Vol 1 CH 8 AnswersDokument7 Seiten2016 Vol 1 CH 8 AnswersIsla PageNoch keine Bewertungen

- Chapter12 - AnswerDokument26 SeitenChapter12 - AnswerAubreyNoch keine Bewertungen

- PRACTICEDokument4 SeitenPRACTICEGleeson Jay NiedoNoch keine Bewertungen

- Financial Asset ClassifiedDokument6 SeitenFinancial Asset ClassifiedQueenie ValleNoch keine Bewertungen

- ACCT 410 Candel Financial StatementDokument14 SeitenACCT 410 Candel Financial StatementAthia Adams-KerrNoch keine Bewertungen

- 1365464987statement of Financial Positio 3Dokument1 Seite1365464987statement of Financial Positio 3Glen JavellanaNoch keine Bewertungen

- Pe2 SolutionDokument3 SeitenPe2 SolutionRiezel PepitoNoch keine Bewertungen

- Intangible Answer Problem 1Dokument2 SeitenIntangible Answer Problem 1krizzmaaaayNoch keine Bewertungen

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDokument25 SeitenManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNoch keine Bewertungen

- AUDITING Material 2Dokument9 SeitenAUDITING Material 2Blessy Zedlav LacbainNoch keine Bewertungen

- Ppe ProblemsDokument8 SeitenPpe ProblemsPeter Elijah AntonioNoch keine Bewertungen

- Suggested Answers: ExercisesDokument15 SeitenSuggested Answers: ExercisesLele CaparasNoch keine Bewertungen

- Efficiency of Investment in a Socialist EconomyVon EverandEfficiency of Investment in a Socialist EconomyMieczyslaw RakowskiNoch keine Bewertungen

- AbusocmDokument4 SeitenAbusocmPrince PierreNoch keine Bewertungen

- RetentionDokument4 SeitenRetentionPrince PierreNoch keine Bewertungen

- AccountingDokument1 SeiteAccountingPrince PierreNoch keine Bewertungen

- Integrated SubjectsDokument1 SeiteIntegrated SubjectsPrince PierreNoch keine Bewertungen

- AccountingDokument1 SeiteAccountingPrince PierreNoch keine Bewertungen

- Decision Under UncertaintyDokument14 SeitenDecision Under UncertaintyPrince PierreNoch keine Bewertungen

- Audit of SheDokument3 SeitenAudit of ShePrince PierreNoch keine Bewertungen

- Quali Reviewer Quali CutieDokument7 SeitenQuali Reviewer Quali CutiePrince PierreNoch keine Bewertungen

- Exercise On Operational BudgetingDokument3 SeitenExercise On Operational BudgetingPrince PierreNoch keine Bewertungen

- Revised Code CGDokument19 SeitenRevised Code CGRheneir MoraNoch keine Bewertungen

- Anime ListDokument2 SeitenAnime ListPrince PierreNoch keine Bewertungen

- Years Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Dokument4 SeitenYears Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Prince PierreNoch keine Bewertungen

- DocumentDokument2 SeitenDocumentPrince PierreNoch keine Bewertungen

- Total Budgeted Factory Overhead - 50000Dokument7 SeitenTotal Budgeted Factory Overhead - 50000Prince PierreNoch keine Bewertungen

- Preclec WalaDokument1 SeitePreclec WalaPrince PierreNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentPrince PierreNoch keine Bewertungen

- Prelec Post TestDokument3 SeitenPrelec Post TestPrince PierreNoch keine Bewertungen

- Search Form: Jump To NavigationDokument31 SeitenSearch Form: Jump To NavigationPrince PierreNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentPrince PierreNoch keine Bewertungen

- GmerbicDokument1 SeiteGmerbicPrince PierreNoch keine Bewertungen

- 70 Ways The UN Makes A Difference: Peace and SecurityDokument35 Seiten70 Ways The UN Makes A Difference: Peace and SecurityPrince PierreNoch keine Bewertungen

- Total Budgeted Factory Overhead - 50000Dokument7 SeitenTotal Budgeted Factory Overhead - 50000Prince PierreNoch keine Bewertungen

- Add Engagement Partner's Name (Separate From The Firm Name)Dokument1 SeiteAdd Engagement Partner's Name (Separate From The Firm Name)Prince PierreNoch keine Bewertungen

- Anime ListDokument1 SeiteAnime ListPrince PierreNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentPrince PierreNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentPrince PierreNoch keine Bewertungen

- Ticket No. WorkDokument1 SeiteTicket No. WorkPrince PierreNoch keine Bewertungen

- Philosophy of ReligionDokument32 SeitenPhilosophy of ReligionPrince PierreNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentPrince PierreNoch keine Bewertungen

- Profit Prior To IncorporationDokument4 SeitenProfit Prior To Incorporationgourav mishraNoch keine Bewertungen

- Assignment Fin544Dokument12 SeitenAssignment Fin544Yumi MayNoch keine Bewertungen

- Export Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesDokument13 SeitenExport Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesTricia Rozl PimentelNoch keine Bewertungen

- Habib Resume PDFDokument4 SeitenHabib Resume PDFAshief AhmedNoch keine Bewertungen

- Quality Manual CGPLDokument39 SeitenQuality Manual CGPLወይኩን ፍቃድከNoch keine Bewertungen

- Coconut Husk PDFDokument6 SeitenCoconut Husk PDFMaxine FernandezNoch keine Bewertungen

- ITM Communications Limited Project Assumptions & Exclusions 2017 V1.4Dokument1 SeiteITM Communications Limited Project Assumptions & Exclusions 2017 V1.4J DashNoch keine Bewertungen

- Elimination Round QuestionnairesDokument5 SeitenElimination Round Questionnairesmitakumo uwuNoch keine Bewertungen

- Financial Accounting and Reporting: The Game of Financial RatiosDokument8 SeitenFinancial Accounting and Reporting: The Game of Financial RatiosANANTHA BHAIRAVI MNoch keine Bewertungen

- Yeu Log BookDokument36 SeitenYeu Log BookDylanNoch keine Bewertungen

- Internet of Things (Iot) : End-Of-Course Assessment - January Semester 2022Dokument5 SeitenInternet of Things (Iot) : End-Of-Course Assessment - January Semester 2022PrasadNooluNoch keine Bewertungen

- Brief History of BPO Sector in The PhilippinesDokument2 SeitenBrief History of BPO Sector in The PhilippinesCyrille De OcampoNoch keine Bewertungen

- Popular Cover Letter Template For Job SearchDokument2 SeitenPopular Cover Letter Template For Job SearchcelynNoch keine Bewertungen

- BS As On 23-09-2023Dokument28 SeitenBS As On 23-09-2023Farooq MaqboolNoch keine Bewertungen

- Mackenzie Fasone: Objective SkillsDokument2 SeitenMackenzie Fasone: Objective Skillsapi-533837327Noch keine Bewertungen

- Lecture 2 18102021 102305amDokument25 SeitenLecture 2 18102021 102305amAqsa KhanNoch keine Bewertungen

- Activity Based Costing (Abc) - Concept in Foundry IndustryDokument6 SeitenActivity Based Costing (Abc) - Concept in Foundry Industrytushak mNoch keine Bewertungen

- Tally Marathi 256Dokument24 SeitenTally Marathi 256Santosh JadhavNoch keine Bewertungen

- Personal SWOT Analysis - Career Planning From MindToolsDokument6 SeitenPersonal SWOT Analysis - Career Planning From MindToolsDaniel Giaj-Levra LavieriNoch keine Bewertungen

- Hedge Fund Business PlanDokument12 SeitenHedge Fund Business PlanfalconkudakwasheNoch keine Bewertungen

- FBI TBCh10Dokument5 SeitenFBI TBCh10vincewk179Noch keine Bewertungen

- Gurus of Total Quality Management: ObjectivesDokument15 SeitenGurus of Total Quality Management: ObjectivesKaryll JustoNoch keine Bewertungen

- Creamline Site Visit ReviewDokument3 SeitenCreamline Site Visit ReviewSai SapnuNoch keine Bewertungen

- How To Write An Analysis (With Examples and Tips)Dokument2 SeitenHow To Write An Analysis (With Examples and Tips)Al Jairo KaishiNoch keine Bewertungen