Beruflich Dokumente

Kultur Dokumente

Kci-Ufr Q3fy11

Hochgeladen von

Shashi PandeyOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Kci-Ufr Q3fy11

Hochgeladen von

Shashi PandeyCopyright:

Verfügbare Formate

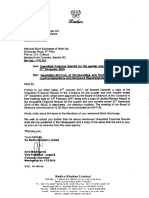

KANORIA CHEMICALS & INDUSTRIES LIMITED

“Park Plaza”, 71, Park Street, Kolkata–700 016

Website : www.kanoriachem.com

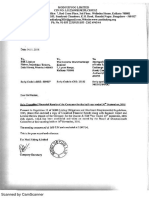

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31ST DECEMBER, 2010

(Rs. in Lakh)

Quarter ended Nine months ended 2009-2010

Particulars

31.12.2010 31.12.2009 31.12.2010 31.12.2009 (Audited)

1. Net Sales

Gross Sales 15,891 11,933 44,487 41,008 53,836

Less: Inter Unit Transfer 2,690 1,848 7,710 6,837 8,597

Excise Duty 954 658 2,772 2,259 3,121

12,247 9,427 34,005 31,912 42,118

2. Other Operating Income 137 260 328 718 934

3. Total Operating Income 12,384 9,687 34,333 32,630 43,052

4. Expenditure :

a) (Increase)/Decrease in Stock-in-Trade & work-in-progress (368) (205) (262) 537 688

b) Consumption of Raw Materials 5,256 4,174 13,924 12,218 16,879

c) Purchases 190 93 192 93 93

d) Power & Fuel 2,408 1,638 6,149 6,050 7,812

e) Staff Cost 899 812 2,671 2,462 3,325

f) Depreciation & Amortisation 1,008 999 3,004 2,993 3,996

g) Other Expenditure 1,816 1,467 5,150 4,383 5,806

h) Total Expenditure 11,209 8,978 30,828 28,736 38,599

5. Profit from operations before other Income, Interest & Finance Charges and Exceptional 1,175 709 3,505 3,894 4,453

items

6. Other Income - 302 1 317 317

7. Profit before Interest & Finance Charges and Exceptional Items 1,175 1,011 3,506 4,211 4,770

8. Interest & Finance Charges 550 545 1,587 1,757 2,323

9. Profit from Ordinary Activities before Exceptional items & Tax 625 466 1,919 2,454 2,447

10. Exceptional item (refer note 2) 7 335 65 1,052 1,432

11. Profit/(Loss) from Ordinary Activities before Tax 632 801 1,984 3,506 3,879

12. Tax Expenses 140 192 431 840 1,082

13. Net Profit/(Loss) from Ordinary Activities after tax 492 609 1,553 2,666 2,797

14. Extraordinary items - - - - -

15. Net Profit/(Loss) 492 609 1,553 2,666 2,797

16. Paid up Equity Share Capital (Rs.5/- per Share) 2,815 2,815 2,815 2,815 2,815

17. Reserves (excluding Revaluation Reserve) - - - - 21,695

18. Earings per Shares (Rs.) - Basic 0.88 1.09 2.76 4.74 4.97

- Diluted 0.64 0.79 2.02 3.46 3.63

19. Public Shareholding

Number of Shares 24178269 24178269 24178269 24178269 24178269

Percentage of Shareholding 42.95% 42.95% 42.95% 42.95% 42.95%

20. Promoters and Promoter Group Shareholding

a) Pledged/Encumbered

Number of Shares Nil Nil Nil Nil Nil

Percentage of Shares (as a % of the total Sharesholding of promoter & promoter group) Nil Nil Nil Nil Nil

Percentage of Shares (as a % of the total Share Capital of the Company ) Nil Nil Nil Nil Nil

b) Non-encumbered

Number of Shares 32118231 32118231 32118231 32118231 32118231

Percentage of Shares (as a % of the total Sharesholding of promoter and promoter group) 100.00% 100.00% 100.00% 100.00% 100.00%

Percentage of Shares (as a % of the total Share Capital of the Company ) 57.05% 57.05% 57.05% 57.05% 57.05%

SEGMENT WISE REVENUE, RESULTS & CAPITAL EMPLOYED:

1. Segment Revenue (net of excise)

Chloro Chemicals 10,910 8,664 30,916 30,088 38,915

Alco Chemicals 4,027 2,611 10,799 8,661 11,800

Total 14,937 11,275 41,715 38,749 50,715

Less : Inter/Intra Segment Sales 2,690 1,848 7,710 6,837 8,597

Net Sales 12,247 9,427 34,005 31,912 42,118

2. Segment Results

(Profit before Tax and Interest & Finance Charges)

Chloro Chemicals 1,219 802 3,728 4,023 4,709

Alco Chemicals 178 136 494 527 646

Total 1,397 938 4,222 4,550 5,355

Less :

i) Interest & Finance Charges 550 545 1,587 1,757 2,323

ii) Other un-allocable expenditure net off un-allocable income 215 (408) 651 (713) (847)

Profit/(Loss) before Tax 632 801 1,984 3,506 3,879

3. Capital Employed

Chloro Chemicals 47,324 50,297 47,324 50,297 49,481

Alco Chemicals 20,373 13,296 20,373 13,296 14,478

Un-allocated 1,247 (1,316) 1,247 (1,316) (2,267)

Total 68,944 62,277 68,944 62,277 61,692

Notes :

1. The above results have been reviewed by the audit committee and taken on record by the Board of Directors at its Meeting held on 3rd February, 2011. The

above results have been reviewed by the Statutory Auditors of the Company as per clause 41 of the listing agreement.

2. The gain/loss arising from the effect of change in the foreign exchange rates on revaluation of the outstanding Foreign Currency Convertible Bonds (FCCB) &

premium thereon are shown as exceptional items.

3. During the quarter, one Investor Complaint was received which was disposed off. No complaint was pending at the beginning and end of the quarter.

4. The Company has commissioned Formaldehyde plant with an installed capacity of 105,000 TPA at its Greenfield Project at Vishakhapatnam, Andhra Pradesh

and started commercial production on 23rd January, 2011.

5. Previous year figures have been regrouped/rearranged, wherever necessary.

Place : New Delhi R.V. Kanoria

Date : 3rd February, 2011 Chairman & Managing Director

Das könnte Ihnen auch gefallen

- NDTV Q2-09 ResultsDokument8 SeitenNDTV Q2-09 ResultsmixedbagNoch keine Bewertungen

- ANNEXURE 4 - Q4 FY08-09 Consolidated ResultsDokument1 SeiteANNEXURE 4 - Q4 FY08-09 Consolidated ResultsPGurusNoch keine Bewertungen

- (Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Dokument4 Seiten(Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Ravi AgarwalNoch keine Bewertungen

- Statement of Standalone Unaudited Results For The Quarter Ended December 31, 2012Dokument3 SeitenStatement of Standalone Unaudited Results For The Quarter Ended December 31, 2012Ravi AgarwalNoch keine Bewertungen

- National Stock Exchange of India LimitedDokument2 SeitenNational Stock Exchange of India LimitedAnonymous DfSizzc4lNoch keine Bewertungen

- Catholic Syrian Bank half-year, annual resultsDokument2 SeitenCatholic Syrian Bank half-year, annual resultssaravanan aNoch keine Bewertungen

- Qtrly - Reportq1 FY 2008 2009Dokument2 SeitenQtrly - Reportq1 FY 2008 2009Bhavin SagarNoch keine Bewertungen

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Dokument4 SeitenUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Published Results 31 March 2010Dokument2 SeitenPublished Results 31 March 2010Ravi ChaturvediNoch keine Bewertungen

- RCOM 4thconsoliated 09-10Dokument3 SeitenRCOM 4thconsoliated 09-10Goutam YenupuriNoch keine Bewertungen

- Arss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Dokument2 SeitenArss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Likun sahooNoch keine Bewertungen

- KPIs Bharti Airtel 04022020Dokument13 SeitenKPIs Bharti Airtel 04022020laksikaNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Venetian Inc. 2014 and 2013 Financial StatementsDokument14 SeitenVenetian Inc. 2014 and 2013 Financial StatementsheyzzupNoch keine Bewertungen

- Aurobindo Mar20Dokument10 SeitenAurobindo Mar20free meNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Dokument8 Seiten4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiNoch keine Bewertungen

- PT Inti Agri ResourcestbkDokument2 SeitenPT Inti Agri ResourcestbkmeilindaNoch keine Bewertungen

- MRF QTR 1 14 15 PDFDokument1 SeiteMRF QTR 1 14 15 PDFdanielxx747Noch keine Bewertungen

- Takaful Companies - Overall: ItemsDokument6 SeitenTakaful Companies - Overall: ItemsZubair ArshadNoch keine Bewertungen

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Dokument13 SeitenIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89Noch keine Bewertungen

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Dokument12 SeitenAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABNoch keine Bewertungen

- TML q4 Fy 21 Consolidated ResultsDokument6 SeitenTML q4 Fy 21 Consolidated ResultsGyanendra AryaNoch keine Bewertungen

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Dokument2 SeitenColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Yash ModiNoch keine Bewertungen

- Quarter1 2010Dokument2 SeitenQuarter1 2010DhruvRathoreNoch keine Bewertungen

- Instructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadDokument7 SeitenInstructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadyshazwaniNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Icici 2009Dokument4 SeitenIcici 2009Anudeep ReddyNoch keine Bewertungen

- Q2 09 ConsolidateDokument1 SeiteQ2 09 ConsolidatecayogeshguptaNoch keine Bewertungen

- KPIT Cummins Infosystems Ltd. Income Statement and Balance Sheet AnalysisDokument22 SeitenKPIT Cummins Infosystems Ltd. Income Statement and Balance Sheet AnalysisArun C PNoch keine Bewertungen

- Zensar Standalone Clause 33 Results Mar2023Dokument3 SeitenZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Published Result Q-1-10 PrintDokument1 SeitePublished Result Q-1-10 Prints natarajanNoch keine Bewertungen

- Kinetic Engineering Limited Regd - Off.: D-1 Block, Plot No.18/2, Chinchwad, Pune - 411019Dokument4 SeitenKinetic Engineering Limited Regd - Off.: D-1 Block, Plot No.18/2, Chinchwad, Pune - 411019karmjeethundalNoch keine Bewertungen

- Sun Pharma Q1 ResultsDokument4 SeitenSun Pharma Q1 ResultsSagar ChaurasiaNoch keine Bewertungen

- Afr Q4fy20Dokument8 SeitenAfr Q4fy20Abhilash ABNoch keine Bewertungen

- Spyder Student ExcelDokument21 SeitenSpyder Student ExcelNatasha PerryNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Dokument14 SeitenSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNoch keine Bewertungen

- Standalone Financial Results for Q4 and FY 2016Dokument7 SeitenStandalone Financial Results for Q4 and FY 2016Headshot's GameNoch keine Bewertungen

- KPI_Q1_FY24_june2023Dokument12 SeitenKPI_Q1_FY24_june2023tapas.patel1Noch keine Bewertungen

- MRF Limited reports Rs 288 crore net profit for Q3Dokument2 SeitenMRF Limited reports Rs 288 crore net profit for Q3Preeti KhatwaNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial MStatements Ceres MGardening MCompanyDokument11 SeitenFinancial MStatements Ceres MGardening MCompanyRodnix MablungNoch keine Bewertungen

- Financial Ratios of Home Depot and Lowe'sDokument30 SeitenFinancial Ratios of Home Depot and Lowe'sM UmarNoch keine Bewertungen

- 1q23 QuarterlyseriesDokument21 Seiten1q23 Quarterlyseriesmana manaNoch keine Bewertungen

- Rl1Chfilzri (Indlll) LTDDokument4 SeitenRl1Chfilzri (Indlll) LTDJigneshNoch keine Bewertungen

- FY11 Q3 Financials TableDokument3 SeitenFY11 Q3 Financials TableSujit JainNoch keine Bewertungen

- Unitech Consolidated 31-03-10Dokument3 SeitenUnitech Consolidated 31-03-10sriramrangaNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Jet Airways Q1 2008 ResultsDokument2 SeitenJet Airways Q1 2008 ResultsRKMNoch keine Bewertungen

- Apollo Hospitals Q1 2010 Financial ResultsDokument2 SeitenApollo Hospitals Q1 2010 Financial ResultsKaif KidwaiNoch keine Bewertungen

- The Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Dokument13 SeitenThe Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Javed MuhammadNoch keine Bewertungen

- Annexure 7 - Audited Financial Results For The Year Ended March 31 2011Dokument3 SeitenAnnexure 7 - Audited Financial Results For The Year Ended March 31 2011PGurusNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Quarter1 2008Dokument2 SeitenQuarter1 2008Raghavendra DevadigaNoch keine Bewertungen

- Castrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Dokument3 SeitenCastrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Sona DuttaNoch keine Bewertungen

- HBL FSAnnouncement 3Q2016Dokument9 SeitenHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNoch keine Bewertungen

- Corporate Actions: A Guide to Securities Event ManagementVon EverandCorporate Actions: A Guide to Securities Event ManagementNoch keine Bewertungen

- New Asian Abstracts June 2009Dokument10 SeitenNew Asian Abstracts June 2009Restu AnggrainiNoch keine Bewertungen

- Income Under The Head "Salary"Dokument15 SeitenIncome Under The Head "Salary"NITESH SINGHNoch keine Bewertungen

- PCAB License Requirements SummaryDokument3 SeitenPCAB License Requirements SummaryJorge ParkerNoch keine Bewertungen

- Viceroy 2Dokument18 SeitenViceroy 2OinkNoch keine Bewertungen

- Workbook For StudentDokument63 SeitenWorkbook For StudentVin PheakdeyNoch keine Bewertungen

- Types of Credit BSBA 3B, GROUP 2Dokument20 SeitenTypes of Credit BSBA 3B, GROUP 2Rizzle RabadillaNoch keine Bewertungen

- Perbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurDokument16 SeitenPerbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurkswongNoch keine Bewertungen

- Capital IQ Transaction Screening Report: Announced Mergers & AcquisitionsDokument12 SeitenCapital IQ Transaction Screening Report: Announced Mergers & AcquisitionsaspiringstudentNoch keine Bewertungen

- Company Law Question BankDokument83 SeitenCompany Law Question Bankshakthi jayanth100% (1)

- Porters Generic StrategiesDokument6 SeitenPorters Generic Strategiessaransh maheshwariNoch keine Bewertungen

- A Study On Difference in Gender Attitude in Investment Decision Making in IndiaDokument17 SeitenA Study On Difference in Gender Attitude in Investment Decision Making in IndiaAkit yadavNoch keine Bewertungen

- Should College/Universities Be Free To All Students or Should It Cost Those Seeking To Obtain A Higher EducationDokument7 SeitenShould College/Universities Be Free To All Students or Should It Cost Those Seeking To Obtain A Higher Educationapi-311098404Noch keine Bewertungen

- Lembar Kerja UD BuanaDokument48 SeitenLembar Kerja UD BuanaRizkyNoch keine Bewertungen

- Attributes and Features of InvestmentDokument5 SeitenAttributes and Features of InvestmentAashutosh ChandraNoch keine Bewertungen

- SODA SodaStream IR Presentation August 2016Dokument28 SeitenSODA SodaStream IR Presentation August 2016Ala BasterNoch keine Bewertungen

- Three Circle Family ModelDokument5 SeitenThree Circle Family ModelAnoosha MazharNoch keine Bewertungen

- Pakistan-Regional Economic Integration Activity (PREIA)Dokument8 SeitenPakistan-Regional Economic Integration Activity (PREIA)Umer MinhasNoch keine Bewertungen

- Leave and License AgreeDokument4 SeitenLeave and License AgreeYogesh SaindaneNoch keine Bewertungen

- Cake | Extra | James | Sukree Die Hard Strategy Results and LearningDokument72 SeitenCake | Extra | James | Sukree Die Hard Strategy Results and LearningAkshay SinghNoch keine Bewertungen

- Preo PosterDokument9 SeitenPreo PosterJames Tyrone MedinaNoch keine Bewertungen

- Standard normal distribution word problemsDokument2 SeitenStandard normal distribution word problemshamad0% (1)

- Supporting Papers For RetirementDokument5 SeitenSupporting Papers For RetirementKatherine DahangNoch keine Bewertungen

- Reevaluation FormDokument2 SeitenReevaluation FormkanchankonwarNoch keine Bewertungen

- Income Statement and Balance SheetDokument25 SeitenIncome Statement and Balance SheetKhizer Waseem100% (1)

- Indirect TaxDokument3 SeitenIndirect TaxRupal DalalNoch keine Bewertungen

- Sicav Annual Report Final Audited and Signed 2021Dokument465 SeitenSicav Annual Report Final Audited and Signed 2021sirinekadhi7Noch keine Bewertungen

- Government Accounting Chapter 2Dokument5 SeitenGovernment Accounting Chapter 2Jeca RomeroNoch keine Bewertungen

- Lessons from Past Hydropower Models in NepalDokument34 SeitenLessons from Past Hydropower Models in NepalRazn NhemaphukiNoch keine Bewertungen

- De La Rosa V Ortega Go-Catay PDFDokument2 SeitenDe La Rosa V Ortega Go-Catay PDFGertrude GamonnacNoch keine Bewertungen

- Cost AccountingDokument8 SeitenCost Accountingtushar sundriyalNoch keine Bewertungen