Beruflich Dokumente

Kultur Dokumente

Change in Fed Strategy

Hochgeladen von

Neeraj GargOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Change in Fed Strategy

Hochgeladen von

Neeraj GargCopyright:

Verfügbare Formate

Change in Strategy of the Fed

The Federal Reserve adopted a historic shift in its approach to interest-rate policy that places more

emphasis on boosting employment and allows inflation to rise above the Fed’s 2% target during

economic expansions, keeping rates lower for longer.

This is because persistently low inflation leads consumers and businesses to expect it to continue,

perpetuating a cycle of meager price increases. If workers, for example, expect prices to remain

stable, they’re less likely to seek solid wage increases.

Low inflation can lead to deflation, or falling prices, that may prompt consumers to put off

purchases, hurting the economy.

Fed’s review was spurred by four key developments in the economy in recent years:

Slower economic growth: Since 2012, Fed officials’ median estimate of the economy’s potential

annual growth has fallen to 1.8% from 2.5%. There are several forces, including slowing population

growth, an aging population and sluggish productivity growth.

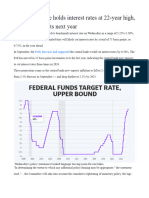

Lower interest rates: The Fed’s “neutral federal funds rate” – consistent with a strong economy and

stable inflation – has fallen from 4.25% to 2.5%. That’s a problem because a low long-run rate

means the Fed “has less scope to support the economy during an economic downturn by simply

cutting the federal funds rate.

The result can be worse economic outcomes in terms of both employment and price stability, with

the cost of such outcomes likely falling hardest on those least able to bear them.

A robust labor market before the pandemic: The record 10.5 year old expansion that was abruptly

halted by the pandemic “led to the best labor market we had seen in some time,” Powell said.

Besides unemployment that hovered near 50-year lows for about two years, a larger-than-expected

share of Americans were working or looking for jobs despite massive baby boomer retirements. And

black and Hispanic unemployment rates had reached record lows.

Stubbornly low inflation: The strong labor market did not trigger a significant rise in inflation.

Typically, low unemployment leads to higher inflation as employers bid up wages to attract a

smaller pool of workers. But that hasn’t happened. The Fed’s estimate of the jobless rate that’s likely

to begin pushing inflation higher has fallen to 4.1% from 5.5%.

Reference: https://www.livemint.com/news/world/fed-to-allow-inflation-to-rise-to-maximize-job-

growth-jerome-powell-11598534698018.html

Das könnte Ihnen auch gefallen

- Reviving Economic Growth: Policy Proposals from 51 Leading ExpertsVon EverandReviving Economic Growth: Policy Proposals from 51 Leading ExpertsNoch keine Bewertungen

- Economist - The Federal Reserve MeetsDokument3 SeitenEconomist - The Federal Reserve MeetsJeniffer GuillenNoch keine Bewertungen

- Yellen HHDokument7 SeitenYellen HHZerohedgeNoch keine Bewertungen

- Fed DiscussionDokument3 SeitenFed DiscussionE learningNoch keine Bewertungen

- 2023-12-13-Federal Reserve Holds Interest Rates at 22-Year High, Signals Three Cuts Next YearDokument3 Seiten2023-12-13-Federal Reserve Holds Interest Rates at 22-Year High, Signals Three Cuts Next YearAurel AchilNoch keine Bewertungen

- FOMCpresconf 20220615Dokument27 SeitenFOMCpresconf 20220615S CNoch keine Bewertungen

- Impact of Global Finacial Crises On EconomyDokument2 SeitenImpact of Global Finacial Crises On EconomyHabiba FouadNoch keine Bewertungen

- Interest RatesDokument25 SeitenInterest RatesMatthew KimNoch keine Bewertungen

- FOMCpresconf 20210922Dokument26 SeitenFOMCpresconf 20210922marcoNoch keine Bewertungen

- Kimberly - Economics Internal AssesmentDokument8 SeitenKimberly - Economics Internal Assesmentkimberly.weynata.4055Noch keine Bewertungen

- Fomc Pres Conf 20160615Dokument21 SeitenFomc Pres Conf 20160615petere056Noch keine Bewertungen

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Dokument4 SeitenTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNoch keine Bewertungen

- FOMCpresconf20230503 PDFDokument4 SeitenFOMCpresconf20230503 PDFJavierNoch keine Bewertungen

- India Struggles To Avoid Curse of StagflationDokument8 SeitenIndia Struggles To Avoid Curse of StagflationSohil KisanNoch keine Bewertungen

- Transcript of Chair Powell's Press Conference July 27, 2022Dokument26 SeitenTranscript of Chair Powell's Press Conference July 27, 2022Psilocybe CubensisNoch keine Bewertungen

- Inflationary Pressure and Indian Economic GrowthDokument10 SeitenInflationary Pressure and Indian Economic GrowthNisha PadhiNoch keine Bewertungen

- Macro IADokument4 SeitenMacro IAAnnieZouNoch keine Bewertungen

- Christopher WallerDokument29 SeitenChristopher WallerTim MooreNoch keine Bewertungen

- Fomc Pres Conf 20141217Dokument23 SeitenFomc Pres Conf 20141217JoseLastNoch keine Bewertungen

- Stock Market UnstableDokument2 SeitenStock Market UnstableHiroaki KomatsuNoch keine Bewertungen

- Global Weekly Economic Update - Deloitte InsightsDokument8 SeitenGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiNoch keine Bewertungen

- Transcript of Chair Powell's Press Conference May 4, 2022Dokument24 SeitenTranscript of Chair Powell's Press Conference May 4, 2022Learning的生活Noch keine Bewertungen

- Federal Reserve Officials Are Keeping A Close Eye On Jobs DataDokument1 SeiteFederal Reserve Officials Are Keeping A Close Eye On Jobs DatafhriNoch keine Bewertungen

- Fomc Pres Conf 20230614Dokument26 SeitenFomc Pres Conf 20230614LAKHAN TRIVEDINoch keine Bewertungen

- Fomc Pres Conf 20231101Dokument26 SeitenFomc Pres Conf 20231101Quynh Le Thi NhuNoch keine Bewertungen

- The Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy - Federal Reserve Bank of ChicagoDokument5 SeitenThe Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy - Federal Reserve Bank of ChicagoAlvaroNoch keine Bewertungen

- March 22, 2023 - Fed Chair Prepared RemarksDokument5 SeitenMarch 22, 2023 - Fed Chair Prepared RemarksRam AhluwaliaNoch keine Bewertungen

- FOMCpresconf 20230503Dokument25 SeitenFOMCpresconf 20230503Edi SaputraNoch keine Bewertungen

- FOMCpresconf 20230614Dokument5 SeitenFOMCpresconf 20230614Jhony SmithYTNoch keine Bewertungen

- Powell 20221130Dokument16 SeitenPowell 20221130Zerohedge100% (1)

- Fed YardeniDokument2 SeitenFed Yardenipta123Noch keine Bewertungen

- Macroeconomics Commentary Number 2Dokument8 SeitenMacroeconomics Commentary Number 2gqf94jy9rtNoch keine Bewertungen

- FOMCpresconf 20230920Dokument4 SeitenFOMCpresconf 20230920KHAIRULNoch keine Bewertungen

- Yellen TestimonyDokument7 SeitenYellen TestimonyZerohedgeNoch keine Bewertungen

- Modifying The Fed's Policy Framework Does A Higher Inflation Target Beat Negative Interest RatesDokument23 SeitenModifying The Fed's Policy Framework Does A Higher Inflation Target Beat Negative Interest RatesJoão Pedro ShcairaNoch keine Bewertungen

- Jackson Hole 2021 US Inflation Rate Covid Upend Powell Fed Policy RevolutionDokument7 SeitenJackson Hole 2021 US Inflation Rate Covid Upend Powell Fed Policy RevolutionCalvin YeohNoch keine Bewertungen

- Weekly Trends March 20, 2015Dokument4 SeitenWeekly Trends March 20, 2015dpbasicNoch keine Bewertungen

- Fed Slows Its Tightening With Quarter-Point Interest Rate Rise - WSJDokument6 SeitenFed Slows Its Tightening With Quarter-Point Interest Rate Rise - WSJHassaan ImranNoch keine Bewertungen

- Week of November 7, 2022Dokument14 SeitenWeek of November 7, 2022Steve PattrickNoch keine Bewertungen

- SystemDokument8 SeitenSystempathanfor786Noch keine Bewertungen

- Inflation or DeflationDokument2 SeitenInflation or DeflationJames HetNoch keine Bewertungen

- Macro Economics and Business Environment Assignment: Submitted To: Dr. C.S. AdhikariDokument8 SeitenMacro Economics and Business Environment Assignment: Submitted To: Dr. C.S. Adhikarigaurav880Noch keine Bewertungen

- Understanding Inflation During Covid EraDokument88 SeitenUnderstanding Inflation During Covid EraShubha TandonNoch keine Bewertungen

- MFM Jun 17 2011Dokument13 SeitenMFM Jun 17 2011timurrsNoch keine Bewertungen

- Inflation: A Comparative StudyDokument17 SeitenInflation: A Comparative StudyShubham A AgrawalNoch keine Bewertungen

- DEFINITION of 'Overheated Economy': Is The Economy Overh Eating? Here's Why It's So Hard To SayDokument3 SeitenDEFINITION of 'Overheated Economy': Is The Economy Overh Eating? Here's Why It's So Hard To SayRehan AhmadNoch keine Bewertungen

- Monetary PolicyDokument4 SeitenMonetary PolicySadia R ChowdhuryNoch keine Bewertungen

- Chapter 5 CW With SolutionsDokument3 SeitenChapter 5 CW With SolutionsSarah MoonNoch keine Bewertungen

- Weekly Economic Commentary 3/18/2013Dokument7 SeitenWeekly Economic Commentary 3/18/2013monarchadvisorygroupNoch keine Bewertungen

- Westpac - Fed Doves Might Have Last Word (August 2013)Dokument4 SeitenWestpac - Fed Doves Might Have Last Word (August 2013)leithvanonselenNoch keine Bewertungen

- Anish (5) Macroeconomics IADokument17 SeitenAnish (5) Macroeconomics IA5IB5 BALAJI MAHALAKSHMI ANISHNoch keine Bewertungen

- Federal Reserve Issues FOMC Statement: ShareDokument2 SeitenFederal Reserve Issues FOMC Statement: ShareTREND_7425Noch keine Bewertungen

- FOMCpresconf 20220316Dokument26 SeitenFOMCpresconf 20220316marchmtetNoch keine Bewertungen

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Dokument23 SeitenTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNoch keine Bewertungen

- (Q: Why Is Deflation Bad? A: Why Would You Buy Something If It Gets Cheaper Tomorrow)Dokument2 Seiten(Q: Why Is Deflation Bad? A: Why Would You Buy Something If It Gets Cheaper Tomorrow)Lian Wei ZhengNoch keine Bewertungen

- Inflation: India Philippines United StatesDokument3 SeitenInflation: India Philippines United StatesKaname KuranNoch keine Bewertungen

- Bernanke 20121120 ADokument16 SeitenBernanke 20121120 Atax9654Noch keine Bewertungen

- Economic Snapshot: February 2015Dokument8 SeitenEconomic Snapshot: February 2015Center for American ProgressNoch keine Bewertungen

- First Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoDokument5 SeitenFirst Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoUttam AuddyNoch keine Bewertungen

- American: Memorandum (SAMPLE ONLY)Dokument8 SeitenAmerican: Memorandum (SAMPLE ONLY)testtest1Noch keine Bewertungen

- Nikhil Kandwal - 19020841022Dokument16 SeitenNikhil Kandwal - 19020841022Neeraj GargNoch keine Bewertungen

- Control Charts (X-Bar and R Charts)Dokument22 SeitenControl Charts (X-Bar and R Charts)Neeraj GargNoch keine Bewertungen

- Narayana Health Care - MainDokument19 SeitenNarayana Health Care - MainNeeraj GargNoch keine Bewertungen

- Abc Analysis: TRISHA SINGH-19020841036 MONIKA - 19020841019Dokument9 SeitenAbc Analysis: TRISHA SINGH-19020841036 MONIKA - 19020841019Neeraj GargNoch keine Bewertungen

- Kano's Model of Customer Satisfaction: Nikhil Kandwal 19020841022 Neeraj Garg 19020841021Dokument13 SeitenKano's Model of Customer Satisfaction: Nikhil Kandwal 19020841022 Neeraj Garg 19020841021Neeraj GargNoch keine Bewertungen

- SIBM-MBA-OS-Session 14-18Dokument14 SeitenSIBM-MBA-OS-Session 14-18Neeraj GargNoch keine Bewertungen

- Agarwal Packers and Movers LimitedDokument8 SeitenAgarwal Packers and Movers LimitedNeeraj GargNoch keine Bewertungen

- Crux 3.0 - 08Dokument13 SeitenCrux 3.0 - 08Neeraj GargNoch keine Bewertungen

- Operation Management Case Study On "GUJRAT AMBUJA"Dokument17 SeitenOperation Management Case Study On "GUJRAT AMBUJA"Neeraj GargNoch keine Bewertungen

- SIBM-MBA-OS-Session 01-06Dokument23 SeitenSIBM-MBA-OS-Session 01-06Neeraj GargNoch keine Bewertungen

- Launching Amul Kitchen: Presented By: Team A (Group 1 & 3)Dokument10 SeitenLaunching Amul Kitchen: Presented By: Team A (Group 1 & 3)Neeraj GargNoch keine Bewertungen

- Crux 3.0 - 09Dokument11 SeitenCrux 3.0 - 09Neeraj GargNoch keine Bewertungen

- Crux 3.0 - 12Dokument10 SeitenCrux 3.0 - 12Neeraj GargNoch keine Bewertungen

- Crux 3.0 - 10Dokument11 SeitenCrux 3.0 - 10Neeraj GargNoch keine Bewertungen

- Crux 3.0 - 11Dokument10 SeitenCrux 3.0 - 11Neeraj GargNoch keine Bewertungen

- Packaging &: LabelingDokument9 SeitenPackaging &: LabelingNeeraj GargNoch keine Bewertungen

- Crux 3.0 - 07Dokument10 SeitenCrux 3.0 - 07Neeraj GargNoch keine Bewertungen

- Differentiated PricingDokument48 SeitenDifferentiated PricingNeeraj GargNoch keine Bewertungen

- Pricemix 170718162420Dokument29 SeitenPricemix 170718162420Neeraj GargNoch keine Bewertungen

- Project On: Smoke Detector For Homes and IndustriesDokument7 SeitenProject On: Smoke Detector For Homes and IndustriesNeeraj GargNoch keine Bewertungen

- Neeraj Garg - 19020841021 - Pricing PDFDokument1 SeiteNeeraj Garg - 19020841021 - Pricing PDFNeeraj GargNoch keine Bewertungen

- What Is GPT PDFDokument1 SeiteWhat Is GPT PDFNeeraj GargNoch keine Bewertungen

- Promotion Mix: Key ConceptsDokument4 SeitenPromotion Mix: Key ConceptsNeeraj GargNoch keine Bewertungen

- Project On: Smoke Detector For Homes and IndustriesDokument7 SeitenProject On: Smoke Detector For Homes and IndustriesNeeraj GargNoch keine Bewertungen

- Neeraj Garg - 19020841021 - Pricing - Zara PDFDokument1 SeiteNeeraj Garg - 19020841021 - Pricing - Zara PDFNeeraj GargNoch keine Bewertungen

- Adel Lock ManualDokument1 SeiteAdel Lock Manual24245677843Noch keine Bewertungen

- GCGM PDFDokument11 SeitenGCGM PDFMiguel Angel Martin100% (1)

- Application of SPACE MatrixDokument11 SeitenApplication of SPACE Matrixdecker444975% (4)

- Month Puzzle Two VariableDokument6 SeitenMonth Puzzle Two VariableNayan KaithwasNoch keine Bewertungen

- ASC 2020-21 Questionnaire PDFDokument11 SeitenASC 2020-21 Questionnaire PDFShama PhotoNoch keine Bewertungen

- House Staff OrderDokument2 SeitenHouse Staff OrderTarikNoch keine Bewertungen

- Motor BookDokument252 SeitenMotor BookKyaw KhNoch keine Bewertungen

- Roles of Community Health NursingDokument2 SeitenRoles of Community Health Nursingdy kimNoch keine Bewertungen

- Text Descriptive Tentang HewanDokument15 SeitenText Descriptive Tentang HewanHAPPY ARIFIANTONoch keine Bewertungen

- Wapda CSR 2013 Zone 3Dokument245 SeitenWapda CSR 2013 Zone 3Naveed Shaheen91% (11)

- South San Francisco Talks Plans For Sports Park ImprovementsDokument32 SeitenSouth San Francisco Talks Plans For Sports Park ImprovementsSan Mateo Daily JournalNoch keine Bewertungen

- CrumpleZonesSE (Edit)Dokument12 SeitenCrumpleZonesSE (Edit)Dah Unknown MarksmenNoch keine Bewertungen

- TheBigBookOfTeamCulture PDFDokument231 SeitenTheBigBookOfTeamCulture PDFavarus100% (1)

- Cyanocobalamin Injection Clinical Pharmacology Drug MonographDokument36 SeitenCyanocobalamin Injection Clinical Pharmacology Drug MonographLaureyNoch keine Bewertungen

- Refrigerant Unit Lab ReportDokument19 SeitenRefrigerant Unit Lab Reportakmal100% (2)

- CN Blue Love Rigt Lyrics (Romanized)Dokument3 SeitenCN Blue Love Rigt Lyrics (Romanized)Dhika Halet NinridarNoch keine Bewertungen

- 14 Days of Prayer and FastingDokument40 Seiten14 Days of Prayer and FastingntsakoramphagoNoch keine Bewertungen

- FacebookDokument2 SeitenFacebookAbhijeet SingareNoch keine Bewertungen

- Zoology LAB Scheme of Work 2023 Hsslive HSSDokument7 SeitenZoology LAB Scheme of Work 2023 Hsslive HSSspookyvibee666Noch keine Bewertungen

- Revised LabDokument18 SeitenRevised LabAbu AyemanNoch keine Bewertungen

- Rotex GS Zero-Backlash Shaft CouplingDokument19 SeitenRotex GS Zero-Backlash Shaft CouplingIrina DimitrovaNoch keine Bewertungen

- Bluesil Ep 150 A3: Insulator Grade Silicone RubberDokument2 SeitenBluesil Ep 150 A3: Insulator Grade Silicone RubberNagendra KumarNoch keine Bewertungen

- Resume LittletonDokument1 SeiteResume Littletonapi-309466005Noch keine Bewertungen

- Valuing Construction Variation by Using PWA, FIDIC, ICWMF and CEDA Fluctuation Formula MechanismDokument5 SeitenValuing Construction Variation by Using PWA, FIDIC, ICWMF and CEDA Fluctuation Formula MechanismAzman YahayaNoch keine Bewertungen

- Application Tracking System: Mentor - Yamini Ma'AmDokument10 SeitenApplication Tracking System: Mentor - Yamini Ma'AmBHuwanNoch keine Bewertungen

- FBDokument27 SeitenFBBenjaminNoch keine Bewertungen

- Maharishi Language of Gravity - SoS 27Dokument3 SeitenMaharishi Language of Gravity - SoS 27Prof. MadhavanNoch keine Bewertungen

- 04 DosimetryDokument104 Seiten04 DosimetryEdmond ChiangNoch keine Bewertungen

- Happiest Refugee Coursework 2013Dokument10 SeitenHappiest Refugee Coursework 2013malcrowe100% (2)

- Bagi CHAPT 7 TUGAS INGGRIS W - YAHIEN PUTRIDokument4 SeitenBagi CHAPT 7 TUGAS INGGRIS W - YAHIEN PUTRIYahien PutriNoch keine Bewertungen