Beruflich Dokumente

Kultur Dokumente

Stock Market Reports For The Week (14th - 18th February '11)

Hochgeladen von

Dasher_No_1Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stock Market Reports For The Week (14th - 18th February '11)

Hochgeladen von

Dasher_No_1Copyright:

Verfügbare Formate

>>

WEEKLY 14th Feb - 18th Feb 2011

Global Research Limited

STOCKS REPORT>>

MARKET Markets Rebound from

this Week Oversold Territory !

WEEK WRAP

The 50-share NSE Nifty saw the 5300-mark towards close today - for the first time since yesterday and settled trade at 5,310, up 84.20 points or 1.61% compared

to previous close. The 30-share BSE Sensex Sensex gained 265.57 points or 1.52%, to end at 17,728.61, after showing recovery of 433 points from days low.

The 50-share National Stock Exchange index gained 1.6% to 5,310. In early trade, world stocks measured by MSCI All-Country World Index slipped 0.5%, while

the MSCI emerging market index dropped 0.7%.

The 50-share National Stock Exchange index gained 1.6% to 5,310. In early trade, world stocks measured by MSCI All-Country World Index slipped 0.5%, while

the MSCI emerging market index dropped 0.7%.

All the banks, starting from HDFC, Axis Bank, Kotak Mahindra Bank, IDFC (the beaten down), ICICI Bank and State Bank of India were the big movers of the rally.

ASIAN & EMERGING MARKET

Asian markets were trading mixed. China's Shanghai Composite added 0.21% or 6.01 points at 2,824.17.

The benchmark S&P/ASX 200 index slipped 33.534 points to 4,880.9, according to the latest available data. The index had closed up 0.2 percent on Thursday at

its highest close since April 21.

Economic data for January due next week is expected to show that lending surged and inflation accelerated, prompting concerns among some investors that the

central bank could take more steps to control money supply, after raising interest rates this week

US MARKET

Economic data for January due next week is expected to show that lending surged and inflation accelerated, prompting concerns among some investors that the

central bank could take more steps to control money supply, after raising interest rates this week.

The S&P's five-month surge, which has taken it up almost 27%, has confounded those calling for a correction, but weak volume recently has been undercutting

the unfailingly bullish direction in equities. Only 7.7 billion shares traded on the New York Stock Exchange, the American Stock Exchange and Nasdaq below last

year's daily average of 8.47 billion.

Commodities were a weak spot as crude oil prices declined in parallel with a falling-off of worries of possible oil supply problems in the Middle East. March

crude futures dropped 1.5%.

Agribusiness Bunge Ltd rose 3.4% to USD 71.36 and Archer-Daniels Midland Co gained 2.2% to USD 36.22.

MICRO ECONOMIC FRONT

Industrial production, measured by the index of industrial production (IIP), slowed to a 20 month low of 1.6 per cent in December, from 2.7 per cent in

November 2010.

The advance estimates by Central Statistical Organisation (CSO) has estimated the country's economic growth for the current financial year at 8.6 per cent, as

against 8 per cent a year ago.

The government announced a Rs 500-crore annual package of incentives for export for products still struggling to make an impact in the global market.

Capital goods contracted 13.7 per cent in December indicating companies may have put off capacity expansion in the face of cost pressures because of

consistent monetary tightening.

1 | JANUARY 2011 | www.capitalvia.com

>>

WEEKLY 14th Feb - 18th Feb 2011

Global Research Limited

STOCKS REPORT>>

MARKET Markets Rebound from

this Week Oversold Territory !

NIFTY WORLD INDICES

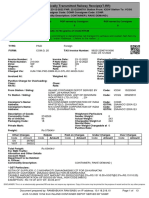

NIFTY Properties Values World Indices Close Weekly Chg Points % Chg

Weekly Open 5430.15 Sensex 17728.61 -279.54 -1.55%

Weekly High 5440.35 Nifty 5310.00 -120.15 -2.21%

Weekly Low 5177.70 DOW Jones 12272.26 +181.11 +1.49%

Weekly Close 5310.00 Shanghai Comp. 2827.77 +28.81 +1.02%

Weekly Chg Points -120.15 Nikkei 10605.65 +0.58% +1.02%

Weekly Chg% -2.21% CAC 40 4101.31 +54.01 +1.33%

FTSE 6062.90 +65.05 +1.08%

SECTORIAL INDICES

Indices Open High Low Close

BANK NIFTY 10457.80 10509.80 10061.40 10447.75

CNX NIFTY JUNIOR 10726.65 10804.65 10037.90 10406.25

S&P CNX 500 4358.40 4362.95 4128.25 4240.45

CN XIT 6916.85 6920.35 6624.05 6719.65

CNX MIDCAP 7771.90 7793.70 7219.40 7483.90

CNX 100 5334.25 5343.40 5077.10 5209.70

GAINERS LOSERS

Scrip GAINERS

Current Close Change Chg % Scrip Current Close Change Chg %

BF INVEST 102.15 78.10 30.79 ALLIED DIGIT 74.50 150.35 -50.44

WELSPUNSTAHL 172.25 150.05 14.79 PARSVNATH 28.10 45.20 -37.83

PRADIP OVER 71.80 63.40 13.24 KOPRAN 20.75 30.45 -31.85

BEARDSELL 51.00 46.10 10.62 ALPHA GEO 103.10 146.25 -29.50

JAINIRRIGATN 190.70 172.55 10.51 WANBURY LTD 27.45 38.90 -29.43

DII’S INVESTMENTS FII’S INVESTMENTS

Indices Buy Value Sell Value Net Value Indices Buy Value Sell Value Net Value

10-Feb-2011 676.80 599.90 76.80 11-Feb-2011 3046.20 3891.70 -845.50

09-Feb-2011 585.30 788.90 -203.60 10-Feb-2011 3692.70 3977.40 -284.60

08-Feb-2011 557.90 573.80 -16.00 09-Feb-2011 3004.40 3536.00 -531.60

07-Feb-2011 451.90 471.50 -19.60 08-Feb-2011 2757.90 2757.20 0.70

07-Feb-2011 2575.50 2351.10 224.40

1 | DECEMBER 2010 | www.capitalvia.com

2 | JANUARY 2011 | www.capitalvia.com

>>

WEEKLY 14th Feb - 18th Feb 2011

Global Research Limited

STOCKS REPORT>>

MARKET Markets Rebound from

this Week Oversold Territory !

WEEK AHEAD SPOT NIFTY

TECHNICALS

Figure: 1 Nifty Weekly

Properties Values

Support 1 5170

Support 2 5090

Resistance 1 5425

Resistance 2 5350

NIFTY Futures closed at 5312.90, up by 83.75 or 1.58 %. It is looking bullish in the coming trading session if it manages to break the

resistance level of 5350 else below 5170 it would be in a bearish trend.

WEEK AHEAD BANK NIFTY

TECHNICALS

Figure: Bank Nifty Weekly

Properties Values

Support 1 10000

Support 2 9860

Resistance 1 10800

Resistance 2 10515

Bank Nifty Futures closed at 10465, up 370.25 points or 3.67 %.In banking sector index heavy weighted PNB, ICICI, AXIS lead the row.

South Indian bank and ING Vysya Bank gained 7.10 % or 6.51 % respectively. It is looking bullish in the coming trading session if it

manages to trade above the resistance level of 10515 else below 10000 it would be in a downward trend.

3 | JANUARY 2011 | www.capitalvia.com

>>

WEEKLY 14th Feb - 18th Feb 2011

Global Research Limited

STOCKS REPORT>>

MARKET Markets Rebound from

this Week Oversold Territory !

Stock of the Week

TECHNICAL PICTURE

DLF LTD. BUY

Symbol DLF (NSE)

Company Name DLF LTD.

Price ` 247

Change ` 1.10

Volume 5357092

52 Week High 397.50

% From High -37.86%

Day High 248.90 DLF is in consolidation phase from last few trading session and forming higher

bottom pattern .If it manages to sustain above 250 levels, it will take up

EPS 5.56

move. We recommend to Buy DLF in NSE cash above 250 for targets of

TECHNICALS 256,270 with stop loss of 240.

Indices DLF

Support 240

Resistance 250

TECHNICAL PICTURE

SHREE RENUKA SUGARS FUTURE SELL

Symbol RENUKA (NSE)

Company Name SHREE RENUKA SUGARS LTD.

Price ` 84.75

Change ` 1.30

Volume 11118072

52 Week High 194

% From High -2.41%

Day High 86.85 Shree Renuka Sugars Future is technically weak in the charts. 81.35 is the

important support level on the downside which if broken it can see further

EPS 6.13

downfall. We recommend to Sell Shree Renuka Sugars Future below 81.35

TECHNICALS for targets 78.35,75 of with stop loss of 85 .

Indices SHREE RENUKA SUGARS FUTURE

Support 81.35

Resistance 85

4 | JANUARY 2011 | www.capitalvia.com

>>

WEEKLY 14th Feb - 18th Feb 2011

Global Research Limited

STOCKS REPORT>>

MARKET Markets Rebound from

this Week Oversold Territory !

KEY STATISTICS

Current Quarter Earning per Share. The Higher The Better.

C

WHY CAN SLIM?

Primary Factors

Almost 68.05 % increase in Q o Q Earnings.

Annual Earnings Increases: Look for a significant growth.

A Primary Factors

Annual Earnings showed a decline of 50.57% Y o Y.

New Products, New Management, New Highs, Buying at

N Right Time.

Primary Factors

DLF LTD. is set to have a breakout as it is being consolidating after a

“CAN SLIM is a formula created by sharp fall previously.

William J. O'Neil, who is the founder

of the Investor's Business Daily and

author of the book How to Make

Money in Stocks - A Winning System

S Supply and Demand: Shares Outstanding Plus Big Volume

Demand.

in Good Times or Bad. Primary Factors

DLF LTD. is a large cap stock consisting of Rs. 41751.38

Each letter in CAN SLIM stands for crores Shares Outstanding (Total Public Shareholding)

one of the seven chief

characteristics that are commonly

found in the greatest winning Leader or Laggard: Which is your stock?

stocks. The C-A-N-S-L-I-M. L Primary Factors

DLF LTD. is a large cap stock consisting of Rs. 41751.38

characteristics are often present crores Shares Outstanding (Total Public Shareholding)

prior to a stock making a significant

rise in price, and making huge

profits for the shareholders! Institutional Sponsorship: Follow the Leaders.

I Primary Factors

O'Neil explains how he conducted Approximately 16.12% of Shares are held by the

an intensive study of 500 of the Institutional Investors (FII”s, Mutual Funds etc.)

biggest winners in the stock market

from 1953 to 1990. A model of each

Market Direction

of these companies was built and

studied. Again and again, it was Primary Factors

noticed that almost all of the M If Market continues to remain in a secular uptrend,

biggest stock market winners had

hence overall conditions are appropriate to initiate long

very similar characteristics just

position in the stock: A Big plus for the Stock

before they began their big moves.”

Sources: Sihl.in

4 | JANUARY 2011 | www.capitalvia.com

>>

WEEKLY 14th Feb - 18th Feb 2011

Global Research Limited

STOCKS REPORT>>

MARKET Markets Rebound from

this Week Oversold Territory !

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or

liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Investment in Stocks has its own risks. Sincere efforts have been made to present the right investment perspective. The information contained herein is

based on analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is

for personal information and we are not responsible for any loss incurred based upon it & take no responsibility whatsoever for any financial profits or

loss which may arise from the recommendations above.

The stock price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and

forecasts, can change without notice.

CapitalVia does not purport to be an invitation or an offer to buy or sell any financial instrument.

Analyst or any person related to CapitalVia might be holding positions in the stocks recommended.

It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for

which either the site or its owners or anyone can be held responsible for.

Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by

us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Any surfing and reading of the information is the acceptance of this disclaimer.

All Rights Reserved.

Contact Number:

Hotline: +91-91790-02828

Landline: +91-731-668000

Fax: +91-731-4238027

C O N TA C T U S

Corporate Office Address:

India: No. 99, 1st Floor, Surya Complex

CapitalVia Global Research Limited R. V. Road, Basavangudi

No. 506 West, Corporate House Opposite Lalbagh West Gate

169, R. N. T. Marg, Near D. A. V. V. Bangalore - 560004

Indore - 452001

Singapore:

CapitalVia Global Research Pvt. Ltd.

Block 2 Balestier Road

#04-665 Balestier Hill

Shopping Centre

Singapore - 320002

6 | JANUARY 2011 | www.capitalvia.com

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Captable Guide Formation To ExitDokument24 SeitenCaptable Guide Formation To ExitV100% (1)

- (Wiley Finance) Nauzer J. Balsara - Money Management Strategies For Futures Traders-Wiley (1992)Dokument137 Seiten(Wiley Finance) Nauzer J. Balsara - Money Management Strategies For Futures Traders-Wiley (1992)Devyash JhaNoch keine Bewertungen

- Total Quality ManagementDokument35 SeitenTotal Quality ManagementLaura Sumido100% (2)

- Fundamentals of Financial Management Lecture Notes 21mar2021Dokument311 SeitenFundamentals of Financial Management Lecture Notes 21mar2021Ruchita SinghalNoch keine Bewertungen

- Stock Market Reports For The Week (16-20th August '11)Dokument5 SeitenStock Market Reports For The Week (16-20th August '11)Dasher_No_1Noch keine Bewertungen

- Bullion Commodity Reports For The Week (16-20th August '11)Dokument8 SeitenBullion Commodity Reports For The Week (16-20th August '11)Dasher_No_1Noch keine Bewertungen

- Stock Futures and Options Reports For The Week (8th - 12th August '11)Dokument4 SeitenStock Futures and Options Reports For The Week (8th - 12th August '11)Dasher_No_1Noch keine Bewertungen

- Stock Market Reports For The Week (8th - 12th August '11)Dokument5 SeitenStock Market Reports For The Week (8th - 12th August '11)Dasher_No_1Noch keine Bewertungen

- Nifty 50 Reports For The Week (16-20th August '11)Dokument52 SeitenNifty 50 Reports For The Week (16-20th August '11)Dasher_No_1Noch keine Bewertungen

- Agri Commodity Reports For The Week (16-20th August '11)Dokument6 SeitenAgri Commodity Reports For The Week (16-20th August '11)Dasher_No_1Noch keine Bewertungen

- Bullion Commodity Reports For The Week (8th - 12th August '11)Dokument8 SeitenBullion Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1Noch keine Bewertungen

- Stock Market Reports For The Week (25th - 29th July '11)Dokument5 SeitenStock Market Reports For The Week (25th - 29th July '11)Dasher_No_1Noch keine Bewertungen

- Stock Market Reports For The Week (1st - 5th August '11)Dokument5 SeitenStock Market Reports For The Week (1st - 5th August '11)Dasher_No_1Noch keine Bewertungen

- Nifty 50 Reports For The Week (8th - 12th August '11)Dokument52 SeitenNifty 50 Reports For The Week (8th - 12th August '11)Dasher_No_1Noch keine Bewertungen

- Agri Commodity Reports For The Week (1st - 5th August '11)Dokument6 SeitenAgri Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1Noch keine Bewertungen

- Rollover Statistics (From July 2011 Series To September 2011 Series)Dokument10 SeitenRollover Statistics (From July 2011 Series To September 2011 Series)Dasher_No_1Noch keine Bewertungen

- Agri Commodity Reports For The Week (8th - 12th August '11)Dokument6 SeitenAgri Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1Noch keine Bewertungen

- Nifty 50 Reports For The Week (1st - 5th August '11)Dokument52 SeitenNifty 50 Reports For The Week (1st - 5th August '11)Dasher_No_1Noch keine Bewertungen

- Stock Market Reports For The Week (11th - 15th July '11)Dokument5 SeitenStock Market Reports For The Week (11th - 15th July '11)Dasher_No_1Noch keine Bewertungen

- Bullion Commodity Reports For The Week (1st - 5th August '11)Dokument8 SeitenBullion Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1Noch keine Bewertungen

- Stock Futures and Option Reports For The Week (25th - 29th July '11)Dokument4 SeitenStock Futures and Option Reports For The Week (25th - 29th July '11)Dasher_No_1Noch keine Bewertungen

- Stock Market Reports For The Week (4th - 8th July '11)Dokument5 SeitenStock Market Reports For The Week (4th - 8th July '11)Dasher_No_1Noch keine Bewertungen

- Nifty 50 Reports For The Week (25th - 29th July '11)Dokument52 SeitenNifty 50 Reports For The Week (25th - 29th July '11)Dasher_No_1Noch keine Bewertungen

- Bullion Commodity Reports For The Week (25th - 29th July '11)Dokument8 SeitenBullion Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1Noch keine Bewertungen

- Nifty 50 Reports For The Week (4th - 8th July '11)Dokument52 SeitenNifty 50 Reports For The Week (4th - 8th July '11)Dasher_No_1Noch keine Bewertungen

- Bulion Commodity Reports For The Week (11th - 15th July '11)Dokument8 SeitenBulion Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1Noch keine Bewertungen

- Agri Commodity Reports For The Week (25th - 29th July '11)Dokument6 SeitenAgri Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1Noch keine Bewertungen

- Nifty 50 Reports For The Week (11th - 15th July '11)Dokument52 SeitenNifty 50 Reports For The Week (11th - 15th July '11)Dasher_No_1Noch keine Bewertungen

- Agri Commodity Reports For The Week (11th - 15th July '11)Dokument6 SeitenAgri Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1Noch keine Bewertungen

- Bullion Commodity Reports For The Week (4th - 8th July '11)Dokument8 SeitenBullion Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1Noch keine Bewertungen

- Rollover Statistics (From June 2011 Series To July 2011 Series)Dokument10 SeitenRollover Statistics (From June 2011 Series To July 2011 Series)Dasher_No_1Noch keine Bewertungen

- Agri Commodity Reports For The Week (4th - 8th July '11)Dokument6 SeitenAgri Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1Noch keine Bewertungen

- Construction Equipment ThesisDokument7 SeitenConstruction Equipment ThesisNeedHelpWithPaperCanada100% (1)

- Commerce Kset PQDokument120 SeitenCommerce Kset PQDhruvaNoch keine Bewertungen

- SOP For Sale of Assets - FinalDokument7 SeitenSOP For Sale of Assets - FinalTejas JoshiNoch keine Bewertungen

- Economics: The Core Issues: Mcgraw-Hill/IrwinDokument36 SeitenEconomics: The Core Issues: Mcgraw-Hill/IrwinJishnu PvNoch keine Bewertungen

- Nestle Group Antitrust Law Policy September 2016Dokument8 SeitenNestle Group Antitrust Law Policy September 2016yuszriNoch keine Bewertungen

- Icdw VCSG PDFDokument13 SeitenIcdw VCSG PDFjanmenjaya swain sonuNoch keine Bewertungen

- BB BoxesDokument4 SeitenBB BoxesleilycarreyNoch keine Bewertungen

- Reservation Confirmed: Tel: +971 6 558 0000, Fax: +971 6 558 0008Dokument4 SeitenReservation Confirmed: Tel: +971 6 558 0000, Fax: +971 6 558 0008S DevaNoch keine Bewertungen

- Reliability Management at Asian PaintsDokument33 SeitenReliability Management at Asian PaintsRACHURI POOJITHANoch keine Bewertungen

- RUS Pace and New ERA Program Webinar Details 5-17-2023Dokument7 SeitenRUS Pace and New ERA Program Webinar Details 5-17-2023Linda ReevesNoch keine Bewertungen

- Wesleyan University - Philippines MAS AreasDokument5 SeitenWesleyan University - Philippines MAS AreasPrinces S. RoqueNoch keine Bewertungen

- 1111 Rosselmeax CooperativeDokument10 Seiten1111 Rosselmeax Cooperativeprince kupaNoch keine Bewertungen

- Special Power of Attorney GeneralDokument2 SeitenSpecial Power of Attorney GeneralOlivia CruzNoch keine Bewertungen

- FC ProjectDokument25 SeitenFC ProjectRaut BalaNoch keine Bewertungen

- Economics of Managerial Decisions 1st Edition Blair Test BankDokument36 SeitenEconomics of Managerial Decisions 1st Edition Blair Test BankCynthiaJordanMDkqyfj100% (19)

- Aqa Media Studies A Level Coursework ExamplesDokument8 SeitenAqa Media Studies A Level Coursework Examplesrqaeibifg100% (2)

- Professional Luminaires: Price ListDokument72 SeitenProfessional Luminaires: Price ListAnt SandNoch keine Bewertungen

- PY Vs PWCDokument2 SeitenPY Vs PWCJeric VendiolaNoch keine Bewertungen

- Istruktura: NG PamilihanDokument33 SeitenIstruktura: NG PamilihanSher-Anne Fernandez - BelmoroNoch keine Bewertungen

- MQM - General Track Master Quality ManagementDokument9 SeitenMQM - General Track Master Quality ManagementHaitham NegmNoch keine Bewertungen

- ASPM Assignment - 1Dokument1 SeiteASPM Assignment - 1pochasrinuvasNoch keine Bewertungen

- Financial Justification of ProjectsDokument5 SeitenFinancial Justification of ProjectsDilippndtNoch keine Bewertungen

- Sampling PDFDokument30 SeitenSampling PDFAbid RahimNoch keine Bewertungen

- Class 11 Account Solution For Session (2023-2024) Chapter-4 Recording of Transaction-IIDokument104 SeitenClass 11 Account Solution For Session (2023-2024) Chapter-4 Recording of Transaction-IIsyed mohdNoch keine Bewertungen

- Sintex Plastics 070917Dokument4 SeitenSintex Plastics 070917E.n. SreenivasuluNoch keine Bewertungen

- (Event Ticket) Road To Bitcoin Halving - Road To Bitcoin Halving - 1 40086-B2664-187Dokument3 Seiten(Event Ticket) Road To Bitcoin Halving - Road To Bitcoin Halving - 1 40086-B2664-187ghaniysultan100% (1)