Beruflich Dokumente

Kultur Dokumente

Standard Cost Systems: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking Cases

Hochgeladen von

sumanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standard Cost Systems: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking Cases

Hochgeladen von

sumanCopyright:

Verfügbare Formate

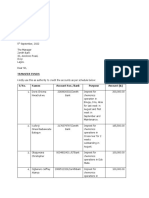

CHAPTER 24

STANDARD COST SYSTEMS

OVERVIEW OF BRIEF EXERCISES, EXERCISES, PROBLEMS, AND CRITICAL

THINKING CASES

Brief Learning

Exercises Topic Objectives Skills

B. Ex. 24.1 Variances and normal capacity 1, 2, 5 Analysis, judgment

B. Ex. 24.2 Standard cost applied to production 3 Analysis

B. Ex. 24.3 Expected volume variance 4 Analysis

B. Ex. 24.4 Volume and spending variances 4, 5 Analysis

B. Ex. 24.5 Normal vs. ideal standard costs 2, 5 Analysis, communication,

judgment

B. Ex. 24.6 Computing labor cost variances 1, 3, 5 Analysis, judgment

B. Ex. 24.7 Journal entry for direct labor 3 Analysis

B. Ex. 24.8 Computing materials cost variances 3 Analysis

B. Ex. 24.9 Journal entry for direct materials 3 Analysis

B. Ex. 24.10 Overhead cost variances 4 Analysis, communication

Learning

Exercises Topic Objectives Skills

24.1 Accounting terminology 1–5 Analysis

24.2 Relationships among standard costs, actual 3, 4 Analysis

costs, and cost variances

24.3 Understanding materials cost variances 3, 5 Analysis, judgment

24.4 Computing materials cost variances and 3–5 Analysis, judgment

volume variance

24.5 Manufacturing overhead variances 4, 5 Analysis, judgment

24.6 Computing labor cost variances 1, 3, 5 Analysis, judgment,

communication

24.7 Elements of materials cost variances 3 Analysis

24.8 Interpreting variances 5 Analysis, communication,

judgment

24.9 Computing overhead cost variances 4 Analysis

24.10 Overhead journal entries 4 Analysis

24.11 Overhead cost variances 4, 5 Analysis

24.12 Understanding overhead variances 4 Analysis, communication,

judgment

24.13 Computing materials and labor variances 3 Analysis

24.14 Causes of cost variances 1, 3, 5 Analysis, communication,

judgment

24.15 Real World: Standards for Home Depot 1, 5 Analysis, communication,

judgment, research

© The McGraw-Hill Companies, Inc., 2010

CH24-Overview

Problems Learning

Sets A, B Topic Objectives Skills

24.1 A,B Understanding materials cost variances and 3–5 Analysis, judgment,

volume variance communication

24.2 A,B Computing and journalizing cost variances 3, 4 Analysis

24.3 A,B Computing and journalizing cost variances 3, 4 Analysis

24.4 A,B Computing and journalizing cost variances 3, 4 Analysis

24.5 A,B Computing and journalizing cost variances 3, 4 Analysis

24.6 A,B Computing and journalizing cost variances 3, 4 Analysis

24.7 A,B Computing, journalizing, and analyzing cost 3–5 Analysis, communication,

variances judgment

24.8 A,B Understanding cost variances: solving for 1, 3, 4 Analysis, judgment

missing data

24.9 A,B Understanding variance calculations 3, 4 Analysis

Critical Thinking Cases

24.1 It's not my fault 1, 3–5 Analysis, communication,

judgment

24.2 Determination and use of standard costs 1, 3–5 Analysis, communication,

judgment

24.3 Real World: Penske Truck Leasing 1, 2 Analysis, communication,

(Business Week) Outsourcing and labor judgment

efficiency

24.4 Real World: Travelocity.com 2, 5 Analysis, communication,

(Internet) Standards for travel costs judgment, research,

technology

24. 5 Standard cost systems and inventory 4 Analysis, communication,

misstatement judgment, research,

(Ethics, fraud and corporate governance) technology

© The McGraw-Hill Companies, Inc., 2010

CH24-Overview (p.2)

DESCRIPTIONS OF PROBLEMS AND CRITICAL THINKING CASES

Below are brief descriptions of each problem and case. These descriptions are accompanied by the

estimated time (in minutes) required for completion and by a difficulty rating. The time estimates

assume use of the partially filled-in working papers.

Problems (Sets A and B)

24.1 A,B Wilson’s/Denton's 25 Strong

Materials variances must be computed with missing data. The problem

requires an understanding of relationships among variances, including a

volume variance.

24.2 A,B AgriChem Industries/Dyelot Industries 30 Medium

Compute cost variances for direct materials, direct labor, and overhead,

and prepare journal entries to record manufacturing costs in a standard

cost system.

24.3 A,B American Hardwood Products/Latin Silk Products 25 Medium

Prepare journal entries to record cost variances and the costs incurred in

the Work in Process account. Also record cost of units completed and

cost of units sold. Compute fixed manufacturing overhead.

24.4 A,B Sven Enterprises/Hans Enterprises 45 Strong

A comprehensive problem requiring knowledge of all variances and

corresponding journal entries.

24.5 A,B Slick Corporation/Smooth Corporation 45 Strong

A comprehensive problem requiring knowledge of all variances and

corresponding journal entries.

24.6 A,B Polyglaze, Inc./Monoglut, Inc. 40 Strong

Compute cost variances and prepare journal entries to record the flow of

manufacturing costs through a standard cost accounting system.

24.7 A,B Heritage Furniture Co./Colonial Furniture Co. 40 Strong

A comprehensive standard cost problem. Requires computation of cost

variances, journal entries, and an analysis of the company’s strengths and

weaknesses.

24.8 A,B Ripley Corporation/Foding Corporation 60 Strong

This is a comprehensive problem with missing data. An analytical

approach is required. This would be an excellent problem to assign to

small groups or to teams of students.

© The McGraw-Hill Companies, Inc., 2010

Description Problems

24.9 A,B The Anton Company/The Ninna Company 45 Medium

Given budget items and a variance report, the student is asked to solve

for various actual amounts. Also, the meaning of favorable and

unfavorable variances must be applied. A good comprehensive review

problem well suited for a group assignment.

© The McGraw-Hill Companies, Inc., 2010

Desc. of Problems (p.2)

Critical Thinking Cases

24.1 It’s Not My Fault 25 Strong

In a company using standard costs and a responsibility cost accounting

system, who should be charged with the responsibility for unfavorable

labor rate variances incurred when the production department works

overtime to fill “rush” orders?

24.2 Armstrong Chemical 50 Strong

Evaluate arguments given by the president of a company against the

revision of standard costs and the value assigned to inventory. Assuming

that standards for the year just ended should be revised, determine the

value of ending inventory using revised standard costs.

24.3 Outsourcing and Labor Efficiency 20 Strong

Business Week

Students consider the impact of outsourcing labor jobs on labor

standards for rates and efficiency. The ethical difficulties of managing

global employees are considered.

24.4 Travelocity.com 30 Medium

Internet

Students are given a budgeted amount for travel to a given destination.

Using actual ticket prices obtained from travelocity.com they calculate a

current spending variance. Factors that might affect the reasonability of

the budgeted amount are also discussed.

24.5 Standard Cost Systems and Inventory Misstatements 30 Medium

Ethics, Fraud & Corporate Governance

The ethical problems created by inappropriate standards are explained.

Students visit the IMA website for this research.

© The McGraw-Hill Companies, Inc., 2010

Desc. of Cases

SUGGESTED ANSWERS TO DISCUSSION QUESTIONS

1. Standard costs are predetermined estimates of what it should cost to produce a product or to

perform a particular operation under normal conditions. The use of a standard cost helps

management plan (preparing a budget, for example) and control, which requires the

establishment of performance standards. The essence of control is the comparison of actual

results (costs incurred, for example) with the performance standards and the taking of corrective

action when actual results do not measure up to standards.

2. The statement is incorrect because job order and process are the names of cost accounting

systems in which costs may be compiled on either an actual cost basis or a standard cost basis. In

other words, standard costs may be used in connection with either a job order cost system or a

process cost system.

3. Standard costs are developed from a set of assumptions about future (budgeted) prices, wages,

production methods, and normal production levels. If unexpected changes in prices, such as the

costs of direct materials or wage rates occur, the standard costs should be revised to reflect the

new existing conditions. Also, standard costs should be revised if significant changes are made in

production methods or in the normal volume of production.

4. Variances from standard cost that are generally computed are:

Direct materials: price and quantity variances.

Direct labor: rate and efficiency variances.

Manufacturing overhead: spending and volume variances.

5. The production manager exercises a degree of control over the quantities of materials used in the

production process and is therefore responsible for the materials quantity variance. However, the

price paid for materials is negotiated by the purchasing department, not by the production

manager. Therefore, the production manager should not be held responsible for the materials

price variance.

6. A favorable labor efficiency variance indicates that the actual number of labor hours worked in

achieving a given level of production was less than the standard number of hours for that

production level. The labor efficiency variance is equal to the difference between the standard

and the actual labor hours multiplied by the standard hourly rate.

7. The amount of fixed manufacturing overhead included in the standard unit cost is computed

under the assumption of a normal volume of production. Whenever actual production is below

normal volume, the fixed manufacturing overhead costs charged to production (standard fixed

overhead per unit times units produced) will be less than actual fixed manufacturing overhead

costs, resulting in an unfavorable volume variance. A favorable volume variance will occur

whenever actual production exceeds normal volume.

© The McGraw-Hill Companies, Inc., 2010

Q1-7

8. A basic principle in evaluating the performance of department managers is that managers should

be evaluated based only upon events under their control. An unfavorable volume variance

results automatically whenever the actual volume of production is less than the “normal” level

assumed in developing the standard unit cost. The level of production scheduled in a given

month may be affected by many factors that are not controllable by the production manager, such

as seasonal demand for the product or the company’s desire to reduce the size of its inventories.

Thus, as long as the production department produces the desired (scheduled) number of units, the

production manager has no control over the resulting volume variance.

9. Responsibility centers identify the assets and costs that a manager will have responsibility for

during the period. The budget is an essential part of the manager’s plan for the coming period.

The budget can be thought of as an informal contract agreed upon between the manager and

upper management about what the manager should be doing in the coming period. The standard

cost system is an integral part of how the manager knows if the operations of the responsibility

center are meeting the expectations set out in the budget. All three components, assigning

responsibility, laying out the budget plan and continuously monitoring progress toward meeting

budget goals through the standard cost variances are important for maintaining cost control.

10. Overtime hours are normally paid at a higher rate than regular hours. Also, overtime hours are

not typically part of the budget plan and are not used in setting standards because they are not

viewed as normal operating procedures. Thus, the extra pay for overtime hours usually increase

the actual labor cost above the standard labor cost and result in an unfavorable labor rate

variance.

11. Standard cost systems are typically based on normal operations. If the waste, spoilage or

equipment breakdowns are not part of the normal operating procedures of the company, then

these items will appear in either material quantity variances (waste and spoilage) or in the

overhead spending variance for equipment breakdown. If the equipment breakdown results in

idle time for labor, the labor efficiency variance could also be influenced.

12. The costs associated with a closed or idle factory are not typically part of normal operations.

Thus these idle capacity costs should not be part of normal product costs.

13. Direct materials and direct labor are variable costs that are directly traceable to the product.

Overhead items, by definition are indirect and not traceable. Furthermore, overhead typically

includes a significant fixed portion that does not vary with production. Thus, the fixed portion

cannot be associated with the efficiency of the operations that create the product.

14. Immaterial standard variance account balances are added to (for unfavorable variances-debit) or

deducted from (for favorable variances-credit) cost of goods sold. Material standard variance

account balances are divided between cost of goods sold and the inventory accounts: direct

materials inventory, work in process inventory, and finished goods inventory.

© The McGraw-Hill Companies, Inc., 2010

Q8-14

15. When a company operates at 100% capacity, there is no margin for any errors. Thus, there are no

sick workers, no equipment down time, no late shipments of supplies or materials, etc. A

company, fully utilizing its capacity, is typically operating above its normal or expected

operating range. The normal range allows for unforeseen or unexpected events. As a result, the

standards are set for a normal operating range. A late shipment or sick workers can result in cost

over-runs that appear as unfavorable variances.

16. The selling price of the finished product includes a consideration of the quality of the direct

materials used to create the finished product. Of course the quality of the direct materials is

typically related to the cost of those materials with higher quality materials typically costing

more money. Thus, when determining the selling price of the finished product both cost and

quality of direct materials must be considered. The standards that are established for the product

at that selling price must be based on that cost and quality consideration.

17. A plant accountant might want to consult with the manager or supervisor of the production line

to get an idea of the skill level of the direct labor personnel and the quantity of labor needed for a

given production level. Then, the human resources department could identify for the plant

accountant the wage rates for those skill levels.

18. Unfavorable variances are recorded by debit entries because they represent costs in excess of the

budgeted standards. Favorable variances, however, are recorded by credit entries because they

represent cost savings relative to standard amounts.

19. Direct labor rates are typically tied to the skill and efficiency of the labor. Thus, higher paid

laborers are frequently more efficient. In addition, increased labor costs as a result of overtime

can be associated with inefficient labor. In this case, labor costs are higher because the laborers

were inefficient and did not get the production completed during the standard labor hours

allowed.

20. Ideal standards do not allow any downtime for normal happenings such as machine downtime for

repairs, employee turnover or training time, occasional late shipments of supplies, etc. Under

ideal standards there are no allowances for uncertainty in the production process. Reasonably

attainable standards allow for uncertainties by building into the standards a certain amount of

downtime, employee turnover, etc.

If the variances from these two types of standard cost systems are used to evaluate managers,

then under ideal standards the manager will expect unfavorable variances as a normal outcome.

The goal of the manager under ideal standards will be to make the unfavorable variances as small

as possible. Under reasonably attainable standards, the manager will expect variances equal to

zero. Favorable variances will be considered good performance.

© The McGraw-Hill Companies, Inc., 2010

Q15-20

SOLUTIONS TO BRIEF EXERCISES

B. Ex. 24.1 The problem at Bramford Industries is a result of operating well above normal

capacity. The standard rates and efficiencies were based on normal operations.

Because production was required to be ramped up 25% above normal, there

were likely to be overtime hours at higher pay, machine breakdowns, spoilage

and waste that created significant unfavorable variances.

B. Ex. 24.2 The standard direct labor applied to production was $89,500 (actual direct labor

of $87,000, less an unfavorable rate variance of $2,500, plus a favorable

efficiency variance of $5,000).

B. Ex. 24.3

Production = 750 units

Overhead applied to work in process

at a $14 standard rate $ 10,500

Less budgeted overhead:

Fixed 5,600

Variable ($6 per unit) 4,500

Volume variance - favorable $ 400

B. Ex. 24.4 The normal or expected hours are lower than the actual billed hours.

Furthermore, the actual expenditures were more than expected. The actual,

budgeted, and applied overhead are:

$48,000 (applied based

$56,000 (actual) $42,000 (budget based on normal) on actual)

$14,000 unfavorable Spending Var. $6,000 favorable Volume Var.

B. Ex. 24.5 Normal standard cost per unit = (2 lbs. x $8) + (3 hrs. x $22 ) = $82.

Ideal standard cost per unit = (1.8 lbs. x $7.75) + (2.8 hrs. x $21.50) = $74.15.

Managers using ideal standards would expect unfavorable variances on a

regular basis. They would strive to make the unfavorable variances as small as

possible, but would recognize that there will never be favorable variances.

Normal standards are based on reasonably attainable costs and efficiencies so

managers expect no unfavorable variances and expect to occasionally see

favorable variances.

B. Ex. 24.6 Actual labor rate = $24,464 ÷ 2,780 hours = $8.80 per hour.

Labor efficiency variance = $8.25 x [(0.75 hrs./vase x 4000 vases) – 2,780 hours] =

$1815 favorable.

Labor rate variance = ($8.80 - $8.25) x 2,780 hours = $1, 529 unfavorable.

© The McGraw-Hill Companies, Inc., 2010

BE24.1,2,3,4,5,6

Loring seemed to be able to hire workers that were more efficient (2,780 actual

hours rather than 3,000 hours allowed). Thus the favorable efficiency variance

of $1,815 offset the unfavorable rate variance of $1,529.

B. Ex. 24.7 The direct labor journal entry for Loring Glassware in September is:

Work in Process Inventory …………………………… 24,750

Labor Rate Variance ………………………………… 1,529

Labor Efficiency Variance ………………………………… 1,815

Direct Labor Payable ……………………………………… 24,464

B. Ex. 24.8 Materials price variance = 42,640 – (20,800 lbs × $2 / lb.) = $1,040 unfav.

Materials quantity variance = (20,000lbs. – 20,800lbs.) × $2/lb. = $1,600

unfav.

B. Ex. 24.9 The journal entry for Hearts and Flowers is:

Work in Process Inventory …………………………… 40,000

Materials Price Variance …………………………… 1,040

Materials Quantity Variance ………………………… 1,600

Direct Materials Inventory ………………………………… 42,640

B. Ex. 24.10 Given that Ringo incurred actual overhead costs of $8,000, applied

overhead costs of $7,200, and reported a $1,500 unfavorable overhead

spending variance for the period, we can construct the diagam shown

below:

Actual Overhead Standard Overhead Overhead

Costs Incurred Costs Allowed Costs Applied

$8,000 ? $7,200

$1,500 Unfavorable ?

Spending Variance

From the above diagram, we see the standard overhead costs allowed

must be $6,500 ($8,000 less the $1,500 unfavorable spending variance).

Since overhead costs applied ($7,200) exceeds the standard amount

allowed ($6,500), actual output must have exceeded normal output,

making the $700 volume variance favorable.

© The McGraw-Hill Companies, Inc., 2010

BE24.7,8,9,10

SOLUTIONS TO EXERCISES

Ex. 24.1 a. Standard costs

b. Labor efficiency variance

c. Volume variance

d. Materials quantity variance

e. Spending variance

f. Materials price variance

g. Labor rate variance

Ex. 24.2 Actual costs incurred:

Direct materials: Standard cost ($90,000), plus unfavorable price

variance ($4,500), less favorable quantity variance ($2,700) …………$ 91,800

Direct labor: Standard cost ($180,000), less favorable rate

variance ($1,800), plus unfavorable efficiency variance

($5,400) ………………………………………………………………… $ 183,600

Manufacturing overhead: Standard cost ($270,000), less

favorable spending variance ($3,600) and favorable

volume variance ($2,400) ……………………………………………… $ 264,000

Ex. 24.3 a. MPV = Actual Quantity × (Standard Price - Actual Price)

= 100,000 grams × ($60/g - $60/g*)

= $0

*Actual Price = $6,000,000 ÷ 100,000 grams = $60 per gram

b. Given that Blue’s materials price variance equals its materials quantity

variance, both variances must equal zero. Thus, the standard quantity of

material allowed per batch of Allegro must equal the 4,000 grams actually

used, as shown below:

Total grams used ……………………………… 100,000

Number of batches …………………………… 25

Grams per batch ……………………………… 4,000 grams (or 4.0 kg)

c. Materials usage in the pharmaceutical industry must be extremely accurate

and precise. Thus, one would not expect to see a significant materials quantity

variance.

© The McGraw-Hill Companies, Inc., 2010

E24.1,2,3

Ex. 24.4 a. Gumchara’s materials price variance is computed as follows:

Materials Price Variance = Actual Quantity Used × (Standard Price -

Actual Price)

= 2,800 grams × ($1.25 - $1.40*)

= -$420 (or $420 Unfavorable)

*Actual Price per Gram = $3,920 ÷ 2,800 grams = $1.40/gram

b. Gumchara’s materials quantity variance is computed as follows:

Materials Quantity Variance = Standard Price × (Standard Quantity -

Actual Quantity)

= $1.25 per gram × (2,080 grams* -

2,800 grams)

= -$900 (or $900 Unfavorable)

*Standard Quantity Allowed = 520 units × 4 grams/unit = 2,080

c. Gumchara’s overhead volume variance will be unfavorable because its actual

output for the period (520 units) was less than “normal” output (550 units).

Ex. 24.5 a. Fixed overhead rate = $330,000 ÷ 60,000 units = $5.50 per unit,

Total overhead application rate = $5.50 + $2.50 = $8.00 per unit.

b. Overhead applied = $8.00 × 65,000 units = $520,000.

c. The amount of overapplied overhead = $520,000 - $400,000 = $120,000, the

spending variance = $330,000 + ($2.5 × 65,000) - $400,000 = $92,500

favorable, the volume variance = (65,000 × $5.50) - $330,000 = $27,500

favorable.

d. Chasman was able to spend less than budget for the overhead while

simultaneously producing more than the normal or expected number of units.

Ex. 24.6 a. Marlo’s labor rate variance is computed as follows:

Labor Rate Variance = Actual Labor Hours × (Standard Rate -

Actual Rate)

= 3,600 hrs. × ($16 - $18*)

= -$7,200 (or $7,200 Unfavorable)

*Actual Rate per Hour $64,800 ÷ 3,600 hours = $18/hour

b. Marlo’s labor efficiency variance is computed as follows:

Labor Efficiency Variance = Standard Rate × (Standard Hours -

Actual Hours)

= $16 per hour × (4,500 hours* - 3,600

hours)

= $14,400 Favorable

*Standard Hours Allowed = 9,000 units × 0.5 hours/unit = 4,500

hours

© The McGraw-Hill Companies, Inc., 2010

E24.4,5,6

c. Extended hours worked during the period may have resulted in an

increased average wage rate due to overtime wage premiums. This may

explain Marlo’s unfavorable labor rate variance. The standard time allowed

to produce a single unit is 0.5 hours. The average time it actually took to

produce a single unit during the period was 0.4 hours (3,600 hours/9,000

units). Thus, although many employees worked extra hours during the

period, their time spent in production was efficiently used as evidenced by

Marlo’s favorable labor efficiency variance.

Ex. 24.7 a. Standard price, $8.75 per pound

The unfavorable materials price variance, $910, indicates actual costs were

$0.25 per pound above standard ($910 ÷ 3,640 lbs. = $0.25/lb.). Thus, as the

actual cost was $9.00/lb., the standard cost must have been $8.75/lb.

b. Standard price, $8.75 per pound

The materials quantity variance is found by multiplying the standard

materials price by the difference between the standard quantity of materials

and the actual quantity used. The standard price of materials, $8.75/lb., was

determined in part a, above.

c. Actual quantity of materials used, 3,640 pounds

In computing the materials quantity variance, the actual quantity of

materials used is deducted from the standard quantity, and this difference

is multiplied by the standard price. Thus, (c) represents the actual quantity

of materials used. This amount, 3,640 pounds, appeared in the partially

complete formula for computing the materials price variance.

d. Materials quantity variance, $1,400 favorable

Computation: $8.75 Standard Price × (3,800 Standard Pounds - 3,640

Actual Pounds) = $1,400.

Ex. 24.8 a. A favorable direct materials price variance means that the purchase price of

materials was lower than budgeted. Reasons for favorable price variances

could include better negotiation on the part of purchasing agents, the

purchase of lower quality materials at a lower price, higher quantity

discounts, inaccurate budgeted prices for materials, or a lowering of the

basic cost of materials due to external economic factors.

© The McGraw-Hill Companies, Inc., 2010

E24.7,8

b. One explanation of the variances is that higher skilled workers were hired at

wages greater than the budgeted rate. The higher skilled workers may have

been more efficient at performing their tasks and at using materials, resulting

in favorable labor efficiency and materials quantity variances. The favorable

materials price variance could be due to any of the factors listed in part a

(except the purchase of lower quality materials).

Ex. 24.9 Overhead spending variance:

Overhead budgeted for actual production (18,000 units):

Fixed …………………………………………………$ 300,000

Variable ($5 per unit × 18,000 units) ……………… 90,000

Overhead per flexible budget ………………………………… $ 390,000

Actual overhead …………………………………………………… 383,800

Overhead spending variance—favorable ………………………… $ 6,200

Volume variance:

Overhead applied to Work in Process Inventory

at standard cost (18,000 units × $20/unit) ………………………… $ 360,000

Less: Budgeted overhead for 18,000 unit production level ………… 390,000

Volume variance (unfavorable) …………………………………… $ (30,000)

Ex. 24.10 Work in Process Inventory ……………………………… 360,000

Overhead Volume Variance …………………………… 30,000

Overhead Spending Variance …………………………………… 6,200

Manufacturing Overhead ………………………………………… 383,800

Ex. 24.11 a. Overhead Spending Variance = Standard Overhead Allowed

at Actual Production Level - Actual Overhead Costs

Standard overhead allowed at the actual production of 4,500

units:

Fixed overhead allowed ……………………………………………$ 40,000

Variable overhead allowed

($60,000/10,000 hrs. × 2 hours per unit × 4,500 units) ……… 54,000

Total overhead allowed ……………………………………… $ 94,000

Spending Variance = $94,000 $93,000 = $1,000 Favorable

b. Overhead Volume Variance = Overhead Applied - Overhead Allowed at

Actual Production Level

Overhead Rate per Direct Labor Budgeted Overhead

=

Hour Budgeted Labor Hours

$100,000

= = $10 per direct labor hour

10,000

© The McGraw-Hill Companies, Inc., 2010

E24.9,10,11

Overhead rate per unit = $10 per labor hr. × 2 labor hours per unit = $20 per

unit

Overhead applied = 4,500 actual production units × $20 per unit = $90,000

Volume variance = $90,000 $94,000 (from part a ) = $4,000 Unfavorable

c. Although the overall overhead variance is unfavorable, it is mostly due to an

unfavorable volume variance, reflecting that actual production was less than

budgeted production. The overhead spending variance was favorable, due to

fixed costs that were $2,000 lower than expected ($40,000 $38,000) and variable

costs that were $1,000 higher than allowed at the actual production level ($54,000

$55,000). Zeta’s manager may want to investigate why the variable overhead

costs per unit were higher than expected and determine if it is linked to the lower

fixed costs. As long as Zeta is meeting its sales demand, the unfavorable volume

variance may not require any corrective action.

Ex. 24.12 The entry to close McGill’s unfavorable overhead spending variance required that

the variance account be credited for $600. Given that the Cost of Goods Sold

account was also credited for $4,200 to close both the spending and the volume

variance, its volume variance must have been favorable by $4,800 as shown in the

following journal entry:

Overhead Volume Variance ……………………………… 4,800*

Overhead Spending Variance …………………………………………… 600

Cost of Goods Sold ……………………………………………………… 4,200

*The entry required to close McGill’s favorable volume variance of $4,800.

Ex. 24.13 a. Materials Price Variance = Actual Quantity × (Standard Price - Actual

= 27,000 yds. × ($3.10/yd. - $3.05/yd.)

= $1,350 Favorable

Materials Quantity Variance = Standard Price × (Standard Quantity - Actual

Quantity)

= $3.10/yd. × (26,250 yds.* - 27,000 yds.)

= -$2,325 (or $2,325 Unfavorable)

*15,000 pillowcases × 1.75 yds./pillowcase = 26,250 yds.

b. Labor Rate Variance = Actual Hours × (Standard Hourly Rate - Actual

Hourly Rate)

= 3,300 hrs. × ($5.95/hr - $5.80/hr.*)

= $495 Favorable

*$19,140 3,300 hrs. = $5.80/hr.

Labor Efficiency Variance = Standard Hourly Rate × (Standard Hours -

Actual Hours)

= $5.95/hr. × (3,000 hrs.** - 3,300 hrs.)

= -$1,785 (or $1,785 Unfavorable)

**Standard Quantity = 15,000 pillowcases × 0.2 hr./pillowcase = 3,000 hrs.

© The McGraw-Hill Companies, Inc., 2010

E24.12,13

Ex. 24.15 Several items from the Store Sales and Other Data section of Home Depot’s 10-

Year Summary could be used to create direct labor standards. For example,

weighted average sales per store per employee, number of customer transactions

per employee, and average ticket price per employee are three that seem obvious.

Below are suggestions or examples about how a store manager could use these

standards to help manage a Home Depot Store:

• Standard number of customer transactions per employee — a variance

showing more actual customer transactions than the standard allowed per

employee, might be a signal to hire more employees. Alternatively, if fewer

actual customer transactions than the standard occurred in a given month,

then an investigation might be necessary to assess if the store is overstaffed or

if some other inefficiency is occurring.

• Average ticket price per employee — when a variance occurs showing average

ticket price per employee below standard, the store manager might want to

manage advertising or employee incentives in such a way to encourage the sale

of larger ticket items.

• Weighted average sales per store per employee — when a variance occurs

showing higher actual average store sales per employee, the manager may want

to reward employees for their team efforts in creating sales above the standard

or expected amounts.

© The McGraw-Hill Companies, Inc., 2010

E24.14,15

SOLUTIONS TO PROBLEMS SET A

25 Minutes, Strong PROBLEM 24.1A

WILSON'S

a. MPV = Actual Quantity × (Standard Price - Actual Price)

= 600 pounds × ($15/lb - $16/lb)

= $600 (or $600 Unfavorable)

b. The materials quantity variance (MQV) is first used to find the standard quantity of

material allowed for producing 500 units:

MQV = Standard Price × (Standard Quantity - Actual Quantity)

300 = $15/lb × (Standard Quantity - 600 pounds)

Thus we may solve for the Standard Quantity as follows:

-300 = 15 (Standard Quantity) - 9,000

8,700 = 15 (Standard Quantity)

8,700 ÷ 15 = (Standard Quantity) = 580 pounds for 500 units.

580 pounds divided by 500 units = 1.16 pounds per unit.

550 units × 1.16 pounds per unit = 638 pounds, standard quality of materials allowed for

550 units.

c. Work in Process Inventory (580 pounds × $15 per pound) ……………… 8,700

Materials Quantity Variance (unfavorable) ……………………………… 300

Materials Price Variance (unfavorable) ………………………………… 600

Direct Materials Inventory (600 pounds × $16 per pound) ………………… 9,600

To record direct materials applied to production.

d. Wilson’s overhead volume variance is $600, given that it is twice the unfavorable materials

quantity variance of $300. The volume variance is unfavorable because actual output of 500

units was less than normal output of 550 units.

© The McGraw-Hill Companies, Inc., 2010

P24.1A

30 Minutes, Medium PROBLEM 24.2A

AGRICHEM INDUSTRIES

a. Computation of materials price variance (MPV):

MPV = Actual Quantity Used × (Standard Price - Actual Price)

= 102,500 lbs. × ($0.60/lb - $0.57/lb.)

= 102,500 lbs. × $0.03/lb.

= $3,075 Favorable

Computation of materials quantity variance (MQV):

MQV = Standard Price × (Standard Quantity - Actual Quantity)

= $0.60 × [(500 lbs. × 200 batches) - 102,500 lbs.]

= $0.60 × -2,500 lbs.

= -$1,500 (or $1,500 Unfavorable)

Computation of labor rate variance (LRV):

LRV = Actual Hours × (Standard Hourly Rate - Actual Hourly Rate)

= 4,750 × ($7.00/hr. - $6.80/hr.)

= 4,750 × $0.20/hr.

= $950 Favorable

Computation of labor efficiency variance (LEV):

LEV = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $7.00/hr. × [(25 hrs. × 200 batches) - 4,750 hrs.]

= $7.00/hr. × 250 hrs.

= $1,750 Favorable

Overhead variances are computed on the following page.

© The McGraw-Hill Companies, Inc., 2010

P24.2A

PROBLEM 24.2A

AGRICHEM INDUSTRIES (concluded)

Computation of overhead spending variance:

Overhead budgeted for 200 batches:

Fixed $ 50,000

Variable (200 batches × $25 per batch) 5,000

Total budgeted overhead $ 55,000

Less: Actual overhead for the month 54,525

Overhead spending variance (favorable) $ 475

Computation of volume variance:

Overhead applied at standard cost ($225 × 200 batches) $ 45,000

Less: Budgeted overhead (above) 55,000

Volume variance (unfavorable) $ (10,000)

b.

General Journal

Jan. 31 Work in Process Inventory (at standard) 60,000

Materials Quantity Variance 1,500

Materials Price Variance 3,075

Materials Inventory (actual) 58,425

To record direct materials used in January.

Standard cost (200 batches × $300) = $60,000

Actual cost = $58,425

31 Work in Process Inventory (at standard) 35,000

Labor Rate Variance 950

Labor Efficiency Variance 1,750

Direct Labor (actual) 32,300

To record direct labor cost applicable to January

production:

Standard cost (200 batches × $175) = $35,000

Actual cost = $32,300

31 Work in Process Inventory (at standard) 45,000

Volume Variance 10,000

Overhead Spending Variance 475

Manufacturing Overhead (actual) 54,525

To apply overhead to work in process, using standard

unit cost:

Standard cost (200 batches × $225) = $45,000

Actual cost = $54,525

© The McGraw-Hill Companies, Inc., 2010

P24.2A (p.2)

25 Minutes, Medium PROBLEM 24.3A

AMERICAN HARDWOOD PRODUCTS

General Journal

a. (1) Work in Process (standard cost) 90,000

Materials Quantity Variance 8,400

Materials Price Variance 2,400

Direct Materials Inventory (actual cost) 96,000

To record materials used.

(2) Work in Process (standard cost) 84,000

Labor Efficiency Variance 1,500

Labor Rate Variance 3,000

Direct Labor (actual cost) 82,500

To record direct labor cost.

(3) Work in Process (standard cost) 115,500

Overhead Spending Variance 3,240

Overhead Volume Variance 4,500

Manufacturing Overhead (actual cost) 123,240

To record manufacturing overhead assigned to

production, and to record overhead variances.

b. (1) Finished Goods Inventory (at standard cost) 270,000

Work in Process (at standard cost) 270,000

To transfer cost of units completed to finished goods

inventory, 9,000 units at $30 per unit.

(2) Cost of Goods Sold (at standard cost) 264,000

Finished Goods Inventory (at standard cost) 264,000

To record cost of units sold, 8,800 units at $30 per unit.

c. Fixed overhead per month = $4,500 (unfavorable

volume variance) ÷ 0.10 (idle capacity percentage) $ 45,000

© The McGraw-Hill Companies, Inc., 2010

P24.3A

45 Minutes, Strong PROBLEM 24.4A

SVEN ENTERPRISES

a. Materials Price Variance = Actual Quantity Used × (Standard Price - Actual Price)

= 148,450 pounds × ($4.20 - $4.00*)

= $29,690 Favorable

*Actual Price per Pound = $593,800/148,450 pounds = 4.00/pound

Materials Quantity Variance = Standard Price × (Standard Quantity - Actual Quantity)

= $4.20 per pound × (149,940 pounds* - 148,450 pounds)

= $6,258 Favorable

*Standard Quantity Allowed = 147 batches × 1,020 pounds/batch = 149,940 pounds

b. Labor Rate Variance = Actual Labor Hours × (Standard Rate - Actual Rate)

= 2,200 hours × ($8.50 - $8.00*)

= $1,100 Favorable

*Actual Rate per Hour = $17,600/2,200 hours = $8.00/hour

Labor Efficiency Variance = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $8.50 per hour × (2,058 hours* - 2,200 hours)

= -$1,207 (or $1,207 Unfavorable)

*Standard Hours Allowed = 147 batches × 14 hours/batch = 2,058 hours

© The McGraw-Hill Companies, Inc., 2010

P24.4A

Problem 24.4A

SVEN ENTERPRISES (continued)

c. Overhead variances:

Actual Overhead Standard Overhead Overhead

Costs Incurred Costs Allowed Costs Applied

Fixed $2,450 Fixed $2,800

Variable 1,175 Variable 1,323* $29/batch × 147 batches = $4,263

$3,625 $4,123

$498 Favorable $140 Favorable

Spending Variance Volume Variance

*Standard Variable Overhead Allowed = $9.00/batch × 147 batches = $1,323

d. Entry to charge materials to production:

Work in Process Inventory (at standard cost) ……………………… 629,748 *

Materials Quantity Variance (favorable) ………………………………… 6,258

Materials Price Variance (favorable) ……………………………………… 29,690

Direct Materials Inventory (at actual cost) ……………………………… 593,800

To record the cost of direct materials charged to production.

*147 actual batches × 1,020 pounds allowed per batch × $4.20 per pound = $629,748

e. Entry to charge direct labor to production:

Work in Process Inventory (at standard cost) ……………………… 17,493 *

Labor Efficiency Variance (unfavorable) …………………………… 1,207

Labor Rate Variance (favorable) ………………………………………… 1,100

Direct Labor (at actual cost) ……………………………………………… 17,600

To record the cost of direct labor charged to production.

*147 actual batches × 14 hours allowed per batch × $8.50 per hour = $17,493

f. Entry to charge overhead to production:

Work in Process Inventory (at standard cost) ……………………… 4,263

Overhead Spending Variance (favorable) ………………………………………… 498

Overhead Volume Variance (favorable) ………………………………………… 140

Manufacturing Overhead (at actual cost) ………………………………………… 3,625

To apply overhead to production.

© The McGraw-Hill Companies, Inc., 2010

24.4A (p.2)

PROBLEM 24.4A

SVEN ENTERPRISES (concluded)

g. Entry to transfer the 147 batches of puppy meal produced in April to finished goods:

Finished Goods Inventory (at standard cost) 651,504

Work in Process Inventory (at standard cost) 651,504*

To transfer 147 batches of puppy meal to finished goods in April.

*The $651,504 figure equals the total direct materials, direct labor, and manufacturing

overhead charged to production at standard cost during April ($629,748 + $17,493 +

$4,263).

h. Entry to close overapplied overhead to cost of goods sold:

Overhead Spending Variance (favorable) 498

Overhead Volume Variance (favorable) 140

Cost of Goods Sold 638

To close overhead variances to Cost of Goods Sold.

© The McGraw-Hill Companies, Inc., 2010

24.4A (p.3)

45 Minutes, Strong PROBLEM 24.5A

SLICK CORPORATION

a. Materials Price Variance = Actual Quantity Used × (Standard Price - Actual Price)

= 16,500 gallons × ($1.30 - $1.25*)

= $825 Favorable

*Actual Price per Pound = $20,625 ÷ 16,500 gallons = $1.25/gallon

Materials Quantity Variance = Standard Price × (Standard Quantity - Actual

Quantity)

= $1.30 per gallon × (16,250 gallons* - 16,500 gallons)

= -$325 (or $325 Unfavorable)

*Standard Quantity Allowed = 5,000 cases × 3.25 gallons/case = 16,250 gallons

b. Labor Rate Variance = Actual Labor Hours × (Standard Rate - Actual Rate)

= 4,200 hours × ($16 - $15)

= $4,200 Favorable

Labor Efficiency Variance = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $16 per hour × (3,750 hours* - 4,200 hours)

= -$7,200 (or $7,200 Unfavorable)

*Standard Hours Allowed = 5,000 cases × 0.75 hours/case = 3,750 hours

© The McGraw-Hill Companies, Inc., 2010

24.5A

Problem 24.5A

SLICK CORPORATION (concluded)

c. Overhead variances:

Actual Overhead Standard Overhead Overhead

Costs Incurred Costs Allowed Costs Applied

Fixed $2,200 Fixed $2,600

Variable 7,750 Variable 7,500* $2/case × 5,000 cases = $10,000

$9,950 $10,100

$150 Favorable $100 Unfavorable

Spending Variance Volume Variance

*Standard Variable Overhead Allowed = $1.50/case × 5,000 cases = $7,500

d. (1) Work in Process Inventory (at standard cost) ………………… 21,125 *

Materials Quantity Variance (unfavorable) …………………… 325

Materials Price Variance (favorable) …………………………………… 825

Direct Materials Inventory (at actual cost) ……………………………… 20,625

To record the cost of direct materials charged to production.

*5,000 actual cases x 3.25 gallons allowed per case x $1.30 per gallon = $21,125

(2) Work in Process Inventory (at standard cost) ………………… 60,000 *

Labor Efficiency Variance (unfavorable) ……………………… 7,200

Labor Rate Variance (favorable) ………………………………………… 4,200

Direct Labor (at actual cost) ……………………………………………… 63,000

To record the cost of direct labor charged to production.

*5,000 actual cases x 0.75 hours allowed per case x $16 per hour = $60,000

(3) Work in Process Inventory (at standard cost) ………………… 10,000

Overhead Volume Variance (unfavorable) …………………… 100

Overhead Spending Variance (favorable) ……………………………… 150

Manufacturing Overhead (at actual cost) ……………………………… 9,950

To apply overhead to production.

(4) Finished Goods Inventory (at standard cost) ………………… 91,125

Work in Process Inventory (at standard cost) …………………………… 91,125*

To transfer 5,000 cases to finished goods in May.

*The $91,125 figure equals the total direct materials, direct labor, and manufacturing

over-head charged to production at standard cost during May ($21,125 + $60,000 +

$10,000).

(5) Overhead Spending Variance (favorable) ……………………… 150

Overhead Volume Variance (unfavorable) …………………………… 100

Cost of Goods Sold ……………………………………………………. 50

To close overhead variances to Cost of Goods Sold.

© The McGraw-Hill Companies, Inc., 2010

P24.5A (p.2)

40 Minutes, Strong PROBLEM 24.6A

POLYGLAZE, INC.

a. Materials price variance:

Actual Quantity × (Standard Price - Actual Price)

(8,000 units × 11 ounces) × ($0.15/oz. - $0.16/oz.) $ (880) Unfavorable

Materials quantity variance:

Standard Price × (Standard Quantity - Actual Quantity)

$0.15/oz. × (80,000 ounces - 88,000 ounces) $ (1,200) Unfavorable

Journal entry to record direct materials used in June:

Work in Process Inventory (8,000 units × 10 oz. × $0.15/oz.) 12,000

Materials Price Variance 880

Materials Quantity Variance 1,200

Materials Inventory (8,000 units × 11 oz. × $0.16/oz.) 14,080

To record cost of direct materials used in June.

b. Labor rate variance:

Actual Hours × (Standard Hourly Rate - Actual Hourly Rate)

(8,000 units × .45 hr.) × ($10.00/hr. - $10.40/hr.) $ (1,440) Unfavorable

Labor efficiency variance:

Standard Hourly Rate × (Standard Hours - Actual Hours)

$10.00/hr. × [(8,000 units × .5 hr.) - (8,000 units × 0.45 hr.)]

$10.00/hr. × 400 hrs. $ 4,000 Favorable

Journal entry to record direct labor cost for June:

Work in Process Inventory (8,000 units × 0.5 hr. × $10/hr.) 40,000

Labor Rate Variance 1,440

Labor Efficiency Variance 4,000

Direct Labor (8,000 units × 0.45 hr. × $10.40/hr.) 37,440

To record direct labor costs applicable to production

during June.

© The McGraw-Hill Companies, Inc., 2010

P24.6A

PROBLEM 24.6A

POLYGLAZE, INC. (concluded)

c. Overhead spending variance:

Overhead per flexible budget—8,000 units:

Fixed $ 5,000

Variable (8,000 units × $0.50 per unit) 4,000

Total overhead per flexible budget $ 9,000

Less: Actual overhead in June ($5,000 + $4,600) 9,600

Overhead spending variance $ (600) Unfavorable

Overhead volume variance:

Overhead applied at standard cost (8,000 units × $1) $ 8,000

Less: Overhead per flexible budget (above) 9,000

Overhead volume variance $ (1,000) Unfavorable

Journal entry to record overhead applied to work in process:

Work in Process Inventory (8,000 units × $1 per unit) 8,000

Overhead Spending Variance 600

Overhead Volume Variance 1,000

Manufacturing Overhead (Actual cost, $5,000 + $4,600) 9,600

To apply overhead cost to 8,000 units produced at the

standard rate of $1 per unit.

© The McGraw-Hill Companies, Inc., 2010

P24.6A (p.2)

40 Minutes, Strong PROBLEM 24.7A

HERITAGE FURNITURE CO.

a. (1) Computation of materials price variance (MPV):

MPV = Actual Quantity Used × (Standard Price - Actual Price)

= (800 units × 110 ft.) × ($1.30/ft. - $1.20/ft.)

= 88,000 ft. × $0.10

= $8,800 Favorable

(2) Computation of materials quantity variance (MQV):

MQV = Standard Price × (Standard Quantity - Actual Quantity)

= $1.30/ft. × [(800 units × 100 ft.) - (88,000 ft.)]

= $1.30/ft. × -8,000 ft.

= -$10,400 (or $10,400 Unfavorable)

(3) Computation of labor rate variance (LRV)

LRV = Actual Hours × (Standard Hourly Rate - Actual Hourly Rate)

= (800 units × 5.5 hrs.) × ($8.00/hr. - $7.80/hr.)

= 4,400 hrs. × $0.20

= $880 Favorable

(4) Computation of labor efficiency variance (LEV):

LEV = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $8.00/hr. × [(800 units × 5 hrs.) - (800 units × 5.5 hrs.)]

= $8.00/hr. × -400 hours

= -$3,200 (or $3,200 Unfavorable)

Overhead variances are computed on the following page.

© The McGraw-Hill Companies, Inc., 2010

P24.7A

PROBLEM 24.7A

HERITAGE FURNITURE CO. (continued)

(5) Computation of overhead spending variance:

Overhead per flexible budget for 800 units:

Fixed $ 15,000

Variable (800 units × $7.00 per unit) 5,600 $ 20,600

Less: Actual overhead for the month 18,480

Overhead spending variance (favorable) $ 2,120

(6) Computation of volume variance:

Overhead applied using standard cost

($800 units × $22 per unit) $ 17,600

Overhead per flexible budget for 800 units

(computed above) 20,600

Volume variance (unfavorable) $ (3,000)

b.

General Journal

July 31 Work in Process Inventory (at standard) 104,000

Materials Quantity Variance 10,400

Materials Price Variance 8,800

Materials Inventory (at actual) 105,600

To record direct materials used during July.

Standard cost = 800 units @ $130 = $104,000

Actual cost = 800 units @ $132 = $105,600

31 Work in Process Inventory (at standard) 32,000

Labor Efficiency Variance 3,200

Labor Rate Variance 880

Direct Labor (actual cost) 34,320

To charge July production with direct labor cost.

Standard cost = 800 units @ $40.00 = $32,000

Actual cost = 800 units @ $42.90 = $34,320

31 Work in Process Inventory (at standard) 17,600

Volume Variance 3,000

Overhead Spending Variance 2,120

Manufacturing Overhead (actual cost) 18,480

To charge overhead to production at standard cost.

Standard cost = 800 units @ $22.00 = $17,600

Actual cost = $18,480

© The McGraw-Hill Companies, Inc., 2010

P24.7A (p.2)

PROBLEM 24.7A

HERITAGE FURNITURE CO. (concluded)

c. Comments on cost variances:

The company appears to be having significant problems in two areas. First, the large

unfavorable materials quantity variance ($10,400) indicates that far more material is being

used in the production process than is provided for in the cost standards. Assuming that the

cost standards are reasonable, the quantity of materials being used is excessive. Second, the

unfavorable labor efficiency variance indicates that more labor hours are being used than

indicated by the standards. This indicates low productivity by direct workers. (The

unfavorable volume variance results only from scheduled production being less than

“normal” production and is not a cause for concern.)

The company shows two significant favorable variances: the materials price variance and

the overhead spending variance. The favorable materials price variance ($8,800) may

indicate that the purchasing department is doing an excellent job of securing materials at

advantageous prices. The overhead spending variance may indicate that the production

manager is doing very well at controlling spending on overhead. However, these favorable

variances may be closely linked to the company’s problems in the areas of materials usage

and labor efficiency.

The favorable materials price variance may mean that the purchasing department is

purchasing lower-grade materials than normal and perhaps contributing to the large

unfavorable materials quantity variance because some of these materials prove to be

unusable. The favorable overhead spending variance may result from unfilled supervisory

positions, which may be contributing to the inefficient use of materials and the low

productivity of direct workers. Thus, management should thoroughly investigate the causes

of these cost variances.

© The McGraw-Hill Companies, Inc., 2010

P24.7A (p.3)

60 Minutes, Strong PROBLEM 24.8A

RIPLEY COPRORATION

a. Based on the journal entry to charge direct materials costs to work in process, the actual

quantity of material purchased and used during June is determined as follows:

Materials Price Variance = Actual Quantity Used × (Standard Price - Actual Price)

$8,200 = Actual Quantity Used × ($6 - $5)

Thus, the actual quantity of material used during June was 8,200 pounds.

b. Based on the journal entry to charge direct material costs to work in process, the standard

quantity of material allowed for the actual level of output achieved in June is determined as

follows:

Materials Quantity Variance = Standard Price × (Standard Quantity - Actual Quantity)

-$1,200 = $6 per pound × (Standard Quantity - 8,200 pounds*)

-$1,200 = $6 (Standard Quantity) - $49,200

$48,000 = $6 (Standard Quantity)

Thus, the standard quantity allowed = $48,000/$6 per pound = 8,000 pounds.

*The 8,200 pounds figure was calculated in part a above.

c. Based on the journal entry to charge direct labor costs to work in process, the average per hour

labor cost incurred in June is determined as follows:

Labor Rate Variance = Actual Labor Hours × (Standard Rate - Actual Rate)

-$950 = 9,500 hours × ($9 - Actual Rate)

-$950 = $85,500 - 9,500 (Actual Rate)

-$86,450 = 9,500 (Actual Rate)

Thus, the actual hourly rate incurred = -$86,450 ÷ -9,500 hours = $9.10 per hour.

d. Based on the journal entry to charge direct labor costs to work in process, the standard direct

labor hours allowed during June is determined as follows:

Labor Efficiency Variance = Standard Hourly Rate × (Standard Hours - Actual

Hours)

-$4,500 = $9 per hour × (Standard Hours - 9,500 hours)

-$4,500 = $9 (Standard Hours) $85,500

$81,000 = $9 (Standard Hours)

Thus, the standard hours allowed = $81,000/$9 per hour = 9,000 hours.

© The McGraw-Hill Companies, Inc., 2010

P24.8A

Problem 24.8A

RILEY CORPORATION (concluded)

e. Based on the journal entry to charge overhead costs to work in process, the following

relation-ships exist:

Actual Overhead Standard Overhead Overhead

Costs Incurred Costs Allowed Costs Applied

$22,000 ? $25,000

$2,000 Unfavorable $5,000 Favorable

Spending Variance Volume Variance

Thus standard overhead costs allowed for in June of $20,000 can be computed as follows:

$22,000 - $2,000 = $20,000, or $25,000 - $5,000 = $20,000.

f. Finished Goods Inventory (at standard cost) 154,000

Work in Process Inventory (at standard cost) 154,000*

To transfer cost of completed units to finished goods.

*The $154,000 figure equals the total direct materials, direct labor, and manufacturing

overhead charged to production at standard cost during June ($48,000 + $81,000 + $25,000).

g. Overhead Volume Variance (favorable) ……………………………… 5,000

Materials Price Variance (favorable) ………………………………… 8,200

Materials Quantity Variance (unfavorable) ……………………………………… 1,200

Direct Labor Rate Variance (unfavorable) ……………………………………… 950

Direct Labor Efficiency Variance (unfavorable) ………………………………… 4,500

Overhead Spending Variance (unfavorable) ……………………………………… 2,000

Cost of Goods Sold ………………………………………………………………… 4,550

To close the cost variance accounts.

h. Given that Ripley’s overhead volume variance was favorable, its actual production during

June must have exceeded “normal” output.

© The McGraw-Hill Companies, Inc., 2010

P24.8A (p.2)

45 Minutes, Medium PROBLEM 24.9A

THE ANTON COMPANY

a. Since the direct materials quantity variance is $0, the actual quantity of materials used per stand

must equal the budgeted quantity per stand. Thus the total quantity purchased and used is:

220 stands × 3 square feet per stand = 660 square feet.

Materials Price Variance = Actual Quantity Used × (Standard Price - Actual Price)

-$33 (Unfavorable) = 660 sq. ft. × ($.25 - actual price)/sq. ft.

-33

= $.25 actual price

660

-0.05 = $.25 actual price

Actual Price = $ .30 per square foot

b. Labor Efficiency Variance = Standard Hourly Rate × (Standard Hours - Actual Hours)

-$550 (Unfavorable) = $10 × (.5 hours per unit - actual hours per unit) × 220 units

-550

= .5 hours per unit - actual hours per unit

$2,200

-0.25 = .5 hours per unit - actual hours per unit

Actual Hours Per Unit = .75 hours per unit

c. Labor Rate Variance = Actual Labor Hours × (Standard Rate - Actual Rate)

$231 (Favorable) = .75 hours per unit × 220 units × ($10 per hour - actual rate)

$231 = 165 hours × ($10 per hour - actual rate)

$231

= $10 - actual rate

165

$1.40 = $10 - actual rate

Actual Rate Per Hour = $8.60 per hour

d. Overhead Spending Variance = Standard Overhead Allowed at Actual Production Level

- Actual Overhead Costs

-$210 (Unfavorable) = $1,040* - actual overhead costs

Actual Overhead Costs = $1,250

*Standard overhead allowed at the actual production of 220 units:

Fixed overhead allowed ($3 × 200 units) ………………………………………………… $ 600

Variable overhead allowed ($2 × 220 units) ……………………………………………… 440

Total overhead allowed …………………………………………………………………$ 1,040

© The McGraw-Hill Companies, Inc., 2010

P24.9A

SOLUTIONS TO PROBLEMS SET B

25 Minutes, Strong PROBLEM 24.1B

DENTON'S

a. MPV = Actual Quantity × (Standard Price - Actual Price)

= 800 pounds × ($12/lb - $15/lb)

= -$2,400 (or $2,400 Unfavorable)

b. The materials quantity variance (MQV) is first used to find the standard quantity of material

allowed for producing 600 units:

MQV = Standard Price × (Standard Quantity - Actual Quantity)

-$1,200 = $12/lb - (Standard Quantity - 800 pounds)

Thus we may solve for the Standard Quantity as follows:

-1,200 = 12 (Standard Quantity) - 9,600

8,400 = 12 (Standard Quantity)

8,400 ÷ 12 = (Standard Quantity) = 700 pounds for 600 units.

700 pounds ÷ 600 units = 1.167 pounds per unit.

700 units × 1.167 pounds/unit = 817 pounds, standard quantity allowed for 700 units (rounded).

c. Work in Process Inventory (700 pounds × $12 per pound) ………… 8,400

Materials Quantity Variance (unfavorable) …………………………… 1,200

Materials Price Variance (unfavorable) ……………………………… 2,400

Direct Materials Inventory (800 pounds × $15 per pound) …….. 12,000

To record direct materials applied to production.

d. Denton’s overhead volume variance is unfavorable by $2,400, given that it is twice the unfavorable

materials quantity variance of $1,200. The volume variance is unfavorable because actual output

of 600 units was less than normal output of 700 units.

© The McGraw-Hill Companies, Inc., 2010

P24.1B

30 Minutes, Medium PROBLEM 24.2B

DYELOT INDUSTRIES

a. Computation of materials price variance (MPV):

MPV = Actual Quantity Used × (Standard Price - Actual Price)

= 410,000 lbs. × ($0.80/lb - $0.75/lb.)

= 410,000 lbs. × $0.05/lb.

= $20,500 Favorable

Computation of materials quantity variance (MQV):

MQV = Standard Price × (Standard Quantity - Actual Quantity)

= $0.80 × [(1,000 lbs. × 400 batches) - 410,000 lbs.]

= $0.80 × -10,000 lbs.

= -$8,000 (or $8,000 Unfavorable)

Computation of labor rate variance (LRV):

LRV = Actual Hours × (Standard Hourly Rate - Actual Hourly Rate)

= 7,950 × ($8.00/hr. - $7.80/hr.)

= 7,950 × $0.20/hr.

= $1,590 Favorable

Computation of labor efficiency variance (LEV):

LEV = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $8.00/hr. × [(20 hrs. × 400 batches) - 7,950 hrs.]

= $8.00/hr. × 50 hrs.

= $400 Favorable

Overhead variances are computed on the following page.

© The McGraw-Hill Companies, Inc., 2010

P24.2B

PROBLEM 24.2B

DYELOT INDUSTRIES (concluded)

Computation of overhead spending variance:

Overhead budgeted for 400 batches:

Fixed $ 150,000

Variable (400 batches × $20 per batch) 8,000

Total budgeted overhead $ 158,000

Less: Actual overhead for the month 150,490

Overhead spending variance (favorable) $ 7,510

Computation of volume variance:

Overhead applied at standard cost

($320 × 400 batches) $ 128,000

Budgeted overhead (above) 158,000

Volume variance (unfavorable) $ (30,000)

b.

General Journal

Jan. 31 Work in Process Inventory (at standard) 320,000

Materials Quantity Variance 8,000

Materials Price Variance 20,500

Materials Inventory (actual) 307,500

To record direct materials used in January.

Standard cost (400 batches × $800) = $320,000

Actual cost = $307,500

31 Work in Process Inventory (at standard) 64,000

Labor Rate Variance 1,590

Labor Efficiency Variance 400

Direct Labor (actual) 62,010

To record direct labor cost applicable to January

production:

Standard cost (400 batches × $160) = $64,000

Actual cost = $62,010

31 Work in Process Inventory (at standard) 128,000

Volume Variance 30,000

Overhead Spending Variance 7,510

Manufacturing Overhead (actual) 150,490

To apply overhead to work in process, using

standard unit cost:

Standard cost (400 batches × $320) = $128,000

Actual cost = $150,490

© The McGraw-Hill Companies, Inc., 2010

P24.2B (p.2)

25 Minutes, Medium PROBLEM 24.3B

LATIN SILK PRODUCTS

a.

General Journal

(1) Work in Process (standard cost) 100,000

Materials Quantity Variance 10,000

Materials Price Variance 2,000

Direct Materials Inventory (actual cost) 108,000

To record materials used.

(2) Work in Process (standard cost) 94,000

Labor Efficiency Variance 8,000

Labor Rate Variance 6,000

Direct Labor (actual cost) 96,000

To record direct labor cost.

(3) Work in Process (standard cost) 112,800

Overhead Spending Variance 1,200

Overhead Volume Variance 6,000

Manufacturing Overhead (actual cost) 120,000

To record manufacturing overhead assigned to

production, and to record overhead variances.

b. (1) Finished Goods Inventory (at standard cost) 300,000

Work in Process (at standard cost) 300,000

To transfer cost of units completed to finished goods

inventory, 20,000 units at $15 per unit.

(2) Cost of Goods Sold (at standard cost) 270,000

Finished Goods Inventory (at standard cost) 270,000

To record cost of units sold, 18,000 units at $15 per unit.

c. Fixed overhead per month = $6,000 (unfavorable

volume variance) ÷ 0.20 (idle capacity percentage) $ 30,000

© The McGraw-Hill Companies, Inc., 2010

P24.3B

45 Minutes, Strong PROBLEM 24.4B

HANS ENTERPRISES

a. Materials Price Variance = Actual Quantity Used × (Standard Price - Actual Price)

= 170,000 pounds × ($5.00 - $4.80*)

= $34,000 Favorable

*Actual Price per Pound = $816,000/170,000 pounds = 4.80/pound

Materials Quantity Variance = Standard Price × (Standard Quantity - Actual

Quantity)

= $5.00 per pound × (164,000 pounds* - 170,000 pounds)

= $30,000 Unfavorable

*Standard Quantity Allowed = 160 batches × 1,025 pounds/batch = 164,000 pounds

b. Labor Rate Variance = Actual Labor Hours × (Standard Rate - Actual Rate)

= 2,500 hours × ($8.25 - $8.00*)

= $625 Favorable

*Actual Rate per Hour = $20,000/2,500 hours = $8.00/hour

Labor Efficiency Variance = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $8.25 per hour × (2,400 hours* - 2,500 hours)

= -$825 Unfavorable

*Standard Hours Allowed = 160 batches × 15 hours/batch = 2,400 hours

© The McGraw-Hill Companies, Inc., 2010

P24.4B

PROBLEM 24.4B

HANS ENTERPRISES (continued)

c. Overhead variances:

Actual Overhead Standard Overhead Overhead

Costs Incurred Costs Allowed Costs Applied

Fixed $3,100 Fixed $3,300

Variable 1,100 Variable 1,600 $32/batch × 160 batches = $5,120

$4,200 $4,900

$700 Favorable $220 Favorable

Spending Variance Volume Variance

*Standard Variable Overhead Allowed = $10.00/batch × 160 batches = $1,600

d. Entry to charge materials to production:

Work in Process Inventory (at standard cost) ……………………… 820,000 *

Materials Quantity Variance (unfavorable) ………………………… 30,000

Material Price Variance (favorable) …………………………………………… 34,000

Direct Materials Inventory (at actual cost) ……………………………………… 816,000

To record the cost of direct materials charged to production.

*160 actual batches × 1,025 pounds allowed per batch × $5.00 per pound = $820,000

e. Entry to charge direct labor to production:

Work in Process Inventory (at standard cost) ……………………… 19,800 *

Labor Efficiency Variance (unfavorable) …………………………… 825

Labor Rate Variance (favorable) ………………………………………………… 625

Direct Labor (at actual cost) …………………………………………………… 20,000

To record the cost of direct labor charged to production.

*160 actual batches × 15 hours allowed per batch × $8.25 per hour = $19,800

f. Entry to charge overhead to production:

Work in Process Inventory (at standard cost) ……………………… 5,120

Overhead Spending Variance (favorable) ………………………………………… 700

Overhead Volume Variance (favorable) ………………………………………… 220

Manufacturing Overhead (at actual cost) ………………………………………… 4,200

To apply overhead to production.

© The McGraw-Hill Companies, Inc., 2010

P24.4B (p.2)

PROBLEM 24.4B

HANS ENTERPRISES (concluded)

g. Entry to transfer the 160 batches of crow bait produced in June to finished goods:

Finished Goods Inventory (at standard cost) ………………………… 844,920

Work in Process Inventory (at standard cost) …………………………………… 844,920*

To transfer 160 batches of crow bait to finished goods in June.

*The $844,920 figure equals the total direct materials, direct labor, and manufacturing

overhead charged to production at standard cost during June ($820,000 + $19,800 + $5,120).

h. Entry to close overapplied overhead to cost of goods sold:

Overhead Spending Variance (favorable) ……………………………… 700

Overhead Volume Variance (favorable) ……………………………… 220

Cost of Goods Sold …………………………………………………… 920

To close overhead variances to Cost of Goods Sold.

© The McGraw-Hill Companies, Inc., 2010

P24.4B (p.3)

45 Minutes, Strong PROBLEM 24.5B

SMOOTH CORPORATION

a. Materials Price Variance = Actual Quantity Used × (Standard Price - Actual Price)

= 34,000 gallons × ($1.32 - $1.28*)

= $1,360 Favorable

*Actual Price per Pound = $43,520 ÷ 34,000 gallons = $1.28/gallon

Materials Quantity Variance = Standard Price × (Standard Quantity - Actual Quantity)

= $1.32 per gallon × (30,000 gallons* - 34,000 gallons)

= -$5,280 (or $5,280 Unfavorable)

*Standard Quantity Allowed = 10,000 cases × 3.0 gallons/case = 30,000 gallons

b. Labor Rate Variance = Actual Labor Hours × (Standard Rate - Actual Rate)

= 8,300 hours × ($15 - $14)

= $8,300 Favorable

Labor Efficiency Variance = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $15 per hour × (8,000 hours* - 8,300 hours)

= -$4,500 (for $4,500 Unfavorable)

*Standard Hours Allowed = 10,000 cases × 0.80 hours/case = 8,000 hours

© The McGraw-Hill Companies, Inc., 2010

P24.5B

PROBLEM 24.5B

SMOOTH CORPORATION (concluded)

c. Overhead variances:

Actual Overhead Standard Overhead Overhead

Costs Incurred Costs Allowed Costs Applied

Fixed $ 4,500 Fixed $ 5,252

Variable 15,500 Variable 16,000* $2.12/case × 10,000 cases = $21,200

$21,000 $21,252

$252 Favorable $52 Unfavorable

Spending Variance Volume Variance

*Standard Variable Overhead Allowed = $1.60/case × 10,000 cases = $16,000

d. (1) Work in Process Inventory (at standard cost) ………………… 39,600 *

Materials Quantity Variance (unfavorable) …………………… 5,280

Materials Price Variance (favorable) …………………………………… 1,360

Direct Materials Inventory (at actual cost) ……………………………… 43,520

To record the cost of direct materials charged to production.

*10,000 actual cases × 3.00 gallons allowed per case × $1.32 per gallon = $39,600

(2) Work in Process Inventory (at standard cost) …………………… 120,000 *

Labor Efficiency Variance (unfavorable) ………………………… 4,500

Labor Rate Variance (favorable) ……………………………………………… 8,300

Direct Labor (at actual cost) ………………………………………………… 116,200

To record the cost of direct labor charged to production.

*10,000 actual cases × 0.80 hours allowed per case × $15 per hour = $120,000

(3) Work in Process Inventory (at standard cost) …………………… 21,200

Overhead Volume Variance (unfavorable) ……………………… 52

Overhead Spending Variance (favorable) …………………………………… 252

Manufacturing Overhead (at actual cost) …………………………………… 21,000

To apply overhead to production.

(4) Finished Goods Inventory (at standard cost) ……………………… 180,800

Work in Process Inventory (at standard cost) ……………………………… 180,800*

To transfer 10,000 cases to finished goods in June.

*The $180,800 figure equals the total direct materials, direct labor, and manufacturing

overhead charged to production at standard cost during June ($39,600 + $120,000 +

$21,200).

(5) Overhead Spending Variance (favorable) ………………………… 252

Overhead Volume Variance (unfavorable) …………………………………… 52

Cost of Goods Sold …………………………………………………………… 200

To close overhead variances to Cost of Goods Sold.

© The McGraw-Hill Companies, Inc., 2010

P24.5B (p.2)

40 Minutes, Strong PROBLEM 24.6B

MONOGLUT, INC.

a. Materials price variance:

Actual Quantity × (Standard Price - Actual Price)

(7,000 units × 13 ounces) × ($0.20/oz. - $0.22/oz.) $ (1,820) Unfavorable

Materials quantity variance:

Standard Price × (Standard Quantity - Actual Quantity)

$0.20/oz. × (84,000 ounces - 91,000 ounces) $ (1,400) Unfavorable

Journal entry to record direct materials used in March:

Work in Process Inventory (7,000 units × 12 oz. × $0.20/oz.) 16,800

Materials Price Variance 1,820

Materials Quantity Variance 1,400

Materials Inventory (7,000 units × 13 oz. × $0.22/oz.) 20,020

To record cost of direct materials used in March.

b. Labor rate variance:

Actual Hours × (Standard Hourly Rate - Actual Hourly Rate)

(7,000 units × 0.50 hr.) × ($12.00/hr. - $13.00/hr.) $ (3,500) Unfavorable

Labor efficiency variance:

Standard Hourly Rate × (Standard Hours - Actual Hours)

$12.00/hr. × [(7,000 units × 0.6 hr.) - (7,000 units × 0.50 hr.)]

$12.00/hr. × 700 hrs. $ 8,400 Favorable

Journal entry to record direct labor cost for March:

Work in Process Inventory (7,000 units × 0.6 hr. × $12/hr.) 50,400

Labor Rate Variance 3,500

Labor Efficiency Variance 8,400

Direct Labor (7,000 units × 0.50 hr. × $13.00/hr.) 45,500

To record direct labor costs applicable to production during

during March.

© The McGraw-Hill Companies, Inc., 2010

P24.6B

PROBLEM 24.6B

MONOGLUT, INC. (concluded)

c. Overhead spending variance:

Overhead per flexible budget—7,000 units:

Fixed $ 6,000

Variable (7,000 units × $0.40 per unit) 2,800

Total overhead per flexible budget $ 8,800

Less: Actual overhead in March ($6,000 + $2,540) 8,540

Overhead spending variance $ 260 Favorable

Overhead volume variance:

Overhead applied at standard cost (7,000 units × $1) $ 7,000

Less: Overhead per flexible budget (above) 8,800

Overhead volume variance $ (1,800) Unfavorable

Journal entry to record overhead applied to work in process:

Work in Process Inventory (7,000 units × $1 per unit) 7,000

Overhead Volume Variance 1,800

Overhead Spending Variance 260

Manufacturing Overhead (Actual costs) 8,540

To apply overhead cost to 7,000 units produced at the

standard rate of $1 per unit.

© The McGraw-Hill Companies, Inc., 2010

P24.6B (p.2)

40 Minutes, Strong PROBLEM 24.7B

COLONIAL FURNITURE CO.

a. (1) Computation of materials price variance (MPV):

MPV = Actual Quantity Used × (Standard Price - Actual Price)

= (1,800 units × 105 ft.) × ($1.50/ft. - $1.40/ft.)

= 189,000 ft. × $0.10

= $18,900 Favorable

(2) Computation of materials quantity variance (MQV):

MQV = Standard Price × (Standard Quantity - Actual Quantity)

= $1.50/ft. × [(1,800 units × 100 ft.) - (189,000 ft.)]

= $1.50/ft. × -9,000 ft.

= -$13,500 (or $13,500 Unfavorable)

(3) Computation of labor rate variance (LRV)

LRV = Actual Hours × (Standard Hourly Rate - Actual Hourly Rate)

= (1,800 units × 4.5 hrs.) × ($10.00/hr. - $9.00/hr.)

= 8,100 hrs. × $1.00

= $8,100 Favorable

(4) Computation of labor efficiency variance (LEV):

LEV = Standard Hourly Rate × (Standard Hours - Actual Hours)

= $10.00/hr. × [(1,800 units × 4 hrs.) - (1,800 units × 4.5 hrs.)]

= $10.00/hr. × -900 hours

= -$9,000 (or $9,000 Unfavorable)

Overhead variances are computed on the following page.

© The McGraw-Hill Companies, Inc., 2010

P24.7B

PROBLEM 24.7B

COLONIAL FURNITURE CO. (continued)

(5) Computation of overhead spending variance:

Overhead per flexible budget for 800 units:

Fixed $ 20,000

Variable (1,800 units × $8.00 per unit) 14,400 $ 34,400

Less: Actual overhead for the month 34,200

Overhead spending variance (favorable) $ 200

(6) Computation of volume variance:

Overhead applied using standard cost

($1,800 units × $18 per unit) $ 32,400

Overhead per flexible budget for 1,800 units

(computed above) 34,400

Volume variance (unfavorable) $ (2,000)

b.

General Journal

May 31 Work in Process Inventory (at standard) 270,000

Materials Quantity Variance 13,500

Materials Price Variance 18,900

Materials Inventory (at actual) 264,600

To record direct materials used during May.

Standard cost = 1,800 units @ $150 = $270,000

Actual cost = 1,800 units @ $147 = $264,600

31 Work in Process Inventory (at standard) 72,000

Labor Efficiency Variance 9,000

Labor Rate Variance 8,100

Direct Labor (actual cost) 72,900

To charge May production with direct labor cost.

Standard cost = 1,800 units @ $40.00 = $72,000

Actual cost = 1,800 units @ $40.50 = $72,900

31 Work in Process Inventory (at standard) 32,400

Volume Variance 2,000

Overhead Spending Variance 200

Manufacturing Overhead (actual cost) 34,200

To charge overhead to production at standard cost.

Standard cost = 1,800 units @ $18.00 = $32,400

Actual cost = $34,200

© The McGraw-Hill Companies, Inc., 2010

P24.7B (p.2)

PROBLEM 24.7B

COLONIAL FURNITURE CO. (concluded)

c. Comments on cost variances:

The company appears to be having significant problems in two areas. First, the large

unfavorable materials quantity variance ($13,500) indicates that far more material is being

used in the production process than is provided for in the cost standards. Assuming that the

cost standards are reasonable, the quantity of materials being used is excessive. Second, the

unfavorable labor efficiency variance indicates that more labor hours are being used than

indicated by the standards. This indicates low productivity by direct workers. (The

unfavorable volume variance results only from scheduled production being less than

“normal” production and is not a cause for concern.)

The company had two significantly favorable variances: (1) the material price variance,

and (2) the labor rate variance. The favorable price variance may indicate that the

purchasing department is doing an excellent job of securing materials at advantageous

prices. The favorable labor rate variance may indicate that the number of lower paid