Beruflich Dokumente

Kultur Dokumente

Allied Office Products Case Analysis

Hochgeladen von

MegaApple0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

123 Ansichten2 SeitenHBR

Management Control Systems

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenHBR

Management Control Systems

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

123 Ansichten2 SeitenAllied Office Products Case Analysis

Hochgeladen von

MegaAppleHBR

Management Control Systems

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

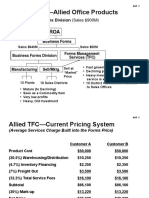

Allied Office Products

MCS Assignment -1

Group A1

Hemang Chauhan (P40015)

Narendra S. P. (P40086)

Veena Priya Lakshami V (P40106)

Date – 13 November 2020

Brief about the Case:

In 1988, Allied Office Products, company specialized in making business forms and specialty

paper products, launched “Total Forms Control” (TFC) programme for its corporate clients as

a value added service. It stablished a separate company within their business forms division

to handle TFC’s sales. Services provided by TFC included warehousing and distribution of

forms (including inventory financing) as well as inventory control and forms usage reporting

to its clients. As part of their services, Allied also offered “pick pack” and “desk top

delivery”. They charge a fixed 32.2% of product cost to client for their warehousing and

distribution services, irrespective of the services provided.

Central Point of the Case:

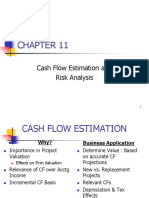

TFC’s declining profitability and very less ROI of 6%, set off the evaluation of the current

activities and the distribution charges. Various activities contributing to the cost and the

profits are analysed to understand the gaps. This includes the analysis of control systems and

the tools used such as the revenue models and the pricing methods and rejigging the same to

improve profitability.

Control Systems Discussed in the Case:

Purchase Control System is used for the purchase of paper from Allied by TFC and the tool

used is transfer pricing at fair market Value. The standard product price is marked up with

32.2% for the service costs and 20% for margins. TFC charges uniform margins across all its

clients. Here, the uniform pricing system is the control system and the tool used is the mark-

up pricing or cost-plus pricing. The management then decided to shift to Service Based

Pricing which acts as a control system and the margins across different revenue slabs acts as

the tool. The case mentions about the Inventory control systems and tools used can be better

aisle management, leasing programs and charging the client for dormant inventory. The case

also indicates the use of depreciation in the calculation of costs. Hence consistency principle

acts control system and WDV or SLM acts as the tool.

Learning from the case:

Given Allied is a service providing firm, their contribution is not directly proportionally to

product cost. Rather it is based on services provided against each account. Therefore they

should charge based on service provided to each client as opposed to being based on product

cost. The two accounts A and B had similar size, but had different level of service and so

based on the above reasoning, both would be charge differently. Service Based Pricing like

this will help Allied to differentiate the accounts that they should concentrate to improve

profitability.

Das könnte Ihnen auch gefallen

- Corporate Finance Minicase Chapter 21Dokument4 SeitenCorporate Finance Minicase Chapter 21Phan Huỳnh Châu TrânNoch keine Bewertungen

- Max, M. (2004) ABC Trends in The Banking Sector - A Practitioner's Perspective'Dokument17 SeitenMax, M. (2004) ABC Trends in The Banking Sector - A Practitioner's Perspective'Anonymous WFjMFHQNoch keine Bewertungen

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDokument7 SeitenTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNoch keine Bewertungen

- CHAPTER 13 The Strategy of International BusinessDokument6 SeitenCHAPTER 13 The Strategy of International Businessmasfiq HossainNoch keine Bewertungen

- Birch Paper CompanyDokument12 SeitenBirch Paper CompanyChristina AgustinNoch keine Bewertungen

- Allied Office ProductDokument26 SeitenAllied Office ProductAnanda Agustin Fitriana100% (1)

- Hemang Chauhan P40015 OSD AssignmentDokument1 SeiteHemang Chauhan P40015 OSD AssignmentMegaAppleNoch keine Bewertungen

- B3 PDFDokument465 SeitenB3 PDFabdulramani mbwana100% (7)

- KASUS CUP CorporationDokument7 SeitenKASUS CUP CorporationNia Azura SariNoch keine Bewertungen

- Chapter 26Dokument32 SeitenChapter 26karlosgwapo3Noch keine Bewertungen

- Case 1 - TQMDokument8 SeitenCase 1 - TQMladdooparmarNoch keine Bewertungen

- IEOR 162 Group Project (Fall 2013)Dokument4 SeitenIEOR 162 Group Project (Fall 2013)DracoAndruw0% (2)

- Pamafert ContentDokument1 SeitePamafert ContentAlethea Regina FarhanNoch keine Bewertungen

- Pricing Products Pricing Considerations and ApproachesDokument19 SeitenPricing Products Pricing Considerations and ApproachesMhel DemabogteNoch keine Bewertungen

- Customer Relationship Managemen ProjectDokument10 SeitenCustomer Relationship Managemen ProjectDishank BaidNoch keine Bewertungen

- Eastman Kodak CompanyDokument9 SeitenEastman Kodak CompanyArveen KaurNoch keine Bewertungen

- Nine Cell MatrixDokument9 SeitenNine Cell Matrixjonyshakya0% (1)

- 4-6 Analytics Lifecycle Case Study NetflixDokument2 Seiten4-6 Analytics Lifecycle Case Study NetflixLuis Alfonso Dañez0% (1)

- 8.1 Allied Office Product Case McsDokument5 Seiten8.1 Allied Office Product Case McsMahfoz Kazol100% (1)

- Business PlanDokument34 SeitenBusiness Planjohn mwambuNoch keine Bewertungen

- ABC Costing Allied Office ProductsDokument13 SeitenABC Costing Allied Office ProductsProfessorAsim Kumar Mishra100% (1)

- Tesco GSCMDokument6 SeitenTesco GSCMadmbad2Noch keine Bewertungen

- Mis Prelim ExamDokument10 SeitenMis Prelim ExamRonald AbletesNoch keine Bewertungen

- Pak Taufikur CH 11 Financial Management BrighamDokument69 SeitenPak Taufikur CH 11 Financial Management BrighamRidhoVerianNoch keine Bewertungen

- 961 Beer CaseDokument3 Seiten961 Beer CaseDio Ardana PramandikaNoch keine Bewertungen

- Baldwin Bicycle CompanyDokument19 SeitenBaldwin Bicycle CompanyMannu83Noch keine Bewertungen

- Individual Assignment Case 2 - Financial Report and Control - DILEMBA 1 Mohammad Alfian Syah Siregar - 29322150Dokument3 SeitenIndividual Assignment Case 2 - Financial Report and Control - DILEMBA 1 Mohammad Alfian Syah Siregar - 29322150iancroottNoch keine Bewertungen

- Levi's "Personal Pair" Jeans (A)Dokument27 SeitenLevi's "Personal Pair" Jeans (A)VAIBHAV SWARNKARNoch keine Bewertungen

- Quietly Brilliant HTCDokument2 SeitenQuietly Brilliant HTCOxky Setiawan WibisonoNoch keine Bewertungen

- Kanthal Activity-Based Costing 20200118 - RVADokument12 SeitenKanthal Activity-Based Costing 20200118 - RVARaymon AquinoNoch keine Bewertungen

- 2009-01-06 043437 GoodDokument3 Seiten2009-01-06 043437 GoodAlthea LandichoNoch keine Bewertungen

- 5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467Dokument152 Seiten5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467sukriti2812Noch keine Bewertungen

- Marketing - Kotler - Managing Mass CommunicationDokument34 SeitenMarketing - Kotler - Managing Mass Communicationjohn07bbb75% (4)

- Hilton 11e Chap001 PPT-STU PDFDokument41 SeitenHilton 11e Chap001 PPT-STU PDFKhánh Linh CaoNoch keine Bewertungen

- Allied Services Case Study-ABC CostingDokument20 SeitenAllied Services Case Study-ABC CostingSavita Soni100% (4)

- Kasus 7.1 Mercator Corp.Dokument3 SeitenKasus 7.1 Mercator Corp.Septiana DA0% (3)

- Bounce Case StudyDokument12 SeitenBounce Case StudyAnudeep NagaliaNoch keine Bewertungen

- Corporate Level Strategy: By-Devesh Hari ROLL - NO. - 15 Mpmir 3 SemesterDokument21 SeitenCorporate Level Strategy: By-Devesh Hari ROLL - NO. - 15 Mpmir 3 SemesterSuraj RajbharNoch keine Bewertungen

- NortelDokument7 SeitenNortelSaras AgrawalNoch keine Bewertungen

- Yamaha BDokument4 SeitenYamaha BallanNoch keine Bewertungen

- Price Discrimination: Presented By: - Ruhaan Khan Mohd. Shauzab Kazmi Shantanu Sharma Stuti Garg Sudeep GuptaDokument16 SeitenPrice Discrimination: Presented By: - Ruhaan Khan Mohd. Shauzab Kazmi Shantanu Sharma Stuti Garg Sudeep Guptashan785Noch keine Bewertungen

- Ikea Group Yearly Summary Fy14Dokument43 SeitenIkea Group Yearly Summary Fy14ArraNoch keine Bewertungen

- Case16 1 HospitalSupplyDokument1 SeiteCase16 1 HospitalSupplyChristine Joy RoxasNoch keine Bewertungen

- Giridhar Case StudyDokument9 SeitenGiridhar Case StudySahil AroraNoch keine Bewertungen

- Mm5003 - Marketing Management Case: Youtube For BrandsDokument6 SeitenMm5003 - Marketing Management Case: Youtube For BrandsNadia Ayuning PutriNoch keine Bewertungen

- Shukrullah Assignment No 2Dokument4 SeitenShukrullah Assignment No 2Shukrullah JanNoch keine Bewertungen

- FinalDokument32 SeitenFinalreegup0% (1)

- Mejik CooperDokument17 SeitenMejik CooperWito Aja67% (3)

- Abc PDFDokument6 SeitenAbc PDFمحمد عقابنةNoch keine Bewertungen

- ME15 - Unit 3Dokument59 SeitenME15 - Unit 3Bharathi RajuNoch keine Bewertungen

- Mobilink Management ReportDokument76 SeitenMobilink Management Reportibrahim_ghaznaviNoch keine Bewertungen

- New War of Currents Case Study SolutionDokument4 SeitenNew War of Currents Case Study SolutionAkshat ChauhanNoch keine Bewertungen

- Westport Electrical Corporation Case Study AnlysisDokument4 SeitenWestport Electrical Corporation Case Study AnlysisMilanPadariyaNoch keine Bewertungen

- Case Study - ALDI & HomePlusDokument3 SeitenCase Study - ALDI & HomePlusgiemansitNoch keine Bewertungen

- The Value ChainDokument5 SeitenThe Value ChainNehal AbdellatifNoch keine Bewertungen

- Product Line DecisionsDokument10 SeitenProduct Line DecisionsRodney DabalosNoch keine Bewertungen

- Excel Solutions - CasesDokument25 SeitenExcel Solutions - CasesJerry Ramos CasanaNoch keine Bewertungen

- Chapter 14 SolutionsDokument35 SeitenChapter 14 SolutionsAnik Kumar MallickNoch keine Bewertungen

- Intial Information Report (Financial Analysis)Dokument13 SeitenIntial Information Report (Financial Analysis)NiveditaSnehiNoch keine Bewertungen

- Managerial AccountingDokument6 SeitenManagerial AccountingqamariyahNoch keine Bewertungen

- Designing and Implementing A TransferDokument18 SeitenDesigning and Implementing A TransferManser KhalidNoch keine Bewertungen

- Cost AccountingDokument25 SeitenCost AccountingkapilmmsaNoch keine Bewertungen

- OffshoringDokument11 SeitenOffshoringMegaAppleNoch keine Bewertungen

- Collective Cooperative Action Swades (FINAL2)Dokument13 SeitenCollective Cooperative Action Swades (FINAL2)MegaAppleNoch keine Bewertungen

- Quiz Yourself - Do You Lead With Emotional IntelligenceDokument5 SeitenQuiz Yourself - Do You Lead With Emotional IntelligenceMegaAppleNoch keine Bewertungen

- Vanraj Tractors: Case AnalysisDokument3 SeitenVanraj Tractors: Case AnalysisMegaAppleNoch keine Bewertungen

- Gall Fly Attack: Case AnalysisDokument3 SeitenGall Fly Attack: Case AnalysisMegaAppleNoch keine Bewertungen

- AIM Assignment: Market Structure of Pesticides IndustryDokument20 SeitenAIM Assignment: Market Structure of Pesticides IndustryMegaAppleNoch keine Bewertungen

- Birch Paper Company Case Analysis MCSDokument3 SeitenBirch Paper Company Case Analysis MCSMegaAppleNoch keine Bewertungen

- Vershire Company: MCS Assignment 3Dokument2 SeitenVershire Company: MCS Assignment 3MegaAppleNoch keine Bewertungen

- Acetic Acid CBSE Project Class 12Dokument17 SeitenAcetic Acid CBSE Project Class 12MegaAppleNoch keine Bewertungen

- BT Gioi TuDokument4 SeitenBT Gioi TuPhạm TrâmNoch keine Bewertungen

- Citizenship Articles 3Dokument13 SeitenCitizenship Articles 3Jagadish PrasadNoch keine Bewertungen

- DDI - Company Profile 2024Dokument9 SeitenDDI - Company Profile 2024NAUFAL RUZAINNoch keine Bewertungen

- Syllabus 2640Dokument4 SeitenSyllabus 2640api-360768481Noch keine Bewertungen

- Kami Export - (Template) Understanding The Black Death Student MaterialsDokument4 SeitenKami Export - (Template) Understanding The Black Death Student Materialscookniya1Noch keine Bewertungen

- Synopsis Movie Ticket BookingDokument18 SeitenSynopsis Movie Ticket BookingRaj Bangalore17% (6)

- K.E.E.I. Notes - Fall 2010Dokument8 SeitenK.E.E.I. Notes - Fall 2010Kijana Educational Empowerment InitiativeNoch keine Bewertungen

- Additional English - 4th Semester FullDokument48 SeitenAdditional English - 4th Semester FullanuNoch keine Bewertungen

- Incoterms For Beginners 1Dokument4 SeitenIncoterms For Beginners 1Timur OrlovNoch keine Bewertungen

- User Manual For State ExciseDokument29 SeitenUser Manual For State ExciserotastrainNoch keine Bewertungen

- Arts Q2 Module 3 FINAL1Dokument14 SeitenArts Q2 Module 3 FINAL1halemahpacoteNoch keine Bewertungen

- Josefa V MeralcoDokument1 SeiteJosefa V MeralcoAllen Windel BernabeNoch keine Bewertungen

- Curso Inglés Desde CERO - Nivel Básico - 21-25Dokument11 SeitenCurso Inglés Desde CERO - Nivel Básico - 21-25david morrisonNoch keine Bewertungen

- Registration of Patient Transport VehicleDokument2 SeitenRegistration of Patient Transport VehicleMenGuitar100% (1)

- Business Standard 18th AugDokument11 SeitenBusiness Standard 18th AugSandeep SinghNoch keine Bewertungen

- Master Nilai RDM Semseter Gasal 2020 Kelas 1Dokument50 SeitenMaster Nilai RDM Semseter Gasal 2020 Kelas 1Ahmad Syaihul HNoch keine Bewertungen

- Proposal Argument (FINAL)Dokument10 SeitenProposal Argument (FINAL)NgoziNoch keine Bewertungen

- Quo Vadis PhilippinesDokument26 SeitenQuo Vadis PhilippineskleomarloNoch keine Bewertungen

- Building Brand Architecture by Prachi VermaDokument3 SeitenBuilding Brand Architecture by Prachi VermaSangeeta RoyNoch keine Bewertungen

- The Chosen by Chaim PotokDokument12 SeitenThe Chosen by Chaim PotokDavid A. Malin Jr.Noch keine Bewertungen

- Money of Georgia & OmanDokument18 SeitenMoney of Georgia & OmanHana Danische ElliotNoch keine Bewertungen

- Case Digest-Mejoff V Director of PrisonersDokument2 SeitenCase Digest-Mejoff V Director of PrisonersJestherin BalitonNoch keine Bewertungen

- Marriage in The Law EssayDokument2 SeitenMarriage in The Law EssayRica Jane TorresNoch keine Bewertungen

- OBE - Student Presentation 2021 - V1Dokument18 SeitenOBE - Student Presentation 2021 - V1Mubashir KhanNoch keine Bewertungen

- 2019-04-01 BESTPRAC Financial Management of H2020 Projects - Guide To Best Practice PDFDokument87 Seiten2019-04-01 BESTPRAC Financial Management of H2020 Projects - Guide To Best Practice PDFDes Des Z MottaNoch keine Bewertungen

- Dubai Nursery SchoolsDokument2 SeitenDubai Nursery SchoolsDipti Risbud100% (1)

- WORKING CAPITAL MANAGEMENT of The Ultra Light Technology. VidishaDokument49 SeitenWORKING CAPITAL MANAGEMENT of The Ultra Light Technology. Vidishasai projectNoch keine Bewertungen

- Chapter One: Perspectives On The History of Education in Nigeria, 2008Dokument26 SeitenChapter One: Perspectives On The History of Education in Nigeria, 2008Laura ClarkNoch keine Bewertungen

- CounterfeitingDokument21 SeitenCounterfeitingnujahm1639Noch keine Bewertungen