Beruflich Dokumente

Kultur Dokumente

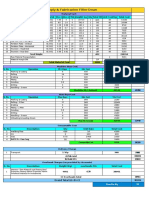

By: Mudassar Gillani: Factory Overhead Include

Hochgeladen von

Syed Mudassar GillaniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

By: Mudassar Gillani: Factory Overhead Include

Hochgeladen von

Syed Mudassar GillaniCopyright:

Verfügbare Formate

Buyer produced 20,000 units and their total factory cost was Rs.

450,000,other cost like property

tax on factory building was Rs. 10,000 included in that cost till year ended the cost of per unit

would be:

Rs.22.5

Rs.23.5

Rs.24.5

Rs.26.5

The abbreviation LIFO is:

Large integrated financial organization

Least interesting financial option

The last in first out method

None of the given options

Amount of net purchase can be calculated as follow

Purchase of direct material add trade discount less purchase return add carriage inward less other

material handling cost

Purchase of direct material less trade discount add purchase return add carriage inward less other

material handling cost

Purchase of direct material less trade discount less purchase less carriage inward add other material

handling cost

Purchase of direct material less trade discount less purchase return add carriage inward add

other material handling cost

Cost accounting department prepares_______that helps the in preparing final accounts.

Cost sheets

Cost of goods sold statement

Cost of production Report

Material requisition form

Opportunity cost is the best example of:

Sunk Cost

Standard Cost

Relevant Cost

Irrelevant Cost

Which of the following items of expense are to be add in FOH cost:

Rent of factory + Head office rent + salaries of factory watchman

Rent of factory + factory lighting bill + directors salaries

Rent of factory + factory lighting bill + factory employees salaries

Head office rent + factory property tax + factory small tools

The components of factory overhead are as follows:

Direct material + Indirect material + Direct expences

Indirect material + Indirect labor + Others indirect cost

Direct material + Indirect expences + Indirect labor

Direct labor + Indirect labor + Indirect expences

Factory Overhead include:

By: Mudassar Gillani

1. Indirect materials

2. Indirect labor and

3. Indirect costs attributable to production and the service activities associated with

manufacturing.

Net sales=Sales less:

Sales returns

Sales discounts

Sales returns & allowances

Sales return & allowances and sales discount

Closing work in process inventory of last year:

Is treated as opening inventory for current year

Is not carried forward to next year

Become expense in the nest year

Change to profit & Loss account

The term Maximum level represents:

The maximum stock level indicates the maximum quantity of an item of material which can be

held in stock at any time.

The maximum stock level indicates the maximum quantity of an item of material which cannot be held in

stock at any time.

The average stock level indicates the maximum quantity of an item of material which can be held in stock

at any time.

The available stock level indicates the maximum quantity of an item of material which can be held in stock

at any time.

Which of the following statement measures the financial position of the entity on particular time?

Income statement

Balance sheet

Cash Flow statement

Statement of Retained earning

The supervisor salary is treated as:

Direct labor cost

Indirect labor coat

Conversion cost

None of the given options

Indirect Cost Examples include:

Wages of supervisor, cleaning material and workshop insurance.

The main purpose of cost accounting is to:

Maximize profits

Help inventory valuation

Provide information to management for decision making

Aid in the fixation of selling price

An organization sold units 4000 and have closing finished goods 3500 units and opening finished

goods units were 1000. The quantity of unit produced would be:

By: Mudassar Gillani

7500 units

6500 units

4500 units

8500 units.

Units produced = Units sold + Closing finished goods units - Opening finished goods units

Q.1)Cost is expenditure incurred.

A.TRUE

B.FALSE

Q.2)Accounting has ____________ branches

A.1

B.2

C.3

D.4

Q.3)Cost that can be traced in full to the product or services is called

A.Direct Cost

B.Indirect Cost

Q.4)Direct Material + Direct Labor + other direct cost =

A.Prime Cost

B.Factory OverHead (FOH)

C.Conversion Cost

D.None

Q.5) A firm Uses its own capital or Uses its owner's time and/or financial resources

both are examples of ____________

A.Implicit Cost

B.Explicit Cost

Explanation

A cost that is represented by lost opportunity in the use of a company's own

resources, excluding cash

These are intangible costs that are not easily accounted for. For example, the time

and effort that an owner puts into the maintenance of the company rather than

working on expansion

Q.6) accounting is always a language of business

A.TRUE

By: Mudassar Gillani

B.FALSE

Q.7) If Direct Material = 12,000

Direct Labor = 8000

other Direct Cost = 2000 then what will be the Prime Cost?

A.12000

B.14000

C.20000

D.22000

Q.8) Financial Accounting is a branch of management accounting.

A.TRUE

B.FALSE

Q.9) _________________ is a Predetermine cost of the units.

A.Standard cost (correct answer)

B.Implicit Cost

C.Product Cost

D.None

Explanation

The budgeted or planned cost of material, labour, or overheads expected to be

paid during a given accounting period.

standard cost- The normal or specified cost used as the basis for measurement

against an actual. Standard costs for manufactured items include labor, material

and overhead, and vendor acquisition, freight, duty fees and other categories for

purchased items.

Q.10 Wage, Rent & Materials are examples of ____________.

)

A.Implicit Cost

B.Explicit Cost

Explanation

A business expense that is easily identified and accounted for. Explicit costs

represent clear, obvious cash outflows from a business that reduce its bottom-line

profitability. This contrasts with less-tangible expenses such as goodwill

amortization, which are not as clear cut regarding their effects on a business's

bottom-line value

Good examples of explicit costs would be items such as wage expense, rent or

lease costs, and the cost of materials that go into the production of goods. With

these expenses, it is easy to see the source of the cash outflow and the business

activities to which the expense is attributed

By: Mudassar Gillani

Q.11 An investor invests in stock exchange he foregoes the opportunity to invest further

) in his hotel. The profit which the investor will be getting from the hotel is

_________________.

A.opportunity cost

B.Period Cost

C.Product Cost

D.Historical Cost

Explanation

1. The cost of an alternative that must be forgone in order to pursue a certain

action. Put another way, the benefits you could have received by taking an

alternative action.

2. The difference in return between a chosen investment and one that is

necessarily passed up. Say you invest in a stock and it returns a paltry 2% over

the year. In placing your money in the stock, you gave up the opportunity of

another investment - say, a risk-free government bond yielding 6%. In this

situation, your opportunity costs are 4% (6% - 2%)

Q.12 Cost is classified in _____________ categories.

)

A.1

B.2

C.3

D.4

Q.13 Cost Accounting is an art of Recording , Classifying, summarizing, Reporting,

) Interpreting of the Financial Information.

A.TRUE

B.FALSE

Q.14 Management Accounting deals with Ascertainment, Measurement, Accumulation,

) Budgeting & Evaluating cost structure of the entity.

A.True

B.FALSE

Explanation

Its done by Cost Accounting

Q.15 Accounting is a language of ________________.

)

A.Accountants

B.Mathematics

C.Mathematics

By: Mudassar Gillani

D.NONE

Q.16 _________________ is the cost that is subject to actual payment or will be paid

) for in future.

A.Implicit Cost

B.Explicit Cost

Explanation

A business expense that is easily identified and accounted for. Explicit costs

represent clear, obvious cash outflows from a business that reduce its bottom-line

profitability. This contrasts with less-tangible expenses such as goodwill

amortization, which are not as clear cut regarding their effects on a business's

bottom-line value

Good examples of explicit costs would be items such as wage expense, rent or

lease costs, and the cost of materials that go into the production of goods. With

these expenses, it is easy to see the source of the cash outflow and the business

activities to which the expense is attributed.

Q.17 Indirect cost is also known as overhead cost.

)

A.True

B.False

Explanation

Indirect Cost/Overhead Cost

An indirect cost or overhead cost is a cost that is incurred in the course of

producing product or rendering service, but which cannot be traced in the product

or service in full.

Expenditure incurred on labor, material or other services which cannot be

economically identified

with a specific cost product or service (cost unit).

Examples include: Wages of supervisor, cleaning material, workshop insurance

Q.18 Direct Labour + Other Direct Cost + FOH =

)

A.Prime Cost

B.Factory OverHead (FOH)

C.Conversion Cost

D.None

Q.19 ____________ is verifiable through invoices/agreements.

)

A.Opportunity Cost

B.Product Cost

C.Period Cost

D.Historical Cost

Q.20 Cost Accounting deals with decisions relating to the generation & effective

) utilization of the financial resources of an entity.

By: Mudassar Gillani

A.TRUE

B.FALSE

Explanation

Its done by Management Accounting.

By: Mudassar Gillani

Das könnte Ihnen auch gefallen

- Cat/fia (Ma2)Dokument12 SeitenCat/fia (Ma2)theizzatirosli50% (2)

- LAS ABM - FABM12 Ic D 5 6 Week 2Dokument7 SeitenLAS ABM - FABM12 Ic D 5 6 Week 2ROMMEL RABONoch keine Bewertungen

- Summary Notes - Accounting For Manufacturing PDFDokument14 SeitenSummary Notes - Accounting For Manufacturing PDFnicole sisonNoch keine Bewertungen

- Basic Accounting MCQsDokument22 SeitenBasic Accounting MCQsOrtyomNoch keine Bewertungen

- MAS MIDTERM EXAM 1ST SEM AY2017-18 - With AnswersDokument19 SeitenMAS MIDTERM EXAM 1ST SEM AY2017-18 - With AnswersUy Samuel100% (1)

- Chapter 3 Cost IDokument64 SeitenChapter 3 Cost IBikila MalasaNoch keine Bewertungen

- Session On Expenses and Introduction To Income StatementDokument39 SeitenSession On Expenses and Introduction To Income Statementtonyferg140820Noch keine Bewertungen

- List of Basic Accounting McqsDokument11 SeitenList of Basic Accounting Mcqsalc4levelsNoch keine Bewertungen

- MANAGERIAL ACCOUNTING - Test 1Dokument5 SeitenMANAGERIAL ACCOUNTING - Test 1Saad AhmedNoch keine Bewertungen

- MAS Compilation of QuestionsDokument14 SeitenMAS Compilation of QuestionsKatrina AngelicaNoch keine Bewertungen

- 102 Test No. 3 Solutions KeeperDokument17 Seiten102 Test No. 3 Solutions KeepergirlyserendipityNoch keine Bewertungen

- NtantDokument6 SeitenNtantmahedreNoch keine Bewertungen

- Managerial Accounting-QuizDokument11 SeitenManagerial Accounting-QuizPrincessNoch keine Bewertungen

- Q1 LAS 3 FABM2 12 Week 2 3Dokument7 SeitenQ1 LAS 3 FABM2 12 Week 2 3Flare ColterizoNoch keine Bewertungen

- MG WE FNSACC517 Provide Management Accounting InformationDokument9 SeitenMG WE FNSACC517 Provide Management Accounting InformationGurpreet KaurNoch keine Bewertungen

- Test 3 FALL 2011 AcctDokument15 SeitenTest 3 FALL 2011 AcctAndy LauNoch keine Bewertungen

- MBA - Buss Acc and Finance - 1 - RDokument10 SeitenMBA - Buss Acc and Finance - 1 - RNikesh MunankarmiNoch keine Bewertungen

- Cost AccountingDokument27 SeitenCost AccountingLkjiklNoch keine Bewertungen

- Final Accounts: Receipts & Expenditure Adjustment & Closing Entries Final Accounts of Manufacturing ConcernsDokument9 SeitenFinal Accounts: Receipts & Expenditure Adjustment & Closing Entries Final Accounts of Manufacturing ConcernsVidhi Patel100% (1)

- Illustrative Exercises On Cost Terms and BehaviorDokument7 SeitenIllustrative Exercises On Cost Terms and BehaviorTherence LaguaNoch keine Bewertungen

- Business Managmenet HL Finance and Accounts - Introduction To FinanceDokument7 SeitenBusiness Managmenet HL Finance and Accounts - Introduction To FinanceAlyasin FrougaNoch keine Bewertungen

- Fabm2 WK2Dokument3 SeitenFabm2 WK2john lester pangilinanNoch keine Bewertungen

- Ans: D: Multiple ChoiceDokument14 SeitenAns: D: Multiple ChoiceNah HamzaNoch keine Bewertungen

- Mas 2 Departmental ExamzDokument8 SeitenMas 2 Departmental ExamzjediiikNoch keine Bewertungen

- Chapter 2 MULTIPLE CHOICES QUESTIONSDokument8 SeitenChapter 2 MULTIPLE CHOICES QUESTIONSPacaña, Vincent Michael M.Noch keine Bewertungen

- Q2las4 1Dokument9 SeitenQ2las4 1Justine BuenaventuraNoch keine Bewertungen

- Pre FinalDokument8 SeitenPre Finalpdmallari12Noch keine Bewertungen

- Bainte1l Quiz 3 Final Period 1trisem 2022-2023Dokument14 SeitenBainte1l Quiz 3 Final Period 1trisem 2022-2023chen.lauriadaNoch keine Bewertungen

- Cost Accounting QuestionsDokument52 SeitenCost Accounting QuestionsEych Mendoza67% (9)

- 2nd Evaluation Exam Key FINALDokument7 Seiten2nd Evaluation Exam Key FINALChristian GeronimoNoch keine Bewertungen

- Final Exammm 3Dokument10 SeitenFinal Exammm 3Marianne Adalid MadrigalNoch keine Bewertungen

- General Instructions: Write All Your Answers in The Assignment Notebook Only. Answers Will Be Declared Later This Week. True or FalseDokument5 SeitenGeneral Instructions: Write All Your Answers in The Assignment Notebook Only. Answers Will Be Declared Later This Week. True or FalseIrishNoch keine Bewertungen

- LEARNERS COPY FABM2 CHAPTER 2 Statement of Comprehensive IncomeDokument10 SeitenLEARNERS COPY FABM2 CHAPTER 2 Statement of Comprehensive IncomeAliyha MendozaNoch keine Bewertungen

- Write Advantages and Disadvantages of Cost AccountingDokument6 SeitenWrite Advantages and Disadvantages of Cost AccountingAditya ManglamNoch keine Bewertungen

- ACF L 4 ExamDokument5 SeitenACF L 4 ExamJemal SeidNoch keine Bewertungen

- A5 MockDokument13 SeitenA5 MockEjaz KhanNoch keine Bewertungen

- Chapter 11 Reporting and Analyzing The Statement of Cash Flows PDFDokument66 SeitenChapter 11 Reporting and Analyzing The Statement of Cash Flows PDFDyenNoch keine Bewertungen

- Discussion 3 FinanceDokument7 SeitenDiscussion 3 Financepeter njovuNoch keine Bewertungen

- Intermediate AccountingDokument12 SeitenIntermediate AccountingLeah BakerNoch keine Bewertungen

- (New) Acc 561 Acc561 Final Exam Entire Answers With Questions Correct 100%Dokument5 Seiten(New) Acc 561 Acc561 Final Exam Entire Answers With Questions Correct 100%triskilie0% (1)

- BCA Unit 4 Cost and Revenue CurvesDokument24 SeitenBCA Unit 4 Cost and Revenue CurvesRupesh ThakurNoch keine Bewertungen

- Saa Group Cat TT7 Mock 2011 PDFDokument16 SeitenSaa Group Cat TT7 Mock 2011 PDFAngie NguyenNoch keine Bewertungen

- Cost - Accounting 04122022-1Dokument30 SeitenCost - Accounting 04122022-1Mohamed SamerNoch keine Bewertungen

- AssigmentDokument20 SeitenAssigmentEricka SantiagoNoch keine Bewertungen

- Midterm Exam-Fabm2Dokument4 SeitenMidterm Exam-Fabm2je-ann montejoNoch keine Bewertungen

- Questionnaires Auditing Quiz 2Dokument10 SeitenQuestionnaires Auditing Quiz 2Engel QuimsonNoch keine Bewertungen

- Mid Term Assessment - Accounting For Managers (D) - Summer 2021Dokument5 SeitenMid Term Assessment - Accounting For Managers (D) - Summer 2021Hole StudioNoch keine Bewertungen

- Joacent Brix Tamalla BSA - 2A Cost Accounting & ControlDokument8 SeitenJoacent Brix Tamalla BSA - 2A Cost Accounting & Controljaocent brixNoch keine Bewertungen

- Food Costs Supervisory SalariesDokument11 SeitenFood Costs Supervisory SalariesJames CrombezNoch keine Bewertungen

- Questions For ExamDokument9 SeitenQuestions For ExamjojoinnitNoch keine Bewertungen

- Examination Paper: Instruction To CandidatesDokument11 SeitenExamination Paper: Instruction To CandidatesNikesh MunankarmiNoch keine Bewertungen

- Mangament AccountingDokument17 SeitenMangament AccountingDue WellNoch keine Bewertungen

- Measuring Product CostsDokument71 SeitenMeasuring Product CostsNitin100% (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageVon EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageBewertung: 5 von 5 Sternen5/5 (1)

- 1040 Exam Prep Module X: Small Business Income and ExpensesVon Everand1040 Exam Prep Module X: Small Business Income and ExpensesNoch keine Bewertungen

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesVon EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNoch keine Bewertungen

- Cost & Managerial Accounting II EssentialsVon EverandCost & Managerial Accounting II EssentialsBewertung: 4 von 5 Sternen4/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsVon EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNoch keine Bewertungen

- MCQ'S Financial Accounting.Dokument36 SeitenMCQ'S Financial Accounting.Syed Mudassar GillaniNoch keine Bewertungen

- Cost & Management Accounting Solved MCQ'S: Each Service Department in Turn and Re-Allocates Its Costs To All DepartmentsDokument22 SeitenCost & Management Accounting Solved MCQ'S: Each Service Department in Turn and Re-Allocates Its Costs To All DepartmentsSyed Mudassar GillaniNoch keine Bewertungen

- Leave FormDokument32 SeitenLeave FormSyed Mudassar GillaniNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 141441493Dokument1 SeiteIncome Tax Payment Challan: PSID #: 141441493Syed Mudassar GillaniNoch keine Bewertungen

- Future Worktech Forum 2020 19-20 August, 2020 Virtual EventDokument5 SeitenFuture Worktech Forum 2020 19-20 August, 2020 Virtual EventSyed Mudassar GillaniNoch keine Bewertungen

- Best Choice..Easy Service..High Value: MGT 402 Cost & Management Accounting Solved MCQ'SDokument22 SeitenBest Choice..Easy Service..High Value: MGT 402 Cost & Management Accounting Solved MCQ'SSyed Mudassar GillaniNoch keine Bewertungen

- Gazette of PakistanDokument7 SeitenGazette of PakistanSyed Mudassar Gillani100% (1)

- HRM Mcom Version 2Dokument2 SeitenHRM Mcom Version 2Syed Mudassar GillaniNoch keine Bewertungen

- Insem - Qse Ii - Question Bank For StudentsDokument3 SeitenInsem - Qse Ii - Question Bank For StudentsshaolinNoch keine Bewertungen

- Fielder Budget & Forecasting - TechnicalDokument74 SeitenFielder Budget & Forecasting - TechnicalKiran PNoch keine Bewertungen

- MAS PreweekDokument46 SeitenMAS PreweekJoy Bernadette GruesoNoch keine Bewertungen

- Drum FilterDokument1 SeiteDrum FilterKarthimeena MeenaNoch keine Bewertungen

- 19 Process CostingDokument30 Seiten19 Process Costingsabinaeghan1Noch keine Bewertungen

- Chapter 5 Factory Overhead Accounting ExercisesDokument10 SeitenChapter 5 Factory Overhead Accounting ExercisesxicoyiNoch keine Bewertungen

- Hospital CostingDokument29 SeitenHospital CostingShardulWaikar50% (2)

- Standard CostingDokument18 SeitenStandard Costingpakistan 123Noch keine Bewertungen

- 5.FORMWORK Built Up RatesDokument14 Seiten5.FORMWORK Built Up RatesCarol Jan100% (2)

- Course Outline - ACT422 BRAC UniversityDokument4 SeitenCourse Outline - ACT422 BRAC UniversitySaiyan IslamNoch keine Bewertungen

- Cost Mock Test Paper 2Dokument7 SeitenCost Mock Test Paper 2Soul of honeyNoch keine Bewertungen

- Budgeting For Profit and Control - StuDokument42 SeitenBudgeting For Profit and Control - StuAlexis Kaye DayagNoch keine Bewertungen

- Ias 2Dokument16 SeitenIas 2Kazi93_thefatNoch keine Bewertungen

- Chapter 8 Solutions: Solutions To Questions For Review and DiscussionDokument37 SeitenChapter 8 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzNoch keine Bewertungen

- Chapter 4 - Job Order and Process CostingDokument12 SeitenChapter 4 - Job Order and Process Costingchelsea kayle licomes fuentesNoch keine Bewertungen

- Maricopa Corporation Is Developing Departmental Overhead Rates BDokument1 SeiteMaricopa Corporation Is Developing Departmental Overhead Rates BAmit PandeyNoch keine Bewertungen

- Cost and Management Accounting MCQDokument17 SeitenCost and Management Accounting MCQKhushbu Kumari100% (1)

- YuurwDokument37 SeitenYuurwagnesNoch keine Bewertungen

- Swaraj Mazda Limited A Project Report On Working Capital ManagementDokument84 SeitenSwaraj Mazda Limited A Project Report On Working Capital ManagementVivek Nayak100% (3)

- Indirect Cost in Primavera P6Dokument4 SeitenIndirect Cost in Primavera P6shahidbolar100% (1)

- Tutorial Questions CVPDokument6 SeitenTutorial Questions CVPChristopher LoisulieNoch keine Bewertungen

- Costing JK ShawDokument289 SeitenCosting JK Shawtholkappiyanjk14Noch keine Bewertungen

- Book 1Dokument7 SeitenBook 1Ankit pattnaikNoch keine Bewertungen

- Manufacturing AccountsDokument11 SeitenManufacturing Accountslukamasia100% (1)

- Job Order Costing QuestionsDokument2 SeitenJob Order Costing QuestionsPASCHAL IBELENoch keine Bewertungen

- The Institute of Chartered Accountants of PakistanDokument4 SeitenThe Institute of Chartered Accountants of PakistanShehrozSTNoch keine Bewertungen

- Master BudgetDokument10 SeitenMaster BudgetFareha Riaz0% (1)

- Cost Estimation Tutorial SolutionDokument11 SeitenCost Estimation Tutorial Solutionmichellebaileylindsa100% (1)

- 1 FNSACC507 Provide Management Accounting InformationDokument79 Seiten1 FNSACC507 Provide Management Accounting InformationSyed Bilal Ali89% (9)

- Jamil - 1418 - 2494 - 1 - Cost and Management Accounting (Summer 2021)Dokument2 SeitenJamil - 1418 - 2494 - 1 - Cost and Management Accounting (Summer 2021)kashif aliNoch keine Bewertungen