Beruflich Dokumente

Kultur Dokumente

Chapter 2 Introduction To Money

Hochgeladen von

Remar22Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 2 Introduction To Money

Hochgeladen von

Remar22Copyright:

Verfügbare Formate

INTRODUCTION TO MONEY

ROLE OF MONEY IN THE ECONOMY

• Money is any item or commodity that is generally accepted as a means of payment for goods and services.

• It is use for repayment of debt.

• It serves as an asset to its holder.

On the simplest level, money is composed of the bills and coins which have been printed or minted by the National Government (these are called

currency). But money also includes the funds stored as electronic entries in one's checking account and savings account.

Money is the oil that keeps the machinery of our world turning. It facilitates the billions of transactions that take place every day. Without it, the

industry and trade that form the basis of modern economies would grind to a halt and the flow of wealth around the world would cease.

Today it is the nation's government and central bank that control a country' economy. The Federal Reserve (known as "The Fed") is the central bank in

the US. In the Philippines, the central bank that controls the country's economy is the "Bangko Sentral ng Pilipinas".

CHARACTERISTICS AND KEY FUNCTIONS OF MONEY

Money must have value, be durable, portable, uniform, divisible, in limited supply, and be usable as a means of exchange.

• Store of value - Money acts as a means by which people can store their wealth for future use. It must not, therefore, be perishable, and it helps if

it is of a practical size that can be stored and transported easily.

• Item of worth - Most money originally has an intrinsic value, such as that of the precious metal that was used to make the coin. This in itself acted

as some guarantee the coin would be accepted.

• Means of exchange - It must be possible to exchange money freely and widely for goods, and its value should be as stable as possible. It helps if

that value is easily divisible and if there are sufficient denominations so change can be given.

• Unit of account - Money can be used to record wealth possessed, traded or spent-personally and nationally. It helps if only one recognized

authority issues money. If anybody could issue it, then trust in its value would disappear.

• Standard of Deferred Payment - Money is also useful because of its ability to serve as a standard of deferred payment. Money can facilitate

exchange at a given point by providing a medium of exchange and unit of account.

THE EVOLUTION OF MONEY

1. Barter (10,000 — 3000BCE) - In early forms of trading, specific items were exchanged for others agreed by the negotiating parties to be of similar

value. Barter — the direct exchange of goods — formed the basis of trade for thousands of years. Adam Smith, 18th-century author of The Wealth

of Nations, was one of the first to identify it as a precursor to money.

Advantages of Barter

• Trading relationship - Fosters strong links between partners.

• Physical goods are exchanged - Barter does not rely on trust that money will retain its value.

Disadvantages

• Market needed - Both parties must want what the other offers.

• Hard to establish a set value on items - Two goats may have a certain value to one party one day, but less a week later.

• Goods may not be easily divisible - For example, a living animal cannot be divided.

• Large-scale transactions can be difficult. - Transporting one goat is easy, moving 1,000 is not.

2. Evidence of trade records (7000 BCE) - Pictures of items were used to record trade exchanges, becoming more complex as values were established

and documented.

3. Coinage (600 BCE -1100 BCE) - Defined weights of precious metals used by some merchants were later formalized as coins that were usually issued

by states.

4. Bank notes (1100-2000) - States began to use bank notes, issuing paper IOUs that were traded as currency, and could be exchanged for coins at

any time.

5. Digital money (2000 onward) - Money can now exist "virtually," on computers, and large transactions can take place without any physical cash

changing hands.

ARTIFACTS OF MONEY

1. Barter (5000BCE) – Early trade involved directly exchanged items— often perishable ones such as a cow.

2. Sumerian cuneiform tablets (4000BCE) – Scribes recorded transactions on clay tablets, which could also act as receipts.

3. Cowrie shells (1000BCE) – Used As currency across India and the South Pacific, they appeared in many color and sizes.

4. Lydian gold coins (600BCE) – a mixture of gold and silver was formed into disks, or coins, stamped with inscriptions.

5. Athenian drachma (600BCE) – The Athenians used silver from Laurion to mint a currency used across the Greek world.

6. Han dynasty coin (200BCE) – Often made of bronze or copper, early Chinese coins had holes pinched in their center.

7. Roman coin (27BCE) – Bearing the head of the emperor, these coins circulated throughout the Roman Empire.

8. Byzantine coin (700CE) - Early Byzantine coins were pure gold; later ones also contained metals such as copper.

9. Anglo-Saxon coin (900CE) – This 10th century silver penny has an inscription stating that Offa is King (“rex”) of Mercia.

10. Arabic dirham (900CE) – Many silver coins from the Islamic empire were carried to Scandinavia by Vikings.

THE ECONOMICS OF MONEY

1. Potosi inflation (1540-1640) - The Spanish discovered silver in Potosi, Bolivia, and caused a century of inflation by shipping 350 tons of the metal

back to Europe annually.

2. The great debasement (1542-1551) - England's Henry VIII debased the silver penny, making it three-quarters copper. Inflation increased as trust

dropped.

3. Early joint-stock companies (1553) - Merchants in England began to form companies in which investors bought shares (stock) and shared its

rewards.

4. Bank of England (1694) - The Bank of England was created as a body that could raise funds at a low interest rate and manage national debt.

5. The Royal Mint (1696) - Isaac Newton became Warden and argued that debasing undermined confidence. All coins were recalled and new silver

ones were minted.

6. US dollar (1775) - The Continental Congress authorized the issue of United States dollars in 1775, but the first national currency was not minted

by the US Treasury until 1794.

7. Gold Standard (From 1844) - The British pound was tied to a defined equivalent amount of gold. Other countries adopted a similar Gold Standard.

8. Credit Cards (1970s) - The creation of credit cards enabled consumers to access short-term credit to make smaller purchases. This resulted in the

growth of personal debt.

9. Digital Money (1990s) - The easy transfer of funds and convenience of electronic payments became increasingly popular as internet use increased.

10. Euro (1999) - Twelve EU countries joined together and replaced their national currencies with the Euro. Bank notes and coins were issued three

years later.

11. Bitcoin (2008) - Bitcoin — a form of electronic money that exists solely as encrypted data on servers — is announced. The first transaction took

place in January 2009.

HISTORY OF MONEY IN THE PHILIPPINES

1. Pre-Spanish Regime - Prior to the coming of the Spanish in 1521, the Philippine was already trading with neighboring countries such as China, Java

and Macau. Through the prevailing medium of exchange was barter, some coins were circulating in the Philippines as early as the 8th century.

2. Spanish Regime - The Spanish introduced coins in the Philippines when they colonized the country in 1521.

3. American Regime - The country's first local currency, the Philippine Peso, was introduced replacing the Spanish-Filipino Peso. The Philippine

National Bank was authorized to issue Philippine Bank Notes.

4. Japanese Regime - The Japanese issued the Japanese War Notes. There bills had no reserves nor backed up by any government asset and were

called "mickey mouse" money.

5. Post-War Period

• In 1944, the Philippine Commonwealth was established under President Sergio Osmenia. All Japanese currencies circulating in the Philippines

were declared illegal, all banks were closed and all Philippine National Bank notes were withdrawn from circulation.

• The new treasury certificate (called Victory Money) were printed in P500, P200, P100, P50, P20, P10, P5, P2 and P1 denominations with the

establishment of the Central Bank.

• In 1949, a new currency called "Central Bank Notes" was issued.

• In 2010 the Central Bank launched the "New Generation Currency"

• In 2018, the New Generation Currency Coin series were put in circulation.

THE SUPPLY AND DEMAND FOR MONEY

Money facilitates the flow of resources in the circular model of macroeconomy. Not enough money will slow down the economy, and too much money

can cause inflation because of higher price levels. Either way, monitoring the supply and demand for money is vital for the e conomy's central bank's

monetary policy, which aims to stabilize price levels and to support economic growth.

The Key Measures for the Money Supply are:

• M1. The narrowest measure of the money supply. It includes currency in circulation held by the nonbank public, demand deposits, other checkable

deposits, and traveler's checks. M1 refers primarily to money used as a medium of exchange.

• M2. In addition to M1, this measure includes money held in savings deposits, money market deposit accounts, noninstitutional money market

mutual funds and other short-term money market assets (e.g., "overnight" Eurodollars). M2 refers primarily to money used as a store of value.

• M3. In addition to M2, this measure includes the financial institutions, (e.g., large-denomination time deposits and term Eurodollars). M3 refers

primarily to money used as a unit of account.

• L. In addition to M3, this measure includes liquid and near-liquid (e.g., short-term Treasury notes, high-grade commercial paper an acceptance

notes).

The Demand for Money

The Sources of the Demand for Money are:

• Transaction demand. Money demanded for day-to-day payments through balances held by households and firms (instead of stocks, bonds or

other assets). This kind of demand varies with GDP; it does not depend on the rate of interest.

• Precautionary demand. Money demanded as a result of unanticipated payments. This kind of demand varies with GDP.

• Speculative demand. Money demanded because of expectations about interest rates in the future. This means that people will decide to expand

their money balances and hold off on bond purchases if they expect interest rates to rise. This kind of demand has a negative relationship with

the interest rate.

THE IMPACT OF MONEY

Higher interest rates will decrease investment because it becomes more expensive to borrow money, and will also decrease consumption because

consumers will tend to, save more as interest rate returns increase. In addition, as higher Philippine interest rates increase the demand for pesos on

the foreign exchange markets (because of the higher returns on Philippines deposits), the higher pesos will decrease exports by making them

increasingly expensive. This means that real GDP growth and the inflation rate slow when the BSP raises the interest rate. The reverse occurs when the

interest rate is lowered.

THE QUANTITY THEORY OF MONEY

The quantity theory of money holds that changes in the money supply MS directly influences the economy's price level, but nothing else. This theory

follows from the equation of exchange:

MxV=PxY

where M= quantity of money

V = velocity of money (i.e., the average number of times a unit of money is used during a year to purchase GDP's goods and services)

P = price level

Y= real GDP

THE TIME VALUE OF MONEY

Interest is defined as the cost of using money over time. This definition is in close agreement with the definition used by economists, who prefer to say

that interest represents the time value of money.

Present Value

The concept of present value (or present discounted value) is based on the commonsense notion that a peso of cash flow paid to you one year from

now is less valuable to you than a peso paid to you today.

Das könnte Ihnen auch gefallen

- Introduction On MoneyDokument34 SeitenIntroduction On MoneyJoseph sunday CarballoNoch keine Bewertungen

- Unit 9 - Exchange Rate KeyDokument7 SeitenUnit 9 - Exchange Rate KeyBò SữaNoch keine Bewertungen

- A Detailed Lesson Plan in Mapeh - Music GRADE - 7 (4 Quarter)Dokument6 SeitenA Detailed Lesson Plan in Mapeh - Music GRADE - 7 (4 Quarter)Remar22100% (6)

- Chapter 10: Mortgage Markets and DerivativesDokument6 SeitenChapter 10: Mortgage Markets and DerivativesRemar22Noch keine Bewertungen

- AP Macro Unit 4 SummaryDokument45 SeitenAP Macro Unit 4 SummarySikandar KhattakNoch keine Bewertungen

- q1 Business Math Module 7Dokument20 Seitenq1 Business Math Module 7Reigi May50% (2)

- Lesson 2 LectureDokument17 SeitenLesson 2 LectureQueeny CuraNoch keine Bewertungen

- Concept of Money Group2 1 3Dokument47 SeitenConcept of Money Group2 1 3Danica ZabalaNoch keine Bewertungen

- Money Banking CHAPTER TWO AND THREEDokument62 SeitenMoney Banking CHAPTER TWO AND THREELeulNoch keine Bewertungen

- 6 BA 223 Banking and Financial Institutions ModuleDokument55 Seiten6 BA 223 Banking and Financial Institutions ModuleNika Abayan YakitNoch keine Bewertungen

- Papers Pamphlets The Measurement of Money SupplyDokument24 SeitenPapers Pamphlets The Measurement of Money SupplyNitesh AgrawalNoch keine Bewertungen

- Definition of MoneyDokument4 SeitenDefinition of MoneysofiaNoch keine Bewertungen

- Economic Policies and Growth and DevelopmentDokument64 SeitenEconomic Policies and Growth and DevelopmentUnknown 01Noch keine Bewertungen

- FinMar PrelimDokument6 SeitenFinMar PrelimCeline Therese BuNoch keine Bewertungen

- Dfi 211 Lecturer I-3Dokument40 SeitenDfi 211 Lecturer I-3CatherineNoch keine Bewertungen

- Mathematics in The Modern World First ModulePDF 2Dokument13 SeitenMathematics in The Modern World First ModulePDF 2jecille magalongNoch keine Bewertungen

- CH3 Money in The EconomyDokument30 SeitenCH3 Money in The EconomyIrish AlvaradoNoch keine Bewertungen

- FM4 ReviewerDokument11 SeitenFM4 ReviewerXa ShionNoch keine Bewertungen

- History of Philippine Money XXDokument7 SeitenHistory of Philippine Money XXBlezelle CalpitoNoch keine Bewertungen

- Money and BankingDokument15 SeitenMoney and BankingDj I amNoch keine Bewertungen

- The Overview of Money The History of Money: From Barter To BanknotesDokument9 SeitenThe Overview of Money The History of Money: From Barter To BanknotesfarahNoch keine Bewertungen

- لقطة شاشة 2024-01-13 في 4.24.15 مDokument17 Seitenلقطة شاشة 2024-01-13 في 4.24.15 مjihadaradni97Noch keine Bewertungen

- Business Finance LessonDokument2 SeitenBusiness Finance LessonAngelie JalandoniNoch keine Bewertungen

- Unit 1: Money and BankingDokument48 SeitenUnit 1: Money and BankingAbhikaam SharmaNoch keine Bewertungen

- Currency: From Wikipedia, The Free EncyclopediaDokument8 SeitenCurrency: From Wikipedia, The Free Encyclopediasandeep_s333Noch keine Bewertungen

- Money and BankingDokument18 SeitenMoney and BankingAnnu BidhanNoch keine Bewertungen

- Chapter 9-Money - Pagapong Jaiprely PreciousDokument16 SeitenChapter 9-Money - Pagapong Jaiprely PreciousJaiprely PagapongNoch keine Bewertungen

- Finance 1, Philippine MoneyDokument46 SeitenFinance 1, Philippine MoneyAbegail Uyaco-Salvador92% (12)

- Introducing MoneyDokument63 SeitenIntroducing MoneyReyzza Mae EspenesinNoch keine Bewertungen

- CH 1 Money and Banking PrincipleDokument14 SeitenCH 1 Money and Banking Principleananya tesfayeNoch keine Bewertungen

- Monetary Policy and Central Banking Role of Money in Nation's EconomyDokument2 SeitenMonetary Policy and Central Banking Role of Money in Nation's EconomyJessa CastanedaNoch keine Bewertungen

- Finma ReviewerDokument129 SeitenFinma ReviewerMIAKAHNoch keine Bewertungen

- Module 2Dokument9 SeitenModule 2Jonna EsquilunaNoch keine Bewertungen

- Financial Marekts (Chapter 2)Dokument3 SeitenFinancial Marekts (Chapter 2)Kyla DayawonNoch keine Bewertungen

- Money and Finance IGCSE ECONOMICS Notes 2020Dokument3 SeitenMoney and Finance IGCSE ECONOMICS Notes 2020TYDK MediaNoch keine Bewertungen

- Money and Its Functions-StDokument10 SeitenMoney and Its Functions-StEmporasNoch keine Bewertungen

- MACRO 4.lecDokument6 SeitenMACRO 4.lecАдамNoch keine Bewertungen

- Evolution of MoneyDokument8 SeitenEvolution of MoneyUtkarshMalikNoch keine Bewertungen

- Money CreationDokument7 SeitenMoney CreationTrifan_DumitruNoch keine Bewertungen

- Types of Money: Money Is Any Object or Record That Is GenerallyDokument5 SeitenTypes of Money: Money Is Any Object or Record That Is GenerallyAngelNoch keine Bewertungen

- Basic Finance Chapter 1Dokument38 SeitenBasic Finance Chapter 1jayrenNoch keine Bewertungen

- Bfi Actvty 2Dokument9 SeitenBfi Actvty 2Bhebz Erin MaeNoch keine Bewertungen

- C1 Inroducing MoneyDokument4 SeitenC1 Inroducing MoneyRiza Mae Ramos AddatuNoch keine Bewertungen

- Money: Money Is Any Object That Is Generally Accepted As Payment For Goods and Services and Repayment ofDokument50 SeitenMoney: Money Is Any Object That Is Generally Accepted As Payment For Goods and Services and Repayment ofChetan Ganesh RautNoch keine Bewertungen

- Finance ProjectDokument13 SeitenFinance ProjectLhyNn Navarosa QuintanaNoch keine Bewertungen

- MoneyDokument6 SeitenMoneyMD. IBRAHIM KHOLILULLAHNoch keine Bewertungen

- MoneyDokument49 SeitenMoneyShalini Singh IPSANoch keine Bewertungen

- Module 10Dokument12 SeitenModule 10Trayle HeartNoch keine Bewertungen

- Money ReviewerDokument5 SeitenMoney ReviewerCalago, James Carlo V.Noch keine Bewertungen

- ContentDokument6 SeitenContentMulat Salegn TemesgenNoch keine Bewertungen

- Reviewer MPCBDokument7 SeitenReviewer MPCBMJ NuarinNoch keine Bewertungen

- CH1 The Role and Uses of MoneyDokument26 SeitenCH1 The Role and Uses of MoneyPatrisha Georgia AmitenNoch keine Bewertungen

- Plastic Money Full Project Copy ARNABDokument41 SeitenPlastic Money Full Project Copy ARNABarnab_b8767% (3)

- What Is MoneyDokument9 SeitenWhat Is MoneyMira Andriani100% (1)

- Macro 2Dokument89 SeitenMacro 2Kanchan MishraNoch keine Bewertungen

- Chapter 5Dokument27 SeitenChapter 5ArrianeNoch keine Bewertungen

- What Is MoneyDokument87 SeitenWhat Is MoneyJitendra GangwarNoch keine Bewertungen

- FM ReviewerDokument13 SeitenFM ReviewerCeiNoch keine Bewertungen

- Eco InvestigatoryDokument24 SeitenEco InvestigatoryVishnu PriyaaNoch keine Bewertungen

- Chapter 123 MonetaryDokument8 SeitenChapter 123 MonetaryMarlyn T. EscabarteNoch keine Bewertungen

- Monetary SystemsDokument160 SeitenMonetary Systemskiler2424Noch keine Bewertungen

- What Does Money Look Like In Different Parts of the World? - Money Learning for Kids | Children's Growing Up & Facts of Life BooksVon EverandWhat Does Money Look Like In Different Parts of the World? - Money Learning for Kids | Children's Growing Up & Facts of Life BooksNoch keine Bewertungen

- HANDOUT 1 - Overview of AccountingDokument3 SeitenHANDOUT 1 - Overview of AccountingRemar22Noch keine Bewertungen

- HANDOUT 3.0 - JournalizingDokument3 SeitenHANDOUT 3.0 - JournalizingRemar22Noch keine Bewertungen

- HANDOUT 5.0 Trial BalanceDokument2 SeitenHANDOUT 5.0 Trial BalanceRemar22Noch keine Bewertungen

- Debit Side Credit Side: General JournalDokument2 SeitenDebit Side Credit Side: General JournalRemar22Noch keine Bewertungen

- HANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemDokument3 SeitenHANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemRemar22Noch keine Bewertungen

- HANDOUT 3.0 - JournalizingDokument3 SeitenHANDOUT 3.0 - JournalizingRemar22Noch keine Bewertungen

- FINMAR Group2 InterestRatesDokument1 SeiteFINMAR Group2 InterestRatesRemar22Noch keine Bewertungen

- HANDOUT 3.0 - JournalizingDokument3 SeitenHANDOUT 3.0 - JournalizingRemar22Noch keine Bewertungen

- Debit Side Credit Side: General JournalDokument2 SeitenDebit Side Credit Side: General JournalRemar22Noch keine Bewertungen

- HANDOUT 5.0 Trial BalanceDokument2 SeitenHANDOUT 5.0 Trial BalanceRemar22Noch keine Bewertungen

- HANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemDokument3 SeitenHANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemRemar22Noch keine Bewertungen

- HANDOUT 1 - Overview of AccountingDokument3 SeitenHANDOUT 1 - Overview of AccountingRemar22Noch keine Bewertungen

- Subic Mobymix Trading, Inc. Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar Year 2016Dokument5 SeitenSubic Mobymix Trading, Inc. Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar Year 2016Remar22Noch keine Bewertungen

- Chapter 5 and 6 Financial SystemDokument7 SeitenChapter 5 and 6 Financial SystemRemar22Noch keine Bewertungen

- Chapter 8Dokument7 SeitenChapter 8Remar22Noch keine Bewertungen

- HANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemDokument3 SeitenHANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemRemar22Noch keine Bewertungen

- Fixed Exchange Rate System - Under This System, All Countries Were Required To Set A SpecificDokument3 SeitenFixed Exchange Rate System - Under This System, All Countries Were Required To Set A SpecificRemar22Noch keine Bewertungen

- Handout 2 - Professional Environment of Cost ManagementDokument2 SeitenHandout 2 - Professional Environment of Cost ManagementRemar22100% (1)

- HANDOUT 1 - Overview of AccountingDokument3 SeitenHANDOUT 1 - Overview of AccountingRemar22Noch keine Bewertungen

- HANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemDokument3 SeitenHANDOUT 2 - Introduction To Accouting Equation and Double Entry SYstemRemar22Noch keine Bewertungen

- Handout 4 Strategy and Master BudgetDokument4 SeitenHandout 4 Strategy and Master BudgetRemar22Noch keine Bewertungen

- HANDOUT 1 - Overview of AccountingDokument3 SeitenHANDOUT 1 - Overview of AccountingRemar22Noch keine Bewertungen

- ECO403 MegaQuizFileECODokument123 SeitenECO403 MegaQuizFileECOXeroxNoch keine Bewertungen

- Mathematics in The Modern World AmortizationDokument5 SeitenMathematics in The Modern World AmortizationLeiLezia Dela Cruz100% (1)

- Samples of Solution Manual For Real Estate Finance and Investments 16th Edition by William B BrueggemanDokument4 SeitenSamples of Solution Manual For Real Estate Finance and Investments 16th Edition by William B BrueggemanMasumNoch keine Bewertungen

- Personal Finance 11th Edition Garman Test BankDokument24 SeitenPersonal Finance 11th Edition Garman Test Bankjohnvuaaefxh100% (28)

- Blanchard Ab - Macroeconomics.Ch03 4eDokument36 SeitenBlanchard Ab - Macroeconomics.Ch03 4eMuhammad Nadeem SarwarNoch keine Bewertungen

- Answer All: TEST 2 FIN 542 International Financial Management 2012Dokument5 SeitenAnswer All: TEST 2 FIN 542 International Financial Management 2012Janeahmadzack100% (1)

- English File 4th Edition Intermediate WorkbookDokument85 SeitenEnglish File 4th Edition Intermediate WorkbookElyce CattleNoch keine Bewertungen

- Regressive ExpectationsDokument4 SeitenRegressive ExpectationsNavratan ChoudharyNoch keine Bewertungen

- The Structural Causes of Mortgage FraudDokument30 SeitenThe Structural Causes of Mortgage FraudForeclosure Fraud100% (2)

- Recommended VendorsDokument1 SeiteRecommended Vendorsapi-26011493Noch keine Bewertungen

- SBA Guaranteed Loan Application FormsDokument1 SeiteSBA Guaranteed Loan Application FormsalexNoch keine Bewertungen

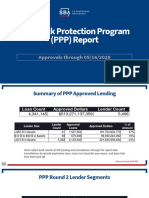

- PPP ReportDokument7 SeitenPPP ReportBrittany EtheridgeNoch keine Bewertungen

- Practice Problems 2Dokument19 SeitenPractice Problems 2SUBHA SHIVUMANoch keine Bewertungen

- Money Supply and Money Demand: MacroeconomicsDokument37 SeitenMoney Supply and Money Demand: MacroeconomicsHay JirenyaaNoch keine Bewertungen

- QuizDokument3 SeitenQuizmuhammad_sajid98Noch keine Bewertungen

- Islm ModelDokument7 SeitenIslm ModelPrastuti SachanNoch keine Bewertungen

- Chapter SolutionsDokument7 SeitenChapter SolutionsFakhir ZaidiNoch keine Bewertungen

- CIBIl GDokument38 SeitenCIBIl GAlok G ShindeNoch keine Bewertungen

- Hancock TheDokument52 SeitenHancock Theshubhkarman_sin2056Noch keine Bewertungen

- Form Nov 30, 2021Dokument1 SeiteForm Nov 30, 2021jagadish chandra prasadNoch keine Bewertungen

- Partial Discharge - NoteDokument1 SeitePartial Discharge - NotePrakruthi RanganathNoch keine Bewertungen

- Solution Manual For Economics of Money Banking and Financial Markets The Business School Edition 3rd Edition by Mishkin ISBN 0132741377 9780132741378Dokument14 SeitenSolution Manual For Economics of Money Banking and Financial Markets The Business School Edition 3rd Edition by Mishkin ISBN 0132741377 9780132741378daisyNoch keine Bewertungen

- Saunders 8e PPT Chapter07Dokument26 SeitenSaunders 8e PPT Chapter07sdgdfs sdfsfNoch keine Bewertungen

- Report On Interest Rates in NepalDokument12 SeitenReport On Interest Rates in NepalRupesh Shah100% (2)

- HW Assignment For Week 2:: FV PV × (1+ I) FV $ 2,000 × (1+0.06) FV $ 2,000 × (1,06) FV $ 2,676.45Dokument6 SeitenHW Assignment For Week 2:: FV PV × (1+ I) FV $ 2,000 × (1+0.06) FV $ 2,000 × (1,06) FV $ 2,676.45Lưu Gia BảoNoch keine Bewertungen

- 63 - Ankita Baburao Nighut-FDRM-Case Study 1Dokument4 Seiten63 - Ankita Baburao Nighut-FDRM-Case Study 1Ankita NighutNoch keine Bewertungen

- State Bank of Pakistan Consumer Protection Department: Consumer Credit Information ReportDokument2 SeitenState Bank of Pakistan Consumer Protection Department: Consumer Credit Information Reportabrar sabir0% (1)

- Term LoansDokument9 SeitenTerm LoansAbhishek .SNoch keine Bewertungen