Beruflich Dokumente

Kultur Dokumente

Solutiondone 2-134

Hochgeladen von

trilocksp SinghOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Solutiondone 2-134

Hochgeladen von

trilocksp SinghCopyright:

Verfügbare Formate

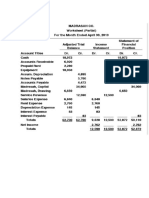

Based on the following information prepare a Statement of

Revenues

Based on the following information, prepare a Statement of Revenues, Expenses, and Changes

in Net Position for Hudgins County (government) Hospital for the year ended December 31,

20X7:Patient service charges (gross) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$14,000,000Premium fees earned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5,000,000Restricted contributions for heart research . . . . . . . . . . . . . . . . . . . . . . . .

20,000,000Medical record transcript fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

75,000Cafeteria sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150,000Restricted

contributions for specialized equipment purchases . . . . . . . . 6,500,000Unrestricted income from

endowments . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000,000Donated services. . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . 330,000Donated materials. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . 88,000Unrestricted contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . 550,000Nursing services expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7,850,000Other professional services expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5,400,000General services expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3,210,000Fiscal services expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

300,000Administrative expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

900,000Interest expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

440,000Depreciation expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,200,000Provision for uncollectibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

430,000Charity services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

375,000Contractual adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

950,000Equipment purchases paid from donor-restricted resources . . . . . . . . . . 3,750,300Also,

a term endowment restricted to heart research expired during the year. The foregoing expenses

include $800,000 payable from donor-restricted resources.View Solution: Based on the

following information prepare a Statement of Revenues

SOLUTION-- http://solutiondone.online/downloads/based-on-the-following-information-prepare-

a-statement-of-revenues/

Unlock answers here solutiondone.online

Das könnte Ihnen auch gefallen

- HFMA's Introduction to Hospital Accounting, Fifth EditionVon EverandHFMA's Introduction to Hospital Accounting, Fifth EditionNoch keine Bewertungen

- SOAL LATIHAN INTER 1 - Chapter 4Dokument14 SeitenSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- Solutiondone 2-270Dokument1 SeiteSolutiondone 2-270trilocksp SinghNoch keine Bewertungen

- Tugas 4 AKM - Kelompok 5 - 142200278Dokument13 SeitenTugas 4 AKM - Kelompok 5 - 142200278muhammad alfariziNoch keine Bewertungen

- Accounting ExerciseDokument6 SeitenAccounting Exercisenourhan hegazyNoch keine Bewertungen

- General Ledger Relationships Under and Over AllocationDokument1 SeiteGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNoch keine Bewertungen

- Gazarra Company Is A Very Profitable Small Business It HasDokument1 SeiteGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- Flexible Budget Variances Review of Chapters David James Is ADokument1 SeiteFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNoch keine Bewertungen

- Verizon Sample Bill PDFDokument55 SeitenVerizon Sample Bill PDFhash guruNoch keine Bewertungen

- SOCIAL WELFARE POLICIES PROGRAMS SERVICESDokument16 SeitenSOCIAL WELFARE POLICIES PROGRAMS SERVICESVilla Rose Zabala Raposas100% (2)

- Full Download Ebook PDF Health Promotion Programs From Theory To Practice 2nd Edition PDFDokument41 SeitenFull Download Ebook PDF Health Promotion Programs From Theory To Practice 2nd Edition PDFelizabeth.shannon124100% (33)

- ACCT336 Chapter23 SolutionsDokument7 SeitenACCT336 Chapter23 SolutionskareemrawwadNoch keine Bewertungen

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDokument1 SeiteThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNoch keine Bewertungen

- Intermedite AccountingDokument1 SeiteIntermedite AccountingNicolas ErnestoNoch keine Bewertungen

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDokument1 SeiteABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNoch keine Bewertungen

- Cash FlowsDokument6 SeitenCash FlowsZaheer AhmadNoch keine Bewertungen

- Solutiondone 2-157Dokument1 SeiteSolutiondone 2-157trilocksp SinghNoch keine Bewertungen

- 2010 06 24 - 172141 - P3 3aDokument4 Seiten2010 06 24 - 172141 - P3 3aVivian0% (1)

- Assign 1 FA2 SP 23Dokument2 SeitenAssign 1 FA2 SP 23AbdulNoch keine Bewertungen

- Assignment No 1Dokument15 SeitenAssignment No 1M Naveed SultanNoch keine Bewertungen

- 03 Course Notes On Statement of Cash Flows-2 PDFDokument4 Seiten03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNoch keine Bewertungen

- Ashley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouDokument1 SeiteAshley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouMiroslav GegoskiNoch keine Bewertungen

- 1 The Following Are The Estimated Revenues For A Special: Unlock Answers Here Solutiondone - OnlineDokument1 Seite1 The Following Are The Estimated Revenues For A Special: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNoch keine Bewertungen

- Problem 3,5,&8Dokument4 SeitenProblem 3,5,&8Mark CalapatanNoch keine Bewertungen

- Cost ManagementDokument5 SeitenCost ManagementSohag KhanNoch keine Bewertungen

- Jawaban S 3-2Dokument4 SeitenJawaban S 3-2Lamtiur LidiaqNoch keine Bewertungen

- The Following Information For The Year Ending December 31 2015Dokument1 SeiteThe Following Information For The Year Ending December 31 2015Muhammad ShahidNoch keine Bewertungen

- P 13-9A - SolutionDokument1 SeiteP 13-9A - SolutionMichelle GraciaNoch keine Bewertungen

- Additional Problem Chap 3 SolutionDokument6 SeitenAdditional Problem Chap 3 SolutionominNoch keine Bewertungen

- Solutiondone 2-207Dokument1 SeiteSolutiondone 2-207trilocksp SinghNoch keine Bewertungen

- Presented Here Is The Total Column of The Governmental FundsDokument1 SeitePresented Here Is The Total Column of The Governmental Fundstrilocksp SinghNoch keine Bewertungen

- SSGA US Government Money Market Annual ReportDokument61 SeitenSSGA US Government Money Market Annual ReportnickNoch keine Bewertungen

- AKM 1 Bab 3Dokument5 SeitenAKM 1 Bab 3alesha nindyaNoch keine Bewertungen

- Assignment After Week 6Dokument5 SeitenAssignment After Week 6MUHAMMAD JAHANGIRNoch keine Bewertungen

- Acct 3101 Chapter 05Dokument13 SeitenAcct 3101 Chapter 05Arief RachmanNoch keine Bewertungen

- Solution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54Dokument7 SeitenSolution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54ReilpeterNoch keine Bewertungen

- 3 Spreadsheet PR 3.5ADokument2 Seiten3 Spreadsheet PR 3.5ARizkyDirectioners'ZaynsterNoch keine Bewertungen

- Solutiondone 2-267Dokument1 SeiteSolutiondone 2-267trilocksp SinghNoch keine Bewertungen

- The Following Information For 20X7 Was Derived From The RecordsDokument1 SeiteThe Following Information For 20X7 Was Derived From The Recordstrilocksp SinghNoch keine Bewertungen

- Cash Flow 1Dokument3 SeitenCash Flow 1Percy JacksonNoch keine Bewertungen

- Solutions - CH 5Dokument4 SeitenSolutions - CH 5Khánh AnNoch keine Bewertungen

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Dokument4 SeitenBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNoch keine Bewertungen

- Chapter 11 & 12Dokument5 SeitenChapter 11 & 12katie kateNoch keine Bewertungen

- Predetermined Overhead Rates - ProblemsDokument2 SeitenPredetermined Overhead Rates - ProblemsShaina Jean PiezonNoch keine Bewertungen

- Cost Sheet Format: Profit or Loss Statement For The Year Ended On 31 December 2020Dokument6 SeitenCost Sheet Format: Profit or Loss Statement For The Year Ended On 31 December 2020sanathNoch keine Bewertungen

- Tutorial Test 4 AnswerDokument5 SeitenTutorial Test 4 AnswerHoang Bich Kha NgoNoch keine Bewertungen

- Jawaban Webster CompanyDokument4 SeitenJawaban Webster CompanyHans WakhidaNoch keine Bewertungen

- NKLT - PR1-3B-GR8Dokument1 SeiteNKLT - PR1-3B-GR8kimphuc3819Noch keine Bewertungen

- Balance Sheet and Cash Flow AnalysisDokument8 SeitenBalance Sheet and Cash Flow AnalysisAntonios FahedNoch keine Bewertungen

- Prepare in Good Form The 20X9 GAAP Based Statement of RevenuesDokument1 SeitePrepare in Good Form The 20X9 GAAP Based Statement of Revenuestrilocksp SinghNoch keine Bewertungen

- Chapter 1 TutorialDokument5 SeitenChapter 1 TutorialAnisaNoch keine Bewertungen

- CA2 Valenko CompanyDokument1 SeiteCA2 Valenko CompanyArshia EmamiNoch keine Bewertungen

- Winterschid Company 2008 year-end trial balance and financial statementsDokument6 SeitenWinterschid Company 2008 year-end trial balance and financial statementsJa Mi LahNoch keine Bewertungen

- Fa AssignmentDokument6 SeitenFa AssignmentemnagrichiNoch keine Bewertungen

- Your Sister Operates Watercraft Supply Company An Online Boat PartsDokument1 SeiteYour Sister Operates Watercraft Supply Company An Online Boat Partstrilocksp SinghNoch keine Bewertungen

- Assignment - ABC CostingDokument2 SeitenAssignment - ABC Costingjoneth.duenasNoch keine Bewertungen

- Solutiondone 2-180Dokument1 SeiteSolutiondone 2-180trilocksp SinghNoch keine Bewertungen

- aEXPENDITURE ACCOUNTINGDokument8 SeitenaEXPENDITURE ACCOUNTING20211211017 SKOLASTIKA ANABELNoch keine Bewertungen

- CH # 4 Financial StatementsDokument4 SeitenCH # 4 Financial StatementsAbubakar AliNoch keine Bewertungen

- Final Term PaperDokument3 SeitenFinal Term PaperUmerNoch keine Bewertungen

- ISCF - Income Statements and Cash FlowsDokument17 SeitenISCF - Income Statements and Cash FlowsSen Ho Ng100% (1)

- Accounting for Business CombinationsDokument10 SeitenAccounting for Business CombinationsnaddieNoch keine Bewertungen

- Module 2 Homework Answer KeyDokument5 SeitenModule 2 Homework Answer KeyMrinmay kunduNoch keine Bewertungen

- The Company Reported The Following Information For The Year Ending Work in ProcessDokument1 SeiteThe Company Reported The Following Information For The Year Ending Work in ProcessMuhammad ShahidNoch keine Bewertungen

- Chapter 5Dokument4 SeitenChapter 5Ngô Hoàng Bích KhaNoch keine Bewertungen

- Purchasing Power Parities and the Real Size of World EconomiesVon EverandPurchasing Power Parities and the Real Size of World EconomiesNoch keine Bewertungen

- Fred S Frames Mass Produces and Wholesales Wooden Picture FramesDokument1 SeiteFred S Frames Mass Produces and Wholesales Wooden Picture Framestrilocksp SinghNoch keine Bewertungen

- Governments Often Impose Costs On Businesses in Direct Relation ToDokument1 SeiteGovernments Often Impose Costs On Businesses in Direct Relation Totrilocksp SinghNoch keine Bewertungen

- General Guideline Transfer Pricing The Slate Company ManufacturDokument1 SeiteGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNoch keine Bewertungen

- Global Company Ethical Challenges in June 2009 The GovernmentDokument2 SeitenGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNoch keine Bewertungen

- George Marcus A Recent College Graduate Has Been Hired byDokument1 SeiteGeorge Marcus A Recent College Graduate Has Been Hired bytrilocksp SinghNoch keine Bewertungen

- General Guideline Transfer Pricing The Shamrock Company ManufaDokument1 SeiteGeneral Guideline Transfer Pricing The Shamrock Company Manufatrilocksp SinghNoch keine Bewertungen

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDokument2 SeitenGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNoch keine Bewertungen

- Giovanni Construction Company Uses The Job Order Cost System inDokument2 SeitenGiovanni Construction Company Uses The Job Order Cost System intrilocksp SinghNoch keine Bewertungen

- General Equilibrium Effects of A Property Tax in Chapter 19Dokument2 SeitenGeneral Equilibrium Effects of A Property Tax in Chapter 19trilocksp SinghNoch keine Bewertungen

- Game Guys Is A Retail Store Selling Video GamesDokument1 SeiteGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNoch keine Bewertungen

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDokument1 SeiteGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNoch keine Bewertungen

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDokument1 SeiteGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNoch keine Bewertungen

- Following The Example in The Text Consider Two Hiv PreventionDokument1 SeiteFollowing The Example in The Text Consider Two Hiv Preventiontrilocksp SinghNoch keine Bewertungen

- For Each of The Following Transactions Determine The Contribution ToDokument1 SeiteFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNoch keine Bewertungen

- Framing The Options Praying While Smoking and Fighting Pandemics byDokument1 SeiteFraming The Options Praying While Smoking and Fighting Pandemics bytrilocksp SinghNoch keine Bewertungen

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDokument1 SeiteGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNoch keine Bewertungen

- Fishing in The Commons in The Text We Introduced TheDokument2 SeitenFishing in The Commons in The Text We Introduced Thetrilocksp SinghNoch keine Bewertungen

- Follete Inc Operates at Capacity and Makes Plastic Combs andDokument2 SeitenFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNoch keine Bewertungen

- Financing A Strategic Investment Under Quantity Competition Suppose You OwnDokument2 SeitenFinancing A Strategic Investment Under Quantity Competition Suppose You Owntrilocksp SinghNoch keine Bewertungen

- Fifteen Workers Are Assigned To A Group Project The ProductionDokument1 SeiteFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNoch keine Bewertungen

- Figures 1 2 and 1 6 Rely On Data From 2010 andDokument1 SeiteFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNoch keine Bewertungen

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDokument1 SeiteFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNoch keine Bewertungen

- Financial Budgets Cash Outflows Country Club Road NurseriesDokument1 SeiteFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNoch keine Bewertungen

- Figures A B and C Are Taken From A PaperDokument1 SeiteFigures A B and C Are Taken From A Papertrilocksp SinghNoch keine Bewertungen

- Following Are Transactions and Events of The General Fund ofDokument2 SeitenFollowing Are Transactions and Events of The General Fund oftrilocksp SinghNoch keine Bewertungen

- First and Second Best Rawlsian Income Redistribution Most Governments Raise TaxDokument2 SeitenFirst and Second Best Rawlsian Income Redistribution Most Governments Raise Taxtrilocksp SinghNoch keine Bewertungen

- Financial and Nonfinancial Performance Measures Goal CongruenceDokument1 SeiteFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNoch keine Bewertungen

- PNLE - Fundamentals in Nursing Exam 2Dokument8 SeitenPNLE - Fundamentals in Nursing Exam 2Edralee VillanuevaNoch keine Bewertungen

- Machinery Safety ModuleDokument132 SeitenMachinery Safety ModuleKar YiNoch keine Bewertungen

- Nursing Process Mcqs Session by Husain.ZDokument14 SeitenNursing Process Mcqs Session by Husain.ZInam ullah KhanNoch keine Bewertungen

- BMC - H60 Humidifier ESTERILIZACION INGLESDokument4 SeitenBMC - H60 Humidifier ESTERILIZACION INGLESAna Teresa Manjarres MonteroNoch keine Bewertungen

- Defibrillatorppt 131028115457 Phpapp01Dokument41 SeitenDefibrillatorppt 131028115457 Phpapp01Simon JosanNoch keine Bewertungen

- SadguruDokument6 SeitenSadguruTrần Vũ Mỹ Nga 1C-20ACNNoch keine Bewertungen

- Gersalina - Final Paper MMOKDokument32 SeitenGersalina - Final Paper MMOKEnrique TeodoroNoch keine Bewertungen

- Family Counselling Enhances Environmental Control of Allergic PatientsDokument6 SeitenFamily Counselling Enhances Environmental Control of Allergic PatientsNinuk KurniawatiNoch keine Bewertungen

- Oligodontia Case Report and Review of LiteratureDokument2 SeitenOligodontia Case Report and Review of LiteratureWindaNoch keine Bewertungen

- Lifestyle Diseases Affecting The Nursing Faculty at Tarlac State University During Covid 19 PandemicDokument19 SeitenLifestyle Diseases Affecting The Nursing Faculty at Tarlac State University During Covid 19 PandemicDeinielle Magdangal RomeroNoch keine Bewertungen

- Examination of Consumption Habits of Fast Food Patrons in SingaporeDokument41 SeitenExamination of Consumption Habits of Fast Food Patrons in SingaporeAngeline Leong100% (1)

- Yogic Asanas: Module - IDokument15 SeitenYogic Asanas: Module - Isudinavada2009Noch keine Bewertungen

- Quality of Work Life With Reference To Vits CollegeDokument62 SeitenQuality of Work Life With Reference To Vits CollegeAbhay JainNoch keine Bewertungen

- Penentuan Parameter Spesifik Dan Nonspesifik Ekstrak Kental ETANOL BATANG AKAR KUNING (Fibraurea Chloroleuca Miers)Dokument10 SeitenPenentuan Parameter Spesifik Dan Nonspesifik Ekstrak Kental ETANOL BATANG AKAR KUNING (Fibraurea Chloroleuca Miers)AfridhausmanNoch keine Bewertungen

- Drug StudyDokument10 SeitenDrug Studyjho_Noch keine Bewertungen

- Concepts of Transtibial Amputation: Burgess Technique Versus Modified Bru Ckner ProcedureDokument5 SeitenConcepts of Transtibial Amputation: Burgess Technique Versus Modified Bru Ckner ProcedureSanjay NatarajanNoch keine Bewertungen

- Student's PortfolioDokument6 SeitenStudent's PortfolioApril Joy de LimaNoch keine Bewertungen

- Ossiculoplasty Materials Hearing OutcomesDokument33 SeitenOssiculoplasty Materials Hearing OutcomesPushkar Raaj PatidarNoch keine Bewertungen

- 11 EnglishDokument12 Seiten11 EnglishIndrajitNoch keine Bewertungen

- Theoritical Base of CoDokument8 SeitenTheoritical Base of CoAndresa LasduceNoch keine Bewertungen

- Impacting Employee Performance Through CoachingDokument5 SeitenImpacting Employee Performance Through CoachingNANDANA BALAKRISHNANNoch keine Bewertungen

- Soal Bahas TBI TO 6 - Alumni - TubelstanDokument26 SeitenSoal Bahas TBI TO 6 - Alumni - TubelstanAbtasani HasibuanNoch keine Bewertungen

- Weightlifting An Applied Method of Technical AnalysisDokument11 SeitenWeightlifting An Applied Method of Technical AnalysisPabloAñonNoch keine Bewertungen

- Addiction and The BrainDokument53 SeitenAddiction and The BrainNational Press Foundation100% (1)

- Stress Management OutlineDokument7 SeitenStress Management OutlineJericko Allen Resus100% (1)

- Organ System OverviewDokument3 SeitenOrgan System OverviewVan DajayNoch keine Bewertungen

- Lockout Tagout ProposalDokument9 SeitenLockout Tagout Proposalapi-710221113Noch keine Bewertungen