Beruflich Dokumente

Kultur Dokumente

Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheld

Hochgeladen von

ACYATAN & CO., CPAs 2020Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheld

Hochgeladen von

ACYATAN & CO., CPAs 2020Copyright:

Verfügbare Formate

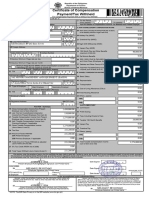

DLN:

BIR Form No.

Certificate of Compensation

2316

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Payment/Tax Withheld

For Compensation Payment With or Without Tax Withheld July 2008 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Year 2 For the Period

( YYYY ) 2020 From (MM/DD) 01 01 To (MM/DD) 12 31

Part I Employee Information Part IV-B Details of Compensation Income and Tax Withheld from Present Employer

3 Taxpayer Amount

Identification No. 732 229 911 0000 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code

32 Basic Salary/ 32

DELGADO, JULIUS MARANTAL 041 Statutory Minimum Wage 79,083.00

6 Registered Address 6A Zip Code Minimum Wage Earner (MWE)

33 Holiday Pay (MWE) 33 0.00

6B Local Home Address 6C Zip Code

34 Overtime Pay (MWE) 34

0.00

6D Foreign Address 6E Zip Code

35 Night Shift Differential (MWE) 35

0.00

7 Date of Birth (MM/DD/YYYY) 8 Telephone Number 36 Hazard Pay (MWE) 36

0.00

37 13th Month Pay 37

9 Exemption Status and Other Benefits 7,995.67

x Single Married

9A Is the wife claiming the additional exemption for qualified dependent children? 38 De Minimis Benefits 38

Yes No

3,908.36

10 Name of Qualified Dependent Children 11 Date of Birth (MM/DD/YYYY)

39 SSS, GSIS, PHIC & Pag-ibig 39

7,800.00

Contributions, & Union Dues

(Employee share only)

40 Salaries & Other Forms of 40 8,340.83

12 Statutory Minimum Wage rate per day 12 Compensation

303.00

13 Statutory Minimum Wage rate per month 13 41 Total Non-Taxable/Exempt 41

6,590.25 Compensation Income 107,127.86

14

X Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject to income tax B. TAXABLE COMPENSATION INCOME

Part II Employer Information (Present) REGULAR

15 Taxpayer

Identification No. 001 668 428 0000 42 Basic Salary 42

0.00

16 Employer's Name

43

ACYATAN AND CO CPAS 43 Representation

17UNIT 123

Registered 12TH FLR THE COLUMBIA

Address 17A Zip Code

44 Transportation 44

TOWER WACK WACK ORTIGAS 1550

AVENUE MainMANDALUYONG

Employer CITY

Secondary Employer 45 Cost of Living Allowance 45

Part III Employer Information (Previous)

18 Taxpayer 46 Fixed Housing Allowance 46

Identification No.

19 Employer's Name 47 Others (Specify)

47A 47A

0.00

20 Registered Address 20A Zip Code 47B 47B

SUPPLEMENTARY

Part IV-A Summary 48 Commission 48

21 Gross Compensation Income from 21

Present Employer (Item 41 plus Item 55) 107,127.86

22 Less: Total Non-Taxable/ 22 49 Profit Sharing 49

Exempt (Item 41) 107,127.86

23 Taxable Compensation Income 23

from Present Employer (Item 55) 0.00 50 Fees Including Director's 50

24 Add: Taxable Compensation 24 Fees

Income from Previous Employer 0.00

25 Gross Taxable 25 51 Taxable 13th Month Pay 51

Compensation Income 0.00 and Other Benefits

0.00

26 Less: Total Exemptions 26

0.00 52 Hazard Pay 52

27 Less: Premium Paid on Health 27

and/or Hospital Insurance (If applicable) 0.00

28 Net Taxable 28 53 Overtime Pay 53

Compensation Income 0.00

29 Tax Due 29 54 Others (Specify)

0.00

30 Amount of Taxes Withheld 54A 54A

30A Present Employer 30A 0.00

54B 54B

30B Previous Employer 30B 0.00

55 Total Taxable Compensation 55

31 Total Amount of Taxes Withheld 31 0.00 0.00

As adjusted Income

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

56 ANTONINO A ACYATAN Date Signed

Present Employer/ Authorized Agent Signature Over Printed Name

CONFORME:

57 JULIUS MARANTAL DELGADO Date Signed

CTC No. Employee Signature Over Printed Name Amount Paid

of Employee Place of Issue Date of Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury, that the information herein stated are reported I declare,under the penalties of perjury that I am qualified under substituted filing of

under BIR Form No. 1604CF which has been filed with the Bureau of Internal Revenue. Income Tax Returns(BIR Form No. 1700), since I received purely compensation income

from only one employer in the Phils. for the calendar year; that taxes have been

correctly withheld by my employer (tax due equals tax withheld); that the BIR Form

58 ANTONINO A ACYATAN No. 1604CF filed by my employer to the BIR shall constitute as my income tax return;

Present Employer/ Authorized Agent Signature Over Printed Name and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700

(Head of Accounting/ Human Resource or Authorized Representative) had been filed pursuant to the provisions of RR No. 3-2002, as amended.

59 JULIUS MARANTAL DELGADO

Employee Signature Over Printed Name

Das könnte Ihnen auch gefallen

- BIR Form 2316Dokument1 SeiteBIR Form 2316edz_ramirez87% (15)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDokument2 Seiten2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 (1) 2Dokument2 Seiten2316 (1) 2jeniffer pamplona100% (2)

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNoch keine Bewertungen

- Certificate of Compensation Payment/Tax WithheldDokument1 SeiteCertificate of Compensation Payment/Tax WithheldJexterNoch keine Bewertungen

- Certificate of Compensation Payment/Tax WithheldDokument26 SeitenCertificate of Compensation Payment/Tax WithheldLalai SaflorNoch keine Bewertungen

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument1 SeiteKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNoch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: Maricar CoronelDokument1 SeiteCertificate of Compensation Payment/Tax Withheld: Maricar CoronelAmy P. DalidaNoch keine Bewertungen

- ITR2015Dokument1 SeiteITR2015Drizza FerrerNoch keine Bewertungen

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNoch keine Bewertungen

- Certificate of Compensation Tax Withheld FormDokument1 SeiteCertificate of Compensation Tax Withheld Formكيمبرلي ماري إنريكيز100% (1)

- Certificate of Compensation Payment/Tax WithheldDokument2 SeitenCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNoch keine Bewertungen

- Philippine Certificate of Compensation FormDokument1 SeitePhilippine Certificate of Compensation Formregin pioNoch keine Bewertungen

- Certificate of Compensation Payment/Tax WithheldDokument1 SeiteCertificate of Compensation Payment/Tax WithheldLency FelarcaNoch keine Bewertungen

- Tax Form Certificate of CompensationDokument8 SeitenTax Form Certificate of CompensationRafael ZamoraNoch keine Bewertungen

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNoch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)Dokument1 SeiteCertificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)jacotesaluna09Noch keine Bewertungen

- Bayani, JeniferDokument1 SeiteBayani, JenifergeekerytimeNoch keine Bewertungen

- Amc 2316 2022Dokument14 SeitenAmc 2316 2022Boracay BeachAthonNoch keine Bewertungen

- Osea Aileen 2316Dokument1 SeiteOsea Aileen 2316Maricel PestañoNoch keine Bewertungen

- Philippine Certificate of Compensation PaymentDokument1 SeitePhilippine Certificate of Compensation PaymentIzza Joy MartinezNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDokument1 SeiteCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNoch keine Bewertungen

- Republic of the Philippines Certificate of Compensation Payment/Tax WithheldDokument3 SeitenRepublic of the Philippines Certificate of Compensation Payment/Tax Withheldjeffrey s. lebatiqueNoch keine Bewertungen

- Cruz 413519429 122022Dokument1 SeiteCruz 413519429 122022Rhea C CabillanNoch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: (Present)Dokument2 SeitenCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNoch keine Bewertungen

- BIR-2316-UPDATED-2023-DEGUZMAN-SignedDokument1 SeiteBIR-2316-UPDATED-2023-DEGUZMAN-Signedmikel bautistaNoch keine Bewertungen

- CARINGAL_477712081Dokument1 SeiteCARINGAL_477712081Jennifer LambinoNoch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadDokument1 SeiteCertificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadJeffree Lann AlvarezNoch keine Bewertungen

- Certificate of Compensation Tax DetailsDokument1 SeiteCertificate of Compensation Tax DetailsKimberly IgbalicNoch keine Bewertungen

- BIR Form 2316 Certificate of CompensationDokument2 SeitenBIR Form 2316 Certificate of CompensationACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: (Present)Dokument2 SeitenCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNoch keine Bewertungen

- Jai2316 Sep 2021 ENCS - Final - CorrectedDokument2 SeitenJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNoch keine Bewertungen

- 2316 (1) 1 Manilyn Nervar 2023Dokument1 Seite2316 (1) 1 Manilyn Nervar 2023Beng moralesNoch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDokument2 SeitenCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNoch keine Bewertungen

- 2316 PepitoDokument1 Seite2316 PepitoRiezel PepitoNoch keine Bewertungen

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument1 SeiteKawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheldjarra andrea jacaNoch keine Bewertungen

- 2316 Jan 2018 ENCSDokument262 Seiten2316 Jan 2018 ENCSAndrea BuenoNoch keine Bewertungen

- Aclon 4726323910000 12312023Dokument1 SeiteAclon 4726323910000 12312023Jeanne D. GozoNoch keine Bewertungen

- Certificate of Compensation FormDokument1 SeiteCertificate of Compensation FormGeorgia HolstNoch keine Bewertungen

- Certificate of Compensation FormDokument1 SeiteCertificate of Compensation FormTrish CalumaNoch keine Bewertungen

- Certificate of Compensation Payment/Tax WithheldDokument2 SeitenCertificate of Compensation Payment/Tax WithheldJane Tricia Dela penaNoch keine Bewertungen

- 2022 BIR Form 2316 - 2013650Dokument1 Seite2022 BIR Form 2316 - 2013650erik skiNoch keine Bewertungen

- Bir Form 2316Dokument2 SeitenBir Form 2316Benjie T Madayag100% (1)

- 2316 Sep 2021 ENCS - Final - CorrectedDokument1 Seite2316 Sep 2021 ENCS - Final - Correctedchelleabogado27Noch keine Bewertungen

- Bob Miller's Algebra for the Clueless, 2nd editionVon EverandBob Miller's Algebra for the Clueless, 2nd editionBewertung: 5 von 5 Sternen5/5 (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- AXIS MONTHLY TRIAL BALANCES 2021Dokument23 SeitenAXIS MONTHLY TRIAL BALANCES 2021ACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Certificate of Compensation Payment/Tax Withheld: (Present)Dokument2 SeitenCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNoch keine Bewertungen

- Almc - Cash Position - 11may2021Dokument246 SeitenAlmc - Cash Position - 11may2021ACYATAN & CO., CPAs 2020Noch keine Bewertungen

- ALMC - Affidavit of No RentDokument1 SeiteALMC - Affidavit of No RentACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Amended Articles - Jelmact Realty 2021 (Revised June 15, 2021)Dokument6 SeitenAmended Articles - Jelmact Realty 2021 (Revised June 15, 2021)ACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Lagrosas - Draft Deed of ExjsDokument5 SeitenLagrosas - Draft Deed of ExjsACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Axis Level PF 2021Dokument1 SeiteAxis Level PF 2021ACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Lagrosas - Draft Deed of ExjsDokument5 SeitenLagrosas - Draft Deed of ExjsACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Amended Articles - Jelmact Realty 2021 (Revised June 15, 2021)Dokument6 SeitenAmended Articles - Jelmact Realty 2021 (Revised June 15, 2021)ACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Directors Certificate - JELMACT REALTY 2021 (Revised June 15, 2021)Dokument2 SeitenDirectors Certificate - JELMACT REALTY 2021 (Revised June 15, 2021)ACYATAN & CO., CPAs 2020Noch keine Bewertungen

- New Cover Sheet For Amended - Jelmact RealtyDokument1 SeiteNew Cover Sheet For Amended - Jelmact RealtyACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Secretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021Dokument1 SeiteSecretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021ACYATAN & CO., CPAs 2020Noch keine Bewertungen

- BIR Form 2316 Certificate of CompensationDokument2 SeitenBIR Form 2316 Certificate of CompensationACYATAN & CO., CPAs 2020Noch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNoch keine Bewertungen

- Form 12BB (See Rule 26C)Dokument2 SeitenForm 12BB (See Rule 26C)Biswadip BanerjeeNoch keine Bewertungen

- General Principles: Answer: CDokument13 SeitenGeneral Principles: Answer: CReno PhillipNoch keine Bewertungen

- How To Comply With Summary Lists of Sales and Purchases - Tax and Accounting Center, IncDokument8 SeitenHow To Comply With Summary Lists of Sales and Purchases - Tax and Accounting Center, IncJames SusukiNoch keine Bewertungen

- Statement of Earnings and DeductionsDokument2 SeitenStatement of Earnings and Deductionstaylorizabella1Noch keine Bewertungen

- Resident Income Tax Return Resident Income Tax ReturnDokument6 SeitenResident Income Tax Return Resident Income Tax ReturnlooseshengjiNoch keine Bewertungen

- Gst-Challan - Igst - 170 - Nov 2019Dokument2 SeitenGst-Challan - Igst - 170 - Nov 2019urpranav_indNoch keine Bewertungen

- System Integration Document - Avalara AvaTax For NetSuite Basic v8.6Dokument16 SeitenSystem Integration Document - Avalara AvaTax For NetSuite Basic v8.6Abhay Singh100% (1)

- Determining Taxable Value of SupplyDokument23 SeitenDetermining Taxable Value of SupplyBba ANoch keine Bewertungen

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Dokument3 Seiten1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikNoch keine Bewertungen

- GST Training and Certification Program in IndiaDokument4 SeitenGST Training and Certification Program in IndiaHenry Harvin EducationNoch keine Bewertungen

- GSTDokument4 SeitenGSTThendralzeditzNoch keine Bewertungen

- Mock BarDokument3 SeitenMock BarAe-cha Nae GukNoch keine Bewertungen

- Cir V Cebu Toyo CorpDokument5 SeitenCir V Cebu Toyo CorpChanel GarciaNoch keine Bewertungen

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDokument4 SeitenAescartin/Tlopez/Jpapa: Mobile Telephone GmailKarenNoch keine Bewertungen

- Fee ScheduleDokument39 SeitenFee Scheduleapi-127186411Noch keine Bewertungen

- H&R Block Tax Service LeaderDokument2 SeitenH&R Block Tax Service LeaderSathish KumarNoch keine Bewertungen

- Sumit Singh-Zomato InvoiceDokument1 SeiteSumit Singh-Zomato InvoiceSumit SinghNoch keine Bewertungen

- Kalyani Technoforge LTD - 301 - 18-10-2021Dokument1 SeiteKalyani Technoforge LTD - 301 - 18-10-2021Pragnesh PrajapatiNoch keine Bewertungen

- B.a.H SEC VI Contemporary Economic IssuesDokument4 SeitenB.a.H SEC VI Contemporary Economic IssuessifarNoch keine Bewertungen

- Tax Deposit-Challan 281-Excel FormatDokument8 SeitenTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNoch keine Bewertungen

- Joyce Performance-Informed Budgeting in The United States-Tastes Great or Less FillingDokument20 SeitenJoyce Performance-Informed Budgeting in The United States-Tastes Great or Less FillingInternational Consortium on Governmental Financial ManagementNoch keine Bewertungen

- TRAIN Law (PWC Philippines)Dokument16 SeitenTRAIN Law (PWC Philippines)Rose Ann Juleth Licayan100% (1)

- TRAIN LAW - Estate TAX - SUMMARY OF CHANGESDokument10 SeitenTRAIN LAW - Estate TAX - SUMMARY OF CHANGESBon BonsNoch keine Bewertungen

- Tally InvoiceDokument1 SeiteTally InvoiceAlok S YadavNoch keine Bewertungen

- Corporate Income Tax Return: Paradise Produce Dist., Inc. 59-3024048Dokument31 SeitenCorporate Income Tax Return: Paradise Produce Dist., Inc. 59-3024048kevin kuhnNoch keine Bewertungen

- My Maruti My IndusDokument2 SeitenMy Maruti My IndusAbhijith uNoch keine Bewertungen

- AA Chapter2Dokument6 SeitenAA Chapter2Nikki GarciaNoch keine Bewertungen

- FORM 16 TDS CERTIFICATEDokument8 SeitenFORM 16 TDS CERTIFICATESaleemNoch keine Bewertungen

- Income Taxation and MCIT RulesDokument4 SeitenIncome Taxation and MCIT RulesMJNoch keine Bewertungen

- Deductibility of Executive Compensation For C CorporationsDokument10 SeitenDeductibility of Executive Compensation For C Corporationsanthony jassoNoch keine Bewertungen