Beruflich Dokumente

Kultur Dokumente

The Financial Statements of Abc Corporation A Retail Chain Reveal PDF

Hochgeladen von

Muhammad ShahidOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Financial Statements of Abc Corporation A Retail Chain Reveal PDF

Hochgeladen von

Muhammad ShahidCopyright:

Verfügbare Formate

The financial statements of ABC Corporation a retail chain

reveal #6998

The financial statements of ABC Corporation, a retail chain, reveal the information for income

taxes shown in Exhibit 2.15.a. Assuming that ABC had no significant permanent differences

between book income and taxable income, did income before taxes for financial reporting

exceed or fall short of taxable income for 2013? Explain.b. Did income before taxes for financial

reporting exceed or fall short of taxable income for 2014? Explain.c. Will the adjustment to net

income for deferred taxes to compute cash flow from operations in the statement of cash flows

result in an addition or a subtraction for 2013? For 2014?d. ABC does not contract with an

insurance agency for property and liability insurance; instead, it self-insures. ABC recognizes an

expense and a liability each year for financial reporting to reflect its average expected long-term

property and liability losses. When it experiences an actual loss, it charges that loss against the

liability. The income tax law permits self-insured firms to deduct such losses only in the year

sustained. Why are deferred taxes related to self-insurance disclosed as a deferred tax asset

instead of a deferred tax liability? Suggest reasons for the direction of the change in amounts

for this deferred tax asset between 2012 and 2014.e. ABC treats certain storage and other

inventory costs as expenses in the year incurred for financial reporting but must include these in

inventory for tax reporting. Why are deferred taxes related to inventory disclosed as a deferred

tax asset? Suggest reasons for the direction of the change in amounts for this deferred tax

asset between 2012 and 2014.f. Firms must recognize expenses related to postretirement

health care and pension obligations as employees provide services, but claim an income tax

deduction only when they make cash payments under the benefit plan. Why are deferred taxes

related to health care obligation disclosed as a deferred tax asset? Why are deferred taxes

related to pensions disclosed as a deferred tax liability? Suggest reasons for the direction of the

change in amounts for these deferred tax items between 2012 and 2014.g. Firms must

recognize expenses related to uncollectible accounts when they recognize sales revenues, but

claim an income tax deduction when they deem a particular customer's accounts uncollectible.

Why are deferred taxes related to this item disclosed as a deferred tax asset? Suggest reasons

for the direction of the change in amounts for this deferred tax asset between 2012 and 2014.h.

ABC uses the straight-line depreciation method for financial reporting and accelerated

depreciation methods for income tax purposes. Why are deferred taxes related to depreciation

disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts

for this deferred tax liability between 2012 and 2014.View Solution:

The financial statements of ABC Corporation a retail chain reveal

ANSWER

http://paperinstant.com/downloads/the-financial-statements-of-abc-corporation-a-retail-chain-

reveal/

1/1

Powered by TCPDF (www.tcpdf.org)

Das könnte Ihnen auch gefallen

- Your Supervisor Has Asked You To Research A Potential TaxDokument1 SeiteYour Supervisor Has Asked You To Research A Potential TaxMuhammad ShahidNoch keine Bewertungen

- You Have Been Asked To Evaluate Two Companies As PossibleDokument2 SeitenYou Have Been Asked To Evaluate Two Companies As PossibleMuhammad ShahidNoch keine Bewertungen

- Yuki Inc Acquired The Following Assets On January 1 2012 EquipmentDokument1 SeiteYuki Inc Acquired The Following Assets On January 1 2012 EquipmentMuhammad ShahidNoch keine Bewertungen

- You Are The Controller Treasurer For A Small Import Export Company YouDokument1 SeiteYou Are The Controller Treasurer For A Small Import Export Company YouMuhammad ShahidNoch keine Bewertungen

- You Are The Controller of Small Toys Inc Marta JohnsDokument1 SeiteYou Are The Controller of Small Toys Inc Marta JohnsMuhammad ShahidNoch keine Bewertungen

- Zeus Industries Manufactures Two Types of Electrical Power Units CustomDokument1 SeiteZeus Industries Manufactures Two Types of Electrical Power Units CustomMuhammad ShahidNoch keine Bewertungen

- You Are A Portfolio Manager and Senior Executive Vice PresidentDokument1 SeiteYou Are A Portfolio Manager and Senior Executive Vice PresidentMuhammad ShahidNoch keine Bewertungen

- You Can Find A Spreadsheet Containing The Historic Returns PresentedDokument1 SeiteYou Can Find A Spreadsheet Containing The Historic Returns PresentedMuhammad ShahidNoch keine Bewertungen

- You Have Recently Started Business As An Accounting Consultant CompaniesDokument1 SeiteYou Have Recently Started Business As An Accounting Consultant CompaniesMuhammad ShahidNoch keine Bewertungen

- You Are Being Interviewed For A Job As A PortfolioDokument1 SeiteYou Are Being Interviewed For A Job As A PortfolioMuhammad ShahidNoch keine Bewertungen

- You Decide Which Method Is Better The Direct Write Off Method orDokument1 SeiteYou Decide Which Method Is Better The Direct Write Off Method orMuhammad ShahidNoch keine Bewertungen

- Winnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atDokument2 SeitenWinnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atMuhammad ShahidNoch keine Bewertungen

- You Have Been Named As Investment Adviser To A FoundationDokument1 SeiteYou Have Been Named As Investment Adviser To A FoundationMuhammad ShahidNoch keine Bewertungen

- You Are Considering Making A Contribution To The Conservation FundDokument1 SeiteYou Are Considering Making A Contribution To The Conservation FundMuhammad ShahidNoch keine Bewertungen

- Wimberley Glass Inc Has Shops in The Shopping Malls ofDokument1 SeiteWimberley Glass Inc Has Shops in The Shopping Malls ofMuhammad ShahidNoch keine Bewertungen

- Wireless Communications Inc Is Preparing Its Cash Budget For 2014Dokument1 SeiteWireless Communications Inc Is Preparing Its Cash Budget For 2014Muhammad ShahidNoch keine Bewertungen

- You Are Reviewing The Financial Statements of Rising Yeast CoDokument1 SeiteYou Are Reviewing The Financial Statements of Rising Yeast CoMuhammad ShahidNoch keine Bewertungen

- You Are Given The Following Price of The Stock 18 PriceDokument1 SeiteYou Are Given The Following Price of The Stock 18 PriceMuhammad ShahidNoch keine Bewertungen

- You Are Given The Following Information Expected Return On Stock ADokument1 SeiteYou Are Given The Following Information Expected Return On Stock AMuhammad ShahidNoch keine Bewertungen

- World Mosaic Furniture Gallery Inc Provided The Following Data FromDokument2 SeitenWorld Mosaic Furniture Gallery Inc Provided The Following Data FromMuhammad ShahidNoch keine Bewertungen

- While Preparing Massie Miller S 2015 Schedule A You Review TheDokument1 SeiteWhile Preparing Massie Miller S 2015 Schedule A You Review TheMuhammad ShahidNoch keine Bewertungen

- West Texas Exploration Co Was Established On October 15 2016Dokument2 SeitenWest Texas Exploration Co Was Established On October 15 2016Muhammad ShahidNoch keine Bewertungen

- Wholegrain Health Foods Inc Is Authorized To Issue 5 000 000 CommonDokument1 SeiteWholegrain Health Foods Inc Is Authorized To Issue 5 000 000 CommonMuhammad ShahidNoch keine Bewertungen

- You Are P J Walter Cfa A Managing Partner ofDokument1 SeiteYou Are P J Walter Cfa A Managing Partner ofMuhammad ShahidNoch keine Bewertungen

- You Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresDokument1 SeiteYou Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresMuhammad ShahidNoch keine Bewertungen

- Westside Copiers LTD Has Recently Been Plagued With Lacklustre SalesDokument1 SeiteWestside Copiers LTD Has Recently Been Plagued With Lacklustre SalesMuhammad ShahidNoch keine Bewertungen

- When Sandra Costello S Father Died Suddenly Sandra Had Just CompletedDokument1 SeiteWhen Sandra Costello S Father Died Suddenly Sandra Had Just CompletedMuhammad ShahidNoch keine Bewertungen

- Williams Cleaning and Maintenance Owned by Jay Williams Provides CleaningDokument1 SeiteWilliams Cleaning and Maintenance Owned by Jay Williams Provides CleaningMuhammad ShahidNoch keine Bewertungen

- Wilma Company Must Decide Whether To Make or Buy SomeDokument1 SeiteWilma Company Must Decide Whether To Make or Buy SomeMuhammad ShahidNoch keine Bewertungen

- Wilson Reed The Bookkeeper For Home Interior Improvements and DesignsDokument1 SeiteWilson Reed The Bookkeeper For Home Interior Improvements and DesignsMuhammad ShahidNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- One Form Per Adult Member of The Household: Tenant Income Certification Questionnaire Name: Telephone NumberDokument5 SeitenOne Form Per Adult Member of The Household: Tenant Income Certification Questionnaire Name: Telephone NumbervipetetNoch keine Bewertungen

- P2Mindmap (JoeFang)Dokument41 SeitenP2Mindmap (JoeFang)Mubashar HussainNoch keine Bewertungen

- Sources of Family IncomeDokument12 SeitenSources of Family IncomeJeanicar A. AniñonNoch keine Bewertungen

- AP MPL Act 1965 SectionsDokument32 SeitenAP MPL Act 1965 SectionsRaghu RamNoch keine Bewertungen

- F Business Taxation 671079211Dokument4 SeitenF Business Taxation 671079211anand0% (1)

- Complete Guide To PhilhealthDokument8 SeitenComplete Guide To PhilhealthJoenas TunguiaNoch keine Bewertungen

- Joining Induction FormDokument24 SeitenJoining Induction FormAnaruzzaman SheikhNoch keine Bewertungen

- Latest PCDA Circular Feb 09Dokument13 SeitenLatest PCDA Circular Feb 09navdeepsingh.india884991% (46)

- Continental Zed Interlines Agreement ListDokument1 SeiteContinental Zed Interlines Agreement ListManuelMoricheNoch keine Bewertungen

- Time Context: Amado ValdezDokument2 SeitenTime Context: Amado ValdezJenn GosiengfiaoNoch keine Bewertungen

- Moody's Adjustments To Vattenfall's Accounts: ObjectiveDokument4 SeitenMoody's Adjustments To Vattenfall's Accounts: ObjectiveSunny VohraNoch keine Bewertungen

- Vijaya Bank Pension Regulation 1995Dokument78 SeitenVijaya Bank Pension Regulation 1995Latest Laws Team0% (1)

- RulesDokument186 SeitenRulesgnarayanswami82Noch keine Bewertungen

- TAX Allowable Deductions-1Dokument35 SeitenTAX Allowable Deductions-1lyza nedtranNoch keine Bewertungen

- Sustainability Report 2014-15 of Coal India Limited 10082015Dokument80 SeitenSustainability Report 2014-15 of Coal India Limited 10082015Swayamprakash RoutNoch keine Bewertungen

- Ceiling of GPFDokument4 SeitenCeiling of GPFkaus9199Noch keine Bewertungen

- Guidlines For Filling PF Withdrawal FormsDokument4 SeitenGuidlines For Filling PF Withdrawal Formsr47693Noch keine Bewertungen

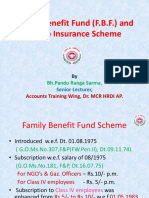

- FBF, GisDokument17 SeitenFBF, GisKumarVijay100% (1)

- GSIS/SSS LawDokument3 SeitenGSIS/SSS LawCecille MangaserNoch keine Bewertungen

- Nrs1014 Job SpecificationDokument7 SeitenNrs1014 Job SpecificationGracia MayaNoch keine Bewertungen

- Sindoor 2Dokument2 SeitenSindoor 2sanju.wageeshaNoch keine Bewertungen

- Manual Pension OfficersDokument166 SeitenManual Pension OfficersSourabh Singh100% (1)

- Private & Strictly Confidential: Letter of AppointmentDokument3 SeitenPrivate & Strictly Confidential: Letter of AppointmentIBA MBANoch keine Bewertungen

- Baby BoomerDokument18 SeitenBaby BoomerBethany CrusantNoch keine Bewertungen

- MakenhamDokument40 SeitenMakenhamsoledup4454Noch keine Bewertungen

- PGBP Chart 1Dokument2 SeitenPGBP Chart 1Aashish Kumar Singh100% (1)

- Covi D I N LTC: Covi D Posi Ti Ve Resi Dents (SNF & Alf)Dokument17 SeitenCovi D I N LTC: Covi D Posi Ti Ve Resi Dents (SNF & Alf)ABC Action NewsNoch keine Bewertungen

- Stockholder and Manager Conflicts PDFDokument2 SeitenStockholder and Manager Conflicts PDFPhil SingletonNoch keine Bewertungen

- Modern Auditing Chapter 16Dokument13 SeitenModern Auditing Chapter 16Charis SubiantoNoch keine Bewertungen

- AIBOA Service ConditionsDokument57 SeitenAIBOA Service ConditionsBhanwar Singh ChoudharyNoch keine Bewertungen