Beruflich Dokumente

Kultur Dokumente

CHECKLIST OF REQUIREMENTS NHA and PagIBIG MTO REVISED

Hochgeladen von

richard0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

360 Ansichten4 SeitenOriginaltitel

CHECKLIST-OF-REQUIREMENTS-NHA-and-PagIBIG-MTO-REVISED

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

360 Ansichten4 SeitenCHECKLIST OF REQUIREMENTS NHA and PagIBIG MTO REVISED

Hochgeladen von

richardCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

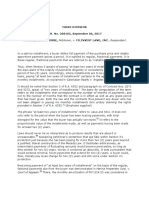

CHECKLIST OF REQUIREMENTS

REQUIRED DOCUMENTS WHERE TO SECURE

1. NHA AWARD

1.1. Duly accomplished Application to Purchase House NHA District Office

and Lot Form

1.2. Proof of Income. Any of the following:

Employer's Certificate of Compensation Office where the applicant works

BIR Certified Income Tax Return Bureau of Internal Revenue

1.3. Proof of Identity/Civil Status (BIR)

For Single Applicants:

Birth Certificate Civil Registry/Philippine

Any two (2) government-issued ID (Statistic Authority PSA)

For Married Applicants:

Marriage Certificate

For Separated Applicant - Affidavit of Separation-in-Fact (for Executed by the Applicant

applicants not legally separated/annulled)

Any two (2) government-issued ID

Concerned Government Agency

List of Acceptable Government-Issued ID:

- Driver's License

- Postal ID

- Voter's ID

- Passport

- GSIS/SSS/PHILHEALTH/PAG-IBIG Card/UMID

- NBI/Police Clearance/ID

- Government Office I.D.

- Barangay Certification with Picture

- DSWD Certification/ Solo Parent ID

- PRC/IBP/OWWA

- Senior Citizen ID

- Persons with Disabilities (PWD) ID

1.4. Specific Program/ Project Requirements, if any.

2. PAG-IBIG FUND LOAN TAKE OUT

2.1. UPON FILING OF THE LOAN APPLICATION

2.1.1. NHA AWARDEE-APPLICANT*

2.1.1.1. Duly accomplished Housing Loan Application Pag-IBIG website

(HQP-HLF-068) with recent 1” x 1” ID photo of (www.pagibigfund.gov.ph) or in

borrower/co-borrower (if applicable) (2 original any Pag-IBIG Branch

copies) Computer generated or photocopied

picture is not acceptable.

Note: For employers who are requiring their

employees of an authorization letter allowing

said employer to disclose employment

information to Pag-IBIG Fund, the member

applicant shall execute a letter in the format

being required by his/her employer.

2.1.1.2. Proof of Income

For Locally Employed, any of the following: Employer

2.1.1.2.1. Notarized Certificate of

Employment and Compensation (CEC),

indicating the gross monthly income and

monthly allowances or monthly

monetary benefits received by the

employee (1 original copy) duly signed

by the authorized signatory of the

employer. For system generated CEC,

notarize the said CEC with signature of

the authorized signatory of the

employer.

2.1.1.2.2. Latest Income Tax Return (ITR) Employer

for the year immediately preceding the

date of loan application, with attached

BIR Form No. 2316, duly acknowledged

by the BIR or authorized representative

of employer (1 photocopy)

2.1.1.2.3. One (1) Month Pay slip, within Employer

the last three (3) months prior to date of

loan application with name and

signature of the authorized signatory of

the employer (1 certified true copy)

NOTE: For government employees who

will be paying their loan amortization

through salary deduction, the original

copy of One (1) Month Payslip, within

the last three (3) months prior to date of

loan application, must be submitted

together with CEC or ITR as mentioned

above.

2.1.1.3. One (1) valid ID with signature (1 photocopy, Concerned government

back-to-back) of borrower and spouse, co- agencies

borrower and spouse, if applicable. The same ID (Pls. refer to list of government

must be presented during the conduct of issued IDs above)

borrower’s validation.

2.1.1.4. In case of discrepancy in personal details Principal Borrower and Spouse,

of the Principal Borrower and Spouse, Co- Co-Borrower and Spouse,

Borrower and Spouse, Seller/s and Spouse/s Seller/s and Spouse/s

(e.g. name, date of birth), Notarized Affidavit of

Two Disinterested Person (1 original copy and

1 photocopy)

2.1.1.5. Insurance Coverage Pag-IBIG Fund

Health Statement Form (Medical Questionnaire)

(1 original copy)

* For borrowers over 60 years old

* For borrowers up to 60 years old, if loan is

over P2.0M to P6.0M

2.1.1.6. Notarized Borrower’s Conformity (HQP- Pag-IBIG Fund

HLF-108) (1 original copy)

2.1.1.7. Authority to Deduct Loan Amortization (HQP- Pag-IBIG Fund website or in any

HLF124/634) (1 original copy) for employers with Pag_IBIG Fund branch

existing CSA and in case that payment is

through salary deduction.

2.1.1.8. If with outstanding Housing Account with Pag-IBIG Fund

Pag-IBIG Fund

Notice of Application for a New Housing

Account (HQP-HLF-409) with signature of

other borrower/s of the existing housing account

on the “Conforme” portion of the notice

signifying their consent and awareness to the

policies on availment of multiple housing in Pag-

IBIG Fund. (1 original copy)

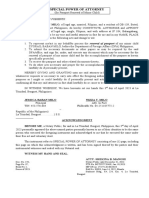

2.1.1.9. In case, there’s an Attorney-In-Fact (AIF) Pag-IBIG Fund

Notarized Special Power of Attorney (SPA) of

the borrower/s and spouse (1 original copy and

1 photocopy)

2.1.1.10. Notarized Borrower’s Conformity (HQP-HLF- PagIBIG Fund

108) (1 original copy)

2.1.1.11. Deed of Conditional Sale (HQP-HLF- PagIBIG Fund

234/235) between Pag-IBIG Fund and the

borrower, (HQP-HLF-162/163) (7 original

copies)

2.1.2. NHA (DEVELOPER)

Pag-IBIG Fund

2.1.2.1. PagIBIG Fund Dev. Entry System Developer/Registry of Deeds

2.1.2.2. Two (2) photocopies of Latest Transfer (RD)/ Land Registration

Certificate of Title (TCT) in the name of the Authority (LRA)

developer or land Owner, (in case of Joint

Venture)/ Condominium Certificate of Title

(CCT) in the name of the developer or land

Owner.

2.1.2.3. Updated Tax Declaration (House and Lot Assessor’s Office/ Municipal’s

and Updated Real Estate Tax Receipt as of Office/Local

the quarter immediately preceding the date of Government Unit (LGU)

application (2 photocopies)

2.1.2.4. Deed of Absolute Sale executed by Pag-IBIG Fund

Developer in favor of the Pag-IBIG Fund or

(HQP-HLF-236/237) (7original copies)

2.1.2.5. Notarized Developer’s Sworn Certification Pag-IBIG Fund

(HQP-HLF-062) (1 original copy)

2.2. PRIOR TO RELEASE OF LOAN PROCEEDS**

2.2.1. NHA AWARDEE APPLICANT

2.2.1.1. Security Documents

2.2.1.1.1. Deed of Conditional Sale (HQP- Pag-IBIG Fund (Pres-signed

HLP-234/235) between Pag-IBIG Fund already submitted upon loan

and the Borrower, if the TCT is still application)

under the name of Pag-IBIG Fund;

2.2.1.1.2. Duly Notarized Promissory Note Pag-IBIG Fund

(HQP-HLF-086/087) (7 original copies)

2.2.1.1.3. Signed Disclosure Statement on Pag-IBIG Fund

Loan Transaction with conformity of the

borrower (HQP-HLF-085) (1 original

copy and 2 photocopies)

2.2.1.1.4. Signed Notice of Approval with Pag-IBIG Fund

conformity of the borrower (HQP-HLF-

152/153) (1 original copy and 2

photocopies)

2.2.1.2. Notarized Certificate of Acceptance (HQP- Pag-IBIG Fund

HLF-083) (1 original copy and 1 photocopy)

.2.2. NHA (DEVELOPER)

2.2.2.1. Deed of Absolute Sale executed by Developer Pag-IBIG Fund

in favor of the Pag-IBIG Fund or (HQP-HLF-

236/237) (7original copies)

2.2.2.2. TCT/CCT covering the subject property in the Registry of Deeds

name of Pag-IBIG Fund or the borrower (1

original copy) - In case of discrepancy in name

and other personal circumstances of owner/s or

errors in technical description, registration of

judicial correction or annotation of affidavit of

correction Assessor’s Office/ Municipal’s

2.2.2.3. Updated Tax Declaration on the Land in the Office/ LGU

name of Pag-IBIG Fund (1 photocopy) Assessor’s Office/ Municipal’s

2.2.2.4. Updated Tax Declaration on the Improvements Office/ (LGU)

in the name of Pag-IBIG Fund (1 photocopy) Municipal’s Office/Local

2.2.2.5. Updated Real Estate Tax Receipt as of the Government Unit (LGU)

quarter immediately preceding the date of

submission of documents in compliance to

Notice of Approval (1 photocopy) Municipal’s Office/ LGU

2.2.2.6. Occupancy Permit (1 photocopy) Municipal’s Office/ LGU

2.2.2.7. Transfer Tax Receipt for Lot and Building (1

photocopy)

Note: In all instances wherein photocopies are submitted, the original document must

be presented for authentication.

*HQP-HLF-738 Checklist of Requirements for Pag-IBIG Housing Loan

Application Under Regular Developer

** HQP-HLF-738 Checklist of Requirements for Release of Loan Proceeds to the

Regular Developer

Through Check

Das könnte Ihnen auch gefallen

- Retail Accounts - Checklist of Requirements For Pag-IBIG Housing Loan (COR, HQP-HLF-067, V03)Dokument2 SeitenRetail Accounts - Checklist of Requirements For Pag-IBIG Housing Loan (COR, HQP-HLF-067, V03)johnghieNoch keine Bewertungen

- HLF065 ChecklistRequirementsWindow1Accounts V05Dokument2 SeitenHLF065 ChecklistRequirementsWindow1Accounts V05Jerson OboNoch keine Bewertungen

- Documentation of OwnershipDokument12 SeitenDocumentation of OwnershipventuristaNoch keine Bewertungen

- Cireba-Fillableoffertopurchasesecureseptember2021 1631568886Dokument8 SeitenCireba-Fillableoffertopurchasesecureseptember2021 1631568886Brigita NemetNoch keine Bewertungen

- PAL Holdings Annual Report Provides Business OverviewDokument126 SeitenPAL Holdings Annual Report Provides Business OverviewLian Blakely CousinNoch keine Bewertungen

- Franchise Agreement 05Dokument14 SeitenFranchise Agreement 05Mae-ann Enoc SalibioNoch keine Bewertungen

- Commercial Lease Agreement SummaryDokument2 SeitenCommercial Lease Agreement SummaryAndreea ConstantinNoch keine Bewertungen

- Deed of Absolute Sale for CTS SchemeDokument3 SeitenDeed of Absolute Sale for CTS SchemePermits & LicensingNoch keine Bewertungen

- Cancellation of Rem-Kumala MendozaDokument2 SeitenCancellation of Rem-Kumala MendozaNicolo Jay PajaritoNoch keine Bewertungen

- Affidavit of Explanation. Bacduyan.10.2019Dokument1 SeiteAffidavit of Explanation. Bacduyan.10.2019black stalkerNoch keine Bewertungen

- Affidavit of Loss of A DriverDokument1 SeiteAffidavit of Loss of A DriverJessa Mae SalasNoch keine Bewertungen

- 7 Lessor Information Sheet Final 6-2-2015Dokument1 Seite7 Lessor Information Sheet Final 6-2-2015Jey DiNoch keine Bewertungen

- MOA - Grandland Tungkop Minglanilla - v4Dokument3 SeitenMOA - Grandland Tungkop Minglanilla - v4carlgerNoch keine Bewertungen

- Certificate of Acceptance: HQP-HLF-083 (V03, 08/2017)Dokument2 SeitenCertificate of Acceptance: HQP-HLF-083 (V03, 08/2017)Permits & LicensingNoch keine Bewertungen

- Deed of Extra-Judicial With SaleDokument3 SeitenDeed of Extra-Judicial With SaleFrancisNoch keine Bewertungen

- DEED OF ABSOLUTE SALE With Spa SampleDokument3 SeitenDEED OF ABSOLUTE SALE With Spa SampleDon BenitezNoch keine Bewertungen

- SPA - TeodoricoDokument2 SeitenSPA - TeodoricoCoy Resurreccion CamarseNoch keine Bewertungen

- EXTRAJUDICIAL Settlement of Estate APRONIO CORONADODokument3 SeitenEXTRAJUDICIAL Settlement of Estate APRONIO CORONADOFiona FedericoNoch keine Bewertungen

- Stirling HomexDokument3 SeitenStirling HomexAnne cutieNoch keine Bewertungen

- Non-Compete Dittb DecisionDokument22 SeitenNon-Compete Dittb DecisionRyan Ceazar RomanoNoch keine Bewertungen

- Background Check RequirementsDokument2 SeitenBackground Check RequirementsANTHONNETTE DELA TORRENoch keine Bewertungen

- Republic of The Philippines Securities and Exchange CommissionDokument13 SeitenRepublic of The Philippines Securities and Exchange CommissionArmando TerceroNoch keine Bewertungen

- Extra-Judicial Settlement of Real EstateDokument4 SeitenExtra-Judicial Settlement of Real EstateSam RamosNoch keine Bewertungen

- Memorandum of Agreement 1Dokument3 SeitenMemorandum of Agreement 1JOCOM & QUEZADA LAW FIRMNoch keine Bewertungen

- Deed of Rescission and Annulment of Sale: Seller/VendorDokument2 SeitenDeed of Rescission and Annulment of Sale: Seller/VendorYvesNoch keine Bewertungen

- Philippine trademark law evolutionDokument10 SeitenPhilippine trademark law evolutionCoco NavarroNoch keine Bewertungen

- Special Power of AttorneyDokument3 SeitenSpecial Power of AttorneyalaricelyangNoch keine Bewertungen

- Deed of Extrajudicial Settlement of EstateDokument2 SeitenDeed of Extrajudicial Settlement of EstateEmil AlviolaNoch keine Bewertungen

- Philippines Trust Banks RegulationsDokument58 SeitenPhilippines Trust Banks RegulationsJulio Cesar NavasNoch keine Bewertungen

- Aknowledgement ReceiptDokument1 SeiteAknowledgement ReceiptDaryl Ann NardoNoch keine Bewertungen

- Special Power of Attorney TransferDokument2 SeitenSpecial Power of Attorney TransferPegass GomezNoch keine Bewertungen

- Contract To SellDokument2 SeitenContract To SellEric EchonNoch keine Bewertungen

- Spa Bir TransferDokument3 SeitenSpa Bir TransferElamar de Leon100% (1)

- Sample Family Agreement1 PDFDokument9 SeitenSample Family Agreement1 PDFShelleyMaeSilaganMartosNoch keine Bewertungen

- Extra Judicial Settlement of EstateDokument9 SeitenExtra Judicial Settlement of EstatekealaNoch keine Bewertungen

- Chattel Mortgage Loan DocumentDokument2 SeitenChattel Mortgage Loan DocumentRepolyo Ket Cabbage100% (1)

- Boi Form 501 RegularDokument4 SeitenBoi Form 501 RegularGabe RuaroNoch keine Bewertungen

- Real Estate ContractDokument3 SeitenReal Estate Contractjodine bongcawilNoch keine Bewertungen

- Conditional Contract Land SaleDokument3 SeitenConditional Contract Land SaleAnastacio VergaraNoch keine Bewertungen

- Affidavit of Loss Atm CardDokument2 SeitenAffidavit of Loss Atm Carddempearl2315Noch keine Bewertungen

- Affid - Loss - PLDT Stock CertificateDokument3 SeitenAffid - Loss - PLDT Stock CertificateAnonymous VgZb91pLNoch keine Bewertungen

- Compromise Agreement CabillageDokument3 SeitenCompromise Agreement Cabillagebrad abonadoNoch keine Bewertungen

- Extrajudicial Settlement of Estate in The PhilippinesDokument4 SeitenExtrajudicial Settlement of Estate in The PhilippinesDon Astorga Dehayco0% (1)

- Simple Contract of LeaseDokument2 SeitenSimple Contract of LeaseEsanime HighlightsNoch keine Bewertungen

- Maceda Law 2-Year Installment DiscussionDokument3 SeitenMaceda Law 2-Year Installment DiscussionRamelo M. ToledoNoch keine Bewertungen

- (P3,300,000.00), Philippine Currency, Payable As FollowsDokument3 Seiten(P3,300,000.00), Philippine Currency, Payable As FollowsMPat EBarr0% (1)

- Deed of Conditional Sale PhilippinesDokument3 SeitenDeed of Conditional Sale PhilippinesSharrah San MiguelNoch keine Bewertungen

- FLH061 SPA Housing 052009Dokument1 SeiteFLH061 SPA Housing 052009Ellar LarayaNoch keine Bewertungen

- Sample Deed of Absolute Sale (Realty)Dokument3 SeitenSample Deed of Absolute Sale (Realty)Romualdo BarlosoNoch keine Bewertungen

- 2018 Spa AcacioDokument2 Seiten2018 Spa AcacioRussell Galvez HufanoNoch keine Bewertungen

- Deed of Assignment of Shares of StockDokument2 SeitenDeed of Assignment of Shares of StockCarla FloresNoch keine Bewertungen

- Traditional Life PlanDokument2 SeitenTraditional Life PlanGladys EreveNoch keine Bewertungen

- Anthropos Realty, Inc.: Contract To SellDokument8 SeitenAnthropos Realty, Inc.: Contract To SellRenald Tabon AñascoNoch keine Bewertungen

- SPA MiLo&milo 2023Dokument1 SeiteSPA MiLo&milo 2023black stalkerNoch keine Bewertungen

- Sample ResolutionDokument2 SeitenSample ResolutionKevin0% (1)

- Affidavit: Philippines, After Having Been Duly Sworn To in Accordance With The LawDokument2 SeitenAffidavit: Philippines, After Having Been Duly Sworn To in Accordance With The Lawmay santeNoch keine Bewertungen

- Notice of Approval ChecklistDokument3 SeitenNotice of Approval ChecklistRocky CruzadoNoch keine Bewertungen

- HLF735 ChecklistRequirementsInitialFinalRetail V02Dokument9 SeitenHLF735 ChecklistRequirementsInitialFinalRetail V02Ti NeNoch keine Bewertungen

- HLF735 ChecklistRequirementsInitialFinalRetail V01 3Dokument8 SeitenHLF735 ChecklistRequirementsInitialFinalRetail V01 3Kyzer Calix LaguitNoch keine Bewertungen

- Pag-IBIG Home Loan Requirements ChecklistDokument2 SeitenPag-IBIG Home Loan Requirements ChecklistJireh DuhinaNoch keine Bewertungen

- (TEMPLATE) COE in Line With The COVID19 Precautionary MeasuresDokument1 Seite(TEMPLATE) COE in Line With The COVID19 Precautionary MeasuresrichardNoch keine Bewertungen

- Commission On Audit Circular No. 88-282aDokument4 SeitenCommission On Audit Circular No. 88-282aPrateik Ryuki100% (2)

- Updated 2016 IRR - 31 March 2021Dokument356 SeitenUpdated 2016 IRR - 31 March 2021richardNoch keine Bewertungen

- HGDG ChecklistsDokument235 SeitenHGDG ChecklistsrichardNoch keine Bewertungen

- Modified Pag-Ibig Ii Enrollment FormDokument1 SeiteModified Pag-Ibig Ii Enrollment FormrichardNoch keine Bewertungen

- Central Office: DQ'L, TWW// 0"Dokument2 SeitenCentral Office: DQ'L, TWW// 0"richardNoch keine Bewertungen

- PDS - SamCuyosDokument4 SeitenPDS - SamCuyosrichardNoch keine Bewertungen

- Comment On Non-Residency AuditDokument1 SeiteComment On Non-Residency AuditrichardNoch keine Bewertungen

- PLDT Paid July 7, 2020Dokument1 SeitePLDT Paid July 7, 2020richardNoch keine Bewertungen

- 1604E Jan 2018 ENCS Final Annex BDokument2 Seiten1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Updated 2016 IRR - 31 March 2021Dokument356 SeitenUpdated 2016 IRR - 31 March 2021richardNoch keine Bewertungen

- List of Cars For BiddingDokument6 SeitenList of Cars For Biddingrichard100% (1)

- List of Cars For BiddingDokument6 SeitenList of Cars For Biddingrichard100% (1)

- List of Cars For BiddingDokument6 SeitenList of Cars For Biddingrichard100% (1)

- Minutes of 43rd Videoconf Nov 12Dokument4 SeitenMinutes of 43rd Videoconf Nov 12richardNoch keine Bewertungen

- Minutes of 46th Videoconference MeetingDokument4 SeitenMinutes of 46th Videoconference MeetingrichardNoch keine Bewertungen

- Minutes of 53rd Videoconf Jan 7 2021Dokument4 SeitenMinutes of 53rd Videoconf Jan 7 2021richardNoch keine Bewertungen

- HGDG Guidelines CompleteDokument53 SeitenHGDG Guidelines CompleteVichel Rse JuguilonNoch keine Bewertungen

- Application To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramDokument3 SeitenApplication To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramrichardNoch keine Bewertungen

- Engr. Mariano R. Alquiza, CESO IIIDokument2 SeitenEngr. Mariano R. Alquiza, CESO IIIrichardNoch keine Bewertungen

- COA Davao City Consolidated Management Letter on DPWH RO XI Cluster 3 MVUC Funds 2016Dokument2 SeitenCOA Davao City Consolidated Management Letter on DPWH RO XI Cluster 3 MVUC Funds 2016richardNoch keine Bewertungen

- Joint Ventures Taxation FDD 8.15.13Dokument3 SeitenJoint Ventures Taxation FDD 8.15.13Marlou CantosNoch keine Bewertungen

- RJMR - Chapter 1Dokument10 SeitenRJMR - Chapter 1richardNoch keine Bewertungen

- Certified Matric For SPCR - OPCRDokument2 SeitenCertified Matric For SPCR - OPCRrichardNoch keine Bewertungen

- Policy 127Dokument3 SeitenPolicy 127reymatlasacaNoch keine Bewertungen

- RJMR - Chapter 2Dokument7 SeitenRJMR - Chapter 2richardNoch keine Bewertungen

- Badminton UniformDokument1 SeiteBadminton UniformrichardNoch keine Bewertungen

- RJMR - Chapter 2Dokument7 SeitenRJMR - Chapter 2richardNoch keine Bewertungen

- Affidavit of LossDokument1 SeiteAffidavit of LossrichardNoch keine Bewertungen

- Stranger Danger: Legal Analysis of Child Trafficking Maya Begovic First Colonial High School Legal Studies AcademyDokument18 SeitenStranger Danger: Legal Analysis of Child Trafficking Maya Begovic First Colonial High School Legal Studies Academyapi-350352704Noch keine Bewertungen

- Ulster County Milage Reimbursement ReoportDokument12 SeitenUlster County Milage Reimbursement ReoportDaily FreemanNoch keine Bewertungen

- Sales Force MotivatorsDokument15 SeitenSales Force MotivatorsAshirbadNoch keine Bewertungen

- 2020 - How Vocational EducationDokument14 Seiten2020 - How Vocational EducationLisna MelaniNoch keine Bewertungen

- Sochum Israel Position Paper, BRAINWIZ MUN Dhaka CouncilDokument2 SeitenSochum Israel Position Paper, BRAINWIZ MUN Dhaka CouncilLubzana AfrinNoch keine Bewertungen

- San Diego: A Premier Home For The NFLDokument41 SeitenSan Diego: A Premier Home For The NFLapi-197535656Noch keine Bewertungen

- Paramedics Plus Alameda Appendices Redacted - Web - 2of6Dokument80 SeitenParamedics Plus Alameda Appendices Redacted - Web - 2of6Adam PJNoch keine Bewertungen

- Sri Lanka HR Law ExamDokument2 SeitenSri Lanka HR Law ExamShanilka WickramaratneNoch keine Bewertungen

- Westpac Red Book (September 2013)Dokument28 SeitenWestpac Red Book (September 2013)leithvanonselenNoch keine Bewertungen

- PM Kisan Maan Dhan YojanaDokument1 SeitePM Kisan Maan Dhan YojanaRadhey Shyam KumawatNoch keine Bewertungen

- Business Organization OrgChart Organigramm - Exercises v1bDokument4 SeitenBusiness Organization OrgChart Organigramm - Exercises v1bBob E ThomasNoch keine Bewertungen

- Supreme Court upholds convictions of petitioner for illegal recruitment and estafaDokument6 SeitenSupreme Court upholds convictions of petitioner for illegal recruitment and estafaTeodoro Jose BrunoNoch keine Bewertungen

- Personal Financial Lifecycle Chart - CompletedDokument1 SeitePersonal Financial Lifecycle Chart - Completedapi-381832809Noch keine Bewertungen

- The Failed Legal Career of Americans For Prosperity's Ohio Rep, Rebecca Heimlich After 8 Years of Practicing Law, She Was Making $19/hrDokument5 SeitenThe Failed Legal Career of Americans For Prosperity's Ohio Rep, Rebecca Heimlich After 8 Years of Practicing Law, She Was Making $19/hramerican_posteriorsNoch keine Bewertungen

- High Demand Jobs in Australia For Skilled Migration in 2023Dokument5 SeitenHigh Demand Jobs in Australia For Skilled Migration in 2023Darshan NiroulaNoch keine Bewertungen

- Impact of Working Environment On Job SatisfactionDokument10 SeitenImpact of Working Environment On Job SatisfactionAdanNoch keine Bewertungen

- Exploring Retention Factors in Gen y EngineersDokument18 SeitenExploring Retention Factors in Gen y EngineersuriiiNoch keine Bewertungen

- Rumki PDFDokument41 SeitenRumki PDFShelveyElmoDiasNoch keine Bewertungen

- A20254 Strategic Workforce Planning - Assessments - v1.2Dokument12 SeitenA20254 Strategic Workforce Planning - Assessments - v1.2Rayza OliveiraNoch keine Bewertungen

- Interview Questions and AnswersDokument7 SeitenInterview Questions and AnswersAsif JavaidNoch keine Bewertungen

- Effective Ehs TrainingDokument57 SeitenEffective Ehs TrainingGustavo FeisbukeroNoch keine Bewertungen

- Candidate Ref. No. Date: Position Code: Position:: HR Interview Form - DDokument1 SeiteCandidate Ref. No. Date: Position Code: Position:: HR Interview Form - DFadi BachirNoch keine Bewertungen

- Manpower Planning ProcessDokument38 SeitenManpower Planning ProcessTuhin Subhra SamantaNoch keine Bewertungen

- Chapter 1Dokument31 SeitenChapter 1Param TrivediNoch keine Bewertungen

- WhatMotivatesGenerationZatWork PDFDokument13 SeitenWhatMotivatesGenerationZatWork PDFpreeti100% (1)

- Guidelines On Permit To Work (P.T.W.) Systems: Report No. 6.29/189 January 1993Dokument30 SeitenGuidelines On Permit To Work (P.T.W.) Systems: Report No. 6.29/189 January 1993merajuddin64_6144004Noch keine Bewertungen

- Writing A Curriculum Vitae - 2 KTDokument8 SeitenWriting A Curriculum Vitae - 2 KTsbg007hiNoch keine Bewertungen

- Integrated Contextual ModelDokument23 SeitenIntegrated Contextual ModelSahana Sameer Kulkarni0% (1)

- Royal Bank of Scotland: by Group 9Dokument8 SeitenRoyal Bank of Scotland: by Group 9sheersha kkNoch keine Bewertungen

- Hrmo Prime-Hrm: Self-Assessment ToolDokument24 SeitenHrmo Prime-Hrm: Self-Assessment ToolJoy SingsonNoch keine Bewertungen