Beruflich Dokumente

Kultur Dokumente

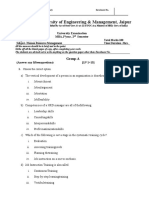

University of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 Semester

Hochgeladen von

Supriyo BiswasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

University of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 Semester

Hochgeladen von

Supriyo BiswasCopyright:

Verfügbare Formate

MBA/Even/MB205/2018-19 (Regular) Enrolment No.

University of Engineering & Management, Jaipur

(Established by Act of State Govt. & u/s 22 of UGC Act, Ministry of HRD, Govt. of India)

University Examination

MBA,1styear, 2nd Semester

Subject Code-MB 205 Total Marks-100

Subject- Indian Financial System & Financial Markets Time Duration -3hrs.

All the answers should be in brief and to the point.

Strike off all the blank pages of copy, after completing your work.

The students are advised not to write anything on the question paper other than Enrolment No.

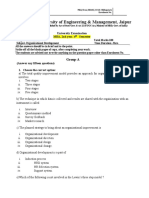

Group-A

(Answer any fifteenquestions) [15*1=15]

1.A merchant bank is a financial institution conducting money market activities and:

a.Lending

b.Underwriting and financial advice

c.Investment service

d.All of the above

2. In the call money market, time repayment varies from

(a) 1–365 days

(b) 1–14 days

(c) 1–21 days

(d) 1–164 days

3. Commercial bills

(a) Increases the size of goods market

(b) Provides liquidity

(c) Expands credit facilities

(d) All of the above

4. The treasury bills are issued by

(a) Reserve bank of India

(b) Commercial banks

(c) Merchant banks

(d) Development banks

5. Which is not a type of treasury bills?

(a) 15 days

(b) 91 days

(c) 182 days

(d) 364 days

6. Certificate of deposit was introduced on India in

(a) 1991

(b) 1990

MBA/Even/MB205/2018-19 (Regular) Enrolment No.

(c) 1989

(d) 1988

7. New issue market refers to

(a) Commodity market

(b) Primary market

(c) Secondary market

(d) Stock market

8. The period of future contract generally varies from

(a) 1–14 days

(b) 3–21 days

(c) 3–21 months

(d) 1–2 years

9 Forward contract involves

(a) Generally a single delivery date

(b) Liquidity

(c) No credit risk

(d) Margin requirements

10.RBI was established in

(a) 1935

(b) 1940

(c) 1937

(d) 1952

11. The Banking Ombudsman-

(a) Is in charge of bank loans for buses

(b) Fixes the rates of interest for loans

(c) Resolves complaints of customers

(d) Issues licenses for new bank branches

(e) Is the head of all nationalized banks

12. The Forward Markets commission is responsible for regulation of which type of trading in

India?

(a) Commodities futures Trading

(b) Currency futures Trading

(c) Equity futures Trading

(d) Derivative futures Trading

(e) All of these

13.Which of the following represents correct meaning of ‘REPO RATE’?

(a) Rate on which RBI sells Government Securities to Banks

(b) Rate for borrowing rupees by banks from RBI

(c) Rate offered by banks to their prime customers

(d) Rate applicable for grant of priority sector loans

(e) None of these

MBA/Even/MB205/2018-19 (Regular) Enrolment No.

14. Savings bank accounts are opened by-

(a) Trading entities, manufacturing entities and individuals for savings purposes

(b) Traders and manufactures for business purposes

(c) Individuals for savings purposes

(d) Limited companies and partnerships for savings purposes

(e) Cooperative banks for savings

15. Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) are terms most closely

related to which of the following industries/markets?

(a) Capital market

(b) Banking industry

(c)Commodities market

(d) Money Market

(e) Mutual fund industry

16. How many times has financial emergency been declared in

India so far ?

(a) 5 times

(b) 4 times

(c) Once

(d) Never

(e) None of these

17. New issue market refers to

(a) Commodity market

(b) Primary market

(c) Secondary market

(d) Stock market

18. The period of future contract generally varies from

(a) 1–14 days

(b) 3–21 days

(c) 3–21 months

(d) 1–2 years

19 What is the full form of NSDL?

(a) National Securities Depository Limited

(b) National Securities Demanding Liability

(c) National Sample Depository Limited

(d) National Sample Driven Land

(e) None of these

20. Which of the following Negotiable Instruments can be crossed

to the banks ?

(a) Cheques

(b) Bills of Exchange

(c) Drafts

MBA/Even/MB205/2018-19 (Regular) Enrolment No.

(d) All of above

(e) None of these

Group-B

(Answer any five questions) [5*5=25]

2. Define financial market. Mention its role and significance.

3. What do you mean by future contract? Discuss the features of the same.

4. Differentiate between promissory notes, bills of exchange and cheques.

5. What are NPA’s? Describe the major factors that contribute to high levels of NPA in

India. Explain the steps taken by banking sector to resolve this problem

6. Why do you think financial markets are required? What are your views on proper

regulation of these markets?

7. If you are a Merchant banker, what issues would you consider before accepting a public

issue proposal of a company? Briefly discuss.

8. "Mutual funds route offer several important benefits to the small investor." What are

these benefits? Briefly discuss.

9. Who is a "merchant banker". Enumerate the services provided by a merchant banker.

Critically analyze the regulatory framework for merchant bankers in India.

10. Mutual funds are an important segment of financial markets. How is this role

performed? Also discuss the management of a mutual fund company.

Group-C

(Answer any four questions) [4*15=60]

11. Discuss the factors which led the Indian Financial markets into Global Financial

markets.

12. Explain the meaning of 'capital market' and 'money market'. Compare and contrast these

two markets.

13. 'Stock exchanges in India have not served their purpose.' Do you agree? Validate your

arguments.

14. Compare and contrast 'Leasing' and 'Hire Purchasing'. Why do companies go for leasing

of assets? Briefly explain.

15. Explain the importance of E-banking system in India. Describe how Indian customers

are reacting to E-banking post demonetization?

16. What was the modus operandi of the Harshad Mehta scam?

17. Explain the following terms in detail

a.Commercial paper

b.Treasury bills

c.Repo

d.GDR

18. Briefly explain the role and guidelines of SEBI in Primary and secondary market.

Das könnte Ihnen auch gefallen

- A Practical Approach to the Study of Indian Capital MarketsVon EverandA Practical Approach to the Study of Indian Capital MarketsNoch keine Bewertungen

- University of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Dokument4 SeitenUniversity of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Supriyo BiswasNoch keine Bewertungen

- QP CODE: 21100520: Reg No: NameDokument2 SeitenQP CODE: 21100520: Reg No: NameOnline Class, CAS KPLYNoch keine Bewertungen

- IFS Suggestion GKJDokument6 SeitenIFS Suggestion GKJAN-DROID GAMER RATULNoch keine Bewertungen

- IFS End Term 2015Dokument6 SeitenIFS End Term 2015SharmaNoch keine Bewertungen

- IFS Suggested Questions by GKJDokument5 SeitenIFS Suggested Questions by GKJNayanNoch keine Bewertungen

- Time 3 Hours MM 100: All India Management Association End Term Examination E-Fm 06 Financial ServicesDokument7 SeitenTime 3 Hours MM 100: All India Management Association End Term Examination E-Fm 06 Financial ServicesJimit ShahNoch keine Bewertungen

- Cfmip 28092 P 2Dokument19 SeitenCfmip 28092 P 2Amit MakwanaNoch keine Bewertungen

- Galaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii TrimesterDokument5 SeitenGalaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii Trimesteralbinus1385Noch keine Bewertungen

- MCOM 1st Year English PDFDokument8 SeitenMCOM 1st Year English PDFakshaykr1189Noch keine Bewertungen

- M.B.A. DEGREE EXAMINATION December 2014: (Financial Management)Dokument1 SeiteM.B.A. DEGREE EXAMINATION December 2014: (Financial Management)Ravi KrishnanNoch keine Bewertungen

- Syjc Ocm PrelimDokument3 SeitenSyjc Ocm PrelimjaijaibambholeNoch keine Bewertungen

- MBA-2 Sem-III: Management of Financial ServicesDokument17 SeitenMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNoch keine Bewertungen

- IBO - English Assign.Dokument8 SeitenIBO - English Assign.Browse PurposeNoch keine Bewertungen

- Mefa Imp+ Arryasri Guide PDFDokument210 SeitenMefa Imp+ Arryasri Guide PDFvenumadhavNoch keine Bewertungen

- TY-BFM Question BankDokument17 SeitenTY-BFM Question BankManish SolankiNoch keine Bewertungen

- MEFA Important QuestionsDokument14 SeitenMEFA Important Questionstulasinad123Noch keine Bewertungen

- Bba 706Dokument2 SeitenBba 706api-3782519Noch keine Bewertungen

- MCom AssignmentsDokument4 SeitenMCom AssignmentsrakikiraNoch keine Bewertungen

- Master of Commerce: 1 YearDokument8 SeitenMaster of Commerce: 1 YearAston Rahul PintoNoch keine Bewertungen

- MEFA Important Questions JWFILESDokument14 SeitenMEFA Important Questions JWFILESEshwar TejaNoch keine Bewertungen

- Unit 1: Indian Financial System: Multiple Choice QuestionsDokument31 SeitenUnit 1: Indian Financial System: Multiple Choice QuestionsNisha PariharNoch keine Bewertungen

- 306 FIn Financial System of India Markets & ServicesDokument6 Seiten306 FIn Financial System of India Markets & ServicesNikhil BhaleraoNoch keine Bewertungen

- Economics of Pakistan Important QuestionsDokument7 SeitenEconomics of Pakistan Important QuestionsKhalid MahmoodNoch keine Bewertungen

- QP Financial Planning and Wealth ManagementDokument2 SeitenQP Financial Planning and Wealth ManagementHarpreet KaurNoch keine Bewertungen

- SFM MOCK P14 - Dec2021Dokument22 SeitenSFM MOCK P14 - Dec202174ef8465d65d1bNoch keine Bewertungen

- (WWW - Entrance-Exam - Net) - ICFAI University Financial Management - I (MB2E1) Sample Paper 1Dokument26 Seiten(WWW - Entrance-Exam - Net) - ICFAI University Financial Management - I (MB2E1) Sample Paper 1mrajgolikarNoch keine Bewertungen

- Indi Securities MarketDokument5 SeitenIndi Securities MarketsunilsoniaguptaNoch keine Bewertungen

- Financial Institution & MarketsDokument1 SeiteFinancial Institution & MarketsPILLO PATELNoch keine Bewertungen

- Management Point: Bank PO, ClerkDokument3 SeitenManagement Point: Bank PO, ClerkPawan KumarNoch keine Bewertungen

- 7Dokument22 Seiten7Sanket MhetreNoch keine Bewertungen

- Security Analysis & Portfolio ManagementDokument2 SeitenSecurity Analysis & Portfolio ManagementGunamoy Hazra100% (1)

- Examination Paper - Principles and Practices of Banking & Financial ServicesDokument9 SeitenExamination Paper - Principles and Practices of Banking & Financial ServicesJesjames123Noch keine Bewertungen

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Dokument202 SeitenMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaNoch keine Bewertungen

- MEFA Unit Wise Imp QuestionsDokument6 SeitenMEFA Unit Wise Imp QuestionsSatya KumarNoch keine Bewertungen

- QP CODE: 18103380: Third SemesterDokument2 SeitenQP CODE: 18103380: Third SemesterOnline Class, CAS KPLYNoch keine Bewertungen

- Economy: Money and Banking: Previous Year QuestionDokument9 SeitenEconomy: Money and Banking: Previous Year Questionabhimmanyu2021Noch keine Bewertungen

- MBFM4002 Global Financial ManagementDokument3 SeitenMBFM4002 Global Financial ManagementShakthi RaghaviNoch keine Bewertungen

- Financial Awareness by Das Sir, Kolkata (09038870684)Dokument23 SeitenFinancial Awareness by Das Sir, Kolkata (09038870684)Tamal Kumar DasNoch keine Bewertungen

- 1st Sem PapersDokument66 Seiten1st Sem PapersJanvi 86 sec.BNoch keine Bewertungen

- MBA III Semester Supplementary Examinations October 2020: Code: 17E00308Dokument5 SeitenMBA III Semester Supplementary Examinations October 2020: Code: 17E00308Beedam BalajiNoch keine Bewertungen

- Banking and InsuranceDokument13 SeitenBanking and InsuranceKiran Kumar50% (2)

- Cs Paper June 2010Dokument4 SeitenCs Paper June 2010Amit AggarwalNoch keine Bewertungen

- Ankith Interim ReportDokument22 SeitenAnkith Interim ReportAnkith100% (1)

- Banking and Finanac PDFDokument28 SeitenBanking and Finanac PDFVijendra ThakreNoch keine Bewertungen

- K 2830202mfsDokument2 SeitenK 2830202mfsFaisal MalekNoch keine Bewertungen

- MBFM4003Dokument3 SeitenMBFM4003PreethiNoch keine Bewertungen

- Class 11th - Business StudiesDokument4 SeitenClass 11th - Business StudiesNihalSoniNoch keine Bewertungen

- Revalidation Test Paper Question GR IIIDokument9 SeitenRevalidation Test Paper Question GR IIIMinhaz AlamNoch keine Bewertungen

- Investment Banking QP - PGDM - TRIM 3Dokument6 SeitenInvestment Banking QP - PGDM - TRIM 3SharmaNoch keine Bewertungen

- Ankith Final ReportDokument50 SeitenAnkith Final ReportAnkith100% (1)

- Introduction To Financial ServicesDokument2 SeitenIntroduction To Financial ServicesDr.Pratixa JoshiNoch keine Bewertungen

- QP CODE: 19102080: Reg No: NameDokument2 SeitenQP CODE: 19102080: Reg No: NameOnline Class, CAS KPLYNoch keine Bewertungen

- NCFM SMBM QuestionsDokument12 SeitenNCFM SMBM QuestionslifeeeNoch keine Bewertungen

- FRA Test Papers: Archive - Sem VDokument32 SeitenFRA Test Papers: Archive - Sem VBharatSirveeNoch keine Bewertungen

- Financial ServicesDokument2 SeitenFinancial Servicesannugautam1902Noch keine Bewertungen

- Bcom 3 Sem Financial Markets and Operations 22100580 Apr 2022Dokument2 SeitenBcom 3 Sem Financial Markets and Operations 22100580 Apr 2022lightpekka2003Noch keine Bewertungen

- CFGB6308 Capital Markets and Investment Test QuizDokument4 SeitenCFGB6308 Capital Markets and Investment Test QuizMasrul FaizalNoch keine Bewertungen

- MBA Assignment V PSDokument3 SeitenMBA Assignment V PSSupriyo BiswasNoch keine Bewertungen

- Assignment - 1Dokument1 SeiteAssignment - 1Supriyo BiswasNoch keine Bewertungen

- University of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 SemesterDokument3 SeitenUniversity of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 SemesterSupriyo BiswasNoch keine Bewertungen

- University of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveDokument4 SeitenUniversity of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveSupriyo BiswasNoch keine Bewertungen

- University of Engineering & Management, Jaipur: Group-ADokument4 SeitenUniversity of Engineering & Management, Jaipur: Group-ASupriyo BiswasNoch keine Bewertungen

- MM 405 - SM - Mba - IDokument4 SeitenMM 405 - SM - Mba - ISupriyo BiswasNoch keine Bewertungen

- University of Engineering & Management, Jaipur: Group-ADokument4 SeitenUniversity of Engineering & Management, Jaipur: Group-ASupriyo BiswasNoch keine Bewertungen

- University of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterDokument5 SeitenUniversity of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterSupriyo BiswasNoch keine Bewertungen

- University of Engineering & Management, Jaipur: University Examination MBA, 2nd Year, 4 SemesterDokument5 SeitenUniversity of Engineering & Management, Jaipur: University Examination MBA, 2nd Year, 4 SemesterSupriyo BiswasNoch keine Bewertungen

- University of Engineering & Management, Jaipur: University Examination M.Tech, 1 Year, 2 SemesterDokument4 SeitenUniversity of Engineering & Management, Jaipur: University Examination M.Tech, 1 Year, 2 SemesterSupriyo BiswasNoch keine Bewertungen

- State Exam Questions & Answers UpdateDokument15 SeitenState Exam Questions & Answers UpdateBeatrice Bebe OnabiyiNoch keine Bewertungen

- Credit Rating of Companies Using Financial RatiosDokument37 SeitenCredit Rating of Companies Using Financial Ratiosavinash singh100% (1)

- A Project Report ON Investment Options Offered by Icici Bank and HDFC BankDokument78 SeitenA Project Report ON Investment Options Offered by Icici Bank and HDFC BanksimanttNoch keine Bewertungen

- Credit FunctionDokument19 SeitenCredit FunctionPrincess Di BaykingNoch keine Bewertungen

- Inspection ReportsDokument9 SeitenInspection Reportsratnesh811100% (1)

- Investment Vs FinancingDokument6 SeitenInvestment Vs FinancingSolomon, Heren Mae M.Noch keine Bewertungen

- G.R. No. 153852 October 24, 2012 Spouses Humberto P. Delossantos and Carmencita M. Delos Santos, Petitioners, Metropolitan Bank and Trust Company, RespondentDokument1 SeiteG.R. No. 153852 October 24, 2012 Spouses Humberto P. Delossantos and Carmencita M. Delos Santos, Petitioners, Metropolitan Bank and Trust Company, RespondentSah SaahNoch keine Bewertungen

- Chapter Four Financial Market in The Financial SystemsDokument136 SeitenChapter Four Financial Market in The Financial SystemsNatnael Asfaw100% (1)

- Sheriff's SalesDokument28 SeitenSheriff's SalesJoliet_HeraldNoch keine Bewertungen

- Federal Urdu University of Arts, Science and Technology, IslamabadDokument6 SeitenFederal Urdu University of Arts, Science and Technology, IslamabadQasim Jahangir WaraichNoch keine Bewertungen

- Chapter-2 Central Bank and Its Functions: An Institution Such As National Bank of EthiopiaDokument34 SeitenChapter-2 Central Bank and Its Functions: An Institution Such As National Bank of EthiopiaEmebet TesemaNoch keine Bewertungen

- PMS EXAM CHP 3Dokument3 SeitenPMS EXAM CHP 3Rachaita AdhikaryNoch keine Bewertungen

- Business FinanceDokument22 SeitenBusiness FinanceMoonprideloverNoch keine Bewertungen

- Noa - Abante JDokument1 SeiteNoa - Abante JJomarc Cedrick GonzalesNoch keine Bewertungen

- Cecchetti 6e Chapter 06updatedDokument53 SeitenCecchetti 6e Chapter 06updatedmithatfurkananlarNoch keine Bewertungen

- Dissertation On Real EstateDokument6 SeitenDissertation On Real EstateBuyPapersOnlineCheapSingapore100% (1)

- A Study On Income Tax Law & Accounting 2019Dokument26 SeitenA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNoch keine Bewertungen

- Banking Operations FinalDokument440 SeitenBanking Operations FinalKandasamy AnbuNoch keine Bewertungen

- Arun Khanal BBS 4th YearDokument28 SeitenArun Khanal BBS 4th YearKarma Dhundup100% (1)

- Chapter 5 NumericalDokument4 SeitenChapter 5 Numericalkapil DevkotaNoch keine Bewertungen

- Finance Applications and Theory 4th Edition Cornett Test BankDokument41 SeitenFinance Applications and Theory 4th Edition Cornett Test Bankaletheasophroniahae100% (24)

- Outline: MFIN6003 Derivative SecuritiesDokument14 SeitenOutline: MFIN6003 Derivative SecuritiesMavisNoch keine Bewertungen

- BBFS (R-3)Dokument4 SeitenBBFS (R-3)Mohammed ShoaibNoch keine Bewertungen

- Comparative Study On Financial Performance of State Bank of India and Bank of BarodaDokument62 SeitenComparative Study On Financial Performance of State Bank of India and Bank of BarodaVIKAS MishraNoch keine Bewertungen

- NovationDokument12 SeitenNovationsubhashni kumariNoch keine Bewertungen

- 12 Land Use Plan Republic Act No. 7279 - Official Gazette of The Republic of The PhilippinesDokument23 Seiten12 Land Use Plan Republic Act No. 7279 - Official Gazette of The Republic of The PhilippinesjrstockholmNoch keine Bewertungen

- 510 - Sps Vega vs. SSS, 20 Sept 2010Dokument2 Seiten510 - Sps Vega vs. SSS, 20 Sept 2010anaNoch keine Bewertungen

- Money MarketDokument19 SeitenMoney Marketramesh.kNoch keine Bewertungen

- 141 Northern Motors vs. HerreraDokument2 Seiten141 Northern Motors vs. Herrerak santosNoch keine Bewertungen

- The Mathematics of Valuing Structured Securities in The Secondary MarketDokument9 SeitenThe Mathematics of Valuing Structured Securities in The Secondary MarketAnn Elaine RutledgeNoch keine Bewertungen

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresVon EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresBewertung: 4.5 von 5 Sternen4.5/5 (3)

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Von Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Noch keine Bewertungen

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersVon EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersNoch keine Bewertungen

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsVon EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsBewertung: 5 von 5 Sternen5/5 (1)

- PTCE: Pharmacy Technician Certification Exam Premium: 4 Practice Tests + Comprehensive Review + Online PracticeVon EverandPTCE: Pharmacy Technician Certification Exam Premium: 4 Practice Tests + Comprehensive Review + Online PracticeNoch keine Bewertungen

- Drilling Supervisor: Passbooks Study GuideVon EverandDrilling Supervisor: Passbooks Study GuideNoch keine Bewertungen

- Life Insurance Agent: Passbooks Study GuideVon EverandLife Insurance Agent: Passbooks Study GuideNoch keine Bewertungen

- Master the Boards USMLE Step 3 7th Ed.Von EverandMaster the Boards USMLE Step 3 7th Ed.Bewertung: 4.5 von 5 Sternen4.5/5 (6)

- Pilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CVon EverandPilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CNoch keine Bewertungen

- Preclinical Physiology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Von EverandPreclinical Physiology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Noch keine Bewertungen

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessVon EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessBewertung: 4.5 von 5 Sternen4.5/5 (17)

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsVon EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsBewertung: 4.5 von 5 Sternen4.5/5 (77)

- Medical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldVon EverandMedical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Certified Professional Coder (CPC): Passbooks Study GuideVon EverandCertified Professional Coder (CPC): Passbooks Study GuideBewertung: 5 von 5 Sternen5/5 (1)

- CUNY Proficiency Examination (CPE): Passbooks Study GuideVon EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideNoch keine Bewertungen

- Textbook of Plastic and Reconstructive SurgeryVon EverandTextbook of Plastic and Reconstructive SurgeryDeepak K. Kalaskar B.Tech PhDBewertung: 4 von 5 Sternen4/5 (9)

- Elevator Mechanic: Passbooks Study GuideVon EverandElevator Mechanic: Passbooks Study GuideNoch keine Bewertungen

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusVon EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusBewertung: 3.5 von 5 Sternen3.5/5 (10)