Beruflich Dokumente

Kultur Dokumente

Direct Material Usage Budget March 31, 2008: Executive Line Chairman Line

Hochgeladen von

Mule AbuyeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Direct Material Usage Budget March 31, 2008: Executive Line Chairman Line

Hochgeladen von

Mule AbuyeCopyright:

Verfügbare Formate

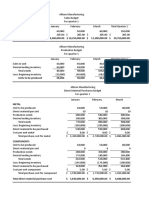

A.

Revenue budget

March 31, 2008

Budgeted sales in units Target selling price Budgeted revenue

Executive line 740 birr 1,020 birr 754,800

Chairman line 390 1,600 624,000

total budgeted revenue birr 1,378,800

B. Production budget

March 31, 2008

Product Executive line chairman line

budgeted unit sales 740 390

Add: target ending finished goods inventory 30 15

Total required units 770 405

less: beginning finished goods inventory 20 5

Budgeted production(units to be produced) 750 400

Direct material usage budget

March 31, 2008

Materials Total

Oak top Oak legs Red oak top Red oak legs

Direct materials required 16sqf *750= 4legs*750=

for executive line 12,000 3000

Direct materials required 25sqf*400= 4legs*400=

for chairman line 10,000 1600

Total direct materials to 12,000sqs 3000legs 10,000sqf 1600legs

be used

Cost data Materials total

Oak top Oak legs red oak top red oak legs

Available from 320*18= 100*11=110 150*23= 3450 40*17= 680 10990

beginning direct 5760 0

materials inventory

Cost of units to be (12000-320) (3000-100) * (10,000- (1600-40)*18= 542730

purchase this period *20= 12= 34800 150)*25=2462 28080

233,600 50

Cost direct materials to 239360 35900 249700 28760 553720

used this period

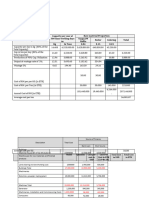

Direct material purchase budget

March 2008

Physical units Materials Total

Oak top Oak legs Red oak top Red oak legs

To be used in production 12000 sqf 3000 legs 10,000 sqf 1600 legs

add: target ending inventory (192 sqf 80 legs 200 sqf 44 legs

total requirements 12192 sqf 3080 legs 10200 sqf 1644 legs

Deduct: beginning inventory 320 sqf 100 legs 150 sqf 40 legs

purchase to be made 11,872 sqf 2,980 legs 10,050 sqf 1604 legs

Cost budget

11872*20= 2980*12= 10,050*25= 1604*18= 553322

237,440 35,760 251,250 28,872

Direct manufacturing labor budget

March 2008

items Production Direct Total Hourly wage Total direct

budget manufacturing hours rate labor cost

labor hour per unit budget

Executive line 750 3 hrs 2,250 birr 30 67,500

Chairman line 400 5hrs 2,000 30 60,000

total birr 127,500

Manufacturing Overhead Costs Budget

March 2008

Executive line Chairman line Total

Variable manufacturing overhead

Executive line(2250*birr 35), Chairman birr 78750 birr 70,000 birr148,750

line(2000* birr 35)

Fixed manufacturing overhead

(42,500*3/8; 42500*5/8) 15937.5 26562.5 42,500

Total budgeted manufacturing overhead birr 94687.5 birr 96562.5 Birr 191250

Unit Costs of Ending Finished Goods Inventory

Products

Cost per Unit Executive Line Chairman Line

of Input per Unit Total cost per Input per Unit Total cost per

Input of Output unit of output of Output unit of output

Oak top birr 20 16 sqf birr 320

Oak legs birr 12 4 legs 48

Red Oak Top birr 25 25 sqf 625

Red Oak legs birr 18 4 legs 72

DML birr 30 3 hrs 90 5 hrs 150

VMoH birr 35 3 hrs 105 5 hrs 175

FMoH 126.25 241.406

Total birr 689.25 birr 1263.406

Ending inventory Budget

March 2008

Quantity Cost per unit Total cost total

1. Direct materials inventory

Oak top 192 20 3840

Oak legs 80 12 960

Red Oak Top 200 25 5000

Red Oak legs 44 18 792 10,592

2. Finished Good Inventory

Executive Line 30 birr 689.25 20677.5

Chairman Line 15 birr 1263.406 18,951.09 39628.59

Total 50220.59

Cost of goods sold budget

March 2008

items Total costs

Beginning finished goods inventory 15,330

Direct materials used 553720

Direct manufacturing labor 127,500

manufacturing overhead costs 191250

Costs of goods manufactured 872470

Costs of goods available for sale 887800

Deduct: Ending Finished Goods Inventory 39628.59

Cost of Goods Sold Birr 848171.41

#2. Flexible budget and level 2 variance analysis

Actual Flexible Flexible Sales Volume Static Budget

Results Budget Budget Variance Amount

Variance Amount

Units Sold 13,000 0 13,000 2000U 15,000

Revenue Br. 2860,000 260,000F 2,600,000 400,000U Br. 3,000,000

Variable Br. 1,560,000 65,000U 1,495,000 230,000F Br. 1,725,000

Costs

Contribution Br.1 ,300,000 195,000F 1,105,000 170,000U Br. 1,275,000

Margin

Fixed Costs 950,000 150,000 U 800,000 0 800,000

Operating 350,000 45,000F 305,000 170,000U 475,000

Profit

Flexible budget variance Sales volume variance

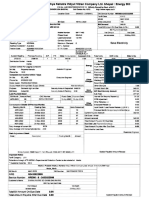

#3

Actual Costs Flexible Budget

Incurred (Budgeted Input

Quantity Allowed for

Actual Input Quantity *

Actual Output *

Budgeted Price

(Actual Input Quantity* Budgeted Price)

Actual Price)

Direct materials 46000*1.92 46,000*2 (80*525)2

= 88,320 = 92,000 = 84,000

a. Material Price variance 3,680F

b. Material Quantity variance 8,000U

Actual Costs Flexible Budget

Incurred (Budgeted Input

Quantity Allowed for

Actual Input Quantity *

Actual Output *

Budgeted rate

(Actual Input Quantity* Budgeted rate)

Actual rate)

Direct materials 682.5*16.1 682.5*16 (1.25*525)*16

= 10988.25 = 10,920 = 10,500

c. Labor rate variance 68.25U

d. Labor Efficiency variance 420U

e. Variable overhead spending and efficiency variance

Actual variable overhead Actual hour at standard Budgeted variable overhead

costs (AH*AR) rate cost(Flexible budget)

(AH*SR) (SH*SR)

270 hrs*51=13770 270hrs *50=13,500 300hrs*50= 15,000

spending variance efficiency variance

spending variance = 270U

efficiency variance = 1,500F

Das könnte Ihnen auch gefallen

- Classes 3.a 4.a EXCERCISES From COGS To Planning - September 2022Dokument9 SeitenClasses 3.a 4.a EXCERCISES From COGS To Planning - September 2022Maram PageNoch keine Bewertungen

- Acc Assignment Sem 2Dokument23 SeitenAcc Assignment Sem 2Luqman HaqimNoch keine Bewertungen

- ACT202 Term PaperDokument10 SeitenACT202 Term Paperarafkhan1623Noch keine Bewertungen

- Factory Costing Report BreakdownDokument8 SeitenFactory Costing Report BreakdownsananeNoch keine Bewertungen

- Cost Accounting Question BankDokument28 SeitenCost Accounting Question BankdeepakgokuldasNoch keine Bewertungen

- Exercise 1: Schedule of Expected Cash CollectionDokument7 SeitenExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNoch keine Bewertungen

- BAC B203- COST ACCOUNTING (1)Dokument4 SeitenBAC B203- COST ACCOUNTING (1)Carol NzauNoch keine Bewertungen

- Cost Sheet HandoutDokument7 SeitenCost Sheet HandoutSidhant AirenNoch keine Bewertungen

- Handout No. 2Dokument4 SeitenHandout No. 2Gertim CondezNoch keine Bewertungen

- Flint Manufacturers 2021 Sales and Production BudgetDokument12 SeitenFlint Manufacturers 2021 Sales and Production BudgetJastine CahimtongNoch keine Bewertungen

- Cost Sheet QuestionsDokument4 SeitenCost Sheet QuestionsAbhishekNoch keine Bewertungen

- Millichem Solution XDokument6 SeitenMillichem Solution XMuhammad JunaidNoch keine Bewertungen

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 20Dokument2 SeitenAllocation and Apportionment and Job and Batch Costing Worked Example Question 20Roshan RamkhalawonNoch keine Bewertungen

- ამოცანები ბიუჯეტის შედგენაზე #1Dokument34 Seitenამოცანები ბიუჯეტის შედგენაზე #1Berika EbanoidzeNoch keine Bewertungen

- E1049217046 18320 141590299475Dokument14 SeitenE1049217046 18320 141590299475Sumit PattanaikNoch keine Bewertungen

- Chapter 19 Manufacturing Accounts Q1 Spinners & CoDokument2 SeitenChapter 19 Manufacturing Accounts Q1 Spinners & Comelody shayanwakoNoch keine Bewertungen

- Cost ProblemsDokument7 SeitenCost ProblemsMadanNoch keine Bewertungen

- Completed (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkDokument4 SeitenCompleted (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkYolo LeetNoch keine Bewertungen

- Acc 202 Exercise MyselfDokument5 SeitenAcc 202 Exercise Myselfnhidiepnguyet08112004Noch keine Bewertungen

- A - Mock PSPM Set 2Dokument6 SeitenA - Mock PSPM Set 2IZZAH NUR ATHIRAH BINTI AZLI MoeNoch keine Bewertungen

- Exercise 6,7Dokument2 SeitenExercise 6,7Damian Sheila MaeNoch keine Bewertungen

- College of Business and Economics Department of Accounting and Finance Assignment For The Course Cost and Management Accounting IiDokument7 SeitenCollege of Business and Economics Department of Accounting and Finance Assignment For The Course Cost and Management Accounting IiAnwar yimerNoch keine Bewertungen

- Af 211-Assignment 1Dokument6 SeitenAf 211-Assignment 1latifa.haroun100% (1)

- ACC416Dokument20 SeitenACC416Anonymous N0mQBENoch keine Bewertungen

- Cost of Goods Manufactured and Sold StatementDokument11 SeitenCost of Goods Manufactured and Sold Statementali chahilNoch keine Bewertungen

- UTS AkutansiDokument24 SeitenUTS AkutansiAbraham KristiyonoNoch keine Bewertungen

- Brocher Solution Problem 5-51Dokument5 SeitenBrocher Solution Problem 5-51Alif ArmadanaNoch keine Bewertungen

- Quiz Absorption and Variable CostingDokument2 SeitenQuiz Absorption and Variable CostingPISONANTA KRISETIANoch keine Bewertungen

- Semester Paper CostDokument4 SeitenSemester Paper CostMd HussainNoch keine Bewertungen

- Tugas Kelompok 1 (AkMen) - Maria .HDokument18 SeitenTugas Kelompok 1 (AkMen) - Maria .HMaria YohanaNoch keine Bewertungen

- CNA33A3 2024 Unit 2 Class Activities Solutions 6-25 6-34 6-42Dokument6 SeitenCNA33A3 2024 Unit 2 Class Activities Solutions 6-25 6-34 6-42realfeelanimeNoch keine Bewertungen

- Hassan Exame 21 AugustrDokument4 SeitenHassan Exame 21 Augustrsardar hussainNoch keine Bewertungen

- Unit and Output Costing QuestionDokument14 SeitenUnit and Output Costing QuestionSilver TricksNoch keine Bewertungen

- Illustration Questions 7Dokument3 SeitenIllustration Questions 7mohammedahalysNoch keine Bewertungen

- Problem 9-47Dokument8 SeitenProblem 9-47wiwit_karyantiNoch keine Bewertungen

- Problem 9-47Dokument8 SeitenProblem 9-47wiwit_karyantiNoch keine Bewertungen

- CMA Vol 1-1Dokument211 SeitenCMA Vol 1-1Shahaer MumtazNoch keine Bewertungen

- Day 2 - COST - TEMPLATEDokument27 SeitenDay 2 - COST - TEMPLATEum23328Noch keine Bewertungen

- Module 4 Cost AccountingDokument2 SeitenModule 4 Cost AccountingSinclair Faith GalarioNoch keine Bewertungen

- Mamun Act 360Dokument40 SeitenMamun Act 360JUBAIR AHMEDNoch keine Bewertungen

- Cost SheetDokument10 SeitenCost Sheetchukku2803Noch keine Bewertungen

- ABC CostingDokument7 SeitenABC CostingNafiz RahmanNoch keine Bewertungen

- ACMA Unit 7 Problems - Cost Sheet PDFDokument3 SeitenACMA Unit 7 Problems - Cost Sheet PDFPrabhat SinghNoch keine Bewertungen

- Module 2 - Problems On Cost SheetDokument8 SeitenModule 2 - Problems On Cost SheetSupreetha100% (1)

- CS Uthkarsh PaiDokument9 SeitenCS Uthkarsh Paiankita sahuNoch keine Bewertungen

- Santol-Candy-Feasibility StudyDokument71 SeitenSantol-Candy-Feasibility StudyManto RoderickNoch keine Bewertungen

- Schedule of Cash Collection, Production Needs, and Manufacturing Overhead CostsDokument5 SeitenSchedule of Cash Collection, Production Needs, and Manufacturing Overhead CostsYến Hoàng HảiNoch keine Bewertungen

- Accounting For Manufctuirng - PQ)Dokument6 SeitenAccounting For Manufctuirng - PQ)usama sarwerNoch keine Bewertungen

- Fma Assignment 3Dokument5 SeitenFma Assignment 3Abdul AhmedNoch keine Bewertungen

- CostConExercise - COGM & COGSDokument3 SeitenCostConExercise - COGM & COGSLee Tarroza100% (1)

- Harsh Electricals: Analyzing Cost in Search of ProfitDokument11 SeitenHarsh Electricals: Analyzing Cost in Search of ProfitSanJana NahataNoch keine Bewertungen

- Calculating production costs and profitability for ketchup manufacturerDokument16 SeitenCalculating production costs and profitability for ketchup manufacturerSandeep PeddadaNoch keine Bewertungen

- CH5 CostDokument33 SeitenCH5 CostNickey DickeyNoch keine Bewertungen

- AsratDokument27 SeitenAsratMechal Awerka SmammoNoch keine Bewertungen

- Chapter 04Dokument4 SeitenChapter 04Nouman BaigNoch keine Bewertungen

- Job Order Costing: Illustrative ProblemsDokument30 SeitenJob Order Costing: Illustrative ProblemsPatrick LanceNoch keine Bewertungen

- Energy Efficient Manufacturing: Theory and ApplicationsVon EverandEnergy Efficient Manufacturing: Theory and ApplicationsNoch keine Bewertungen

- Advanced Processing and Manufacturing Technologies for Nanostructured and Multifunctional Materials IIIVon EverandAdvanced Processing and Manufacturing Technologies for Nanostructured and Multifunctional Materials IIITatsuki OhjiNoch keine Bewertungen

- How to Find Out About Patents: The Commonwealth and International Library: Libraries and Technical Information DivisionVon EverandHow to Find Out About Patents: The Commonwealth and International Library: Libraries and Technical Information DivisionNoch keine Bewertungen

- Ethiopia's Federal Tax System ExplainedDokument40 SeitenEthiopia's Federal Tax System ExplainedMule AbuyeNoch keine Bewertungen

- Chapter 6 - Perfromance Evaluation (Revised)Dokument24 SeitenChapter 6 - Perfromance Evaluation (Revised)Mule AbuyeNoch keine Bewertungen

- Working Capital Management: Discussion PointsDokument85 SeitenWorking Capital Management: Discussion PointsMule AbuyeNoch keine Bewertungen

- Seminar Group Ass.Dokument13 SeitenSeminar Group Ass.Mule Abuye100% (1)

- Chapter 3 PA IIDokument8 SeitenChapter 3 PA IIMule AbuyeNoch keine Bewertungen

- Skorpion Zinc Sustainability Report 2012 2013Dokument40 SeitenSkorpion Zinc Sustainability Report 2012 2013Mac'Ann Ditshego MashaoNoch keine Bewertungen

- Chapter 6 - Slides (Part 2)Dokument18 SeitenChapter 6 - Slides (Part 2)azade azamiNoch keine Bewertungen

- A) KLOC: B) Function Points: C) Pages or Words of DocumentationDokument1 SeiteA) KLOC: B) Function Points: C) Pages or Words of Documentationamulya sNoch keine Bewertungen

- Problem 1. Estimating Hugo Boss' Equity Value (Updated 1-2011)Dokument4 SeitenProblem 1. Estimating Hugo Boss' Equity Value (Updated 1-2011)Walm KetyNoch keine Bewertungen

- Staf Pengajar Fakultas Ekonomi Dan Bisnis Universitas Pembangunan Panca Budi MedanDokument9 SeitenStaf Pengajar Fakultas Ekonomi Dan Bisnis Universitas Pembangunan Panca Budi MedanCamelia HamidahNoch keine Bewertungen

- Peninsular Malaysia Electricity Supply Industry Outlook 2019 PDFDokument55 SeitenPeninsular Malaysia Electricity Supply Industry Outlook 2019 PDFShudhan NambiarNoch keine Bewertungen

- Solved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHDokument1 SeiteSolved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHAnbu jaromiaNoch keine Bewertungen

- Keya Soap Sales Decline and Corrective StrategiesDokument14 SeitenKeya Soap Sales Decline and Corrective StrategiesRifat ChowdhuryNoch keine Bewertungen

- BM1 Slide Chap 1Dokument43 SeitenBM1 Slide Chap 1Thuy DungNoch keine Bewertungen

- Hiraya Marketing Agency: By: Jolina A. ReyesDokument26 SeitenHiraya Marketing Agency: By: Jolina A. ReyesjolinaNoch keine Bewertungen

- JioMart Invoice 16798974620090885ADokument2 SeitenJioMart Invoice 16798974620090885AMarc GuptaNoch keine Bewertungen

- Ceo Exchange Transcript Episode 407Dokument27 SeitenCeo Exchange Transcript Episode 407Đức Duẩn LêNoch keine Bewertungen

- Quizzes Chapter 9 Acctg Cycle of A Service BusinessDokument26 SeitenQuizzes Chapter 9 Acctg Cycle of A Service BusinessJames CastañedaNoch keine Bewertungen

- Success Factors For Mobile Money ServicesDokument22 SeitenSuccess Factors For Mobile Money ServicesMaha zeinelabdinNoch keine Bewertungen

- Lesson 12 HandoutDokument8 SeitenLesson 12 HandoutMary Joyce RamosNoch keine Bewertungen

- Adobe Scan Jun 17, 2023Dokument1 SeiteAdobe Scan Jun 17, 2023Dhiraj RatreNoch keine Bewertungen

- Rules in RCC and OCC RequiredDokument8 SeitenRules in RCC and OCC RequiredXNoch keine Bewertungen

- Entrepreneurship Notes (1-8)Dokument58 SeitenEntrepreneurship Notes (1-8)Lyle BanksNoch keine Bewertungen

- UK Economy Overview and ExercisesDokument13 SeitenUK Economy Overview and ExercisesTomasNoch keine Bewertungen

- Job Order CostingDokument3 SeitenJob Order CostingIrtiza HaiderNoch keine Bewertungen

- Capitalism A Love StoryDokument3 SeitenCapitalism A Love StoryDiego Alvarez Polo0% (1)

- Chapter Two The Recording Process FinalDokument35 SeitenChapter Two The Recording Process Finalsolomon takeleNoch keine Bewertungen

- Bs Nishad SamajDokument5 SeitenBs Nishad SamajBhavesh JainNoch keine Bewertungen

- OIKN - Investment Brief - MBX MBS 01 - 220711 - 180529Dokument25 SeitenOIKN - Investment Brief - MBX MBS 01 - 220711 - 180529Safrin SangiaNoch keine Bewertungen

- Financial Plan of PomeloDokument7 SeitenFinancial Plan of PomeloChris YanNoch keine Bewertungen

- FX Magazine January 2011Dokument124 SeitenFX Magazine January 2011kosurugNoch keine Bewertungen

- Understanding Culture, Society, and Politics Quarter 2 - Module 4 Nonstate InstitutionsDokument15 SeitenUnderstanding Culture, Society, and Politics Quarter 2 - Module 4 Nonstate Institutionsaliza crisostomo100% (1)

- Unit 4Dokument32 SeitenUnit 4Fentahun Ze WoinambaNoch keine Bewertungen

- Lecture 3 - Part 2 - TC70020E - Advanced Construction Procurement and Processes - 2020-21 - w15Dokument62 SeitenLecture 3 - Part 2 - TC70020E - Advanced Construction Procurement and Processes - 2020-21 - w15Jatin ChhabraNoch keine Bewertungen

- m3m Noida 1Dokument33 Seitenm3m Noida 1Nitin AgnihotriNoch keine Bewertungen