Beruflich Dokumente

Kultur Dokumente

Calculate:: Instructions To Be Followed

Hochgeladen von

Yasir AminOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Calculate:: Instructions To Be Followed

Hochgeladen von

Yasir AminCopyright:

Verfügbare Formate

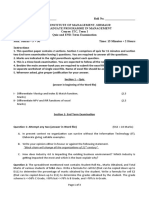

Instructions to be followed:

1. Provide your answers as handwritten preferably in black ball pen on A4 paper with margins on both sides.

2. Write your name and roll number on top of the each answer sheet which must be numbered ( 1/6,2/6, ….)

3. Answer your question by providing “answer to question 1” for example. Do not reproduce the question pl.

4. Having finished the exam, scan it and send it by email at dcomexam@gmail.com and Cc to the teacher

concerned (abkhan@bzu.edu.pk)

5. Do not submit your paper in the Whatsapp group.

6. The answer sheet should reach within 15 minutes after the exam time is over.

7. Delay in submission would lead to deduction of marks.

8. If the exam is not submitted within 15 minutes, you will be awarded zero marks.

Final-term Exam: MCOM Morning Semester 3, Session 2019-21 Investment Analysis &

Portfolio Management Maximum Marks 38( 8+12+ 10+8) Maximum time: 95 Minutes

Q#2 Compare and contrast the top-down and bottom –up approaches of security valuation. Why we

analyze the security market and alternative industries prior to analyzing a company security?

Q#3: What do you understand about a risk-free asset, state its major characteristics and explain how it is

used in the Harry Markowitz Portfolio Model, capital market theory and the Capital asset Pricing Model?

Q#4: Monthly returns of three market Indexes are given hereunder:

Index/Month 1 2 3 4 5 6

S&P-500 (%) 2 6 -1.5 2.5 4 -4

AMEX-100(%) 3 7 0-2 2 - 5.5 6

NASDAQ (%) 4 -3 7 3 2 7

Calculate:

i). Arithmetic average monthly return and standard deviation of each of the Indexes.

ii). Covariance between S&P-500 and AMEX-100 as well as between AMEX-100 and NASDAQ

iii). Correlation Coefficient between S&P-500 and AMEX-100 as well as between AMEX-100 and NASDAQ

iv). Calculate the expected return and standard deviation of a portfolio consisting of S&P-500 and AMEX-

100 with 60% proportion of the investment in S&P-500 and remaining investment in AMEX-100

Q#5: How efficient market theory and random walk theory are related? Explain and contrast the Semi-

strong form of efficiency with the strong form of market efficiency in terms of abnormal rate of return.

___________________________Good Luck ___________________________________

Das könnte Ihnen auch gefallen

- AP Statistics Flashcards, Fourth Edition: Up-to-Date PracticeVon EverandAP Statistics Flashcards, Fourth Edition: Up-to-Date PracticeNoch keine Bewertungen

- Data Interpretation Guide For All Competitive and Admission ExamsVon EverandData Interpretation Guide For All Competitive and Admission ExamsBewertung: 2.5 von 5 Sternen2.5/5 (6)

- Assignment 3Dokument5 SeitenAssignment 3aklank_218105Noch keine Bewertungen

- CM SampleExam 2Dokument10 SeitenCM SampleExam 2sarahjohnsonNoch keine Bewertungen

- BSAD 295 Fall 2018 SyllabusDokument6 SeitenBSAD 295 Fall 2018 SyllabusraghidkNoch keine Bewertungen

- University of San Francisco: Section 7 & 8: MWF 9:15a - 10:20a & 10:30a - 11:35a, Malloy LL5Dokument6 SeitenUniversity of San Francisco: Section 7 & 8: MWF 9:15a - 10:20a & 10:30a - 11:35a, Malloy LL5ceebsNoch keine Bewertungen

- Beatrice Peabody CaseDokument14 SeitenBeatrice Peabody CaseSindhura Mahendran100% (9)

- Final-Term Exam (Take-Home) Fall - 2020 Department of Business AdministrationDokument4 SeitenFinal-Term Exam (Take-Home) Fall - 2020 Department of Business Administrationsyed aliNoch keine Bewertungen

- DerivativesandRiskManagementReDokument9 SeitenDerivativesandRiskManagementReayushi kNoch keine Bewertungen

- ACCT355 - SyllabusDokument4 SeitenACCT355 - SyllabusNguyen NguyenNoch keine Bewertungen

- Pcalc II-i Naveed Resit-2 Sem 1 2019-2020 2Dokument6 SeitenPcalc II-i Naveed Resit-2 Sem 1 2019-2020 2Mojahed YahyaNoch keine Bewertungen

- Model Paper - Compensation ManagementDokument2 SeitenModel Paper - Compensation ManagementChandrabhan OjhaNoch keine Bewertungen

- UT Dallas Syllabus For bps6310.501 05f Taught by Marilyn Kaplan (Mkaplan)Dokument7 SeitenUT Dallas Syllabus For bps6310.501 05f Taught by Marilyn Kaplan (Mkaplan)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- 2007 Spring VoldDokument25 Seiten2007 Spring VoldMark LeviyNoch keine Bewertungen

- Pre Release Material Buss4Dokument2 SeitenPre Release Material Buss4api-246565830Noch keine Bewertungen

- 6 Hah SQ6 GDokument2 Seiten6 Hah SQ6 GSumit Dhyani40% (5)

- B294-TMA-Fall 2023-2024-V1Dokument4 SeitenB294-TMA-Fall 2023-2024-V1adel.dahbour97Noch keine Bewertungen

- Assessment Case Paper Analysis / Tutorialoutlet Dot ComDokument37 SeitenAssessment Case Paper Analysis / Tutorialoutlet Dot Comjorge0048Noch keine Bewertungen

- Staff Services Analyst Transfer Exam StudyguideDokument11 SeitenStaff Services Analyst Transfer Exam Studyguidegnostication50% (2)

- Security Analysis and Portfolio Management (Fiba732) Mba 3 SemesterDokument3 SeitenSecurity Analysis and Portfolio Management (Fiba732) Mba 3 SemesterAnay BiswasNoch keine Bewertungen

- Microsoft Word - Examiner's Report PM D18 FinalDokument7 SeitenMicrosoft Word - Examiner's Report PM D18 FinalMuhammad Hassan Ahmad MadniNoch keine Bewertungen

- Advanced Strategic Management Simulation CourseDokument6 SeitenAdvanced Strategic Management Simulation CourseAdina RobertsNoch keine Bewertungen

- MGMT3057 04122018Dokument7 SeitenMGMT3057 04122018Xhano M. WilliamsNoch keine Bewertungen

- Midterm Paper-FMA-Fall 2020Dokument4 SeitenMidterm Paper-FMA-Fall 2020Hamdan SheikhNoch keine Bewertungen

- FIN340 Ajay Bhootra Syllabus MW 4-00Dokument3 SeitenFIN340 Ajay Bhootra Syllabus MW 4-00JGONoch keine Bewertungen

- 2020 Level III Final Branded Exam Information DocumentDokument12 Seiten2020 Level III Final Branded Exam Information DocumentJBNoch keine Bewertungen

- Coursera Online Course Corporate Finance Essentials Quiz All AnswersDokument4 SeitenCoursera Online Course Corporate Finance Essentials Quiz All AnswersMD GOLAM SARWER100% (5)

- End Term Examination ItcDokument5 SeitenEnd Term Examination ItcAgam ShahNoch keine Bewertungen

- Edexcel GCE: Statistics S4Dokument24 SeitenEdexcel GCE: Statistics S4yvg95Noch keine Bewertungen

- Allama Iqbal Open University, Islamabad (Commonwealth MBA/MPA Programme) WarningDokument6 SeitenAllama Iqbal Open University, Islamabad (Commonwealth MBA/MPA Programme) Warninglfeng9359Noch keine Bewertungen

- Information About The Summer 2010 Final Exam For MBA 8135Dokument4 SeitenInformation About The Summer 2010 Final Exam For MBA 8135yazanNoch keine Bewertungen

- P4-Advanced Financial ManagementDokument454 SeitenP4-Advanced Financial ManagementJack Tan100% (1)

- General InstructionsDokument26 SeitenGeneral InstructionsbhaiyarakeshNoch keine Bewertungen

- 2022 SUpplementryDokument10 Seiten2022 SUpplementryzaharaaebrahim06Noch keine Bewertungen

- ACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFDokument19 SeitenACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFPiyal HossainNoch keine Bewertungen

- Assessment Grade:: AQ015-3.5-3 CORP Individual Assignment Page 1 of 3Dokument3 SeitenAssessment Grade:: AQ015-3.5-3 CORP Individual Assignment Page 1 of 3Mhd AminNoch keine Bewertungen

- 9e02102fe75047a6977a619f430c231fDokument4 Seiten9e02102fe75047a6977a619f430c231fMOHSINA NAZNoch keine Bewertungen

- Old Cat Papers - Di+Lr: CAT 2008, CAT 2007, CAT 2006, CAT 2005 & CAT 2004Dokument41 SeitenOld Cat Papers - Di+Lr: CAT 2008, CAT 2007, CAT 2006, CAT 2005 & CAT 2004Setu AhujaNoch keine Bewertungen

- FINA Final - PracticeDokument9 SeitenFINA Final - Practicealison dreamNoch keine Bewertungen

- Behavioural FinanceDokument41 SeitenBehavioural Financemomo tonisNoch keine Bewertungen

- Edu 2008 11 Fete ExamDokument22 SeitenEdu 2008 11 Fete ExamcalvinkaiNoch keine Bewertungen

- F5 Examiner's Report: March 2017Dokument7 SeitenF5 Examiner's Report: March 2017Pink GirlNoch keine Bewertungen

- CPT Term Paper SampleDokument5 SeitenCPT Term Paper Sampleafdttjcns100% (1)

- Unlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFDokument17 SeitenUnlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFAbhishekNoch keine Bewertungen

- Mba-2012-14 (I, Ii, Iii & Iv)Dokument85 SeitenMba-2012-14 (I, Ii, Iii & Iv)Nandini MehrotraNoch keine Bewertungen

- Tute 4Dokument4 SeitenTute 4Rony RahmanNoch keine Bewertungen

- India Glycols Limited: Project Report ON Capital BudgetingDokument49 SeitenIndia Glycols Limited: Project Report ON Capital BudgetingvishalaroraccnaNoch keine Bewertungen

- Chapter 10Dokument14 SeitenChapter 10Vidyasagar Ayyappan100% (1)

- T B S G: A P R N O E: HE Usiness Trategy AME Erformance Eview of The EW Nline DitionDokument7 SeitenT B S G: A P R N O E: HE Usiness Trategy AME Erformance Eview of The EW Nline DitionSubham Prakash SinghNoch keine Bewertungen

- Information About The Spring 2009 Final Exam For MBA 8135Dokument4 SeitenInformation About The Spring 2009 Final Exam For MBA 8135yazanNoch keine Bewertungen

- Mini Project Part - A (Take-Home) Summer - 2020Dokument3 SeitenMini Project Part - A (Take-Home) Summer - 2020Maryam EjazNoch keine Bewertungen

- Allama Allama Iqbal Open University Open UniversityDokument1 SeiteAllama Allama Iqbal Open University Open UniversityShafqat BukhariNoch keine Bewertungen

- Muhammad Shamaun Ahmad - CILT-Business Applications-MidtermSpring2021Dokument2 SeitenMuhammad Shamaun Ahmad - CILT-Business Applications-MidtermSpring2021Assam AltafNoch keine Bewertungen

- MFE Syllabus - Nov 2012Dokument3 SeitenMFE Syllabus - Nov 2012krly_888Noch keine Bewertungen

- Ssat Middle Level Test AnswersDokument7 SeitenSsat Middle Level Test Answerseinnoel0% (2)

- Part 1: 60 Points.: Bus 145-D09 Midterm Exam #2 April 2020Dokument6 SeitenPart 1: 60 Points.: Bus 145-D09 Midterm Exam #2 April 2020Shubeg SinghNoch keine Bewertungen

- Portfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationVon EverandPortfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationBewertung: 3 von 5 Sternen3/5 (1)

- SERIES 9 EXAM REVIEW 2022+ TEST BANKVon EverandSERIES 9 EXAM REVIEW 2022+ TEST BANKBewertung: 5 von 5 Sternen5/5 (1)

- Roadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideVon EverandRoadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideNoch keine Bewertungen

- Financial Reporting Mcom 3 Semester: AssetsDokument2 SeitenFinancial Reporting Mcom 3 Semester: AssetsYasir AminNoch keine Bewertungen

- Taxation Paper 2021 ODD 1,3,5,7,9Dokument4 SeitenTaxation Paper 2021 ODD 1,3,5,7,9Yasir AminNoch keine Bewertungen

- EVEN Taxation Paper 2021 EVEN 2,4,6,8,0Dokument4 SeitenEVEN Taxation Paper 2021 EVEN 2,4,6,8,0Yasir AminNoch keine Bewertungen

- Please Follow The Instructions CarefullyDokument3 SeitenPlease Follow The Instructions CarefullyYasir AminNoch keine Bewertungen

- RB - EconomyDokument10 SeitenRB - EconomyYasir AminNoch keine Bewertungen

- BRM Paper Mcom MorningDokument3 SeitenBRM Paper Mcom MorningYasir AminNoch keine Bewertungen

- Topi Csofassi Gnment SDokument4 SeitenTopi Csofassi Gnment SYasir AminNoch keine Bewertungen

- Topi Csofassi Gnment SDokument4 SeitenTopi Csofassi Gnment SYasir AminNoch keine Bewertungen

- Value Proposition Tool PDFDokument1 SeiteValue Proposition Tool PDFYasir AminNoch keine Bewertungen

- Lecture Common Stock ValuationDokument31 SeitenLecture Common Stock ValuationYasir AminNoch keine Bewertungen

- Topi Csofassi Gnment SDokument4 SeitenTopi Csofassi Gnment SYasir AminNoch keine Bewertungen

- 7C's AssignmentDokument5 Seiten7C's AssignmentYasir AminNoch keine Bewertungen

- Value Proposition Tool PDFDokument1 SeiteValue Proposition Tool PDFYasir AminNoch keine Bewertungen

- BMI - Business Model CanvasDokument1 SeiteBMI - Business Model CanvasDario Bernardo Montufar BlancoNoch keine Bewertungen

- NetworkingDokument5 SeitenNetworkingYasir AminNoch keine Bewertungen

- Organisation: The Strategy Group'S Value Proposition Design Tool™Dokument1 SeiteOrganisation: The Strategy Group'S Value Proposition Design Tool™Yasir AminNoch keine Bewertungen

- Management Asiment PepsiDokument19 SeitenManagement Asiment PepsiYasir AminNoch keine Bewertungen

- ADC INTRO Good Governance and Social Responsibility 2Dokument65 SeitenADC INTRO Good Governance and Social Responsibility 2Donna Mae Hernandez100% (1)

- Africa Fintech Rising SummitDokument15 SeitenAfrica Fintech Rising Summitace187Noch keine Bewertungen

- Mortgage Backed SecuritiesDokument13 SeitenMortgage Backed SecuritiessaranNoch keine Bewertungen

- Keybanc April 28 Research ReportDokument6 SeitenKeybanc April 28 Research ReportDsp AlphaNoch keine Bewertungen

- M3 PJM1204 - BusinessAnalysis P2 Fall 2022Dokument59 SeitenM3 PJM1204 - BusinessAnalysis P2 Fall 2022Kedze BaronNoch keine Bewertungen

- RocheDokument7 SeitenRochePrattouNoch keine Bewertungen

- Exercises Budgeting ACCT2105 3s2010Dokument7 SeitenExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Cujuangco Vs Republic GR 180705Dokument21 SeitenCujuangco Vs Republic GR 180705M Azeneth JJNoch keine Bewertungen

- Project Final SwatiDokument78 SeitenProject Final SwatiSarah MitchellNoch keine Bewertungen

- The Seeker 1983 - Master Time FactorDokument169 SeitenThe Seeker 1983 - Master Time FactorNarendra Kamma93% (15)

- Microeconomic Analysis: Review OfDokument8 SeitenMicroeconomic Analysis: Review OfNaman AgarwalNoch keine Bewertungen

- Exotic OptionsDokument26 SeitenExotic OptionsJitin MehtaNoch keine Bewertungen

- Money and Monetary StandardsDokument40 SeitenMoney and Monetary StandardsZenedel De JesusNoch keine Bewertungen

- Career Opportunities After Hsc/Xii STDDokument38 SeitenCareer Opportunities After Hsc/Xii STDSupriya AshokaNoch keine Bewertungen

- Form No. Dpt-3: Return of DepositsDokument7 SeitenForm No. Dpt-3: Return of Depositstiger SNoch keine Bewertungen

- HW1-time Value of Money SOLUÇÃODokument6 SeitenHW1-time Value of Money SOLUÇÃOSahid Xerfan NetoNoch keine Bewertungen

- Mba-511 Bata Shoe Company LTDDokument11 SeitenMba-511 Bata Shoe Company LTDNasim HaidarNoch keine Bewertungen

- How The Eggheads Cracked - The New York TimesDokument17 SeitenHow The Eggheads Cracked - The New York TimesAleksandar SpasojevicNoch keine Bewertungen

- PWC Strategic Talent ManagementDokument4 SeitenPWC Strategic Talent Managementlimited100% (2)

- QuoraDokument6 SeitenQuoraValleyWag100% (4)

- Alasdair Macleod Sound Money 555Dokument5 SeitenAlasdair Macleod Sound Money 555Kevin CreaseyNoch keine Bewertungen

- Sap Fi MaterialDokument175 SeitenSap Fi MaterialKarthik SelvarajNoch keine Bewertungen

- 2010-2014 Business Plan: Petróleo Brasileiro S.A. - Petrobras Material FactDokument7 Seiten2010-2014 Business Plan: Petróleo Brasileiro S.A. - Petrobras Material FactMarcio RoblesNoch keine Bewertungen

- 1Q21 Net Income Above Expectation: Semirara Mining CorporationDokument8 Seiten1Q21 Net Income Above Expectation: Semirara Mining CorporationJajahinaNoch keine Bewertungen

- Set 1 PM - ADokument36 SeitenSet 1 PM - AMUHAMMAD SAFWAN AHMAD MUSLIMNoch keine Bewertungen

- Chariot Race Advertisement Poster CompressedDokument1 SeiteChariot Race Advertisement Poster Compressedapi-595747845Noch keine Bewertungen

- Memo 2 Final Michael LamaitaDokument16 SeitenMemo 2 Final Michael Lamaitaapi-247303303100% (2)

- CCFDokument19 SeitenCCFDeepak JainNoch keine Bewertungen

- Transaction Cycle and Substantive TestingDokument5 SeitenTransaction Cycle and Substantive TestingZaira PangesfanNoch keine Bewertungen