Beruflich Dokumente

Kultur Dokumente

Equity premium puzzle arbitrage opportunity circuit breakers

Hochgeladen von

Brandon Lumibao0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten3 SeitenOriginaltitel

If the equity premium puzzle is the result of security mispricing

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten3 SeitenEquity premium puzzle arbitrage opportunity circuit breakers

Hochgeladen von

Brandon LumibaoCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

If the equity premium puzzle is the result of security

mispricing, then there is an arbitrage opportunity. It

means that investor can gain by borrowing at the

Treasury bill rate and investing in stocks. Borrowing

limitations and transaction costs may reduce this

arbitrage profit, but not eliminate it. The concern

about the fair and ethical stock market trading

require imposing discipline on individuals and

institutional investors. The organized stock

exchanges introduce surveillance of all transactions

at the exchanges. Computerized systems are

installed to detect unusual trading of any particular

stock. Any abnormal price or trading volume of

particular stock or unusual trading practices of

market participants is investigated. Additional

regulations on imposing good corporate governance

practice for listed companies are imposed through

introduced corporate governance codes.

Regulations require disclosure of financial

statements, having a majority of independent

directors (not employees of the companies) on their

boards of directors. Such requirements are aimed at

reducing existing or potential conflicts of interest

between management and minority as well as

majority shareholders, focusing management on

maximizing stock value for company shareholders.

Specific regulation concerns are related to

restrictions on trading in case of market downturns.

Stock exchanges can impose circuit breakers, which

are restrictions on trading when stock prices or

stock indexes reaches a specified threshold level.

The necessity of such restriction became vivid

during stock market crashes, e.g of NYSE in October

1987 and the later ones. When market maker

swamp market with sell orders, stock prices cannot

reflect the fair value any longer and move into a

freefall. The market experiences huge liquidity

crisis, which feeds panic and exacerbates the price

decline. As a result of such experience, in order to

provide time for market participants to regroup and

obtain backup sources of liquidity, a series of circuit

breakers are put to use. may be imposed on

particular stocks if stock exchanges believe that

market participants need more time to receive and

absorb material information, which can affect stock

price. Such trading halts are imposed of stocks that

are associated with mergers and acquisitions,

earning reports, lawsuits and other important news.

The purpose of them is to ensure that market has

complete information before trading on the news. A

halt may last a few minutes, hours or several days.

Trading is resumed after it is believed that the

market has complete information. This does not

prevent investors from a trading loss in response

100 to the news. However, it can prevent from

excessive optimism or pessimism about a stock, and

can reduce stock market volatility

Das könnte Ihnen auch gefallen

- Estimating Walmarts Cost of CapitalDokument6 SeitenEstimating Walmarts Cost of CapitalPrashuk Sethi0% (1)

- Capital Budgeting Idea For Netflix Inc.Dokument26 SeitenCapital Budgeting Idea For Netflix Inc.PraNoch keine Bewertungen

- 9.403 Chapter 4: Efficient Securities MarketsDokument10 Seiten9.403 Chapter 4: Efficient Securities MarketsYanee ReeNoch keine Bewertungen

- Corporate governance, agency problems, and stock exchange functionsDokument13 SeitenCorporate governance, agency problems, and stock exchange functionsRuben CollinsNoch keine Bewertungen

- FinancialPlan - 2013 Version - Prof DR IsmailDokument129 SeitenFinancialPlan - 2013 Version - Prof DR IsmailSyukur Byte0% (1)

- Cftcsecac CroninDokument5 SeitenCftcsecac CroninMarketsWikiNoch keine Bewertungen

- Financial Institution CH-5Dokument6 SeitenFinancial Institution CH-5Gadisa TarikuNoch keine Bewertungen

- 9.403 Chapter 4: Efficient Securities MarketsDokument10 Seiten9.403 Chapter 4: Efficient Securities MarketsRahmi MayaNoch keine Bewertungen

- The Regulation of Financial Markets and InstitutionDokument6 SeitenThe Regulation of Financial Markets and InstitutionMany GirmaNoch keine Bewertungen

- JOSEDokument5 SeitenJOSEWillhem PhillyNoch keine Bewertungen

- Other ASX Research 4Dokument92 SeitenOther ASX Research 4asxresearchNoch keine Bewertungen

- ASIC Senate Submission Update 3Dokument48 SeitenASIC Senate Submission Update 3asxresearchNoch keine Bewertungen

- Random Walk TheoryDokument11 SeitenRandom Walk TheoryDavid OparindeNoch keine Bewertungen

- Understanding Stock MarketsDokument14 SeitenUnderstanding Stock Marketsrobin boseNoch keine Bewertungen

- A STUDY ON INDIAN FinalDokument80 SeitenA STUDY ON INDIAN FinalAnkita SolankiNoch keine Bewertungen

- What Is The Stock Market 1 1Dokument17 SeitenWhat Is The Stock Market 1 1ionantonio2018Noch keine Bewertungen

- Investor: Essential Quality Types of InvestorsDokument6 SeitenInvestor: Essential Quality Types of InvestorsFirman HamdanNoch keine Bewertungen

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingVon EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingNoch keine Bewertungen

- INVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)Von EverandINVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)Noch keine Bewertungen

- EMH AssignmentDokument8 SeitenEMH AssignmentJonathanNoch keine Bewertungen

- Presentation 14Dokument16 SeitenPresentation 14Rakesh ShuklaNoch keine Bewertungen

- An Introduction To Trading Types Fundamental TradersDokument11 SeitenAn Introduction To Trading Types Fundamental TradersGopi KrishnaNoch keine Bewertungen

- Mastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesVon EverandMastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesNoch keine Bewertungen

- Cftcsecac ArchardDokument2 SeitenCftcsecac ArchardMarketsWikiNoch keine Bewertungen

- Security AnalysisDokument18 SeitenSecurity AnalysisQais NomanNoch keine Bewertungen

- Ai 2Dokument2 SeitenAi 2Adam wizNoch keine Bewertungen

- Risk 2Dokument7 SeitenRisk 2Vedha VetriselvanNoch keine Bewertungen

- Annexure - V Risk Disclosure Document: National Stock Exchange of India Limited Regulations (F&O Segment)Dokument4 SeitenAnnexure - V Risk Disclosure Document: National Stock Exchange of India Limited Regulations (F&O Segment)CS NarayanaNoch keine Bewertungen

- INVESTMENTDokument3 SeitenINVESTMENTCaroline B CodinoNoch keine Bewertungen

- Patterns of BehaviourDokument24 SeitenPatterns of BehaviourHannah GohNoch keine Bewertungen

- Features of Stock Exchanges: Organized MarketDokument9 SeitenFeatures of Stock Exchanges: Organized MarketPraTik JaInNoch keine Bewertungen

- Market Timing Via Monthly and Holiday PatternsDokument10 SeitenMarket Timing Via Monthly and Holiday PatternsSteven KimNoch keine Bewertungen

- Post-announcement drift anomalyDokument5 SeitenPost-announcement drift anomalyRonald Ian GoontingNoch keine Bewertungen

- Moduel 4Dokument4 SeitenModuel 4sarojkumardasbsetNoch keine Bewertungen

- Day Trading Strategies You Need To KnowDokument20 SeitenDay Trading Strategies You Need To Knowjeevandran0% (1)

- A Study On Technical Analysis At: Industry Overview Company ProfileDokument109 SeitenA Study On Technical Analysis At: Industry Overview Company ProfilePrathamesh TaywadeNoch keine Bewertungen

- Short SellingDokument2 SeitenShort SellingTayyaba TariqNoch keine Bewertungen

- Security and Trade AssignmentDokument10 SeitenSecurity and Trade AssignmentMaarij KhanNoch keine Bewertungen

- A Project Report On Technical Analysis at Share KhanDokument105 SeitenA Project Report On Technical Analysis at Share KhanBabasab Patil (Karrisatte)100% (3)

- A Project Report On Technical Analysis at Cement Sector in Share KhanDokument105 SeitenA Project Report On Technical Analysis at Cement Sector in Share KhanBabasab Patil (Karrisatte)100% (1)

- 5 Moving Average Signals That Beat Buy and Hold - Backtested Stock Market SignalsDokument39 Seiten5 Moving Average Signals That Beat Buy and Hold - Backtested Stock Market Signalsআম্লান দত্ত100% (2)

- Investing Program Features and BenefitsDokument10 SeitenInvesting Program Features and BenefitsNarendran SrinivasanNoch keine Bewertungen

- Foreign Exchange Regulation On Edging Speculation Short Note 300 WordsDokument1 SeiteForeign Exchange Regulation On Edging Speculation Short Note 300 WordsYumna SyedNoch keine Bewertungen

- Financial Institutions and MarketsDokument8 SeitenFinancial Institutions and MarketsAnkur KaushikNoch keine Bewertungen

- BVGDF 65z5hDokument18 SeitenBVGDF 65z5hsuduh09Noch keine Bewertungen

- Do fundamentals or emotions drive stock marketDokument9 SeitenDo fundamentals or emotions drive stock marketJessy SeptalistaNoch keine Bewertungen

- SSK SirDokument11 SeitenSSK Sirneetish singhNoch keine Bewertungen

- Part BDokument8 SeitenPart BSaumya SinghNoch keine Bewertungen

- Efficient Market Theory: Prof Mahesh Kumar Amity Business SchoolDokument23 SeitenEfficient Market Theory: Prof Mahesh Kumar Amity Business SchoolasifanisNoch keine Bewertungen

- Greed and Fear in Stock Market: Area-Behavioral FinanceDokument2 SeitenGreed and Fear in Stock Market: Area-Behavioral FinanceManuj PareekNoch keine Bewertungen

- Investment trusts vs OEICs and factors influencing CIV strategyDokument3 SeitenInvestment trusts vs OEICs and factors influencing CIV strategyArqum BajwaNoch keine Bewertungen

- Your Investment Policy Statement (IPS) in 40 CharactersDokument6 SeitenYour Investment Policy Statement (IPS) in 40 CharactersAjay KumarNoch keine Bewertungen

- Aprojectreportontechnicalanalysisatsharekhan 120809060800 Phpapp02Dokument109 SeitenAprojectreportontechnicalanalysisatsharekhan 120809060800 Phpapp02touffiqNoch keine Bewertungen

- Understanding Investors and Equity MarketsDokument81 SeitenUnderstanding Investors and Equity Marketschaluvadiin100% (2)

- Investors Guide PDFDokument8 SeitenInvestors Guide PDFadeelshahzadqureshi8086Noch keine Bewertungen

- Portfolio Investment ProcessDokument6 SeitenPortfolio Investment ProcessmayurroyalssNoch keine Bewertungen

- Chapter 6Dokument24 SeitenChapter 6sdfklmjsdlklskfjd100% (2)

- Efficient Markets TheoryDokument4 SeitenEfficient Markets Theoryanindyta kusumaNoch keine Bewertungen

- investment law assignmentDokument9 Seiteninvestment law assignmentBansiflourmillNoch keine Bewertungen

- Trading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsVon EverandTrading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsBewertung: 1 von 5 Sternen1/5 (1)

- QLDMDT Q&aDokument2 SeitenQLDMDT Q&aNguyễn Thanh PhongNoch keine Bewertungen

- A Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIADokument45 SeitenA Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIAKiran AryaNoch keine Bewertungen

- The Annualized Yield They Pay Is The Annualized Interest Rate On Negotiable CDsDokument2 SeitenThe Annualized Yield They Pay Is The Annualized Interest Rate On Negotiable CDsBrandon LumibaoNoch keine Bewertungen

- Certificate of DepositDokument2 SeitenCertificate of DepositBrandon LumibaoNoch keine Bewertungen

- Terms of Instrument DevelopmentDokument2 SeitenTerms of Instrument DevelopmentBrandon LumibaoNoch keine Bewertungen

- Interest Rate Answer by BrighamDokument15 SeitenInterest Rate Answer by BrighamBrandon LumibaoNoch keine Bewertungen

- The Interbank Market Loans Interbank Market Is A Market Through Which Banks Lend To Each OtherDokument1 SeiteThe Interbank Market Loans Interbank Market Is A Market Through Which Banks Lend To Each OtherBrandon LumibaoNoch keine Bewertungen

- Understanding Key Bond Concepts and TerminologyDokument2 SeitenUnderstanding Key Bond Concepts and TerminologyBrandon LumibaoNoch keine Bewertungen

- When Equity Shares Are Initially IssuedDokument3 SeitenWhen Equity Shares Are Initially IssuedBrandon LumibaoNoch keine Bewertungen

- Interbank Rates Are Generally Slightly Higher and More Volatile Than Interest Rates in The Traditional MarketDokument1 SeiteInterbank Rates Are Generally Slightly Higher and More Volatile Than Interest Rates in The Traditional MarketBrandon LumibaoNoch keine Bewertungen

- If The InvestorDokument3 SeitenIf The InvestorBrandon LumibaoNoch keine Bewertungen

- Terms of Instrument DevelopmentDokument2 SeitenTerms of Instrument DevelopmentBrandon LumibaoNoch keine Bewertungen

- Yield To Maturity Answer KeyDokument2 SeitenYield To Maturity Answer KeyBrandon LumibaoNoch keine Bewertungen

- Financial Markets StudiesDokument2 SeitenFinancial Markets StudiesBrandon LumibaoNoch keine Bewertungen

- Chapter 2 INTEREST RATE DETERMINATION AND STRUCTUREDokument1 SeiteChapter 2 INTEREST RATE DETERMINATION AND STRUCTUREBrandon LumibaoNoch keine Bewertungen

- Chapter 2 MONEY MARKETDokument2 SeitenChapter 2 MONEY MARKETBrandon LumibaoNoch keine Bewertungen

- Chapter 1 FINANCIAL MARKET STRUCTURE AND ROLE IN THE FINANCIAL SYSTEMDokument2 SeitenChapter 1 FINANCIAL MARKET STRUCTURE AND ROLE IN THE FINANCIAL SYSTEMBrandon LumibaoNoch keine Bewertungen

- Chapter 1 GITMAN Financial Markets Structure and Role in The Financial SystemDokument2 SeitenChapter 1 GITMAN Financial Markets Structure and Role in The Financial SystemBrandon LumibaoNoch keine Bewertungen

- Compilation Report by Brandon LumibaoDokument1 SeiteCompilation Report by Brandon LumibaoBrandon LumibaoNoch keine Bewertungen

- Chapter 2 & 3 GITMAN INTEREST RATE AND BOND VALUATIONDokument2 SeitenChapter 2 & 3 GITMAN INTEREST RATE AND BOND VALUATIONBrandon LumibaoNoch keine Bewertungen

- The Internal MarketDokument2 SeitenThe Internal MarketBrandon LumibaoNoch keine Bewertungen

- The Internal MarketDokument2 SeitenThe Internal MarketBrandon LumibaoNoch keine Bewertungen

- Financial Intermediaries and Their FunctionsDokument2 SeitenFinancial Intermediaries and Their FunctionsBrandon LumibaoNoch keine Bewertungen

- Motivation For Developing The CourseDokument2 SeitenMotivation For Developing The CourseBrandon LumibaoNoch keine Bewertungen

- PurposiveDokument2 SeitenPurposiveBrandon LumibaoNoch keine Bewertungen

- In Contrast To A Debt ObligationDokument2 SeitenIn Contrast To A Debt ObligationBrandon LumibaoNoch keine Bewertungen

- A PopularDokument2 SeitenA PopularBrandon LumibaoNoch keine Bewertungen

- Arket HypothesisDokument1 SeiteArket HypothesisBrandon LumibaoNoch keine Bewertungen

- Financial Markets Structure 1Dokument2 SeitenFinancial Markets Structure 1Brandon LumibaoNoch keine Bewertungen

- PerformanceDokument2 SeitenPerformanceBrandon LumibaoNoch keine Bewertungen

- Rationale Behind The Hypothesis To See Why The Efficient Market Hypothesis Makes SenseDokument2 SeitenRationale Behind The Hypothesis To See Why The Efficient Market Hypothesis Makes SenseBrandon LumibaoNoch keine Bewertungen

- P1 Accounting ScannerDokument286 SeitenP1 Accounting Scannervishal jalan100% (1)

- 134 135 Keshav Garg Rosy KalraDokument12 Seiten134 135 Keshav Garg Rosy KalraJosep CorbynNoch keine Bewertungen

- CHP 18 - Revenue RecognitionDokument43 SeitenCHP 18 - Revenue RecognitionatikahNoch keine Bewertungen

- Chapter 3Dokument12 SeitenChapter 3Briggs Navarro BaguioNoch keine Bewertungen

- Risk and Rates of ReturnDokument23 SeitenRisk and Rates of ReturnIo Aya100% (1)

- Capital Structure Decision: An Overview: Kennedy Prince ModuguDokument14 SeitenCapital Structure Decision: An Overview: Kennedy Prince ModuguChaitanya PrasadNoch keine Bewertungen

- Chapter 9 12Dokument91 SeitenChapter 9 12Trisha Anne ClataroNoch keine Bewertungen

- Portfolio Return MeasurementDokument7 SeitenPortfolio Return Measurementkusi786Noch keine Bewertungen

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Dokument17 SeitenGuide To Original Issue Discount (OID) Instruments: Publication 1212ChaseF31ckzwhrNoch keine Bewertungen

- Surat DataDokument1.063 SeitenSurat Datadeltaphi1234Noch keine Bewertungen

- Dr. Sharan Shetty PHD (Banking & Finance) Mba (Finance) B. Com (Hons)Dokument54 SeitenDr. Sharan Shetty PHD (Banking & Finance) Mba (Finance) B. Com (Hons)Nagesh Pai MysoreNoch keine Bewertungen

- Malaysia Bursa IPO Vs HKEX IPO (Brief Guide To Listing)Dokument6 SeitenMalaysia Bursa IPO Vs HKEX IPO (Brief Guide To Listing)nestleomegasNoch keine Bewertungen

- Financial Statements Analyses and Their Implications To ManagementDokument9 SeitenFinancial Statements Analyses and Their Implications To ManagementMarie Frances SaysonNoch keine Bewertungen

- 01 Quiz On Topic 02 With Answer KeyDokument7 Seiten01 Quiz On Topic 02 With Answer KeyNye NyeNoch keine Bewertungen

- Trial Balance TantiDokument1 SeiteTrial Balance TantiSMK Bisnis InformatikaNoch keine Bewertungen

- Arbitrage Pricing TheoryDokument20 SeitenArbitrage Pricing TheoryDeepti PantulaNoch keine Bewertungen

- 67 2 3 AccountancyDokument27 Seiten67 2 3 AccountancySai I SiriNoch keine Bewertungen

- 0 - Co-Investment Diligence Assessing The Operating Plan - RCP AdvisorsDokument24 Seiten0 - Co-Investment Diligence Assessing The Operating Plan - RCP Advisorsdajeca7Noch keine Bewertungen

- Ziraat Bank 2014 US Resolution PlanDokument9 SeitenZiraat Bank 2014 US Resolution Planahmet aslanNoch keine Bewertungen

- Strategic Management Concepts and Cases Rothaermel Rothaermel 1st Edition Test Bank DownloadDokument79 SeitenStrategic Management Concepts and Cases Rothaermel Rothaermel 1st Edition Test Bank DownloadJacobScottnwgp100% (39)

- Awareness Among The Traders About The Settlement of Online TradingDokument13 SeitenAwareness Among The Traders About The Settlement of Online TradingElson Antony PaulNoch keine Bewertungen

- Capital Budgeting Illustrative NumericalsDokument6 SeitenCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- Investment Management Analysis: Your Company NameDokument70 SeitenInvestment Management Analysis: Your Company NameJojoMagnoNoch keine Bewertungen

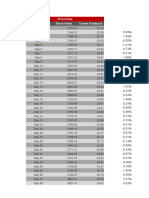

- Price Data Date Stock Index Turner FastbuckDokument14 SeitenPrice Data Date Stock Index Turner FastbuckRampraveen ChamarthiNoch keine Bewertungen

- Inventories Time Stamped & Los StampedDokument30 SeitenInventories Time Stamped & Los StampedRajnish RajNoch keine Bewertungen

- Revised Schedule VI in Excel FormatDokument3 SeitenRevised Schedule VI in Excel FormatSatyabrata DasNoch keine Bewertungen

- NISM CertificationsDokument3 SeitenNISM CertificationsPooja MauryaNoch keine Bewertungen