Beruflich Dokumente

Kultur Dokumente

Taxation of Individuals

Hochgeladen von

Clyde Ian Brett Peña0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten2 Seitentax

Originaltitel

TAXATION OF INDIVIDUALS

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten2 SeitenTaxation of Individuals

Hochgeladen von

Clyde Ian Brett Peñatax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

UNIVERSITY OF THE EAST

College of Business Administration

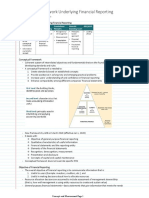

Income RC NRC RA NRAETB NRANETB

1) Sale, exchange, or other

disposition of real property Final Tax : 6%

located in the Philippines On Gross Selling Price or Fair Market Value, whichever is higher

held as capital asset

2) Sale, barter or exchange or

other disposition of shares of

On Net Capital Gain (selling price less cost)

stock of a domestic

Not over P 100,000.00 : 5%

corporation, not disposed

On amount in excess of P 100,000 : 10%

through a local stock exchange

(NOTE A)

3) Interest from any peso bank

deposit, and yield or any other

monetary substitute and from Final Tax : 20%

trust fund and similar

arrangements. Final tax : 25%

4) Royalties Final Tax : 20% (Gross

5) Royalties on books, literary Income)

Final Tax : 10%

works, musical compositions

6) Prizes > P 10,000.00 Final Tax : 20%

7) Prizes < P 10,000.00 Graduated Rates

8) Other winnings Final Tax : 20%

9) PCSO & Lotto winnings Exempt

10) Interest income, foreign

depositary bank under Final Tax : Final Tax :

Exempt Exempt

Foreign Currency Deposit 7.5% 7.5%

System (FCDU)

11) Interest income, long-term

deposit or investment in banks

Exempt

with maturity of 5 years or

more

12) Interest income, long-term

deposit or investment in the

form of savings, common or

individual trust funds, deposit

substitutes, investment Holding Period Final Tax Rate

management accounts and 4 years to less than 5 years : 5%

other investments evidenced by 3 years to less than 4 years : 12%

certificates in such forms Less than 3 years : 20%

prescribed by the Bangko

Sentral which was

preterminated by the

holder before the 5th year

13) Cash and/or property

Final tax : 25%

dividends received from

(Gross

a) Domestic Corp.

Income)

b) Joint stock company

c) Insurance or Mutual fund

companies

d) Share of partner in

distributable net income after Final Tax :

Final tax : 10%

tax of a partnership (except 20%

general professional

partnership)

e) Share in net income after tax

of an association, a joint

account or joint venture or

consortium of which he is a

member or co-venturer

14) Inside PH: other not in 1 to

13, except 7, + business, Graduated Rates

profession, or compensation Graduated (Taxable Income)

income Rates

15) Outside PH: other items of (Taxable

income, including from Income)

Not taxable

business, profession or

compensation income

BTX 112 - TAXATION OF INDIVIDUALS | Atty. F. R. Soriano

UNIVERSITY OF THE EAST

College of Business Administration

NOTES:

(A) If shares disposed through stock exchange: transaction not subject to income tax, BUT to stock

transaction tax of ½ of 1% of Gross Selling Price. Stock Transaction Tax is a percentage tax.

(B) Final tax for every transaction, and subject to adjustment at yearend for all transactions during the

year, i.e., compute the capital gains tax for the total net capital gain during the year and deduct

therefrom the capital gains tax to determine the capital gains tax still due or refundable.

(C) Prizes : Recipient exerts effort

Winnings : Game of chance

(D) Taxable Income = Gross Income - Allowable Deductions & Exemptions

BTX 112 - TAXATION OF INDIVIDUALS | Atty. F. R. Soriano

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Oasis 360 Overview 0710Dokument21 SeitenOasis 360 Overview 0710mychar600% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Oddball NichesDokument43 SeitenOddball NichesRey Fuego100% (1)

- 2 and 3 Hinged Arch ReportDokument10 Seiten2 and 3 Hinged Arch ReportelhammeNoch keine Bewertungen

- La Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlDokument6 SeitenLa Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlMarlouis U. PlanasNoch keine Bewertungen

- BSL-3 Training-1Dokument22 SeitenBSL-3 Training-1Dayanandhi ElangovanNoch keine Bewertungen

- TNCT Q2 Module3cDokument15 SeitenTNCT Q2 Module3cashurishuri411100% (1)

- Measurement: Thursday, January 9, 2020 11:00 PMDokument5 SeitenMeasurement: Thursday, January 9, 2020 11:00 PMClyde Ian Brett PeñaNoch keine Bewertungen

- Date Transaction Debit CreditDokument9 SeitenDate Transaction Debit CreditClyde Ian Brett PeñaNoch keine Bewertungen

- A) Determine The Weighted Average Number of Common SharesDokument7 SeitenA) Determine The Weighted Average Number of Common SharesClyde Ian Brett PeñaNoch keine Bewertungen

- Should Be (Correct Entry and Period) :: 2018 2017 2016 Transaction Debit Credit Debit Credit Debit 1Dokument5 SeitenShould Be (Correct Entry and Period) :: 2018 2017 2016 Transaction Debit Credit Debit Credit Debit 1Clyde Ian Brett PeñaNoch keine Bewertungen

- Revenue Recognition: Tuesday, January 14, 2020 10:09 AMDokument7 SeitenRevenue Recognition: Tuesday, January 14, 2020 10:09 AMClyde Ian Brett PeñaNoch keine Bewertungen

- 2208 ch22Dokument7 Seiten2208 ch22Clyde Ian Brett PeñaNoch keine Bewertungen

- 015 Anti-Money Laundering LawDokument5 Seiten015 Anti-Money Laundering LawClyde Ian Brett PeñaNoch keine Bewertungen

- CCA WorksheetDokument6 SeitenCCA WorksheetClyde Ian Brett PeñaNoch keine Bewertungen

- Conceptual Framework Underlying Financial Reporting: Thursday, January 9, 2020 9:45 PMDokument10 SeitenConceptual Framework Underlying Financial Reporting: Thursday, January 9, 2020 9:45 PMClyde Ian Brett PeñaNoch keine Bewertungen

- Memorandum To ControllerDokument3 SeitenMemorandum To ControllerClyde Ian Brett PeñaNoch keine Bewertungen

- Moving Expense Deduction 51,393Dokument12 SeitenMoving Expense Deduction 51,393Clyde Ian Brett PeñaNoch keine Bewertungen

- Begun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand TwelveDokument10 SeitenBegun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand TwelveClyde Ian Brett PeñaNoch keine Bewertungen

- Chapter 6 WorkbookDokument21 SeitenChapter 6 WorkbookClyde Ian Brett PeñaNoch keine Bewertungen

- Res Cissi BleDokument2 SeitenRes Cissi BleClyde Ian Brett PeñaNoch keine Bewertungen

- 020 Cooperative Code of The PhilippinesDokument1 Seite020 Cooperative Code of The PhilippinesClyde Ian Brett PeñaNoch keine Bewertungen

- 011 Bouncing Checks LawDokument2 Seiten011 Bouncing Checks LawClyde Ian Brett PeñaNoch keine Bewertungen

- 012 Unclaimed Balances LawDokument1 Seite012 Unclaimed Balances LawClyde Ian Brett PeñaNoch keine Bewertungen

- 018 Intellectual Property LawDokument1 Seite018 Intellectual Property LawClyde Ian Brett PeñaNoch keine Bewertungen

- 017 Secrecy of Bank Deposit LawDokument1 Seite017 Secrecy of Bank Deposit LawClyde Ian Brett PeñaNoch keine Bewertungen

- 016 Central Bank ActDokument1 Seite016 Central Bank ActClyde Ian Brett PeñaNoch keine Bewertungen

- 021 Financial Rehabilitation and Insolvency ActDokument1 Seite021 Financial Rehabilitation and Insolvency ActClyde Ian Brett PeñaNoch keine Bewertungen

- 022 Securities Regulation CodeDokument1 Seite022 Securities Regulation CodeClyde Ian Brett PeñaNoch keine Bewertungen

- 019 God Governance CodeDokument1 Seite019 God Governance CodeClyde Ian Brett PeñaNoch keine Bewertungen

- 007 The Law On Negotiable InstrumentsDokument10 Seiten007 The Law On Negotiable InstrumentsClyde Ian Brett PeñaNoch keine Bewertungen

- 001 The Law On SalesDokument5 Seiten001 The Law On SalesClyde Ian Brett PeñaNoch keine Bewertungen

- 001 The Law On ObligationsDokument5 Seiten001 The Law On ObligationsClyde Ian Brett PeñaNoch keine Bewertungen

- Pee Dee 1 1Dokument5 SeitenPee Dee 1 1Buknoy PinedaNoch keine Bewertungen

- 017 Secrecy of Bank Deposit LawDokument1 Seite017 Secrecy of Bank Deposit LawClyde Ian Brett PeñaNoch keine Bewertungen

- Assignment in Synthesis 5Dokument1 SeiteAssignment in Synthesis 5Clyde Ian Brett PeñaNoch keine Bewertungen

- Medical Devices RegulationsDokument59 SeitenMedical Devices RegulationsPablo CzNoch keine Bewertungen

- CENT - Company Presentation Q1 2020 PDFDokument22 SeitenCENT - Company Presentation Q1 2020 PDFsabrina rahmawatiNoch keine Bewertungen

- Analysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)Dokument11 SeitenAnalysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)AJHSSR JournalNoch keine Bewertungen

- SDM Case AssignmentDokument15 SeitenSDM Case Assignmentcharith sai t 122013601002Noch keine Bewertungen

- T R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentDokument1 SeiteT R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentJapCon HRNoch keine Bewertungen

- E OfficeDokument3 SeitenE Officeஊக்கமது கைவிடேல்Noch keine Bewertungen

- Best Practices in Developing High PotentialsDokument9 SeitenBest Practices in Developing High PotentialsSuresh ShetyeNoch keine Bewertungen

- DC0002A Lhires III Assembling Procedure EnglishDokument17 SeitenDC0002A Lhires III Assembling Procedure EnglishНикола ЉубичићNoch keine Bewertungen

- CORDLESS PLUNGE SAW PTS 20-Li A1 PDFDokument68 SeitenCORDLESS PLUNGE SAW PTS 20-Li A1 PDFΑλεξης ΝεοφυτουNoch keine Bewertungen

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDokument9 SeitenUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiNoch keine Bewertungen

- Math 1 6Dokument45 SeitenMath 1 6Dhamar Hanania Ashari100% (1)

- TRX Documentation20130403 PDFDokument49 SeitenTRX Documentation20130403 PDFakasameNoch keine Bewertungen

- DPC SEMESTER X B Project ListDokument2 SeitenDPC SEMESTER X B Project ListVaibhav SharmaNoch keine Bewertungen

- Fortigate Fortiwifi 40F Series: Data SheetDokument6 SeitenFortigate Fortiwifi 40F Series: Data SheetDiego Carrasco DíazNoch keine Bewertungen

- Deshidratador Serie MDQDokument4 SeitenDeshidratador Serie MDQDAIRONoch keine Bewertungen

- 7373 16038 1 PBDokument11 Seiten7373 16038 1 PBkedairekarl UNHASNoch keine Bewertungen

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianDokument3 SeitenMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaNoch keine Bewertungen

- Company Law Handout 3Dokument10 SeitenCompany Law Handout 3nicoleclleeNoch keine Bewertungen

- 1 Ton Per Hour Electrode Production LineDokument7 Seiten1 Ton Per Hour Electrode Production LineMohamed AdelNoch keine Bewertungen

- PRELEC 1 Updates in Managerial Accounting Notes PDFDokument6 SeitenPRELEC 1 Updates in Managerial Accounting Notes PDFRaichele FranciscoNoch keine Bewertungen

- MP 221 Tanael PLUMBING CODE Definition of Terms 2Dokument3 SeitenMP 221 Tanael PLUMBING CODE Definition of Terms 2Louie BarredoNoch keine Bewertungen

- Expected MCQs CompressedDokument31 SeitenExpected MCQs CompressedAdithya kesavNoch keine Bewertungen

- S SSB29 - Alternator Cables PM: WARNING: This Equipment Contains Hazardous VoltagesDokument3 SeitenS SSB29 - Alternator Cables PM: WARNING: This Equipment Contains Hazardous VoltagesMohan PreethNoch keine Bewertungen

- Civil NatureDokument3 SeitenCivil NatureZ_Jahangeer100% (4)