Beruflich Dokumente

Kultur Dokumente

Bank of Granite: - GRAN Ranks

Hochgeladen von

darwin12Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank of Granite: - GRAN Ranks

Hochgeladen von

darwin12Copyright:

Verfügbare Formate

VALUE

BANK OF GRANITE NDQ--GRAN 21.44 37.60 25.90

RECENT

PRICE 19.13 TRAILING

19.60

RELATIVE

19.12

DIV’D

P/E RATIO 18.8 P/E RATIO 0.94 YLD 2.7%

20.48 26.96 22.93

LINE

21.81 High

RANKS 17.36 19.20 14.80 12.90 15.09 13.44 16.17 17.67 16.60 Low

PERFORMANCE 3 Average LEGENDS 45

12 Mos Mov Avg

Technical 3 Average . . . . Rel Price Strength

3-for-2 split 6/96

30

Above

SAFETY 2 Average

5-for-4 split 6/98

5-for-4 split 6/02

22.5

Shaded area indicates recession

BETA .80 (1.00 = Market) 13

9

Financial Strength A 6

Price Stability 85 4

3

Price Growth Persistence 50

375

Earnings Predictability 90 VOL.

(thous.)

© VALUE LINE PUBLISHING, INC. 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006/2007

EARNINGS PER SH 1.00 .94 1.02 1.10 .99 1.11 1.13 .94 1.13 A,B 1.22 C/NA

DIV’DS DECL’D PER SH .24 .27 .30 .34 .37 .41 .46 .49 --

BOOK VALUE PER SH 6.66 7.36 7.90 8.56 9.09 9.56 10.43 10.59 --

COMMON SHS OUTST’G (MILL) 14.29 14.33 14.37 13.94 13.73 13.33 13.60 13.32 --

AVG ANN’L P/E RATIO 19.3 24.7 18.8 15.0 16.9 16.3 16.8 21.5 16.9 15.7/NA

RELATIVE P/E RATIO 1.11 1.28 1.07 .98 .87 .89 .96 1.14 --

AVG ANN’L DIV’D YIELD 1.2% 1.2% 1.6% 2.0% 2.2% 2.3% 2.4% 2.4% --

TOTAL ASSETS ($MILL) 529.0 606.2 610.7 661.6 715.4 742.0 971.4 1032.2 -- Bold figures

LOANS ($MILL) 352.6 381.0 385.4 444.0 504.0 556.5 728.1 786.0 -- are consensus

NET INTEREST INC ($MILL) 28.6 31.5 32.3 36.1 32.8 34.9 39.3 42.2 -- earnings

LOAN LOSS PROV’N ($MILL) 1.2 4.3 1.9 3.9 4.2 3.5 4.8 5.4 -- estimates

NONINTEREST INC ($MILL) 8.1 8.7 8.2 8.0 10.1 11.4 14.4 11.3 -- and, using the

NONINTEREST EXP ($MILL) 14.1 15.8 16.5 16.8 18.3 20.3 25.9 29.1 -- recent prices,

NET PROFIT ($MILL) 14.4 13.5 14.7 15.6 13.8 15.1 15.3 12.7 -- P/E ratios.

INCOME TAX RATE 32.5% 32.8% 33.2% 33.6% 32.4% 32.9% 33.8% 32.6% --

RETURN ON TOTAL ASSETS 2.73% 2.22% 2.41% 2.35% 1.93% 2.04% 1.58% 1.23% --

LONG-TERM DEBT ($MILL) -- -- -- -- -- -- -- -- --

SHR. EQUITY ($MILL) 95.2 105.4 113.5 119.3 124.8 127.4 141.8 141.0 --

SHR. EQ. TO TOTAL ASSETS 18.0% 17.4% 18.6% 18.0% 17.4% 17.2% 14.6% 13.7% --

LOANS TO TOT ASSETS 66.7% 62.8% 63.1% 67.1% 70.4% 75.0% 75.0% 76.1% --

RETURN ON SHR. EQUITY 15.2% 12.8% 13.0% 13.1% 11.1% 11.9% 10.8% 9.0% --

RETAINED TO COM EQ 11.6% 9.1% 9.1% 9.1% 7.0% 7.4% 6.4% 4.3% --

ALL DIV’DS TO NET PROF 23% 29% 30% 31% 37% 37% 41% 52% --

ANo. of analysts changing earn. est. in last 13 days: 0 up, 0 down, consensus 5-year earnings growth 9.0% per year. BBased upon 2 analysts’ estimates. CBased upon 2 analysts’ estimates.

ANNUAL RATES

ASSETS ($mill.) 2002 2003 12/31/04

INDUSTRY: Bank

of change (per share) 5 Yrs. 1 Yr.

Loans 556.5 728.1 786.0

Loans 14.5% 10.5% BUSINESS: Bank of Granite Corp. operates as a multi-

Earnings 1.5% -17.0% Funds Sold 5.9 .0 .0

Dividends 11.0% 6.5% bank holding company. It owns Bank of Granite, a state

Securities 124.9 159.4 158.6

Book Value 7.0% 1.5% bank, and GLL Associates, Inc., a mortgage bank. The

Total Assets 11.0% 8.5% Other Earning 2.7 4.1 3.6

company provides its community banking business opera-

Other 52.0 79.8 84.0 tions from 20 full-service offices and one loan-production

Fiscal LOANS ($mill.)

Year 1Q 2Q 3Q 4Q LIABILITIES ($mill.) office in North Carolina. The company conducts its mort-

12/31/03 568.2 609.2 721.1 728.1

Deposits 547.3 735.1 749.9 gage banking business operations from 13 offices in the

12/31/04 714.8 729.1 740.5 786.0 Funds Borrowed 62.4 90.5 135.3 central and southern Piedmont and Catawba Valley regions

12/31/05 778.5 820.9 Long-Term Debt .0 .0 .0 of North Carolina and on Hilton Head Island, South

12/31/06 Net Worth 127.4 141.8 141.0 Carolina. The Community Banking segment offers a variety

Fiscal EARNINGS PER SHARE Full Other 4.9 4.0 6.0 of loan and deposit products and other financial services.

Year 1Q 2Q 3Q 4Q Year Granite Mortgage’s principal mortgage banking activities

Total 742.0 971.4 1032.2

12/31/02 .28 .25 .27 .31 1.11 Loan Loss Resrv. include the origination and underwriting of mortgage loans

8.8 10.8 13.7

12/31/03 .28 .30 .31 .24 1.13 to individuals. Has 315 employees. Chairman: John A.

12/31/04 .22 .24 .23 .25 .94 Forlines, Jr. Address: P.O. Box 128, Granite Falls, NC

12/31/05 .24 .30 .30 .30 28630. Tel.: (828) 496-2000. Internet:

12/31/06 .29 LONG-TERM DEBT AND EQUITY http://www.bankofgranite.com.

QUARTERLY DIVIDENDS PAID as of 12/31/04

Cal- Full

endar 1Q 2Q 3Q 4Q Year

LT Debt None Due in 5 Yrs. None

2002 .096 .11 .11 .11 .43 Including Cap. Leases None

2003 .11 .11 .12 .12 .46

Leases, Uncapitalized Annual rentals $.9 mill.

C.B.

2004 .12 .12 .12 .13 .49

2005 .13 .13 .13 Pension Liability None in ’04 vs. None in ’03

August 26, 2005

INSTITUTIONAL DECISIONS Pfd Stock None Pfd Div’d Paid None TOTAL SHAREHOLDER RETURN

3Q’04 4Q’04 1Q’05 Dividends plus appreciation as of 7/31/2005

to Buy 13 21 13 Common Stock 13,316,102 shares

3 Mos. 6 Mos. 1 Yr. 3 Yrs. 5 Yrs.

to Sell 10 12 13

Hld’s(000) 1914 2006 1937 20.66% 6.43% 13.25% 17.11% 29.70%

©2005 Value Line Publishing, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part To subscribe call 1-800-833-0046.

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Das könnte Ihnen auch gefallen

- The Power of Scarcity: Leveraging Urgency and Demand to Influence Customer DecisionsVon EverandThe Power of Scarcity: Leveraging Urgency and Demand to Influence Customer DecisionsNoch keine Bewertungen

- Stock Composite ListDokument20 SeitenStock Composite Listdsh100% (1)

- American Airlines: 10.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokument1 SeiteAmerican Airlines: 10.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDReaLNoch keine Bewertungen

- Proposed Construction: Kumbara Gundi RoadDokument1 SeiteProposed Construction: Kumbara Gundi RoadPRAVEEN KUMARNoch keine Bewertungen

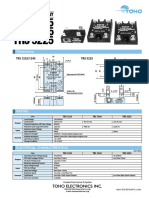

- TRS 1225 TRS 1245 TRS 5225: Solid State RelayDokument2 SeitenTRS 1225 TRS 1245 TRS 5225: Solid State RelayserpilNoch keine Bewertungen

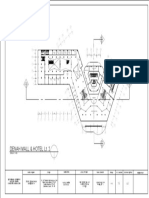

- Denah Mall & Hotel Lt. 2: R. Bermain Anak R. PrefunctionDokument1 SeiteDenah Mall & Hotel Lt. 2: R. Bermain Anak R. PrefunctionEceNoch keine Bewertungen

- PM Calls For Arab Growth Model: Gulf TimesDokument42 SeitenPM Calls For Arab Growth Model: Gulf TimesAli MohamedNoch keine Bewertungen

- Imprimir Mamposteria 2Dokument1 SeiteImprimir Mamposteria 2Maria Celeste Ramirez HurtadoNoch keine Bewertungen

- Upperbasement PlanDokument1 SeiteUpperbasement PlanAkash MohantyNoch keine Bewertungen

- Lenovo Yoga 900S-12ISK - NM-A591 Maksim 12.5 SKL-YDokument37 SeitenLenovo Yoga 900S-12ISK - NM-A591 Maksim 12.5 SKL-YGuntur BaktiawanNoch keine Bewertungen

- 1760 RPM 60 Hz-140 PDFDokument84 Seiten1760 RPM 60 Hz-140 PDFRonny Estremadoiro ArteagaNoch keine Bewertungen

- A B B C 1 2 3 3 1 2 3 3: Rear Elevation Left Side Elevation Section Thru Y - Y A3 4 B A3 4 D FDokument1 SeiteA B B C 1 2 3 3 1 2 3 3: Rear Elevation Left Side Elevation Section Thru Y - Y A3 4 B A3 4 D FMary Joy AzonNoch keine Bewertungen

- Final Placement Report MBA Batch 2020-22Dokument7 SeitenFinal Placement Report MBA Batch 2020-22harshad mehtaNoch keine Bewertungen

- Budget: February 2022Dokument139 SeitenBudget: February 2022Vedant KalkhandayNoch keine Bewertungen

- Adobe Scan Apr 18, 2024Dokument2 SeitenAdobe Scan Apr 18, 2024Chandan kumar ChoudhuryNoch keine Bewertungen

- Uttarakhand Infographic June 2020Dokument1 SeiteUttarakhand Infographic June 2020Bharat KumarNoch keine Bewertungen

- Planta de EstructuraDokument1 SeitePlanta de EstructuraKestter SanchezNoch keine Bewertungen

- Plano Sub division-PERIMETRICODokument1 SeitePlano Sub division-PERIMETRICOyecodeNoch keine Bewertungen

- The Cloud's Veil - SD Arragnement-Violin - 2Dokument1 SeiteThe Cloud's Veil - SD Arragnement-Violin - 2Shania DavisNoch keine Bewertungen

- Marathon Oil: 15.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokument1 SeiteMarathon Oil: 15.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDlondonmorganNoch keine Bewertungen

- Mro Aa PDFDokument1 SeiteMro Aa PDFlondonmorganNoch keine Bewertungen

- Astrep840 Q4report AbudhabiDokument9 SeitenAstrep840 Q4report AbudhabiGopi TadikamallaNoch keine Bewertungen

- 3.7 - 1270 Pump Assy - 15114504Dokument2 Seiten3.7 - 1270 Pump Assy - 15114504Hery Mardiono HeryNoch keine Bewertungen

- 3.7 - 1270 Pump Assy - 15114504 - 1 PDFDokument2 Seiten3.7 - 1270 Pump Assy - 15114504 - 1 PDFHery Mardiono HeryNoch keine Bewertungen

- FDAS - 5-StoreyDokument4 SeitenFDAS - 5-Storeyaureliojrtambiga.dotrNoch keine Bewertungen

- INFIBEAM StockReport 20230919 0135Dokument13 SeitenINFIBEAM StockReport 20230919 0135sunny996316192Noch keine Bewertungen

- 165-Sotrafer Depot Project (51) - 21-09-2021Dokument1 Seite165-Sotrafer Depot Project (51) - 21-09-2021Mitendra Kumar ChauhanNoch keine Bewertungen

- Kingdom of Saudi Arabia: Engineer: Contractors Joint VentureDokument1 SeiteKingdom of Saudi Arabia: Engineer: Contractors Joint VentureMohamed BukhamsinNoch keine Bewertungen

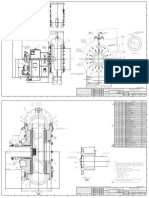

- Heat Exchanger: Front View Side ViewDokument1 SeiteHeat Exchanger: Front View Side ViewNeocent DesignsNoch keine Bewertungen

- Annual Review 2018 PDFDokument33 SeitenAnnual Review 2018 PDFSleek StyleNoch keine Bewertungen

- Annual Review 2018-1 PDFDokument33 SeitenAnnual Review 2018-1 PDFMirang ShahNoch keine Bewertungen

- ProjectDokument1 SeiteProjectRamiro Acosta CepedaNoch keine Bewertungen

- Manual Panacom ParlanteDokument20 SeitenManual Panacom Parlanteagustina fernandezNoch keine Bewertungen

- PT P ST: Site Development Plan Vicinity MapDokument1 SeitePT P ST: Site Development Plan Vicinity MapTrishia EndayaNoch keine Bewertungen

- Output Diy Platform MetricDokument1 SeiteOutput Diy Platform MetricdanilorussosaxNoch keine Bewertungen

- KS-5 AppDokument9 SeitenKS-5 AppAnas ArpaniNoch keine Bewertungen

- Zone L Sector 23Dokument1 SeiteZone L Sector 23atul singhNoch keine Bewertungen

- Tugas 7 Growia RevisiDokument2 SeitenTugas 7 Growia RevisiyogipragatamaNoch keine Bewertungen

- KV 2322Dokument1 SeiteKV 2322mpveraviNoch keine Bewertungen

- Analysis & Overview: Support & Resistance Fauji Cement Company Limited (FCCL) What Should You DoDokument3 SeitenAnalysis & Overview: Support & Resistance Fauji Cement Company Limited (FCCL) What Should You DoAwais KhalidNoch keine Bewertungen

- Apex Footwear Limited: Symbol: APEXFOOT Sector: Tannery Industries Board: MainDokument2 SeitenApex Footwear Limited: Symbol: APEXFOOT Sector: Tannery Industries Board: MainRizwanul Islam 1912111630Noch keine Bewertungen

- Sample - ThusySuckyCarDokument1 SeiteSample - ThusySuckyCarapi-26855111Noch keine Bewertungen

- Sheet 8 - Distilation Final-ModelDokument1 SeiteSheet 8 - Distilation Final-ModelHarshil TejaniNoch keine Bewertungen

- Linea B-C (4) 7,1 Linea D-E (4) 9,0 T3 (.. 46,6 T2 (.. 3,7: Voltages / LoadingDokument1 SeiteLinea B-C (4) 7,1 Linea D-E (4) 9,0 T3 (.. 46,6 T2 (.. 3,7: Voltages / LoadingEdwin Elvis Ccallo SaicoNoch keine Bewertungen

- Perrigo Company: © Zacks Company Report As ofDokument1 SeitePerrigo Company: © Zacks Company Report As ofjomanousNoch keine Bewertungen

- Bantu Ukur LayoutDokument1 SeiteBantu Ukur Layoutibnuhajar_stNoch keine Bewertungen

- For Reference Only Unless Properly Endorsed For Additional Details and Specifications, Consult ManualDokument1 SeiteFor Reference Only Unless Properly Endorsed For Additional Details and Specifications, Consult ManualLuis Fernando Gomez SalasNoch keine Bewertungen

- Gender Diffferences in Personality and Leaderhsip PerformanceDokument32 SeitenGender Diffferences in Personality and Leaderhsip PerformanceMarco FNNoch keine Bewertungen

- Daily Newspaper - 2015 - 10 - 03 - 000000Dokument44 SeitenDaily Newspaper - 2015 - 10 - 03 - 000000Rachid MeftahNoch keine Bewertungen

- Vridhi MagazineDokument22 SeitenVridhi MagazinemahboobahmedlaskarNoch keine Bewertungen

- Dainik Jagran Transfer StationDokument1 SeiteDainik Jagran Transfer Stationvikram243001Noch keine Bewertungen

- How Far Ill GoDokument1 SeiteHow Far Ill GoIgor FreitasNoch keine Bewertungen

- Donotscale: Fractions Decimals Angle X/XX .25 X.X° .XXXDokument1 SeiteDonotscale: Fractions Decimals Angle X/XX .25 X.X° .XXXCarlos JiménezNoch keine Bewertungen

- Collaborative Thinking XWDDokument1 SeiteCollaborative Thinking XWDVivianaNoch keine Bewertungen

- Pizza Oven SchematicDokument1 SeitePizza Oven Schematicsir.roy.keaneNoch keine Bewertungen

- FS14 18 PDFDokument2 SeitenFS14 18 PDFPhong DoNoch keine Bewertungen

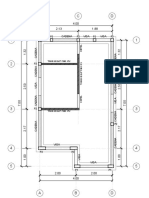

- Kindergarden PLAN VIEW-ModelDokument1 SeiteKindergarden PLAN VIEW-Modelvinod n rajandranNoch keine Bewertungen

- Dainik Jagran SiteDokument1 SeiteDainik Jagran Sitevikram243001Noch keine Bewertungen

- A B C D E F G H Date BY Alteration Detail Location Symbol: Philippine Batteries IncDokument1 SeiteA B C D E F G H Date BY Alteration Detail Location Symbol: Philippine Batteries IncDhenil ManubatNoch keine Bewertungen

- Pari AppliedDokument11 SeitenPari Applieddarwin12Noch keine Bewertungen

- 2-10 Warranty Book PDFDokument48 Seiten2-10 Warranty Book PDFdarwin12Noch keine Bewertungen

- Reit Wells 2Dokument3 SeitenReit Wells 2darwin12Noch keine Bewertungen

- Vanguard Dividend Growth Fund Investor (VDIGX) : Ranking CommentaryDokument6 SeitenVanguard Dividend Growth Fund Investor (VDIGX) : Ranking Commentarydarwin12Noch keine Bewertungen

- WFC Wells Fargo & Co: (New York Stock Exchange)Dokument12 SeitenWFC Wells Fargo & Co: (New York Stock Exchange)darwin12Noch keine Bewertungen

- TodaysGolferANewWayToPutt PDFDokument3 SeitenTodaysGolferANewWayToPutt PDFdarwin12Noch keine Bewertungen

- Mycroft TMFDokument11 SeitenMycroft TMFdarwin12100% (1)

- 2-10 Warranty Book PDFDokument48 Seiten2-10 Warranty Book PDFdarwin12Noch keine Bewertungen

- Class Notes-FundamentalsDokument12 SeitenClass Notes-Fundamentalsdarwin1291% (11)

- Web App Programming in Python - Johar 20152 PDFDokument5 SeitenWeb App Programming in Python - Johar 20152 PDFdarwin12Noch keine Bewertungen

- Applied Value Investing (Duggal) FA2016Dokument3 SeitenApplied Value Investing (Duggal) FA2016darwin12Noch keine Bewertungen

- Applied Value Investing (Renjen, Oro-Hahn) FA2015Dokument4 SeitenApplied Value Investing (Renjen, Oro-Hahn) FA2015darwin12Noch keine Bewertungen

- Security Analysis (Begg) FA2016Dokument8 SeitenSecurity Analysis (Begg) FA2016darwin12Noch keine Bewertungen

- Behavioral Economics & Decision Making (Webb) SP2017Dokument11 SeitenBehavioral Economics & Decision Making (Webb) SP2017darwin12Noch keine Bewertungen

- Applied Value Investing (Williams, Quinn JR) FA2016Dokument4 SeitenApplied Value Investing (Williams, Quinn JR) FA2016darwin12Noch keine Bewertungen

- Value & Special Situation Investment (Yarsky, Greenblatt) FA2016Dokument2 SeitenValue & Special Situation Investment (Yarsky, Greenblatt) FA2016darwin12Noch keine Bewertungen

- Applied Value Investing (Horn) SP2016Dokument2 SeitenApplied Value Investing (Horn) SP2016darwin12Noch keine Bewertungen

- Applied Value Investing (Quinn JR, Williams) FA2015Dokument4 SeitenApplied Value Investing (Quinn JR, Williams) FA2015darwin12Noch keine Bewertungen

- DNL Use of Proceeds Annual Progress As of 12.31.14Dokument6 SeitenDNL Use of Proceeds Annual Progress As of 12.31.14WrLw7pcufeGUNoch keine Bewertungen

- Chapter 2 - How To Calculate Present Value - Extra ExercisesDokument2 SeitenChapter 2 - How To Calculate Present Value - Extra ExercisesTrọng PhạmNoch keine Bewertungen

- Woohysun OHh KRX NsDokument2 SeitenWoohysun OHh KRX NsYadav ShailendraNoch keine Bewertungen

- Jesus TambuntingDokument5 SeitenJesus TambuntingheinzteinNoch keine Bewertungen

- Statement of Account No:037910100226003 For The Period (From:01/02/2019 To:13/02/2020)Dokument7 SeitenStatement of Account No:037910100226003 For The Period (From:01/02/2019 To:13/02/2020)Babu SumanNoch keine Bewertungen

- Account Activity Generated Through HBL MobileDokument4 SeitenAccount Activity Generated Through HBL MobileMohammad ali HassanNoch keine Bewertungen

- 5010 XXXXXX 32021Dokument3 Seiten5010 XXXXXX 32021SHIVALAYA CONSTRUCTIONNoch keine Bewertungen

- Monetary Policy and Central Banking History of Philippine BankingDokument14 SeitenMonetary Policy and Central Banking History of Philippine BankingGloria MalabananNoch keine Bewertungen

- MORFXTDokument99 SeitenMORFXTMilesNoch keine Bewertungen

- Stockquotes 12012020 PDFDokument9 SeitenStockquotes 12012020 PDFXander 4thNoch keine Bewertungen

- Bangko Sentral NG PilipinasDokument4 SeitenBangko Sentral NG PilipinasHanaNoch keine Bewertungen

- Cholamandalam Investment and Finance Company Limited Repayment Schedule Date:22/05/2022Dokument3 SeitenCholamandalam Investment and Finance Company Limited Repayment Schedule Date:22/05/2022Saket KumarNoch keine Bewertungen

- NEW LOAN-APPLICATION-FORM November 2021 v2 PDFDokument4 SeitenNEW LOAN-APPLICATION-FORM November 2021 v2 PDFjohnson mwauraNoch keine Bewertungen

- Meaning and Definition of Premium (Insurance Law) : IntroductionDokument3 SeitenMeaning and Definition of Premium (Insurance Law) : IntroductionishwarNoch keine Bewertungen

- Invoice A2H 1937698Dokument1 SeiteInvoice A2H 1937698Robert AlvaradoNoch keine Bewertungen

- A Guide To Your Account: Monthly Service FeeDokument4 SeitenA Guide To Your Account: Monthly Service FeeUtibeima UbomNoch keine Bewertungen

- DME NEET UG 2022 Institute Fee Paymet User ManualDokument9 SeitenDME NEET UG 2022 Institute Fee Paymet User ManualYash AdhauliaNoch keine Bewertungen

- Exercises w1Dokument6 SeitenExercises w1hqfNoch keine Bewertungen

- Sample Navy FederalDokument3 SeitenSample Navy Federalhitta100% (1)

- Ali Mousa and Sons ContractingDokument1 SeiteAli Mousa and Sons ContractingMohsin aliNoch keine Bewertungen

- Smiu Fee VCHDokument1 SeiteSmiu Fee VCHshahzad ArainNoch keine Bewertungen

- MCB Internship Report 2010 NUMLDokument119 SeitenMCB Internship Report 2010 NUMLmani151850% (2)

- History CamelDokument2 SeitenHistory CamelSumi PgNoch keine Bewertungen

- REQUEST For Refund Form Version 3.03232021Dokument1 SeiteREQUEST For Refund Form Version 3.03232021Isape Hope Maningo-Burguite Bagaipo100% (1)

- Central Banking SyllabusDokument16 SeitenCentral Banking Syllabuslloewens0% (1)

- PayPal Bank StatementDokument1 SeitePayPal Bank StatementNadiia Avetisian100% (1)

- Internship Report ON Muslim Commercial Bank: Branch ManagerDokument35 SeitenInternship Report ON Muslim Commercial Bank: Branch ManagerRida FatimaNoch keine Bewertungen

- BRPD 8Dokument8 SeitenBRPD 8Arman Hossain Warsi100% (1)