Beruflich Dokumente

Kultur Dokumente

Outdoor World Inc Owi Is A Sporting Goods Retailer That

Hochgeladen von

Amit PandeyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Outdoor World Inc Owi Is A Sporting Goods Retailer That

Hochgeladen von

Amit PandeyCopyright:

Verfügbare Formate

Solved: Outdoor World Inc OWI is a sporting goods retailer

that

Outdoor World Inc. (OWI) is a sporting goods retailer that specializes in bicycles, running shoes,

and related clothing. The firm has become successful by careful attention to trends in cycling,

running, and changes in the technology and fashion of sport clothing. In recent years however,

the profit margins have begun to fall, and OWI has decided to employ a contribution income

statement to further analyze the company’s profitability. The company has two stores, one in

Hartford, Connecticut, and the other in Boston, Massachusetts. The total sales for the two

stores for the most recent year are $6,875,000 and $5,625,000 for the Hartford and Boston

stores respectively. Both stores are considered profit centers, and within each store are two

profit centers: one for clothing and the other for cycles and running shoes. The breakdown of

sales within the two stores is approximately 50 percent clothing and 50 percent cycles/shoes for

Boston but is estimated to be 60 percent/40 percent for Hartford, due to the greater interest in

cycling in the Boston area. OWI is interested in finding the profit contribution of clothing and

cycling/shoes at the Hartford store but not at the Boston store.

Cost of purchases for resale averages 60 percent of retail value at Boston, and at Hartford the

cost is 70 percent for clothing and 50 percent for cycles/shoes. Variable operating costs at each

store are similar—30 percent of retail sales at Boston, and at Hartford operating costs are 25

percent of retail sales for the clothing unit and 35 percent for the cycle/shoes unit. OWI

estimates it has a total of $1,075,000 fixed cost, of which $325,000 could not be traced to either

store; of the remaining $750,000, $400,000 was traceable to the stores and controllable by

store managers and $350,000 could be traced to the stores but could not be controlled in the

short term by the store managers. These fixed costs are estimated to be traceable to the stores

as follows.

Percent of

Fixed Controllable Costs Total Cost

Boston ................. 45%

Hartford total ............... 40

Clothing ................. 50

Cycle&Run ............... 30

Could not be traced to clothing or cycling

at Hartford ............... 20

Could not be traced to Boston or Hartford .... 15

Percent of

Fixed Noncontrollable Costs Total Cost

Boston ................. 40%

Hartford total .............. 50

Clothing ................. 55

Cycle&Run ............... 35

Could not be traced to clothing or cycling

at Hartford ............... 10

Could not be traced to Boston or Hartford ... 10

Reach out to freelance2040@yahoo.com for enquiry.

Required

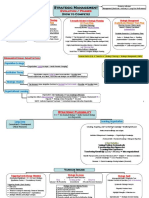

1. Prepare a contribution income statement for OWI showing the contribution margin,

controllable margin, and contribution by profit center for both the Boston and Hartford stores,

and also for the clothing and cycles/shoes units of the Hartford store.

2. Interpret the contribution income statement you prepared in (1) above. What

recommendations do you have for the management of OWI?

ANSWER

https://solvedquest.com/outdoor-world-inc-owi-is-a-sporting-goods-retailer-that/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

Das könnte Ihnen auch gefallen

- You May Refer To The Opening Story of Tony andDokument3 SeitenYou May Refer To The Opening Story of Tony andAmit PandeyNoch keine Bewertungen

- You Were Appointed The Manager of Drive Systems Division DSDDokument2 SeitenYou Were Appointed The Manager of Drive Systems Division DSDAmit PandeyNoch keine Bewertungen

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDokument2 SeitenYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNoch keine Bewertungen

- You Are The Controller For Crystalclean Services A Company ThatDokument2 SeitenYou Are The Controller For Crystalclean Services A Company ThatAmit PandeyNoch keine Bewertungen

- Zimmerman Company of Shawnee Kansas Spreads Herbicides and Applies LiquidDokument1 SeiteZimmerman Company of Shawnee Kansas Spreads Herbicides and Applies LiquidAmit PandeyNoch keine Bewertungen

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDokument2 SeitenXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNoch keine Bewertungen

- You Have Recently Been Hired by Layton Motors Inc LmiDokument1 SeiteYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNoch keine Bewertungen

- Your Company Is Considering Investing in Its Own Transport FleetDokument2 SeitenYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Your Company Produces Cookies in A Two Step Process The MixingDokument1 SeiteYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNoch keine Bewertungen

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDokument1 SeiteZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNoch keine Bewertungen

- You Have Been Hired To Assist The Management of GreatDokument2 SeitenYou Have Been Hired To Assist The Management of GreatAmit PandeyNoch keine Bewertungen

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDokument1 SeiteZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNoch keine Bewertungen

- You Are Employed As The Assistant Accountant in Your CompanyDokument1 SeiteYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNoch keine Bewertungen

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDokument2 SeitenXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNoch keine Bewertungen

- X PLC Manufactures Product X Using Three Different Raw MaterialsDokument2 SeitenX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- XL Industries Uses Department Budgets and Performance Reports in PlanningDokument1 SeiteXL Industries Uses Department Budgets and Performance Reports in PlanningAmit PandeyNoch keine Bewertungen

- York PLC Was Formed Three Years Ago by A GroupDokument2 SeitenYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNoch keine Bewertungen

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDokument2 SeitenXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNoch keine Bewertungen

- You Have Been Asked To Assist The Management of IronwoodDokument2 SeitenYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNoch keine Bewertungen

- Xy Limited Commenced Trading On 1 February With Fully PaidDokument2 SeitenXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNoch keine Bewertungen

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDokument1 SeiteWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNoch keine Bewertungen

- Wright Manufacturing Has Recently Studied Its Order Filling ProcDokument1 SeiteWright Manufacturing Has Recently Studied Its Order Filling ProcAmit PandeyNoch keine Bewertungen

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDokument1 SeiteWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNoch keine Bewertungen

- Wise Company Began Operations at The Beginning of 2018 TheDokument2 SeitenWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNoch keine Bewertungen

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDokument2 SeitenWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNoch keine Bewertungen

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDokument1 SeiteWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNoch keine Bewertungen

- Winston Medical Clinic Proposed The Acquisition of Some Expensive X RayDokument2 SeitenWinston Medical Clinic Proposed The Acquisition of Some Expensive X RayAmit PandeyNoch keine Bewertungen

- When The Fraud at Pepsico Occurred The Company Had FiveDokument2 SeitenWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNoch keine Bewertungen

- Wayne Coyle The Controller of Pei Potato Co Is DisillusionedDokument1 SeiteWayne Coyle The Controller of Pei Potato Co Is DisillusionedAmit PandeyNoch keine Bewertungen

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDokument2 SeitenWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Module 2 Introduction To Cost Terms and ConceptsDokument52 SeitenModule 2 Introduction To Cost Terms and ConceptsChesca AlonNoch keine Bewertungen

- Welcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal SteelDokument11 SeitenWelcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal Steelब्राह्मण विभोरNoch keine Bewertungen

- Dampak Digitalisasi Terhadap Peran Front Office Dalam Bisnis PerbankanDokument12 SeitenDampak Digitalisasi Terhadap Peran Front Office Dalam Bisnis PerbankanGSI indonesiaNoch keine Bewertungen

- Strategic Management - Chapter (1) - Modified Maps - Coloured - March 2021Dokument4 SeitenStrategic Management - Chapter (1) - Modified Maps - Coloured - March 2021ahmedgelixNoch keine Bewertungen

- Rek April2023Dokument14 SeitenRek April2023asna simamoraNoch keine Bewertungen

- SOA Platform Basics and Support in J2EE and .NETDokument46 SeitenSOA Platform Basics and Support in J2EE and .NETBala SubramanianNoch keine Bewertungen

- Maintenance of Machinery Course Code: Mceng 5142 Instructor: Mesfin S. (PH.D.)Dokument30 SeitenMaintenance of Machinery Course Code: Mceng 5142 Instructor: Mesfin S. (PH.D.)Mikias Tefera100% (1)

- Mentorship Platform For Your GrowthDokument3 SeitenMentorship Platform For Your Growthmentor kartNoch keine Bewertungen

- Key Roles and Life CycleDokument4 SeitenKey Roles and Life CycleAmanNoch keine Bewertungen

- Case Digest - BRENT SCHOOL v. RONALDO ZAMORADokument3 SeitenCase Digest - BRENT SCHOOL v. RONALDO ZAMORAAnton Ric Delos ReyesNoch keine Bewertungen

- Project Report On Paper Bags ManufacturingDokument8 SeitenProject Report On Paper Bags ManufacturingEIRI Board of Consultants and Publishers100% (2)

- BCPODokument2 SeitenBCPOJaylord AgpuldoNoch keine Bewertungen

- 1 Fundamentals of Market Research 2 1Dokument34 Seiten1 Fundamentals of Market Research 2 1Reem HassanNoch keine Bewertungen

- Simulated Exam 1Dokument28 SeitenSimulated Exam 1Erin CruzNoch keine Bewertungen

- Tvlrcai Bot Meeting FTM January 2024Dokument83 SeitenTvlrcai Bot Meeting FTM January 2024Keds MikaelaNoch keine Bewertungen

- Request Proposals Evaluation GuideDokument12 SeitenRequest Proposals Evaluation Guidemehdi kamaliNoch keine Bewertungen

- Resume - J.P. DubeyDokument5 SeitenResume - J.P. DubeyRanjana DubeyNoch keine Bewertungen

- Lean Six Sigma Essential Glossary of TermsDokument17 SeitenLean Six Sigma Essential Glossary of TermsDebashishDolonNoch keine Bewertungen

- Harvard PDP - Teams Under Pressure-MergedDokument8 SeitenHarvard PDP - Teams Under Pressure-Mergedapi-551397274Noch keine Bewertungen

- Tutorial 3 DB U2000429Dokument3 SeitenTutorial 3 DB U2000429Haikal HaziqNoch keine Bewertungen

- Chapter 1 - Accounting Information Systems: An Overview: Dennis T. Fajarito, MBADokument36 SeitenChapter 1 - Accounting Information Systems: An Overview: Dennis T. Fajarito, MBARohanne Garcia AbrigoNoch keine Bewertungen

- Dell EMC ProDeploy For PowerStoreDokument14 SeitenDell EMC ProDeploy For PowerStoreMohamed AddaNoch keine Bewertungen

- EWO STRM042 Critical Issues in Business: Modified STRM042 List For Use by Education With Others (EWO) Students and StaffDokument5 SeitenEWO STRM042 Critical Issues in Business: Modified STRM042 List For Use by Education With Others (EWO) Students and StaffmbauksupportNoch keine Bewertungen

- Cost Accounting Traditions and Innovations: Standard CostingDokument45 SeitenCost Accounting Traditions and Innovations: Standard CostingMaricon BerjaNoch keine Bewertungen

- PT Karya Mandri Accounts SummaryDokument2 SeitenPT Karya Mandri Accounts SummaryFerdi PutraNoch keine Bewertungen

- LTFRB Operator Data SheetDokument3 SeitenLTFRB Operator Data SheetHaultech TrucksNoch keine Bewertungen

- As 5016-2004 Metallic Materials - Conversion of Hardness ValuesDokument10 SeitenAs 5016-2004 Metallic Materials - Conversion of Hardness ValuesSAI Global - APAC0% (1)

- Thermoplastic&ThermosetDokument7 SeitenThermoplastic&Thermosetrex tanongNoch keine Bewertungen

- RFP for AIIMS Guwahati Executing AgencyDokument32 SeitenRFP for AIIMS Guwahati Executing AgencyAmlan BiswalNoch keine Bewertungen

- FM SMN 01 Memorandum of Agreement 1Dokument5 SeitenFM SMN 01 Memorandum of Agreement 1MineNoch keine Bewertungen