Beruflich Dokumente

Kultur Dokumente

June Maylyn Topic 9 HW in FINMAX

Hochgeladen von

June Maylyn MarzoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

June Maylyn Topic 9 HW in FINMAX

Hochgeladen von

June Maylyn MarzoCopyright:

Verfügbare Formate

June Maylyn D.

Marzo

BSAIS 3rd year

Topic 9: Dividend Policy

Essay

1. Why did most of the investors prefer capital gains than dividends pay-out?

Investors prefer Capital Gains than Dividends Pay-Out because dividends are taxable whether it is classified as

ordinary or qualified. Capital gains is also taxable but it is different than dividends. Because it is based on

whether it is short-term or long-term holdings.

2. Why is it important to investors to know the ex-dividend date?

Ex-Dividend Date is important to the investors because it's the cut-off period for you to buy shares of a company

and receive the dividends for the next pay-out date. So, in order for shareholders to get paid the upcoming

dividend, they must own shares of the dividend-yielding stock at least one day prior to the ex-dividend date.

3. How do stock dividends and splits affect stock prices?

When a company decides to issue a Stock Split (or stock dividend), any upcoming cash dividends can be affected

in a couple of ways. In most cases, the dividend will be adjusted along with the share price. The factors to

consider are the date of the stock split and the time of the cash dividend's record date.

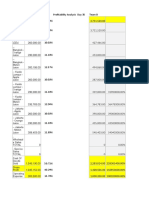

Problems

Problem A

Tinky-Winky Co. has a capital budget of P1.2 million. Tinky-Winky Co. has 10,000 outstanding shares. The company

maintains a capital structure that is 60% debt funded. The company projects that its net income this year will be

P600,000. The company follows a residual dividend policy.

1. The amount to be financed by equity is. ANSWER: P 480,000

Capital Budget- P 1,200,000

Debt (60%) - x 60%

Fund for Debt - 720,000

Equity (40%) - P 480,000

Capital Budget- P 1,200,000

2. What will be its payout ratio? ANSWER: 20%

Pay-out ratio= Dividend/Net Income

Dividend - P 120,000

Net Income- / 600,000

Pay-out ratio= 20%

3. How much is the dividends per share? ANSWER: P 12

Dividends per share= Total Dividends/No. of outstanding shares

Total Dividend - P 120,000

No. of outstanding shares - / 10,000

Dividends per share = P 12

Problem B

Laa-Laa Co. utilizes the residual dividend model to determine its ordinary dividend payout. This year the

company expects its net income to be P2,000,000, and it expects to retain 75% of the income. The company’s

target ordinary equity ratio is 40%, and the firm is financed with only ordinary equity and debt.

1. How much is the addition to retained earning? ANSWER: P 1,500,000

Net Income = P 2,000,000

Dividends (25%) = 25%

Fund for Dividend= 500,000

RE (75%) = P 1,500,000

Net Income = P 2,000,000

2. What is the plowback ratio? ANSWER: 75%

Plowback Ratio- 1 - Dividend/Net Income

PR= 1 – (500,000/2,000,000)

PR= 75%

3. What is the company’s forecasted total capital budget for the year? ANSWER: P 3,750,000

Forecasted Capital Budget- Retained Earnings/Equity Ratio

RE = P 1,500,000

ER = / 40%

FCP= P 3,750,000

Problem C

Dipsy Corp. recently completed a 2-for-1 stock split. Before the split, the company had 10,000,000 shares

outstanding and its stock price was P150 per share. After the split, the total market value of the company’s

stock equaled P1.5 billion. The total share capital balance of Dipsy Corp. is P350,000,000.

1. What was the price of the company’s stock following the stock split? ANSWER: P 75

New Stock Price- Old Stock Price/Share-split provision

OSP = P 150

SSP = / 2

NSP = P 75

2. Determine the new par value of each shares. ANSWER: P 75

New Par Value- Old Stock Price/Share-split provision

OSP = P 150

SSP = / 2

NPV = P 75

Problem D

Po Inc. believes that at its current share price of P16.00 the firm is undervalued. Makeover plans to

repurchase 2.4 million of its 20 million shares outstanding. The Po Inc.’s managers expect that they can

repurchase the entire 2.4 million shares at the expected equilibrium price after repurchase. The Po Inc.’s

current earnings are P44,000,000. If management’s assumptions hold, answer the following,

1. The current earnings per share is ANSWER: P 2.2

Current Earnings per share- Current Earnings/Share Outstanding

CE = P 44,000,000

SO = / 20,000,000

CE/share = P 2.2

2. What is the price to earnings ratio? ANSWER: 7.27

Price to Earnings Ratio- Current share price/Current Earnings per share

CSP = P 16

CE/share = / 2.2

P to E ratio = 7.27

3. How much is the earnings per share after the repurchase? ANSWER: P 2.5

Earnings per share after the repurchase- Current Earnings/(Shares Outstanding - Repurchase)

CE = P 44,000,000

(20,000,000 – 2,400,000) = / 17,600,000

E/ S after the repurchase = P 2.5

4. What is the expected per-share market price after repurchase? ANSWER: P 18.18

Expected/share market price after repurchase- Price to earnings ratio x EPS after the repurchase

P to E ratio = 7.27

EPS after the repurchase= x P 2.50

E/ SMP after repurchase= P 18.18

Das könnte Ihnen auch gefallen

- AfarDokument7 SeitenAfarelizabeth angelNoch keine Bewertungen

- Exam 7Dokument15 SeitenExam 7mohit verrmaNoch keine Bewertungen

- Year1 Year3 Year3Dokument3 SeitenYear1 Year3 Year3Kyla de SilvaNoch keine Bewertungen

- Budgetary Control & Responsibility AccountingDokument61 SeitenBudgetary Control & Responsibility AccountingLouris NuquiNoch keine Bewertungen

- Advanced AccountingDokument14 SeitenAdvanced AccountingBehbehlynn67% (3)

- A7 Topic 10 - Gross Profit Variance AnalysisDokument1 SeiteA7 Topic 10 - Gross Profit Variance AnalysisAnna CharlotteNoch keine Bewertungen

- Joint CostDokument35 SeitenJoint CostthenikkitrNoch keine Bewertungen

- ACR107 Exercises 02.04.19Dokument102 SeitenACR107 Exercises 02.04.19Patrick Kyle AgraviadorNoch keine Bewertungen

- Man ConDokument24 SeitenMan ConCho Andrea100% (1)

- Uloc Answer Key Let's Check: A. Contingent ConsiderationsDokument2 SeitenUloc Answer Key Let's Check: A. Contingent Considerationszee abadillaNoch keine Bewertungen

- FM Assignment 7&8Dokument6 SeitenFM Assignment 7&8kartika tamara maharaniNoch keine Bewertungen

- NU-Long-Test-2-Rizal-for-ARC-and-ACT MarzoDokument8 SeitenNU-Long-Test-2-Rizal-for-ARC-and-ACT MarzoJune Maylyn MarzoNoch keine Bewertungen

- Beauty Salon Company Profile SampleDokument9 SeitenBeauty Salon Company Profile SampleSanjay TulsankarNoch keine Bewertungen

- B. 39,000 Stethoscopes: Results For Item 2Dokument20 SeitenB. 39,000 Stethoscopes: Results For Item 2Kath LeynesNoch keine Bewertungen

- MAS1Dokument46 SeitenMAS1Frances Bernadette BaylosisNoch keine Bewertungen

- MasDokument20 SeitenMasMarie AranasNoch keine Bewertungen

- Finals Manaco2Dokument6 SeitenFinals Manaco2Kenneth Bryan Tegerero Tegio100% (1)

- This Study Resource WasDokument5 SeitenThis Study Resource WasadssdasdsadNoch keine Bewertungen

- Master Budget ProblemsDokument3 SeitenMaster Budget ProblemsMelDominiLicardoEboNoch keine Bewertungen

- First Evaluation Examination Practical Accounting Problems 2 (BSA 4-1 P2 EVALS)Dokument18 SeitenFirst Evaluation Examination Practical Accounting Problems 2 (BSA 4-1 P2 EVALS)LJBernardoNoch keine Bewertungen

- Chapter 18Dokument16 SeitenChapter 18Norman DelirioNoch keine Bewertungen

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Dokument7 SeitenFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNoch keine Bewertungen

- Capital Budgeting Sample QuestionsDokument2 SeitenCapital Budgeting Sample QuestionsNCTNoch keine Bewertungen

- 09 X07 C ResponsibilityDokument9 Seiten09 X07 C ResponsibilityAnjo PadillaNoch keine Bewertungen

- SCM Quiz 1Dokument10 SeitenSCM Quiz 1Melanie SamsonaNoch keine Bewertungen

- OPT QuizDokument5 SeitenOPT QuizAngeline VergaraNoch keine Bewertungen

- Quiz 2 ReviewerDokument4 SeitenQuiz 2 ReviewerMariel Garra0% (1)

- Derivatives Qs PDFDokument5 SeitenDerivatives Qs PDFLara Camille CelestialNoch keine Bewertungen

- Case ProblemDokument45 SeitenCase ProblemJonath M GelomioNoch keine Bewertungen

- Chapter 8Dokument7 SeitenChapter 8Yenelyn Apistar CambarijanNoch keine Bewertungen

- Quiz 3 PROBLEMS SOLMAN UNFINISHEDDokument2 SeitenQuiz 3 PROBLEMS SOLMAN UNFINISHEDJacinto Doctolero Barruga IIINoch keine Bewertungen

- Fa2prob4 4Dokument2 SeitenFa2prob4 4jayNoch keine Bewertungen

- QuzziesDokument2 SeitenQuzziesKionna TamaraNoch keine Bewertungen

- PSA 300 RedraftedDokument5 SeitenPSA 300 RedraftedKenneth M. GonzalesNoch keine Bewertungen

- MAS 25A 27TH BATCH With AnswersDokument12 SeitenMAS 25A 27TH BATCH With AnswersSarah Jane GanigaNoch keine Bewertungen

- Master Budget, BudgetingDokument2 SeitenMaster Budget, BudgetinggeminailnaNoch keine Bewertungen

- Required: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToDokument2 SeitenRequired: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToErica AbegoniaNoch keine Bewertungen

- Midterm Exam On AUDIT PROBLEMS PPE AND INVESTMENTSDokument28 SeitenMidterm Exam On AUDIT PROBLEMS PPE AND INVESTMENTSReginald ValenciaNoch keine Bewertungen

- 10Dokument4 Seiten10kyla christineNoch keine Bewertungen

- AP Equity 1Dokument3 SeitenAP Equity 1Mark Michael Legaspi100% (1)

- Mancon Quiz 4Dokument32 SeitenMancon Quiz 4Quendrick SurbanNoch keine Bewertungen

- 2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)Dokument2 Seiten2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)max pNoch keine Bewertungen

- MASDokument7 SeitenMASHelen IlaganNoch keine Bewertungen

- Quiz 17Dokument2 SeitenQuiz 17warning urgentNoch keine Bewertungen

- MA PresentationDokument6 SeitenMA PresentationbarbaroNoch keine Bewertungen

- Long Quiz 2Dokument8 SeitenLong Quiz 2CattleyaNoch keine Bewertungen

- Ac4 CbaDokument1 SeiteAc4 CbaRobelyn Lacorte100% (1)

- 123Dokument13 Seiten123Nicole Andrea TuazonNoch keine Bewertungen

- Macr 009Dokument1 SeiteMacr 009Graal GasparNoch keine Bewertungen

- Ex12 - Quantitative MethodsDokument7 SeitenEx12 - Quantitative MethodsSheena Pearl AlinsanganNoch keine Bewertungen

- TAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsDokument1 SeiteTAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsGie MaeNoch keine Bewertungen

- Resa - The Review School of Accountancy Management ServicesDokument8 SeitenResa - The Review School of Accountancy Management ServicesKindred Wolfe100% (1)

- Practical Accounting 1Dokument21 SeitenPractical Accounting 1Christine Nicole BacoNoch keine Bewertungen

- Sample Final 11BDokument11 SeitenSample Final 11Bjosephmelkonian1741100% (1)

- Take Home Long QuizDokument5 SeitenTake Home Long QuizMa Yumi Angelica TanNoch keine Bewertungen

- Appendix Ebleta MatsDokument17 SeitenAppendix Ebleta MatsEl Yang0% (2)

- Mod5Act1 - Distribution To ShareholdersDokument12 SeitenMod5Act1 - Distribution To ShareholdersArnelli Marie Asher GregorioNoch keine Bewertungen

- 1 - Dividend PolicyDokument8 Seiten1 - Dividend PolicyoryzanoviaNoch keine Bewertungen

- Problem 16-4: Finmar Module 3: Distribution To Shareholders Assigned ProblemsDokument13 SeitenProblem 16-4: Finmar Module 3: Distribution To Shareholders Assigned ProblemsRose Mae GaleroNoch keine Bewertungen

- Tugas 12 - C16 - Distributions To ShareholdersDokument9 SeitenTugas 12 - C16 - Distributions To ShareholdersIqbal BaihaqiNoch keine Bewertungen

- 3.3 Dividend PolicyDokument38 Seiten3.3 Dividend PolicyOwlHeadNoch keine Bewertungen

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15Dokument7 SeitenA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15PRA MBANoch keine Bewertungen

- Internal Factor Evaluation Matrix IFE MATRIX DUCADokument3 SeitenInternal Factor Evaluation Matrix IFE MATRIX DUCAJune Maylyn MarzoNoch keine Bewertungen

- Baseball Salaries With Team Info1Dokument22 SeitenBaseball Salaries With Team Info1June Maylyn MarzoNoch keine Bewertungen

- Online Activity 1 BASTATSL MarzoDokument2 SeitenOnline Activity 1 BASTATSL MarzoJune Maylyn MarzoNoch keine Bewertungen

- Age Gender State Children Salary OpinionDokument2 SeitenAge Gender State Children Salary OpinionJune Maylyn MarzoNoch keine Bewertungen

- BAINSADL Activity 2 FinalsDokument2 SeitenBAINSADL Activity 2 FinalsJune Maylyn MarzoNoch keine Bewertungen

- Midterm Exam WikaDokument2 SeitenMidterm Exam WikaJune Maylyn MarzoNoch keine Bewertungen

- Analysis A. Summary of The Story The Little People by Maria Aleah G. TaboclaonDokument4 SeitenAnalysis A. Summary of The Story The Little People by Maria Aleah G. TaboclaonJune Maylyn MarzoNoch keine Bewertungen

- Volleyball Official Hand Signals Volleyball Official Hand SignalsDokument33 SeitenVolleyball Official Hand Signals Volleyball Official Hand SignalsJune Maylyn MarzoNoch keine Bewertungen

- A Kaizen Improvement Plan Paper For National UniversityDokument7 SeitenA Kaizen Improvement Plan Paper For National UniversityJune Maylyn MarzoNoch keine Bewertungen

- Hello Gab, Its Nice To See You Again! Here Is Some Short Activity For You and Just Take Your Time To AnswerDokument4 SeitenHello Gab, Its Nice To See You Again! Here Is Some Short Activity For You and Just Take Your Time To AnswerJune Maylyn MarzoNoch keine Bewertungen

- Questions:: June Maylyn D. MarzoDokument1 SeiteQuestions:: June Maylyn D. MarzoJune Maylyn MarzoNoch keine Bewertungen

- COMPILATION of InsightsDokument3 SeitenCOMPILATION of InsightsJune Maylyn MarzoNoch keine Bewertungen

- Reviewer For BAFACR4X Accounting Intermediate 3Dokument1 SeiteReviewer For BAFACR4X Accounting Intermediate 3June Maylyn MarzoNoch keine Bewertungen

- Palaris Cargo Handlers: - Rendering Logistic Services and Brokerage For Private Exporting and Importing CompaniesDokument1 SeitePalaris Cargo Handlers: - Rendering Logistic Services and Brokerage For Private Exporting and Importing CompaniesJune Maylyn MarzoNoch keine Bewertungen

- Case Study Homework Income TaxDokument3 SeitenCase Study Homework Income TaxJune Maylyn Marzo100% (2)

- Day 18 Profitability Analysis Day 35 Team D 100.00%Dokument8 SeitenDay 18 Profitability Analysis Day 35 Team D 100.00%June Maylyn MarzoNoch keine Bewertungen

- Self-Assessment: June Maylyn D. Marzo Advance Communication-2 Year BSAISDokument2 SeitenSelf-Assessment: June Maylyn D. Marzo Advance Communication-2 Year BSAISJune Maylyn MarzoNoch keine Bewertungen

- Company ProfileDokument1 SeiteCompany ProfileJune Maylyn MarzoNoch keine Bewertungen

- Loa NuDokument1 SeiteLoa NuJune Maylyn MarzoNoch keine Bewertungen

- National University: Labor Market and Income Inequality: What Are New Insights After Public ConsensusDokument12 SeitenNational University: Labor Market and Income Inequality: What Are New Insights After Public ConsensusJune Maylyn MarzoNoch keine Bewertungen

- Green Activities & Classroom Resources: Reducing Trash, Litter & WasteDokument3 SeitenGreen Activities & Classroom Resources: Reducing Trash, Litter & WasteJune Maylyn MarzoNoch keine Bewertungen

- Rizal EssayDokument1 SeiteRizal EssayJune Maylyn MarzoNoch keine Bewertungen

- Products Price List and ProceduresDokument4 SeitenProducts Price List and ProceduresmanugeorgeNoch keine Bewertungen

- BO Temporary KeysDokument5 SeitenBO Temporary Keysamanblr12Noch keine Bewertungen

- Birhan Final Research PaperDokument109 SeitenBirhan Final Research PaperyibeltalNoch keine Bewertungen

- UntitledDokument6 SeitenUntitledBipin Kumar JhaNoch keine Bewertungen

- Shipserv Problem: Shipserv, An E-Marketplace For The Marine Industry, Connects More ThanDokument4 SeitenShipserv Problem: Shipserv, An E-Marketplace For The Marine Industry, Connects More ThanLorraine CalvoNoch keine Bewertungen

- Livlong WellnessDokument8 SeitenLivlong WellnessShakshi SharmaNoch keine Bewertungen

- برامج الانعاش من 2000-2019Dokument14 Seitenبرامج الانعاش من 2000-2019MedBoulNoch keine Bewertungen

- Assignment 1Dokument4 SeitenAssignment 1Muhammad Ali RazaNoch keine Bewertungen

- Bar Review Material 2019 TaxDokument41 SeitenBar Review Material 2019 Taxsam cadley0% (1)

- Company Industry Employee Count Country: Plastic OmniumDokument4 SeitenCompany Industry Employee Count Country: Plastic OmniumA AlamNoch keine Bewertungen

- Ministry of ICT Strategic-Plan-2023-2027Dokument80 SeitenMinistry of ICT Strategic-Plan-2023-2027Marvin nduko bosireNoch keine Bewertungen

- Mapa Conceptual Valentina AlarcónDokument4 SeitenMapa Conceptual Valentina AlarcónRosa mariaNoch keine Bewertungen

- Sample Letter For Damages To PropertyDokument14 SeitenSample Letter For Damages To PropertyQuinton Nick100% (1)

- Indonesia Jakarta Rental Apartment Q1 2021Dokument2 SeitenIndonesia Jakarta Rental Apartment Q1 2021Grace SaragihNoch keine Bewertungen

- HR SpecializationDokument8 SeitenHR SpecializationRamdulariNoch keine Bewertungen

- JD Edwards Enterpriseone 9.X: Release Highlights (Applications)Dokument13 SeitenJD Edwards Enterpriseone 9.X: Release Highlights (Applications)alcajaNoch keine Bewertungen

- India 2030 PDFDokument188 SeitenIndia 2030 PDFGray HouserNoch keine Bewertungen

- Bujor George Petrisor: Contact DetailsDokument2 SeitenBujor George Petrisor: Contact DetailsGeorge BujorNoch keine Bewertungen

- 551-Article Text-1455-1-10-20230209Dokument9 Seiten551-Article Text-1455-1-10-20230209Chandra PratamaNoch keine Bewertungen

- ERP Course: Production and Materials Management Reading: Chapter 6 From Mary SumnerDokument40 SeitenERP Course: Production and Materials Management Reading: Chapter 6 From Mary SumnerRedouan AFLISSNoch keine Bewertungen

- Jey Ram Groups (M) SDN - BHD.: User Name: JeyramgroupsDokument22 SeitenJey Ram Groups (M) SDN - BHD.: User Name: JeyramgroupsmssoftwareNoch keine Bewertungen

- Chapter One Cost-Volume-Profit Relationship Variable and Fixed Cost Behavior and PatternsDokument12 SeitenChapter One Cost-Volume-Profit Relationship Variable and Fixed Cost Behavior and PatternsEid AwilNoch keine Bewertungen

- Financial Highlights: Year Ended December 31, 2020Dokument8 SeitenFinancial Highlights: Year Ended December 31, 2020Muhammad NadeemNoch keine Bewertungen

- Kantar MediaDokument4 SeitenKantar MediaAnjana JogyNoch keine Bewertungen

- Non Disclosure Agreement INTERN FINAL 2015-06-17Dokument3 SeitenNon Disclosure Agreement INTERN FINAL 2015-06-17GarimaSinghNoch keine Bewertungen

- MRL2601 Assignment 01Dokument3 SeitenMRL2601 Assignment 01Milanda MagwenziNoch keine Bewertungen

- 86, JaponDokument4 Seiten86, JaponTimotius RaborNoch keine Bewertungen

- BMW Integrative Case StudyDokument2 SeitenBMW Integrative Case StudyMairene Castro100% (1)

- OCDA Press Release Insurance FraudDokument6 SeitenOCDA Press Release Insurance Fraudapi-3808536Noch keine Bewertungen