Beruflich Dokumente

Kultur Dokumente

CREF Ar Page33

Hochgeladen von

Ljubi0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

0 Ansichten1 SeiteCopyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

0 Ansichten1 SeiteCREF Ar Page33

Hochgeladen von

LjubiCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

CREF Inflation-Linked Bond Account

Account profile Holdings by maturity

as of 12/31/2019 % of fixed-income investments

(excluding short-term investments)

Net assets $6.63 billion as of 12/31/2019

Portfolio turnover rate 26%

Number of issues 49 Less than 1 year 0.1

Option-adjusted duration‡ 4.93 years 1–3 years 25.4

Average maturity§ 5.26 years 3–5 years 21.9

5–10 years 51.3

‡

Option-adjusted duration estimates how much the

Over 10 years 1.3

value of a bond portfolio would be affected by a

change in prevailing interest rates, taking into Total 100.0

account the options embedded in the individual

securities. The longer a portfolio’s duration, the more

sensitive it is to changes in interest rates. Holdings by credit quality

§

Average maturity is a simple average of the

maturities of all the bonds in an account’s portfolio. % of fixed-income investments

The maturity of a bond is the amount of time until (excluding short-term investments)

the bond’s principal becomes due or payable. as of 12/31/2019

U.S. Treasury & U.S. agency securities* 99.7

Portfolio composition

Non-rated 0.3

% of net assets

Sector as of 12/31/2019 Total 100.0

* These securities are guaranteed by the full faith and

U.S. Treasury securities 97.4 credit of the U.S. government.

Mortgage-backed securities 1.5

Credit quality ratings are based on the Bloomberg

U.S. agency securities 0.8

Barclays methodology, which uses the median rating

Short-term investments, of those compiled by the Moody’s, Standard & Poor’s

other assets & liabilities, net 0.3 and Fitch ratings agencies. If ratings are available

from only two of these agencies, the lower rating is

Total 100.0 used. When only one rating is available, that one is

used. These ratings are subject to change without

notice.

College Retirement Equities Fund 2019 Annual Report 33

Das könnte Ihnen auch gefallen

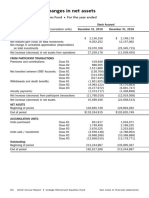

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDokument1 SeiteStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNoch keine Bewertungen

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDokument1 SeiteStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNoch keine Bewertungen

- Statements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019Dokument1 SeiteStatements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019LjubiNoch keine Bewertungen

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDokument1 SeiteStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNoch keine Bewertungen

- Statements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019Dokument1 SeiteStatements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019LjubiNoch keine Bewertungen

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDokument1 SeiteStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNoch keine Bewertungen

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDokument1 SeiteStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNoch keine Bewertungen

- Statements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019Dokument1 SeiteStatements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNoch keine Bewertungen

- Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019Dokument1 SeitePortfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019LjubiNoch keine Bewertungen

- Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019Dokument1 SeitePortfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNoch keine Bewertungen

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Dokument1 SeiteSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Analisa Kelayakan Investasi Bisnis LogistikDokument15 SeitenAnalisa Kelayakan Investasi Bisnis LogistikSaid Muchsin AlkaffNoch keine Bewertungen

- Lcture 3 and 4 Risk and ReturnDokument8 SeitenLcture 3 and 4 Risk and Returnmuhammad hasanNoch keine Bewertungen

- Chapter 6 - Portfolio Evaluation and Revision - KeyDokument26 SeitenChapter 6 - Portfolio Evaluation and Revision - KeyShahrukh ShahjahanNoch keine Bewertungen

- Capital BudgetingDokument41 SeitenCapital Budgetingalum jacobNoch keine Bewertungen

- Group 2 Financing The Mozal ProjectDokument10 SeitenGroup 2 Financing The Mozal ProjectYohan100% (1)

- Chapter 8 254-262Dokument9 SeitenChapter 8 254-262Anthon AqNoch keine Bewertungen

- V V Brown - Samson (Official Video) - Part 1 - Youtube: Mga Resulta Sa WebDokument8 SeitenV V Brown - Samson (Official Video) - Part 1 - Youtube: Mga Resulta Sa WebFu Yu Hui JuNoch keine Bewertungen

- Expat Investing GuideDokument9 SeitenExpat Investing GuidejudikidNoch keine Bewertungen

- Visa & Mastercard: The Pain of Paying The Psychology of MoneyDokument16 SeitenVisa & Mastercard: The Pain of Paying The Psychology of Moneyferoz_bilalNoch keine Bewertungen

- What Is Options TradingDokument10 SeitenWhat Is Options TradingRayzwanRayzmanNoch keine Bewertungen

- Module Week 6 EntrepDokument6 SeitenModule Week 6 Entrepゔ違でStrawberry milkNoch keine Bewertungen

- Goodpack LTDDokument3 SeitenGoodpack LTDventriaNoch keine Bewertungen

- Quiz AppliedDokument12 SeitenQuiz AppliedLharissa Ballesteros100% (1)

- Financial Analysis of Colony Textile Mills Limited MultanDokument18 SeitenFinancial Analysis of Colony Textile Mills Limited MultanRizwan YousafNoch keine Bewertungen

- 40k Elss Mutual FundDokument1 Seite40k Elss Mutual FundSachin Khamitkar100% (1)

- Chapter 11 Test Bank - Static - Version1Dokument48 SeitenChapter 11 Test Bank - Static - Version1mahasalehl200Noch keine Bewertungen

- What Is AccountingDokument13 SeitenWhat Is AccountingFaridullah MohammadiNoch keine Bewertungen

- FAR.2643 - Statement of Cash FlowsDokument26 SeitenFAR.2643 - Statement of Cash Flowslijeh312Noch keine Bewertungen

- Gujarat Ambuja Exports Not Rated: Result UpdateDokument10 SeitenGujarat Ambuja Exports Not Rated: Result UpdateAshokNoch keine Bewertungen

- BAT4M UniversityCollege Grade 12 Accounting Chapter 12 Study NotesDokument5 SeitenBAT4M UniversityCollege Grade 12 Accounting Chapter 12 Study NotesBingyi Angela ZhouNoch keine Bewertungen

- CF Project On Hul.Dokument20 SeitenCF Project On Hul.Ankit Jaiswal0% (1)

- Accounting Concepts and ConventionsDokument2 SeitenAccounting Concepts and ConventionsWelcome 1995Noch keine Bewertungen

- The Five-Factor Asset Pricing Model - A Theoretical Review and AssessmentDokument7 SeitenThe Five-Factor Asset Pricing Model - A Theoretical Review and AssessmentHiru RodrigoNoch keine Bewertungen

- 07 Comm 308 Final Exam (Fall 2010) SolutionsDokument16 Seiten07 Comm 308 Final Exam (Fall 2010) SolutionsAfafe ElNoch keine Bewertungen

- Silo - Tips - Eb 5 Immigrant Investor Program Overview PDFDokument9 SeitenSilo - Tips - Eb 5 Immigrant Investor Program Overview PDFValdo De BaráNoch keine Bewertungen

- Usiness Aluation: DigestDokument28 SeitenUsiness Aluation: Digestgioro_miNoch keine Bewertungen

- Secrets To Retire RichDokument41 SeitenSecrets To Retire RichBarun SinghNoch keine Bewertungen

- 1.1 Introduction To Investment: What Is An 'Investment'Dokument51 Seiten1.1 Introduction To Investment: What Is An 'Investment'Rohit VishwakarmaNoch keine Bewertungen

- SdsaDokument3 SeitenSdsaPocari OnceNoch keine Bewertungen

- Case Study: Accounting Information SystemDokument9 SeitenCase Study: Accounting Information SystemAlliah SomidoNoch keine Bewertungen