Beruflich Dokumente

Kultur Dokumente

Feb 27 - Gammon India

Hochgeladen von

Madhukar DasOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Feb 27 - Gammon India

Hochgeladen von

Madhukar DasCopyright:

Verfügbare Formate

to r ’s Focus

Inves -Madhukar Das

Issue 9, Vol 1

Gammon India

The steep spike in crude oil prices has hit the sentiment of the stock markets like a thunderbolt. The -Feb 27, 2011

crude shock has triggered jitters in the markets of further increase in inflation and thus the interest

rates. A huge oil import bill is expected to hit India’s external balance sheet and fiscal health. These Other Picks

concerns has caused wild swings in the benchmark indices which were showing signs of recovery

before getting a second blow from the middle east. In the month of February we saw Sensex swing- BUY :

ing from as high as 18700 to as low as 17300 which is a 1400 point difference. To sum it up, the

tough times are here to stay for now. SAIL

Gammon India is the largest and one of the oldest civil engineering and construction company in CMP—`152

India. It constructed the foundations of Gateway of India in 1919. It is the only Indian Construction

Company to have be awarded ISO 9001 certification for all fields of Civil Engineering work. It is Target—`165

involved in some high potential R&D projects including nuclear plant structures, tunnel structures,

industrial structures and innovating techniques of building complex structures. Some of the past Stop Loss—`145

clients for the company are Delhi Metro Rail Corporation, GAIL India, Godrej properties, Govern-

ment and municipal corporations of various states, NHAI, NHPC, Satluj Jal Vidyut Nigam etc. They

are currently handling many prestigious projects ranging from roadways to pipelines to tunnels etc Subex

in India and many more across the globe. However they had three projects under execution in Libya

which is under extreme political unrest and thus the projects face a question mark in terms of com- CMP—`51.55

pletion. About three months back they acquired 84% stake in Metropolitan Infrahousing making it a Target—`61

subsidiary of Gammon India. This news caused the scrip to move up by 15% in 4 sessions to `185

but has been on a deep downtrend and has lost 50% in 5 months. This correction was due to its rich Stop Loss—`49

valuations against its peers and also the companies profitability ratios are lower than the industry.

However taking a contrarian approach we find that at current levels, P/B stands at 0.81 whereas

price to sales is a low 0.35 even though there are quite a few projects in execution and the company Sell :

is winning more contracts. Three years’ earnings growth is at 41% CAGR which is very healthy.

Reliance Power

The enterprise value per share is `224 therefore the market may now find it a value proposition at

current levels and ignore the lackluster performance in latest quarter which was mainly marred by CMP—`110.50

high interest payments. We may see a reversal from downtrend and a short term rally in this scrip.

Target—`99

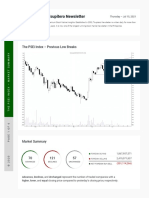

Technically Speaking Stop Loss—`115

Special points of inter-

est:

Since we are looking at a

trading horizon of 15-30

The 5 day moving average is con- days, we shall give more

verging back with 15 day MA The MACD chart reinsures the weightage to technical

after falling under on Jan 10 and stochastic signal and suggests a The volume chart shows low vol- analysis and price trend

doji star formation in recent ses- sharp uptrend however it may not umes on period of downtrends and of the stock.

sions signifies a tussle between last. sudden spikes on sessions when the

bulls and bears. scrip traded higher. Therefore sig- We shall also study the

naling that the bulls are looking for fundamental aspects of a

opportunities to go long in the company to avoid getting

scrip. into loss making trade

positions in case of

Recommendation : BUY movement of market in

direction opposite to that

CMP : `115 of my prediction.

The RSI chart suggest weakening

Target Price : `133 The previous issue

The stochastic chart signals a of bears and thus suggest an op-

recovery from oversold region portunity of bull operators to enter achieved an average

that the scrip was in for 5 weeks. fresh positions. Stop loss : `109 return of 6.18%

Das könnte Ihnen auch gefallen

- Mar 13 - Jubilant FoodworksDokument1 SeiteMar 13 - Jubilant FoodworksMadhukar DasNoch keine Bewertungen

- Apr 14 - Allied DigitalDokument1 SeiteApr 14 - Allied DigitalMadhukar DasNoch keine Bewertungen

- Nov 14 - Nava Bharat VenturesDokument1 SeiteNov 14 - Nava Bharat VenturesMadhukar DasNoch keine Bewertungen

- Mar 29 - Tata SteelDokument1 SeiteMar 29 - Tata SteelMadhukar DasNoch keine Bewertungen

- May 13 - Omax AutosDokument1 SeiteMay 13 - Omax AutosMadhukar DasNoch keine Bewertungen

- Dec 12 - Bajaj Auto FinanceDokument1 SeiteDec 12 - Bajaj Auto FinanceMadhukar DasNoch keine Bewertungen

- Apr 29 - Godrej IndustriesDokument1 SeiteApr 29 - Godrej IndustriesMadhukar DasNoch keine Bewertungen

- Jan 30 - Finolex CablesDokument1 SeiteJan 30 - Finolex CablesMadhukar DasNoch keine Bewertungen

- Nov 26 - HCL InfosystemsDokument1 SeiteNov 26 - HCL InfosystemsMadhukar DasNoch keine Bewertungen

- Oct 29 - Reliance InfrastructureDokument1 SeiteOct 29 - Reliance InfrastructureMadhukar DasNoch keine Bewertungen

- Medium Term Techincal Call: Start Building Short PositionsDokument9 SeitenMedium Term Techincal Call: Start Building Short Positionskaushamb100% (2)

- RHB Equity 360° - 18 October 2010 (Budget, PLUS Technical: Axiata, CMS)Dokument3 SeitenRHB Equity 360° - 18 October 2010 (Budget, PLUS Technical: Axiata, CMS)Rhb InvestNoch keine Bewertungen

- WEEK 38 Daily For September 24, 2010 FridayDokument2 SeitenWEEK 38 Daily For September 24, 2010 FridayJC CalaycayNoch keine Bewertungen

- Nirmal Bang (Ipo)Dokument11 SeitenNirmal Bang (Ipo)financeharsh6Noch keine Bewertungen

- Oct 14 - HCL InfosystemsDokument1 SeiteOct 14 - HCL InfosystemsMadhukar DasNoch keine Bewertungen

- Sep 28 - VideoconDokument1 SeiteSep 28 - VideoconMadhukar DasNoch keine Bewertungen

- Bhavya Gada 024 - GVK PowerDokument10 SeitenBhavya Gada 024 - GVK Powervyomthakkar17Noch keine Bewertungen

- Gann Square of Nine - Trading SystemDokument11 SeitenGann Square of Nine - Trading SystemAbbas AliNoch keine Bewertungen

- IDEA - Technical AnalysisDokument8 SeitenIDEA - Technical Analysisricky1011100% (1)

- PMS Snapshot - August 2019Dokument3 SeitenPMS Snapshot - August 2019rocky700inrNoch keine Bewertungen

- Screenshot 2022-08-25 at 10.52.12 AMDokument9 SeitenScreenshot 2022-08-25 at 10.52.12 AMakanksha gautamNoch keine Bewertungen

- PDF 132490607617482980Dokument22 SeitenPDF 132490607617482980Swades DNoch keine Bewertungen

- Cie LKPDokument9 SeitenCie LKPRajiv HandaNoch keine Bewertungen

- MIRANDA - Module 5 Post Task (Questions 1,2&3)Dokument7 SeitenMIRANDA - Module 5 Post Task (Questions 1,2&3)SHARMAINE CORPUZ MIRANDA100% (1)

- Indian Terrain Ltd. - Q2FY17 Result Update: Mixed Show CMP INR: 137 Target Price: 195Dokument9 SeitenIndian Terrain Ltd. - Q2FY17 Result Update: Mixed Show CMP INR: 137 Target Price: 195Arjun Shanker GuptaNoch keine Bewertungen

- Relative Momentum Index PDFDokument7 SeitenRelative Momentum Index PDFalexmorenoasuarNoch keine Bewertungen

- Voltas FirstcallDokument25 SeitenVoltas Firstcallrajivkum@indiatimes.com100% (1)

- You Always Rued Missing These IPO Shares Now Buy Below Issue Prices - The Economic TimesDokument2 SeitenYou Always Rued Missing These IPO Shares Now Buy Below Issue Prices - The Economic TimesRommel RodriguesNoch keine Bewertungen

- Engineers India-ICICI DirectDokument5 SeitenEngineers India-ICICI DirectSalman KhanNoch keine Bewertungen

- MNM Finance-Mar03 2023Dokument7 SeitenMNM Finance-Mar03 2023Rajavel GanesanNoch keine Bewertungen

- Emerging Trends in The IPO Market: Managing Director SBI Capital Markets LTDDokument3 SeitenEmerging Trends in The IPO Market: Managing Director SBI Capital Markets LTDNeha PrajapatiNoch keine Bewertungen

- Gulf Oil Lubricants PDFDokument4 SeitenGulf Oil Lubricants PDFDoshi VaibhavNoch keine Bewertungen

- Kalpataru Power - 1QFY20 Result - EdelDokument14 SeitenKalpataru Power - 1QFY20 Result - EdeldarshanmadeNoch keine Bewertungen

- Sep 2017 Page 1Dokument27 SeitenSep 2017 Page 1ajujkNoch keine Bewertungen

- Document No 85 - Changes in Market Capitalization Ranges Over The Last 5 YearsDokument2 SeitenDocument No 85 - Changes in Market Capitalization Ranges Over The Last 5 YearsAmrutaNoch keine Bewertungen

- Tata Motors LTD - SellDokument5 SeitenTata Motors LTD - SellSuranjoy SinghNoch keine Bewertungen

- TechnoFunda - PowerGridDokument3 SeitenTechnoFunda - PowerGridparchure123Noch keine Bewertungen

- InvestmentIdea - Larsen Toubro300821Dokument5 SeitenInvestmentIdea - Larsen Toubro300821vikalp123123Noch keine Bewertungen

- Cement Sector Green Shoots - 03 Dec 18Dokument56 SeitenCement Sector Green Shoots - 03 Dec 18SaranNoch keine Bewertungen

- Bajaj Finance - SKDokument3 SeitenBajaj Finance - SKADNoch keine Bewertungen

- Weekly: Join in Our Telegram Channel - T.Me/Equity99Dokument9 SeitenWeekly: Join in Our Telegram Channel - T.Me/Equity99Lingesh SivaNoch keine Bewertungen

- India Equity Analytics Today: Hold Rating On Prestige Estates StockDokument25 SeitenIndia Equity Analytics Today: Hold Rating On Prestige Estates StockNarnolia Securities LimitedNoch keine Bewertungen

- Tsupitero Newsletter: The Psei Index - Previous Low BreaksDokument6 SeitenTsupitero Newsletter: The Psei Index - Previous Low BreaksEdsel LoquillanoNoch keine Bewertungen

- Stock Watch 2009-06-08 14 - 47Dokument1 SeiteStock Watch 2009-06-08 14 - 47amanghotra1Noch keine Bewertungen

- AngelTopPicks Oct 2022Dokument12 SeitenAngelTopPicks Oct 2022dipyaman patgiriNoch keine Bewertungen

- Newsletter April 2023 NewsletterDokument7 SeitenNewsletter April 2023 NewsletterakkikediaNoch keine Bewertungen

- Ambit - Strategy - Err Group - Delivering Alpha in India PDFDokument24 SeitenAmbit - Strategy - Err Group - Delivering Alpha in India PDFshahavNoch keine Bewertungen

- Fundamental Muhurat Picks - Nov 2013Dokument15 SeitenFundamental Muhurat Picks - Nov 2013Yogesh raoNoch keine Bewertungen

- 1995.12.13 - The More Things Change, The More They Stay The SameDokument20 Seiten1995.12.13 - The More Things Change, The More They Stay The SameYury PopovNoch keine Bewertungen

- Reliance Industries LTDDokument17 SeitenReliance Industries LTDShArp ,Noch keine Bewertungen

- Company Research 20091014162453Dokument14 SeitenCompany Research 20091014162453ranjith_999Noch keine Bewertungen

- Query & Solution-3Dokument5 SeitenQuery & Solution-3శ్రీ వాసు. అవనిNoch keine Bewertungen

- CA Final SFM - New Scheme - Dawn 2022 - Merger & AcquisitionsDokument23 SeitenCA Final SFM - New Scheme - Dawn 2022 - Merger & Acquisitionsideasthat worthNoch keine Bewertungen

- Futures 0Dokument10 SeitenFutures 0Tithi jainNoch keine Bewertungen

- RegionalDokument129 SeitenRegionalJing GokNoch keine Bewertungen

- Gateway Distriparks: Making The Right Moves, Retain BuyDokument3 SeitenGateway Distriparks: Making The Right Moves, Retain BuydarshanmadeNoch keine Bewertungen

- Kencana Petroleum Berhad: Medium-Term Outlook Has Turned Bearish - 31/5/2010Dokument2 SeitenKencana Petroleum Berhad: Medium-Term Outlook Has Turned Bearish - 31/5/2010Rhb InvestNoch keine Bewertungen

- Summary of Aswath Damodaran's The Little Book of ValuationVon EverandSummary of Aswath Damodaran's The Little Book of ValuationNoch keine Bewertungen

- Raising Venture Capital for the Serious EntrepreneurVon EverandRaising Venture Capital for the Serious EntrepreneurBewertung: 3 von 5 Sternen3/5 (4)

- Apr 29 - Godrej IndustriesDokument1 SeiteApr 29 - Godrej IndustriesMadhukar DasNoch keine Bewertungen

- Feb 11 - Subex LTDDokument1 SeiteFeb 11 - Subex LTDMadhukar DasNoch keine Bewertungen

- Oct 29 - Reliance InfrastructureDokument1 SeiteOct 29 - Reliance InfrastructureMadhukar DasNoch keine Bewertungen

- Jan 14-VIP IndustriesDokument1 SeiteJan 14-VIP IndustriesMadhukar DasNoch keine Bewertungen

- Jan 30 - Finolex CablesDokument1 SeiteJan 30 - Finolex CablesMadhukar DasNoch keine Bewertungen

- Oct 14 - HCL InfosystemsDokument1 SeiteOct 14 - HCL InfosystemsMadhukar DasNoch keine Bewertungen

- Sep 28 - VideoconDokument1 SeiteSep 28 - VideoconMadhukar DasNoch keine Bewertungen

- Nov 26 - HCL InfosystemsDokument1 SeiteNov 26 - HCL InfosystemsMadhukar DasNoch keine Bewertungen

- Dec 29 - TitanDokument1 SeiteDec 29 - TitanMadhukar DasNoch keine Bewertungen

- Dec 12 - Bajaj Auto FinanceDokument1 SeiteDec 12 - Bajaj Auto FinanceMadhukar DasNoch keine Bewertungen

- Cigna Fourth Quarter 2015 Form 10 KDokument148 SeitenCigna Fourth Quarter 2015 Form 10 KDaniel KerouacNoch keine Bewertungen

- Diffusion Osmosis Enzymes Maths and Write Up Exam QuestionsDokument9 SeitenDiffusion Osmosis Enzymes Maths and Write Up Exam QuestionsArooj AbidNoch keine Bewertungen

- Glint 360 Design GuideDokument2 SeitenGlint 360 Design GuidebNoch keine Bewertungen

- ARCHESDokument10 SeitenARCHESCaroline MugureNoch keine Bewertungen

- Strength Exp 2 Brinell Hardness TestDokument13 SeitenStrength Exp 2 Brinell Hardness Testhayder alaliNoch keine Bewertungen

- The Confederation or Fraternity of Initiates (1941)Dokument82 SeitenThe Confederation or Fraternity of Initiates (1941)Clymer777100% (1)

- Promises From The BibleDokument16 SeitenPromises From The BiblePaul Barksdale100% (1)

- Chessboard PDFDokument76 SeitenChessboard PDFAlessandroNoch keine Bewertungen

- Pedia Edited23 PDFDokument12 SeitenPedia Edited23 PDFAnnJelicaAbonNoch keine Bewertungen

- Stdy RCD PDFDokument204 SeitenStdy RCD PDFBol McSafeNoch keine Bewertungen

- Text Mohamed AliDokument2 SeitenText Mohamed AliARYAJAI SINGHNoch keine Bewertungen

- Presbuteroi (Elders) and Episkopoi (Overseers) and Are Described in 1 Tim 3 and TitusDokument15 SeitenPresbuteroi (Elders) and Episkopoi (Overseers) and Are Described in 1 Tim 3 and TitusNimaro Brenda100% (1)

- Simple FTP UploadDokument10 SeitenSimple FTP Uploadagamem1Noch keine Bewertungen

- CHP 11: Setting Goals and Managing The Sales Force's PerformanceDokument2 SeitenCHP 11: Setting Goals and Managing The Sales Force's PerformanceHEM BANSALNoch keine Bewertungen

- Mudbound: Virgil Williams and Dee ReesDokument125 SeitenMudbound: Virgil Williams and Dee Reesmohan kumarNoch keine Bewertungen

- Indian School Bousher Final Term End Exam (T2) : Academic Session - 2021-22 Grade: 7Dokument7 SeitenIndian School Bousher Final Term End Exam (T2) : Academic Session - 2021-22 Grade: 7Shresthik VenkateshNoch keine Bewertungen

- Geotagging ManualDokument93 SeitenGeotagging ManualAlthea AcasNoch keine Bewertungen

- Ogl 350 Paper 2Dokument5 SeitenOgl 350 Paper 2api-672448292Noch keine Bewertungen

- Reason and ImpartialityDokument21 SeitenReason and ImpartialityAdriel MarasiganNoch keine Bewertungen

- Justice at Salem Reexamining The Witch Trials!!!!Dokument140 SeitenJustice at Salem Reexamining The Witch Trials!!!!miarym1980Noch keine Bewertungen

- ISCOM5508-GP (A) Configuration Guide (Rel - 02)Dokument323 SeitenISCOM5508-GP (A) Configuration Guide (Rel - 02)J SofariNoch keine Bewertungen

- DentinogenesisDokument32 SeitenDentinogenesisNajeeb UllahNoch keine Bewertungen

- Eva Karene Romero (Auth.) - Film and Democracy in Paraguay-Palgrave Macmillan (2016)Dokument178 SeitenEva Karene Romero (Auth.) - Film and Democracy in Paraguay-Palgrave Macmillan (2016)Gabriel O'HaraNoch keine Bewertungen

- Coaching Manual RTC 8Dokument1 SeiteCoaching Manual RTC 8You fitNoch keine Bewertungen

- Feasibility Study For A Sustainability Based Clothing Start-UpDokument49 SeitenFeasibility Study For A Sustainability Based Clothing Start-UpUtso DasNoch keine Bewertungen

- Snap Fasteners For Clothes-Snap Fasteners For Clothes Manufacturers, Suppliers and Exporters On Alibaba - ComapparelDokument7 SeitenSnap Fasteners For Clothes-Snap Fasteners For Clothes Manufacturers, Suppliers and Exporters On Alibaba - ComapparelLucky ParasharNoch keine Bewertungen

- FAR09 Biological Assets - With AnswerDokument9 SeitenFAR09 Biological Assets - With AnswerAJ Cresmundo50% (4)

- Security Gap Analysis Template: in Place? RatingDokument6 SeitenSecurity Gap Analysis Template: in Place? RatingVIbhishan0% (1)

- Using JAXB For XML With Java - DZone JavaDokument20 SeitenUsing JAXB For XML With Java - DZone JavajaehooNoch keine Bewertungen

- Nota 4to Parcial ADokument8 SeitenNota 4to Parcial AJenni Andrino VeNoch keine Bewertungen