Beruflich Dokumente

Kultur Dokumente

2021 Tax 1 List of Cases For ADMU Final

Hochgeladen von

hellomynameisOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2021 Tax 1 List of Cases For ADMU Final

Hochgeladen von

hellomynameisCopyright:

Verfügbare Formate

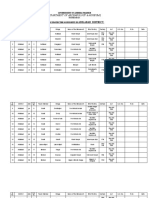

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

PART A: GENERAL PRINCIPLES OF TAXATION

WEEK ONE

I. TAXATION

1. Hilado v CIR, G.R. No. L-9408, October 31, 1956 100 Phil 288

2. Sison v Ancheta, G.R. No. L-59431, July 25, 1984, 130 SCRA 654

3. Phil. Guaranty v CIR, G.R. No. L-22074, April 30, 1965, 13 SCRA 775

4. Tio v Videogram Regulatory Board, G.R. No. 75697 (1987)

5. Republic v Caguioa G.R. No. 168584 (2007)

6. Commissioner v. Algue, G.R. No. L-28896, February 17, 1988, 158 SCRA 9

7. Lorenzo v. Posadas, G.R. No. 43082, June 18, 1937, 64 Phil 353

8. Paseo Realty & Development Corporation v. CA, G.R. No. 119286 (2004)

9. Napocor v Province of Albay G.R. No. 87479, 4 June 1990

10. Tolentino v. Secretary of Finance, G.R. No. 115455, August 8, 1994, 235 SCRA 630; 249

SCRA 628

11. Southern Cross Cement Corporation v. Cement Manufacturers Association of the

Philippines, et al., G. R. No. 158540 (2005)

12. Osmena v. Orbos, G.R. No. 99886, March 31, 1993, 220 SCRA 703

13. PAL v Edu, G.R. No. L-41383, 164 SCRA 320

14. Chavez v Ongpin, G.R. No. 76778, June 6, 1990, 186 SCRA 33

15. Taganito Mining v CIR CTA Case 4702 April 28, 1995

16. Roxas v. CTA, G.R. No. L-25043, April 26, 1968, 23 SCRA 276

17. LTO v. City of Butuan, G.R. No. 131512, Jan. 20, 2000

18. Lutz v. Araneta, G.R. No. L-7859, December 22, 1955, 98 Phil 48

19. NTC v. CA, G.R. No. 127937, July 28, 1999, 311 SCRA 508

II. TAXES

1. Tan v. Del Rosario, G.R. No. 109289, October 3, 1994, 237 SCRA 324

2. Gaston v. Republic Planters Bank, G.R. No. 77194 (1988)

3. Caltex v COA, G.R. No. 92585, May 8, 1992, 208 SCRA 726

4. Republic v. Mambulao Lumber Company, G.R. No. L-17725, 4 SCRA 622

5. Philex Mining v. CIR, G.R. No.125704, August 28, 1998

6. Domingo v Garlitos, G.R. No. L-18994, June 29, 1963, 8 SCRA 443

7. Progressive Dev. Corp. v QC, G.R. No. L-36081, April 24, 1989, 172 SCRA 629

8. Ferrer, Jr. V. Bautista, G.R.No. 210551, June 30, 2015

9. Gonzalo Sy Trading vs. Central Bank of the Phil., G.R. No. L-41480 (1976)

10. Apostolic Prefect v Treasurer of Baguio, G.R. No. L-47252, April 18, 1941, 71 Phil. 547

11. City of Ozamis v. Lumapas, GR No. L-30727, July 15, 1975

12. NDC v CIR 151, G.R. No. L-53961, June 30, 1987, SCRA 472

WEEK TWO

III. SOURCES OF TAX LAW

1. Tan v. Del Rosario, G.R. No. 1019289, October 3, 1994, 237 SCRA 234

2. CIR v. Seagate Technology, G.R. No. 153866, February 11, 2005

3. CIR v. San Miguel Corporation, G.R. No. 184428, November 23, 2011

4. CIR v. Fortune Tobacco, G.R. No. 180006, September 28, 2011

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 1

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

5. CIR v Mega Gen. Merchandising, G.R. No. L-69136, September 30, 1988, 166 SCRA 166

6. PBCOM vs. CIR, G.R. No. 112024, January 28, 1999, 302 SCRA 241

7. COC and the District Collector of the Port of Subic v. Hypermix Feeds Corporation, G.R.

No. 179579, Feb. 1, 2012

8. Hagonoy Market Vendor v. Municipality of Hagonoy, G.R. No. 137621, February 6, 2002

9. Jardine Davies v. Aliposa, G.R. No. 118900, February 27, 2003

10. Tañada v. Angara, G.R. No. 118295, May 2, 1997

11. Deutsche Bank AG Manila Branch v. CIR, G.R. No. 188550, August 19, 2013

IV. LIMITATIONS UPON THE POWER OF TAXATION

1. Lutz v Araneta, G.R. No. L-7859, December 22, 1955, 98 Phil. 48

2. Pascual v Sec. of Public Works, G.R. No. L-10405, December 29, 1960, 110 Phil. 331

3. Commissioner of Internal Revenue v. Central Luzon Drug Corporation, G.R. No. 159647

(2005)

4. Phil Comm. Satellite Corp. v Alcuaz, G.R. No. 84818, December 18, 1989, 180 SCRA

218

5. LTO v. City of Butuan, G.R. No. 131512, January 20, 2000

6. City Government of Quezon City v. Bayantel, G.R. No. 162015, Mar. 6, 2006

7. Garcia v. Executive Secretary, G.R. No. 101273, July 30, 2012, 210 SCRA 219

8. Osmena v. Orbos, G.R. No. 99886, March 3, 1993, 220 SCRA 703

9. CIR v. CA, G.R. No. 119761, August 29, 1996

10. Maceda v. Macaraig, G.R. No. 88291, June 8, 1993, supra

11. Mactan Cebu Airport v. Marcos, G.R. No. 120082, Sept. 11, 1996

12. Collector v. Bisaya Land Transportation, 105 Phil. 338 (1959)

13. Manila Gas v. Collector, G.R. No. L-42780, January 17, 1936, 62 Phil 895

14. Vegetable Oil Corp. v Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822

15. Wells Fargo Bank v Col, G.R. No. L-46720, June 28, 1940, 70 Phil. 325

16. CIR v. BOAC, G.R. Nos. L-65773-4, April 30, 1987, 149 SCRA 395

17. Collector v. Lara, G.R. No. L-9456 & L-9481, January 6, 1958, 102 Phil 813

18. Tanada v. Angara, G.R. No. 118295, May 2, 1997

19. Mitsubishi Corp. v. CIR, CTA Case 6139, Dec. 17, 2003

WEEK THREE

20. Com. of Customs v CTA & Campos Rueda Co., 152 SCRA 641

21. Phil Bank of Comm v. CIR, G.R. No. 112024, January 28, 1999, 302 SCRA 241

22. Sison v Ancheta, G.R. No. L-59431, July 25, 1984, 130 SCRA 654

23. Ormoc Sugar Co. v. Treasurer of Ormoc City, G.R. No. L-23794, February 18, 1968, 22

SCRA 603

24. Villegas v. Hiu Chiong Tsai Pao, G.R. No. L-29646, November 10, 1978, 86 SCRA 270

25. Shell Co. v Vano, G.R. No. L-6093, Februrary 24, 1954, 94 Phil. 388

26. Tiu v. CA, G.R. No. 127410, Jan 20, 1999, 301 SCRA 278

27. Tan v. Del Rosario, G.R. No. 109289, October 3, 1994, 237 SCRA 324

28. Phil. Rural Electric v. Secretary, G.R. No. 143706, Jun 10, 2003

29. Sison v. Ancheta, G.R. No. L-59431, July 25, 1984, 130 SCRA 654

30. Tolentino v. Sec of Finance, G.R. No. 115455, October 30, 1995, 249 SCRA 628

31. City of Baguio v. De Leon, G.R. No. L-24756 (1968)

32. Churchill v Concepcion, GR No. 11572, 22 September 1916

33. Tolentino v. Sec of Finance (supra)

34. Misamis Oriental v CEPALCO, G.R. No. L-45355, Jan 12, 1990, 181 SCRA 38

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 2

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

35. Phil. Rural Electric v. Secretary, G.R. No. 143076, June 10, 2003, supra

36. Lladoc v CIR, G.R. No. L-19201, Jun 16, 1965, 14 SCRA 292

37. Apostolic Prefect v. City Treasurer of Baguio, G.R. No. L-47252 (1941)

38. Abra Valley College v. Aquino, G.R. No. L-39086, June 15, 1988, 162 SCRA 106

39. Lung Center of the Philippines v. Quezon City, G.R. No. 144104 (2004)

40. CIR v. CA & YMCA, G.R. No. 124043, October 14, 1998, 298 SCRA 83

41. De La Salle University, Inc. v. CIR, C.T.A. EB Case No. 671, June 8, 2011 (C.T.A. Case

No. 7303)

42. American Bible Society v Manila, G.R. No. L-9637, April 30, 1957, 101 Phil. 386

43. Aglipay v Ruiz, G.R. No. L-45459, March 13, 1937

44. Tolentino v Secretary of Finance, G.R. No. 115455, Aug 8, 1994, 249 SCRA 628

WEEK FOUR

V. CONSTRUCTION OF TAX LAWS

1. Stevedoring v Trinidad, G.R. No. L-18316, September 23, 1922, 43 Phil. 803

2. Lorenzo v. Posada, G.R. No. L-43082, June 18, 1937, 64 Phil 353

3. Umali v. Estanislao, G.R. No. 104037, May 29, 1992, 209 SCRA 446

4. CIR v. Solidbank, G.R. No. 148191, Nov. 25, 2003

5. Collector v. La Tondena, G.R. No. L-10431, April 30, 1964, 5 SCRA 665

6. Serafica v Treasurer of Ormoc City, G.R. No. L-24813, April 28, 1969, 27 SCRA 110

7. Roxas v. Rafferty, G.R. No. 12182, March 27, 1918, 37 Phil 958

8. Pecson v. CA, G.R. No. 115814, May 26, 1995, 222 SCRA 580

9. CIR v. CA, G.R. No. 119761, August 29, 1996

10. CIR v. Michel Lhuillier, G.R. No. 150947, July 25, 2003

11. CIR v. Benguet Corp., G.R. No. 134587, July 8, 2005

VI. EXEMPTIONS FROM TAXATION

1. Greenfield v. Meer, G.R. No. 156, Sept 27, 1946, 77 Phil 394

2. Basco v. PAGCOR, G.R. No. 91649, May 14, 1991, 196 SCRA 52

3. CIR v Botelho Shipping Corp., G.R. Nos. L-216334-34m June 29, 1967, 20 SCRA 487

4. Phil. Acetylene v CIR, G.R. No. L-19707, August 17, 1967, 20 SCRA 1056

5. PLDT v. Davao City, G.R. No. 143867, August 22, 2001

6. Surigao Con. Min. v. Collector, G.R. No. L-14878, December 26, 1963, 9 SCRA 728

7. CIR v. CA, G.R. No. 119761, August 29, 1996, 240 SCRA 368

8. CIR v. Marubeni, G.R. No. 137377, December 18, 2001

9. CIR v CA & YMCA, G.R. No. 124043, October 14, 1998, 298 SCRA 83

10. Misamis Oriental Asso. V. DOF, G.R. No. 108524, November 10, 1994, 238 SCRA 63

11. Nestle Phils. v. CA, G.R. No. 134114, July 6, 2001

12. Maceda v. Macaraig, G.R. No. 88291, May 31, 1991, 196 SCRA 771

13. Maceda v. Macaraig, G.R. No. 88291, Jun 8, 1993, 223 SCRA 217

VII. OTHER DOCTRINES IN TAXATION

1. San Miguel Corporation v. CIR, CTA Case Nos. 7052 and 7053, Oct. 18, 2011

2. CIR v. CA and Alhambra Industries, Inc., G.R. No. 117982. February 6, 1997

3. Republic v. Fernandez, G.R. No. L-9141 (1956)

4. Central Azucarera v. CTA, G.R. No. L-23236 (1967)

5. CIR v. Ayala Securities Corp., G.R. No. L-29485, November 21, 1980, 189 Phil 159-168

6. Commissioner v. Standard Chartered Bank, G.R. No. 192173 (2015)

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 3

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

7. Procter & Gamble Co. v Mun of Jagna, G.R. No. L-24265, December 28, 1979, 94 SCRA

894

8. Punzalan v Mun Board of Manila, G.R. No. L-4817, May 26, 1954, 95 Phil. 46

9. CIR v. SC Johnson & Sons, Inc., G.R. No. 127105, June 25, 1999, 309 SCRA 87

10. Sison v. Ancheta, G.R. No. 59431, July 25, 1984, 130 SCRA 654

11. Roxas v. CTA, G.R. No. L-25043, April 26, 1968, 23 SCRA 276

12. Collector v. Univ of Sto. Tomas, G.R. No. 11274, 104 Phil. 1062

13. Bagatsing v. San Juan, GR No. 97787, Aug 1, 1996, 329 Phil. 8-15

14. Republic v. Gonzales, G.R. No. L-17962, April 30, 1965, 13 SCRA 633

15. Delpher Traders v. IAC, G.R. No. L-69259, January 26, 1988, 157 SCRA 349

16. CIR v. Lincoln Philippine Life, G.R. No. 119176, Mar. 19, 2002

VIII. FUNCTIONS OF THE BIR; JURISDICTION OF THE COURT OF TAX APPEALS

1. CIR v. CA, CTA, and Fortune Tobacco Corporation, 261 SCRA 236 (1996),

2. Marcos v CA, 339 Phil 253, 271-273 (1997)

3. Philippine Bank of Communications v. CIR, 203 SCRA 241 (1999)

4. Secretary of Finance v La Suerte Cigar, GR No. 166498, June 11, 2009

5. ABS-CBN Broadcasting Corporation v. CTA, 108 SCRA 142

6. CIR v. Hedcor Sibulan, Inc. - G.R. No. 209306 (2017)

7. Mitsubishi Cor-Manila Br. V CIR, GR No. 175772, Jun 5, 2017

8. Oceanic Wireless Network v. CIR - G.R. No. 148380 (2005)

PART B: INCOME TAXATION

WEEK FIVE

I. BASIC STRUCTURAL AND DEFINITIONAL CONCEPTS

1. Conwi v. CTA, 213 SCRA 83

2. CIR v. Manila Jockey Club, Inc., G.R. Nos. L-13887 & L-13890, June 30, 1960

3. Association of Non-Profit Clubs, Inc. v. Bureau of Internal Revenue, G.R. No. 228539

(2019)

4. CIR v. BOAC, 149 SCRA 395

5. CIR v. Tours Specialist, 183 SCRA 402

6. CIR v. CA, CTA & Anscor, 301 SCRA 152 (1999)

7. Javier v. Ancheta, CTA Case No. 3393, July 27, 1983

8. CIR v. Manila Electric Company, CTA EB No. 773, November 13, 2012

9. Republic v. Sandiganbayan, GR. No. 152154, July 15, 2003

10. Republic v. Marcos, Sandiganbayan Case No 0141, Dec 19, 2019

11. Republic v. Dela Rama, 18 SCRA 861

12. CIR v. Javier, 199 SCRA 824

13. Sison v. Ancheta, GR L-59431, July 25, 1984

WEEK SIX

II. GROSS INCOME: INCLUSIONS AND EXCLUSIONS

1. Gutierrez v. Collector, G.R. Nos. L-9738 & L-9771, May 31, 1957 101 Phil 713

2. CIR v. BOAC, G.R. No. L-65773-74, April 30, 1987, 149 SCRA 395

3. NDC v. CIR, G.R. No. L-53961, June 30, 1987, 151 SCRA 472

4. Air Canada v. CIR, CTA EB No. 86. Aug. 26, 2005

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 4

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

5. CIR v. CTA, G.R. No. 81446, August 18, 1988, 127 SCRA 9

6. CIR v. Marubeni, G.R. No. 137377, December 18, 2001

7. CIR v. Baier-Nickel, G.R. No. 165793, August 29, 2006

8. Manila Electric v. Yatco, G.R. No. 45697, November 1, 1939 69 Phil 89

9. Phil. Guaranty v. CIR, G.R. No. L-22074, Apr. 30, 1965

10. Henderson v. Collector, 1 SCRA 649;

11. CIR v. Castaneda, G.R. No. 96016, October 17, 1991, 203 SCRA 72

12. Polo v. CIR, G.R. No. L-78780, July 23, 1987

13. Endencia v. David, G.R. No. L-6355-56, July 23, 1987, 93 Phil 696

14. Kuenzle v. CIR, G.R. No. L-18840, May 29, 1969, 28 SCRA 365

15. CIR v. Castaneda, G.R. No. 96016, October 17, 1991, 203 SCRA 72

16. Reagan v. CIR, G.R. No. L-26379, December 27, 1969, 30 SCRA 968

17. CIR v. CA, G.R. No. 96016, Oct 17, 1991, 203 SCRA 72

18. CIR v. GCI Retirement, G.R. No. 95022, March 23, 1992, 207 SCRA 487

19. In re Zialcita, AM No. 90-6-015-SC, Oct. 18, 1990

WEEK SEVEN

1. CIR v. Filinvest Development Corporation, G.R. No. 163653, July 19, 2011

2. CIR v. Mitsubishi Metal, G.R. No. L-54908, January 22, 1990, 181 SCRA 214

3. NDC v. CIR, G.R. No. L-53961, June 30, 1987

4. Limpan v. CIR, GR No. L-21570, Jul 26, 1966, 17 SCRA 70

5. CIR v. SC Johnson, G.R. No. 127105, June 25, 1999

6. CIR v. Manning, G.R. No. L-28398, August 6, 1975, 66 SCRA 14

7. CIR v. CA, G.R. No. 108576, Jan. 20, 1999

8. Oriente Fabrica v. Posadas, G.R. No. 34774, September 21,1931 56 Phil 147

9. CIR v. COA, G.R. No. 101976, Jan. 29, 1993

10. Ramnani v. CTA, CA-GR SP No. 42873, January 8, 1998

11. Penid v. Virata, G.R. No. L-44004, March 25, 1983

WEEK EIGHT

III. TAXPAYERS

1. CIR v. Procter & Gamble, GR No. 66838, December 2, 1991

2. SilkAir (Singapore) Pte. Ltd. v. CIR, G.R. No. 184398, February 25, 2010

IV. INDIVIDUALS: CLASSIFICATIONS, BASES, AND RATES

1. Soriano v. Secretary of Finance, G.R. No. 184450, January 24, 2017

WEEK NINE

2. Benguet Corporation v. CIR, CTA Case No. 5324, July 2, 1998

V. TAX ON CORPORATIONS: BASES AND RATES

1. Lorenzo Ona v. CIR, G.R. No. L-19342, May 25, 1972

2. Evangelista v. Collector, G.R.No. L-9996, October 15, 1957

3. Afisco Insurance Corp. v. CIR, G.R.No. 112675, Jan. 25, 1999

4. CIR v. Batangas Tayabas Bus Co., 102 Phil 822

5. Obillos v. CIR, L-68118, Oct. 29, 1985

6. Reyes v. Commissioner, 24 SCRA 198

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 5

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

7. Gatchalian v. Collector, 67 Phil 666

8. Pascual v. CIR, 166 SCRA 560

9. Solidbank v. CIR, CTA Case No. 4868, June 19, 1997

10. Tan v. Del Rosario and CIR, G.R.No. L-109289, October 3, 1994

WEEK TEN

1. Island Power Corporation v. CIR, CTA EB No. 26, March 6, 2006

2. NV Reederij v. CIR, G.R. No. 46029, June 23, 1988, 162 SCRA 487

3. B. Van Zuiden Bros. Ltd. vs. GTVL Manufacturing Industries, Inc., G.R. No. 147905, 28

May 2007

4. CIR v. British Overseas Airways Corporation, G.R. No. L-65773, April 30, 1987

5. South African Airways v. CIR, G.R. No. 180356, February 16, 2010

6. Bank of America v. CIR, GR 10392, July 21, 1994, 234 SCRA 302

7. Marubeni v. CIR, 177 SCRA 500

8. Campania General de Tabacos, CTA 4451, Aug 23, 1993

9. Shinko Electric Industries Co. Ltd. v. CIR, CTA Case 8213, February 10, 2014

10. CIR v. United Parcel Service Co. (Phil. Branch), CTA Case No. 721, May 16, 2012

WEEK ELEVEN

11. CIR v. Procter and Gamble, 160 SCRA 650; 204 SCRA 377

12. CIR v. Wander Philippines, 160 SCRA 573

13. Marubeni v. Commissioner, 177 SCRA 500

14. Chamber of Real Estate and Builders’ Associations, Inc. v. Romulo, G.R. No. 160756,

March 9, 2010

15. The Manila Banking Corporation v. CIR, G.R. No. 168118, August 28, 2006

16. CIR v. Philippine Airlines, G.R. No. 180066, July 7, 2009

17. Cyanamid Phils. v. CA, GR 1008067, Jan. 20, 2000

18. Manila Wine Merchants v. CIR, GR L-26145, Feb. 25, 1984

19. Basilan Estates, Inc. v. CIR, G.R. No. L-22492, September 5, 1967

20. Abra Valley Colleges v. CFI, G.R.No.L-39086, June 15, 1988

21. CIR v. CA, CTA and YMCA of the Philippines, G.R. No. 124043, October 14, 1998

22. Ateneo de Manila University v. CIR, CTA Case No. 7246 and 7293, March 11, 2010

23. CIR v. De La Salle University, Inc., G.R. No. 196596, November 9, 2016

24. CIR v. St. Luke’s Medical Center, G.R. No. 195960, Sept 26, 2012

25. Dumaguete Cathedral Credit Cooperative (DCCCO) v. CIR, G.R. N. 182722, January 22,

2010

WEEK TWELVE

VI. CAPITAL ASSETS V. ORDINARY ASSETS; OTHER RULES

1. Tuazo vs. Lingad, 58 SCRA 170

2. Calasanz vs. CIR, G.R. No. L-26284, Oct. 9, 1986

3. Ferrer vs. Collector, 5 SCRA 1022

4. Roxas vs. CIR, G.R. No. L-25043, Apr. 26, 1968

5. W.C. Ogan and Bohol Land Transportation Co., G.R. No. 49102, May 30, 1949

6. CIR vs. Rufino, 148 SCRA 42

7. Liddell & Co., Inc. vs. Collector, 2 SCRA 632

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 6

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

VII. COSTS, DEDUCTIONS, AND EXEMPTIONS: IN GENERAL

1. CIR v. General Foods, G.R. No. 143672, April 24, 2003

2. Commissioner v. Philippine Acetylene, G.R. No. L-22443, May 29, 1971, 39 SCRA 70

3. Esso Standard v. CIR, G.R. Nos. L-28508-9, July 7, 1989, 176 SCRA 149

4. Atlas Consolidated Mining & Development Corp. v. CIR, G.R. No. L-26911, Jan. 27,

1981

5. CIR v. Isabela Cultural Corp, G.R. No. 172231, Feb. 12, 2007

6. Kepco Phil Corp. v. CIR, G.R. No. 179356, Dec. 14, 2009

7. Tambunting v. CIR, G.R. No.173373, July 29, 2013

WEEK THIRTEEN

8. M.E. Holding Corporation v. Court of Appeals, G.R. No. 160193, March 3, 2008, 547

SCRA 389

9. Yutivo Sons v. CIR, G.R. No. L-13203, Jan 28, 1961, 1 SCRA 160

VIII. SPECIFIC ITEM OF DEDUCTION

1. Atlas Consolidated v. CIR, G.R. Nos. 141104 & 148763, June 8, 2007, 102 SCRA 246

2. Aguinaldo Industries v. Collector, G.R. No. L-29790, February 25, 1982, 112 SCRA 136

3. Goodrich v. Collector, CTA Case No. 468, June 8, 1965

4. Kuenzle v. CIR, G.R. No. L-18840, May 29, 1969, 28 SCRA 365

5. Paper Industries v. CA, G.R. Nos. 106494-50, December 1, 1995, 250 SCRA 434

6. CIR v. Lednicky, G.R. No. L-18169, July 31, 1964

7. Gutierrez v. Collector, G.R. No. L-19537, May 20, 1965, 14 SCRA 33

8. Mercury Drug Corporation v. CIR, G.R. No. 164050, July 20, 2011, 654 SCRA 124

9. Fernandez Hermanos v. CIR, G.R. No. L-21551, L-21557, L-24972, L-24978, September

30, 1969, 29 SCRA 552

10. China Bank v. CA, G.R. No. 125508, July 19, 2000, 336 SCRA 178

11. Phil. Sugar Estate v. Collector, G.R. No. 45189, May 26, 1939, 60 Phil 565

12. Paper Industries v. CA, G.R. Nos. 106494-50, December 1, 1995, 250 SCRA 434

13. Philex Mining Corporation v. CIR, G.R. No. 125704, August 28, 1998, 551 SCRA 428

(2008)

14. Collector v. Goodrich, G.R. No. L-22265, December 22, 1967, 21 SCRA 1336

15. Metro Inc. v CIR, CTA Case 6356, June 9, 2009

16. Basilan Estates v. CIR, G.R. No. L-22492, September 5, 1967, 21 SCRA 17

17. Limpan Investments Corp. v. CIR, G.R. No. L-21570, July 26, 1966

18. Consolidated Mines v. CTA, G.R. Nos. L-18843 & 18844, 58 SCRA 618

19. Esso Standard Eastern v. CIR, G.R. Nos. L-28508-9, July 7, 1989, 176 SCRA

WEEK FOURTEEN

20. Roxas v. CTA, G.R. No. L-25043, April 26, 1968, 23 SCRA 276

IX. NON-DEDUCTIBLE EXPENSES/LOSSES

1. Callanoc v. Collector, 3 SCRA 517

2. 3M Philippines v. CIR, G.R. No. 82833, Sept. 26, 1988

3. Atlas Consolidated v. CIR, G.R. No. L-26911, Jan. 27, 1981

4. Gancayco v. Collector, G.R. No. L-13325, April 20, 1961, 1 SCRA 980

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 7

LIST OF CASES

TAXATION 1 – GENERAL PRINCIPLES AND INCOME TAXATION

X. TAX ON ESTATES AND TRUSTS

1. CIR v. CA, G.R. No. 95022, March 23, 1992

2. CIR v. Visayas Electric, 23 SCRA 715

3. CIR v. CA, GCL Retirement Plan 207 SCRA 487

WEEK FIFTEEN

XI. ACCOUNTING PERIODS AND METHODS

1. CIR v. Isabela Cultural Corp. GR No. 172231, February 12, 2007

2. Filipinas Synthetic Fiber Corp vs. CA 316 SCRA 480

3. CIR v. Wyeth Suaco, 202 SCRA 135

4. Consolidated Mines v. CTA, G.R. No. 18843, August 29, 1974; 58 SCRA 618

5. CIR v. Isabela Cultural Corp., G.R. No. 172231, Feb. 12, 2007

6. CIR v. Lancaster, G.R. No. 183408, July 12, 2017

XII. WITHHOLDING OF TAXES

1. CIR v. Solidbank Corporation, GR No. 148191. November 25, 2003

2. Chamber of Real Estate and Builders’ Associations, Inc. v. Romula, et al., GR No.

160756, March 9, 2010

3. CIR v. Wander Philippines, GR L-68375, Apr. 15, 1988

4. Banco Filipino Savings and Mortgage Bank v. Court of Appeals, 548 Phil 32 (2007)

5. Philam Asset Mgt. Inc. V. CIR, 477 SCRA 761

6. Asiaworld Properties Phil.Corp. v. CIR, G.R. No.171766, July 29, 2010

7. BDO v Republic, GR No. 198756, Aug 16, 2016

8. CIR v. La Flor dela Isabela, GR No. 211289, Jan 14, 2019

XIII. RETURNS AND PAYMENT OF TAXES

1. CIR v. TMX Sales, 205 SCRA 18

2. ACCRA Investment v. CA, 204 SCRA 957

3. San Carlos Milling v. CIR, 228 SCRA 135

2021 Tax 1 [Atty. Marissa O. Cabreros, CPA] Page 8

Das könnte Ihnen auch gefallen

- Realestate - Real Estate Professionals HandbookDokument206 SeitenRealestate - Real Estate Professionals HandbookCiobanu Dan Andrei100% (4)

- The Bilderberg GroupDokument35 SeitenThe Bilderberg GroupTimothy100% (2)

- Tax Remedies Digest 62 70Dokument12 SeitenTax Remedies Digest 62 70Christine Angelus MosquedaNoch keine Bewertungen

- Limpan Investment Corporation vs. Commissioner of Internal Revenue, Et Al., 17 SCRA 703Dokument10 SeitenLimpan Investment Corporation vs. Commissioner of Internal Revenue, Et Al., 17 SCRA 703fritz frances danielleNoch keine Bewertungen

- The Marcos DynastyDokument19 SeitenThe Marcos DynastyRyan AntipordaNoch keine Bewertungen

- I. Course Identification: Syllabus Tax 1 - General Principles and Income TaxationDokument31 SeitenI. Course Identification: Syllabus Tax 1 - General Principles and Income TaxationhellomynameisNoch keine Bewertungen

- Nasiad V CTADokument2 SeitenNasiad V CTAAntonio RebosaNoch keine Bewertungen

- TAX Midterm CasesDokument1 SeiteTAX Midterm CasesBeng Alenton0% (1)

- Civil Procedure: Administrative MattersDokument32 SeitenCivil Procedure: Administrative MattershellomynameisNoch keine Bewertungen

- Republic vs. Heirs of JalandoniDokument2 SeitenRepublic vs. Heirs of JalandoniJo BudzNoch keine Bewertungen

- Taxation 1 Course Syllabus A. General Principles of Taxation I. TaxationDokument11 SeitenTaxation 1 Course Syllabus A. General Principles of Taxation I. TaxationAjay Ann De La CruzNoch keine Bewertungen

- 42 G.R. No. 169144 - Palaganas v. PalaganasDokument4 Seiten42 G.R. No. 169144 - Palaganas v. PalaganasCamille CruzNoch keine Bewertungen

- Conflicts in IP Rights: International Conventions and Case AnalysisDokument34 SeitenConflicts in IP Rights: International Conventions and Case AnalysisLorenz Angelo Mercader PanotesNoch keine Bewertungen

- 13 Danan v. BuencaminoDokument5 Seiten13 Danan v. BuencaminoEmi CagampangNoch keine Bewertungen

- National Investment and Development Corp V Judge Aquino 163 Scra 153Dokument37 SeitenNational Investment and Development Corp V Judge Aquino 163 Scra 153Kaye Miranda LaurenteNoch keine Bewertungen

- Corp Law Syllabus 2020 2021Dokument68 SeitenCorp Law Syllabus 2020 2021hellomynameisNoch keine Bewertungen

- St. Stephen's Association V CIRDokument3 SeitenSt. Stephen's Association V CIRPatricia GonzagaNoch keine Bewertungen

- Batch 7 Consolidated Case DigestDokument53 SeitenBatch 7 Consolidated Case DigestalexjalecoNoch keine Bewertungen

- 82 Morillo V PP 584 SCRA 304Dokument10 Seiten82 Morillo V PP 584 SCRA 304RA MorenoNoch keine Bewertungen

- BJMP Time Allowances Manual Revised Version 2016Dokument46 SeitenBJMP Time Allowances Manual Revised Version 2016hellomynameisNoch keine Bewertungen

- CIR Vs Baier-NickelDokument4 SeitenCIR Vs Baier-NickelJohnde MartinezNoch keine Bewertungen

- Course Syllabus: The Following Materials Are Recommended But The Purchase of Which Is Not RequiredDokument18 SeitenCourse Syllabus: The Following Materials Are Recommended But The Purchase of Which Is Not Requiredhellomynameis100% (1)

- Juvenile Deliquency and Juvenile Justice SystemDokument32 SeitenJuvenile Deliquency and Juvenile Justice SystemDrew FigueroaNoch keine Bewertungen

- Raymundo v. CA, 213 SCRA 457 (1992)Dokument4 SeitenRaymundo v. CA, 213 SCRA 457 (1992)Jon Gilbert MagnoNoch keine Bewertungen

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDokument73 Seiten2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- Trial Memorandum SampleDokument9 SeitenTrial Memorandum SampleLacesand solesNoch keine Bewertungen

- Unlawful Detainer Complaint Filed in Cagayan de OroDokument5 SeitenUnlawful Detainer Complaint Filed in Cagayan de OroAynex AndigNoch keine Bewertungen

- Corporate Income Tax GuideDokument46 SeitenCorporate Income Tax GuideCanapi AmerahNoch keine Bewertungen

- Republic VH IzonDokument4 SeitenRepublic VH IzonanailabucaNoch keine Bewertungen

- The Project Saboteur1Dokument28 SeitenThe Project Saboteur1pharezeNoch keine Bewertungen

- Gonzales vs. CFIDokument4 SeitenGonzales vs. CFIBestie BushNoch keine Bewertungen

- RMC No 50-2018Dokument18 SeitenRMC No 50-2018JajajaNoch keine Bewertungen

- Villanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.Dokument5 SeitenVillanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.billy joe andresNoch keine Bewertungen

- Estanislao, Jr. v. CA, G.R. No. L-49982Dokument6 SeitenEstanislao, Jr. v. CA, G.R. No. L-49982Krister VallenteNoch keine Bewertungen

- Ona Vs CIR Digest PersonalDokument2 SeitenOna Vs CIR Digest PersonalTrish VerzosaNoch keine Bewertungen

- Hilado v. CADokument6 SeitenHilado v. CAIan SerranoNoch keine Bewertungen

- Republic Vs HizonDokument1 SeiteRepublic Vs HizonCarl MontemayorNoch keine Bewertungen

- En The Beautiful Names of Allah PDFDokument89 SeitenEn The Beautiful Names of Allah PDFMuhammad RizwanNoch keine Bewertungen

- Coca Cola Export v. CIRDokument1 SeiteCoca Cola Export v. CIRJack JacintoNoch keine Bewertungen

- Ramnani v. CTADokument6 SeitenRamnani v. CTAhellomynameisNoch keine Bewertungen

- Conwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992Dokument6 SeitenConwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992zac100% (1)

- Marubeni Corp V CirDokument3 SeitenMarubeni Corp V CirTintin CoNoch keine Bewertungen

- Accord Textiles LimitedDokument41 SeitenAccord Textiles LimitedSyed Ilyas Raza Shah100% (1)

- Bailon-Casilao Vs CA PDFDokument15 SeitenBailon-Casilao Vs CA PDFPam MiraflorNoch keine Bewertungen

- 2021 Tax 1 List of Cases For ADMU FinalDokument8 Seiten2021 Tax 1 List of Cases For ADMU FinalhellomynameisNoch keine Bewertungen

- Pascual v. CIR, 166 SCRA 560 (1988)Dokument2 SeitenPascual v. CIR, 166 SCRA 560 (1988)DAblue ReyNoch keine Bewertungen

- 2016 Global Vs SchedularDokument1 Seite2016 Global Vs SchedularClarissa de VeraNoch keine Bewertungen

- Perez, Hilado v. CADokument9 SeitenPerez, Hilado v. CAPepper PottsNoch keine Bewertungen

- TUCP Vs CosculluelaDokument4 SeitenTUCP Vs CosculluelaAsHervea AbanteNoch keine Bewertungen

- Tanada V Angara DigestDokument16 SeitenTanada V Angara DigestPouǝllǝ ɐlʎssɐNoch keine Bewertungen

- 4 What Is TWAILDokument11 Seiten4 What Is TWAILhellomynameisNoch keine Bewertungen

- Dizon-Rivera vs. DizonDokument2 SeitenDizon-Rivera vs. Dizonmmabbun001Noch keine Bewertungen

- Winter ParkDokument7 SeitenWinter Parksadafkhan210% (1)

- 1 CBT Sample Questionnaires-1Dokument101 Seiten1 CBT Sample Questionnaires-1Mhee FaustinaNoch keine Bewertungen

- Insigne vs. Abra Valley Colleges, Inc., 764 SCRA 261, G.R. No. 204089 July 29, 2015Dokument10 SeitenInsigne vs. Abra Valley Colleges, Inc., 764 SCRA 261, G.R. No. 204089 July 29, 2015Claudia LapazNoch keine Bewertungen

- Facts: A Lot With An Area of 17,311 Sq.m. Situated in BarrioDokument20 SeitenFacts: A Lot With An Area of 17,311 Sq.m. Situated in BarrioRV MadiamNoch keine Bewertungen

- Supreme Court rules on import permit expiration for fresh fruitsDokument16 SeitenSupreme Court rules on import permit expiration for fresh fruitsSocNoch keine Bewertungen

- Davao SawmillDokument7 SeitenDavao SawmillMichelle BernardoNoch keine Bewertungen

- Garcia Vs GatchalianDokument2 SeitenGarcia Vs GatchalianBruno GalwatNoch keine Bewertungen

- CIR Vs CIR and CASTANEDA G.R. No. 96016, October 17, 1991Dokument2 SeitenCIR Vs CIR and CASTANEDA G.R. No. 96016, October 17, 1991Gwen Alistaer CanaleNoch keine Bewertungen

- GUILLERMO-Vda. de Chua vs. IAC (Lease)Dokument1 SeiteGUILLERMO-Vda. de Chua vs. IAC (Lease)PATRICIA MAE GUILLERMONoch keine Bewertungen

- Gempesaw v. CADokument15 SeitenGempesaw v. CAPMVNoch keine Bewertungen

- 69 Fernandez Hermanos Vs CIRDokument22 Seiten69 Fernandez Hermanos Vs CIRYaz CarlomanNoch keine Bewertungen

- Bagong Filipinas Overseas CorporationDokument1 SeiteBagong Filipinas Overseas CorporationRegina FordNoch keine Bewertungen

- Special Proceedings Rules SummaryDokument6 SeitenSpecial Proceedings Rules Summarybudztheone100% (1)

- Philippine American Life and General Insurance Company vs. Secretary of Finance and Commissioner On Internal RevenueDokument1 SeitePhilippine American Life and General Insurance Company vs. Secretary of Finance and Commissioner On Internal Revenuehigoremso giensdksNoch keine Bewertungen

- Employer-employee relationship factors and labor law principlesDokument29 SeitenEmployer-employee relationship factors and labor law principlesRicric CalluengNoch keine Bewertungen

- Compania General, CTA 4451 August 23, 1993Dokument10 SeitenCompania General, CTA 4451 August 23, 1993codearcher27Noch keine Bewertungen

- ABELLA v. ABELLADokument2 SeitenABELLA v. ABELLAEmmanuel Princess Zia SalomonNoch keine Bewertungen

- Bonifacio Sy Po Vs CTADokument1 SeiteBonifacio Sy Po Vs CTALouie SalladorNoch keine Bewertungen

- Municipal Council of Iloilo Vs EvangelistaDokument7 SeitenMunicipal Council of Iloilo Vs EvangelistaMeg VillaricaNoch keine Bewertungen

- Injuries at Work: Understanding CompensabilityDokument5 SeitenInjuries at Work: Understanding CompensabilityJade Marlu DelaTorreNoch keine Bewertungen

- Judicial Affidavit Col. Jesus B. AlmojeraDokument8 SeitenJudicial Affidavit Col. Jesus B. AlmojeraWendell MaunahanNoch keine Bewertungen

- MCIT ReportDokument13 SeitenMCIT ReportfebwinNoch keine Bewertungen

- 2 - A.L. Ang Network Inc. v. Mondejar - HungDokument2 Seiten2 - A.L. Ang Network Inc. v. Mondejar - HungHylie HungNoch keine Bewertungen

- Review Ombudsman Decisions Criminal ProcedureDokument2 SeitenReview Ombudsman Decisions Criminal ProcedurePetallar Princess LouryNoch keine Bewertungen

- CIR Vs Arthur Henderson (1961, 1 SCRA 649)Dokument15 SeitenCIR Vs Arthur Henderson (1961, 1 SCRA 649)KTNoch keine Bewertungen

- 01 Butte Vs Manuel Uy and Sons, 4 SCRA 526 (1962)Dokument4 Seiten01 Butte Vs Manuel Uy and Sons, 4 SCRA 526 (1962)Angeli Pauline JimenezNoch keine Bewertungen

- Locus standi of Congress members in challenging PETRON privatizationDokument1 SeiteLocus standi of Congress members in challenging PETRON privatizationRuby SantillanaNoch keine Bewertungen

- Juan Sala vs. CFI Negros OrientalDokument1 SeiteJuan Sala vs. CFI Negros Orientalamareia yapNoch keine Bewertungen

- Certified Checks Deemed Cash Under Philippine LawDokument7 SeitenCertified Checks Deemed Cash Under Philippine LawJul A.Noch keine Bewertungen

- Tax Case List Part 1Dokument2 SeitenTax Case List Part 1Jairus LacabaNoch keine Bewertungen

- Comparative Matrix General Professional Partnership and General Partnership (Updated November 2020)Dokument2 SeitenComparative Matrix General Professional Partnership and General Partnership (Updated November 2020)hellomynameisNoch keine Bewertungen

- Income Taxation of Individuals: Citizens: Resident Non-Residents CitizensDokument2 SeitenIncome Taxation of Individuals: Citizens: Resident Non-Residents CitizenshellomynameisNoch keine Bewertungen

- Annual Income Tax ReturnDokument2 SeitenAnnual Income Tax ReturnRAS ConsultancyNoch keine Bewertungen

- Matrix Persons Tax BaseDokument1 SeiteMatrix Persons Tax BasehellomynameisNoch keine Bewertungen

- Annual Income Tax Return: Republic of The Philippines Department of Finance Bureau of Internal RevenueDokument2 SeitenAnnual Income Tax Return: Republic of The Philippines Department of Finance Bureau of Internal RevenueDCNoch keine Bewertungen

- Club Membership Suspension Leads to Damages CaseDokument18 SeitenClub Membership Suspension Leads to Damages CaseiptrinidadNoch keine Bewertungen

- Uniform Manual On Time AllowancesDokument104 SeitenUniform Manual On Time AllowancesjvpvillanuevaNoch keine Bewertungen

- Bir 1701Dokument4 SeitenBir 1701Vanesa Calimag ClementeNoch keine Bewertungen

- General Provisions Title: Rule IDokument10 SeitenGeneral Provisions Title: Rule IhellomynameisNoch keine Bewertungen

- DAR's Failure to Observe Due Process in Land Acquisition Nullifies ProceedingsDokument58 SeitenDAR's Failure to Observe Due Process in Land Acquisition Nullifies ProceedingshellomynameisNoch keine Bewertungen

- Land Reform Ruling on Hacienda LuisitaDokument220 SeitenLand Reform Ruling on Hacienda LuisitahellomynameisNoch keine Bewertungen

- DAR's Failure to Observe Due Process in Land Acquisition Nullifies ProceedingsDokument58 SeitenDAR's Failure to Observe Due Process in Land Acquisition Nullifies ProceedingshellomynameisNoch keine Bewertungen

- Revenue Regulations No 3-98 FBTDokument15 SeitenRevenue Regulations No 3-98 FBTeric yuulNoch keine Bewertungen

- Réserves A Convention Pour La Prévention Et La Répression Du Crime de GénocideDokument32 SeitenRéserves A Convention Pour La Prévention Et La Répression Du Crime de GénocideLALANoch keine Bewertungen

- Revenue Regulations No. 02-98Dokument56 SeitenRevenue Regulations No. 02-98hellomynameis100% (1)

- Petitioner Vs Vs Respondents The Solicitor General Angara Abello Concepcion Regala & CruzDokument15 SeitenPetitioner Vs Vs Respondents The Solicitor General Angara Abello Concepcion Regala & CruzhellomynameisNoch keine Bewertungen

- 191032-2016-Saguisag v. Ochoa Jr.Dokument109 Seiten191032-2016-Saguisag v. Ochoa Jr.Joanna ENoch keine Bewertungen

- 5 Province of North Cotabato v. Government Of20181003-5466-CfawbiDokument177 Seiten5 Province of North Cotabato v. Government Of20181003-5466-CfawbiCarmille MagnoNoch keine Bewertungen

- Hargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesDokument1 SeiteHargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesEric MooreNoch keine Bewertungen

- Municipal Best Practices - Preventing Fraud, Bribery and Corruption FINALDokument14 SeitenMunicipal Best Practices - Preventing Fraud, Bribery and Corruption FINALHamza MuhammadNoch keine Bewertungen

- Ensuring Ethical Supply ChainsDokument19 SeitenEnsuring Ethical Supply ChainsAbhishekNoch keine Bewertungen

- DiphtheriaDokument30 SeitenDiphtheriaBinayaNoch keine Bewertungen

- 01082023-Stapled Visa ControversyDokument2 Seiten01082023-Stapled Visa Controversyakulasowjanya574Noch keine Bewertungen

- ASAP Current Approved Therapists MDokument10 SeitenASAP Current Approved Therapists MdelygomNoch keine Bewertungen

- Accounting Estimates, Including Fair Value Accounting Estimates, and Related DisclosuresDokument26 SeitenAccounting Estimates, Including Fair Value Accounting Estimates, and Related DisclosuresAtif RehmanNoch keine Bewertungen

- Tourism and Hospitality LawDokument4 SeitenTourism and Hospitality LawSarah Mae AlcazarenNoch keine Bewertungen

- Early Registration FormDokument2 SeitenEarly Registration FormMylene PilongoNoch keine Bewertungen

- New Venture Creation IdeasDokument6 SeitenNew Venture Creation IdeasDaoud HamadnehNoch keine Bewertungen

- Amazon InvoiceDokument1 SeiteAmazon InvoiceChandra BhushanNoch keine Bewertungen

- Rbi Balance SheetDokument26 SeitenRbi Balance SheetjameyroderNoch keine Bewertungen

- Appendix F - Property ValueDokument11 SeitenAppendix F - Property ValueTown of Colonie LandfillNoch keine Bewertungen

- Career Lesson Plan Cheat SheetDokument2 SeitenCareer Lesson Plan Cheat Sheetapi-278760277Noch keine Bewertungen

- Group 1 ResearchDokument28 SeitenGroup 1 ResearchKrysler EguiaNoch keine Bewertungen

- Clearlake City Council PacketDokument57 SeitenClearlake City Council PacketLakeCoNewsNoch keine Bewertungen

- Protected Monument ListDokument65 SeitenProtected Monument ListJose PerezNoch keine Bewertungen

- (123doc) - New-Tuyen-Chon-Bai-Tap-Chuyen-De-Ngu-Phap-On-Thi-Thpt-Quoc-Gia-Mon-Tieng-Anh-Co-Dap-An-Va-Giai-Thich-Chi-Tiet-Tung-Cau-133-TrangDokument133 Seiten(123doc) - New-Tuyen-Chon-Bai-Tap-Chuyen-De-Ngu-Phap-On-Thi-Thpt-Quoc-Gia-Mon-Tieng-Anh-Co-Dap-An-Va-Giai-Thich-Chi-Tiet-Tung-Cau-133-TrangLâm Nguyễn hảiNoch keine Bewertungen

- Literature ReviewDokument6 SeitenLiterature Reviewapi-549249112Noch keine Bewertungen