Beruflich Dokumente

Kultur Dokumente

CH 2 Ex 7 - 8 - 9-1

Hochgeladen von

Wepa AkiyewOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CH 2 Ex 7 - 8 - 9-1

Hochgeladen von

Wepa AkiyewCopyright:

Verfügbare Formate

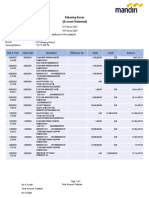

Ex.

2-7

2019

Oct. 1 Rent Expense 3,600

Cash 3,600

3 Advertising Expense 1,200

Cash 1,200

5 Supplies 750

Cash 750

6 Office Equipment 8,000

Accounts Payable 8,000

10 Cash 14,800

Accounts Receivable 14,800

15 Accounts Payable 7,110

Cash 7,110

27 Miscellaneous Expense 400

Cash 400

30 Utilities Expense 250

Cash 250

31 Accounts Receivable 33,100

Fees Earned 33,100

31 Utilities Expense 1,050

Cash 1,050

31 Jason Payne, Drawing 2,500

Cash 2,500

Ex. 2-8

a.

JOURNAL Page

87

Post.

Date Description Ref. Debit Credit

2019

Sept. 18 Supplies 15 2,475

Accounts Payable 21 2,475

Purchased supplies on account.

b., c., d.

Account: Supplies Account No. 15

Post. Balance

Date Item Ref. Debit Credit Debit Credit

2019

Sept. 1 Balance 840

18 87 2,475 3,315

Account: Accounts Payable Account No. 21

Post. Balance

Date Item Ref. Debit Credit Debit Credit

2019

Sept. 1 Balance 10,900

18 87 2,475 13,375

e. Yes. The rules of debit and credit apply to all companies.

Ex. 2-9

a. (1) Accounts Receivable 73,900

Fees Earned 73,900

(2) Supplies 1,960

Accounts Payable 1,960

(3) Cash 62,770

Accounts Receivable 62,770

(4) Accounts Payable 820

Cash 820

Ex. 2-9 (Concluded)

b.

Cash Accounts Payable

(3) 62,770 (4) 820 (4) 820 (2) 1,960

Supplies Fees Earned

(2) 1,960 (1) 73,900

Accounts Receivable

(1) 73,900 (3) 62,770

c. No. An error may not have necessarily occurred. A credit balance

in Accounts Receivable could occur if a customer overpaid his or

her account. Regardless, the credit balance should be

investigated to verify that an error has not occurred.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Prob 14 - 6A SolutionDokument1 SeiteProb 14 - 6A SolutionWepa AkiyewNoch keine Bewertungen

- Ex 16 - 5 SolutionDokument1 SeiteEx 16 - 5 SolutionWepa AkiyewNoch keine Bewertungen

- Ex 16 - 8 SolutionDokument1 SeiteEx 16 - 8 SolutionWepa AkiyewNoch keine Bewertungen

- CH 1 Ex 21 SolutionDokument2 SeitenCH 1 Ex 21 SolutionWepa AkiyewNoch keine Bewertungen

- Introduction To The Python Interpreter and Its Use.: Mac Littlefield COMSC-122Dokument25 SeitenIntroduction To The Python Interpreter and Its Use.: Mac Littlefield COMSC-122Wepa AkiyewNoch keine Bewertungen

- Understanding Internet Technologies and Security: Discovering The Internet, 5 EditionDokument58 SeitenUnderstanding Internet Technologies and Security: Discovering The Internet, 5 EditionWepa AkiyewNoch keine Bewertungen

- Communicating Online: Discovering The Internet, 5 EditionDokument66 SeitenCommunicating Online: Discovering The Internet, 5 EditionWepa AkiyewNoch keine Bewertungen

- Searching The Web: Discovering The Internet, 5 EditionDokument39 SeitenSearching The Web: Discovering The Internet, 5 EditionWepa AkiyewNoch keine Bewertungen

- DTI5e Ch01Dokument39 SeitenDTI5e Ch01Wepa AkiyewNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FA1 Chapter 6 EngDokument9 SeitenFA1 Chapter 6 EngNicola PoonNoch keine Bewertungen

- Logistics and Transportation Industry in IndiaDokument79 SeitenLogistics and Transportation Industry in Indiaabdulkhaderjeelani14Noch keine Bewertungen

- Cost Accounting RefresherDokument15 SeitenCost Accounting Refresherfat31udm100% (1)

- Accounting NotesDokument9 SeitenAccounting NotesJerusha ENoch keine Bewertungen

- 03 Job Order CostingDokument50 Seiten03 Job Order CostingKevin James Sedurifa Oledan100% (1)

- Special JournalsDokument14 SeitenSpecial JournalsMarlou Danieles100% (1)

- Bookkeeping Case Study 1Dokument10 SeitenBookkeeping Case Study 1Manu Madaan75% (4)

- Basic Accounting EquationDokument49 SeitenBasic Accounting Equationwhyme_bNoch keine Bewertungen

- Cpa Review School of The PhilippinesDokument12 SeitenCpa Review School of The PhilippinesMike SerafinoNoch keine Bewertungen

- All SCMDokument23 SeitenAll SCMthkim8Noch keine Bewertungen

- Account Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Dokument6 SeitenAccount Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Khaja Naseeruddin MuhammadNoch keine Bewertungen

- 6018-P3&P4-Format Dan Kunci JawabanDokument42 Seiten6018-P3&P4-Format Dan Kunci JawabanHaji Suarni100% (1)

- SCMDokument3 SeitenSCMGanesh Kumar. RNoch keine Bewertungen

- Kode Nama Akun Debet Kredit: Ud. Buana Trial Balance, Per 30 Desember 2020Dokument53 SeitenKode Nama Akun Debet Kredit: Ud. Buana Trial Balance, Per 30 Desember 202010 100100% (1)

- DownloadDokument6 SeitenDownloadanip amirNoch keine Bewertungen

- Observations On Supply-ChainDokument3 SeitenObservations On Supply-ChainBianca Andreea DrăganNoch keine Bewertungen

- ch12 SolutionsDokument49 Seitench12 Solutionsaboodyuae2000Noch keine Bewertungen

- 6e Brewer Ch02 B EocDokument10 Seiten6e Brewer Ch02 B EocHa Minh0% (1)

- 1 Accounting For Merchandising BusinessDokument23 Seiten1 Accounting For Merchandising BusinessKhay2 ManaliliDelaCruz100% (1)

- Account Activity: Site Search TD HomeDokument23 SeitenAccount Activity: Site Search TD HomeJj DNoch keine Bewertungen

- Accounting QBDokument661 SeitenAccounting QBTrang VũNoch keine Bewertungen

- Tutoring ServicesDokument29 SeitenTutoring ServicesJayMoralesNoch keine Bewertungen

- TRƯƠNG THỊ QUỲNH NHƯ - ESSAY TEST - - ACC101 - IB17CDokument15 SeitenTRƯƠNG THỊ QUỲNH NHƯ - ESSAY TEST - - ACC101 - IB17CTrương Thị Quỳnh NhưNoch keine Bewertungen

- International Business: by Jafin Muneer Melita StephenDokument54 SeitenInternational Business: by Jafin Muneer Melita Stephendeejayblog2114Noch keine Bewertungen

- Dixion Company Worksheet For The Month Ended June 30,2017Dokument7 SeitenDixion Company Worksheet For The Month Ended June 30,2017Hà HoàngNoch keine Bewertungen

- MGT 201 Chapter 9Dokument41 SeitenMGT 201 Chapter 9lupi99Noch keine Bewertungen

- Account - Statement - PDF - 1480016649116 - 16 February 2021Dokument2 SeitenAccount - Statement - PDF - 1480016649116 - 16 February 2021Adipt MarajaNoch keine Bewertungen

- Ch04SM Solution Manual.Dokument19 SeitenCh04SM Solution Manual.Aida IrsyahmaNoch keine Bewertungen

- Master Budget With SolutionsDokument12 SeitenMaster Budget With SolutionsDea Andal100% (4)

- P2P & O2C (Entries)Dokument9 SeitenP2P & O2C (Entries)hari koppalaNoch keine Bewertungen