Beruflich Dokumente

Kultur Dokumente

Cash and Compliance Audit Procedure

Hochgeladen von

Khyam Ahmed Qazi0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten2 SeitenCopyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten2 SeitenCash and Compliance Audit Procedure

Hochgeladen von

Khyam Ahmed QaziCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Audit Objective

To review the existing internal controls system, with reference to the company policies and related

activities, evaluate the internal controls system with regards to effectiveness of its design, identify

weaknesses, if any, and suggest measures for improvements therein.

A. Areas Covered in Compliance Audit

1. Retail System.

Audited by Remarks

- Unauthorized use of Login ID’s in absence of the concern user.

- Sharing of BM ID Password.

- Multiple login with single User Login ID.

- Negative stock quantity in system.

- Card sales punched in Cash mode.

- Missing cashier name from Computer Generated Receipt.

2. Documentations

- Gate Passes

- Outslips

- Attendance Record

- Customers Survey Forms.

- Deposits receipts for proper authentication.

3. Stock Movements

- Delivery Documents

- IST’s related documents

4. Cash Handling.

- Sales Proceed.

- Petty Cash

- Unclaimed Expense vouchers

- Float Amount.

5. Operational and Maintenance Related Issues.

- Inappropriate placement of Stock.

- Damaged/manually written barcode/ price tag articles on display.

- Damaged or no security tags on displayed articles.

- Staff without uniforms.

- Talkers not placed where required.

- Cleaning not up to the mark.

- Store policy not installed.

- Fused Lights at different parts of the Branch.

- Missing signage plate at Trial/Store/Wash Room.

- Seepage issues or crack mark on ceilings and walls.

- Damaged mannequins use for product display.

- Damaged Company Logo’s

- Security Checkpoints.

- Emergency Exit.

- Safety equipment training.

- Any other maintenance issues

6. Customer Facilitation

CRM Record for complaints.

Complaint resolution process.

7. Safety & Security Analysis.

- Distortion in view/ need to relocate or addition or no view due to

faulty camera

- Panic button not in working condition.

- Unavailability or malfunctioning of Security Checkpoints.

- Open electrical wirings.

- Expired fire extinguishers.

- Unavailability of monthly inspection card on fire extinguishers.

- Inactive smoke detectors.

- Fire Extinguishers not placed on prominent place.

B. Monthly/Management Change Cash Audits

To ensure the completeness and the protocols define to undertake the Cash Management.

Scope

- To verify the completeness and accuracy of cash.

- Sales Proceed

- Manual Sales Receipts, if any

- Petty Cash

- Float Amount

- Previous Sales Deposits (If Any).

- Any other cash found from till or cash safe, which was not part of

cash count activity, will be subject to investigation

Physical Cash Audits

Cash Audits will be done once a month at every business unit and also in the event of management

change or during investigations.

Issues addressed through Cash Audits;

a.Disallowed Expenses.

b.Payment given to government officials (Labor / Form C / SESSI.

c. Differences in Manual Sale Bills.

f. Long pending issues.

g.Unsettled amounts with ex-employees

h.Cash Counting against daily sales receipts.

Das könnte Ihnen auch gefallen

- Tata - INVOICEDokument75 SeitenTata - INVOICEVivek Bhoir0% (2)

- Harrison Chapter 4 StudentDokument52 SeitenHarrison Chapter 4 StudentDakshin SooryaNoch keine Bewertungen

- Types of AuditDokument17 SeitenTypes of AuditMubashir KhanNoch keine Bewertungen

- CH 3 Types of AuditDokument17 SeitenCH 3 Types of AuditLaiba KanwalNoch keine Bewertungen

- Auditing The Revenue CycleDokument9 SeitenAuditing The Revenue CycleWendelyn TutorNoch keine Bewertungen

- Revenue Cycle Audit ObjectivesDokument2 SeitenRevenue Cycle Audit ObjectivesRinokukun100% (1)

- Jawaban CH 7Dokument3 SeitenJawaban CH 7Friista Aulia LabibaNoch keine Bewertungen

- Aa-Threat and Control For Each CycleDokument9 SeitenAa-Threat and Control For Each CycleKucing Brow Brow100% (1)

- AC404 - Acqusitions and Payments Cycle Class NotesDokument33 SeitenAC404 - Acqusitions and Payments Cycle Class NotesObey KamutsamombeNoch keine Bewertungen

- Paper Tech IndustriesDokument20 SeitenPaper Tech IndustriesMargaret TaylorNoch keine Bewertungen

- Artificial Intelligence and AuditingDokument16 SeitenArtificial Intelligence and AuditingkoutftNoch keine Bewertungen

- Chapter 19 - Answer PDFDokument12 SeitenChapter 19 - Answer PDFjhienellNoch keine Bewertungen

- Pengauditan 2 TM 5Dokument7 SeitenPengauditan 2 TM 5Ilham IsnantoNoch keine Bewertungen

- Expenditure Cycle Case - GARCIADokument3 SeitenExpenditure Cycle Case - GARCIAARLENE GARCIANoch keine Bewertungen

- Nigel Uruilal - 008201800059 - Chapter 9 Auditing The Revenue Cycle - Assignment 9Dokument2 SeitenNigel Uruilal - 008201800059 - Chapter 9 Auditing The Revenue Cycle - Assignment 9Nigel UruilalNoch keine Bewertungen

- Auditing Expenditure CycleDokument7 SeitenAuditing Expenditure CycleHannaj May De GuzmanNoch keine Bewertungen

- Retail AuditDokument44 SeitenRetail AuditNivethitha Narayanasamy50% (2)

- AssuranceDokument3 SeitenAssurancehazel.yiran.liuNoch keine Bewertungen

- Chapter 8 Systems and ControlsDokument4 SeitenChapter 8 Systems and Controlsrishi kareliaNoch keine Bewertungen

- Pertemuan 4Dokument46 SeitenPertemuan 4narutouzumaki785Noch keine Bewertungen

- CH13 and 14: November 29, 2022 3:26 PMDokument6 SeitenCH13 and 14: November 29, 2022 3:26 PMdre thegreatNoch keine Bewertungen

- Audit of The Sales and Collection CycleDokument51 SeitenAudit of The Sales and Collection CycleZaza FrenchkiesNoch keine Bewertungen

- Georgia Vasantha - 041911333233 - Resume Minggu 4Dokument3 SeitenGeorgia Vasantha - 041911333233 - Resume Minggu 4Georgia VasanthaNoch keine Bewertungen

- Audit Eunice Cheatsheet (Autosaved) PrintDokument8 SeitenAudit Eunice Cheatsheet (Autosaved) PrintEric OngNoch keine Bewertungen

- Chapter 15-Auditing The Expenditure CycleDokument9 SeitenChapter 15-Auditing The Expenditure CycleWaye EdnilaoNoch keine Bewertungen

- Chapter 15-Auditing The Expenditure CycleDokument9 SeitenChapter 15-Auditing The Expenditure CycleWaye EdnilaoNoch keine Bewertungen

- Chapter 15-Auditing The Expenditure CycleDokument9 SeitenChapter 15-Auditing The Expenditure CycleWaye EdnilaoNoch keine Bewertungen

- 2.3 Discussion Assignment The Revenue CycleDokument8 Seiten2.3 Discussion Assignment The Revenue CycleRosemarie CruzNoch keine Bewertungen

- SAP Final Exam PreparationDokument5 SeitenSAP Final Exam PreparationRabin GadalNoch keine Bewertungen

- Sistem Administrasi DagangDokument2 SeitenSistem Administrasi DagangNurhafizahNoch keine Bewertungen

- Customer Grievance PolicyDokument10 SeitenCustomer Grievance PolicyanilkoduruNoch keine Bewertungen

- Assignment For Audit AssistantDokument3 SeitenAssignment For Audit AssistantDipali PatilNoch keine Bewertungen

- Internal Control WeaknessesDokument3 SeitenInternal Control WeaknessesRosaly JadraqueNoch keine Bewertungen

- Ais903 Hall 2007 Ch04 The Revenue CycleDokument16 SeitenAis903 Hall 2007 Ch04 The Revenue CyclewichupinunoNoch keine Bewertungen

- Accounting Information System - Expenditure CycleDokument3 SeitenAccounting Information System - Expenditure CycleSecret LangNoch keine Bewertungen

- Presentation About EthicsDokument5 SeitenPresentation About EthicsShahed Chy.Noch keine Bewertungen

- f8 JUNE 2009 ANSwerDokument12 Seitenf8 JUNE 2009 ANSwerPakistan Dramas67% (3)

- Expenditure Cycle Case - GARCIADokument2 SeitenExpenditure Cycle Case - GARCIAARLENE GARCIANoch keine Bewertungen

- Audit of The Sales and Collection CycleDokument5 SeitenAudit of The Sales and Collection Cyclemrs lee100% (1)

- AnswersDokument11 SeitenAnswersEkin SapianNoch keine Bewertungen

- Audit Fraud MemoDokument16 SeitenAudit Fraud MemoManish AggarwalNoch keine Bewertungen

- SD ProcessDokument28 SeitenSD ProcessVeena PindiNoch keine Bewertungen

- ASAP M Tute10 Answers GuideDokument5 SeitenASAP M Tute10 Answers GuideAndreea M.Noch keine Bewertungen

- Lesson 3aDokument22 SeitenLesson 3aLorica EloisaNoch keine Bewertungen

- Section 404 Audits of Internal Control and Control RiskDokument8 SeitenSection 404 Audits of Internal Control and Control RiskMuneera Al HassanNoch keine Bewertungen

- 18 Caro ChecklistDokument39 Seiten18 Caro ChecklistAvinash Arun ShuklaNoch keine Bewertungen

- General Systems and CLERICAL Procedures in BusinessDokument18 SeitenGeneral Systems and CLERICAL Procedures in BusinessknmodiNoch keine Bewertungen

- CRM Modules IIDokument10 SeitenCRM Modules IIAnonymous RVIAhmDGNoch keine Bewertungen

- 9 Inventory of Technical DrawingDokument18 Seiten9 Inventory of Technical DrawingANNIE ROSE DULANGNoch keine Bewertungen

- 3accounting Information SystemsDokument22 Seiten3accounting Information SystemsAirish Justine MacalintalNoch keine Bewertungen

- AC404 - Revenue and Receipts Cycle Class NotesDokument38 SeitenAC404 - Revenue and Receipts Cycle Class NotesObey KamutsamombeNoch keine Bewertungen

- Tata INVOICEDokument75 SeitenTata INVOICEAkhand SinghNoch keine Bewertungen

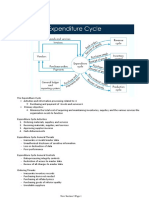

- Expenditure CycleDokument9 SeitenExpenditure CycleDianne BausaNoch keine Bewertungen

- GORISK330-C08 Discussion No. 1 - Suggested Answers Case No. 1 The Following Short Cases Describe Some Specific Internal Control WeaknessesDokument8 SeitenGORISK330-C08 Discussion No. 1 - Suggested Answers Case No. 1 The Following Short Cases Describe Some Specific Internal Control WeaknessesMa Tiffany Gura RobleNoch keine Bewertungen

- Management Accounting:: Major Differences: Legal Requirements, Focus On, Bodies, Time Dimension, Report FrequencyDokument2 SeitenManagement Accounting:: Major Differences: Legal Requirements, Focus On, Bodies, Time Dimension, Report FrequencyOlga SîrbuNoch keine Bewertungen

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDokument40 SeitenThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresstudentresearchonlyNoch keine Bewertungen

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementVon EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNoch keine Bewertungen

- Cadwallader & Co vs. Smith Bell & Co., 7 Phil 461 - ARTICLE 1398Dokument1 SeiteCadwallader & Co vs. Smith Bell & Co., 7 Phil 461 - ARTICLE 1398Danica CaballesNoch keine Bewertungen

- Raute PDFDokument3 SeitenRaute PDFRamuni GintingNoch keine Bewertungen

- DHL 2ndDokument7 SeitenDHL 2ndSafi UllahNoch keine Bewertungen

- (ENTP Assignment3-HMT Watches Case Study) 30 March 2020Dokument4 Seiten(ENTP Assignment3-HMT Watches Case Study) 30 March 2020Manita DhandaNoch keine Bewertungen

- Brochure - We Know BioprocessingDokument20 SeitenBrochure - We Know Bioprocessingclinton ruleNoch keine Bewertungen

- Kashmir Festival - FinalsDokument27 SeitenKashmir Festival - FinalsAhmed Mazhar KhanNoch keine Bewertungen

- Public Sector Marketing: Department of Public Administration Fatima Jinnah Women University Instructor: Sana MukarramDokument22 SeitenPublic Sector Marketing: Department of Public Administration Fatima Jinnah Women University Instructor: Sana MukarramWaljia BaigNoch keine Bewertungen

- IGNOU MBA MS-10 SolvedDokument15 SeitenIGNOU MBA MS-10 SolvedtobinsNoch keine Bewertungen

- An Integrated Lean Approach To Process Failure ModDokument12 SeitenAn Integrated Lean Approach To Process Failure ModLeoo Cotrina FranciaNoch keine Bewertungen

- 20880-Article Text-66052-1-10-20180826Dokument9 Seiten20880-Article Text-66052-1-10-20180826shubham moonNoch keine Bewertungen

- Joint Motion To Dismiss - NLRCDokument3 SeitenJoint Motion To Dismiss - NLRCCath CorcueraNoch keine Bewertungen

- Borosil RenewablesDokument2 SeitenBorosil RenewablesJatin SoniNoch keine Bewertungen

- A Study On Customer Relationship Management at Bandhan Bank LimitedDokument55 SeitenA Study On Customer Relationship Management at Bandhan Bank LimitedNitinAgnihotriNoch keine Bewertungen

- Hei Initiative Pilot Call For ProposalsDokument16 SeitenHei Initiative Pilot Call For ProposalsSerbanoiu Liviu IonutNoch keine Bewertungen

- Corporate Social Responsibility: PT International Nickel IndonesiaDokument8 SeitenCorporate Social Responsibility: PT International Nickel Indonesiadewi wahyuNoch keine Bewertungen

- Term Paper: Bangladesh University of Professionals (Bup)Dokument5 SeitenTerm Paper: Bangladesh University of Professionals (Bup)Muslima Mubashera Reza RupaNoch keine Bewertungen

- Georgia Power Utility AssistanceDokument2 SeitenGeorgia Power Utility AssistanceABC15 NewsNoch keine Bewertungen

- June 2023 SANTA MARTA MARINA AND BEACH FRONT PROPERTY THROUGH FASTBLOC BUILDING SYSTEMDokument14 SeitenJune 2023 SANTA MARTA MARINA AND BEACH FRONT PROPERTY THROUGH FASTBLOC BUILDING SYSTEMLUZ MOSNoch keine Bewertungen

- Intermediate Accounting 18th Edition Stice Test BankDokument33 SeitenIntermediate Accounting 18th Edition Stice Test Bankcolonizeverseaat100% (35)

- File 4Dokument5 SeitenFile 4Sri NehaNoch keine Bewertungen

- Startupreneur Bisnis Digital (SABDA) : Katoyusyi Kano, Lee Kyung Choi, Bob Subhan Riza, Regina Dinda OctavyraDokument18 SeitenStartupreneur Bisnis Digital (SABDA) : Katoyusyi Kano, Lee Kyung Choi, Bob Subhan Riza, Regina Dinda OctavyraGeofakta RazaliNoch keine Bewertungen

- Best Practice For Solar Roof Top Projects in IndiaDokument172 SeitenBest Practice For Solar Roof Top Projects in Indiaoptaneja48Noch keine Bewertungen

- MCQs With Answers On RBIDokument6 SeitenMCQs With Answers On RBIRupeshNoch keine Bewertungen

- Part-1-General - and - Financial - Awareness Set - 1Dokument4 SeitenPart-1-General - and - Financial - Awareness Set - 1Anto KevinNoch keine Bewertungen

- Agile & Scrum Overview SlidesDokument26 SeitenAgile & Scrum Overview SlidesNirdesh DwaNoch keine Bewertungen

- Virtual Teams: A Great Way To Get SuccessfulDokument3 SeitenVirtual Teams: A Great Way To Get SuccessfulFredy Andres Mendoza CastilloNoch keine Bewertungen

- ABC Automotive Inc Collective AgreementDokument43 SeitenABC Automotive Inc Collective AgreementshawnNoch keine Bewertungen

- Ole of Management Information System in Banking Sector IndustryDokument3 SeitenOle of Management Information System in Banking Sector IndustryArijit sahaNoch keine Bewertungen

- British Broadcasting Corporation: Drivers For LeadershipDokument2 SeitenBritish Broadcasting Corporation: Drivers For Leadershipmanagement_seminarNoch keine Bewertungen

- WEST COAST COLL-WPS OfficeDokument6 SeitenWEST COAST COLL-WPS OfficeJan Kryz Marfil PalenciaNoch keine Bewertungen