Beruflich Dokumente

Kultur Dokumente

Netcash Overview

Hochgeladen von

Tresor DuniaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Netcash Overview

Hochgeladen von

Tresor DuniaCopyright:

Verfügbare Formate

Service Overview

The Company

Netcash Account

A Netcash account provides online access to a

range of services which provide you with the

ability to exercise control and manage your

debtors and creditors effectively.

For a monthly service fee of R160 you will have

access to multiple services at no additional cost.

Our range of services currently consist of;

Debit Order Collections

EFT Payments

Credit Card Processing

We have developed the most advanced Business and consumer Credit Data

solutions for modern day businesses and We are constantly reviewing these services to see

organizations to manage, monitor and settle how they can be improved, as well as adding new

business services to our offering.

debtors and creditors.

Our Philosophy Approval Times

There are no lengthy approval times for a Netcash

We have built our service around the straight

merchant account. Implementation of the service

forward truth that people want simple, cost

can be done in a matter of hours.

effective and efficient services. We underpin all of

these with a reputation for delivering beyond

expectation. Service Evaluation

Our Service We invite you to evaluate any of the Netcash

services. If you are not satisfied for any reason,

We understand that your cash flow and your you may cancel the service without any penalties

relationship with your customers and creditors are or cancellation charges.

the two most important aspects of your business.

This is why we will ensure that all your transactions Money Back Guarantee

are processed accurately and on time each and

every time. We have such confidence in our system and

services that we will allow you to evaluate any of

Registration Requirements our services for 60 days. If you are not 100%

satisfied for any reason, we will cancel your

The account registration procedure is completed

service agreement and refund your account setup

online and your service agreement will be

fees.

forwarded to you by email for completion.

No Fixed Term Agreement

No discussions, no questions, just your

Our service agreement has no fixed timeframe complete satisfaction.

which allows you the flexibility to discontinue the

services at any time.

Netcash (Pty) Ltd -2- www.netcash.co.za

Service Features

Multi Bank Transacting

Netcash transacts directly with the 4 large banks

and through Bankserv with the smaller banks. We

can therefore guarantee service levels and

payment clearance times. The advantage to you

as a merchant is that you do not need to change

any of your current banking relationships to use

our service.

Data Validation

Netcash has developed an advanced validation

Our commitment to service is backed by the

component which facilitates the accurate

most technologically advanced internet based capturing of data prior to submitting transactions.

system. The first of its kind in Southern Africa. This saves you the inconvenience of returned or

rejected transactions and the associated costs.

Internet Based Branch Codes

The system provides tables with the branch codes

The Netcash system allows you access to all the

of all the banks in South Africa. We continually

services via the internet from anywhere, at any

update this information as the details are made

time, using any device with a browser. available from BankServ.

With Netcash you do not require dedicated

software which is restricting in nature because it Transaction Notifications

only allows you access to your data from one

PC. We believe in keeping you, your debtors and

creditors informed at all times. The system will

You will not be required to upgrade software

send out email notifications to you when any

when your service requirements change.

transaction authorizations are done. We will also

You will not be required to do software updates. send out transaction notifications to the debtors

User friendly interfaces make it easy for first time and creditors with collection or payment

users to make use of services without training. transaction confirmations.

System Users Reports

The Netcash system allows you to have multiple You will have access to a comprehensive set of

system users on the account. reports that provide you with all of the critical

information that you require. Whether you need to

You can control who may view, add, edit, delete

look at your customers’ payment history or need

data as well as authorize transactions.

to analyze your future revenue streams based on

You can have multiple users with varying your collection history, you will find our online

administration and authorization rights at no reports an invaluable tool.

additional cost.

Netcash (Pty) Ltd -3- www.netcash.co.za

Technical Features

Web Service Validation

The data validation component is available to all

our merchants as a web service which can be

integrated into your web site or management

software. The component can be used to validate;

Bank account numbers and branch codes

Credit Card numbers

SA Identification numbers

This means you can validate details while you are

capturing details on you management system or

website. (Technical document available)

Our commitment to service is backed by the

NetFTP Upload

most technologically advanced internet based

If you are presently capturing your debtors’ and

system. The first of its kind in Southern Africa.

creditors’ information on in-house software

System Integration packages then the relevant details can be

exported into a CSV file format from your financial

We have developed the Netcash system with the

package or database. You then have two options

understanding that our merchants have different

of uploading this data directly onto the Netcash

business process requirements. We offer various

system

methods by which your transactions can be

processed. If you need an alternative to our web NetFTP – Allows you to logon to your Netcash

interface you can choose one of the other account and select the CSV file from your PC

integration methods that suits your unique and upload it onto your Netcash account.

requirements. Automated NetFTP – Allows you to

automatically upload the data from your

Data Security management system or software to the

The netcash system is developed with the Netcash servers with and HTTPS request.

same demands on security and performance (Technical document available)

as the sites used for internet banking services Statement Downloads

and share trading.

We understand that submitting your transactions

Data is secured using Secure Socket Layer for processing is only half of the process. The

(SSL) technology with up to 256bit encryption, results of these transactions can then be

certified by Thawte. downloaded and imported into your accounting

Our servers are hosted behind multiple layered system using the NetFTP services. This will

electronic firewalls to protect transactional and enable you to reconcile the entire process.

banking information against unauthorized (Technical document available)

access from third parties, loss and fraud. Other Software Integration

A number of software vendors have developed

Netcash file formats to allow the CSV files to be

generated and loaded directly into your Netcash

account using one of the NetFTP services.

(Vendor list available)

Netcash (Pty) Ltd -4- www.netcash.co.za

Debit Order Collections

Debit Order Mandate Storage

Client mandates can be uploaded electronically

onto the Netcash system as a backup to your

original documents.

Debit Order Processing

Processing Days - Debit Orders can be processed

on any workday, Monday to Friday, excluding

public holidays. We have two debit order services

available:

2 Day Service - You will be required to process

and authorize your debit order batch by 12pm

If you are a business, group, club or (evening) two working days prior to the requested

association that collects money from action (deduction) date. Funds are transferred to

customers, members or subscribers, then the your account on the action date

Netcash service is the most efficient, reliable Same Day Service - You will be required to

process and authorize your debit order batch by

and cost effective method available

10am on the action (collection) date. Funds are

Service Features transferred to your account the next working day.

With Netcash you can automatically and Credit Card Transactions – You can add and

electronically debit your clients’ accounts for your process debit orders against all Southern African

recurring and non-recurring collections as well as bank accounts, Master & Visa Credit Cards.

eliminate the ongoing expense of accepting

Unpaid Entries

payments through the traditional paper and

magtape methods. It is an effective and safe Notifications of unpaid entries are provided to you

alternative to receiving money in cash, by cheque as part of our extended services. We receive

or stop order. unpaid data information from the Banks in real

time. As these are being processed on our system

Surety Requirements

you will be notified immediately by email.

Netcash does not require you to provide upfront

guarantees against your Debit Order Batch

value. Refer to Service Features section for

You will receive up to 90% of your debit batch

Internet based system

value on the day the debit orders are

System users

processed.

Multibank transacting

The retained amount is released 22 working

days later. Data validation

Transaction notifications

Debit Order Mandate Reports

Netcash will provide you with the required wording

for the debit order instruction forms that need to be

signed by your customers. In addition, Netcash is

the only service that will allow you to debit from

bank accounts as well as selected credit card

accounts.

Netcash (Pty) Ltd -5- www.netcash.co.za

EFT Payments

Pastel Partner Payroll

Software version : 2008 Version 2a

Downloadable at : www.pastelpayroll.co.za

Pastel will be sending CD version 8.0.2.1 to all clients.

Pastel Payroll Support

011 304 4000 - support@pastelpayroll.co.za

Secure electronic payments to all banks and

account types for simultaneous payment. Softline VIP

Service Features

The Netcash service does away with the production of

Software version : Version 2.7a

payroll cheques and cash handling, thus reducing the

merchants costs associated with such payments. The Software update : Contact your VIP Consultant to get

Netcash EFT Payments service works on the same enhancement as it will not be sent to all VIP users, or

basis as internet payments. email info@vippayroll.co.za or Tel 012 4207000

Payment Processing

Why use the Netcash EFT Payments?

Processing Days – Payments can be processed on

User friendly interface

any workday, Monday to Friday, excluding public

Import capabilities mean one point of capture –

holidays. Batches can be post dated.

within your payroll/accounting package and save

you time by not having to recapture batches online Same Day Value - You will be required to process and

Our pricing is generally much cheaper and safer authorize your payments by 11am on the date you

than writing a cheque or internet transfer. want payment made. The payment value will reflect in

All transfers reflect on the beneficiaries accounts the beneficiaries account on the same date.

on the same day, irrelevant of which bank they Credit Balance – If you are processing debit orders,

have an account with. you can release payments against the value of your

It eliminates the risk of having cash on your debit collection batch value.

premises.

Funds Transfer – If you do not have an available

Processing Options balance in your Netcash account to make payments

Capture and submit payment beneficiaries and against, you can transfer the funds to a Netcash

payments directly on the website. This is the same clearing account at the bank of your choice.

as using Internet banking for payments.

Payroll Administration Companies

Import data with CSV file. The Netcash file format

is available on request. If your business is involved with payroll administration

for other companies, Netcash has a tailor made

Data can be imported using Softline’s VIP or Pastel solution for you that will add value to your service

Payroll packages. You will need to obtain the offering. Please enquire with one of our account

software updates in order to have access to this managers.

functionality.

Netcash (Pty) Ltd -6- www.netcash.co.za

Credit Card Processing

Terminal Processing

Processing Days – Transactions can be processed 24

hours a day, seven days a week.

Credit Card Vouchers - Netcash will provide the

merchant with Card Vouchers which they can use to

make an imprint of the credit card and get the

cardholder to sign. These details are entered into the

Netcash system for immediate authorization.

Card Vouchers – The card vouchers are then returned

to Netcash for processing and funds released to you.

Enabling merchants to authorize, settle and Why use Netcash Gateway?

manage credit card transactions from a website. Netcash Gateway enables the merchant to

seamlessly direct credit card transactions from their

Service Features

web site or shopping cart to the Netcash payment

Netcash act as the intermediary between our merchant webpage.

and the financial institution. We offer two distinct credit Your details can be presented on that page so that

card processing services which allow our merchant’s to the customer does not feel as if he/she is leaving

process transactions at any time without an Electronic your website.

Data Capture (EDC) terminal radio or telephone link to The Netcash Gateway can be set up with no

the bank. All our merchant requires in terms of additional programming. SSL encryption is utilized

infrastructure is access to the Internet. The services on the Netcash gateway payment webpage insuring

are designed for ease of use for our merchant, and that security risks are eliminated.

cardholder security.

Gateway Processing

Why use the Netcash Terminal?

The merchants' web site takes the customer through

Netcash Terminal allows you to turn your computer

the purchase process and once the amount of the

into a Point of Sale credit card terminal.

order has been calculated a Credit Card Payment

You can accept Master and Visa Cards

button is pressed by the cardholder. Netcash

No installation, programming or software is required

establishes an SSL3 secure link with the browser and

for this service.

presents the next page which contains the merchants’

Simply log on to your Netcash account and

logo and displays the reference number, description of

manually process your customer’s credit card

the goods and the amount provided by the merchant. It

transaction.

also contains fields for the cardholder to enter the

The authorization happens immediately, allowing

necessary card details. Once the cardholder has

for real time online credit card payments to be

completed the fields and clicked the button, the

processed.

transaction is presented on-line to the cardholders’

bank for authorization.

3 D Secure

Netcash complies with Verified by Visa and Master

Card Secure Code, which are global programmes

designed to make shopping on the Internet safer and

more secure for both consumers and merchants.

Netcash (Pty) Ltd -7- www.netcash.co.za

Credit Data

Identity (ID) Number Verification

An ID Number Verification checks that a supplied ID

number is valid and verified against the supplied

name and surname as per the Department of Home

Affairs.

Consumer Trace

A consumer trace is a tracing product supplying the

latest telephone numbers, addresses and consumer

information on an individual.

Helping our merchants make informed

TransUnion Consumer Enquiry

business decisions to minimize risk and

maximize growth opportunities. A standard consumer credit enquiry showing an

individual’s personal details, address information,

Service Features

employment information, telephone history,

We have partnered with Credit Data (Pty) Ltd, to judgements, notices, notarial bonds, defaults and

provide our merchants with access to data from a enquiry history from the TransUnion credit bureau.

variety of the major credit bureaus and providers in a

Experian Consumer Enquiry

single location. These sources include TransUnion,

Experian, CIPRO and the deeds office. With the use of

A standard consumer credit enquiry showing an

the latest technology, our merchants have access to a

individual’s personal details, address information,

wide range of reports via their Netcash account. We

employment information, telephone history, judgments,

are constantly developing new and unique products

notices, notarial bonds, defaults and enquiry history

based on market needs. The main categories of

from the Experian credit bureau.

products we offer are;

Consumer products Combination Consumer Enquiry

Commercial products The Combination Consumer Enquiry offers the

Deeds searches information from both of the above reports (TransUnion

and Experian Consumer Enquiry) in a single report

Employment Screening

side by side in simple layout.

Business Enquiry

The business identification is displayed (business

name, start date, industry, business function, phone

number, fax number, VAT number, physical and postal

address), name history, registration details as per the

registrar of companies, member’s break down, civil

court records, default data, and notorial bond

information.

Netcash (Pty) Ltd -8- www.netcash.co.za

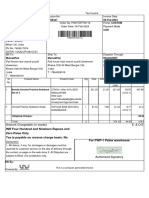

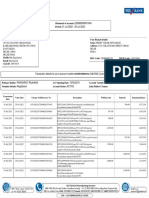

Netcash Pricing

Debit Collections

One account – Multiple services

Maximum value Transactions Cost

0 – 250 R 2.20

Introduction

251 – 500 R 2.10

We have a tiered pricing structure for various 501 – 1000 R 2.05

transaction volumes and values processed per 1001 – 2500 R 2.00

month. 2501 – 5000 R 1.95

5001 – 7500 R 1.90

If your requirements change, or you start doing 7501 – 10000 R 1.80

higher volumes of transactions, we will adjust 10000 or higher – Pricing available on request

the pricing structure to suit those needs and

The pricing above is for the 2 Day Debit service. We

save you further costs.

have a SAME Day service available at R2.90 per

We have kept our pricing structure simple with transaction.

no hidden or arbitrary charges.

Re-direct fee - R 2.50 will be charged if an account has

These prices are quoted as a guide. Should you closed and we re-direct the debit to the new account.

have specific requirements please do not Unpaid transaction - R2.80 for each debit order

hesitate to contact us. transaction returned as unpaid by the bank.

All prices exclude VAT. Minimum batch fee - R10.00 will be charged if the

multiple of the transaction fees are less than the

Netcash Account minimum batch fee.

NAEDOS – Non authenticated early debit order system

Account setup fee R425 - This is a once off charge.

This fee includes the client take on if you already Transaction fee R 6.00

Tracking fee R 2.50

process transactions with another service provider.

Unsuccessful R 2.80

Monthly service fee R160 - The monthly service fee Dispute R 10.00

will give you access to all the Netcash services Credit Card Processing

outlined in this proposal.

A processing charge of R1.00 per transaction and the

commission based on transaction values.

Price comparison – If you are using any of these

Monthly Value Commission

services with another service provider we will gladly

R 25 000 5.00%

do a price comparison for you.

R 50 000 4.75%

R 75 000 4.50%

EFT Payments

R 100 000 4.25%

Transactions Cost R 150 000 4.00%

0 – 50 R 3.00 R 200 000 3.75%

51 – 100 R 2.95 R 250 000 3.50%

101 – 250 R 2.90 Higher value – Pricing available on request

251 – 500 R 2.85

Credit Data

501 – 750 R 2.80

751 – 1000 R 2.75 Identify Verification R 5.00

1001 – 2500 R 2.70 Consumer Trace R 5.00

2501 – 5000 R 2.65 TransUnion Consumer Report R 17.50

5001 or higher – Pricing available on request Experian Consumer Report R 17.50

Combination Report R 32.00

Business Enquiry R 118.00

Netcash (Pty) Ltd -9- www.netcash.co.za

Company Details

Netcash (Pty) Ltd Morne Nortier

www.netcash.co.za

morne@netcash.co.za

Tel : 0861 338-338

Registration number 2001/019308/07 Direct : 021 521-5214

VAT Registration 4620213522 Fax : 086 624 5181

Postal address

PO Box 50354

West Beach, 7449

Registered as a Systems Operator and Third Party Registered offices

Payments Provider

Registration number SO001051 303 Ashwood Towers, Parklands Main Road

Registration number 037/2009

Netcash (Pty) Ltd - 10 -

www.netcash.co.za

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Receipt - LinkedIn FebDokument1 SeiteReceipt - LinkedIn FebJacob PruittNoch keine Bewertungen

- Group StatementDokument1 SeiteGroup StatementJEFF WONNoch keine Bewertungen

- Tax Invoice: Janse Van Rensburg, Pieter Adriaan Po Box 506 Polokwane 0700Dokument1 SeiteTax Invoice: Janse Van Rensburg, Pieter Adriaan Po Box 506 Polokwane 0700Marlene0% (1)

- QTN 23-24 005 Rajesh SirDokument2 SeitenQTN 23-24 005 Rajesh SirLOGIN ANIMONoch keine Bewertungen

- Policy Deposit Receipt: Plan Component Premium Service Tax Applicable Cess Revival Charge (Late Fee) Total Premium PaidDokument1 SeitePolicy Deposit Receipt: Plan Component Premium Service Tax Applicable Cess Revival Charge (Late Fee) Total Premium PaidMohit NarangNoch keine Bewertungen

- Uk PayslipDokument3 SeitenUk PayslipyurijapNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoicemainakpati03Noch keine Bewertungen

- Form 16A. Tata CapitalDokument1 SeiteForm 16A. Tata CapitalparshantduggalNoch keine Bewertungen

- Economic Impact ReportDokument6 SeitenEconomic Impact ReportrkarlinNoch keine Bewertungen

- Introduction To Bookkeeping FA1 Course Map PDFDokument7 SeitenIntroduction To Bookkeeping FA1 Course Map PDFBondhu GuptoNoch keine Bewertungen

- CHAPTER 9 For Cost Con de LeonDokument5 SeitenCHAPTER 9 For Cost Con de LeonRose Ann GarciaNoch keine Bewertungen

- Invoice - 282 EnHDokument4 SeitenInvoice - 282 EnHPriyank PawarNoch keine Bewertungen

- Presented To: Vibha Jain Presented By: Nishu Chopra Semester 03 (2009-11) SrimDokument14 SeitenPresented To: Vibha Jain Presented By: Nishu Chopra Semester 03 (2009-11) Srimbansi2kkNoch keine Bewertungen

- Chapter 2 - Taxes, Tax Laws and AdministrationDokument3 SeitenChapter 2 - Taxes, Tax Laws and AdministrationAEONGHAE RYNoch keine Bewertungen

- Fringe Benefits: Laban Lang Noh!Dokument20 SeitenFringe Benefits: Laban Lang Noh!Alyssa Joie PalerNoch keine Bewertungen

- Pay SlipDokument4 SeitenPay Slipapi-3810267100% (2)

- Avenue E-Commerce Limited: You SavedDokument1 SeiteAvenue E-Commerce Limited: You SavedRahul KeniNoch keine Bewertungen

- TAX SolutionsDokument24 SeitenTAX SolutionsJerome MadrigalNoch keine Bewertungen

- The Transfer Pricing Law Review - Edition 3 - 24 July 2019Dokument327 SeitenThe Transfer Pricing Law Review - Edition 3 - 24 July 2019Sandi Zanz0% (1)

- 01 Jul 2022 - 29 Jul 2022Dokument7 Seiten01 Jul 2022 - 29 Jul 2022Parishrut17Noch keine Bewertungen

- Verizon Wireless : PO# DescriptionDokument22 SeitenVerizon Wireless : PO# DescriptionTamara AufieroNoch keine Bewertungen

- AIAIAI Price List March 9th 2016 USADokument2 SeitenAIAIAI Price List March 9th 2016 USATraktor VenezuelaNoch keine Bewertungen

- Customs Procedure CodesDokument9 SeitenCustoms Procedure CodesTSEDEKENoch keine Bewertungen

- Application Form - Capital Ph-2 Updated 05-10-2022Dokument65 SeitenApplication Form - Capital Ph-2 Updated 05-10-2022Satyender DalalNoch keine Bewertungen

- PDFDokument3 SeitenPDFRISHI KEJRIWALNoch keine Bewertungen

- E-Auctions - MSTC Limited-Powergrid Rangpo-19.06.2020Dokument4 SeitenE-Auctions - MSTC Limited-Powergrid Rangpo-19.06.2020mannakauNoch keine Bewertungen

- Advanced Taxation (Acfn 622) Semester 1, 2012Dokument12 SeitenAdvanced Taxation (Acfn 622) Semester 1, 2012yebegashet100% (1)

- Accounting Transaction, Services CompanyDokument3 SeitenAccounting Transaction, Services CompanyCahyani PrastutiNoch keine Bewertungen

- San Beda Tax Reviewer 2012Dokument26 SeitenSan Beda Tax Reviewer 2012Lenard Trinidad50% (2)

- Accounting VoucherDokument1 SeiteAccounting VoucherPadarabinda ParidaNoch keine Bewertungen