Beruflich Dokumente

Kultur Dokumente

Union Budget 2011

Hochgeladen von

Vikky VasvaniCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Union Budget 2011

Hochgeladen von

Vikky VasvaniCopyright:

Verfügbare Formate

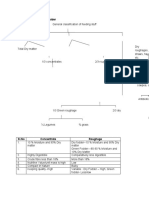

Union Budget 2011-12 – Synopsis

• Income Tax

1. Income Tax exemption limit increased from 1,60,000 to 1,80,000 for individual tax

payers.

2. Income Tax exemption limit increased from 2,40,000 to 2,50,000 – for senior citizen

3. Age for being classified as Senior Citizen cut to 60 years from 65 years Income Tax

4. Exemption limit of Rs 5,00,000 for individual tax payers above 80 years of age.

5. Women Citizens: Remains unchanged; i.e. at Rs. 1,90,000

6. Extension of investment on long-term infrastructure bonds by one more year.

7. Surcharge on domestic companies cut to 5% from 7.5%

8. Minimum Alternate Tax (MAT) raised to 18.5% of book profits

9. Foreign unit dividend tax rate cut to 15 percent for Indian companies

10. Special Economic Zones to come under MAT.

11. Weighted average deduction for donation to national laboratories etc for scientific

research to be enhanced to 200%.

12. Salaried taxpayers with entire tax liability discharged through TDS not required filing

tax returns.

13. LOs will be required to file Annual Information in prescribed Form

• Indirect Tax

A. Service Tax

1. Service Tax rates unchanged at 10%;

2. Service tax net extended to include health check-ups

3. Domestic air travel to pay Rs 50 more and Rs 250 on international air travel.

4. Travel in higher classes on domestic journeys would be taxed at the rate of 10%.

5. Service tax on hotel accommodation above Rs 1000 per day

6. Legal representation for businesses under service tax

7. To tax life insurance service providers

8. AC Restaurants serving liquor to be taxed with 75% abatement

9. Hospitals with more than 25 beds having AC to be taxed with 50% abatement

10. Diagnostic Test Centers to be taxed with 50% abatement

B. Excise & Custom

General

1. Peak excise duty unchanged at 10%.

2. To withdraw 130 items from exemption under Central Excise.

3. Base rate on excise duty raised to 5% from 4% on items attracting VAT of 5 %.

4. Peak Customs duty remains unchanged at 10%.

5. No change in CENVAT rates.

6. Iron ore export duty raised to 20 % / 25%

7. Optional levy on branded garments or made up proposed to be converted into a

mandatory levy at unified rate of 10 per cent.

8. Nominal one per cent central excise duty on 130 items entering the tax net.

9. Basic customs duty on agricultural machinery reduced to 4.5 per cent from 5 per cent.

10. Self-assessment system announced for Customs duty

11. Jumbo rolls import granted exemption.

12.

Sector specific

Agriculture and Related Sectors

1. Scope of exemptions from Excise Duty enlarged to include equipments needed for

storage and warehouse facilities on agricultural produce.

2. Basic Custom Duty reduced for specified agricultural machinery from 5 per cent to

2.5 per cent.

3. Basic Custom Duty reduced on micro-irrigation equipment from 7.5 per cent to 5 per

cent.

4. De-oiled rice bran cake to be fully exempted from basic Custom Duty. Export

5. Duty of 10 per cent to be levied on its export.

Manufacturing Sector

1. Basic Custom Duty reduced for various items to encourage domestic value addition

vis-à-vis imports, to remove duty inversion and anomalies and to provide a level

playing field to the domestic industry.

2. Rate of Export Duty for all types of iron ore enhanced and unified at 20 per cent ad

valorem. Full exemption from Export Duty to iron ore pellets.

3. Basic Custom Duty on two critical raw materials of cement industry viz. petcoke and

gypsum is proposed to be reduced to 2.5 per cent.

4. Cash dispensers fully exempt from basic Customs Duty.

Environment

1. Full exemption from basic Customs Duty and a concessional rate of Central

2. Excise Duty extended to batteries imported by manufacturers of electrical vehicles.

3. Concessional Excise Duty of 10 per cent to vehicles based on Fuel cell technology.

4. Exemption granted from basic custom duty and special CVD to critical

parts/assemblies needed for Hybrid vehicles.

5. Reduction in Excise Duty on kits used for conversion of fossil fuel vehicles into

Hybrid vehicles.

6. Excise Duty on LEDs reduced to 5 per cent and special CVD being fully exempted.

7. Basic Customs Duty on solar lantern reduced from 10 to 5 per cent.

8. Full exemption from basic Customs Duty to Crude Palm Stearin used in manufacture

of laundry soap.

9. Full exemption from basic Excise Duty granted to enzyme based preparation for pretanning.

Infrastructure

1. Parallel Excise Duty exemption for domestic suppliers producing capital goods

needed for expansion of existing mega or ultra mega power projects.

2. Full exemption from basic Customs Duty to bio-asphalt and specified machinery for

application in the construction of national highways.

• Others

1. Gives 3 percent interest subsidy to farmers in 2011-12.

2. Cold storage chains to be given sub sector of infrastructure status.

3. Fiscal deficit seen at 5.1 percent of GDP in 2010-11.

4. Disinvestment in 2011-12 seen at 400 billion rupees.

5. A new revised income tax return form 'Sugam' to be introduced for small tax papers.

6. Old age pension to persons of over the age of 80 raised from Rs. 200 to Rs. 500

Das könnte Ihnen auch gefallen

- Dagdha Rashi Use in AstrologyDokument4 SeitenDagdha Rashi Use in AstrologyVikky Vasvani100% (1)

- House of The FatherDokument2 SeitenHouse of The FatherVikky VasvaniNoch keine Bewertungen

- Ibc 2016 PDFDokument33 SeitenIbc 2016 PDFVikky VasvaniNoch keine Bewertungen

- Input Tax Credit GSTDokument21 SeitenInput Tax Credit GSTVikky VasvaniNoch keine Bewertungen

- GTPL Annual Report 2017Dokument208 SeitenGTPL Annual Report 2017Vikky VasvaniNoch keine Bewertungen

- The Chartered Accountant Oct 11Dokument144 SeitenThe Chartered Accountant Oct 11Vikky Vasvani100% (1)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- English - Unseen PassageDokument3 SeitenEnglish - Unseen PassagemmddNoch keine Bewertungen

- 3 Cornmill Project Presentation - MakinaSaka2015Dokument17 Seiten3 Cornmill Project Presentation - MakinaSaka2015The Municipal AgriculturistNoch keine Bewertungen

- The Syngenta Challenge 2012 CaseDokument8 SeitenThe Syngenta Challenge 2012 CaseAbhinav VarunNoch keine Bewertungen

- GrapeDokument70 SeitenGrapeananiya dawitNoch keine Bewertungen

- Vijay Kumar Kaushik and N.C.PahariaDokument8 SeitenVijay Kumar Kaushik and N.C.PahariaPoornima ANoch keine Bewertungen

- Pulp & PaperDokument42 SeitenPulp & PaperGautam SharmaNoch keine Bewertungen

- Anonymous 2007. LOHMANNDokument8 SeitenAnonymous 2007. LOHMANNYoyok WiyonoNoch keine Bewertungen

- FSSAI Final Version Jul 29Dokument74 SeitenFSSAI Final Version Jul 29PradeepMathadNoch keine Bewertungen

- Dairy DevelopmentDokument100 SeitenDairy DevelopmentidkrishnaNoch keine Bewertungen

- Measurement and Use of PH and Electrical Conductivity For Soil Quality Analysis.Dokument17 SeitenMeasurement and Use of PH and Electrical Conductivity For Soil Quality Analysis.Salomon Saravia TorresNoch keine Bewertungen

- Silk Fiber BookDokument28 SeitenSilk Fiber BookMorgan Mccarty100% (1)

- Sandbox Samana Competition BriefDokument17 SeitenSandbox Samana Competition Brief박성진Noch keine Bewertungen

- Grand Coulee DamDokument49 SeitenGrand Coulee DamIrene Jaye Yusi100% (1)

- Persuasive Speech OutlineDokument5 SeitenPersuasive Speech Outlineapi-253462060Noch keine Bewertungen

- Hotspots Magazine - 2015-02-01Dokument100 SeitenHotspots Magazine - 2015-02-01Holstein PlazaNoch keine Bewertungen

- Classification Feed and FodderDokument4 SeitenClassification Feed and FoddermathiNoch keine Bewertungen

- Poultry, Fisheries, Apiculture and Sericulture PDFDokument280 SeitenPoultry, Fisheries, Apiculture and Sericulture PDFAli100% (1)

- Apricot Diseases Diagnostic Key PDFDokument2 SeitenApricot Diseases Diagnostic Key PDFkhouchaymiNoch keine Bewertungen

- Ra 8550 PDFDokument32 SeitenRa 8550 PDFVance CeballosNoch keine Bewertungen

- CanadaDokument86 SeitenCanadasameergarg04Noch keine Bewertungen

- Automated Indoor FarmingDokument16 SeitenAutomated Indoor Farmingpranay rajuNoch keine Bewertungen

- 15 Eco TourismDokument8 Seiten15 Eco TourismManoj SatheNoch keine Bewertungen

- Nestle Corporate Social Responsibility in Latin AmericaDokument68 SeitenNestle Corporate Social Responsibility in Latin AmericaLilly SivapirakhasamNoch keine Bewertungen

- Distance Learning Wheat WorksheetDokument2 SeitenDistance Learning Wheat WorksheetEydis KershawNoch keine Bewertungen

- SanMark Masons Training ManualDokument44 SeitenSanMark Masons Training ManualMarian MihalacheNoch keine Bewertungen

- 52-Week Seedless Grapes: AllisonDokument2 Seiten52-Week Seedless Grapes: AllisonFiderman Szabolcs100% (1)

- The Effects of Land Tenure Policy On Rural Livelihoods and Food Sufficiency in The Upland Village of Que, North Central VietnamDokument2 SeitenThe Effects of Land Tenure Policy On Rural Livelihoods and Food Sufficiency in The Upland Village of Que, North Central VietnamNguyễn ThùyNoch keine Bewertungen

- CHR Hansen Q3 Roadshow Presentation 201819 PDFDokument38 SeitenCHR Hansen Q3 Roadshow Presentation 201819 PDFAravind100% (1)

- Fiber Pancakes-3Dokument23 SeitenFiber Pancakes-3api-384617170Noch keine Bewertungen