Beruflich Dokumente

Kultur Dokumente

Indian Food Industry

Hochgeladen von

Rahul DwivediOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indian Food Industry

Hochgeladen von

Rahul DwivediCopyright:

Verfügbare Formate

Indian Processed Food Industry

Sector Coverage

April 15, 2008

Opportunities Galore

Industry Overview

Global Processed Food Industry

Indian Processed Food Industry

Processed Food Industry - A Sunrise sector

Where the opportunity lies- areas for investment

Industry Analysis

Driving Forces

Major Challenges

Indian Food Processing Industry by sectors

Diary

Fruits and Vegetable

Grains

Meat and Poultry

Fish

Packaged/Convenience Food

Aerated Soft Drinks, Packaged drinking

water

Exports

FDI in Food Processing

Government Regulation and support

Regulatory framework

Outlook

Initiating Coverage

Lakshmi Energy & Foods

Ruchi Soya

Analyst - Nisha Harchekar

nishaharchekar@way2wealth.com

Sectors - FMCG, Pharma, Entertainment

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Executive Summary

The size of global processed food industry is estimated to be valued around US $3.6 trillion

and accounts for three-fourth of the global food sales. Despite its large size, only 6% of

processed foods are traded across borders compared to 16% of major bulk agricultural

commodities. Indian food-processing industry is miniscule in comparison and is estimated to

be US $40 billion and is likely to grow at over 10%, on the basis of an expected GDP growth

Ruchi Soya rate of 8-8.5% p.a.

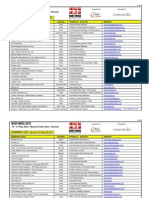

FY09(E) With enormous scope for value addition, increase in the consumption of processed food

CMP (Rs) 86 products in India and many fiscal incentives being planned by the government, this sector is

Marketcap (Rs poised to maintain the growth momentum in the future. Moreover, the advent of the WTO

crores) 1570 regime and the possibility of reduced subsidies in developed countries can add to India’s

PE (x) 6.8 strengths in food production and processing industry.

Mktcap/sales (x) 0.1 India accounts for less than 1.5% of international food trade despite being one of the

EV/EBITDA (x) 5.3 world’s major food producers, which indicates huge potential for both investors and

RoCE (%) 16.8 exporters. With rapid increase in the per capita income and purchasing power along with

RoNW (%) 15.0 increased urbanization, improved standards of living, there lies a large untapped

opportunity to cater to 1000 million domestic consumers. It is estimated that 300 million

upper and middle class consume processed food. With the convenience needs of dual

income families, 200 million more consumers are expected to move to processed food by

Lakshmi Energy & Foods 2010. The market size for the processed foods is thus bound to increase from US $102

billion currently to US $330 billion by 2014-15 assuming a growth of 10%. The share of the

FY09(E) value added products in processed foods would almost double from US $44 billion currently

CMP (Rs) 200 to US $88 billion during the same period, growing at the rate of 15%. This presents

Marketcap (Rs enormous opportunities for investment in processed food sector.

crores) 1200

Several global food giants and leading Indian industrial enterprises are already making their

PE (x) 7.2

presence felt in a big way in the sector. Some of them are Nestle India, Cadbury's India,

Mktcap/sales (x) 0.9 Kelloggs, Hindustan Unilever, ITC-Agro, Godrej Foods and MTR Foods.

EV/EBITDA (x) 4.4

RoCE (%) 29.3 It is estimated that the food production in India is likely to grow two-fold in the next ten

RoNW (%) 35.5 years. Thus, there is ample of opportunities for investments in food and food-processing

technologies, equipments, especially in areas of canning, dairy & food-processing, specialty

processing, packaging, frozen food and thermo processing, cold chains and in the area of

food retail.

Ministry of food processing in its Vision 2015 document has estimated the size of processed

food sector to treble, processing level of perishable to increase from 6% to 20%, value

addition to increase from 20 % to 35% and India’s share in global food trade to increase

from 1.5 % to 3%.

The government’s focus towards food processing industry as a priority sector will ensure

policies to support investment in this sector and attract more FDI. India with its vast pool

of natural resources and growing technical knowledge base has strong comparative

advantages over other nations. According to CII estimates, food-processing sector has the

potential of attracting US $33 billion of investment in 10 years and generate employment

of 9 million person-days. The food-processing sector in India is clearly an attractive sector

for investment and offers significant growth potential to investors.

The report outlines the tremendous growth potential in the sector and various

opportunities for investments. We initiate coverage on Ruchi Soya and Lakshmi Energy &

Foods with a BUY recommendation.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Global Processed Food Industry

The size of global processed food industry is estimated to be valued around US $3.6 trillion

and accounts for three-fourth of the global food sales. Despite its large size, only 6% of

processed foods are traded across borders compared to 16% of major bulk agricultural

commodities. Over 60% of total retail processed food sales in the world are accounted by

Size of global food- the U.S, EU and Japan taken together.

processing industry –

US $3.6 trillion Japan is the largest food processing market in the Asian region, though India and China are

catching up fast and are likely to grow more rapidly. Leading meat-importing countries

namely Japan and South Korea have a developed processed food industry. One of the most

technically advanced food-processing industry globally is Australia as the products

produced are of international standards and at comparatively lower prices. Countries in the

Sub-Sahara African region, Latin America and parts of Asia continue to be on the lower-end

of technology competence in food items. However, Europe, North America, and Japan are

on the higher-end of technology, with a sharper shift towards convenience and diet foods.

Indian Processed Food Industry

Food and Agriculture: An overview

India has the second largest arable land of 161 million hectares and has the highest acreage

under irrigation. Next to China, India ranks second largest food producer in the world and

has the potential to immerge the biggest with its food and agricultural sector. India

accounts for less than 1.5% of international food trade despite being one of the world’s

major food producers, which indicates huge potential for both investors and exporters.

India’s GDP is expected to grow in the range of 8-8.5% in the coming fiscal year, fuelled by

robust investments and buoyant consumer spending. According to Goldman Sachs

India ranks second

projections, India’s GDP will exceed Italy’s in 2020, France’s in 2020, Germany’s in 2025

largest food producer

and Japan’s in 2035.

in the world next to

China The growth estimated is

Year India’s GDP ($ billion)

2005 604

2020 2014

2025 3174

2030 4935

2035 7854

Excessive controls, low public investment, inadequate infrastructure, poor agri-input

management, distorted pricing and incentives structures, and inadequate credit weighed

down India’s agricultural sector for several decades. The share of agriculture in India’s GDP

has fallen by more than 60% in the past five decades. However, the policy environment is

changing with increase in public investment, fading controls on product marketing and

distribution, better price-discovery mechanisms and improvement in credit availability.

Indian agriculture, particularly food processing and allied activities is thus going through a

major transformation with the government targeting 4% growth for the agri-sector from

2005-2020.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Agri GDP growth (%CAGR)

Agri GDP is expected to 4

grow by 4% from 2005- 4.0

3 3.5

2020, which will be

2.7 2.8

beneficial for the food- 2

2.1

processing sector

1

0

Pre Green Green Revolution Wider Tech Post economic The Agri

Revolution 1951- 1965-80 diffusion 1980- reforms 1995-05 challenge 2005-

65 95 20

Source: RBI, Chand (2005): WTO & Indian Agriculture: Issues & Experience

With the upturn of the agriculture sector, lot of opportunities has opened up for players

having strong linking with the entire agri-value chain and the food-processing sector will be

one of the biggest beneficiaries. Supply chain management, cold storages, financing,

retailing and exports are the areas where sizable opportunities are yet to be tapped. The

Government is taking steps to liberalize the agri sector to encourage investments.

Indian agri-business: Key facts

• Varied agro climatic zones

• 2nd largest arable land (161 million hectares) in the world

• Largest irrigated land (55 million hectares) in the world

• Largest producer of wheat (72 million tones), accounting for nearly 15% of global wheat

production

• Largest producer of pulses (15 million tones), accounting for nearly 21% of global pulse

production

• Largest producer of milk (96 million tons), accounting for nearly 17% of global milk

production

• Largest producer and exporter of spices

• 2nd largest producer of tea, accounting for nearly 28% of the global tea production

• 2nd largest producer of rice (92 million tons), accounting for nearly 22% of global Rice

production

• Largest exporter of the world's best basmati rice

• 2nd largest producer of fruits (50 million tons) and vegetables (100 million tons)

• 2nd largest producer of sugarcane (296 million tons), accounting for nearly 21% of the

global sugarcane production

• 3rd largest producer of coarse grains (31 million tons), including maize, accounting for nearly

4% of the global coarse grain production

• 3rd largest producer of edible oilseeds (25 million tons), accounting for nearly 7% of the

global edible oilseed production

Source: FICCI, Ministry of Agriculture

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Processed Food Industry: A sunrise sector

Introduction

Food-processing industry is significant for India’s development because it has important

link and synergy with industry and agriculture, the two main support of the economy. Total

size of food-processing industry is around US $40 billion growing at 10% and the size of

processing sector is estimated to be US $2.53 billion. The industry is mainly unorganized

with 75% of the processing units belonging to the unorganised category, the organised

category though small, is growing fast. The food production is expected to double in the

next 10 years and the consumption of value added food products is expected to grow at a

much faster pace. This growth will benefit the economy, increase agricultural yields,

create employment and raise the standard of living of various associated people. Rising

consumer affluence and economic liberalization is opening up new opportunities in the

sector.

Structure of Indian Food Processing Industry

Organised

The industry is 25% Unorganised

unorganized with 75% 42%

of the processing units

belonging to the

unorganised category

Small Scale

Industries

33%

Source: FAIDA / Ministry of Food Processing Industries

The food-processing industry has been identified as a focus area for development and has

been included in the priority-lending sector. Most of the food-processing industries with the

exception of beer & alcoholic drinks and items reserved for small scale sector, like vinegar,

bread, and bakery have been exempted from the provisions of industrial licensing under

Industries (Development and Regulation) Act, 1951. Automatic approval up to 100% of

equity in case of foreign investment is available for most of the processed food items.

With over 1.10 billion consumers and fourth largest economy in terms of purchasing power

parity, UNCTAD and AT Kearney has ranked India amongst the top three investment

destinations in the world.

Low level of processing

The industry has very low processing level i.e 2.2% for fruits and vegetables, around 35% in

Low level of processing milk, 21% in meat and 6% in poultry products, which is significantly lower by international

leading to wastage standards. For e.g. processing of agriculture produce is around 40% in China, 30% in

Thailand, 70% in Brazil, 78% in the Philippines and 80% in Malaysia. Value addition to

agriculture produce in India is just 20% with wastage estimated to be valued at around US

$13 billion.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Source: FICCI, KPMG report

Processing levels for key Segments in Indian food-processing industry

50%

Fruits & vegetables 40%

have the lowest level 30% 3 5.0 %

of processing. Milk is

the most processed 20%

food item 21.0%

10%

2.2 % 6.0 %

0%

Fruits and M ilk & D airy M eat Poultry

Vegetables Produ cts

Source: Ministry of Food Processing Annual report 2005-06

Food-processing- a growing market

With rapid increase in the per capita income and purchasing power along with increased

urbanization, improved standards of living, there lies a large untapped opportunity to cater

to 1000 million domestic consumers. It is estimated that 300 million upper and middle class

consume processed food. With the convenience needs of dual income families, 200 million

With 1000 million more consumers are expected to move to processed food by 2010. The market size for the

domestic consumers, processed foods is thus bound to increase from US $102 billion currently to US $330 billion

there lies huge by 2014-15 assuming a growth of 10%. The share of the value added products in processed

untapped opportunity foods would almost double from US $44 billion currently to US $88 billion during the same

period, growing at the rate of 15%. This presents enormous opportunities for investment in

processed food sector.

Several global food giants and leading Indian industrial enterprises are already making their

presence felt in a big way in the sector. Some of them are Nestle India, Cadbury's India,

Kelloggs, Hindustan Unilever, ITC-Agro, Godrej Foods and MTR Foods.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

According to Government estimates, Rs 1,000 billion investment is needed in this sector

across all segments of the value chain, from agri inputs to logistics to front-end

infrastructure and distribution, out of which bulk of investment will be from private sector.

As a result, various private corporate houses like Reliance have ventured in this space with

full vigor. Hence, there is immense potential for investment in this sector. To facilitate the

prompt growth of food-processing industry, the Government has implemented the scheme

for infrastructure development comprising a food park scheme, establishing packaging

centers, integrated cold chain facility; value added centers and irrigation facilities.

Where the opportunity lies- areas for investment

It is estimated that the food production in India is likely to grow two-fold in the next ten

years. Thus, there is ample of opportunities for investments in food and food-processing

technologies, equipments, especially in areas of canning, dairy & food-processing, specialty

processing, packaging, frozen food and thermo processing, cold chains and in the area of

food retail.

One of the key reasons for low levels of food processing is poor infrastructure for storage,

marketing and distribution of food products. 25-40% of agri-produce is lost post harvest

season. According to estimates, India’s marketable surplus is set to increase by 350 mtpa to

870 mtpa by 2012. 40% of the increase (150 mtpa) would be accounted by perishable fruits

and vegetables. The need for investments in the areas of infrastructure and supply chain is

Canning, specialty evident from the fact that India’s current storage infrastructure for all food items is only

processing, packaging, 100 mtpa.

frozen food and

thermo processing, The Government has announced various policy and fiscal measures to expand the storage

cold chains are capacity. It has announced 15-25% capital subsidy scheme for facilitating construction of

attractive areas for rural godowns and has also sanctioned 16 mt of new capacity the last five years.

investments

Cold chain

The estimated cold-storage capacity at 19.5 mt is less than 15% of the annual horticulture

production and is mainly dominated by potatoes (80% of capacity). The size of cold chain

industry is estimated to be around US $2.2-2.7 billion and is expected to grow at 20-25%

annually. FDI to the extent of 100% is allowed in the sector. With the rising focus on

horticulture, increasing corporate participation and advent of food parks and agri export

zones is likely to result in significant restructuring of cold storage infrastructure with an

estimated investment of US $8-10 billion.

Voltas, Blue-Star and Kirloskar Pneumatic are some of the cold storage players and

equipments. Radhakrishna Foodland and Snowman Frozen are major providers of cold

storage facilities. Concor is setting up a countrywide network of 14 cold-chain complexes

for horticulture in Delhi, Mumbai and Bangalore among other places.

Supply chain

An efficient supply chain not only brings down the price of the end product but also

eliminates intermediaries by connecting farmers directly to the super stores. It has thus

become an important aspect of organised retail setup. The food supply chain in India is

highly fragmented with numerous intermediaries and lack of economies of scale.

Sophisticated applications such as demand forecasting, data integration, financial flow

management, supply-demand matching, information sharing will enable it to become

mature and efficient.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Food safety management systems

The tightening of restrictions and the introduction of the Sanitary and Phytosanitary

Agreement by global industry bodies like the World Health Organisation (WHO), have led to

increased adherence of safety norms and regulations. Indian companies will have to strictly

adhere to international food safety standards in order to gain a larger share of world trade.

Machinery

In packaging, freshness and hygiene remains a key factor in determining buying by

consumers. In recent times, a number of new technologies have emerged both in

processing and packaging, which have made an impact on the shelf life of food products.

Food parks

30 mega food parks with investments of around US $110 million are coming up across the

country to attract FDI in the food-processing sector. The food parks will have facilities

ranging from cold storage, sorting, grading, food-processing, packaging and quality control,

and R&D laboratories. The government for these food parks has identified Maharashtra,

Andhra Pradesh, Punjab and Jharkhand and one Northeast region.

Food retail

Food and groceries form major portion (75%) of the retail pie. However, it has the lowest

level of penetration of 1% in organized retail. Branded foods market size is growing at 15-

20%. Players have outlined major expansion plans recognizing the opportunity.

Player expansion plans

Current Expansion Expected

Player Format

outlets Plans year

More (Supermarket) 14 1000 2010

Aditya Birla Group

Trinethra Super Retail 1 4 na

Bharti Wal-Mart Wholesale Stores - 15 2012

Express Retail Services Big Apple/Big Apple Fresh 16 100 na

Big names in the retail

Godrej Group Aadhar 31 1000 na

industry have outlined

huge plans in food & Fresh (Flagship

Heritage Foods 12 100 na

groceries segment Stores,Daily Stores

Big Bazar 62 100 na

Pantaloon Food Bazar 95 na na

KB’s Fairprice Value tores - 1500 2009

Reliance Fresh 240 471 2010

Reliance Retail Hypermarket 2 500 2010

Reliance Town Centres - 784 2010

Spencer’s (Fresh, Express,

RPG 200 5000 2011

Daily, Super, Hyper)

Sahakari Bhandar Sahakari Bhandar 18 na na

Subhiksha Subhiksha 870 150 2009

Wadhan Food Retail

Super Local, Express 84 1500 2010

(Spinach)

Source: Media report

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Industry Analysis

Driving Forces

Abundant availability of raw material

India has varied agro climatic conditions; it has a wide-ranging and large raw material base

suitable for food-processing industries. It has a vast coastline of 8000 km, vast marine land

with 10 major ports. India produces annually 90 million tones of milk (highest in the world),

150 million tones of fruits and vegetables (second largest), 485 million livestock (largest),

204 million tones food grain (third largest), 6.3 million tones fish (third largest), 489 million

poultry and 45,200 million eggs. India's agricultural production base is huge.

With huge agriculture India- Competitive edge

production base, Share in global production Global

cheap labour force, India (%) Rank

lower cost of

production, India has Arable Land (million hectare) 161 2

a competitive edge Irrigated Land (million hectare) 55 1

over others Coast line (km) 8,000 19

Major Food Crops (MT) 35 4 3

Fruits (MT) 50 10 2

Vegetables (MT) 100 10 2

Rice/Paddy (MT) 92 22 2

Wheat (MT) 72 15 1

Milk (MT) 90 17 1

Sugarcane (MT) 296 21 2

Pulses (MT) 31 4 3

Tea (MT) 28 2

Edible Oil seed (MT) 25 7 3

Cattle (million) 485 16 1

Source: FICCI, Ministry of Agriculture

Low cost production base for domestic and export market can be set up considering India’s

comparatively cheap labour force and lower cost of production. India has access to

significant investments to facilitate food-processing industry.

Demographic trends

The food-processing industry has a bright future due to demographic environment in India,

which is a key positive.

Favorable

demographic Rising income levels leading to large customer base

environment works in India with its population of more than 1 billion accounts for close to 17% of the global

favour of the population. It is one of the most attractive consumer markets in the world with the

industry increase in income levels across the population segments. Food and grocery comprise the

largest share of the spending pie followed by personal care items, thus offering a lot of

scope for the food-processing industry. According to NCAER data, the consuming class, with

an annual income of US $980 (Rs 45,000) or above, is growing and is expected to constitute

over 80% of the population by 2009-10. The increase in income levels and higher tendency

to spend provides great opportunities for companies across various sectors.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

200

12.8

15.3

23.4

150 33.0 28.1

74.1 Destitutes (<$327)

44.0 Aspirants ($327-$449)

100 Climbers ($449-$915)

71.6

Consumers ($915-$4388)

54.1 Very Rich (>$4388)

50 90.9

54.6

32.5

0 1.0 2.0 6.0

1997-98 2000-01 2006-07

Growing consuming class (million households-annual income)

The Rupee Spending

3% 4%

6%

3%

7%

57%

Food and grocery

takes away 57% from 5%

the consumer’s wallet

9%

1%

5%

Food and grocery Personal Care items

Home Textiles Savings & Investments

Clothing, Footwear and Accessories Consumer Durable/ Appliances

vacation Eating out

Movies and Entertainment Books and Music

Source: NCAER

Relatively young population

India has a relatively young population with close to 55% of population in the age group of

20- 59 years. This group is also high in consumption and therefore, this trend is expected to

provide a further boost to the growth of consumption in India.

Changing lifestyles

Increase in literacy and exposure to western lifestyles by more and more urban consumers

have led to change in mindset and preference. Increase in the population of working

women and increase in nuclear double income families in urban areas are some of the

other factors that are influencing the lifestyles. As a result, there has been an increase in

demand for processed, ready-to-cook and ready-to-eat food. According to Euromonitor,

money spend by Indians on meals outside the home has more than doubled in the past

decade to about US $5 billion a year, and is expected to further double in the next 5 years.

Thus, there lies significant growth potential for the sector and its investment

attractiveness.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Increase in consuming class in rural areas

Nearly 70% of India’s population resides in rural areas and account for nearly 50% of India’s

Rural areas cannot be consumption. Even with increasing urbanization and migration it is estimated that 63% of

ignored as it accounts India's population will continue to live in rural areas in 2025. Average income levels for

for 50% of India’s rural India will increase with higher agri-incomes and a gradual shift from farm to non-farm

employment. 37% of rural households could move into the middle income-and-above

consumption

consuming class by 2010 according to NCAER survey from just 15-17% in the late 1990s. This

will result in a consuming class of 56 million rural households by 2010 more than half of

India's overall estimated middle class by this time. This will open up vast and relatively

unexplored section of India to companies.

Major Challenges for the Indian Food Industry

Food-processing industry is facing constraints like non-availability of adequate

infrastructural facilities, lack of adequate quality control & testing infrastructure,

inefficient supply chain, seasonality of raw material, high inventory carrying cost, high

taxation, high packaging cost, affordability and cultural preference of fresh food.

Unprocessed foods are prone to spoilage by biochemical processes, microbial attack and

The industry needs to infestation. Good processing techniques, packaging, transportation and storage can play an

overcome various important role in reducing spoilage and extending shelf life. The challenge is to retain the

challenges if it has to nutritional value, aroma, flavour and texture of foods, and presenting them in near natural

grow to the estimated form with added conveniences. Processed foods need to be offered to the consumer in

levels. hygienic and attractive packaging, and at low incremental costs.

Major Challenges for the Indian Food Processing Industry are:

• Consumer education on nutritional facts of processed foods

• Low price-elasticity for processed food products

• Need for distribution network and cold chain

• Backward-forward integration from farm to consumers

• Development of marketing channels

• Development of linkages between industry, government and institutions

• Taxation in line with other nations

• Streamlining of food laws

Indian Food Processing Industry by sectors

India's food-processing sector covers fruit and vegetables; meat and poultry; milk and milk

products, alcoholic beverages, fisheries, plantation, grain processing and other consumer

product groups like confectionery, chocolates and cocoa products, soya-based products,

mineral water, high protein foods etc. The most promising sub-sectors includes- soft-drink

bottling, confectionery manufacture, fishing, aquaculture, grain-milling and grain-based

products, meat and poultry processing, alcoholic beverages, milk processing, tomato paste,

fast food, ready-to-eat breakfast cereals, food additives, flavors etc. Health food and

health food supplement is another rapidly rising segment of this industry, which is gaining

vast popularity amongst the health conscious.

The dairy sector has an estimated consumer demand for milk and milk products at Rs 1,400

billion, growing at about 8% p.a. Poultry meat is estimated to have production of 1.8

million tones, growing at a CAGR of 11%. Besides, ready-to-eat (RTE) industry, still nascent

in India, is estimated to be about Rs 5 billion growing at 30% p.a and expected to cross Rs

15 billion by 2010. The wine sector, is growing at about 50% p.a is expected to have a

market size of Rs 20 billion by 2010.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Segmentation of various sectors in the industry

Sectors Products

Dairy Whole milk powder, skimmed milk powder, condensed milk,

ice cream, butter and ghee, cheese

Fruits &

Beverages, juices, concentrates, pulps, slices, frozen &

Vegetables

dehydrated products, potato wafers/chips, etc

Grains &

Flour, bakeries, starch glucose, cornflakes, malted foods,

Cereals

vermicelli, beer and malt extracts, grain based alcohol

Fisheries

Frozen & canned products mainly in fresh form

Meat & Poultry

Frozen and packed - mainly in fresh form, Egg Powder

Consumer

Snack food, namkeens, biscuits, ready to eat food, alcoholic

Foods

and non-alcoholic beverages

Dairy

Milk and milk products is rated as one of the most promising sectors in the processed food

industry. India is the largest producer of milk in the world with production of 97.1 million

tones in 2005-06, growing at a CAGR of 4%. According to estimates by Dairy India, the size

of the Indian dairy market is Rs 2,27,340 crores, which is expected to more than double to

Rs 5,20,780 crores by 2011. India’s total milk production is projected to cross 100 million

tones by end of 2007 according to the tenth five-year plan estimates. Milk and milk

products account for a significant 17% of India’s total expenditure on food. India is on the

verge of assuming an important position in the global dairy industry.

Production and Per capita availability of milk

Milk and milk products

Per capita availability

is rated as the most Production in million tonnes

Year (grams / day)

promising sectors and

1950-51 124 17

is expected to more

than double by 2011. 1960-61 124 20

1970-71 112 22

1980-81 128 31.6

1990-91 176 53.9

2000-01 220 80.6

2001-02 225 84.4

2002-03 230 86.2

2003-04 231 88.1

2004-05 233 92.5

2005-06 241 97.1

2006-07 245 100

* Provisional

Source: department of Animal Husbandary and dairying

About 35% of milk produced in India is processed. The organized sector comprising of large

dairy plants processes about 13 million tones, whereas the unorganised sector (halwaiis and

vendors) process about 22 mtpa.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Milk Uses in India

22% Value Added (Unorganised)

Vlaue Added (organised)

7%

Packed liquid Milk

63%

8%

Unprocessed

Source: Cygnus

The traditional dairy products are India’s largest selling and profitable segment and

accounts for more than 50% of milk and dairy products. With liberalisation, the import of

technology and machinery has effected modernization and technological breakthrough in

production of traditional milk products and this has encouraged the growth of the

organized sector in the dairy segment.

As per estimates by dairy India 2007, by 2011 private dairies are slated to outpace the co-

operative sector and become the largest producers of milk in the industry. Private dairies

Big names like are likely to contribute double the quantity of milk that would be contributed by co-

Reliance, Walmart, operatives in 2011. Many corporates are planning a foray into the dairy business sensing the

Dabur are entering the big opportunity. Reliance and Walmart have already made an entry into this business by

private diary sector signing deals with farmers to procure 7 lakh litres and 15 lakh litres of milk per day. Dabur

through tie ups with India is exploring the possibility of entering into the milk-based drink segment. Yakult

farmers Danone plans to launch health drinks and yoghurts based on probiotics bacteria. Amul has

also forayed into the flavored yoghurt segment.

The 55,000 tpa branded butter market, valued at US $133 million is estimated to be

growing at 8-10% pa. The cheese market is estimated to be US $110 million in value terms

and an estimated 54,000 tones in volume terms, and has been growing at a CAGR of 8-9%

during 1999- 2003. The ice-cream market in India is estimated to be about US $199 million

pa.

Major Players

The packaged milk segment is dominated by the dairy cooperatives. Gujarat Co-operative

Milk Marketing Federation (GCMMF) is the largest player. All other local dairy cooperatives

have their local brands (For e.g. Gokul, Warana in Maharashtra, Saras in Rajasthan, Verka

in Punjab, Vijaya in Andhra Pradesh, Aavin in Tamil Nadu, etc). Other private players

include J. K Dairy, Heritage Foods, Indiana Dairy, Dairy Specialties, etc.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Some of the major dairy products manufacturers in the country

Company Brands Major Products

Milkmaid, Cerelac, Sweetened condensed

Nestle India Lactogen, Milo, milk, malted foods, milk

Everyday powder and Dairy whitener

Butter, Ghee, milk powder,

Milkfood Milkfood ice cream, and other milk

products

Malted Milkfood, ghee,

GlaxoSmithKline Horlicks, Boost, butter, powdered milk,

Consumer Healthcare Maltova, Viva milk fluid and other milk

based baby foods

Skimmed milk powder,

Indana, Kream

Kwality Dairy (India) whole milk powder, dairy

Kountry

milk whitener, Ghee

Gujarat Co-operative Milk, Butter, cheese, Ghee,

Milk Marketing Amul Ice cream and other milk

Federation products

Farex, Complan,

Infant Milkfood, malted

H.J. Heinz Glactose, Bonniemix,

Milkfood

Vitamilk

Milk, Curd, Ghee, Butter

Heritage Foods Heritage

Milk

Flavoured milk, cheese,

Britannia Milkman

Milk Powder, Ghee

Cadbury Bournvita Malted food

Milk, Ice Cream, milk

Mother Dairy Mother Dairy

products

Source: Company website

Fruits and Vegetable Processing

India is the 2nd largest producer of fruits (50 million tones) and vegetables (100 million

tones). The installed capacity of fruit and vegetable processing industry has increased from

F&V processing is still

11.08 lakh tones in 1993 to 21.18 lakh tones in 2006. The industry is still nascent and just

at its nascent stage

about 2.2% of the total output of fruits and vegetables is processed as per estimates. The

with processing level

country's share in the world trade of processed fruits and vegetables is still less than 1%.

of only 2.2% of total

Likewise, the consumption of value added fruits and vegetables are also low compared to

output

the primary processed food in general and fresh fruits and vegetables in particular. This

throws up a huge opportunity for the sector through increased penetration in the domestic

market. The government expects the processing in this sector to grow to 10% in 2010 and

25% of the total produce by 2025.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Fruit & Vegetable exports (Rs crores)

1800

1600

1400

1200

1000

800

600

400

200

0

2001-02 2002-03 2003-04 2005-06

Source: APEDA

Major players

Company Brands Products

Kissan, Knorr, Jams, Ketchups, wheat flour,

HUL

Annapurna, Fruit Beverages, soups

Real, Real Activ,

Dabur India Fruit Beverages

Coolers

Frozen processed fruits and

Mother Dairy (Safal) Safal

vegetables, Jam, Pickle

Temptation Foods Pure Temptation IQF fruits and vegetables,

Godrej F&B Fruit Juices, Fresh F&V (Retail)

Capital Foods Private Label Frozen Foods, IQF Vegetables

Mafco Mafco Frozen fruits and vegetables

Priya Foods Priya Pickles, Fruit Juices

Frozen Foods, Pickles, spices &

MTR Foods MTR

masala

Allana Cold Storage Allana Frozen Foods

Grains

India produces more than 200 million tones of different food grains every year. All major

grains like rice, wheat, maize, barley and millets like jowar (great millet), bajra (pearl

millet) & ragi (finger millet) are produced in India. About 15% of the annual production of

wheat is converted into wheat products. There are 10,000 pulse mills in the country with a

milling capacity of 14 million tones, milling about 75% of annual pulse production of 14

million tones.

Rice- most processed grain

Branded rice is India is the second largest rice producer in the world with a 20% share in world rice

growing at 15% in production. The total rice market in India is estimated to be worth around Rs 1,00,000

domestic market and crores (growing at 3-4% annually) of which only 10% of the rice is branded. The branded

25% in international rice sales have taken off in recent years and have been growing at around 15% in the

market domestic market compared to 5% for unbranded rice. The branded rice sales growth is an

impressive 25% in the international market as compared to stagnant sales of unbranded

rice. Added to this, of the Rs 3,500 crores worth of basmati rice produced, only around Rs

500 crores worth is sold in branded form.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

While the total rice market is growing at 3-4% p.a, the basmati rice category is growing at

6%, indicating a latent robustness in the country’s consumption. India is the largest

producer and exporter of basmati rice accounting for around 74% of the global production.

Indian basmati rice commands premium over its traditional rivals in terms of prices and

quality. India produces around 2 million tones of basmati p.a, around 50% of India’s total

basmati production is consumed within, while the rest is exported.

In d ia n B a s m a ti R ic e E x p o rt D e s tin a tio n s

0 .7

0 .6

0 .5

0 .4

MMT

0 .3

0 .2

0 .1

0

Saudi K u w a it UAE UK USA O th e r s

A r a b ia

Source: Rice India January 2006

India exports around one million tones of basmati rice every year. Saudi Arabia comprises

60% of the exports. Pakistan is India’s sole basmati competitor in the international market.

The country wise breakup of exports is given in the figure below.

Outlook

The demand for basmati rice is expected to grow for the following reasons:

Growth in world population from 6.2 billion in 2002 to more than 8 billion in 2030;

growth in the Indian population from 1.1 billion in 2005 at 1.7% p.a

Growing per capita incomes, rising disposable surpluses, increasing consumerism and

increase in the share of organised retail. The Indian retail space is also experiencing

enormous growth in retail chains and malls

Rising disposable incomes are growing branded volumes. Demand for branded rice is

likely to grow at around 15%

Basmati accounts for only 2% of India’s Rs 1,000 billion rice market by volume and

about 5% by value, signifying a huge growth potential

The median age of the Indian population is one of the youngest in the world, averaging

around 24, complemented by an increase in income levels, which could translate into

encouraging spending patterns

A rising number of Indian expatriates as well as a growing preference for basmati in the

Middle East are likely to keep demand on the boil

Recent projections made by the IMPACT model developed at the International Food

Policy Research Institute (IFPRI) indicate that the demand for rice will increase by 1.1%

annually over the next three decades

Branded rice is becoming popular in both the domestic as well as the export market.

Indian Basmati rice commands a premium in the international market. This segment thus

offers opportunities in marketing of branded grains, as well as grains processing.

The global rice trade is expected to grow at 2-3% p.a over the next 10 years,

strengthening production to around 34 million tones by 2014. Basmati is expected to

maintain a robust growth of over 6% in the medium-to-long term.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Major players

Company Brands Products

India Gate, Lion, Doon, Bemisal, Nur

KRBL Rice

Jahan, Rice King, Taj Mahal

Rice, Convenience

Kohinoor Foods Kohinoor,

Food

Daawat, Heritage, Orange, Josh,

LT Overseas Rice, Wheat

Apsara,

Lakshmi Energy

Lakshmi Foods Rice, Wheat

and Foods

Usher Agro Rasoi Raa Rice, Cereals

Kasauti, Real Magic, Mr Miller,

REI Agro Rice

Hungama, Ikon, Hansraj, Rain Drop

Meat and poultry processing

At 485 million India has the world’s largest livestock population- accounting for over 55%

and 16% of the world’s buffalo and cattle populations respectively (the world’s largest

bovine population). It ranks second in goats, third in sheep and camels, and seventh in

poultry populations in the world.

Processing of meat products is licensed under Meat Food Products Order, (MFPO), 1973.

Total meat production in the country is estimated at 5 million tones annually. Indian

consumer prefers to buy freshly cut meat, rather than processed or frozen meat. A mere

6% of production of poultry meat is sold in processed form. Of this, only about 1%

undergoes processing into value added products (Ready-to- eat/ Ready-to-cook). Processing

Low preference level

of large animals is largely for the purpose of exports. This is because of low processing of

for frozen meat has

value added meat products and consumer preference for fresh meat. The total processing

resulted in only 6% of

capacity in India is over 1 million tones p.a of which 40-50% is utilized.

poultry meat sold in

processed form In meat & meat processing sector, poultry meat is the fastest growing animal protein in

India. The estimated production is 15,00,000 tones growing at CAGR of 13% through 1991-

2005. India ranks among the top six egg producing countries and ranks among the top five

chicken producing countries. Per capita consumption has grown from 870 grams in 2000 to

about 1.68 kg in 2005. This is expected to grow to 2 kg in 2009. Growth in Buffalo meat

production has been less rapid (CAGR of 5% in the last 6 years). The current production

levels are estimated at 1.9 million mt. Of this about 21% is exported. Mutton and lamb is

relatively small segment where demand is outstripping supply, which explains the high

prices in domestic market. The production levels have been almost constant at 950,000 mt

with annual exports of less than 10,000 mt. This has restricted large processing companies

from developing business interests in this sector.

Details of exports in terms of quantity and value of meat products are given below:

Quantity in mts and value in Rs crores

Items 2001-02 2002-03 2003-04 2004-05

Qty. Value Qty. Value Qty. Value Qty. Value

Buffalo meat 243355.58 1144.42 297897.3 1305.45 343817.1 1536.77 306970.81 1615.59

Sheep/ Goat meat 3915.06 33.07 4973.55 39.95 16820.53 110.39 8885.28 79.36

Poultry Products 19876.02 130.07 26450.01 156.47 415228.2 202.4 264607.54 154.11

Animal casings 464.28 9.63 8296.17 140.27 732.84 12.43 552.33 12.57

Processed Meat 267.13 1.29 669.48 4.8 986.13 7.63 107.45 1.57

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Country-wise Exports of Meat Products in Value Terms (April 06-March 07)

8%

8%

Philippines

7% Saudi Arabia

UAE

54%

14%

Malaysia

Angola

9% Others

Source: CMIE

Processed meat has India exports more than 5,00,000 mt of meat of which major share is buffalo meat. Indian

huge potential with buffalo meat is witnessing strong demand in international markets due to its lean character

rising number of fast and near organic nature.

food outlets and is

expected to double in The total processed meat production in India is likely to double in the next 10 years and

next 10 years has a huge potential with the growing number of fast food outlets in the country. With the

rise in per capita incomes and busy lifestyles, the demand for processed meat products,

which can be quickly cooked, has been rising. Most of the production of meat and meat

products continues to be in the unorganised sector. Branded products like Venky’s and

Godrej’s Real Chicken are, however, becoming popular in the domestic market.

Fish Processing

India is the third largest fish producer in the world and is second in inland fish production.

Fish production in the country has increased from 0.75 mt in 1950-51 to 6.50 mt in 2005-06.

In 2005-06, it contributed about 1% of the total GDP and 5.3% of the GDP from agriculture

sector. The geographic base of Indian marine fisheries has 8,118 km. coastline, 2.02 million

sq.km. of exclusive economic zone including 0.5 million sq. km. of continental shelf, and

3,937 fishing villages. India is endowed with rich fishery resources and has vast potential

for fishes from both inland and marine resources.

Processing of fish into canned and frozen forms is carried out almost entirely for the export

market. It is widely felt that India’s substantial fishery resources are under-utilised and

there is tremendous potential to increase the output of this sector. The potential could be

gauged by the fact that against fish production potential in the exclusive economic zone of

3.9 million tones, actual catch is to the tune of 2.87 million tones. Harvesting from inland

sources is around 2.7 million tones. In last six years there was substantial investment in

fisheries to the tune of Rs 3,000 crores of which foreign investments were of the order of

Rs 700.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Production and export of marine products

Fish production Export of marine

Year (million tones) products

Quantity

Marin ('000 Value

e Inland Total tones) (Rs crores)

1950-51 0.5 0.2 0.7 20 2

1960-61 0.9 0.3 1.2 20 4

1970-71 1.1 0.7 1.8 40 35

1980-81 1.5 0.9 2.4 80 235

1990-91 2.3 1.5 3.8 140 893

2000-01 2.8 2.8 5.6 503 6288

2002-03 3 3.2 6.2 521 6793

2003-04 3 3.4 6.4 412 6086

2004-05 3.52 2.78 6.3 482 6460

2005-06(P) 3.76 2.81 6.57 551 7019

Source: Department of Animal Husbandry, Dairying and Fisheries

Major players in meat, poultry and fisheries

Company Brands Products

Arambagh Hatcheries Arambagh Meat, Poultry

Frozen buffalo meat, Chilled/

Hind Industries Sibaco,Eatco

Frozen sheep and Goat meat

Venkateshwara

Venky's Poultry products

Hatcheries

Alkabeer Exports

Alkabeer Frozen buffalo meat, Chilled/

Limited

ASF Seafoods ASF Seafoods Seafood

Bell Foods Bell Foods Marine foods

Frigo Refico Allana Allana Frozen buffalo and other meat

Godrej Agrovet Real Good Chicken Poultry products

MAFCO, Mumbai MAFCO Pork and other meat products

Packaged/Convenience Food

This segment mainly comprise of pasta, breads, cakes, pastries, rusks, buns, rolls, noodles,

corn flakes, rice flakes, ready to eat and ready to cook products, biscuits etc. Bread and

biscuits constitute the largest segment of consumer foods. The annual production of bakery

products, which includes bread, biscuits, pastries, cakes, buns, rusk etc, is estimated to be

50 lakh tones in 2004-05 with estimated value of Rs 69 billion. The two major bakery

industries, viz., bread and biscuit account for about 82% (4 million tones) of the total

bakery products. The organised sector has a market share of 45% and the balance 55% is

with the unorganised sector in the baked products. The sectors that are projected to

achieve high growth between 10-20% in 2005-06 in bakery segment include bread, cakes,

pastry which is expected to achieve up to 11% growth and biscuits over 13%.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Biscuits

The size of biscuits market in India is Rs 5,000 crores of which Rs 3,000 crores is accounted

for by the organised sector. Glucose and milk biscuits account for 25% each and Marie

biscuits 20% of the biscuits market.

The biscuit industry in India witnessed annual growth as below:

2003-04 15%

2004-05 14%

2005-06 14%

2006-07 13%

While the growth rate has been stagnating during last 4 years, momentum is expected to

pick up during 2007-08, mainly on account of exemption from central excise duty on

Growth rate of biscuits biscuits with MRP up to Rs 100/per kg, as per Union Budget for 2007-08. Indian Biscuit

is expected to pick up Manufacturers’ Association (IBMA), instrumental in obtaining the excise duty exemption,

from 13-15% during estimates annual growth of around 17-18% in 2007-08. Growth in biscuit marketing has

2003-07 to 17-18% in been achieved, mainly due to improvement in rural market penetration.

2007-08

The per capita consumption of biscuits in our country is only 2.1 kg compared to more than

10 kg in the USA, UK and West European countries and above 4.5 kg in South East Asian

countries like Singapore, Hong Kong, Thailand, Indonesia etc. China has a per capita

consumption of 1.9 kg while in the case of Japan it is estimated at 7.5 kg. This shows the

huge untapped potential of biscuit industry in India. Exports of Biscuit is estimated to

around 10% of the annual production during the year 2006-07

With the entry of big players, the domestic biscuit manufacturing sector is to see a healthy

competition that would ensure good quality products at affordable prices to the consumer.

Exports of biscuits would also pick up. It has already increased with Indian biscuits turning

favourite choice in several Middle East markets. The export of high end products (like

cream biscuits) to former East European countries has also begun to rise. Thus, the biscuit-

manufacturing segment is poised for a stronger growth in the coming days.

Bread

The bread industry with estimated production of 27 lakh tones in 2004-05 is represented by

both the organised and unorganised sectors with 55% and 45% contribution to production.

The overall market size for bread in India is a little over 36 lakh loaves a day, and only one-

third of this is from the organised sector.

The large organised sector players who are prominent in the high and medium-price

segments include Britannia, Modern Industries. Brands like Modem and Britannia are major

players in the bread market and together they account for 90% of the organised bread

market. Local manufacturers with numerous local brands cater to populous segment and

contribute considerably in the bread segment. Low margins, high level of fragmentation

are the main features in the bakery industry. Volumes, brand loyalty and strong

distribution networks are the main drivers of growth.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Major players- Bread, Biscuits

Company Brands Products

Modern Foods Inds Bread

Parle-G, Krackjack,

Parle Biscuits

Manaco, Hide & Seek

Priya Food Products Priya Biscuits

Surya Foods and Agro PriyaGold Biscuits

Britannia Industries Britannia Biscuits, Bread, Cakes

ITC Sunfeast Biscuits

Confectionery

The organised market for confectionery estimated at Rs 2,000 crores is growing at around

7-8% p.a. The retail value of the Indian sugar confectionery market, which includes

products such as sweets, jellies and gums, is estimated to be US $461 million in 2007 and is

Sugar confectionery projected to reach US $498 million in 2008. The yearly growth rate from 2002 to 2006 was

market is projected 7.2%. The Indian candy market is currently valued at around US $664 million, with about

to expand at a CAGR 70% in sugar confectionery and the remaining 30%, in chocolate confectionery. The Indian

of 8% until 2011 sugar confectionery market is projected to expand at a CAGR of 8% until 2011, according to

a study by Euromonitor International. Two major players namely Cadbury India and Nestle

India, which together account for about 90% of the total chocolate market, dominate the

chocolate market in India.

Increase in affluent consumers who show a tendency for impulse purchases of products

such as sugar confectionery, the development of supermarkets, hypermarkets and

convenience stores coupled with the trend towards higher allowances for children are

likely to be the primary growth drivers for sugar confectionery.

Major players

Company Brands

Dairy Milk, Eclairs,

Cadbury India

Gems,Temptations,Celebrations, Nutties

Candico (I) Loco Poco, Koffi Toffi, Gumbo Jumbo

Lotte India Corp Coffee bite, Lacto King, Caramilk, Coconut Punch

Nestle India Kit Kat, Milky Bar

Parle Melody, Poppins, Kismi, Mangobite

Mentos, Centerfresh, Alpenliebe, Chlormint,

Perfetti

Happydent

Coffee break, Mango Moods, Pan Pasand,

Ravalgaon Sugar Farms

Klearmint

ITC Mint-o, Candyman

Ready-to-eat foods

Ready-to-eat foods market in India is expected to reach Rs 2,900 crores by 2015 from its

present size of Rs 128 crores (2006). The factors contributing to this growth would be

changes like cold chain development, disintermediation, streamlining of taxation,

economies of scale on the supply side, coupled with increasing disposable incomes,

diminishing culinary skills and the rising need for convenience on the demand side. The

ready-to-eat foods market in India has remained under-penetrated owing to factors like

consumers’ penchant for freshness, low affordability and the Indian housewife’s preference

for home cooked food. Packaged foods in India have grown at approximately 7% p.a

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

between 2000-2005, with ready-to-eat foods (RTE) being the fastest growing category at

CAGR 73%. The Indian RTE foods market, canned/preserved segment is more popular,

contributing to approximately 90% of the market and growing at a CAGR of 63% between

2001 and 2006. The chilled and dried ready meal segments are non-existent. The packaged

foods industry in India has not experienced significant growth due to inadequate demand

arising from low household incomes and consumer preference for fresh and home-cooked

food. There is thus a huge untapped market opportunity arising due to rapid demographic

shifts in income, urbanization and proportion of urban working women in India. The

RTE foods is expected industry needs to concentrate on broadening the market and increasing penetration

is growing at CAGR of amongst Indian consumers.

73% and is the fastest

growing category in Major players

packaged food Company Brands Products

segment Dabur India Hommade

Instant mixes, Puries, Pulihora

Priya Foods Priya

paste, Ready to Eat

Ching’s Secret, Smith

Capital Foods Cooking Paste, Sauce & Ketchups

& Jones

Packaged bhel puri chats, chana

Haldirams Haldirams masala, samosa, pakoras, among

others.

ITC Aashirvaad Atta, Bingo,

Ready to eat/cook foods.

Kitchens of India

Indian curries,

MTR MTR

gravies and rice.

Satnam Overseas Ltd Kohinoor Ready to eat Indian delicacies.

Gits Gits Variety of ethnic Indian cuisine

Aerated Soft Drinks, Packaged drinking water

Aerated soft drinks

The soft drinks constitute the 3rd largest packaged food regularly consumed after packed

tea and packed biscuits. The aerated soft drinks industry in India comprises over 100 plants

across all states. It provides direct and indirect industry related employment to over

1,25,000 employees. It has attracted one of the highest foreign direct investments in the

country. It has strong forward and backward linkages with glass, plastic, refrigeration,

sugar and transportation industry. Installed capacity of sweetened/aerated water as on

January 2006 is reported to be 29.60 lakh tons p.a.

Soft drink market overview: Indian soft drink market is valued to be Rs 6,000 crore. The

soft drink market can be broadly divided into two major segments- carbonated soft drink

and non-carbonated soft drink. The carbonated drinks are the mainstay and accounts for

85% of the total soft drink market, however the growth rate has been stagnant and in fact

on declining trend on account of controversial issue of pesticide. Non-carbonated soft drink

category includes sub category like fruit drink, juices, dairy drinks and more. The

preparatory soft drink market is around Rs 250 crores, out of which Rasna has almost 90%

volume share.

Packaged drinking water

There are 218 companies, which have been granted licence for manufacturing packaged

drinking water and packaged natural mineral water. There has been a spurt in growth for

the last 3-4 years, which can largely be attributed to a range of various packaged sizes to

suit the consumers. 80% of the packaged water sale comes from the bulk containers (5

litres and above).

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Major Players

Company Brands Products

Pepsi, Miranda,

Soft Drink, Packaged drinking

Pepsi & Co Mountain Dew, 7up,

water

Lehar, Duke’s, Aquafina

Coca Cola, Fanta,

Soft Drink, Packaged drinking

Coke Sprite, Thumps Up,

water

Limca, Kinley

Exports

The Ministry of Food Processing Industries has been encouraging the new processing

capacities for agro-food products through its various policy initiatives and plan schemes

providing financial incentives for setting up of new units and modernization of existing

units. The export of processed food items has been as under:

Export of processed food products

Items 2001-02 2002-03 2003-04 2004-05 2005-06

Qty. Value Qty. Value Qty. Value Qty. Value Qty. Value

Processed Fruits & Vegetables

Dried & Preserved

209157.78 537.15 216640.2 561.03 211160.1 520.49 351034.32 765.75 566238 1459.17

Vegetables

Mango Pulp 76735.18 241.34 96107.31 297.01 89514.84 241.99 90988.6 300.86 134613 364.24

Pickle & Chutney 38758.97 120.34 56384.37 154.16 63052.73 119.75 67193.29 120.58 135382 260.98

Other Processed

61332.36 201.74 54792.77 194.73 66070.26 243.58 80760.5 275.53 107335 370.21

Fruits & Vegetables

Total 385984.29 1100.57 423925 1206.93 429798 1125.81 589976.71 1462.72 501826 1359.54

Animal Products

Buffalo Meat 243355.58 1144.42 297897.3 1305.45 343817.1 1536.77 306970.81 1615.59 459938 2629.57

Sheep/Goat Meat 3915.06 33.07 4973.55 39.95 16820.53 110.39 8885.28 79.36 7177.51 80.37

Poultry Products 19876.02 130.07 26450.01 156.47 415228.2 202.4 264607.54 154.11 145889 167.58

Dairy Products 24774.13 182.45 21439.81 153.59 15882.67 155.19 48426.79 389.14 76515 668.5

Animal Casings 464.28 9.63 8296.17 140.27 732.84 12.43 552.33 12.57 1125 .82 17.51

Processed Meat 267.13 1.29 669.48 4.8 986.13 7.63 107.45 1.56 256.04 2.43

Total 292652.2 1500.93 359726 1800.53 793467 2024.81 629550.2 2252.33 690901 3566.96

Other Processed Foods

Groundnuts 112812.81 250.94 67889.75 178.3 176109.3 544.3 177114.96 503 190053 513.69

Guargum 117883.03 403.09 111948.4 486.74 120561.3 507.9 129648.47 664.28 186718 1049.23

Jaggery &

365893.44 436.49 191522.5 212.98 295013.3 331.48 35549.29 77 107197 227.57

Confectionery

Cocoa Products 1293.38 12.87 1235.21 11.94 1688.37 16.15 2273.85 27.3 2147.09 21.83

Cereal

38087.17 224.67 51809.74 268.83 46275.35 241.71 49486.85 277.77 76880.6 393.96

Preparations

Alcoholic & Non

49671.86 118.29 26164.58 102.47 28964.09 108.62 30045.49 113.78 49587.9 117.2

Alch. Beverages

Miscellaneous

23189.16 137.33 38687.41 170.2 65252.02 210.33 52513.73 224.36 49606.7 225.77

Preparations

Milled Products 322346.5 196.39 499692.8 288.65 545755.4 355.95 140123.27 144.85 50901.5 64.68

Total for other

1031177.35 1780.07 988950.4 1720.11 1279619 2316.44 616755.91 2032.34 713092 2613.93

Processed Foods

Grand Total 1709813.8 4381.57 1772601 4727.57 2502884 5467.06 1836282.82 5747.39 19058197539.43

Source: APEDA

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

FDI

According to industry estimates, the food-processing sector needs investment of about US

$28-35 billion to meet the changing food demands in India. The outlay for the food-

processing segment has been increased from US $19.5 million in 2004-05 to US $41.4 million

next year, more than twice the earlier amount.

FDI in the country's food sector is poised to hit the US $3-billion mark. In the last one-year

alone, FDI approvals in food-processing has doubled. Add to this the US $55 million that has

been invested in sugar and cooking oil companies.

The food-processing sector continues to attract FDI. Details of FDI inflow Since 2000-01 is

as under:

FDI

1500

1250 1036.1

1000

Rs crores

750 510.9 441.0

500

198.1 176.5 174.1 182.9

250 26.0

0

2000- 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08

01(Apr- (Apr-

Mar) Mar)

Source: MOFPI

Maharashtra was among the front-runners to receive the highest share of FDI in food

processing during the last five years. The dairy and consumer industries received FDI worth

Rs 2.7 billion each as foreign investment. Nearly 30% of FDI in the food-processing sector

comes from EU countries such as Netherlands, Germany, Italy and France.

Government Regulation and Support

Since liberalisation several policy measures have been taken with regard to regulation &

control, fiscal policy, export & import, taxation, exchange & interest rate control, export

promotion and incentives to high priority industries. Food-processing and agro industries

have been accorded high priority with a number of important relieves and incentives. Some

of the important policy changes are as follows

Regulation and Control

As per extant policy, FDI up to 100% is permitted under the automatic route in the food

infrastructure (food park, cold chain/warehousing).

Automatic approval to FDI up to 100% equity in FPI sector excluding alcoholic beverages

and a few reserved items.

Foreign investments are allowed in SSI reserved items under an export obligation

(pickles, chutneys, bread, pastry, hard-boiled sugar candy, rapeseed oil, sesame oil,

groundnut oil, sweetened cashew nut products, ground and processed spices other than

spice oil and oleoresin, tapioca sago and its flour).

FDI up to 100% is permitted on the automatic route for distillation & brewing of alcohol

subject to licensing by the appropriate authority.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

No industrial license is required for almost all of the food & agro processing industries

except for some items like: beer, potable alcohol & wines, cane sugar, hydrogenated.

Animal fats & oils etc. and items reserved for exclusive manufacture in the small-scale

sector.

Up to a maximum of 24% foreign equity is allowed in SSI sector

Fiscal policy and taxation:

Rupee is now fully convertible on current account and convertibility on capital account

with unified exchange rate mechanism is foreseen in coming years.

Repatriation of profits is freely permitted in many industries except for some, where

there is an additional requirement of balancing the dividend payments through export

earnings.

Liberal corporate tax policy is applicable for export and domestic earnings, income tax

rebate allowed (100% of profits for five years and 25% of profits for the next five years)

for setting up of new agro-processing industries to process and package fruits &

vegetables.

Fruits & vegetables, and dairy machineries are completely exempt from central excise

duty. Central excise duty on preparation of meat, poultry and fish, pectin, pats and

yeast is also completely exempt.

Quantity restrictions on all food products have been removed. Peak rate of customs

duty has been reduced from 30% to 25% (excluding agricultural and dairy products) and

duty structure on designated items has been rationalized.

Customs duty on refrigerated goods transport vehicles has been reduced form 20% to

10%.

Excise Duty of 16% on dairy machinery has been fully waived off and excise duty on

meat, poultry and fish products has been reduced from 16% to 8%.

Export promotion:

Food-processing industry is one of the thrust areas identified for exports. Free Trade

Zones (FTZ) and Export Processing Zones (EPZ) have been set up with all

infrastructures. Also, setting up of 100% Export Oriented Units (EOU) is encouraged in

other areas. They may import free of duty all types of goods, including capital foods.

Capital goods, including spares up to 20% of the CIF value of the capital goods may be

imported at a concessional rate of customs duty subject to certain export obligations

under the EPCG scheme. Export linked duty free imports are also allowed.

Units in EPZ/FTZ and 100% EOUs can retain 50% of foreign exchange receipts in foreign

currency accounts.

50% of the production of EPZ/FTZ and 100% EOU units is saleable in domestic tariff

area.

All profits from export sales are completely free from corporate taxes. Profits from

such exports are also exempt from MAT.

Agri export zones and food parks

Setting up of 60 agri zones for end-to-end development for export of specific product

from geographically contiguous areas.

53 food parks approved to enable small and medium food and beverage units to set up

and to use capital intensive common facilities such as cold storage, warehouse, quality

control labs, effluent treatment plant, etc.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Regulatory Framework

There are different laws that govern the food-processing sector in India. The prevailing

laws and standards adopted by the Government to verify the quality of food and drugs is

one of the best in the world. Multiple laws/regulations prescribe varied standards regarding

food additives, contaminants, food colours, preservatives and labeling. In order to

rationalize the multiplicity of food laws, a Group of Ministers was recently set up to suggest

legislative and other changes to formulate a modern, integrated food law, which will be a

single reference point in relation to the regulation of food products. The food laws in India

are enforced by the Director General of Health Services, Ministry of Health and Family

Welfare, Government of India (GOI).

Various food laws applicable to food and related products in India are:

Prevention of Food Adulteration Act (PFA), 1954 and Rules (Ministry of Health &

Family Welfare): Covers specifications related to food colour, preservatives, pesticide

residues, packaging and labeling, and regulation of sales. The Standards of Weights

and Measures Act, 1976, and Standards of Weights and Measures (Packaged

Commodities) Rules, 1977: Designed to establish fair trade practices with respect to

packaged commodities

Agriculture Produce (Grading & Marking) Act (Ministry of Rural Development).

Essential Commodities Act, 1955 (Ministry of Food & Consumer Affairs).

Fruit Products Order (FPO), 1995: Specifications and quality control requirements

regarding the production and marketing of processed fruits and vegetables, sweetened

aerated water, vinegar, and synethic syrups.

Meat Food Products Order, 1973 (MFPO): Administers the permissible quantity of

heavy metals, preservatives, and insecticide residues for meat products

Milk and Milk Products Order, 1992: Regulates the production, distribution, and

supply of milk products; establishes sanitary requirements for dairies, machinery, and

premises; and sets quality control standards for milk and milk products.

The Food Safety and Standards Act, 2006: In August 2006, the Government of India

had passed a new legislation Food Safety and Standards Act. The Act proposes

establishment of a new authority, the Food Safety and Standards Authority,

reorganisation of scientific support pertaining to the food chain through the

establishment of an independent risk assessment body and a new Food Law, merging

eight separate Acts.

• The Infant Milk Substitutes, Feeding Bottles and Infant Foods (Regulation of

Production, Supply and Distribution) Act, 1992 and Rules 1993.

• The Insecticide Act, 1968.

• Export (Quality Control and Inspection) Act, 1963.

• Environment Protection Act, 1986.

• Pollution Control (Ministry of Environment and Forests).

• Industrial Licenses.

• BIS Act, 1986.

• VOP (Control) Order – 1947.

• SEO (Control) Order -1967.

WAY2WEALTH Securities Pvt. Ltd.,

15/A Chander Mukhi, Nariman Point, Mumbai - 400 021. Tel: +91 22 4019 2900

email: research@way2wealth.com website: www.way2wealth.com

Indian Processed Food Industry

Opportunities Galore

Sector Coverage

Major Food Processing Companies in India

Indian MNCs likely to

Major MNCs Major Indian companies

enter

Nestle, Pepsi, Coke, Kellogs,

Conagra, Unilever, Perfetti, IT, Dabur, Britannia, Parle, Reliance, Bharti Group,

Glaxo Smithkline, Heinz, Amul, Haldiram, Godrej, Tatas, Wipro, thapars

Wyeth, Ajinomoto, Nissinmet, Venky's etc.

Walmart.

Outlook