Beruflich Dokumente

Kultur Dokumente

European Gas Trading 2010

Hochgeladen von

prabup80Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

European Gas Trading 2010

Hochgeladen von

prabup80Copyright:

Verfügbare Formate

European Gas Trading 2010

This document includes a report participation in exchanges and organized hubs

summary, a table of contents, report of banks, trading houses and other parties.

format and price information, and an Chapter 8 to 14 – National and Regional

order form. Markets: each of these chapters reviews the

gas market of a single country or a region of

Report Summary Europe. Details are given of production and

consumption of gas, imports and exports and

This 257 page report offers a comprehensive key infrastructure, including transmission and

analysis of the trading market, the brokers and transit systems, LNG terminals and storage

exchanges, EU competition and environmental facilities. The progress of gas market

policy factors, top industry players, and more. development and competition is assessed and

The market’s dimensions and trends are profiled the main national or regional players are listed

in 94 tables and 63 charts. The report is and described, including their market shares.

structured as follows:

Chapter 15 - Definitions and Conversion

Chapter 1 – Trading Activity: this chapter Factors: this chapter explains the units, unit

reviews the trading volumes at established and conversion factors and currency conversions

emerging gas trading locations in Europe. It used in this report.

describes the instruments being traded, the use

of exchanges, over-the-counter trade and

cleared OTC trade. European gas trading volumes

continued to grow in 2009 and the

Chapter 2 – Markets and Exchanges: this

first half of 2010, despite a sharp

chapter reviews in detail each of the European

trading markets, both exchange-based and over- decrease in gas consumption

the-counter. between 2008 and 2009 across the

region. The UK market showed

Chapter 3 – Gas Prices: this chapter looks into

the drivers behind gas prices in Europe and

signs of recovery after the setback

reviews the development of wholesale and retail of the financial crisis, with a small

market prices over the past year. increase in physical trading

volumes, and strong growth in

Chapter 4 – Regulation: this chapter outlines

the legislative foundation that underpins futures trading volumes. In the

European gas market opening. It describes the newer mainland markets, trading

various processes and bodies working within the volumes rose much faster, but

gas industry to develop competitive market

these markets remain far smaller

structures.

than the UK.

Chapter 5 – Infrastructure: this chapter

reviews European policy and funding for gas

infrastructure projects. It covers existing and

planned gas infrastructure, including import

pipelines, regional interconnections, LNG

terminals and storage facilities.

Chapter 6 – Fundamentals: this chapter To order this

provides an overview of the key fundamentals of report please fill in

the European gas market, including gas the last page and

reserves and production, consumption trends, fax it to us on

trade flows and system flexibility. It also sets the

European market within its global context. +44 20 7900 3844

Chapter 7 – Market Participants: this chapter

reviews the main European gas market

participants, with pen portraits of all the main

physical market players. It reviews the

© 2010 Prospex Research Ltd 1 www.prospex.co.uk

European Gas Trading 2010

Table of Contents

1 TRADING ACTIVITY 13

1.1 TRADING VOLUMES 13

1.1.1 Hubs and Exchanges 13

1.1.2 National Markets 16

1.1.3 Trading Platforms 20

1.2 TRADING LOCATIONS 24

1.3 TRADED INSTRUMENTS 25

1.3.1 Term Contracts 26

1.3.2 Spot and Forward Trading 27

1.3.3 Capacity Trading 29

2 MARKETS AND EXCHANGES 31

2.1 NBP AND UK MARKETS 31

2.1.1 OTC Trading 31

2.1.2 APX Gas UK Markets 33

2.1.3 ICE Gas Futures 35

2.2 TTF AND DUTCH MARKETS 36

2.2.1 APX Gas NL 39

2.2.2 Endex Gas Futures 40

2.2.3 ICE TTF Gas Futures 41

2.3 ZEEBRUGGE MARKETS 41

2.3.1 APX Gas ZEE 43

2.4 GERMAN MARKETS 43

2.4.1 NetConnect Germany (NCG) 44

2.4.2 GASPOOL 45

2.4.3 Other OTC Trading Locations 47

2.4.4 EEX Spot and Futures Exchange 48

2.4.5 Store-x and Trac-x Capacity Exchanges 49

2.5 PEGS AND FRENCH MARKET 50

2.5.1 Powernext Spot and Futures Exchange 52

2.5.2 Capsquare Capacity Exchange 54

2.6 PSV AND ITALIAN MARKET 54

2.7 CEGH AND BAUMGARTEN 56

2.8 OTHER TRADING LOCATIONS 58

2.8.1 Iberian Markets 58

2.8.2 Danish Markets 59

2.8.3 Other Markets 60

3 GAS PRICES 62

3.1 PRICING MECHANISMS 62

3.1.1 Spot and Forward Price Drivers 62

3.1.2 Long-Term Contract Pricing 63

3.1.3 Interaction between Contract and Spot markets 65

3.1.4 The Influence of the LNG Market 66

3.2 WHOLESALE GAS PRICES 68

3.3 END-USER GAS PRICES 70

4 REGULATION 74

4.1 LEGISLATIVE STRUCTURE 74

4.1.1 The EU Gas Directives 74

4.1.2 The EU Gas Regulations 76

4.2 PROCESSES AND BODIES 77

4.2.1 Madrid Forum 77

4.2.2 ERGEG 78

4.2.3 Gas Regional Initiatives 78

4.2.4 ACER 79

4.2.5 ENTSOG 80

4.2.6 Annual Reporting 81

4.2.7 EC Energy Sector Competition Enquiry 82

© 2010 Prospex Research Ltd. 2 www.prospex.co.uk

European Gas Trading 2010

4.2.8 Other Competition Enquiries 83

4.2.9 Gas Release Programmes 85

5 INFRASTRUCTURE 87

5.1 POLICY AND FUNDING 87

5.1.1 Policy Background 87

5.1.2 Trans-European Energy Networks (TEN-E) Programme 88

5.1.3 European Economic Recovery Plan 90

5.2 TRANSMISSION INFRASTRUCTURE 91

5.2.1 Existing Pipeline Infrastructure 93

5.2.2 Major Pipeline Developments 94

5.2.3 North East European Projects 95

5.2.4 South East European Projects 98

5.2.5 South West European Projects 102

5.2.6 Cross-Border Interconnectors 103

5.3 LNG 104

5.3.1 Existing Terminals 104

5.3.2 LNG Terminal Projects 106

5.4 GAS STORAGE 108

6 FUNDAMENTALS 111

6.1 GAS RESERVES AND PRODUCTION 111

6.1.1 Unconventional Gas 115

6.2 CONSUMPTION 116

6.3 TRADE FLOWS 119

6.3.1 LNG Imports 124

6.4 SYSTEM FLEXIBILITY 125

7 MARKET PARTICIPANTS 128

7.1 MAJOR GAS SUPPLIERS 128

7.2 TRADING MARKET PARTICIPANTS 147

7.3 BROKERS 152

7.4 MERGERS AND ACQUISITIONS 153

8 BENELUX 155

8.1 FUNDAMENTALS 155

8.1.1 Reserves and Production 155

8.1.2 Consumption 156

8.1.3 Imports and Exports 157

8.1.4 Infrastructure 159

8.2 GAS MARKET DEVELOPMENT 163

8.2.1 Liberalisation 163

8.2.2 Market Participants 164

9 FRANCE 168

9.1 FUNDAMENTALS 168

9.1.1 Reserves and Production 168

9.1.2 Consumption 168

9.1.3 Imports and Exports 169

9.1.4 Infrastructure 170

9.2 GAS MARKET DEVELOPMENT 174

9.2.1 Liberalisation 174

9.2.2 Market Participants 175

10 GERMANY 177

10.1 FUNDAMENTALS 177

10.1.1 Reserves and Production 177

10.1.2 Consumption 178

10.1.3 Imports and Exports 180

10.1.4 Infrastructure 181

10.2 GAS MARKET DEVELOPMENT 187

© 2010 Prospex Research Ltd. 3 www.prospex.co.uk

European Gas Trading 2010

10.2.1 Liberalisation 187

10.2.2 Market Participants 190

11 IBERIAN PENINSULA: SPAIN AND PORTUGAL 194

11.1 FUNDAMENTALS 194

11.1.1 Reserves and Production 194

11.1.2 Consumption 194

11.1.3 Imports and Exports 196

11.1.4 Infrastructure 197

11.2 GAS MARKET DEVELOPMENT 201

11.2.1 Liberalisation 201

11.2.2 Market Participants 202

12 ITALY 204

12.1 FUNDAMENTALS 204

12.1.1 Reserves and Production 204

12.1.2 Consumption 204

12.1.3 Imports and Exports 206

12.1.4 Infrastructure 207

12.2 GAS MARKET DEVELOPMENT 211

12.2.1 Liberalisation 211

12.2.2 Market Participants 212

13 UK AND IRELAND 215

13.1 FUNDAMENTALS 215

13.1.1 Reserves and Production 215

13.1.2 Consumption 216

13.1.3 Imports and Exports 219

13.1.4 Infrastructure 221

13.2 GAS MARKET DEVELOPMENT 227

13.2.1 Liberalisation 227

13.2.2 Market Participants 228

14 OTHER EUROPEAN COUNTRIES 232

14.1 FUNDAMENTALS 232

14.1.1 Reserves and Production 232

14.1.2 Consumption 235

14.1.3 Imports and Exports 238

14.1.4 Infrastructure 241

14.2 GAS MARKET DEVELOPMENT 249

14.2.1 Liberalisation 249

14.2.2 Market Participants 251

15 DEFINITIONS AND CONVERSION FACTORS 254

15.1 DEFINITIONS 254

15.2 ROUNDING 254

15.3 UNITS AND CONVERSIONS 254

© 2010 Prospex Research Ltd. 4 www.prospex.co.uk

European Gas Trading 2010

Tables

Table 1 Recorded Hub and Exchange Trading Volumes, 2008 - 2009 14

Table 2 Estimated Gas Trading Volumes by Country, 2008 - 2009 17

Table 3 Gas Trading Volumes by Venue and Type, 2009 22

Table 4 Gasoil Price Indexation of Gas Contracts, 2007 - 2010 64

Table 5 EU Gas Directives 74

Table 6 ERGEG Gas Regional Initiatives 79

Table 7 Agency for Cooperation of Energy Regulators (ACER) 80

Table 8 Significant Recent Competition Enquiries 84

Table 9 European Gas Release Schemes, as of August 2010 85

Table 10 Gas Infrastructure Projects Receiving TEN-E Funding, 2005 - 2009 89

Table 11 EU Economic Recovery Plan Gas Project Grants, 2010 90

Table 12 European Major International Gas Pipelines, 2010 93

Table 13 European Major Planned International Gas Pipelines, 2010 95

Table 14 European Operating LNG Terminals, 2010 105

Table 15 European Planned LNG Terminals, 2010 107

Table 16 European Existing and Planned Gas Storage Facilities, 2010 109

Table 17 European Gas Reserves Ranked by Country, 2009 112

Table 18 European Gas Production by Country, 2008 - 2009 114

Table 19 European Gas Consumption by Country, 2008 - 2009 118

Table 20 European Gas Imports and Exports by Country, 2009 121

Table 21 European Gas Imports by Source, 2009 123

Table 22 European LNG Imports by Destination, 2009 125

Table 23 Seasonal Flexibility in Northern Europe, 2009 126

Table 24 Top 20 Companies by European Gas Sales, 2009 129

Table 25 Top 10 European Gas Producers, 2009 130

Table 26 Selected Companies European Gas Trading Volumes, 2008 - 2009 147

Table 27 European Gas Exchange Major Participants, August 2010 149

Table 28 Mergers and Acquisitions in the European Gas Market, 2009 153

Table 29 Dutch Gas Reserves and Production, 2008 - 2009 155

Table 30 Benelux Gas Consumption by Sector, 2009 156

Table 31 Benelux Gas Imports and Exports, 2008 - 2009 158

Table 32 Belgian Operating LNG Terminal, 2010 161

Table 33 Dutch Planned LNG Terminals, 2010 161

Table 34 Benelux Gas Storage Facilities, 2010 162

Table 35 Dutch Planned Gas Storage Facilities, 2010 163

Table 36 Benelux Major Gas Market Participants, 2009 165

Table 37 Market Share of Major Belgian Gas Suppliers, 2009 165

Table 38 Market Share of Major Dutch Gas Producers, 2009 166

Table 39 French Gas Reserves and Production, 2008 - 2009 168

Table 40 French Gas Consumption by Sector, 2008 - 2009 169

Table 41 French Gas Imports and Exports, 2008 - 2009 170

Table 42 French Operating LNG Terminals, 2010 172

Table 43 French Planned LNG Terminals, 2010 172

Table 44 French Existing Gas Storage Facilities, 2010 173

Table 45 French Planned Gas Storage Facilities, 2010 174

Table 46 French Major Gas Market Participants, 2009 175

Table 47 German Reserves and Production, 2008 - 2009 177

Table 48 German Gas Consumption by Sector, 2008 - 2009 178

Table 49 German Gas Imports and Exports, 2008 - 2009 181

Table 50 German Gas Transmission Networks, 2010 182

Table 51 German Gas Storage Facilities, 2010 185

Table 52 German Planned LNG Terminals, 2010 186

Table 53 German Network Zones, as of July 2010 188

Table 54 German Major Gas Market Participants, 2009 190

Table 55 Iberian Gas Consumption by Sector, 2009 194

Table 56 Iberian Gas Imports and Exports, 2008 - 2009 196

Table 57 Iberian Operating LNG Terminals, 2010 199

Table 58 Iberian Planned LNG Terminals, 2010 200

Table 59 Iberian Gas Storage Facilities, 2010 200

© 2010 Prospex Research Ltd. 5 www.prospex.co.uk

European Gas Trading 2010

Table 60 Spanish Planned Gas Storage Facilities, 2010 201

Table 61 Iberian Major Gas Market Participants, 2009 202

Table 62 Spanish Gas Market Shares, 2009 203

Table 63 Italian Gas Reserves and Production, 2008 - 2009 204

Table 64 Italian Gas Consumption by Sector, 2008 - 2009 205

Table 65 Italian Gas Imports and Exports, 2008 - 2009 206

Table 66 Italian Operating LNG Terminals, 2010 208

Table 67 Italian Planned LNG Terminals, 2010 209

Table 68 Italian Gas Storage Facilities, 2010 210

Table 69 Italy Planned Gas Storage Facilities, 2010 211

Table 70 Italian Major Gas Market Participants, 2009 213

Table 71 Market Shares of Major Italian Gas Suppliers, 2009 214

Table 72 UK and Irish Gas Reserves and Production, 2009 215

Table 73 UK and Irish Gas Consumption by Sector, 2009 217

Table 74 UK and Irish Gas Imports and Exports, 2008 - 2009 220

Table 75 UK Operating LNG Terminals, 2010 223

Table 76 UK and Irish Planned LNG Terminals, 2010 224

Table 77 UK and Irish Gas Storage Facilities, 2010 225

Table 78 UK Irish Planned Gas Storage Facilities, 2010 227

Table 79 UK and Irish Major Gas Market Participants, 2009 229

Table 80 UK Gas Production by Major Producers, 2009 230

Table 81 Other European Gas Reserves and Production, 2009 232

Table 82 Other European Gas Consumption, 2009 236

Table 83 Other European Gas Imports by Origin, 2009 238

Table 84 Nordic Gas Exports, 2008 - 2009 240

Table 85 Other European National Gas Networks, 2010 242

Table 86 Other European Gas Storage Facilities, 2010 245

Table 87 Other European Planned Gas Storage Facilities, 2010 246

Table 88 Other European Operating LNG Terminals, 2010 246

Table 89 Other European Planned LNG Terminals, 2010 247

Table 90 Other Europe Gas Market Shares of Dominant Suppliers, 2009 250

Table 91 Other European Gas Market Participants, 2009 253

Table 92 Gas Units and Conversion Factors 255

Table 93 Energy Content of European Gas 256

Table 94 Currency Conversion Factors 256

Charts

Chart 1 Recorded Hub and Exchange Traded Volumes, 2009 13

Chart 2 Quarterly Development of NBP Nomination Volumes, 2008 - 2010 15

Chart 3 Quarterly Development of European Nomination Volumes, 2008 - 2010 16

Chart 4 European Gas Market Churn Factors, 2009 18

Chart 5 European Total Gas Trading Volumes by Country, 2009 19

Chart 6 European Gas Trading Volumes by Trading Platform, 2009 21

Chart 7 European Gas Trading Hubs, 2010 24

Chart 8 Monthly Nominated Trading Volumes at NBP, 2005 to Jun 2010 32

Chart 9 Monthly Trading Volumes on OCM, 2003 to Jun 2010 34

Chart 10 Annual Trading Volume on ICE Gas Futures, 1997 to Jun 2010 36

Chart 11 Monthly Trading Volume at TTF, 2003 to Jun 2010 37

Chart 12 Monthly Gas Trading Volume at Endex, Mar 2006 to Jun 2010 40

Chart 13 Monthly Trading Volumes at Zeebrugge, 2000 to Jun 2010 42

Chart 14 Monthly Gas Trading Volume at NCG, Oct 2006 to Jun 2010 45

Chart 15 Monthly H-Gas Trading Volume at GASPOOL, Oct 2006 to Jun 2010 46

Chart 16 Monthly L-Gas Trading Volumes, Oct 2006 to Jun 2010 47

Chart 17 Monthly Gas Trading Volume at EEX, Jul 2007 to Jun 2010 48

Chart 18 Monthly Net Transfer Volume at the PEGs, 2006 to Jun 2010 51

Chart 19 Monthly Trading Volume at Powernext, Nov 2008 to Jun 2010 53

Chart 20 PSV Trading Volumes, Oct 2003 to Jun 2010 55

Chart 21 CEGH Trading Volumes, Oct 2005 to Jun 2010 57

Chart 22 Monthly Trading Volumes on MS-ATR, 2006 to Mar 2010 59

© 2010 Prospex Research Ltd. 6 www.prospex.co.uk

European Gas Trading 2010

Chart 23 European Gas Price Indexation, 2005 - 2011 65

Chart 24 UK Forward and German Border Gas Prices, 2005 to Jun 2010 66

Chart 25 NBP and Henry Hub Gas Prices, 2005 to Jun 2010 67

Chart 26 NBP, TTF and NCG Day-Ahead Gas Prices, 2007 to Jun 2010 69

Chart 27 Average European Household Gas Prices, 2H 2009 72

Chart 28 Average European Industrial Gas Prices, 2H 2009 73

Chart 29 European Gas Infrastructure, 2010 92

Chart 30 North East European Major Planned Gas Pipelines, 2010 96

Chart 31 South East European Major Planned Gas Pipelines, 2010 98

Chart 32 South West European Major Planned Gas Pipelines, 2010 103

Chart 33 Cumulative European LNG Import Capacity Estimates, 2010 - 2016 106

Chart 34 European Existing and Planned Storage Capacity, 2010 110

Chart 35 World Gas Reserves by Region, December 2009 111

Chart 36 European Gas Reserves by Country, December 2009 112

Chart 37 World Gas Production by Region, 2009 113

Chart 38 European Gas Production by Country, 2009 114

Chart 39 World Gas Consumption by Region, 2009 116

Chart 40 European Gas Consumption by Country, 2009 117

Chart 41 World Gas Net Import/Export by Region, 2009 120

Chart 42 European Gas Imports by Source, 2009 123

Chart 43 European LNG Imports by Destination, 2009 124

Chart 44 Seasonal Flexibility in Northern Europe, 2009 126

Chart 45 Top 20 Companies by European Gas Sales, 2009 128

Chart 46 Belgian Gas Consumption by Sector, 2009 156

Chart 47 Dutch Gas Consumption by Sector, 2009 157

Chart 48 Belgian Gas Imports by Origin, 2009 158

Chart 49 Dutch Gas Exports by Country, 2009 159

Chart 50 French Gas Consumption by Sector, 2009 168

Chart 51 French Gas Imports by Origin, 2009 170

Chart 52 German Gas Consumption by Sector, 2009 178

Chart 53 German Gas Imports by Origin, 2009 180

Chart 54 Spanish Gas Consumption by Sector, 2009 194

Chart 55 Spanish Gas Imports by Origin, 2009 197

Chart 56 Italian Gas Consumption by Sector, 2009 205

Chart 57 Italian Gas Imports by Origin, 2009 206

Chart 58 UK Gas Consumption by Sector, 2009 217

Chart 59 UK Actual and Forecast Demand, 2008 - 2018 218

Chart 60 Irish Gas Consumption by Sector, 2009 219

Chart 61 UK Gas Imports by Origin, 2009 219

Chart 62 Norwegian Gas Exports by Destination, 2009 241

Chart 63 Norwegian Gas Producers by Equity Share of Production, 2009 252

© 2010 Prospex Research Ltd. 7 www.prospex.co.uk

European Gas Trading 2010

About the Authors

Mary Jackson and Nigel Harris are independent energy

market consultants. Each has over 15 years experience of

working with energy traders, providing analysis, training,

information and technology services to companies engaged

in the oil, gas and electricity markets. Mary and Nigel regularly write, speak and lecture on the gas

markets and energy trading.

Kingston Energy Consulting is a consulting company that specialises in energy markets and energy

market information. Its services are aimed at companies that trade in the oil, gas and power markets

and at the information and software companies that serve them.

Kingston Energy Consulting Ltd

e-mail: info@kingstonenergy.com

web: www.kingstonenergy.com

About the Publisher

Prospex Research analyses the European energy business, focusing on

wholesale markets for power, gas, coal and emissions allowances.

Prospex is independent and committed to relevant, accurate and unrestricted reporting and analysis. It

does not accept sponsorship that would compromise this commitment.

Prospex Research Ltd

e-mail: info@prospex.co.uk tel: +44 (0) 20 3239 9905

web: www.prospex.co.uk fax: +44 (0) 20 7900 3844

Other Recent Reports

European Power Trading 2009, July 2010

This 100 page report offers a comprehensive analysis of the trading market, the exchanges

and brokers, top industry players, and power generation system performance in western

Europe. The market’s dimensions and trends are profiled in 33 tables and 34 charts.

German Gas Market 2010, May 2010

This 123 page report covers the physical and commercial aspects of the German natural gas

market, and its role in the wider European gas market. Key market trends, including the

growth of trading liquidity, are highlighted in 33 tables, 24 charts and 9 maps.

UK Gas Market 2010, May 2010

This 104 page report covers the physical and commercial aspects of the UK natural gas

market and its role in the wider European gas business. Key market trends are tracked in 33

tables, 25 charts and 6 maps.

European Coal Trading 2010, December 2009

This 100 page report covers the global coal market context of European trading, market

fundamentals inside Europe, the emissions policy factor, trading volumes, products and

players, and more. It is based on wide-ranging research and interviews with leading players in

all major European markets. Market and industry indicators are also provided in 31 tables and

52 charts.

Dutch Gas Market, May 2009

This 106 page report covers the physical and commercial aspects of the Dutch natural gas

market and its role in the wider European market. Key market trends, including the growth of

trading liquidity, are highlighted in 27 tables, 25 charts and six maps.

© 2010 Prospex Research Ltd. 8 www.prospex.co.uk

European Gas Trading 2010

Report Format and Price and Info

European Gas Trading 2010 will be sent to you by e-mail in electronic format

(Adobe Acrobat) in one of two different versions, depending on your needs:

Individual User: one electronic file for individual use only. The file may be printed only

once and cannot be copied or redistributed in any format. This version costs £1,395

(pounds sterling) or ~ €1,650 (euros) at the time of publication.

Multiple User: this version can be used by more than one person or, in the case of five

or more users, even placed on your company’s intranet. See the table below for multiple

user pricing and savings in pounds sterling.

Number of users 2 3 4 unlimited

Full price, £ (pound sterling) 2,790 4,185 5,580 6,975

Multiple user savings on cover price 420 738 1,163 1,696

Multiple user price 2,370 3,447 4,417 5,279

10% discount for previous buyers 237 345 442 528

Multiple user price for previous report buyers 2,133 3,102 3,975 4,751

Value Added Tax (VAT): UK purchasers please add 17.5% VAT (20% from January 4 2011).

Purchasers from any other EU member state must state their VAT registration number on the order

form.

A 10% discount is available to

previous report buyers.

© 2010 Prospex Research Ltd. 9 www.prospex.co.uk

European Gas Trading 2010

European Gas Trading 2010

ORDER FORM TO BE FAXED TO: + 44 (0) 20 7900 3844

E-mail report to:

Bill to: Company:

Address:

Telephone:

Report version Price Tick your choice

Individual user copy £1,395

Multiple user level 1 (2 users) £2,370

Multiple user level 2 (3 users) £3,447

Multiple user level 3 (4 users) £4,417

Multiple user level 4 (unlimited number of users) £5,279

10% DISCOUNT FOR PREVIOUS PROSPEX REPORT BUYERS

17.5% VAT (20% from 4/1/11) UK customers only

TOTAL DUE (pound sterling)

Companies of any EU member state except UK MUST supply their VAT registration number below:

CHOOSE 1 OF 2 SIMPLE WAYS TO PAY

1 You can pay by Credit Card:

Name of card holder (as it appears on the card):

Credit card billing address:

Please debit my credit card (tick choice):

Card number:

Expiry date: CSC (last 3 digits at the back of the card or last 4 for Amex):

Signature:

If you pay by Credit Card the report will be delivered directly to your desk by e-mail

THE NEXT DAY

2 You can also pay by bank transfer:

I have arranged a payment for the sum of £_________(sterling) or €___________(euro) to:

Nat West Bank, Victoria Branch, PO Box 1357,169 Victoria Street, London SW1E 5BT, UK

Account name: Prospex Research Ltd. Account number: 80904505, Sort code: 51 50 14

Swift/BIC code: NWBK GB 2L IBAN number: GB13NWBK51501480904505.

In this case please fax us your order form together with details of your bank transfer. The report will be sent to the user as

soon as we receive your payment.

www.prospex.co.uk e-mail: info@prospex.co.uk

© 2010 Prospex Research Ltd. 10 www.prospex.co.uk

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Electrical Plan SampleDokument1 SeiteElectrical Plan SampleKit67% (3)

- Optimized Skid Design For Compress Sor PackagesDokument5 SeitenOptimized Skid Design For Compress Sor Packagessantosh kumarNoch keine Bewertungen

- Model TM-T24J TABLE TOP STEAM STERILIZER INSTRUNCTION MANUAL OF OPERATIONDokument9 SeitenModel TM-T24J TABLE TOP STEAM STERILIZER INSTRUNCTION MANUAL OF OPERATIONhuguito320% (1)

- Spe 131758 Ms - GL and EspDokument11 SeitenSpe 131758 Ms - GL and EspSamuel VmNoch keine Bewertungen

- PHYSICSDokument3 SeitenPHYSICSAndrew NibungcoNoch keine Bewertungen

- Accurate Power Demand Forecasting MethodsDokument15 SeitenAccurate Power Demand Forecasting MethodsRathinaKumarNoch keine Bewertungen

- Auto ElectricianDokument3 SeitenAuto Electricianmnrao62Noch keine Bewertungen

- Specific Lube Oil Consumption SLOC: Edition 01 Description Page 1Dokument2 SeitenSpecific Lube Oil Consumption SLOC: Edition 01 Description Page 1Atanasio Perez100% (1)

- Safety Guide for Coal Stockpiles and Reclaim TunnelsDokument46 SeitenSafety Guide for Coal Stockpiles and Reclaim TunnelsFarah SafrinaNoch keine Bewertungen

- Complex Fluid For Olga 5Dokument10 SeitenComplex Fluid For Olga 5angry_granNoch keine Bewertungen

- 7.5 01 02 01Dokument19 Seiten7.5 01 02 01Feri SaputraNoch keine Bewertungen

- Quiet Ducted Exhaust Ventilation Fans for Homes and Commercial SpacesDokument2 SeitenQuiet Ducted Exhaust Ventilation Fans for Homes and Commercial SpacesKyaw ZawNoch keine Bewertungen

- r2 Hy-Optima 720as-Gc Technical Data SheetDokument1 Seiter2 Hy-Optima 720as-Gc Technical Data SheetMohammed SaberNoch keine Bewertungen

- Inphorm Online: Click Here To AccessDokument10 SeitenInphorm Online: Click Here To AccessconimecNoch keine Bewertungen

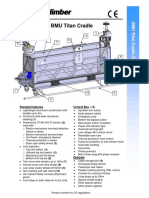

- BMU Titan Cradle: Standard Features Control BoxDokument2 SeitenBMU Titan Cradle: Standard Features Control BoxKashyapNoch keine Bewertungen

- CFBC Boilers & TG Set Auxillaries SpecificationsDokument18 SeitenCFBC Boilers & TG Set Auxillaries SpecificationsJAY PARIKHNoch keine Bewertungen

- Simulation and Experimental Results of PSA Process For Production of Hydrogen Used in Fuel CellsDokument18 SeitenSimulation and Experimental Results of PSA Process For Production of Hydrogen Used in Fuel Cellswww.beatricechongNoch keine Bewertungen

- 2 - Acid and Base TitrationDokument90 Seiten2 - Acid and Base TitrationEnin SofiyaNoch keine Bewertungen

- Exer 2 - PH and BuffersDokument4 SeitenExer 2 - PH and BuffersAsi JenNoch keine Bewertungen

- Lecture 2-KCL& KVL Nodal & Mesh Analysis.Dokument55 SeitenLecture 2-KCL& KVL Nodal & Mesh Analysis.Ben MachariaNoch keine Bewertungen

- 450 Kva Diesel Generator Set Model HG 450Dokument1 Seite450 Kva Diesel Generator Set Model HG 450ghostshotNoch keine Bewertungen

- PAES 233: Multicrop Washer-Peeler StandardDokument16 SeitenPAES 233: Multicrop Washer-Peeler StandardFaroukNoch keine Bewertungen

- OCDE Toolkit de ConstrucciónDokument54 SeitenOCDE Toolkit de ConstrucciónALBERTO GUAJARDO MENESESNoch keine Bewertungen

- LP2014Dokument56 SeitenLP2014Rodrigo Navarra JrNoch keine Bewertungen

- Lista Precios Ahu Mas Accesorios Sinclair 2020Dokument80 SeitenLista Precios Ahu Mas Accesorios Sinclair 2020Jonathan ArboledaNoch keine Bewertungen

- Skyair - LU Series - HeatpumpDokument259 SeitenSkyair - LU Series - HeatpumpHai PhanNoch keine Bewertungen

- Abiogenesis PDFDokument16 SeitenAbiogenesis PDFErik_Daniel_MajcherNoch keine Bewertungen

- Special Working Rules For Bahadurgarh Station 1. General and Subsidiary Rules:-A)Dokument12 SeitenSpecial Working Rules For Bahadurgarh Station 1. General and Subsidiary Rules:-A)sahil4INDNoch keine Bewertungen

- Green Building Rating Systems ExplainedDokument42 SeitenGreen Building Rating Systems ExplainedJake CerezoNoch keine Bewertungen

- HVAC Control Panel ArrangementDokument82 SeitenHVAC Control Panel ArrangementMohamed Ali JNoch keine Bewertungen