Beruflich Dokumente

Kultur Dokumente

StrengtheningCapitalRequirementsBankingIndustry 05 Sep 08

Hochgeladen von

rashidOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

StrengtheningCapitalRequirementsBankingIndustry 05 Sep 08

Hochgeladen von

rashidCopyright:

Verfügbare Formate

September 05, 2008

Strengthening of Capital Requirements for the Banking Industry

To Promote Further Growth in Financial Intermediation as well as to

Encourage further Consolidation: Dr Akhtar

Dr Shamshad Akhtar, Governor State Bank of Pakistan today announced to raise

the Minimum Capital Requirements (MCR) and Capital Adequacy Ratio (CAR) for

locally incorporated banks/DFIs as well as foreign banks in a phased manner in order to

encourage further consolidation in the banking sector. These policy measures are a

critical component of the Pakistan’s next ten years financial sector Blue Print. This

vision statement and strategy was issued at the 60th Anniversary of the State Bank of

Pakistan (SBP). The new Government has supported SBP in its long term vision of the

financial sector reforms.

Presiding over a meeting of the Presidents/CEOs of banks at the State Bank of

Pakistan, Karachi, Dr Akhtar said that appropriate level of banks’ capital is critical for

the industry to strengthen the business prospects as adequate capital buffer helps raise

depositors and public confidence, while allowing industry to achieve the desired asset

growth in line with the growing requirements of the country.

She informed the bankers that the central bank has decided to raise minimum

paid-up capital requirements for locally incorporated banks to Rs23 billion (net of

losses) to be achieved in a phased-manner by December 31, 2013. In addition, Foreign

Banks (FBs) operating in the country are also required to increase their assigned capital

to Rs 23 billion (net of losses) within the prescribed timelines, she added.

However, those FBs, which are operating with up to 5 branches, are required to

increase their assigned capital to Rs 3 billion while FBs operating with 6 to 20 branches

are required to raise their assigned capital to Rs 6 billion by December 31, 2010

provided their Head Offices hold paid-up capital (free of losses) at least equivalent to

$300 million and have a CAR of at least 8% or minimum prescribed by their home

regulator, whichever is higher, Dr Akhtar explained.

Under the existing instructions, the banks/DFIs are required to have the MCR at

Rs 6 billion by December 31, 2009. According to new instructions, the banks will have

to raise their MCR to Rs 10 billion by December 31, 2010, Rs 15 billion by December 31,

2011, Rs 19 billion by December 31, 2012 and finally Rs 23 billion by December 31,

2013.

“All newly-licensed banks will henceforth be required to meet the paid

up/assigned capital requirement of Rs 23 billion before commencement of their

operations,” she added.

2

Dr Akhtar informed the bankers that required minimum CAR, on consolidated as

well as on standalone basis, has also been increased for banks/DFIs to at least 10%. She

also announced that all banks are required to maintain variable CAR, which will now be

based on CAMELS-S Rating assigned by the State Bank to each bank/DFI. Those

banks/DFIs whose CAR falls short of the required ratio are advised to meet the shortfall

latest by December 31, 2008, she added.

SBP Governor said that the required MCR and CAR can be achieved by

banks/DFIs either by fresh capital injection or retention of profits and added that the

stock of dividend declared after all the legal and regulatory requirements, will be

counted towards the required paid-up capital of the bank/DFI pending completion of

the formalities for issuance of bonus shares.

“We are trying to push for consolidation of the banking industry, and to

encourage second-round of mergers and acquisitions,” Dr Akhtar told the participants.

Further consolidation is necessary to ensure presence of stronger and well capitalized banks that

can support diverse financial services and client requirements, while adequately managing risks,

she said.

Dr Akhtar also elaborated 10-Year Vision & Strategy for the Financial Sector with the

participants and focused on issues pertaining to Deposit Protection Scheme, Consolidated

Supervision and Minimum Capital Requirement.

SBP Governor welcomed the Bankers feedback on the blue print for a Deposit Protection

Scheme (DPS) to protect small depositors. She said DPS increases depositor confidence in

banking system and comforts small savers and helps the competitive position of small private

banks in relation to large banks or government owned banks. She said that the proposed DPS

will be in line with the best international practices.

Dr Akhtar said that as a part of supervisory reform agenda, SBP will be moving towards

consolidated supervision system in compliance with Basle Core Principles. To allow for this

appropriate structural change in financial sector, regulatory architecture would be required and

legislated for which Banking Companies Ordinance, 1962 is also in the process of being

amended, she added.

At the conclusion, Dr Akhtar stressed upon the banks to reduce banking spreads which

are ‘high’ as compared to countries in the region. Banks pointed out that lending rates for

corporate sector were relatively low but higher in other sectors as they factor in the risks

associated with the businesses. At the same time, she asked the banks to closely monitor rising

Non-Performing Loans and to keep them in line with international standards. She also

emphasized that banks should work diligently not only to increase their deposit base but also

increase deposit rates for the benefit of the customers. She also urged the banks to explicitly

publicize real and effective deposit rates while mobilizing such deposits.

***************

Das könnte Ihnen auch gefallen

- Financial AccountingDokument944 SeitenFinancial Accountingsivachandirang695491% (22)

- Automobile GarageAggregator BMReport 1566909252539Dokument107 SeitenAutomobile GarageAggregator BMReport 1566909252539user adminNoch keine Bewertungen

- Aasi Group 1 QuizDokument4 SeitenAasi Group 1 QuizNanase SenpaiNoch keine Bewertungen

- Ufficio Centrale Italiano Valid I521 /: (Both Dates Inclusive)Dokument1 SeiteUfficio Centrale Italiano Valid I521 /: (Both Dates Inclusive)maxNoch keine Bewertungen

- Night Audit ChecklistDokument3 SeitenNight Audit ChecklistSequoia CarterNoch keine Bewertungen

- 2 Ceilli Set A (Eng)Dokument24 Seiten2 Ceilli Set A (Eng)chiewteck0% (1)

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeVon EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNoch keine Bewertungen

- Consolidation & Mergers in BankingDokument7 SeitenConsolidation & Mergers in BankingISHAN CHAUDHARYNoch keine Bewertungen

- 4163IIBF Vision March 2015Dokument8 Seiten4163IIBF Vision March 2015Madhumita PandeyNoch keine Bewertungen

- RBI Circular On Financing SMEDokument14 SeitenRBI Circular On Financing SMEImran AkbarNoch keine Bewertungen

- Interim Union Budget Proposals: 2014-15Dokument8 SeitenInterim Union Budget Proposals: 2014-15Mohit AnandNoch keine Bewertungen

- Project Report: Banking ReformsDokument9 SeitenProject Report: Banking ReformsS.S.Rules100% (1)

- 2631IIBF Vision January 2013Dokument8 Seiten2631IIBF Vision January 2013Sukanta DasNoch keine Bewertungen

- Mergers and Acquisitions Introduction and Litrerature ViewDokument8 SeitenMergers and Acquisitions Introduction and Litrerature Viewrock starNoch keine Bewertungen

- Financial Sector Reforms in India Since 1991Dokument11 SeitenFinancial Sector Reforms in India Since 1991AMAN KUMAR SINGHNoch keine Bewertungen

- Bank Credit To MsmesDokument10 SeitenBank Credit To MsmesAarthi ManoharanNoch keine Bewertungen

- State Bank of PakistanDokument4 SeitenState Bank of PakistancalyxtechnologiesNoch keine Bewertungen

- IIBF Vision February 2016 For WebDokument8 SeitenIIBF Vision February 2016 For WebparulvrmNoch keine Bewertungen

- Micro, Small and Medium EnterpricesDokument7 SeitenMicro, Small and Medium EnterpricesTarun BhatejaNoch keine Bewertungen

- Financial InstitutionsDokument9 SeitenFinancial InstitutionsAqib RafiNoch keine Bewertungen

- 8-MM 8A-MSME FinancingDokument42 Seiten8-MM 8A-MSME Financingsenthamarai krishnan0% (1)

- FIM Done PDFDokument244 SeitenFIM Done PDFsNoch keine Bewertungen

- Good Morning To All: HSBC Eyes $1-bn Profit Before Tax From India OpsDokument15 SeitenGood Morning To All: HSBC Eyes $1-bn Profit Before Tax From India Opsyzag66Noch keine Bewertungen

- Good Morning To All: HSBC Eyes $1-bn Profit Before Tax From India OpsDokument15 SeitenGood Morning To All: HSBC Eyes $1-bn Profit Before Tax From India Opsyzag66Noch keine Bewertungen

- Financial Sector Needs To Be FutureDokument6 SeitenFinancial Sector Needs To Be FutureThavam RatnaNoch keine Bewertungen

- BASIC Bank Full ReviewDokument6 SeitenBASIC Bank Full ReviewJonaed Ashek Md. RobinNoch keine Bewertungen

- Merger of Banks With Reference To Central Government SchemeDokument13 SeitenMerger of Banks With Reference To Central Government SchemeEditor IJTSRDNoch keine Bewertungen

- Assignment Financial Institutions and MarketsDokument7 SeitenAssignment Financial Institutions and MarketsafridaNoch keine Bewertungen

- Assignment: Export Financing System of BangladeshDokument8 SeitenAssignment: Export Financing System of BangladeshNafiz ImtiazNoch keine Bewertungen

- Eco Final 3RD SemDokument10 SeitenEco Final 3RD Semnagendra yanamalaNoch keine Bewertungen

- Banking Sector ReformsDokument10 SeitenBanking Sector ReformsTouqeer AhmadNoch keine Bewertungen

- Answers To Some New Questions Asked in The BB & BSC Viva Boards in 2018-2019.pdf Version 1Dokument15 SeitenAnswers To Some New Questions Asked in The BB & BSC Viva Boards in 2018-2019.pdf Version 1Tushar Mahmud SizanNoch keine Bewertungen

- State Level Bankers' Committee - Karnataka Convenor - Syndicate Bank, Regional Office, BangaloreDokument61 SeitenState Level Bankers' Committee - Karnataka Convenor - Syndicate Bank, Regional Office, BangaloreRavi kumarNoch keine Bewertungen

- Banking Licenses: Banking, Financial Services and Insurance (BFSI) BankingDokument3 SeitenBanking Licenses: Banking, Financial Services and Insurance (BFSI) Bankingkaushik638100% (1)

- Class 01 (Banking Regulators)Dokument4 SeitenClass 01 (Banking Regulators)Irfan Sadique IsmamNoch keine Bewertungen

- Financial Sector Reforms in India Since 1991: ImportanceDokument12 SeitenFinancial Sector Reforms in India Since 1991: ImportanceManleen KaurNoch keine Bewertungen

- Call Money Rate Surges To 8.25pc: BB Brings Cheer To Foreign InvestorsDokument7 SeitenCall Money Rate Surges To 8.25pc: BB Brings Cheer To Foreign Investorsfnz88Noch keine Bewertungen

- Overview of Bangladesh BankDokument7 SeitenOverview of Bangladesh BankIshtiaque A. SakibNoch keine Bewertungen

- Hand Out No 6 Core Business DEPOSITSDokument8 SeitenHand Out No 6 Core Business DEPOSITSAbdul basitNoch keine Bewertungen

- Regulators of The Financial System: Central BankDokument4 SeitenRegulators of The Financial System: Central BankmahadiparvezNoch keine Bewertungen

- Banking Sector - Backing On Demographic DividendDokument13 SeitenBanking Sector - Backing On Demographic DividendJanardhan Rao NeelamNoch keine Bewertungen

- Overview of Financial System of BangladeshDokument13 SeitenOverview of Financial System of BangladeshMonjurul Hassan50% (2)

- CRM AssignmentDokument13 SeitenCRM AssignmentAaron RodriguesNoch keine Bewertungen

- Main Objects of The BankDokument23 SeitenMain Objects of The BankNishant GroverNoch keine Bewertungen

- General Banking NewsDokument14 SeitenGeneral Banking NewsShraddha GhagNoch keine Bewertungen

- Monthly News Letter 01.12.10 To 31.12.10Dokument6 SeitenMonthly News Letter 01.12.10 To 31.12.10poojaapandeyNoch keine Bewertungen

- Strategic or Institutional Management Is The Conduct of Drafting, ImplementingDokument8 SeitenStrategic or Institutional Management Is The Conduct of Drafting, ImplementingAnwara KonaNoch keine Bewertungen

- Financial Sector Supervisory InitiativesDokument8 SeitenFinancial Sector Supervisory InitiativesanmuliNoch keine Bewertungen

- In Case of Manufacturing Enterprises The Calculations of Original Cost ofDokument12 SeitenIn Case of Manufacturing Enterprises The Calculations of Original Cost ofVimal kumarNoch keine Bewertungen

- 3896IIBF Vision October 2014 15DPIDokument8 Seiten3896IIBF Vision October 2014 15DPIhvenkiNoch keine Bewertungen

- Finsight 18march2012Dokument11 SeitenFinsight 18march2012Rahul UnnikrishnanNoch keine Bewertungen

- NSE IEA Lecture On Financial Economics 2017 Development BankingDokument20 SeitenNSE IEA Lecture On Financial Economics 2017 Development BankingKumar MangalamNoch keine Bewertungen

- Bank ManagementAssignment 2Dokument7 SeitenBank ManagementAssignment 2Yasir ArafatNoch keine Bewertungen

- MSME Definition by RBIDokument8 SeitenMSME Definition by RBIRahul YadavNoch keine Bewertungen

- Financial Inclusion1363171983 PDFDokument2 SeitenFinancial Inclusion1363171983 PDFAman SSethiNoch keine Bewertungen

- Future of Banking Industry in IndiaDokument15 SeitenFuture of Banking Industry in IndiaCollen MahamboNoch keine Bewertungen

- PRs SMEsDokument77 SeitenPRs SMEsMuhammad Arslan UsmanNoch keine Bewertungen

- RBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Dokument7 SeitenRBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Divya MewaraNoch keine Bewertungen

- BB Moves To Bolster NbfisDokument1 SeiteBB Moves To Bolster NbfisMainul RazeebNoch keine Bewertungen

- New Microsoft Word DocumentDokument3 SeitenNew Microsoft Word DocumentmirfanasgharNoch keine Bewertungen

- The Importance of Financial Discipline in Bangladesh - Business HabitDokument3 SeitenThe Importance of Financial Discipline in Bangladesh - Business HabitDhiman Nath100% (1)

- Non - Performing Assests in State Co-Operative Banks in India - An Empirical StudyDokument9 SeitenNon - Performing Assests in State Co-Operative Banks in India - An Empirical StudykumardattNoch keine Bewertungen

- The Financial System - Assignment 1Dokument10 SeitenThe Financial System - Assignment 1Mohammad ShoaibNoch keine Bewertungen

- Introduction of Rushikulya Gramya BankDokument7 SeitenIntroduction of Rushikulya Gramya BankYaadrahulkumar MoharanaNoch keine Bewertungen

- Financial Services Management Assignment On Articles Collected From Financial DailiesDokument7 SeitenFinancial Services Management Assignment On Articles Collected From Financial DailiesRamya MakeNoch keine Bewertungen

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

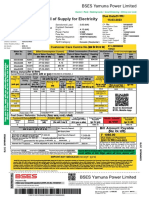

- Bill of Supply For Electricity: BSES Yamuna Power LimitedDokument2 SeitenBill of Supply For Electricity: BSES Yamuna Power LimitedSUJIT SINGHNoch keine Bewertungen

- Radio Frequency Identification (RFID) Opportunities For Mobile Telecommunication ServicesDokument18 SeitenRadio Frequency Identification (RFID) Opportunities For Mobile Telecommunication ServicesAmit NaikNoch keine Bewertungen

- Soal Modul 5 SMT BDokument1 SeiteSoal Modul 5 SMT BarakNoch keine Bewertungen

- Chapter - 4 MineDokument23 SeitenChapter - 4 MineBereket MinaleNoch keine Bewertungen

- e-StatementBRImo 459501040308532 May2023 20230615 102222Dokument3 Seitene-StatementBRImo 459501040308532 May2023 20230615 102222Donni AdvNoch keine Bewertungen

- MGT 330 FinalDokument13 SeitenMGT 330 FinalKANIZ FATEMANoch keine Bewertungen

- Tech Talk 8 Cbse Pages 82 94 CompressedDokument13 SeitenTech Talk 8 Cbse Pages 82 94 CompressedSwayam balaji kotgireNoch keine Bewertungen

- SCM Interview QuestionsDokument2 SeitenSCM Interview QuestionsMuhammad Kashif ArshadNoch keine Bewertungen

- WFH Internet Upgrade Memo EmblemHealth ACPNYDokument2 SeitenWFH Internet Upgrade Memo EmblemHealth ACPNYJoyce AnnNoch keine Bewertungen

- A GIS Approach To The Spatial AssessmentDokument29 SeitenA GIS Approach To The Spatial AssessmentAbdulrahman ElwafiNoch keine Bewertungen

- Kelompok 8Dokument16 SeitenKelompok 8dewi murniNoch keine Bewertungen

- Chapter Sixteen: Auditing The Financing/Investing Process: Cash and InvestmentsDokument30 SeitenChapter Sixteen: Auditing The Financing/Investing Process: Cash and Investmentscheapo printsNoch keine Bewertungen

- An Introduction To Computer Networks - An Introduction To Computer Networks, Desktop Edition 2.0.10Dokument7 SeitenAn Introduction To Computer Networks - An Introduction To Computer Networks, Desktop Edition 2.0.10Mike MikkelsenNoch keine Bewertungen

- Acc406 - Aug 2021 - QDokument12 SeitenAcc406 - Aug 2021 - Qtengku rilNoch keine Bewertungen

- Principles of Accounting1Dokument3 SeitenPrinciples of Accounting1Muhammad SaifullahNoch keine Bewertungen

- Types of Bank Accounts in IndiaDokument3 SeitenTypes of Bank Accounts in IndiaVasudev GovindanNoch keine Bewertungen

- Cash Collection Systems: 2005 by Thomson Learning, IncDokument13 SeitenCash Collection Systems: 2005 by Thomson Learning, IncuuuuufffffNoch keine Bewertungen

- Core SI RFP Volume IDokument354 SeitenCore SI RFP Volume ImrudrabhNoch keine Bewertungen

- How To Start With Indoleads - GuideDokument14 SeitenHow To Start With Indoleads - GuideHilmarNoch keine Bewertungen

- Sigtran-Sctp, M3ua, M2paDokument16 SeitenSigtran-Sctp, M3ua, M2paabhishek sinhaNoch keine Bewertungen

- Amit Project GeneralDokument2 SeitenAmit Project GeneralKrishna YadavNoch keine Bewertungen

- 7 Revenue Cycle Management Best PracticesDokument3 Seiten7 Revenue Cycle Management Best Practicestaytye2Noch keine Bewertungen

- Deposit Accounts & Services For Individuals: Deposits GuideDokument23 SeitenDeposit Accounts & Services For Individuals: Deposits GuideshubhraNoch keine Bewertungen