Beruflich Dokumente

Kultur Dokumente

Money Back LIC of India

Hochgeladen von

Harish Chand0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten1 SeiteWhy Insurance

Almost each one of us has bought or plans to buy life insurance. The usual process is contact an insurance agent who helps you estimate the policy value and goes ahead and buys the policy on your behalf. So you feel good that you now have a life policy showing how much you worth! Take a step back before you buy that policy. Have you ever considered buying more then one policy value you desire? There are some great gains in doing so. These are....

During Financial lows

If you go through a situation where you are financially constrained to surrender your life policy, you will lose the cover for the entire policy even if you do not need the entire surrender value of the policy. For instance if your policy's surrender value is Rs 10 Lakh and you need Rs 4 Lakh cash, you will have to cancel the entire policy and lose life over completely. had this policy of Rs 10 lakh been taken as 2 policies of Rs 5 lakh each, you could have surrendered just one policy. You would still remain covered for Rs 5 lakh!

Distributing your estate

Breaking up your life policy help in this count too. Taking the same example, instead of having one Rs 10 lakh policy, having 2 Rs 5 Lakh policies helps allocate your estate among your children ( this is an ideal situiation if you have 2 children - each child gets proceeds from one policy).

Taking a loan

You can use your life policy as a pledgeable security while taking a loan. Lenders as well as the insurer usually offers loans up to a specified percentage of the surrender value of the policy. If you dont need a loan to the extent of the amount you are eligible for, you will still have to offer the entire policy as security to the lender till the repayment of the loan. During the period the policy remains with the lender, he is eligible for all the rights to the policy. However if you break up your policies, you need to pledge only just that many policies to raise the necessary loan.

Tax Benefits

Section 88 of the Income Tax Act states that premium paid on a life policy is eligible for tax rebate. The beneficiary may be different from the premium paying person. For instance your wife can pay premium for your policy and claim the tax benefit. Breaking up for life policy helps in this case too. If the premium paid on a consolidated policy is higher than the amount of rebate you need, you can break the policy to claim the entire tax rebate. This can be done by another tax paying family member paying the premium for one policy and claiming the rebate.

Meeting your life goals

You can divide your life insurance portfolio into a number of policies spread over different tenors to give you a stream of steady income to take care of your life's financial commitments like children's education and marriage, buying property, asving up for your old age etc. Check out specific plans structured by insurers specifically for these purposes.

What if you have already taken a consolidated life policy?

Dont despair. You can break it to peices! contact your insurance agent to guide you to doing so. By paying a small sum to the insurer, your policy can be broken up into more than one, without any loss to you. It is worth the efforts.

Contact Us

Harish Chand

[Authorised LIC Agent]

9811896425

9212201725

www.delhilicagent.com

harishchand@in.com

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenWhy Insurance

Almost each one of us has bought or plans to buy life insurance. The usual process is contact an insurance agent who helps you estimate the policy value and goes ahead and buys the policy on your behalf. So you feel good that you now have a life policy showing how much you worth! Take a step back before you buy that policy. Have you ever considered buying more then one policy value you desire? There are some great gains in doing so. These are....

During Financial lows

If you go through a situation where you are financially constrained to surrender your life policy, you will lose the cover for the entire policy even if you do not need the entire surrender value of the policy. For instance if your policy's surrender value is Rs 10 Lakh and you need Rs 4 Lakh cash, you will have to cancel the entire policy and lose life over completely. had this policy of Rs 10 lakh been taken as 2 policies of Rs 5 lakh each, you could have surrendered just one policy. You would still remain covered for Rs 5 lakh!

Distributing your estate

Breaking up your life policy help in this count too. Taking the same example, instead of having one Rs 10 lakh policy, having 2 Rs 5 Lakh policies helps allocate your estate among your children ( this is an ideal situiation if you have 2 children - each child gets proceeds from one policy).

Taking a loan

You can use your life policy as a pledgeable security while taking a loan. Lenders as well as the insurer usually offers loans up to a specified percentage of the surrender value of the policy. If you dont need a loan to the extent of the amount you are eligible for, you will still have to offer the entire policy as security to the lender till the repayment of the loan. During the period the policy remains with the lender, he is eligible for all the rights to the policy. However if you break up your policies, you need to pledge only just that many policies to raise the necessary loan.

Tax Benefits

Section 88 of the Income Tax Act states that premium paid on a life policy is eligible for tax rebate. The beneficiary may be different from the premium paying person. For instance your wife can pay premium for your policy and claim the tax benefit. Breaking up for life policy helps in this case too. If the premium paid on a consolidated policy is higher than the amount of rebate you need, you can break the policy to claim the entire tax rebate. This can be done by another tax paying family member paying the premium for one policy and claiming the rebate.

Meeting your life goals

You can divide your life insurance portfolio into a number of policies spread over different tenors to give you a stream of steady income to take care of your life's financial commitments like children's education and marriage, buying property, asving up for your old age etc. Check out specific plans structured by insurers specifically for these purposes.

What if you have already taken a consolidated life policy?

Dont despair. You can break it to peices! contact your insurance agent to guide you to doing so. By paying a small sum to the insurer, your policy can be broken up into more than one, without any loss to you. It is worth the efforts.

Contact Us

Harish Chand

[Authorised LIC Agent]

9811896425

9212201725

www.delhilicagent.com

harishchand@in.com

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten1 SeiteMoney Back LIC of India

Hochgeladen von

Harish ChandWhy Insurance

Almost each one of us has bought or plans to buy life insurance. The usual process is contact an insurance agent who helps you estimate the policy value and goes ahead and buys the policy on your behalf. So you feel good that you now have a life policy showing how much you worth! Take a step back before you buy that policy. Have you ever considered buying more then one policy value you desire? There are some great gains in doing so. These are....

During Financial lows

If you go through a situation where you are financially constrained to surrender your life policy, you will lose the cover for the entire policy even if you do not need the entire surrender value of the policy. For instance if your policy's surrender value is Rs 10 Lakh and you need Rs 4 Lakh cash, you will have to cancel the entire policy and lose life over completely. had this policy of Rs 10 lakh been taken as 2 policies of Rs 5 lakh each, you could have surrendered just one policy. You would still remain covered for Rs 5 lakh!

Distributing your estate

Breaking up your life policy help in this count too. Taking the same example, instead of having one Rs 10 lakh policy, having 2 Rs 5 Lakh policies helps allocate your estate among your children ( this is an ideal situiation if you have 2 children - each child gets proceeds from one policy).

Taking a loan

You can use your life policy as a pledgeable security while taking a loan. Lenders as well as the insurer usually offers loans up to a specified percentage of the surrender value of the policy. If you dont need a loan to the extent of the amount you are eligible for, you will still have to offer the entire policy as security to the lender till the repayment of the loan. During the period the policy remains with the lender, he is eligible for all the rights to the policy. However if you break up your policies, you need to pledge only just that many policies to raise the necessary loan.

Tax Benefits

Section 88 of the Income Tax Act states that premium paid on a life policy is eligible for tax rebate. The beneficiary may be different from the premium paying person. For instance your wife can pay premium for your policy and claim the tax benefit. Breaking up for life policy helps in this case too. If the premium paid on a consolidated policy is higher than the amount of rebate you need, you can break the policy to claim the entire tax rebate. This can be done by another tax paying family member paying the premium for one policy and claiming the rebate.

Meeting your life goals

You can divide your life insurance portfolio into a number of policies spread over different tenors to give you a stream of steady income to take care of your life's financial commitments like children's education and marriage, buying property, asving up for your old age etc. Check out specific plans structured by insurers specifically for these purposes.

What if you have already taken a consolidated life policy?

Dont despair. You can break it to peices! contact your insurance agent to guide you to doing so. By paying a small sum to the insurer, your policy can be broken up into more than one, without any loss to you. It is worth the efforts.

Contact Us

Harish Chand

[Authorised LIC Agent]

9811896425

9212201725

www.delhilicagent.com

harishchand@in.com

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

HARISH CHAND

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

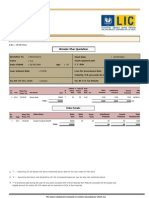

New Bima Gold (Plan - 179)

Insurance Proposal for : Mr. Ullas

Risk Cover Annual Returns

Year Age Normal Accidental Premium from L.I.C.

2010 30 175000 350000 10099 0

2011 31 175000 350000 10099 0

2012 32 175000 350000 10099 0

2013 33 175000 350000 10099 0

2014 34 175000 350000 10099 26250

After a thumping success of the 2015 35 175000 350000 10099 0

Bima Gold Plan, L.I.C. now

2016 36 175000 350000 10099 0

introduces its enhanced version

2017 37 175000 350000 10099 0

in a new Avtaar -

2018 38 175000 350000 10099 26250

2019 39 175000 350000 10099 0

New Bima Gold 2020 40 175000 350000 10099 0

A money back plan with flexible 2021 41 175000 350000 10099 0

premium payment options and 2022 42 175000 350000 10099 26250

extended life cover. 2023 43 175000 350000 10099 0

2024 44 175000 350000 10099 0

Your benefits at-a-glance* 2025 45 175000 350000 10099 0

2026 46 87500 87500 0 125534

Premiums: Your premiums

2027 47 87500 87500 0 0

(excluding rider premiums if any)

are paid back to you during the 2028 48 87500 87500 0 0

policy term in installments. 2029 49 87500 87500 0 0

Loyalty Addition: In addition to the 2030 50 87500 87500 0 0

return of premiums you will also 2031 51 87500 87500 0 0

receive loyalty addition (depending

2032 52 87500 87500 0 0

upon the experience of L.I.C.) at

2033 53 87500 87500 0 0

the end of the policy term.

161584 204284

Risk Cover: Despite the return of

premiums in installments there is a

full insurance cover to the tune of v Loyalty Addition: The maturity amount shown in the year 2026 includes a

the sum assured in the policy. loyalty addition of Rs. 45500. Please note that this is an estimation only and

the actual loyalty amount will be depend upon the experience of L.I.C.

Extended Cover: You also enjoy a

free risk cover of 50% of the sum v Tax Saving: You will save a tax of Rs. 3037 per annum @30.6% under Sec. 80

assured for half the extra term CCE by payment of annual premium.

beyond your policy term.

Auto-Cover: Keep the policy inforce

even if the premiums are not paid

for upto 2 years.

Choice of Terms: New Bima Gold

offers 3 term options to suit your

requirements. You can choose from

12, 16 and 20 year terms.

Loan Available: You can avail of

loan in this policy after the policy

acquires paid-up value.

Riders: Accident Rider is available

at a very nominal rate of Re.1 per

1000 sum assured.

* - Conditions Apply

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Corporate AgentsDokument1.023 SeitenCorporate AgentsVivek Thota0% (1)

- 16 Year at 41 AgeDokument4 Seiten16 Year at 41 AgeHarish ChandNoch keine Bewertungen

- Jeevan AkshayDokument1 SeiteJeevan AkshayHarish ChandNoch keine Bewertungen

- Agency Presentation - ZTCDokument24 SeitenAgency Presentation - ZTCHarish ChandNoch keine Bewertungen

- All Illustration of LICDokument6 SeitenAll Illustration of LICHarish ChandNoch keine Bewertungen

- Mr. Gupta: Insurance Proposal ForDokument8 SeitenMr. Gupta: Insurance Proposal ForHarish ChandNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Multi - Plan Chart: Harish ChandDokument3 SeitenMulti - Plan Chart: Harish ChandHarish ChandNoch keine Bewertungen

- Rad 28 E72Dokument1 SeiteRad 28 E72Harish ChandNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Mrs. Nirali Mehta: Insurance Proposal ForDokument5 SeitenMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNoch keine Bewertungen

- Rad 20356Dokument1 SeiteRad 20356Harish ChandNoch keine Bewertungen

- Harish Chand: Jeevan Anand Plan PresentationDokument4 SeitenHarish Chand: Jeevan Anand Plan PresentationHarish ChandNoch keine Bewertungen

- Anmol Jeevan - 9811896425Dokument1 SeiteAnmol Jeevan - 9811896425Harish ChandNoch keine Bewertungen

- Mr. Gupta: Harish ChandDokument4 SeitenMr. Gupta: Harish ChandHarish ChandNoch keine Bewertungen

- Mr. Harish Chand: Presentation Specially Prepared ForDokument4 SeitenMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Rad 211 D0Dokument1 SeiteRad 211 D0Harish ChandNoch keine Bewertungen

- Premiums Due Statement: Harish ChandDokument1 SeitePremiums Due Statement: Harish ChandHarish ChandNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Rad 09206Dokument3 SeitenRad 09206Harish ChandNoch keine Bewertungen

- Rad 1 FDF9Dokument2 SeitenRad 1 FDF9Harish ChandNoch keine Bewertungen

- Rad 1 F405Dokument3 SeitenRad 1 F405Harish ChandNoch keine Bewertungen

- Rad 09206Dokument3 SeitenRad 09206Harish ChandNoch keine Bewertungen

- Multi - Plan Chart: Harish ChandDokument3 SeitenMulti - Plan Chart: Harish ChandHarish ChandNoch keine Bewertungen

- All Illustration of LICDokument6 SeitenAll Illustration of LICHarish ChandNoch keine Bewertungen

- Rad 1 F405Dokument3 SeitenRad 1 F405Harish ChandNoch keine Bewertungen

- Rad 09206Dokument3 SeitenRad 09206Harish ChandNoch keine Bewertungen

- Harish Chand: Multi - Plan ChartDokument4 SeitenHarish Chand: Multi - Plan ChartHarish ChandNoch keine Bewertungen

- Jeevan Saral IllustrationDokument3 SeitenJeevan Saral IllustrationHarish ChandNoch keine Bewertungen