Beruflich Dokumente

Kultur Dokumente

Accounting Policies: Grants-In-Aid

Hochgeladen von

Zaheer SaiyedOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Policies: Grants-In-Aid

Hochgeladen von

Zaheer SaiyedCopyright:

Verfügbare Formate

ACCOUNTING POLICIES

1. GRANTS-IN-AID

1.1 Grants-in-aid received from the Central Government or other authorities towards capital expenditure as well

as consumers’ contribution to capital works are treated initially as capital reserve and subsequently adjusted

as income in the same proportion as the depreciation written off on the assets acquired out of the grants.

1.2 Where the ownership of the assets acquired out of the grants vests with the government, the grants are adjusted

in the carrying cost of such assets.

1.3 Grants from Government and other agencies towards revenue expenditure are recognized over the period in

which the related costs are incurred and are deducted from the related expenses.

2. FIXED ASSETS

2.1 Fixed Assets are shown at historical cost.

2.2 Intangible assets are recorded at their cost of acquisition.

2.3 Capital expenditure on assets not owned by the Company is reflected as a distinct item in Capital Work-in-

Progress till the period of completion and thereafter in the Fixed Assets.

2.4 Deposits, payments/liabilities made provisionally towards compensation, rehabilitation and other expenses

relatable to land in possession are treated as cost of land.

2.5 In the case of commissioned assets, where final settlement of bills with contractors is yet to be effected,

capitalisation is done on provisional basis subject to necessary adjustment in the year of final settlement.

2.6 Assets and systems common to more than one generating unit are capitalised on the basis of engineering

estimates/assessments.

3. CAPITAL WORK-IN-PROGRESS

3.1 In respect of supply-cum-erection contracts, the value of supplies received at site and accepted is treated as

Capital Work-in-Progress.

3.2 Incidental Expenditure during Construction (net) including corporate office expenses (allocated to the projects

pro-rata to the annual capital expenditure) for the year, is apportioned to Capital Work-in-Progress on the basis

of accretions thereto.

3.3 Deposit work/cost plus contracts are accounted for on the basis of statements of account received from the

contractors.

3.4 Claims for price variation/exchange rate variation in case of contracts are accounted for on acceptance.

4. OIL AND GAS EXPLORATION COSTS

4.1 The Company follows ‘Successful Efforts Method’ for accounting of oil & gas exploration activities.

4.2 Cost of surveys and prospecting activities conducted in the search of oil and gas are expensed in the year in

which these are incurred.

4.3 All acquisition costs are initially capitalized as “Exploratory Wells-in-Progress” under Capital Work-in-Progress.

5. DEVELOPMENT OF COAL MINES

Expenditure on exploration of new coal deposits is capitalized as “Development of coal mines” under Capital

Work-in-Progress till the mines project is brought to revenue account.

72 30th Annual Report

6. FOREIGN CURRENCY TRANSACTIONS

6.1 Foreign currency transactions are initially recorded at the rates of exchange ruling at the date of transaction.

6.2 At the balance sheet date, foreign currency monetary items are reported using the closing rate. Non-monetary

items denominated in foreign currency are reported at the exchange rate ruling at the date of transaction.

6.3 Exchange differences in respect of loans/deposits/liabilities relating to fixed assets/capital work-in-progress

acquired from a country outside India are adjusted in the carrying cost of related assets.

6.4 Exchange differences in respect of loans relating to fixed assets/capital work-in-progress acquired within

India to the extent regarded as an adjustment to interest cost are treated as borrowing cost.

6.5 Exchange differences, in respect of loans (other than regarded as borrowing cost)/deposits/liabilities relating

to fixed assets/capital work-in-progress acquired within India, arising out of transactions entered prior to

01.04.2004, are adjusted in the carrying cost of related assets. Such exchange differences in respect of

transactions entered after 01.04.2004 are treated as Incidental Expenditure During Construction till the assets

are ready for their intended use.

6.6 Other exchange differences are recognized as income or expense in the period in which they arise.

7. BORROWING COSTS

Borrowing costs attributable to the fixed assets during their construction/renovation and modernisation are capitalised.

Such borrowing costs are apportioned on the average balance of capital work-in-progress for the year. Other

borrowing costs are recognised as an expense in the period in which they are incurred.

8. INVESTMENTS

8.1 Current Investments are valued at lower of cost and fair value determined on an individual investment basis.

8.2 Long term investments are carried at cost. Provision is made for diminution, other than temporary, in the value

of such investments.

8.3 Premium paid on long term investments is amortised over the period remaining to maturity.

9. INVENTORIES

9.1 Inventories are valued at the lower of cost, determined on weighted average basis, and net realizable value.

9.2 Dimunition in value of obsolete and unserviceable stores and spares is ascertained on review and provided

for.

10. PROFIT AND LOSS ACCOUNT

10.1 INCOME RECOGNITION

10.1.1 Sale of energy is accounted for based on tariff rates approved by the Central Electricity Regulatory

Commission. In case of power stations where the tariff rates are yet to be approved /agreed with

beneficiaries, provisional rates are adopted.

10.1.2 The incentives/disincentives are accounted for based on the norms notified/approved by the Central

Electricity Regulatory Commission or agreements with the beneficiaries. In cases of power stations where

the same have not been notified/approved/agreed with beneficiaries, incentives/disincentives are

accounted for on provisional basis.

30th Annual Report 73

10.1.3 Advance against depreciation, forming part of tariff to facilitate repayment of loans, is reduced from sales

and considered as deferred revenue to be included in sales in subsequent years.

10.1.4 The surcharge on late payment/overdue sundry debtors for sale of energy is recognized when no significant

uncertainty as to measurability or collectability exists.

10.1.5 Interest/surcharge recoverable on advances to suppliers as well as warranty claims/liquidated damages

are not treated as accrued due to uncertainty of realisation/acceptance and are therefore accounted for

on receipt/acceptances.

10.1.6.1 Income from Consultancy service is accounted for on the basis of actual progress/technical assessment

of work executed, in line with the terms of respective consultancy contracts.

10.1.6.2 Claims for reimbursement of expenditure are recognized as other income, as per the terms of Consultancy

service contracts.

10.1.7 Scrap other than steel scrap is accounted for in the accounts as and when sold.

10.1.8 Insurance claims for loss of profit are accounted for in the year of acceptance. Other insurance claims are

accounted for based on certainty of realisation.

10.2 EXPENDITURE

10.2.1 Depreciation is charged on straight line method at the rates specified in Schedule XIV of the Companies

Act, 1956 except for the following assets in respect of which depreciation is charged at the rates mentioned

below:

a) Kutcha Roads 47.50 %

b) Enabling works

- residential buildings including their internal electrification. 6.33 %

- non-residential buildings including their internal electrification,

water supply, sewerage & drainage works, railway sidings,

aerodromes, helipads and airstrips. 19.00 %

10.2.2 Depreciation on additions to/deductions from fixed assets during the year is charged on pro-rata basis

from/up to the month in which the asset is available for use/disposal.

10.2.3 Assets costing up to Rs.5000/- are fully depreciated in the year of capitalization.

10.2.4 Cost of Computer software recognized as intangible assets is amortised on straight line method over a

period of legal right to use or 3 years, whichever is earlier.

10.2.5 Where the cost of depreciable assets has undergone a change during the year due to increase/decrease

in long term liabilities on account of exchange fluctuation, price adjustment, change in duties or similar

factors, the unamortised balance of such asset is depreciated prospectively over the residual life

determined on the basis of the rate of depreciation.

10.2.6 Machinery spares which can be used only in connection with an item of fixed asset and whose use is

expected to be irregular are capitalised and depreciated over the residual useful life of the related plant

and machinery.

74 30th Annual Report

10.2.7 Capital expenditure on assets not owned by the Company is amortised over a period of 4 years from the

year in which the first unit of project concerned comes into commercial operation and thereafter from

the year in which the relevant asset becomes available for use. However, such expenditure for community

development in case of stations fully under operation is charged off to revenue.

10.2.8 Leasehold buildings are amortised over the lease period or 30 years, whichever is lower. Leasehold land

and buildings, whose lease period is yet to be finalised, are amortised over a period of 30 years.

10.2.9.1 Expenses on training, recruitment and ex-gratia payments under Voluntary Retirement Scheme are charged

to revenue in the year of incurrence.

10.2.9.2 Research and development expenses, other than fixed assets, are charged to revenue in the year of

incurrence.

10.2.9.3 Preliminary expenses on account of new projects incurred prior to approval of feasibility report are

charged to revenue in the year of incurrence.

10.2.10 Expenditure on leave travel concession to employees is recognized in the year of availment due to

uncertainties in accrual.

10.2.11 Expenses common to operation and construction activities are allocated to Profit and Loss Account and

Incidental Expenditure during Construction in proportion of sales to annual capital outlay in the case of

Corporate Office and sales to accretion to Capital Work-in-Progress in the case of projects.

10.2.12 Net pre-commissioning income/expenditure is adjusted directly in the cost of related assets and systems.

10.2.13 Prepaid expenses and prior period expenses/income of items of Rs.100,000/- and below are charged to

natural heads of accounts.

10.2.14 Carpet coal is charged off to coal consumption. However, during pre-commissioning period, carpet

coal is retained in inventories and charged off to consumption in the first year of commercial operation.

Windage and handling losses of coal as per norms are included in cost of coal.

11. RETIREMENT BENEFITS

11.1 The liability for retirement benefits of employees in respect of Provident Fund and Gratuity, which is ascertained

annually on actuarial valuation at the year end, are accrued and funded separately.

11.2 The liabilities for leave encashment and post retirement medical benefits to employees are accounted for on

accrual basis based on actuarial valuation at the year end.

12. FINANCE LEASES

12.1 Assets taken on lease are capitalized at fair value or net present value of the minimum lease payments, whichever

is lower.

12.2 Depreciation on the assets taken on lease is charged at the rate applicable to similar type of fixed assets as per

Accounting Policy 10.2.1. If the leased assets are returnable to the lessor on the expiry of the lease period,

depreciation is charged over its useful life or lease period, whichever is shorter.

12.3 Lease payments made are apportioned between the finance charges and reduction of the outstanding liability

in respect of assets taken on lease.

30th Annual Report 75

Das könnte Ihnen auch gefallen

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateVon EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNoch keine Bewertungen

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Von EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Noch keine Bewertungen

- (Problems) - Audit of LiabilitiessDokument17 Seiten(Problems) - Audit of Liabilitiessapatos0% (2)

- Fixed Assets GuidelinesDokument22 SeitenFixed Assets GuidelinesHary KhreesnaNoch keine Bewertungen

- Cwip & FaDokument44 SeitenCwip & FaRamkrishnarao BV0% (1)

- Module 3 - Borrowing CostsDokument3 SeitenModule 3 - Borrowing CostsLui100% (1)

- Civil Work SOP FinalDokument8 SeitenCivil Work SOP Finalsenthil senthilNoch keine Bewertungen

- Chapter 22 Contract CostingDokument18 SeitenChapter 22 Contract CostingCalvince Ouma100% (2)

- FRA Class NotesDokument16 SeitenFRA Class NotesUtkarsh Sinha100% (1)

- A7X1 Special Conditions of Contract Civil Packages R1 Dated 04.03.2020 PDFDokument9 SeitenA7X1 Special Conditions of Contract Civil Packages R1 Dated 04.03.2020 PDFanjan.kaimal4433Noch keine Bewertungen

- TES-AMM (Singapore) Pte. LTD.: Company Registration No. 200508881RDokument43 SeitenTES-AMM (Singapore) Pte. LTD.: Company Registration No. 200508881RJoyce ChongNoch keine Bewertungen

- 31 Decision MakingDokument53 Seiten31 Decision MakingMangesh KharcheNoch keine Bewertungen

- Accounting Policies: 29th Annual ReportDokument4 SeitenAccounting Policies: 29th Annual ReportTindo MoyoNoch keine Bewertungen

- Schedule - 23 Significant Accounting PoliciesDokument6 SeitenSchedule - 23 Significant Accounting PoliciesPiyush GuptaNoch keine Bewertungen

- Notes To The Financial StatementsDokument39 SeitenNotes To The Financial StatementsBharat AroraNoch keine Bewertungen

- BSNL Benifit MedicalDokument4 SeitenBSNL Benifit MedicalharishsatheNoch keine Bewertungen

- BSNLDokument3 SeitenBSNLPriyanshi AgarwalaNoch keine Bewertungen

- Mindtree Limited (Formerly Mindtree Consulting Limited) : For The Quarter Ended June 30, 2008Dokument15 SeitenMindtree Limited (Formerly Mindtree Consulting Limited) : For The Quarter Ended June 30, 2008gunda prashanthNoch keine Bewertungen

- MANAC - Revenue Recoginition Power IndustryDokument12 SeitenMANAC - Revenue Recoginition Power IndustryAmbujTripathiNoch keine Bewertungen

- Accounting Policies in Bharat ElectronicsDokument4 SeitenAccounting Policies in Bharat ElectronicsNafis SiddiquiNoch keine Bewertungen

- Accounting PoliciesDokument4 SeitenAccounting PoliciesShaiju MohammedNoch keine Bewertungen

- Kerala Financial Corporation Valuation GuidelinesDokument30 SeitenKerala Financial Corporation Valuation GuidelinesriyazNoch keine Bewertungen

- Nykaa E Retail Mar 19Dokument23 SeitenNykaa E Retail Mar 19NatNoch keine Bewertungen

- Request For Quotation (RFQ) : Page 1 of 15Dokument15 SeitenRequest For Quotation (RFQ) : Page 1 of 15Nundeep RakshitNoch keine Bewertungen

- Standalone Notes To AccountsDokument31 SeitenStandalone Notes To AccountsJP Jeya PrasannaNoch keine Bewertungen

- Statement of ComplianceDokument21 SeitenStatement of ComplianceFaiz Smile BuddyNoch keine Bewertungen

- Accounting PolicyDokument28 SeitenAccounting PolicyAkshay AnandNoch keine Bewertungen

- BORROWING COSTS Supplementary Review MaterialDokument2 SeitenBORROWING COSTS Supplementary Review MaterialCaseylyn RonquilloNoch keine Bewertungen

- Agreement - Final RDokument12 SeitenAgreement - Final Rlaloo01Noch keine Bewertungen

- Policies - 09Dokument2 SeitenPolicies - 09Ayeman AnwarNoch keine Bewertungen

- CH 5 Accounting For Disbursements and Related TransactionsDokument3 SeitenCH 5 Accounting For Disbursements and Related TransactionsGem Baguinon100% (1)

- DBM Coa - JC99 6Dokument3 SeitenDBM Coa - JC99 6bolNoch keine Bewertungen

- Fundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatDokument20 SeitenFundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatYadeno GirmaNoch keine Bewertungen

- ACM 402 Unit - IV To V (Classnotes)Dokument78 SeitenACM 402 Unit - IV To V (Classnotes)Vandana Sharma100% (1)

- National Law University Odisha: Ost and Anagement CcountingDokument16 SeitenNational Law University Odisha: Ost and Anagement CcountingPriyam JainNoch keine Bewertungen

- Notes 1 Short Notes Accounts ExamDokument10 SeitenNotes 1 Short Notes Accounts ExamAYUSH MAURYANoch keine Bewertungen

- 15.asset ManagementDokument11 Seiten15.asset ManagementShasikanta MNoch keine Bewertungen

- Notes To Balance Sheet and Statement of Profit and Loss: Hundred and Seventh Annual Report 2013-14Dokument44 SeitenNotes To Balance Sheet and Statement of Profit and Loss: Hundred and Seventh Annual Report 2013-14galacticwormNoch keine Bewertungen

- Bharat Electronics LTD) : Revenue From Contract With CustomersDokument11 SeitenBharat Electronics LTD) : Revenue From Contract With CustomersNikunj WaghelaNoch keine Bewertungen

- Schedule-17 Significant Accounting Policies 1. GeneralDokument4 SeitenSchedule-17 Significant Accounting Policies 1. GeneralsgleenaNoch keine Bewertungen

- Employer Colony-Contract Agreement-VOL IVDokument181 SeitenEmployer Colony-Contract Agreement-VOL IVArshad MahmoodNoch keine Bewertungen

- CA-365 190117-AsDokument5 SeitenCA-365 190117-AsGmt HspNoch keine Bewertungen

- Ias 23Dokument13 SeitenIas 23Mahir RahmanNoch keine Bewertungen

- 5 Long-Term Construction ContractDokument12 Seiten5 Long-Term Construction ContractMark TaysonNoch keine Bewertungen

- PPE - FinalDokument71 SeitenPPE - FinalKristen KooNoch keine Bewertungen

- Ias 23Dokument18 SeitenIas 23Shah KamalNoch keine Bewertungen

- #20 Land, BLDG., & Machinery (Notes For 6204)Dokument3 Seiten#20 Land, BLDG., & Machinery (Notes For 6204)Zaaavnn VannnnnNoch keine Bewertungen

- Accounting Policies and Notes Final 14.09.2016Dokument10 SeitenAccounting Policies and Notes Final 14.09.2016ramaiahNoch keine Bewertungen

- Reviewer Borrowing Cost Sec. 1-10Dokument4 SeitenReviewer Borrowing Cost Sec. 1-10imsana minatozakiNoch keine Bewertungen

- Significant Accounting PoliciesDokument4 SeitenSignificant Accounting PoliciesAdarsh NethwewalaNoch keine Bewertungen

- As 16Dokument11 SeitenAs 16Harsh PatelNoch keine Bewertungen

- 2016 Notes To Financial StatementsDokument66 Seiten2016 Notes To Financial StatementsErika Mariz CunananNoch keine Bewertungen

- Projects Analysis and Implementation Assignment-Ii: Group No: 4Dokument13 SeitenProjects Analysis and Implementation Assignment-Ii: Group No: 4Bindu_Shree_4565Noch keine Bewertungen

- Aef 2013 Audit Acc ReqDokument9 SeitenAef 2013 Audit Acc Reqvikas_ojha54706Noch keine Bewertungen

- GNP CHP 6Dokument21 SeitenGNP CHP 6fentaw melkieNoch keine Bewertungen

- Costing & Cost AllocationDokument10 SeitenCosting & Cost AllocationSultan Mohiuddin BhuiyanNoch keine Bewertungen

- Article Review IAS 23Dokument3 SeitenArticle Review IAS 23belay27haileNoch keine Bewertungen

- 11903AFI DRTD 20121212Dokument20 Seiten11903AFI DRTD 20121212Matika John PierreNoch keine Bewertungen

- Tatasteel15 Notes Balance SheetDokument24 SeitenTatasteel15 Notes Balance Sheetഗോക്Noch keine Bewertungen

- Grant Agreement: 1. The Purpose of The ProjectDokument3 SeitenGrant Agreement: 1. The Purpose of The ProjectatiNoch keine Bewertungen

- Final AccountsDokument2 SeitenFinal AccountsrachuNoch keine Bewertungen

- Chapter 1 PPEDokument22 SeitenChapter 1 PPEGirma NegashNoch keine Bewertungen

- Studdy Note 5Dokument22 SeitenStuddy Note 5s4sahithNoch keine Bewertungen

- Studdy Note 5Dokument22 SeitenStuddy Note 5s4sahithNoch keine Bewertungen

- MM 9aDokument7 SeitenMM 9aZaheer SaiyedNoch keine Bewertungen

- Pizza WarsDokument7 SeitenPizza WarsAshish MishraNoch keine Bewertungen

- Price WarsDokument29 SeitenPrice WarsDave GremmelsNoch keine Bewertungen

- JyothydrhpDokument314 SeitenJyothydrhpPiyush Shah0% (1)

- 3 6int 2006 Dec QDokument9 Seiten3 6int 2006 Dec QHannan SalimNoch keine Bewertungen

- Chapter 6-Cost TheoryDokument28 SeitenChapter 6-Cost TheoryFuad HasanNoch keine Bewertungen

- Millat Tractor Annual Report 2017Dokument206 SeitenMillat Tractor Annual Report 2017Umer Tariq Ch100% (3)

- ACT103 - Topic 5Dokument4 SeitenACT103 - Topic 5Juan FrivaldoNoch keine Bewertungen

- Audit of ReceivableDokument14 SeitenAudit of ReceivableMr.AccntngNoch keine Bewertungen

- RR No. 11-2018Dokument90 SeitenRR No. 11-2018Leticia TaclasNoch keine Bewertungen

- Annual Report 2014-2015 PDFDokument140 SeitenAnnual Report 2014-2015 PDFSana SafarNoch keine Bewertungen

- Aluminium SilicateDokument3 SeitenAluminium Silicatemurali_kundulaNoch keine Bewertungen

- Natural IndigoDokument17 SeitenNatural IndigoNur AishaNoch keine Bewertungen

- UBS ResearchDokument3 SeitenUBS ResearchIsaac Sim Wei SiangNoch keine Bewertungen

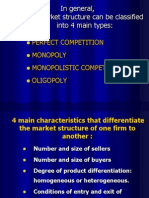

- Eco415 MKT StructureDokument105 SeitenEco415 MKT StructureappyluvtaeminNoch keine Bewertungen

- Chapter 3 SDokument19 SeitenChapter 3 SLê Đăng Cát NhậtNoch keine Bewertungen

- Vibhavadi Medical Center (VIBHA TB) : Regional Morning NotesDokument5 SeitenVibhavadi Medical Center (VIBHA TB) : Regional Morning NotesNapat InseeyongNoch keine Bewertungen

- TM Account XIDokument197 SeitenTM Account XIPadma Ratna Vidya Mandir100% (1)

- Mabola TradingDokument2 SeitenMabola TradingStye Sense PhNoch keine Bewertungen

- Income Tax: Global Income TaxDokument4 SeitenIncome Tax: Global Income TaxMichelle Muhrie TablizoNoch keine Bewertungen

- Summary of Key Changes ACCA F7 - Financial ReportingDokument3 SeitenSummary of Key Changes ACCA F7 - Financial ReportingAnslem TayNoch keine Bewertungen

- Viva Africa Consulting ProfileDokument9 SeitenViva Africa Consulting ProfileNyandia KamaweNoch keine Bewertungen

- Capital Budgeting 2Dokument4 SeitenCapital Budgeting 2rebecabeczNoch keine Bewertungen

- Fania Qinthara Azka - Case Chapter 2Dokument3 SeitenFania Qinthara Azka - Case Chapter 2Fania AzkaNoch keine Bewertungen

- Mass HousingDokument46 SeitenMass HousingSanjeev BumbNoch keine Bewertungen

- Chapter-3: Restructuring & Responsibility Matrix in BSNLDokument13 SeitenChapter-3: Restructuring & Responsibility Matrix in BSNLsfdwhjNoch keine Bewertungen

- BUS020 Chapter 1 (Outline - Libby Libby)Dokument5 SeitenBUS020 Chapter 1 (Outline - Libby Libby)Amanda RodriguezNoch keine Bewertungen

- TAX NotesDokument45 SeitenTAX NotesAlhaji Umaru JallohNoch keine Bewertungen