Beruflich Dokumente

Kultur Dokumente

Daily DAX Journal 060410

Hochgeladen von

Jay SchneiderCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily DAX Journal 060410

Hochgeladen von

Jay SchneiderCopyright:

Verfügbare Formate

Daily DAX The Fed is split, it seems -- opinions differ among the FX illuminati as to whether the ECB or the

or the Fed will raise more

. aggressively. With QEII ending in June, things could get interesting with the USD across the board. The consensus is

Journal that USD-denominated assets will look more attractive.

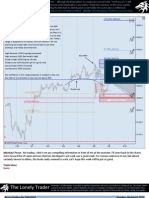

08 Apr 2011 Range studies: Aggressive 127; conservative 55; Extreme estimate H 7350 L 7100 Calendar: ECB, BoE rate decisions

FDAX June 2011

Trade ideas:

Aggressive range H

Short -- On a break below 7220. Wait for a

pullback and short a failure. Target 7180.

Short -- On a failure below 7260, target New development emerging?

7220 and then 7180, depending on the

price action. Conservative range H

Long -- On a push above 7260. Wait for a

pullback and target 7280 or 7300,

depending on price action.

As always, keep CL, ES and 6E price action

in view. Wait for signal and volume

confirmation.

Conservative range L

Aggressive range L

Unfilled runaway gap may be filled in the next 6 trading days. (35% prob.)

Thursday's focus: Today's breakout suggests a retest of the early March consolidation high of 7381. Should interest rates

surprise, or other data come into focus (like another of the PIGS asking for more aid), a range extension to this level is likely. The

aggressive range estimate falls short, but I'll will be watching closely. Next stop is 7470. There are a number of events taking place

in the markets. QEII is ending in June, which should support USD and USD-denominated assets. On the other hand, a lot of people

have been talking about the anticipated rate hikes from the ECB -- the Fed is expected to lag behind. May be a slow market until

the rate decisions come out. This is the first trading plan I've put together in about six months, so I really don't have any

expectations.

The Lonely Trader

Disclaimer: All information is provided as market commentary and not as investment or trading advice. The Lonely Trader

expressly disclaims liability, without limitation, for losses or damages resulting from reliance on such information. Past

results are no guarantee of future performance. Please consult a registered financial advisor before risking your capital.

Range Studies for DAX 0910 Monday, 09 August 2010

Previous day range 87.0 Comments:

Previous day pattern WS 1241 GMT: The opening range was entirely outside of the value area, and in the middle

Number of occurrences 97 of the opening range. This suggests to me a good chance for a new development above

7220 -- and if that level proves weak, price will likely push lower to 7200. (A good

(last 200 days)

intraday short opportunity?) Depending on where DAX opens, I may have to reevaluate

Avg range after WS 79.8% my plans. Gaps can invalidate one side of my trading plan, and sometimes both.

> 69.5 <

Prob of expansion → 24.7% Prob of contraction → 67.0% Prob of duplication → 8.2%

Projected expansion 127.0 Projected contraction 55.0 Projected duplication 86.0

( 146.0% ) ( 63.0% ) ( 98.9% )

Daily range studies Volume studies Time, price and event

3 days 64.7 Value area high 7261.0 Aggressive range est. 127.0

10 days 91.0 Point of control 7238.0 Conservative range est. 55.0

20 days 129.5 Value area low 7220.0 Aggressive range H 7350.0

50 days 110.3 Opening range 11.5 Conservative range H 7290.0

10 day max range 174.5 Initial balance 24.0 Today's H range est. 7315.0

10 day min range 38.0 R2 high vol node n/a 0.70 Today's L range est. 7165.0

3/10 0.71 R1 high vol node 7238.5 0.80 Conservative range L 7175.0

10 day true high 7262.5 Pvt high vol node 7200.0 1.00 Aggressive range L 7105.0

5 day true high 7262.5 S1 high vol node 7173.0 1.20 3 day range pivot 7205.0

Yesterday's high 7262.5 S2 high vol node 7123.0 0.85 18 February swing high 7441.0

Yesterday's low 7175.5 6D VAH 7262.5 01 March cons. high 7383.0

5 day true low 7056.0 6D VPOC 7200.0 16 March swing low 6435.0

10 day true low 6805.5 6D VAL 7120.0

Yesterday's settlement 7236.5 3 day vol avg 108.9 BoE rate decision High

Previous settlement 7198.5 10 day vol avg 119.7 ECB rate decision High

10 day range position 0.94 20 day vol avg 155.3

Calendar GMT Area Event Mkt Risk Exp Prev Remarks

Thursday * JP BoJ rate decision JPY Med 0.10 0.10 JPY Pairs

0130 AU Au employment (Mar) AUD High 24K -8.6K

1000 EU Ger industrial production (YoY) DAX Med 13.2% 12.5% May impact euro. Watch ESX

1100 UK BoE rate decision GBP High 0.50% 0.50% DNT, FTSE may react

UK Asset purchase target GBP Med 200B 200B FTSE may react

1145 EU ECB rate decision Ccy High 1.25% 1.00% All currencies, indices

1900 US Consumer credit ES Med 4.6B 5.01B Effect mild, if no data surprise

2350 JP Trade balance (Feb) JPY Med 746.9B 394.5B CL, USD, euro

This is a work in progress. If you would like to Jay Schneider -- FX and futures, range studies

exchange ideas, or can lend a helping hand, San Diego Area, USA

Email

please contact me --> Blog

The Lonely Trader

Disclaimer: All information is provided as market commentary and not as investment or trading advice. The Lonely Trader

expressly disclaims liability, without limitation, for losses or damages resulting from reliance on such information. Past

results are no guarantee of future performance. Please consult a registered financial advisor before risking your capital.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Waterloo Region LRT Contract Report Mar 4 2014Dokument70 SeitenWaterloo Region LRT Contract Report Mar 4 2014WR_RecordNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Corporate Finance MCQsDokument0 SeitenCorporate Finance MCQsonlyjaded4655100% (1)

- Chap 12Dokument74 SeitenChap 12NgơTiênSinhNoch keine Bewertungen

- Afghanistan - Exit Vs Engagement - Asia Briefing No 115Dokument12 SeitenAfghanistan - Exit Vs Engagement - Asia Briefing No 115Jay SchneiderNoch keine Bewertungen

- National Australia Bank AR 2002Dokument200 SeitenNational Australia Bank AR 2002M Kaderi KibriaNoch keine Bewertungen

- Wise Europe SA Avenue Louise 54/S52 Brussels 1050 Belgium: EUR StatementDokument2 SeitenWise Europe SA Avenue Louise 54/S52 Brussels 1050 Belgium: EUR StatementAchref KaNoch keine Bewertungen

- Daily DAX Journal 070410Dokument2 SeitenDaily DAX Journal 070410Jay SchneiderNoch keine Bewertungen

- Daily DAX Journal 060810Dokument2 SeitenDaily DAX Journal 060810Jay SchneiderNoch keine Bewertungen

- The 2013 Energy ForecastDokument11 SeitenThe 2013 Energy ForecastJay Schneider100% (1)

- Daily Studies 040810Dokument2 SeitenDaily Studies 040810Jay SchneiderNoch keine Bewertungen

- Daily DAX Journal 100810Dokument2 SeitenDaily DAX Journal 100810Jay SchneiderNoch keine Bewertungen

- Myth of DiversificationDokument6 SeitenMyth of DiversificationJay SchneiderNoch keine Bewertungen

- Norton and Ariely - Building A Better AmericaDokument13 SeitenNorton and Ariely - Building A Better AmericaradiorahimNoch keine Bewertungen

- NBS Energy Data RevisionsDokument6 SeitenNBS Energy Data RevisionsJay SchneiderNoch keine Bewertungen

- The Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksDokument5 SeitenThe Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksJay SchneiderNoch keine Bewertungen

- Daily DAX Journal 110810Dokument2 SeitenDaily DAX Journal 110810Jay SchneiderNoch keine Bewertungen

- The Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksDokument5 SeitenThe Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksJay SchneiderNoch keine Bewertungen

- Daily DAX Journal 090810Dokument2 SeitenDaily DAX Journal 090810Jay SchneiderNoch keine Bewertungen

- Daily DAX Journal 050810Dokument2 SeitenDaily DAX Journal 050810Jay SchneiderNoch keine Bewertungen

- Daily DAX Studies 020810Dokument2 SeitenDaily DAX Studies 020810Jay SchneiderNoch keine Bewertungen

- Daily Studies 010810Dokument2 SeitenDaily Studies 010810Jay SchneiderNoch keine Bewertungen

- The Lonely Trader: Date GMT Event Import Forecast Previous RemarksDokument5 SeitenThe Lonely Trader: Date GMT Event Import Forecast Previous RemarksJay SchneiderNoch keine Bewertungen

- The Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksDokument5 SeitenThe Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksJay SchneiderNoch keine Bewertungen

- Weekly Outlook 180710Dokument6 SeitenWeekly Outlook 180710Jay SchneiderNoch keine Bewertungen

- Weekly Outlook 030710Dokument5 SeitenWeekly Outlook 030710Jay Schneider100% (1)

- Daily Outlook 300710Dokument2 SeitenDaily Outlook 300710Jay SchneiderNoch keine Bewertungen

- Q3 2010 03jul 2010Dokument3 SeitenQ3 2010 03jul 2010Jay SchneiderNoch keine Bewertungen

- Dokumenti I ODIHR Per Vezhguesit AfatshkurterDokument9 SeitenDokumenti I ODIHR Per Vezhguesit Afatshkurtershqiptarja.comNoch keine Bewertungen

- Marketing strategies for Central and Eastern EuropeDokument197 SeitenMarketing strategies for Central and Eastern EuropeTom WongNoch keine Bewertungen

- MANAGEMENT ACCOUNTING ACTIVITIES BUDGETING COSTINGDokument8 SeitenMANAGEMENT ACCOUNTING ACTIVITIES BUDGETING COSTINGainonlelaNoch keine Bewertungen

- CIMOS Annual Report 2010 WWWDokument150 SeitenCIMOS Annual Report 2010 WWWsteelboy.indiaNoch keine Bewertungen

- EY Global IPO Trends Q4 2015Dokument16 SeitenEY Global IPO Trends Q4 2015Noah Kulwin100% (1)

- TISK Political Advertisement V4 EN PDFDokument13 SeitenTISK Political Advertisement V4 EN PDFKristína KrokováNoch keine Bewertungen

- Presentation Acquisition of GLGDokument43 SeitenPresentation Acquisition of GLGAkshayNoch keine Bewertungen

- World12 09 15Dokument40 SeitenWorld12 09 15The WorldNoch keine Bewertungen

- Group Cash Flow Statement GuideDokument28 SeitenGroup Cash Flow Statement GuideImran MobinNoch keine Bewertungen

- Barometer Brochure 18-09-27Dokument26 SeitenBarometer Brochure 18-09-27ActuaLittéNoch keine Bewertungen

- Ciadmin, Journal Manager, 28-103-1-CEDokument12 SeitenCiadmin, Journal Manager, 28-103-1-CEmaniNoch keine Bewertungen

- EmaarDokument167 SeitenEmaarTshepo NthoiwaNoch keine Bewertungen

- International Finance Multiple Choice QuestionsDokument44 SeitenInternational Finance Multiple Choice QuestionsDonia WaelNoch keine Bewertungen

- SintexInd Sunidhi 211014Dokument7 SeitenSintexInd Sunidhi 211014MLastTryNoch keine Bewertungen

- The Euro AreaDokument1 SeiteThe Euro AreaDaiuk.DakNoch keine Bewertungen

- Industry Overview Chemical Industry in Germany en DataDokument16 SeitenIndustry Overview Chemical Industry in Germany en DatamarcusNoch keine Bewertungen

- The 12-Month Saving ChallengeDokument7 SeitenThe 12-Month Saving ChallengeJonas Miranda CabusbusanNoch keine Bewertungen

- Hybrid and Derivative Securities: Learning GoalsDokument42 SeitenHybrid and Derivative Securities: Learning GoalsRonna Mae Ferrer0% (1)

- Besserbrau Ag 1 PDFDokument3 SeitenBesserbrau Ag 1 PDFrian saputraNoch keine Bewertungen

- Fin 243 Ex 1 To 3Dokument7 SeitenFin 243 Ex 1 To 3Hilary TseNoch keine Bewertungen

- Sugar Methodology PDFDokument12 SeitenSugar Methodology PDFDeepak DharmarajNoch keine Bewertungen

- 5.practice Set Ibps Cwe Po-IVDokument19 Seiten5.practice Set Ibps Cwe Po-IVgopalraja732Noch keine Bewertungen

- Wozniak, LLC: CHIROPRACTIC PRACTICE - PRO FORMA AND CASH FLOW TEMPLATEDokument6 SeitenWozniak, LLC: CHIROPRACTIC PRACTICE - PRO FORMA AND CASH FLOW TEMPLATEWozniakLLCNoch keine Bewertungen

- Commerzbank ForecastDokument16 SeitenCommerzbank ForecastgordjuNoch keine Bewertungen

- Suttmeier Weekly Market BriefingDokument3 SeitenSuttmeier Weekly Market BriefingRichard SuttmeierNoch keine Bewertungen