Beruflich Dokumente

Kultur Dokumente

Assignment

Hochgeladen von

Harshdeep SinghOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assignment

Hochgeladen von

Harshdeep SinghCopyright:

Verfügbare Formate

Assignment on Time Value of Money

Q1. You are considering the purchase of a new car. You have negotiated with the

salesperson at the dealership and can purchase the vehicle for Rs 30,000. You have Rs

8000 that can be used as a down payment.

Before going to the dealer, you had made up your mind and set an absolute limit of Rs

375 as the monthly payment amount that you can make on the car. You are willing to

finance over five years but you cannot exceed the payment of Rs375 per month. The

dealer is offering to finance you at an annual rate of 6.5% for a 5 year loan or a 5.5%

financing on a 4 year loan.

1. Can you meet your payment restriction and finance the amount required for the

car.

2. What is the maximum amount that you can borrow, to meet your payment

restriction if the loan is to be paid off in 5 years?

3. Suppose, you are limited to paying Rs375 per month but you want to loan off in 4

years and not 5 years. What is the maximum amount that you can borrow?

Q2. Find the present value of the following cash flows using a discount rate of 10%

Year Cash Flow

1-3 1,000

4 2,000

5 3,000

6-14 1,000

15 4,000

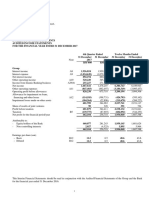

Q3. For the following cases, calculate the amount at the end of the deposit period.

Case Initial amount Interest Rate No of years Compounding

period

1 4000 8 4 3

2 2000 10 5 6

3 1000 11 10 12

Q4. SS purchases a computer system for Rs 35,000, which is borrowed on a 15% interest,

The loan is to be repaid in 12 EMI, payable at he end of each month. Determine the laon

installment amount

Q5. A company purchases a FA for Rs 4, 00,000 by making a down payment of Rs

1, 00,000 and the remaining balance in equal installments of RS 1,00,000 for 4 years.

What is the rate of interest to the firm?

Q6. Mr. Sundaram is planning to retire this year. His company can pay him a lump sum

retirement payments of Rs 2, 00,000 or Rs 25,000 life time annuity which ever he

chooses. Mr. Sundaram is in good health and estimates to live for at least 20 more years.

If his interest rate is 12%, which alternative should he choose?

Q7. Assume that you have given a choice between incurring an immediate outlay of Rs

10,000 and having to pay Rs 2310 a year for 5 years (first payment due one year from

now) the discount rate is 11%. What would be your choice? Will your answer change if

Rs 2310 is paid in the beginning of each year for 5 years.

Q8. Exactly twenty years from now Mr. Ahemd will start receiving a pension of Rs

10,000 a year. The payment will continue for twenty years. How much is pension worth

now, assuming money is worth15% per year.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- PRE-BAR REVIEW PROGRAM 2016 COMMERCIAL LAW REVIEWERDokument25 SeitenPRE-BAR REVIEW PROGRAM 2016 COMMERCIAL LAW REVIEWERKimiko Nishi Hideyoshi100% (1)

- JP Morgan CDO HandbookDokument60 SeitenJP Morgan CDO HandbookForeclosure Fraud100% (2)

- Industry Report On Credit Card Issuing - NrinconDokument7 SeitenIndustry Report On Credit Card Issuing - NrinconNick RinconNoch keine Bewertungen

- Exhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Dokument5 SeitenExhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Rohit Jhawar100% (2)

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Dokument13 SeitenFundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica ParasNoch keine Bewertungen

- Uts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFDokument4 SeitenUts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFSuci Purnama Devi100% (1)

- Final Report - 2010C03Dokument24 SeitenFinal Report - 2010C03Harshdeep SinghNoch keine Bewertungen

- The Evolution of Sales TrainingDokument6 SeitenThe Evolution of Sales TrainingHarshdeep SinghNoch keine Bewertungen

- Can Political Brands Be Successfully ExtendedDokument8 SeitenCan Political Brands Be Successfully ExtendedHarshdeep SinghNoch keine Bewertungen

- Presentation 1Dokument3 SeitenPresentation 1Harshdeep SinghNoch keine Bewertungen

- China in Africa 5Dokument40 SeitenChina in Africa 5Harshdeep SinghNoch keine Bewertungen

- InventoryDokument117 SeitenInventoryHemn YasinNoch keine Bewertungen

- Combined Graduate Level Examination (Tier-II), 2018Dokument17 SeitenCombined Graduate Level Examination (Tier-II), 2018MALOTH BABU RAONoch keine Bewertungen

- FINMAN 103 Module IIIDokument26 SeitenFINMAN 103 Module IIIAlma Teresa NipaNoch keine Bewertungen

- FORM 20-F: United States Securities and Exchange CommissionDokument427 SeitenFORM 20-F: United States Securities and Exchange Commissionميرنا ميرناNoch keine Bewertungen

- Lecture October 17Dokument20 SeitenLecture October 17RanielMBarbosaNoch keine Bewertungen

- Capsule Group1Dokument212 SeitenCapsule Group1Indhumathi ThangaveluNoch keine Bewertungen

- Abm Investama TBK - Bilingual - 31 - Des - 2019 - ReleasedDokument186 SeitenAbm Investama TBK - Bilingual - 31 - Des - 2019 - ReleasedJefri Formen PangaribuanNoch keine Bewertungen

- Internship Report On UCBLDokument47 SeitenInternship Report On UCBLIftakher HossainNoch keine Bewertungen

- Professional Indemnity InsuranceDokument2 SeitenProfessional Indemnity InsuranceCoverYou MarketingNoch keine Bewertungen

- LRB Consulting Owned by Lennox Bronson Has A December 31 PDFDokument1 SeiteLRB Consulting Owned by Lennox Bronson Has A December 31 PDFLet's Talk With HassanNoch keine Bewertungen

- LI&R Val S1 2020 M01 Introduction PDFDokument25 SeitenLI&R Val S1 2020 M01 Introduction PDFJeff GundyNoch keine Bewertungen

- Finals in Gen MathDokument4 SeitenFinals in Gen MathEmelyn V. CudapasNoch keine Bewertungen

- RHB Bank Berhad 2017 Audited Financial StatementsDokument75 SeitenRHB Bank Berhad 2017 Audited Financial StatementssulizaNoch keine Bewertungen

- Cash and Cash EquivsDokument7 SeitenCash and Cash EquivsVic BalmadridNoch keine Bewertungen

- Acctng QuizDokument1 SeiteAcctng QuizSAIDA B. DUMAGAYNoch keine Bewertungen

- Exercises: 1) Acme Borrowed $100,000 From A Local Bank, Which Charges Them An Interest Rate of 7% PerDokument4 SeitenExercises: 1) Acme Borrowed $100,000 From A Local Bank, Which Charges Them An Interest Rate of 7% PerIslam MomtazNoch keine Bewertungen

- Problem Set ZeroBonds SOLDokument4 SeitenProblem Set ZeroBonds SOLChung Chee YuenNoch keine Bewertungen

- Part 3Dokument49 SeitenPart 3neha kalpatriNoch keine Bewertungen

- Ehrentraud & Garcia (2020) - Managing The Winds of Change - Policy Responses To FintechDokument8 SeitenEhrentraud & Garcia (2020) - Managing The Winds of Change - Policy Responses To FintechJeffersonNoch keine Bewertungen

- Transaction AssumptionsDokument21 SeitenTransaction AssumptionsSuresh PandaNoch keine Bewertungen

- SBT Ifsc DetailsDokument125 SeitenSBT Ifsc DetailsPanruti S Sathiyavendhan0% (1)

- Peralta Company Income StatementDokument4 SeitenPeralta Company Income StatementNow OnwooNoch keine Bewertungen

- Redacted Version of Exhibits A J To Letter To The Honorable Kathaleen ST J Mccormick From Edward BDokument151 SeitenRedacted Version of Exhibits A J To Letter To The Honorable Kathaleen ST J Mccormick From Edward BKdnNoch keine Bewertungen

- Sheryl Nieves Santillan: East West Banking CorporationDokument7 SeitenSheryl Nieves Santillan: East West Banking CorporationAngela Cajurao ArenoNoch keine Bewertungen