Beruflich Dokumente

Kultur Dokumente

Entry Barrier

Hochgeladen von

Kuldip_2009Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Entry Barrier

Hochgeladen von

Kuldip_2009Copyright:

Verfügbare Formate

Videocon International's sales from FY1995-FY2000 have increased by 50% to Rs30bn

while earnings have inched up only by 12.5% to Rs20.70. This is because the company has a

problem with its mounting interest burden. The company's net profit for FY2000 has shown an

increase of 9.9% to Rs1.5bn while the company's sales for FY2000 increased by 12.5% to

Rs30bn.

Akai showed a marked rise in its share in 1997-98, thanks to its radical marketing strategy of

pricing CTVs below the psychological barrier of Rs10,000. This re-ignited latent demand

among B&W TV set owners. Besides doubling sales, this strategy also halved the previous

replacement cycle from 12 to 6 years. However, the story was different in FY1999. It lost out

heavily when its tie-up with Baron ended. The company has a market share of just 2%.

Currently, the Akai brand is with Videocon. . Akai, for eg, sold its CTVs at an unbelievable

price of Rs10,000 to lure price-sensitive consumers. Replacement Demand vis-à-vis Entry

Of AkaiIndians have a mindset which prevents them from throwing away old items, especially

items like durables, which cost a big amount. However, if an individual can replace it for a

new one, he/she will readily do so, for eg, items like garments are exchanged for utensils.

Akai's huge success story was scripted largely because it tapped the latent demand for

replacing existing TVs in the early 1990s. With the entry of satellite TV in the early 1990s,

most TV sets in India had turned obsolete. They did not have the S-band facility to receive the

large number of channels. What Akai did was to push the replacement cycle forward by taking

back old TV sets. Their exchange schemes broke the inertia and the sense of guilt that exists

while disposing of an old TV set that works. The old TV sets were supplied to the rural market

at prices ranging from Rs2,000 to 4,000. In time, they formed the new replacement market.

Akai, for eg, sold its CTVs at an unbelievable price of Rs10,000 to lure price-sensitive

consumers. This strategy paid off for some time in the urban areas.

Videocon manufactures 38% of CTVs sold in India. For the period FY2000, the company

enjoyed a 19% market share (including share of brands marketed by Videocon). The

company's strength is a strong brand, which has enabled the group to withstand strong

competition from multinational companies. However, with the Korean multinationals on a roll,

the company will not be able to withstand the pressure if it does not invest innovative ideas

and the latest technology in its products. Videocon also manufactures glass shells, which is

an important input for making CPTs. With this, we can say that every CTV made in India has

about Rs1,300 of Videocon in it.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Diet PlanDokument1 SeiteDiet PlanKuldip_2009Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- CV StyleDokument1 SeiteCV StyleKuldip_2009Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Resume FormatDokument1 SeiteResume FormatKuldip_2009Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Candidate DetailsDokument1 SeiteCandidate DetailsKuldip_2009Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Professional Experience - : Describe Your Qualities, Values and ExpertiseDokument1 SeiteProfessional Experience - : Describe Your Qualities, Values and ExpertiseKuldip_2009Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- TGT - SalesDokument2 SeitenTGT - SalesKuldip_2009Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Channel TGT - SalesDokument2 SeitenChannel TGT - SalesKuldip_2009Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Things To Look While Looking at CTC: Basic HRA Allowances Conveyance MedicalDokument1 SeiteThings To Look While Looking at CTC: Basic HRA Allowances Conveyance MedicalKuldip_2009Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Superior Analytical & Problem Solving Skills Communication & Presentation Skills Multitasking Ability Networking Ability Stakeholder ManagementDokument1 SeiteSuperior Analytical & Problem Solving Skills Communication & Presentation Skills Multitasking Ability Networking Ability Stakeholder ManagementKuldip_2009Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

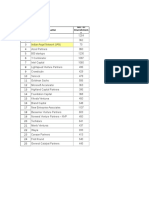

- Sno Name No. of Investmen TDokument2 SeitenSno Name No. of Investmen TKuldip_2009Noch keine Bewertungen

- Particulars of Landlord FormDokument1 SeiteParticulars of Landlord FormKuldip_2009Noch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Basic Salary House Rent Allowance Conveyance Management Allowance Special Allowance Gurgaon Compensatory AllowanceDokument1 SeiteBasic Salary House Rent Allowance Conveyance Management Allowance Special Allowance Gurgaon Compensatory AllowanceKuldip_2009Noch keine Bewertungen

- Trans-National Trip: Internal Control Systems 6. Related Party TransactionsDokument1 SeiteTrans-National Trip: Internal Control Systems 6. Related Party TransactionsKuldip_2009Noch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- DataDokument1 SeiteDataKuldip_2009Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- TripDokument1 SeiteTripKuldip_2009Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Governance at Stock ExchangesDokument1 SeiteGovernance at Stock ExchangesKuldip_2009Noch keine Bewertungen

- Fare Matrix: # StationsDokument15 SeitenFare Matrix: # StationsKuldip_2009Noch keine Bewertungen

- DS - LWT300 - SF - A4 EN Rev BDokument4 SeitenDS - LWT300 - SF - A4 EN Rev BZts MksNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- OEM - Fuel Manager Brand Cross Reference P/Ns For Service Filter Elements 99642 - January 2006Dokument6 SeitenOEM - Fuel Manager Brand Cross Reference P/Ns For Service Filter Elements 99642 - January 2006Miguel RojasNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- ExamDokument446 SeitenExamkartikNoch keine Bewertungen

- Clark Hess1Dokument668 SeitenClark Hess1Jeyner Chavez VasquezNoch keine Bewertungen

- Brigada EskwelaDokument4 SeitenBrigada EskwelaJas Dela Serna SerniculaNoch keine Bewertungen

- No. 3 - Republic vs. DiazDokument7 SeitenNo. 3 - Republic vs. DiazMark Gabriel MarangaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- When RC Columns Become RC Structural WallsDokument11 SeitenWhen RC Columns Become RC Structural Wallssumankanthnelluri7Noch keine Bewertungen

- Ap Human Geography Unit 5Dokument4 SeitenAp Human Geography Unit 5api-287341145Noch keine Bewertungen

- EC1002 Commentary 2022Dokument32 SeitenEC1002 Commentary 2022Xxx V1TaLNoch keine Bewertungen

- Food Safety and StandardsDokument8 SeitenFood Safety and StandardsArifSheriffNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- TQM - Juran ContributionDokument19 SeitenTQM - Juran ContributionDr.K.Baranidharan100% (2)

- 1.3.2 SIC/XE Machine Architecture: 1 Megabytes (1024 KB) in Memory 3 Additional Registers, 24 Bits in LengthDokument8 Seiten1.3.2 SIC/XE Machine Architecture: 1 Megabytes (1024 KB) in Memory 3 Additional Registers, 24 Bits in LengthSENTHILKUMAR PNoch keine Bewertungen

- How To Apply For The UpcatDokument3 SeitenHow To Apply For The UpcatAaron ReyesNoch keine Bewertungen

- Using Excel For Business AnalysisDokument5 SeitenUsing Excel For Business Analysis11armiNoch keine Bewertungen

- FEDokument20 SeitenFEKenadid Ahmed OsmanNoch keine Bewertungen

- Fernbetätigte Armaturen: Remote Controlled Valve SystemsDokument14 SeitenFernbetätigte Armaturen: Remote Controlled Valve SystemslequangNoch keine Bewertungen

- TUF-2000M User Manual PDFDokument56 SeitenTUF-2000M User Manual PDFreinaldoNoch keine Bewertungen

- ChinatownDokument1 SeiteChinatownAiken KomensenNoch keine Bewertungen

- Motorola Droid 2Dokument11 SeitenMotorola Droid 2Likith MNoch keine Bewertungen

- Information Technology and Telecommunications Services Agreement Between County of San Diego and Enterprise Services, LLC ContraDokument106 SeitenInformation Technology and Telecommunications Services Agreement Between County of San Diego and Enterprise Services, LLC ContraJackkk FNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Sarcosine MsdsDokument41 SeitenSarcosine MsdsAnonymous ZVvGjtUGNoch keine Bewertungen

- Enterprise Resource Planning: Computerized AccountingDokument14 SeitenEnterprise Resource Planning: Computerized Accountingjivesh ranjan tiwariNoch keine Bewertungen

- 1-Page TimeBoxing Planner v2.0Dokument2 Seiten1-Page TimeBoxing Planner v2.0ash.webstarNoch keine Bewertungen

- Virtual Asset Insurance Risk Analysis - OneDegreeDokument3 SeitenVirtual Asset Insurance Risk Analysis - OneDegreeShaarang BeganiNoch keine Bewertungen

- ColgateDokument32 SeitenColgategargatworkNoch keine Bewertungen

- Micromagnetic Simulation of Magnetic SystemsDokument12 SeitenMicromagnetic Simulation of Magnetic SystemsImri SsNoch keine Bewertungen

- Principles of Care-Nursing For Children: Principle DescriptionDokument3 SeitenPrinciples of Care-Nursing For Children: Principle DescriptionSanthosh.S.UNoch keine Bewertungen

- Writing White PapersDokument194 SeitenWriting White PapersPrasannaYalamanchili80% (5)

- b1722Dokument1 Seiteb1722RaziKhanNoch keine Bewertungen

- Standard Operating Procedure Template - Single PageDokument1 SeiteStandard Operating Procedure Template - Single PagetesNoch keine Bewertungen

- Fascinate: How to Make Your Brand Impossible to ResistVon EverandFascinate: How to Make Your Brand Impossible to ResistBewertung: 5 von 5 Sternen5/5 (1)

- Summary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedVon EverandSummary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedBewertung: 3 von 5 Sternen3/5 (6)

- Obviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItVon EverandObviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItBewertung: 4.5 von 5 Sternen4.5/5 (152)