Beruflich Dokumente

Kultur Dokumente

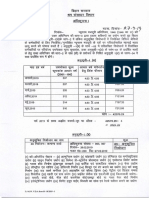

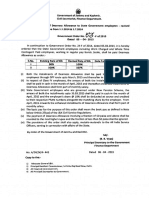

Income Tax 2010-11

Hochgeladen von

Kavita RaniOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Income Tax 2010-11

Hochgeladen von

Kavita RaniCopyright:

Verfügbare Formate

Income Tax

Assessment Year 2010-11

CHAPTER-1

BASIC CONCEPTS OF INCOME TAX

TAX - MEANING THEREOF - Every state needs funds to govern the

country. The need of funds can be fulfilled by taking loans from

their countries, grants & aids from other countries, share of profit

in govt. run organizations and through taxes.

Therefore, tax is that amount which is borne by the

persons and paid to the state for running the state.

KINDS OF TAXES - Taxes are of two kinds:-

(1) Direct Taxes; and (2) Indirect taxes.

DIRECT TAXES - These are borne and paid by the same person. For

example: Income tax, Wealth tax, Gift tax (Gift tax has been

abolished in India) and Interest tax.

INDIRECT TAXES - These are borne by persons who are different

from the payers. For example: Custom duty, Excise duty, Sales

Tax, Entertainment tax, Octroi etc.

INCOME TAX ACT, 1961 -

The current Income tax Act was regulated from 1.4.1961

and its rules were brought into working from 1.4.1962. Every year

the finance minister of the country proposes for various changes in

the Act through the Finance Bill. This bill, when gets nod in the

parliament, becomes ' The Amendment Act.'

SPECIFIC TERMS TO BE USED IN THE ACT-

PREVIOUS YEAR (SECTION 3): It refers to the year in which a

person earns his income which is taxable in the relevant assessment

year. The period of previous year is normally of 12 MONTHS starting

from 1st April to 31st March in the next calendar year. But in case of

NEWLY SET-UP Business/profession or new source of income

the period of previous year may be less than 12 months. Thus the

period of previous year can be of less than 12 months in case of new

source of income but afterwards the period is always equal to 12

months.

ASSESSMENT YEAR [SECTION 2(9)]: It refers to the year in which

income of a person (who has earned his income in the relevant

previous year) is charged to tax. THIS MEANS THAT EACH

PREVIOUS YEAR HAS A UNIQUE ASSESSMENT YEAR. ALSO THE

ASSESSMENT YEAR ALWAYS FOLLOWS THE PREVIOUS YEAR e.g.

a) PREVIOUS YEAR RELEVANT ASSESSMENT YEAR

2004-05 2005-06

(1.4.2004 TO (1.4.2005 TO 31.3.2006)

31.3.2005)

INCOME EARNED INCOME CHARGED TO TAX

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 1

Income Tax

Assessment Year 2010-11

b) PREVIOUS YEAR RELEVANT ASSESSMENT YEAR

2009-10 2010-11

(1.4.2009 TO (1.4.2010 TO 31.3.2011)

31.3.2010)

INCOME EARNED INCOME CHARGED TO TAX

This also leads to the conclusion that every financial year

(1st April to 31st March) is :- (1) ASSESSMENT YEAR for preceding

Financial year; AND

(2) PREVIOUS YEAR for next financial year.

PERSON [SECTION 2(31)]: The definition as per the act is

'INCLUSIVE' one and it includes:-

(1) INDIVIDUAL (may be minor, insane or lunatic).

(2) HINDU UNDIVIDED FAMILY

(3) COMPANY (Indian or Foreign or an entity recognised as

Company by C.B.D.T.).

(4) FIRM (a Partnership firm including a Limited Liability

Partnership as per The Limited Liability Partnership Act, 2008).

(5) ASSOCIATION OF PERSONS/BODY OF INDIVIDUALS (e.g. Co-op.

society)

(6) LOCAL AUTHORITY (e.g. Municipal Corporation, Port Trust etc.).

(7) EVERY OTHER ARTIFICIAL JURIDICAL PERSON (e.g. Indian

Railways, University).

ASSESSEE [SECTION 2(7)]: Assessee means a person (as referred

above) who is liable to pay income tax or any other amount (interest

or penalty) under the Act.

It also includes a person on whom any proceeding has been

taken for assessment of his income/loss or refund due to him.

It also includes a person who represents some other person

who is liable to pay tax. He is called “REPRESENTATIVE ASSESSEE’

or ‘DEEMED ASSESSEE’ (e.g. Father, filing the return of his working

minor child, on his behalf).

It also includes a person who has made default under any

provision of the Income Tax Act. He is called ' ASSESSEE IN

DEFAULT'. For example if a person was responsible to deduct the

Tax at Source but has not deducted the tax or after deducting the

tax he has not deposited such tax. Another example may be a

person who was liable to pay advance tax but he has not paid such

advance tax.

INCOME [SECTION 2(24)]: The definition of 'Income’ under the Act

is inclusive and not exhaustive. It includes:

a) Profits and gains from business or profession;

b) Dividends;

c) Voluntary contributions received by a WHOLLY OR PARTLY

CHARITABLE OR RELIGIOUS TRUST/INSTITUTION EXCEPT the

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 2

Income Tax

Assessment Year 2010-11

contribution forming part of the CORPUS of the trust;

d) Perquisites and profit in lieu of salary;

e) ALLOWANCES or BENEFITS received by the assessee to meet

his expenses for PERFORMANCE OF HIS DUTIES;

f) ALLOWANCES received by the assessee to meet his personal

expenses at the place of duty or compensation for increased

cost of living;

g) BENEFITS OR PERQUISITES enjoyed (by a Director or a person

having substantial interest or a relative of Director/such

person) in a Company;

h) BENEFITS OR PERQUISITES obtained by REPRESENTATIVE

ASSESSEE OR any amount paid by representative assessee for

the benefits of the BENEFICIARY which is required to be paid

by the beneficiary only;

i) Compensation (or similar payments) received by or due to a

person under PGBP;

J) Income of Trade associations (Professional also) who provide

specific services to its members;

k) BENEFITS OR PERQUISITES from BUSINESS OR PROFESSION;

l) Export Incentives to Exporters;

m) Any interest, salary, bonus, commission received by a partner

from Firm;

n) Any sum received under Key man Insurance Policy;

o) Profit and Gains of Managing Agency;

p) Income from speculative transaction;

q) Recovery of any amount which has been allowed as deduction

in any preceding Assessment Year;

r) Income from sale of any fixed asset (except land) put to

scientific research without using it for any other purpose

before sale;

s) Recovery of Bad debts, allowed as deduction in any preceding

Assessment Year;

t) Amount transferred to Special Reserve under section 36(i)

(viii);

u) Recovery out of any discontinued business or profession;

v) Capital gains;

w) Insurance profit computed under section 44;

x) Casual Income;

y) Any sum received by employer from his employees as

contribution to RPF or any other approved fund and the

amount not deposited with in 'DUE DATES’ as per section 43B.

z) Any sum received under a Key-man Insurance Policy.

za) any gift of money received by an individual from non-specified

person(s) in excess of Rs.50000.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 3

Income Tax

Assessment Year 2010-11

THE POINTS TO BE NOTED:-

- A REVENUE INCOME IS TAXABLE UNLESS OTHERWISE STATED

IN THE ACT.

- A CAPITAL INCOME IS EXEMPTED UNLESS OTHERWISE STATED

IN THE ACT.

- PERSONAL GIFTS ARE NOT INCOME IN THE HANDS OF

RECIPIENT (EXCEPT GIFT OF MONEY EXCEEDING RS. 50000

RECEIVED BYINDIVIDUAL OR HUF WITHOUT CONSIDERATION).

- PIN MONEY IS NOT INCOME OF THE HOUSEWIFE.

- AWARDS RECEIVED BY A PROFESSIONAL SPORTS PERSON IS

TAXABLE BUT AWARDS RECEIVED BY AMATEURE SPORTS

PERSON IS NOT TAXABLE AS INCOME.

- THE BURDEN OF PROVING THAT A RECEIPT IS TAXABLE IS ON

THE INCOME TAX DEPARTMENT. BUT THE BURDEN OF

PROVING THAT AN INCOME IS EXEMPT IS ON THE ASSESSEE.

CAPITAL RECEIPTS vs. REVENUE RECEIPTS:

As discussed earlier, that the revenue receipts are

taxable, unless these are specifically exempted from tax under the

Act and the Capital Receipts are exempted unless these are

specifically charged to tax under the Act, so it becomes necessary to

understand the difference between the two. We have only the cases

decided by the courts with the help of which we can draw general

conclusions. These are as follows:-

a) The receipt is capital or revenue is to be considered only from

recipient’s point of view. The payer's motive is to be ignored.

b) Lump sum payments or payment received in Installment do

not affect the nature of the receipt.

c) Compensation received lieu of source of income is CAPITAL

RECEIPT whereas the compensation received for temporary

disablement is a revenue receipt.

d) Income from wasting assets (like mines and quarries are

treated as revenue income).

e) Insurance receipt for loss of current asset or against loss of

profit is Revenue Receipt. But Insurance claim for loss of Fixed

Asset is capital Receipt. The insurance claim for loss of goods,

which are not for business/profession, is Capital Receipt.

f) The receipt due to change in exchange rate of the currency on

current assets is Revenue receipt. But the receipt due to

change in exchange rate of the currency on FIXED

ASSETS/INVESTMENTS is CAPITAL RECEIPT.

g) The subsidy received for setting up a business or completing a

project is CAPITAL RECEIPT. But the subsidy received for

carrying out business activities and after the commencement

of production is REVENUE RECEIPT.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 4

Income Tax

Assessment Year 2010-11

HEADS OF INCOME: The Income Tax is levied an income of a

person. This income is divided into five heads as follows:-

1) INCOME UNDER HEAD SALARY

Income due/received by an employee from his

past/present/future employer is taxable under this head.

2) INCOME UNDER HEAD HOUSE PROPERTY

Income received/earned/deemed to be earned by a person

from house property is charged under this head.

3) INCOME UNDER HEAD PROFITS & GAINS OF BUSINESS OR

PROFESSION

Income received/earned by a person from his business or

profession is charged to tax under this head.

4) INCOME UNDER HEAD CAPITAL GAINS

Income earned /received by a person from sale/transfer of any

capital asset is charged under this head.

5) INCOME FROM OTHER SOURCES

Income from all other sources which can't be covered under

first four heads is charged to tax under this head.

IMPORTANT: INCOME TAX IS CHARGED ON ALL INCOMES OF A

PERSON. VARIOUS INCOMES ARE NOT CHARGED TO TAX

SEPARATELY. For example: Mr. X has income from:

a) Salary Rs. 10, 00,000/-; b) House property Rs. 2, 00,000/-; c)

Profit from cloth business Rs. 2, 00,000/-; d) Profit from Gold

business Rs. 1, 00,000/-; and e) Interest income of Rs.

50,000/-.

All these incomes will be charged to tax in only one RETURN OF

INCOME i.e. of Mr. X. All these incomes will be shown in the above

said Return of Income only.

METHOD OF ACCOUNTING: Under the Act only two accounting

methods are allowed - a) Mercantile system and; b) Cash system.

But these two methods can only be employed for

computing income under head-a) Profit & Gain of Business or

profession; & b) Income from other sources.

The remaining three heads of Income i.e. a) 'Salary; b)

House property and; c) Capital Gain do not recognize any method of

accounting followed by the person/assessee. Under these three

heads, income is calculated as per provisions given in the chapter

concerned.

Previous Year for Cash Credits, Investments,

Money etc.

1. Cash Credit (sec 68): Where any sum is found credited in the

books of an assessee for any previous year for which the assessee

has no satisfactory explanation then such cash credit is treated as

income of the assessee of the previous year in which such income

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 5

Income Tax

Assessment Year 2010-11

was credited.

2. Unexplained Investments (sec 69): Where in any previous

year the assessee has made any investments which are not

recorded in the books of account maintained by him and the

assessee has no satisfactory explanation about the source of

investment then such unexplained investment is treated as income

of the assessee of the previous year in which such investment was

made.

3. Unexplained Money (Sec 69A): Where in any previous year

the assessee is found to be the owner of any money, bullion,

Jewellery or other valuable article which is not recorded in the books

of account and the assessee has no satisfactory explanation about

the source of money etc. then such unexplained money etc. is

treated as income of the assessee of the previous year in which the

assessee was found to be the owner.

4. Investments not fully disclosed in the books of account

(sec 69B): Where in any previous year the assessee has made any

investments which are recorded in the books of account maintained

by him at an amount less than amount expended and the assessee

has no satisfactory explanation about the source of excess amount

expanded in investment then such excess amount is treated as

income of the assessee of the previous year in which such

investment was made.

5. Unexplained Expenditure (Sec 69 C): Where in any previous

year an assessee has incurred any expenditure and the assessee

has no satisfactory explanation about the source of expenditure or

part thereof then such unexplained explained expenditure or part

thereof is treated as income of the assessee of the previous year in

which such expenditure was incurred. Also such unexplained

expenditure can not be allowed as deduction under any head of

income.

6. Amount borrowed or repaid on Hundi (sec 69D): Where any

amount is borrowed on a Hundi from, or any amount due thereon is

repaid to, any person otherwise than through an account payee

cheque drawn on a bank, the amount so borrowed or repaid shall be

deemed to be the income of the borrower or repayer for the

previous year in which such amount was borrowed /repaid. If

amount borrowed has already been taxed then there will be no tax

levied at the time of repayment of such amount.

EXECPTIONS TO THE GENERAL RULE THAT

INCOME OF A PREVIOUS YEAR IS CHARGED TO

TAX IN THE RELEVANT ASSESSMENT YEAR:

1. Non resident shipping business (sec 172) – In case of a non-

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 6

Income Tax

Assessment Year 2010-11

resident assessee owning a ship or ship is chartered by such

assessee carrying passengers, livestock, goods or mail shipped at

any Indian Port then 7.5% of fare on account of such carriage is

deemed to be the income of such assessee. Such income is taxable

in the same year in which such fare was collected. It is immaterial

whether such assessee has any agent or representative in

India or not.

2. Persons leaving India (sec 174) – If it appears to the

Assessing Officer that an individual may leave India during the

previous year or shortly thereafter and the such individual has no

intention of returning back to India then the income of such

individual upto the probable date of his departure from India shall be

charged to tax in the same previous year itself.

3. AOP/BOI/ juridicial person formed for short duration

(sec174A) – If an AOP/BOI/ artificial juridicial person is formed for

short duration for a particular event or purpose and if it appears to

the Assessing Officer that such AOP etc. may be dissolved during

the previous year or shortly thereafter then the income of such AOP

etc. of the previous year shall be charged to tax in the same

previous year itself.

4. Person trying to alienate (transfer) his assets to avoid tax

liability (sec 175) -- If it appears to the Assessing Officer that an

individual may sell, transfer, dispose off or otherwise part with any

of movable or immovable asset with a view to avoid payment of any

liability under the Income Tax Act then the income of such individual

upto date of starting proceedings under this section shall be charged

to tax in the same previous year itself.

5. Discontinued Business (sec 176) – If any business or

profession is discontinued during the previous year then the

Assessing Officer may charge the income of the previous year to tax

in the previous year itself. Alternatively, the Assessing Officer may

charge such income to tax in the relevant assessment year.

PERFORMA OF COMPUTATION CHART OF

INCOME TAX

Name of person :

Address :

Father's Name (if applicable) :

Date of Birth (if applicable) :

Previous Year :

Assessment year :

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 7

Income Tax

Assessment Year 2010-11

Ward/Circle/Range :

Permanent Account Number :

PARTICULARS AMOUNT

1. INCOME UNDER HEAD 'SALARIES' +

2. INCOME UNDER HEAD 'HOUSE +

PROPERTY'

3. INCOME UNDER HEAD 'PROFITS & +

GAINS OF BUSINESS'

4. INCOME UNDER HEAD 'CAPITAL +

GAINS’ +

5. INCOME UNDER HEAD ‘OTHER

SOURCES’

Less Setting off of brought forward losses -

:

GROSS TOTAL INCOME (OR G.T.I.)

Less Deduction under Chapter VI A -

: (Section 80C to 80U)

NET INCOME (OR NET TAXABLE

INCOME) (OR TOTAL INCOME)

TAX LIABILITY

Tax on special Incomes (like casual Income

or long term Capital Gains or undisclosed

Incomes or incomes of non-residents)

Tax on Normal Income +

TOTAL

Add: Surcharge (if applicable) +

Add: Education Cess @2% of Tax and +

surcharge

Add: Secondary & Higher Education Cess +

@1% of Tax and surcharge

TOTAL

Less: Rebate u/s 86, 89, 90 & 91 -

Add: Interest u/s 234 A,234 B & 234 C +

Less: Tax Deducted or collected at source -

Advance Income Tax -

Self Assessment Tax -

NET AMOUNT PAYABLE / REFUND DUE

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 8

Income Tax

Assessment Year 2010-11

RATES OF TAX FOR ASSESSMENT YEAR 2010-11-

A. On Normal Income -

1(a) for woman, resident in India and below 65 years of age till

31.03.2010

Upto Rs. 1,90,000 Nil

From Rs.1,90,010 to Rs. 3,00,000 10%

From Rs.3,00,010 to Rs. 5,00,000 20%

Above Rs. 5,00,000 30%

1(b) For an Individual (man or woman), resident in India who is of 65

years of age or more at any time during the previous year

Upto Rs. 2,40,000 Nil

From Rs.2,40,010 to Rs. 3,00,000 10%

From Rs.3,00,010 to Rs. 5,00,000 20%

Above Rs. 5,00,000 30%

1(c) For Individuals (other than those mentioned above), HUF,

AOP/BOI (other than co-operative societies)

Upto Rs. 1,60,000 Nil

From Rs.1,60,010 to Rs. 3,00,000 10%

From Rs.3,00,010 to Rs. 5,00,000 20%

Above Rs. 5,00,000 30%

1(d) For Firms (including LLP’s) – A firm’s normal income is taxable

@ 30%.

1(e) (i) For Domestic Company normal income is taxable @ 30%.

(ii) For Foreign Company normal income is taxable @ 40%.

1(f) For Co-operative societies

Upto Rs. 10,000 10%

From Rs.10,010 to Rs. 20,000 20%

Above Rs. 20,000 30%

1(g) For Local Authorities: A Local Authority’s normal Income is

taxable @ 30%.

(B) On Special Incomes:

1. Short Term Capital Gain u/s 111 A is taxable @ 15%.

2. Long Term Capital Gain u/s 112 is taxable @20%.

3. Winning from Lotteries, crossword puzzles, card games etc. u/s

115 BB is taxable @ 30%.

SURCHARGE: In case a Company (Domestic or Foreign) has a total

income not exceeding Rs. 1,00,00,000 then there is no surcharge

otherwise there is surcharge of 10% (in case of Domestic Company)

and 2.5% in case of foreign company on income tax less rebate (if

any).

In above case there is marginal relief of surcharge.

For other persons there is no surcharge for A.Y. 2010-11.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 9

Income Tax

Assessment Year 2010-11

EDUCATION CESS: Education cess is 2% of total tax (including

surcharge) for all assessees.

SECONDARY & HIGHER EDUCATION CESS: It is 1% of total tax

(including surcharge) for all assessees.

* * *

CHAPTER-2

RESIDENTIAL STATUS

A person may earn/receive his income from a source or

at a place with in India or outside India. Such income is charged to a

person on the basis of Residential Status. Residential Status is

different from 'Nationality’ or ‘Domicile.’ Before starting the concept

of understanding different types of residential status it is necessary

to understand that:

1) Each and every person has a distinctive residential status for

every relevant previous year. It means that the person can be

either ' ORDINARILY RESIDENT' or 'NOT ORDINARILY RESIDENT’

or ‘NON RESIDENT’:

2) Every person has to consider his residential status in every

relevant previous year. It means that a person Resident in

A.Y.2009-10 may be non-resident in AY 2010-11 according to

the rules to be studied later on.

3) It is not necessary that a person, who is resident in India, can't

be Resident in any other country in the same previous year. It

simply means that a person can be Resident in more than one

country in the same previous year.

4) If a person is resident in a particular previous year for one

source of income then he is also resident for other sources of

income for that previous year. This means that a person

has same residential status for incomes of a particular

previous year.

The residential status is studied by dividing the persons

in following five categories:-

a) Individual b) H.U.F. c) Firm/AOP or BOI.

d) Company e) every other person.

A) RESIDENTIAL STATUS OF INDIVIDUAL: An individual

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 10

Income Tax

Assessment Year 2010-11

can be:

i) Resident; ii) Resident but not ordinarily resident; or iii) Non-

resident.

RESIDENT & ORDINARILY RESIDENT [Sec 6(1), 6(6)(a)]: An

individual is resident in India in a previous year if he fulfills at

least one of the following two conditions:

a) He is in India for at least 182 days in the previous year; or

b) He is in India for at least 60* days in the previous year and at

least 365 days in four years preceding the relevant previous

year.

*This period of 60 days is to be replaced by 182 days if:

i) Individual is Indian Citizen or a person of Indian origin who

comes for a visit to India; or

ii) Individual is Indian Citizen who leaves India during the relevant

previous year for employment purpose outside India or as a

crew member of Indian Ship.

NOTE: AN INDIVIDUAL IS A PERSON OF INDIAN ORIGIN IF HE

OR EITHER OF HIS PARENTS OR ANY OF HIS GRAND PARENTS

(BOTH PATERNAL & MATERNAL) WAS BORN IN UNDIVIDED

INDIA.

An individual, who fulfills either of 'a' or 'b' or both

conditions given above, has to fulfill both of the conditions given

below to be ordinarily Resident:-

a) He is resident in India for at least 2 years out of 10 years

immediately preceding the relevant previous year; &

b) He is in India for at least 730 days in 7 years preceding the

relevant previous year.

RESIDENT BUT NOT ORDINARILY RESIDENT [SEC6 (1), 6(6)

(a)]: An individual who fulfills at least one of the Basic

conditions of resident but does not fulfill both of the

conditions for ordinarily resident is RESIDENT BUT NOT

ORDINARILY RESIDENT.

NON RESIDENT:- An individual who does not fulfill any of the basic

condition of resident is called NON-RESIDENT.

B) RESIDENTIAL STATUS OF H.U.F.: Like Individual, the H.U.F.

can also be i) Resident and ordinarily resident; ii) Resident but not

ordinarily resident; & iii) Non resident.

RESIDENT & ORDINARILY RESIDENT [Sec.6 (2)]: The H.U.F. is

resident in Indian in a previous year if de-facto (actual) control and

management of its affairs is situated wholly or partly in India.

The H.U.F., who is Resident, has to fulfill both of the

conditions given below to be ordinarily resident:-

a) The Karta (Manager) is resident in India for at least 2 years out

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 11

Income Tax

Assessment Year 2010-11

of 10 years immediately preceding the relevant previous year;

&

b) The Karta is in India for at least 730 days in 7 years preceding

the relevant previous year.

RESIDENT BUT NOT ORDINARILY RESIDENT: The HUF who is

resident in India (i.e. the Control & Management of its

affairs is in India either wholly or partly) but it does not

fulfill both of the conditions for ordinarily resident is

resident but not ordinarily resident.

NON-RESIDENT: The H.U.F., control & management, of whose

affairs, is wholly outside India is Non-resident.

C) RESIDENTIAL STATUS OF FIRM/AOP OR BOI [Sec. 6

(2)]: A firm can be either i) resident; or ii) Non resident.

RESIDENT: A firm is resident in India if control and management of

its affairs is situated wholly or partly with in India.

NON RESIDENT: A firm/AOP or BOI is non resident in India if Control

and management of its affairs is situated wholly outside India.

NOTE: A Firm is not 'ordinarily' or 'not ordinarily resident’.

D) RESIDENTIAL STATUS OF A COMPANY [Sec 6(3)] : The

company can be either: i) Resident; or ii) Non- resident

RESIDENT: The Company, which is registered in India (Called Indian

Company), is always resident in India. A foreign company is resident

in India if control and management of its affairs is situated wholly

with in India.

NON RESIDENT: A foreign company is non resident in India if

control & management of its affairs is wholly or partly outside India.

NOTE: A company is never 'ORDINARILY RESIDENT' or 'NOT

ORDINARILY RESIDENT.

E) RESIDENTIAL STATUS OF EVERY OTHER PERSON [SEC

6(4)]: In case of every other person, same rules are

applicable as are in case of a FIRM/AOP/BOI.

TAX INCIDENCE FOR DIFFERENT RESIDENTIAL STATUS:

PARTICULARS ORDINARIL RESIDENT NON

Y BUT NOT RESIDENT

RESIDENT ORDINARIL

Y

RESIDENT

1 Income received in TAXABLE TAXABLE TAXABLE

India (Where ever

accrued)

2 Income deemed to be TAXABLE TAXABLE TAXABLE

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 12

Income Tax

Assessment Year 2010-11

received in India

(wherever accrued )

3 Income accrued in TAXABLE TAXABLE TAXABLE

India(wherever

received)

4 Income deemed to be TAXABLE TAXABLE TAXABLE

accrued in India

(wherever received)

5 Income accrued and TAXABLE TAXABLE NOT

received outside India, TAXABLE

from a business

controlled from India

or a profession set up

in India (wholly or

partly)

6 Income accrued and TAXABLE NOT NOT

received outside India, TAXABLE TAXABLE

from a business

controlled from

outside India or a

profession set up

outside India

7 Income accrued and NOT NOT NOT

received outside India TAXABLE TAXABLE TAXABLE.

during any preceding

previous year but

remitted to India

during the previous

year.

INCOME DEEMED TO BE RECEIVED IN INDIA: The following are

incomes which are deemed to be received in India:-

i) Annual accretion to balance in Recognised provident fund of an

employee i.e. interest credited at a rate exceeding 9.5%.

ii) Contribution in excess of 12% of General Salary (to be

discussed in chapter 'Salary') by the Employer towards R.P.F.

iii) Transfer balance from U.R.P.F. to R.P.F.

iv) Tax Deducted at source on income of payee.

v) Deemed Profit u/s 41 and 59 i.e. Recovery of any deduction or bad

debts or any income after closure of business or profession or sale

of any asset used for scientific research.

vi) Contribution by Central Government towards pension fund of its

employees under section 80 CCD.

vii) Special Incomes like cash credits, unexplained money etc..

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 13

Income Tax

Assessment Year 2010-11

INCOME DEEMED TO ACCRUE OR ARISE IN INDIA: The following

are incomes deemed to accrue or arise in India:-

i) Income from Business connection in India.

ii) Income from property or any source of Income which is

situated in India.

iii) Income from Transfer of Capital Asset situated in India.

iv) Salary (other than allowances and perquisites) received by

Indian National (citizen) Government employees posted

outside India.

v) Salary of an individual if service is rendered in India.

vi) Dividend received by any person from an Indian Company.

vii) Income by way of interest or royalty or fees from technical

service received by any person from Central or State Govt.

viii) Income by way of interest or royalty or fees for technical

service received by any person from any other person if the

fund or money or source of income from royalty is used in

India.

NOTE: Business connection may be of many types i.e. an agent in

India or an Indian Branch Office etc.. But in case of a Non-

resident person the following are not treated as business

connection in India:

a) Activities confined to purchase of goods in India for exports;

b) Activities confined to collection of news and views for

transmission outside India by or on behalf of Non-resident

engaged in business of news agency or publishing newspapers,

magazines or journals;

c) Activities confined to shooting of cinematographic film in India

if such Non-resident is:

i) an individual- not an Indian citizen; or

ii) a firm- having no partner being Indian Citizen or Indian

Resident; or

iii) a company- having no shareholder being Indian Citizen or

Indian Resident.

* * *

Chapter-3

INCOME UNDER HEAD "SALARIES"

The first head of Income is ‘Income from Salaries’. First of all let us

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 14

Income Tax

Assessment Year 2010-11

understand some important concepts about it:-

a) EMPLOYER-EMPLOYEE RELATIONSHIP: The relationship

between payer and the payee must be that of employer and

employee (i.e. master and servant relationship). Whether the

relationship is of master & servant or not, is decided on case to

case basis. The general rule is that a master is a person who

directs the servant WHAT IS TO BE DONE, WHEN IT IS TO BE

DONE, & HOW IT IS TO BE DONE. But this rule can't be applied

in all cases. [for example in case of a teacher or a doctor the

above rule fails].

• Remuneration received by a Member of Parliament is not

chargeable as salary because the relationship between him and the

Government is not of employer & employee. [It is chargeable under

head “Income from other sources”].

• Remuneration received by a partner from his partnership firm is

not chargeable as salary because the relationship between him and

the firm is not of employer & employee. [It is chargeable under head

"Profits & Gains of business and profession"].

b) SURRENDER OF SALARY: Any salary surrendered by the

employee to the Central Government under Section 2 of The

Voluntary Surrender of Salaries (Exemption from taxation) Act,

1961 is not charged to tax. The employee may be in private,

public or Government service.

c) FOREGOING OF SALARY: If any salary is foregone by the

employee (not surrendered as per point (b) then it is to be

charged to tax.

d) PLACE OF ACCRUAL OF SALARY: The salary income is

accrued where the employee renders the services. The place

of receipt of salary is of NO IMPORTANCE.

* But there is one exception to this rule. The salary, received by

Indian National Government Employee posted outside India, is

deemed to accrue or arise in India.

e) TAX FREE SALARY: If an employee receives tax free salary

from his employer then it simply means that tax has been paid

by the employer. The tax paid by employer will be added back

to find total salary due to the employee.

f) SALARY PAID BY FOREIGN EMPLOYER: If employee

rendering service in India is paid salary by his foreign

employer; it is taxable in India (unless otherwise stated to be

exempt u/s 10).

g) SALARY DUE OR RECEIVED IN FOREIGN CURRENCY: If the

employee earns/receives salary in foreign currency, it will be

converted in Rupees by applying. TELEGRAPHIC TRANSFER

BUYING RATE on the last day of the month preceding the

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 15

Income Tax

Assessment Year 2010-11

month in which salary is due or paid or is in arrears.

h) DISTINCTION BETWEEN SALARY & WAGES NOT

IMPORTANT: The Act does not make any difference between

salary and wages. Both are chargeable under 'SALARY'.

i) BASIC SALARY IN GRADE SYSTEM: Under this system, the

annual increments to be given to the employee are already

fixed in the grade. Let us take an example of an employee,

who joins service on 1.7.2008 and is in the grade of 15000-

500-20000-1000-40000. It means that in the first year of

service i.e. from 1.7.2008 to 30.6.2009 he will get Rs. 15,000

per month. In the next year from 1.7.2009 to 30.6.2010, his

basic salary will be Rs. 15,500 (including increment of Rs. 500).

He will get annual increments of Rs. 500 till his basic is Rs.

20,000. Then his annual increments will be Rs. 1,000 till his

basic is Rs. 40,000. After then there will be no increment.

j) SALARY FROM MORE THAN ONE SOURCE: If an employee

gets his salary from more than one employer then all the

salary is taxable under head income from 'SALARIES.'

k) SALARY FROM PAST, PRESENT OR FUTURE EMPLOYER:

Any remuneration received from past, present or future

employer is to be charged under head 'SALARIES'.

l) SALARY WHEN DUE: There are two approaches - i) Salary is

due on the last date of month; and ii) Salary is due on the

first date of next month.

m) BASIS OF ACCOUNTING IRRELEVANT: The books of

accounts kept by employee (if any) and accounting method

followed by him (cash or mercantile) are not relevant for

calculating salary income of the employee.

MEANING OF SALARY U/S 17(1): The definition of Salary is

inclusive one. It includes:-

- Wages;

- Any annuity or pension;

- Any Gratuity;

- Any fees, commissions, perquisites or profits in lieu of or in

addition to any salary or wages;

- Any advance of Salary;

- Any payment received by an employee in respect of any period

of leave not availed by him;

- Annual accretion to the balance at the credit of an employee

participating in a recognized provident fund to the extent to

which it is chargeable to tax;

- The aggregate of all sums that are comprised in the

transferred balance of an employee participating in a

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 16

Income Tax

Assessment Year 2010-11

recognised provident fund to the extent to which it is

chargeable to tax.

- The contribution made by the Central Government to the

account of an employee under pension scheme referred to in

section 80 CCD.

The above definition is inclusive. But in general,

Salary includes all the payments made by employer to employee

(including gratuitous payments, allowances and perquisites).

PROCESS OF COMPUTING SALARY INCOME:

It can be understood from the following table:-

Basic Salary +

Fees and Commission +

Bonus +

Entertainment Allowance +

Other Allowances (Taxable parts +

only)

Perquisites (Taxable parts only) +

Retirement Benefits (taxable parts +

only)

GROSS SALARY

Less: Deduction for Entertainment -

Allowance u/s 16 (ii)

Less: Deduction for Professional/ -

Employment tax u/s 16(iii)

INCOME UNDER HEAD SALARY

BASIS OF CHARGE (SECTION 15): Salary is charged to tax in

"due or receipt" basis whichever is earlier. But advance salary is

taxable on Receipt basis. Arrears of Salary is taxable on receipt

basis if not charged to tax in any previous year on due basis.

Similarly Bonus is taxable on receipt basis if not charged to tax

earlier on due basis. Salary in lieu of notice period is always taxable

on Receipt basis.

Now we shall study all the components of salary and their

taxability one by one.

BASIC SALARY: It is taxable or due on receipt basis whichever is

earlier.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 17

Income Tax

Assessment Year 2010-11

FEES & COMMISSION: It is also taxable on due or receipt basis

w.e. is earlier.

BONUS: It is taxable on receipt basis if not charged to tax earlier on

due basis. However relief u/s 89 can be claimed if it is taxed on

receipt basis.

SALARY IN LIEU OF NOTICE PERIOD [Section 15]: It is taxable

only on receipt basis.

ADVANCE SALARY [Section 17(1)(v)]: It is taxable on receipt

basis because it is never due. However relief u/s 89 can be claimed.

ARREARS OF SALARY: It is taxable on receipt/ allowed basis if it is

not taxed earlier on due basis. However relief u/s 89 can be claimed.

ANNUITY: It is taxable on due or receipt basis w.e. is earlier. If it is

received from present employer, it is taxed as Salary. If it is received

from past employer, it is taxed as profits in lieu of Salary.

RETIREMENT BENEFITS

There are following types of retirement benefits:

1. Gratuity

2. Pension

3. Leave Salary

4. Retrenchment Compensation

5. Compensation on voluntary retirement.

6. Provident Fund

7. Approved Superannuation fund

Now we shall study these one by one:

GRATUITY (DEATH-CUM-RETIREMENT)[Section 10(10)]:

Gratuity is received by employee from his employer in appreciation

of past services. It can be received by either:-

i) The employee himself on his retirement; or

ii) The legal heir on the death of employee.

The Gratuity received by employee is taxable under head

' Salaries' but the Gratuity received by the Legal heir is not

taxable (if employee died while in service). But some part of

Gratuity is exempt u/s 10(10). For this the employees are

divided into three categories:

i) Central/ State Government employees and employees of local

authorities.

ii) Employees covered under ' The payment of Gratuity Act,

1972’.

iii) Other Employees.

EXEMPTION FOR CENTRAL/STATE GOVT. EMPLOYEES &

EMPLOYEES OF LOCAL AUTHORITIES [SECTION 10(10)(i)]: Full

amount of Gratuity received by the employee is EXEMPT from tax.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 18

Income Tax

Assessment Year 2010-11

EXEMPTION FOR EMPLOYEES COVERED UNDER 'THE

PAYMENT OF GRATUITY ACT, 1972 [SECTION 10(10)(ii)]: Least

of the following three amounts is exempt from tax:

a) Actual Gratuity Received;

b) 15 days of salary for every completed year of service a part

thereof in excess of six months;

c) Rs. 3,50,000/-.

NOTE 1) In case of seasonal employee 15 days are to be replaced

with 7 days.

2) The number of days in a month are taken as 26.

3) Salary means Basic salary and Dearness Allowance last drawn.

4) Salary in case of a piece-rated employee is calculated on the

basis of average of last three months’ wages (excluding wages for

overtime work) preceding retirement.

4) The payment of Gratuity Act, 1972 is applicable in case of every

shop/establishment (employing more than 9 workers) and every

factory, mine, oilfield, port, plantation etc.

EXEMPTION FOR OTHER EMPLOYEES (SECTION 10(10)(iii)]:

Least of the following is exempt from tax:

a) Actual Gratuity Received;

b) ½ month’s average Salary for each completed year of service;

c) Rs. 3,50,000/-.

NOTE: 1) Salary means Basic Salary, Dearness Allowance (if terms

of employment so provide) and commission based on fixed

percentage of turnover ACHIEVED BY THE EMPLOYEE.

2) Average Salary means salary (discussed as above) for 10 months

immediately preceding the month of

retirement/resignation/leaving the job.

3) In case of employees not covered under The payment of Gratuity

Act, 1972 the

maximum amount of Gratuity exempt from tax in their lives is

Rs.3,50,000 .

PENSION [SECTION 17(1) (ii)]:

Pension is paid by the employer after retirement or death of

employee in appreciation of his past services. It can be received by

either:

i) The employee himself on his retirement; or

ii) The legal heir on the death of the employee.

The pension received by employee is taxable under head

‘Salaries’. The pension received by the legal heirs is called 'Family

Pension’ and it is taxable under head ‘Income from other sources’.

Pension can be either commuted or uncommuted.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 19

Income Tax

Assessment Year 2010-11

Uncommuted Pension: It is received on monthly basis by the

employee after retirement. It is fully in taxable in case of all

employees.

Commuted pension: It is received by the employee on lump-sum

basis. Exemption is available as follows:-

Exemption for Central or State Government or Local

Authority or Statutory Corporation Employees:

Commuted pension received by these employees is fully exempt

from tax.

Exemption in case of other employees:

a. If the employee receives gratuity also: The commuted

value of 1/3rd of the pension is EXEMPT from tax.

b. If the employee does not receive gratuity: The

commuted value of ½ of the pension is EXEMPT from tax.

Pension scheme for Employee Central Government or any

other employer joining on or after 1st January, 2004:- The

conditions to be fulfilled:

1) The assessee is an Individual.

2) He is employed by the Central Government or any other

employer on or after 1st January, 2004.

3) He has paid or deposited any amount not less than 10% of

salary in his account under a pension scheme notified by the

Central Government in the previous year.

4) The employer also contributes an amount equal to 10% of his

salary in his pension account. Such contribution is fully taxable

under head Salaries.

5) Employee’s contribution as above (not exceeding 10% of his

salary) plus Employer’s contribution to the above pension fund

(not exceeding 10% of his salary) is deductible under section

80CCD.

6) If the employee or his nominee receives any amount on

account of closure of the account or as pension during the

previous year then such amount received will be taxable in the

hands of the employee or his nominee, as the case may be, in

the year of receipt.

7) Salary means Basic Salary plus Dearness Allowance, if the

terms of employment so provide.

LEAVE SALARY [Section 10(10)]: The Employees are entitled to

various types of leaves while in service like casual leaves,

medical leaves, outstation leaves etc. The employee can take

all these leaves. But if he does not avail all leaves then some of

the leaves may either lapse or be cancelled while some may be

earned (earned leaves). These earned leaves can be encashed

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 20

Income Tax

Assessment Year 2010-11

by the employee either in the same year or any other year while

he is in service OR he may get earned leave encashed on

retirement or resignation or his legal heirs may get this amount

after his death.

A) If leave Salary is encashed by the employee when he is in

service with the same employer then it is FULLY TAXABLE.

However relief u/s 89 can be claimed.

B) If Leave Salary is encashed by the employee at the

time of retirement or leaving the job then the exemption is as

follows:

i) Exemption for Central or State Government

Employees [SECTION 10(10AA)(i)]: Leave encashment at

the time of retirement/leaving the job is FULLY EXEMPT.

ii) Exemption for other employees [SECTION 10 (10AA)

(ii)]: Leave encashment at the time of retirement/ leaving the job is

exempt to the least of following:

(a) Leave Encashment actually received;

(b) 10 months X Average Salary;

(c) (Total leave entitlement by taking maximum 30 days for every

completed year of service - Months of leaves

availed/encashed) X Average Salary.

(d) Rs 3,00,000/- (Rupees Three Lac only).

NOTE:

Salary Means Basic Salary, Dearness Allowance (if the terms of

Employment so provide) and Commission based on fixed

percentage of turnover achieved by the employee.

1. Average Salary means “Salary of 10 months immediately

preceding retirement/leaving the job.

2. Leave salary paid to legal heirs of the deceased employee is

not taxable.

3. In case of other employees, maximum amount of leave salary

exempt from tax is Rs. 3,00,000. This is applicable if the

employee has more than one employer in his life.

RETRENCHMENT COMPENSATION [SEC 10(10B)]: Any

compensation received by a workman at the time of his

retrenchment is exempt to the least of following:

a. Actual amount received;

b. Amount as per section 25 F (b) of the Industrial Disputes Act,

1947;

c. Rs 5,00,000/- (Rupees five Lac only).

Note: Under The Industrial Disputes Act, 1947, a workman is

entitled to receive compensation equal to 15 days’ average

salary for every completed year of service a part thereof in

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 21

Income Tax

Assessment Year 2010-11

excess of six months.

COMPENSATION ON VOLUNTARY RETIREMENT [SEC 10(10C)

& RULE 2 BA]:

The compensation received by the employee at the time voluntary

retirement is exempt if following conditions are satisfied –

1. Compensation is received by the employee at the time of

voluntary retirement/ separation.

2. Compensation is received by an employee of the following

undertakings:

a. an Authority established under a Central, State or Provincial

Act;

b. local Authority;

c. university;

d. an Indian Institute of Technology;

e. the State Government;

f. the Central Government;

g. a notified institute having importance throughout India or

any State;

h. a notified institute of management;

i. a public sector company;

j. any company or a co-operative society.

3. Compensation is received in accordance with the scheme of

voluntary retirement/ separation which is framed in accordance with

prescribed guidelines as per Rule 2BA.

4. Where exemption has been allowed to an employee under section

10(10C) for any assessment year, no exemption there under shall be

allowed to him in relation to any other assessment year.

EXEMPTION AMOUNT IS LEAST OF THE FOLLOWING.

(a) Actual Compensation received;

(b) Rs 5,00,000/- (Rupees five Lac only).

GUIDELINES OF VOLUNTARY SCHEME [RULE 2BA]:

(1) The employee must have completed at least 10 years

of service or be of at least 40 years of age.

(2) The employee may be worker or executive but not

Director of Company/ Co-operative Society.

(3) The voluntary retirement is to reduce the existing

strength of employees and no appointment will be

made for the vacancy caused by Voluntary retirement.

(4) The retiring employee is not to be employed in other

concern belonging to the same management.

(5) The amount receivable is least of –

(a) Three months salary for each completed year of service.

(b) Number of Months for retirement x Salary at the time of

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 22

Income Tax

Assessment Year 2010-11

retirement.

NOTE: Salary means Basic Salary, Dearness Allowance (if the terms

of employment so provide) and commission (based on fixed %ge of

turnover achieved by the employee) last drawn.

PROVIDENT FUND: There are four types of Provident Funds:

(a) Statutory Provident fund (SPF or GPF): It is set up under the

provisions of The Provident Funds Act, 1925. This fund is for

employees of Central Government, State Government, Local

Authorities, Semi-Government Organisations, Railways,

Universities and recognised Educational Institutions.

(b) Recognised Provident fund (RPF): It is set up under the

provisions of The Employees’ Provident Fund and

Miscellaneous Provisions Act, 1952. This fund is for employees

of those establishments which have employed 20 or more

workers. The establishments having less than 20 workers can

also join this scheme. Any establishment has two options for

RPF: 1) Join scheme of the Government set up under the above

Act; or 2) To have own scheme of provident fund and to get it

recognised from the Commissioner of Income Tax as per rules

under Part A of the IV schedule to The Income Tax Act.

(c) Unrecognised Provident fund (URPF): Any establishment

having own scheme of provident fund but fails to get it

recognised from the Commissioner of Income Tax as per rules

under Part A of the IV schedule to The Income Tax Act then

such provident fund is known as unrecognised provident fund.

(d) Public Provident Fund (PPF): The Central Government has

established Public Provident Fund for general public. Any

individual can be member PPF (whether employee or not) by

opening PPF account at Post Office or nationalized banks.

PPF is different from others because even a non–employee

can have PPF Account. Thus in PPF employer does not

contribute any amount.

TREATMENT FOR TAX PURPOSES

PARTICULARS SPF RPF URPF

1 Employer’s Fully Exempt up Ignore for the

Contribution Exempt to 12% of time being

Salary

(NOTE-1)

2 Employee’s Deduction Deduction Deduction u/s

contribution u/s 80C u/s 80C 80C not

available available available

3 Interest on P.F Fully Exempt Ignore for the

Balance. Exempt UPTO 9.5% time Being.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 23

Income Tax

Assessment Year 2010-11

p. a.

4. Receipt of Lump Fully Generally Note-3

sum amount on Exempt Exempt

Retirement or (Note-2)

Resignation

NOTE:

1) Salary means Basic Salary, Dearness Allowance (if the terms of

employment so provide) and commission based on fixed percentage

turnover achieved by the employee.

2) The receipt of Lump sum amount on Retirement/ resignation on

shall be exempt if:

(a) The employee has completed continuous service

for 5 years or more; OR

(b) The employee has been terminated due to

employee’s ill health, closure of employer’s business or other

reason beyond control of the employee; OR.

(c) The employee continues with same Provident fund Account

with other employer.

(3) The receipt of Lump-sum amount on URPF balance shall be

treated on follows:-

(a) Employer’s Contribution (total) + Interest on employer’s

Contribution shall be fully taxable as Salary.

(b) Interest on Employee’s Contribution Shall be fully taxable as

‘Income from other Sources’;

(4) PPF: Annual contribution by individual/ HUF fully qualifies for

Deduction u/s 80C. The annual Interest on PPF is fully exempt.

The Lump sum amount received is also fully exempt.

APPROVED SUPERANNUATION FUND: Superannuation fund is

also one of the schemes of retirement benefits. If such fund has

been and continues to be approved by the Commissioner of Income

Tax according to rules contained in Part B of IV schedule of the

Income Tax Act. The tax treatment is as follows-

1. Employer’s Contribution during the

previous year is exempt from tax in the hands of employee upto Rs.

1,00,000. Excess contribution is charged to tax.

2. Employee’s Contribution qualifies for

Deduction under section 80C.

3. Interest on fund Balance is fully

exempt from tax.

4. Any payment from fund shall be fully

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 24

Income Tax

Assessment Year 2010-11

exempt if-

(a) It is made on the death of a beneficiary; or

(b) It is made on retirement at or after specified age or employee

becoming incapacitated before such retirement; or.

(c) It is made as refund of contributions on the death of

beneficiary; or

(d) It is made as refund of contribution of employee leaving

service (other than due to (b)) to the extent of contributions

made before 1/4/1962.

TRANSFERRED BALANCE (URPF Converted in to the RPF):

Whenever the URPF is converted in to the RPF, the employee may

opt to transfer his URPF A/c balance (either fully or partially) to RPF

A/c. Such balance transferred to RPF A/c on the date of conversion is

called transferred balance. The tax treatment is as under –

(a) The URPF Shall be treated as RPF from the beginning. Each

year’s Employer’s Contribution in excess of 12% Salary

(10% of salary till A.Y 1997-98) is calculated. This amount is

taxable in the year URPF is converted in to RPF.

(b) The Interest on RPF balance in excess of 9.5% p.a. (12% p.a.

till A.Y2001-02) is calculated. This amount is taxable in the

year when URPF is converted into RPF.

ALLOWANCES

Allowance is fixed amount of money paid/payable by the

employer to the employee for meeting some expense-the expense

may be official or personal. All allowances are taxable UNLESS

OTHERWISE CLEARLY STATED TO BE EXEMPT. The taxable

allowances are taxed on due or receipt basis whichever is earlier.

The allowances can be studied under following heads –

(a) Fully exempted allowances.

(b) Allowances Exempted UPTO some Limit.

(c) Entertainment allowance.

(d) Fully Taxable Allowances.

Now we shall study them one by one.

FULLY EXEMPTED ALLOWANCES: These are:

(1) Allowances (all) to Indian National Government Employees

posted out side India.

(2) Allowances to High Court Judges under section 22A (2) of

the High court Judges (Conditions of service) Act, 1954.

(3) Sumptuary Allowance to High court and Supreme Court

Judges.

(4) Allowances to UNO employees.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 25

Income Tax

Assessment Year 2010-11

ALLOWANCES EXEMPT UPTO SOME LIMIT: These can be studied

as:

• House Rent Allowance u/s 10 (13 A); &

• Notified Allowances u/s 10 (14).

HOUSE RENT ALLOWANCE [SEC. 10 (13 A) & RULE 2 A]:

House Rent Allowance is exempt to the least of the following-

(a) Actual HRA received (period of occupation of rented place only).

(b) Rent Paid- 10% of Salary (period of occupation of rented place

only).

(c) 40 % (50% in case of rented place at Mumbai, Delhi, Calcutta or

Chennai) of Salary (period of occupation of rented place only).

NOTE: 1. Salary means Basic Salary, Dearness Allowance (if the

terms service so include) and commission based on fixed %ge of

turnover achieved by the employee.

2. Salary for this purpose is determined on DUE Basis only.

3. If there is any change in Salary, Rent, Place of Residence or HRA

in the year then the exemption shall be calculated in parts.

NOTIFIED ALLOWANCES U/S 10 (14) & RULE 2BB:

The allowances are further sub-divided in to three categories

as follows-

(A) ALLOWANCES- (AMOUNT RECEIVED OR AMOUNT SPENT

WHICH EVER IS LESS IS THE AMOUNT EXEMPT):

(1) Travelling Allowance- It is given to meet cost of travel on

tour or on transfer of duty.

(2) Daily allowance- It is given to meet daily ordinary charges

due to absence from normal place of duty when on official tour

or on transfer of duty.

(3) Conveyance Allowance – It is given to meet conveyance

expenses for official purpose.

(4) Helper Allowance: It is given to meet expenditure of helper

for official purpose.

(5) Academic Allowance: It is given to meet academic/

research/ training costs in Educational & Research Institutions.

(6) Uniform Allowance: It is given to meet the cost of purchase

and maintenance of uniform for official purpose.

(B) ALLOWANCES–(AMOUNT RECEIVED OR LIMIT SPECIFIED

WHICH EVER IS LESS IS THE AMOUNT EXEMPT): In case of

following allowances actual expenditure is not considered at all:

(1) Children Education allowance – Exempt up to actual

amount received per child or Rs 100 p.m. per child up to

maximum of 2 children w.e. is less.

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 26

Income Tax

Assessment Year 2010-11

(2) Hostel Expenditure Allowance- Exempt up to actual amount

received per Child or Rs 300 p.m. per child up to maximum of

2 children w. e. is less.

(3) Tribal Area Allowance – Exempt up to actual amount

received or Rs 200 p.m. w.e. is less.

(4) High Altitude allowance (Special Composite Hill

Compensatory Allowance): Exempt from Rs. 300 p.m. to

Rs.7,000 p. m. depending upon level of difficulty.

(5) Border Area/ Remote Area & Disturbed Area Allowance-

Exempt from Rs. 200 p. m. to Rs 1,300 per month.

(6) Compensatory field Area Allowance- Exempt up to Rs

2,600 p.m.

(7) Compensatory Modified field Area Allowance- Exempt up

to Rs 1,000 p.m.

(8) Counter Insurgency allowance- Exempt up to Rs 3,900 p.m.

(9) Transport Allowance- It is given to meet cost of commuting

between office to home. Exempt up to Rs 800 per month (In

case of Disabled persons u/s 80 U it is Rs 1,600 p.m.)

(10) Under ground Allowance – It is given to coal mine workers.

Exempt up to Rs 800 p.m.

(11) High Altitude (Uncongenial climate) allowance- It is given

to member of armed forces. Exempt up to Rs 1,060 p.m. (for

altitude of 9000 ft to 15000 ft) and up to Rs. 1,600 p.m. (for

altitude of above 15000 ft).

(12) Special Compensatory highly active field area

Allowance- It is given to members of armed forces. Exempt to

the extent of Rs 4,200 p.m.

(13) Island duty allowance- It is given to members of armed

forces for Andaman & Nicobar & Lakshadweep Islands. Exempt

up to Rs 3,250/-p.m.

(C) TRANSPORT ALLOWANCE-(CERTAIN %GE OF AMOUNT

RECEIVED OR CERTAIN LIMIT WHICH EVER IS LESS IS

EXEMPT):

An employee of transportation employer receiving fixed

allowance to meet his duties of running such transport from one

place to another can claim exemption as follows –

(a) 70% of allowance; or

(b) Rs 6,000 p.m. w. e .is less.

But such employee can’t get benefit of this allowance plus Daily

allowance simultaneously.

ENTERTAINMENT ALLOWANCE

This allowance is given to entertain various persons while

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 27

Income Tax

Assessment Year 2010-11

performing official duty. This is fully taxable. But in case of Central/

State Government Employees, a deduction u/s 16(ii) can be claimed

to the least of the following:

(a) Actual Entertainment allowance;

(b) 20% of Basic Salary;

(c) Rs 5,000 (Rupees five Thousand only).

ALLOWANCES WHICH ARE FULLY TAXABLE

All other allowances are full taxable. Some of these are -

• City Compensatory Allowance;

• Dearness allowance;

• Medical allowance;

• Lunch/Tiffin allowance;

• Over time allowance;

• Servant allowance ;

• Warden Allowance;

• Non practicing allowance;

• Family Allowance.

PERQUISITES

Perquisites (or perks) are the benefits/ facilities in cash or

in kind provided by the employer to the employee either free of cost

or at concessional rate. The most important feature of perk is that

the employee must have a right to the same and it should not be

voluntary or contingent (i.e. may or may not be) payment.

PERQUISITES AS PER SECTION 17 (2) – DEFINITION:

The Act gives inclusive definition. Accordingly perquisites include-

(a) The value of Rent free Accommodation provided to the

employee by the employer;

(b) The Value of Concessional Rent Accommodation provided to

the employee by the employer;

(c) The VALUE of any benefit or facility provided or granted either

free or at concessional rates in the case of specified employees

(to be discussed later on);

(d) The obligation of employee paid by employer;

(e) The amount paid/payable (on accrual basis) by the employer

for Life Insurance or Contract of Annuity of the employee

(except RPF, approved superannuation fund & deposit Linked

Insurance fund);

(f) The value of sweat equity shares or any specified security (like

Debentures or Warrants) allotted or transferred (directly or

indirectly) by the employer either free or at concessional rates to

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 28

Income Tax

Assessment Year 2010-11

the employee;

(g) The amount of employer’s contribution towards approved

superannuation fund in excess of Rs. 1,00,000;

(h) The value of any other benefit or amenity as may be

prescribed.

NOTE: The perquisites from (a), (b), (d), (e) and (h) are taxable in

the hands of all employees whether specified or non-specified. In

case of specified employees perquisites mentioned in (c) are also

taxable. Perquisites as per (f) and (g) are taxable only if conditions

mentioned therein are fulfilled.

TAXABILITY OF PERQUISITES

Perks are divided into three categories as follows-

1) Perks taxable in case of all the

employees.

2) Perks taxable in case of

specified employees only.

3) Perk of sweat equity shares or any specified security (like

Debentures or Warrants) allotted or transferred (directly or

indirectly) by the employer either free or at concessional rates to

the employee.

4) Perk of employer’s contribution towards approved

superannuation fund in excess of Rs. 1,00,000.

5) Tax-free or exempted perks.

PERQUISITES TAXABLE IN CASE OF ALL EMPLOYEES

The following perquisites are taxable in case of all employees-

1. The Value of Rent Free Accommodation provided to the

employee by the employer;

2. The Value of Concessional Rent Accommodation provided to

the employee by the employer,

3. The monetary obligation of employee paid by the employer;

4. The amount paid/payable (on accrual basis) by the employer

for life Insurance or Contract of Annuity of employee (except

RPF, approved superannuation fund and Deposit Linked

Insurance Fund);

5. The value of any other benefit or amenity (excluding the fringe

benefits chargeable to tax under Chapter XII- H) as may be

prescribed.

PERQUISITES TAXABLE IN CASE OF SPECIFIED EMPLOYEES

ONLY

First of all, let us understand who is a specified employee-

SPECIFIED EMPLOYEE

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 29

Income Tax

Assessment Year 2010-11

• It includes a Director of the company (Full/part time

Director for full year or a single day); or

• An employee having substantial interest (being

beneficial owner of 20% of the voting power) in the employer

company; or

• An employee having Monetary Salary exceeding Rs

50,000. Here monetary Salary refers to all taxable Cash payments

less deduction u/s 16 (ii) & 16 (iii) of Entertainment allowance and

Professional tax.

All monetary obligations of employee paid by employer

are taxable perquisites in the hands of ALL EMPLOYEES. But if the

employer provides non- monetary benefit to the employee then they

are taxable in the hands of SPECIFIED EMPLOYEES only. Some

examples are-

• If watchman/sweeper/gardener/personal attendant is

employed by the employee and his salary is reimbursed by the

employer then it’s taxable in all cases being the obligation of

the employee met by the employer. But if the

watchman/sweeper/gardener/personal attendant is provided

by the employer then this perk is taxable only in case of

specified employees.

• Free or concessional use of gas/electricity/water for

household consumption is taxable in all cases if the bills for

above facilities are in the name of employee being the

obligation of the employee met by the employer. If such bills

are in the name of employer then it will be perquisite in case of

specified employee only.

• If the school fees of children of the employee is reimbursed

to him or paid by employer on his behalf to the school then

such amount shall be perquisite in case of all employees being

the obligation of the employee met by the employer. If the

children of employee are studying in a school maintained by

employer or in a school with which the employer has an

agreement then if shall be perquisite in case of specified

employee only.

• Free or concessional use of motor car

• Private journey of employee and/or any member of household

provided free of cost or at concessional rates

• Any other benefit provided to the employee

So any non-monetary benefit (other than exempted perks and

perks which are taxable in all cases) is taxable in case of

specified employees only.

NOTE: Besides above the following perks are also taxable if

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 30

Income Tax

Assessment Year 2010-11

conditions mentioned therein are fulfilled:

(i) The perk of sweat equity shares or any specified security (like

Debentures or Warrants) allotted or transferred (directly or

indirectly) by the employer either free or at concessional rates to

the employee;

(ii) The perk of amount of employer’s contribution towards approved

superannuation fund in excess of Rs. 1,00,000;

PERQUISITES TAXABLE IN CASE OF ALL

EMPLOYEES

RENT FREE ACCOMODATION [RULE 3 (1)]

The term ‘accommodation’ includes a house, flat, farm house

(or a part thereof), or accommodation in a hotel, motel, service

apartment, guest house, mobile home, ship or any other floating

structure.

The accommodation provided may be unfurnished or

furnished. The Employees are divided into two categories:-

(a) Central and state Government Employees

(b) Private Sector or other employees.

The accommodation is valued as under:

FOR CENTRAL & STATE GOVERNMENT EMPLOYEES:

This employee’s category includes Government employees on

deputation and presently working with any undertaking under

Control of Govt. However employees of foreign Government are not

covered under this category.

1. Where the accommodation is unfurnished – The value of

perk shall be ‘Licence fee’ determined by Government in

accordance with rules framed by it.

2. Where the accommodation is furnished –The value of perk

shall be: Value of unfurnished accommodation plus 10% p.a.

of ‘ACTUAL COST’ of furniture (if owned by the employer)

plus actual hire charges paid/payable by the employer (if

furniture is hired by the employer)..

FOR PRIVATE SECTOR & OTHER EMPLOYEES: This category

includes those employees who are not covered under the above

category.

i) Where the accommodation is unfurnished.

Population It accommodation is If accommodation

of City as owned by employer taken on lease or

per 2001 rent by the

census employer

More than 15% of salary in respect of 15% of salary OR

25,00,000 period during which the actual rent

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 31

Income Tax

Assessment Year 2010-11

accommodation is paid/payable by the

occupied by the employee. employer which ever

is less.

More than 10% of salary in respect of

10,00,000 but period during which Same as above

up to accommodation is

25,00,000 occupied by the employee.

Any other city 7.50% of salary in respect

of period during which Same as above

accommodation is

occupied by the employee.

ii) Where the accommodation is furnished:- The value of

perk shall be : value of unfurnished accommodation plus 10%

p.a. of actual cost of furniture (if owned by the employer) plus

actual hire charges paid/payable by the employer (if furniture

is hired by the employer).

SPECIAL NOTE: FOR ACCOMMODATION PROVIDED BY

EMPLOYER (GOVERNMENT OR OTHER) IN A HOTEL

The perk is not taxable if:-

a a) Such accommodation is provided for a period not exceeding 15

days; AND

b) It has been provided on transfer of the employee.

In every other case it will be valued as:-

i) 24% of salary for the previous year; or

ii) Actual charges of such hotel whichever is less, for the period

for which the accommodation in hotel is provided.

NOTE:

- MEANING OF SALARY FOR RENT FREE

ACCOMMODATION: For this purpose, salary includes:-

Basic salary, dearness allowance / pay (if the terms of

employment so provide), Bonus, Commission, fees, all taxable

parts of allowances and all monetary payments chargeable to

tax (like leave encashment, pension of current year).

For this purpose salary does not include:-

Dearness allowance / pay (if the terms of employment do

not so provide), employer’s contribution to PROVIDENT FUND

ACCOUNT of the employee, all allowances or part of

allowances exempt from tax, value of perquisites specified

under section 17 (2) of the Act.

- Accommodation includes house, flat, farm house or part there

of or accommodation in a hotel, motel, service apartment,

guest house, caravan, mobile home, ship or other floating

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 32

Income Tax

Assessment Year 2010-11

structure.

- Hotel includes licensed accommodation in motel, service

apartment or guest house.

- Salary is to be computed an accrual basis.

- Salary from all employers (in case of two or more employers)

will be taken into consideration for the period during which the

accommodation is provided.

- If employee is provided accommodation is a remote area and

the employee is working at mining site or onshore oil

exploration site or project execution site or an offshore site of

similar nature then value of such accommodation in NIL.

- If an employee is transferred from one place to other and he is

provided accommodation at new place while he occupies the

old accommodation also then value of perk will be only for one

accommodation having lower value till first 90 days and

thereafter both the accommodations will be charged to tax.

VALUATION OF ACCOMMODATION PROVIDED AT

CONCESSIONAL RATE: The value calculated as Rent Free

Accommodation (other than hotel accommodation) as above is

reduced by actual Rent paid by the employee. In case of hotel

accommodation rent paid or payable by the employee is deducted

from calculated value of Rent Free Accommodation.

VALUATION OF OBLIGATION OF EMPLOYEE MET BY

EMPLOYER: If any monetary obligation of employee is met by the

employer then value of such perk is equal to AMOUNT SPENT BY THE

EMPLOYER in this regard. This perk is taxable in case of ALL

EMPLOYEES. Some examples are :-

a) Salary of watchmen/ sweeper/ gardener (engaged by the

employee) paid/reimbursed by the employer;

b) Gas, electricity or water bill (in the name of employee)

paid/reimbursed by the employer;

c) Income tax/professional tax of employee paid/reimbursed by

the employer;

d) Medical Expenses reimbursed in excess of Rs.15,000.

VALUATION OF LIFE INSURANCE PREMIUM/DEFERRED

ANNUITY: Any amount paid/payable by the employer as life

Insurance premium or deferred annuity premium is a perk taxable in

case of ALL EMPOYEES. The value of perk shall be AMOUNT

PAID/PAYABLE (ON DUE BASIS) AS PREMIUM FOR SUCH POLICY. This

is perk only if the EMPLOYEE HAS VESTED INTEREST IN THE POLICY.

* ESI/ Group Insurance/ Fidelity Guarantee Premium paid by

employer is NOT A PERK as such scheme is generally for the benefit

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 33

Income Tax

Assessment Year 2010-11

of the employer.

VALUATION OF FRINGE BENEFITS:

The fringe benefits provided by the employer to the employees are

taxable in the hands of all employees. According to rule 3(7), the

following are prescribed benefits:-

i) Interest free or concessional loan

ii) Travelling, accommodation and any other expenses paid/

borne/ reimbursed by the employer for any holiday availed of

by the employee and/or any family member

iii) Free food and beverages

iv) Any gift voucher or token

v) Expenses on credit cards

vi) Club membership and expenses in club

vii) Use of any moveable Assets by the employee.

viii) Transfer of any moveable assets by the employer in favour of

the employee (directly or indirectly).

i) Interest free or concessional loans [Rule 3(7)(i)]:- The

value of benefit from loan availed by the employee (directly or

indirectly) from the employer is calculated as follows :-

Purpose of Period or Amount of loan Rate to be applied

loan for valuation of

perks

a) For house Up to 5 years 9.75%^ ,10.25%*

Above 5 years but up to 15 10%^,10.50%*

years

Above 15 years but up to 20 10.25%^,10.75%

years **,

11%***

b) For Car Up to 3 years (below Rs. 11.75%

7.50 Lac)

Up to 3 years (Rs. 7.50 Lac 11.50%

and above)

Above 3 years but upto 5 11.75%

years

Above 3 years but up to 7 12%

years

c) For Two 16.25%

Wheelers

c)For Loan Amount up to Rs. 4 Lac 11.75%^^

Education

Loan Amount above Rs. 4 13.25%^^

Lac up to Rs. 7.50 Lac

Loan amount above Rs. 7.50 12.50%^^

Prepared by Navin Chandra: M.Com, M.A. (Eco), FCA Page 34

Income Tax

Assessment Year 2010-11

Lac

d)Personal 16.50%

Loan

e) ESOP Loan 14.50%

^ Up to Rs. 30 Lac

* Above Rs. 30 Lac

** Above Rs. 30 Lac but up to Rs. 75 Lac

*** Above Rs. 75 Lac

The interest shall be calculated on Maximum monthly balance

outstanding. If any interest is ACTUALLY PAID by the employee

(directly or indirectly) then. Value of benefit will be reduced by

such interest actually paid.

But In The Following Cases There Will Be No Perk:

- If the amount of loans do not exceed Rs. 20,000; OR

- If the loan is for medical treatment of specified diseases (as

per rule 3A). But if any amount is reimbursed by the Insurance

Company to the employee then benefit shall be taxable on